Certificate under section 203 of the Income-tax Act, 1961 ... - Sa-Dhan

Certificate under section 203 of the Income-tax Act, 1961 ... - Sa-Dhan

Certificate under section 203 of the Income-tax Act, 1961 ... - Sa-Dhan

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

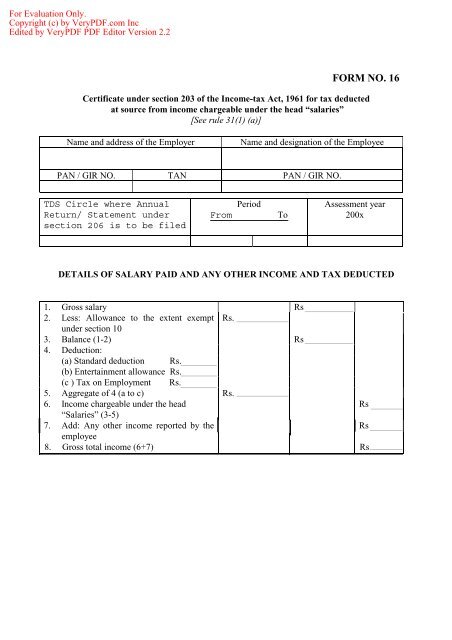

FormNumber 16 FormSection <strong>203</strong> FormLaw <strong>Income</strong> Tax & Direct Tax FORM NO. 16FormTitle <strong>Certificate</strong> <strong>under</strong> <strong>section</strong> <strong>203</strong> <strong>of</strong> <strong>the</strong> <strong>Income</strong>-<strong>tax</strong> <strong>Act</strong>, <strong>1961</strong> for <strong>tax</strong> deducted<strong>Certificate</strong> <strong>under</strong> <strong>section</strong> <strong>203</strong> <strong>of</strong> <strong>the</strong> <strong>Income</strong>-<strong>tax</strong> <strong>Act</strong>, <strong>1961</strong> for <strong>tax</strong> deductedat source from income chargeable <strong>under</strong> <strong>the</strong> head “salaries”[See rule 31(1) (a)] FormParent<strong>Act</strong> <strong>Income</strong>Tax <strong>Act</strong>, <strong>1961</strong>at source from income chargeable <strong>under</strong> <strong>the</strong> head “salaries”Name and address <strong>of</strong> <strong>the</strong> EmployerName and designation <strong>of</strong> <strong>the</strong> EmployeePAN / GIR NO. TAN PAN / GIR NO.TDS Circle where AnnualReturn/ Statement <strong>under</strong><strong>section</strong> 206 is to be filedFromPeriodToAssessment year200xDETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED1. Gross salary Rs x2. Less: Allowance to <strong>the</strong> extent exempt Rs. x<strong>under</strong> <strong>section</strong> 103. Balance (1-2) Rs x4. Deduction:(a) Standard deduction Rs. x(b) Entertainment allowance Rs. x(c ) Tax on Employment Rs. x5. Aggregate <strong>of</strong> 4 (a to c) Rs. x6. <strong>Income</strong> chargeable <strong>under</strong> <strong>the</strong> headRs x“<strong>Sa</strong>laries” (3-5)7. Add: Any o<strong>the</strong>r income reported by <strong>the</strong>Rs xemployee8. Gross total income (6+7) Rs X

9. Deduction <strong>under</strong> GROSS QUALIFYING DEDUCTIBLEchapter vi-AAMOUNT AMOUNT AMOUNT(a) x Rs. x Rs. x Rs. x(b) x Rs. x Rs. x Rs. x(c) x Rs. x Rs. x Rs. x(d) x Rs. x Rs. x Rs. x10 Aggregate <strong>of</strong>deductible amount<strong>under</strong> Chapter VI-A11 Total income (8-10) Rs x12 Tax on total income Rs x13 Rebate and relief14.15.16.17.<strong>under</strong> Chapter VIIII. Under <strong>section</strong> 88(Please specify)GROSSAMOUNTQUALIFYINGAMOUNTTAXREBATE /RELIEF(a) x Rs. x Rs. x x(b) x Rs. x Rs. x x(c ) x Rs. x Rs. x x(d) x Rs. x Rs. x x(e) x Rs. x Rs. x x(f) TOTAL (a to e ) Rs. x Rs. x Rs. xII. Under <strong>section</strong>88A (please specify)GROSSAMOUNTQUALIFYINGAMOUNT(a) x Rs. x Rs. x(b) x Rs. x Rs. x(c ) TOTAL[(a) Rs. x Rs. x Rs. x+(b)]III. Under <strong>section</strong> 89(attach details)Rs. xAggregate <strong>of</strong> <strong>tax</strong>rebates and relief at13 above [ I(f) +II(c) + III ]Tax payable (12-14)and surcharge<strong>the</strong>reonLess: Tax deductedat sourceTax payable /refundable (15-16)RsRs.Rs.Rs.Rs.xxxxx

DETAILS OF TAX DEDUCTED AND DEPOSITED INTO CENTRAL GOVERNMENTACCOUNTAMOUNT DATE OF PAYMENT NAME OF BANK AND BRANCH WHERE TAXDEPOSITEDCertified that a sum <strong>of</strong> Rs. (in words) xhas been deducted at source and paid to <strong>the</strong> credit <strong>of</strong> <strong>the</strong> Central Government. Fur<strong>the</strong>r certifiedthat <strong>the</strong> above information is true and correct as per records.PlaceDatexxSignature <strong>of</strong> <strong>the</strong> person responsible for deduction <strong>of</strong> <strong>tax</strong>Full NamexDesignationx