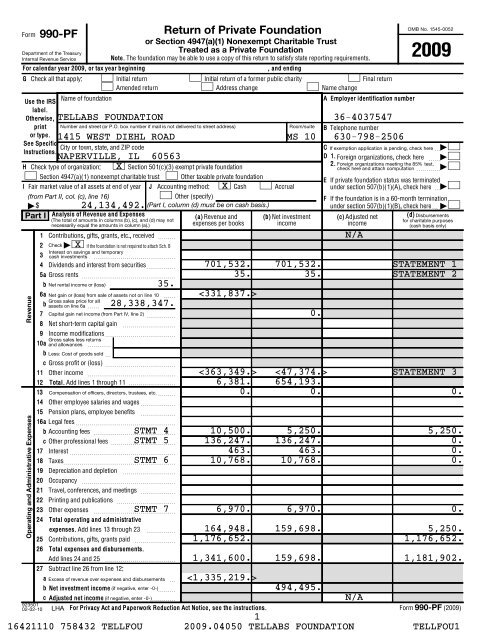

Tellabs Foundation 2009 Tax Return Form 990-PF

Tellabs Foundation 2009 Tax Return Form 990-PF

Tellabs Foundation 2009 Tax Return Form 990-PF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>)AssetsLiabilitiesNet Assets or Fund Balances123456Part II1234567892351102-02-10Other notes and loans receivable ~~~~~~~~Attached schedules and amounts in the descriptioncolumn should be for end-of-year amounts only.9 Prepaid expenses and deferred charges ~~~~~~~~~~~~~10aInvestments - U.S. and state government obligations ~~~~~~~STMT 9b Investments - corporate stock ~~~~~~~~~~~~~~~~~STMT 10c Investments - corporate bonds ~~~~~~~~~~~~~~~~~STMT 1111 Investments - land, buildings, and equipment: basis ~~1213141516171819202122Total assets (to be completed by all filers) Loans from officers, directors, trustees, and other disqualified persons23 Total liabilities (add lines 17 through 22) 2425262728293031Part IIIBalance SheetsCash - non-interest-bearing~~~~~~~~~~~~~~~~~~~Savings and temporary cash investmentsAccounts receivableLess: allowance for doubtful accountsPledges receivableLess: allowance for doubtful accounts<strong>Foundation</strong>s that follow SFAS 117, check hereand complete lines 24 through 26 and lines 30 and 31.and complete lines 27 through 31.~~~~~~~~~~~~Grants receivable ~~~~~~~~~~~~~~~~~~~~~~~Receivables due from officers, directors, trustees, and otherdisqualified persons ~~~~~~~~~~~~~~~~~~~~~~Less: allowance for doubtful accountsInventories for sale or use ~~~~~~~~~~~~~~~~~~~Less: accumulated depreciation ~~~~~~~~Investments - mortgage loans ~~~~~~~~~~~~~~~~~Investments - other ~~~~~~~~~~~~~~~~~~~~~~STMT 12Land, buildings, and equipment: basisLess: accumulated depreciation ~~~~~~~~Other assets (describe STATEMENT 13 )Accounts payable and accrued expenses ~~~~~~~~~~~~~Grants payable ~~~~~~~~~~~~~~~~~~~~~~~~Deferred revenue ~~~~~~~~~~~~~~~~~~~~~~~~~~~Mortgages and other notes payable ~~~~~~~~~~~~~~~Other liabilities (describeUnrestrictedTELLABS FOUNDATION 36-40375479999999999 9~~~~~~~~~~~~~~~~~~~~~~~~~Temporarily restricted ~~~~~~~~~~~~~~~~~~~~~Permanently restricted~~~~~~~~~~~~~~~~~~~~~<strong>Foundation</strong>s that do not follow SFAS 117, check here XCapital stock, trust principal, or current funds ~~~~~~~~~~~Paid-in or capital surplus, or land, bldg., and equipment fund ~~~~Retained earnings, accumulated income, endowment, or other funds~Total net assets or fund balances~~~~~~~~~~~~~~~~Total liabilities and net assets/fund balances Analysis of Changes in Net Assets or Fund Balances99)Beginning of yearEnd of yearPage 2(a) Book Value (b) Book Value (c) Fair Market Value5,030. 61,127. 61,127.1,252,108. 601,042. 601,042.3,276,643. 2,675,551. 2,675,551.11,001,339. 12,918,829. 12,918,829.3,111,887. 5,309,342. 5,309,342.3,335,793. 2,529,157. 2,529,157.45,027. 39,444. 39,444.22,027,827. 24,134,492. 24,134,492.0. 0.0. 0.0. 0.22,027,827. 24,134,492.22,027,827. 24,134,492.22,027,827. 24,134,492.Total net assets or fund balances at beginning of year - Part II, column (a), line 30(must agree with end-of-year figure reported on prior year’s return) ~~~~~~~~~~~~~~~~~~~~~~~~~~~ 1 22,027,827.Enter amount from Part I, line 27a ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 2 Other increases not included in line 2 (itemize)SEE STATEMENT 8 3 3,441,884.9Add lines 1, 2, and 3 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 4 24,134,492.Decreases not included in line 2 (itemize)50.9Total net assets or fund balances at end of year (line 4 minus line 5) - Part II, column (b), line 30 6 24,134,492.<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>)216421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1

<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>)TELLABS FOUNDATION 36-4037547Page 9Part XIIIUndistributed Income (see instructions)12 Undistributed income, if any, as of the end of <strong>2009</strong>:34a Enter amount for 2008 only ~~~~~~~b Total for prior years:aFrom 2004bFrom 2005c From 2006dFrom 2007eFrom 2008f Total of lines 3a through e ~~~~~~~~aApplied to 2008, but not more than line 2a ~bApplied to undistributed income of priorc Treated as distributions out of corpuseRemaining amount distributed out of corpus5 Excess distributions carryover applied to <strong>2009</strong> ~~(If an amount appears in column (d), the same amountmust be shown in column (a).)6 Enter the net total of each column asindicated below:78910a Corpus. Add lines 3f, 4c, and 4e. Subtract line 5~~bPrior years’ undistributed income. Subtractc Enter the amount of prior years’undistributed income for which a notice ofdeficiency has been issued, or on whichthe section 4942(a) tax has been previouslyassessed ~~~~~~~~~~~~~~~dSubtract line 6c from line 6b. <strong>Tax</strong>ableeUndistributed income for 2008. Subtract linef Undistributed income for <strong>2009</strong>. Subtract92358102-02-10Distributable amount for <strong>2009</strong> from Part XI,line 7 ~~~~~~~~~~~~~~~~~, ,Excess distributions carryover, if any, to <strong>2009</strong>:~~~~~~~~~~~~~~~Qualifying distributions for <strong>2009</strong> fromPart XII, line 4: $ 1,181,902.9years (Election required - see instructions) ~(Election required - see instructions)Excess distributions carryover to 2010.aExcess from 2005~bExcess from 2006~c Excess from 2007~dExcess from 2008~eExcess from <strong>2009</strong>~~~dApplied to <strong>2009</strong> distributable amount ~~~line 4b from line 2b ~~~~~~~~~~~amount - see instructions ~~~~~~~~4a from line 2a. <strong>Tax</strong>able amount - see instr.~lines 4d and 5 from line 1. This amount mustbe distributed in 2010 ~~~~~~~~~~Amounts treated as distributions out ofcorpus to satisfy requirements imposed bysection 170(b)(1)(F) or 4942(g)(3) ~~~~Excess distributions carryover from 2004not applied on line 5 or line 7 ~~~~~~~Subtract lines 7 and 8 from line 6a ~~~~Analysis of line 9:(a) (b) (c) (d)Corpus Years prior to 2008 2008 <strong>2009</strong>0.0.0.1,158,245.1,158,245.1,165,328.0.23,657.0.0. 0.0.0.0.0.0.0.0.0.1,141,671.<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>)916421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1

<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>) TELLABS FOUNDATION 36-4037547Part XIV Private Operating <strong>Foundation</strong>s (see instructions and Part VII-A, question 9) N/A1 a If the foundation has received a ruling or determination letter that it is a private operatingfoundation, and the ruling is effective for <strong>2009</strong>, enter the date of the ruling ~~~~~~~~~~~b Check box to indicate whether the foundation is a private operating foundation described in section ~~~ 4942(j)(3) or 4942(j)(5)2 a Enter the lesser of the adjusted net<strong>Tax</strong> yearPrior 3 yearsincome from Part I or the minimum(a) <strong>2009</strong> (b) 2008 (c) 2007 (d) 2006(e) Totalb 85% of line 2a ~~~~~~~~~~c Qualifying distributions from Part XII,d Amounts included in line 2c note Qualifying distributions made directlySubtract line 2d from line 2c~~~~3 Complete 3a, b, or c for thealternative test relied upon:a "Assets" alternative test - enter:(1) Value of all assets ~~~~~~(2) Value of assets qualifyingunder section 4942(j)(3)(B)(i) ~b "Endowment" alternative test - enter2/3 of minimum investment returnshown in Part X, line 6 for each yearlisted ~~~~~~~~~~~~~~c "Support" alternative test - enter:(1)(2)(3)(4) Gross investment income Part XV Supplementary Information (Complete this part only if the foundation had $5,000 or more in assetsat any time during the year-see the instructions.)1 Information Regarding <strong>Foundation</strong> Managers:a List any managers of the foundation who have contributed more than 2% of the total contributions received by the foundation before the close of any taxyear (but only if they have contributed more than $5,000). (See section 507(d)(2).)NONE2investment return from Part X foreach year listed~~~~~~~~~line 4 for each year listed ~~~~~used directly for active conduct ofexempt activities ~~~~~~~~~for active conduct of exempt activities.Total support other than grossinvestment income (interest,dividends, rents, payments onsecurities loans (section512(a)(5)), or royalties)~~~~Support from general publicand 5 or more exemptorganizations as provided insection 4942(j)(3)(B)(iii) ~~~Largest amount of support froman exempt organization ~~~~b List any managers of the foundation who own 10% or more of the stock of a corporation (or an equally large portion of the ownership of a partnership orother entity) of which the foundation has a 10% or greater interest.NONEInformation Regarding Contribution, Grant, Gift, Loan, Scholarship, etc., Programs:Check here9if the foundation only makes contributions to preselected charitable organizations and does not accept unsolicited requests for funds. Ifthe foundation makes gifts, grants, etc. (see instructions) to individuals or organizations under other conditions, complete items 2a, b, c, and d.a The name, address, and telephone number of the person to whom applications should be addressed:SEE STATEMENT 15b The form in which applications should be submitted and information and materials they should include:9Page 10c Any submission deadlines:d Any restrictions or limitations on awards, such as by geographical areas, charitable fields, kinds of institutions, or other factors:923601 02-02-10<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>)1016421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1

<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>) TELLABS FOUNDATION 36-4037547Part XV Supplementary Information (continued)3Grants and Contributions Paid During the Year or Approved for Future PaymentRecipientIf recipient is an individual,show any relationship to <strong>Foundation</strong>any foundation manager status ofName and address (home or business)or substantial contributor recipientPurpose of grant orcontributionPage 11a Paid during the yearSEE ATTACHED STATEMENT 1,176,652.AmountbTotal Approved for future payment93a1,176,652.NONETotal 3b0.923611 02-02-10<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>)1116421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU19

<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>)Part XVI-AEnter gross amounts unless otherwise indicated.1 Program service revenue:abcdefg3 Interest on savings and temporary cash4 Dividends and interest from securities5 Net rental income or (loss) from real estate:ab6 Net rental income or (loss) from personal7 Other investment income ~~~~~~~~~~~~~~8 Gain or (loss) from sales of assets other10 Gross profit or (loss) from sales of inventoryUnrelated business incomeExcluded by section 512, 513, or 514(a)(c)(b) Exclusion(d)BusinesscodeAmountcodeAmount(e)Related or exemptfunction incomePage 1211 Other revenue:a SEE STATEMENT 16 bcdFees and contracts from government agencies ~~~2 Membership dues and assessments ~~~~~~~~~investments ~~~~~~~~~~~~~~~~~~~~Debt-financed propertyAnalysis of Income-Producing Activities~~~~~~~~~~~~~~~~~~~~~Not debt-financed property ~~~~~~~~~~~~property ~~~~~~~~~~~~~~~~~~~~~than inventory ~~~~~~~~~~~~~~~~~~~9 Net income or (loss) from special events ~~~~~~~~~~~~(See worksheet in line 13 instructions to verify calculations.)Part XVI-BTELLABS FOUNDATION 36-403754714 701,532.16 35.14 4,064.18 e12 Subtotal. Add columns (b), (d), and (e) ~~~~~~~~0. 373,794. 13 Total. Add line 12, columns (b), (d), and (e) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 136,381.Relationship of Activities to the Accomplishment of Exempt PurposesLine No.

<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>) TELLABS FOUNDATION 36-4037547 Page 13Part XVII Information Regarding Transfers To and Transactions and Relationships With NoncharitableExempt Organizations1 Did the organization directly or indirectly engage in any of the following with any other organization described in section 501(c) ofYes Nothe Code (other than section 501(c)(3) organizations) or in section 527, relating to political organizations?abcTransfers from the reporting foundation to a noncharitable exempt organization of:(1)(2)(1)(2)(3)(4)(5)(6)Cash ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Other assets~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Other transactions:Sales of assets to a noncharitable exempt organization~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Purchases of assets from a noncharitable exempt organization ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Rental of facilities, equipment, or other assets ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Reimbursement arrangements ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Loans or loan guarantees ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Performance of services or membership or fundraising solicitations~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Sharing of facilities, equipment, mailing lists, other assets, or paid employees ~~~~~~~~~~~~~~~~~~~~~~~~~~~~d If the answer to any of the above is "Yes," complete the following schedule. Column (b) should always show the fair market value of the goods, other assets,or services given by the reporting foundation. If the foundation received less than fair market value in any transaction or sharing arrangement, show incolumn (d) the value of the goods, other assets, or services received.(a) Line no. (b) Amount involved (c) Name of noncharitable exempt organization(d) Description of transfers, transactions, and sharing arrangementsN/A1a(1)1a(2)1b(1)1b(2)1b(3)1b(4)1b(5)1b(6)1cXXXXXXXXX2abIs the foundation directly or indirectly affiliated with, or related to, one or more tax-exempt organizations describedin section 501(c) of the Code (other than section 501(c)(3)) or in section 527? ~~~~~~~~~~~~~~~~~~~~~~~~~~ Yes X NoIf "Yes," complete the following schedule.(a) Name of organization (b) Type of organization (c) Description of relationshipN/AUnder penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct,and complete. Declaration of preparer (other than taxpayer or fiduciary) is based on all information of which preparer has any knowledge.= Signature of officer or trusteeDate = TitlePreparer’s identifying numberPreparer’sDateCheck ifselfemployedsignature = DAVID LOWENTHAL 11/10/109BLACKMAN KALLICK, LL<strong>PF</strong>irm’s name (or yoursEINif self-employed), 10 S. RIVERSIDE PLAZA, 9TH FLOOR 9address, and ZIP code = CHICAGO, ILLINOIS 60606 Phone no. (312) 207-1040<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>)Sign HerePaidPreparer’sUse Only92362202-02-101316421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1

CONTINUATION FOR <strong>990</strong>-<strong>PF</strong>, PART IVTELLABS FOUNDATION 36-4037547 PAGE 1 OF 1Part IV Capital Gains and Losses for <strong>Tax</strong> on Investment Income(a) List and describe the kind(s) of property sold, e.g., real estate,(b) How acquired (c) Date acquired (d) Date soldP - Purchase2-story brick warehouse; or common stock, 200 shs. MLC Co.D - Donation(mo., day, yr.) (mo., day, yr.)1a MERRILL LYNCH CASH IN LIEU - SEE ATTACHED P VARIOUS VARIOUSb FROM K-1: MORGAN STANLEY REAL ESTATE FUND IVPc FROM K-1: MORGAN STANLEY REAL ESTATE FUND IIIPd MERRILL LYNCH P VARIOUS VARIOUSe FROM K-1: AMERICAN INFRASTRUCTURE P VARIOUS VARIOUSf FROM K-1: ARTHUR STREET P VARIOUS VARIOUSg FROM K-1: KINDER MORGAN P VARIOUS VARIOUSabcdefghijklmnoabcdefghijklmno92359104-24-09(e) Gross sales price(f) Depreciation allowed(g) Cost or other basis(h) Gain or (loss)(or allowable)plus expense of sale(e) plus (f) minus (g)10,098. 10,098.94,046. 120,420. 28,328,249. 28,390,269. 2. 31,910. 33,537. (i) F.M.V. as of 12/31/69(j) Adjusted basisas of 12/31/69(k) Excess of col. (i)over col. (j), if anyIf gain, also enter in Part I, line 72 Capital gain net income or (net capital loss) ~~~~~~~~If (loss), enter "-0-" in Part I, line 723hijklmnoComplete only for assets showing gain in column (h) and owned by the foundation on 12/31/69Net short-term capital gain or (loss) as defined in sections 1222(5) and (6):If gain, also enter in Part I, line 8, column (c).If (loss), enter "-0-" in Part I, line 8 ijpmo3(l) Losses (from col. (h))Gains (excess of col. (h) gain over col. (k),but not less than "-0-")N/A10,098.1416421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1

TELLABS FOUNDATION 36-4037547}}}}}}}}}}}}}}}}}} }}}}}}}}}}~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~FORM <strong>990</strong>-<strong>PF</strong> DIVIDENDS AND INTEREST FROM SECURITIES STATEMENT 1}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}CAPITAL GAINS COLUMN (A)SOURCE GROSS AMOUNT DIVIDENDS AMOUNT}}}}}} }}}}}}}}}}}}}} }}}}}}}}}}}}}} }}}}}}}}}}}}}}FROM K-1: AMERICANINFRASTRUCTURE 225. 0. 225.FROM K-1: ARTHUR STREET III 17,827. 0. 17,827.FROM K-1: HOUSE INVESTMENTS REALESTATE OPPORTUNITY FUND II 9. 0. 9.FROM K-1: HOUSE INVESTMENTS REALESTATE OPPORTUNITY FUND III 3,326. 0. 3,326.FROM K-1: HOUSE INVESTMENTS REALESTATE OPPORTUNITY FUND III-A 844. 0. 844.FROM K-1: HOUSE INVESTMENTS REALESTATE OPPORTUNITY FUND IV 12,689. 0. 12,689.FROM K-1: KINDER MORGAN 76. 0. 76.FROM K-1: MORGAN STANLEY REALESTATE FUND IV 987. 0. 987.MERRILL LYNCHTOTAL TO FM <strong>990</strong>-<strong>PF</strong>, PART I, LN 4665,549.}}}}}}}}}}}}}}701,532.0.}}}}}}}}}}}}}}0.665,549.}}}}}}}}}}}}}}701,532.~~~~~~~~~~~~~~ ~~~~~~~~~~~~~~ ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~FORM <strong>990</strong>-<strong>PF</strong> RENTAL INCOME STATEMENT 2}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}ACTIVITY GROSSKIND AND LOCATION OF PROPERTY NUMBER RENTAL INCOME}}}}}}}}}}}}}}}}}}}}}}}}}}}}} }}}}}}}} }}}}}}}}}}}}}}FROM K-1: ARTHUR STREET III 2 35.}}}}}}}}}}}}}}TOTAL TO FORM <strong>990</strong>-<strong>PF</strong>, PART I, LINE 5A 35.~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~FORM <strong>990</strong>-<strong>PF</strong> OTHER INCOME STATEMENT 3}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}(A) (B) (C)REVENUE NET INVEST- ADJUSTEDDESCRIPTION PER BOOKS MENT INCOME NET INCOME}}}}}}}}}}} }}}}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}}FROM K-1: AMERICAN INFRASTRUCTURE 4,064. 4,064.LOSS FROM UNRELATED BUSINESS INCOME[ADD BACK] 0. 315,975.FROM K-1: HOUSE INVESTMENTS REALESTATE OPPORTUNITY FUND III FROM K-1: MORGAN STANLEY REALESTATE FUND IV FROM K-1: ARTHUR STREET FUND III,LP 15STATEMENT(S) 1, 2, 316421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1

TELLABS FOUNDATION 36-4037547}}}}}}}}}}}}}}}}}} }}}}}}}}}}FROM K-1: KINDER MORGAN FROM K-1: HOUSE INVESTMENTS REALESTATE OPPORTUNITY FUND III-A FROM K-1: HOUSE INVESTMENTS REALESTATE OPPORTUNITY FUND IV }}}}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}}TOTAL TO FORM <strong>990</strong>-<strong>PF</strong>, PART I, LINE 11 ~~~~~~~~~~~~~~ ~~~~~~~~~~~~ ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~FORM <strong>990</strong>-<strong>PF</strong> ACCOUNTING FEES STATEMENT 4}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}(A) (B) (C) (D)EXPENSES NET INVEST- ADJUSTED CHARITABLEDESCRIPTION PER BOOKS MENT INCOME NET INCOME PURPOSES}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}LEGAL & ACCOUNTING 10,500.5,250.5,250.}}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}TO FORM <strong>990</strong>-<strong>PF</strong>, PG 1, LN 16B 10,500.5,250.5,250.~~~~~~~~~~~~ ~~~~~~~~~~~~ ~~~~~~~~~~~~ ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~FORM <strong>990</strong>-<strong>PF</strong> OTHER PROFESSIONAL FEES STATEMENT 5}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}(A) (B) (C) (D)EXPENSES NET INVEST- ADJUSTED CHARITABLEDESCRIPTION PER BOOKS MENT INCOME NET INCOME PURPOSES}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}BROKER/MONEY MANAGEMENTFEES 136,247.}}}}}}}}}}}}136,247.}}}}}}}}}}}} }}}}}}}}}}}}0.}}}}}}}}}}}TO FORM <strong>990</strong>-<strong>PF</strong>, PG 1, LN 16C 136,247. 136,247.0.~~~~~~~~~~~~ ~~~~~~~~~~~~ ~~~~~~~~~~~~ ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~FORM <strong>990</strong>-<strong>PF</strong> TAXES STATEMENT 6}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}(A) (B) (C) (D)EXPENSES NET INVEST- ADJUSTED CHARITABLEDESCRIPTION PER BOOKS MENT INCOME NET INCOME PURPOSES}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}FOREIGN TAX ON DIVIDENDS 10,768. 10,768.0.}}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}TO FORM <strong>990</strong>-<strong>PF</strong>, PG 1, LN 18 10,768. 10,768.0.~~~~~~~~~~~~ ~~~~~~~~~~~~ ~~~~~~~~~~~~ ~~~~~~~~~~~16STATEMENT(S) 3, 4, 5, 616421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1

TELLABS FOUNDATION 36-4037547}}}}}}}}}}}}}}}}}} }}}}}}}}}}~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~FORM <strong>990</strong>-<strong>PF</strong> OTHER EXPENSES STATEMENT 7}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}(A) (B) (C) (D)EXPENSES NET INVEST- ADJUSTED CHARITABLEDESCRIPTION PER BOOKS MENT INCOME NET INCOME PURPOSES}}}}}}}}}}} }}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}MISCELLANEOUS EXPENSES 6,535. 6,535. 0.BANK FEES 435.435.0.}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}TO FORM <strong>990</strong>-<strong>PF</strong>, PG 1, LN 236,970.6,970.0.~~~~~~~~~~~ ~~~~~~~~~~~~ ~~~~~~~~~~~~ ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~FORM <strong>990</strong>-<strong>PF</strong> OTHER INCREASES IN NET ASSETS OR FUND BALANCES STATEMENT 8}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}DESCRIPTIONAMOUNT}}}}}}}}}}} }}}}}}}}}}}}}}CHANGE IN UNREALIZED GAIN ON SECURITIES 3,057,009.ADJUSTMENT FOR K-1 ACTIVITY 384,875.}}}}}}}}}}}}}}TOTAL TO FORM <strong>990</strong>-<strong>PF</strong>, PART III, LINE 3 3,441,884.~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~FORM <strong>990</strong>-<strong>PF</strong> U.S. AND STATE/CITY GOVERNMENT OBLIGATIONS STATEMENT 9}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}U.S. OTHERFAIR MARKETDESCRIPTION GOV’T GOV’T BOOK VALUE VALUE}}}}}}}}}}} }}}}} }}}}} }}}}}}}}}}}}}} }}}}}}}}}}}}}}U.S. GOVERNMENT AGENCIES/TREASURY XNOTES2,675,551. 2,675,551.}}}}}}}}}}}}}} }}}}}}}}}}}}}}TOTAL U.S. GOVERNMENT OBLIGATIONS 2,675,551. 2,675,551.}}}}}}}}}}}}}} }}}}}}}}}}}}}}TOTAL STATE AND MUNICIPAL GOVERNMENT OBLIGATIONS}}}}}}}}}}}}}} }}}}}}}}}}}}}}TOTAL TO FORM <strong>990</strong>-<strong>PF</strong>, PART II, LINE 10A 2,675,551. 2,675,551.~~~~~~~~~~~~~~ ~~~~~~~~~~~~~~17STATEMENT(S) 7, 8, 916421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1

TELLABS FOUNDATION 36-4037547}}}}}}}}}}}}}}}}}} }}}}}}}}}}~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~FORM <strong>990</strong>-<strong>PF</strong> OTHER ASSETS STATEMENT 13}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}BEGINNING OF END OF YEAR FAIR MARKETDESCRIPTION YR BOOK VALUE BOOK VALUE VALUE}}}}}}}}}}} }}}}}}}}}}}}}} }}}}}}}}}}}}}} }}}}}}}}}}}}}}ACCRUED INTEREST RECEIVABLETO FORM <strong>990</strong>-<strong>PF</strong>, PART II, LINE 1545,027.}}}}}}}}}}}}}}45,027.39,444.}}}}}}}}}}}}}}39,444.39,444.}}}}}}}}}}}}}}39,444.~~~~~~~~~~~~~~ ~~~~~~~~~~~~~~ ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~FORM <strong>990</strong>-<strong>PF</strong> PART VIII - LIST OF OFFICERS, DIRECTORS STATEMENT 14TRUSTEES AND FOUNDATION MANAGERS}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}EMPLOYEETITLE AND COMPEN- BEN PLAN EXPENSENAME AND ADDRESS AVRG HRS/WK SATION CONTRIB ACCOUNT}}}}}}}}}}}}}}}} }}}}}}}}}}}}} }}}}}}}}}}} }}}}}}}} }}}}}}}}MICHAEL BIRCKPRESIDENT AND TREASURER1415 WEST DIEHL ROAD NO. MS 10 1.00 0. 0. 0.NAPERVILLE, IL 60563DENISE CALLARMANVICE PRESIDENT1415 WEST DIEHL ROAD NO. MS 10 1.00 0. 0. 0.NAPERVILLE, IL 60563STEPHANIE P. MARSHALLVICE PRESIDENT1415 WEST DIEHL ROAD NO. MS 10 1.00 0. 0. 0.NAPERVILLE, IL 60563CAROL GAVINVICE PRESIDENT1415 WEST DIEHL ROAD NO. MS 10 1.00 0. 0. 0.NAPERVILLE, IL 60563TIMOTHY J. WIGGINSVICE PRESIDENT1415 WEST DIEHL ROAD NO. MS 10 1.00 0. 0. 0.NAPERVILLE, IL 60563MEREDITH HILTSECRETARY1415 WEST DIEHL ROAD NO. MS 10 15.00 0. 0. 0.NAPERVILLE, IL 60563}}}}}}}}}}} }}}}}}}} }}}}}}}}TOTALS INCLUDED ON <strong>990</strong>-<strong>PF</strong>, PAGE 6, PART VIII 0. 0. 0.~~~~~~~~~~~ ~~~~~~~~ ~~~~~~~~19STATEMENT(S) 13, 1416421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1

TELLABS FOUNDATION 36-4037547}}}}}}}}}}}}}}}}}} }}}}}}}}}}~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~FORM <strong>990</strong>-<strong>PF</strong> GRANT APPLICATION SUBMISSION INFORMATION STATEMENT 15PART XV, LINES 2A THROUGH 2D}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}NAME AND ADDRESS OF PERSON TO WHOM APPLICATIONS SHOULD BE SUBMITTED}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}TELLABS FOUNDATION C/O MEREDITH HILT1415 WEST DIEHL ROAD, MAIL STOP 10NAPERVILLE, IL 60563TELEPHONE NUMBER}}}}}}}}}}}}}}}}1.630.798.2506FORM AND CONTENT OF APPLICATIONS}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}UNLESS REQUESTED DIRECTLY BY THE BOARD, ALL APPLICANTS MUST FIRST SUBMIT ALETTER OF INQUIRY. THERE IS NO STANDARD FORMAT. SUCH LETTER SHOULD INCLUDEITEMS PER OUR WEBSITE "HTTP://WWW.TELLABS.COM/ABOUT/FOUNDATION.SHTML"ANY SUBMISSION DEADLINES}}}}}}}}}}}}}}}}}}}}}}}}VARIOUSRESTRICTIONS AND LIMITATIONS ON AWARDS}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}CHARITABLE FIELDS CONSIDERED ARE EDUCATION, HEALTH AND WELLNESS ANDENVIRONMENTAL AREAS}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}20STATEMENT(S) 1516421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1

TELLABS FOUNDATION 36-4037547}}}}}}}}}}}}}}}}}} }}}}}}}}}}~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~FORM <strong>990</strong>-<strong>PF</strong> OTHER REVENUE STATEMENT 16}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}RELATED ORBUS UNRELATED EXCL EXCLUDED EXEMPT FUNC-DESCRIPTION CODE BUSINESS INC CODE AMOUNT TION INCOME}}}}}}}}}}} }}}}}} }}}}}}}}}}}} }}}} }}}}}}}}}}} }}}}}}}}}}}}FROM K-1: HOUSEINVESTMENTS REAL ESTATEOPPORTUNITY FUND III FROM K-1: MORGAN STANLEYREAL ESTATE FUND IV FROM K-1: ARTHUR STREETFUND III, LP FROM K-1: KINDER MORGAN FROM K-1: HOUSEINVESTMENTS REAL ESTATEOPPORTUNITY FUND III-A FROM K-1: HOUSEINVESTMENTS REAL ESTATEOPPORTUNITY FUND IV }}}}}}}}}}}} }}}}}}}}}}} }}}}}}}}}}}}TOTAL TO FORM <strong>990</strong>-<strong>PF</strong>, PG 11, LN 11 ~~~~~~~~~~~~ ~~~~~~~~~~~ ~~~~~~~~~~~~21STATEMENT(S) 1616421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1

<strong>Form</strong>Department of the TreasuryInternal Revenue ServiceName| See separate instructions.| Attach to the corporation’s tax return.Note: Generally, the corporation is not required to file <strong>Form</strong> 2220 (see Part II below for exceptions) because the IRS will figure any penalty owed and bill thecorporation. However, the corporation may still use <strong>Form</strong> 2220 to figure the penalty. If so, enter the amount from page 2, line 38 on the estimated taxpenalty line of the corporation’s income tax return, but do not attach <strong>Form</strong> 2220.Part I2220 Underpayment of Estimated <strong>Tax</strong> by CorporationsOMB No. 1545-0142Employer identification numberTELLABS FOUNDATION 36-4037547Required Annual PaymentFORM <strong>990</strong>-<strong>PF</strong><strong>2009</strong>1Total tax (see instructions) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~14,945.2 a Personal holding company tax (Schedule PH (<strong>Form</strong> 1120), line 26) included on line 1 ~~~~~b Look-back interest included on line 1 under section 460(b)(2) for completed long-termcontracts or section 167(g) for depreciation under the income forecast method ~~~~~~~~2a2bc Credit for federal tax paid on fuels (see instructions) ~~~~~~~~~~~~~~~~~~~ 2cd Total. Add lines 2a through 2c ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~34Subtract line 2d from line 1. If the result is less than $500, do not complete or file this form. The corporationdoes not owe the penalty Enter the tax shown on the corporation’s 2008 income tax return (see instructions). Caution: If the tax is zeroor the tax year was for less than 12 months, skip this line and enter the amount from line 3 on line 5 ~~~~~~~~~~~2d344,945.8,566.5Required annual payment. Enter the smaller of line 3 or line 4. If the corporation is required to skip line 4,enter the amount from line 3 5Part II Reasons for Filing - Check the boxes below that apply. If any boxes are checked, the corporation must file <strong>Form</strong> 2220even if it does not owe a penalty (see instructions).678 XThe corporation is using the annualized income installment method.The corporation is a "large corporation" figuring its first required installment based on the prior year’s tax.Part III Figuring the Underpayment(a) (b) (c) (d)9101112131415161718The corporation is using the adjusted seasonal installment method.Installment due dates. Enter in columns (a) through(d) the 15th day of the 4th ( <strong>Form</strong> <strong>990</strong>-<strong>PF</strong> filers:Use 5th month), 6th, 9th, and 12th months of thecorporation’s tax year ~~~~~~~~~~~~~~~~Required installments. If the box on line 6 and/or line 7above is checked, enter the amounts from Sch A, line 38. Ifthe box on line 8 (but not 6 or 7) is checked, see instructionsfor the amounts to enter. If none of these boxes are checked,enter 25% of line 5 above in each column. ~~~~~~ ~Estimated tax paid or credited for each period (seeinstructions). For column (a) only, enter the amountfrom line 11 on line 15 ~~~~~~~~~~~~~~~Complete lines 12 through 18 of one column beforegoing to the next column.Enter amount, if any, from line 18 of the preceding columnAdd lines 11 and 12 ~~~~~~~~~~~~~~~~~Add amounts on lines 16 and 17 of the preceding columnSubtract line 14 from line 13. If zero or less, enter -0- ~~If the amount on line 15 is zero, subtract line 13 from line14. Otherwise, enter -0- ~~~~~~~~~~~~~~~Underpayment. If line 15 is less than or equal to line 10,subtract line 15 from line 10. Then go to line 12 of the nextcolumn. Otherwise, go to line 18 ~~~~~~~~~~~Overpayment. If line 10 is less than line 15, subtract line 10from line 15. Then go to line 12 of the next column 9101112131415161718Go to Part IV on page 2 to figure the penalty. Do not go to Part IV if there are no entries on line 17 - no penalty is owed.4,945.05/15/09 06/15/09 09/15/09 12/15/091,236. 1,237. 1,236. 1,236.11,803.10,567. 9,330. 8,094.10,567. 9,330. 8,094.11,803. 10,567. 9,330. 8,094.0. 0.10,567. 9,330. 8,094.JWA For Paperwork Reduction Act Notice, see separate instructions. <strong>Form</strong> 2220 (<strong>2009</strong>)91280101-05-102216421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1

TAX RETURN FILING INSTRUCTIONSFORM <strong>990</strong>-TFOR THE YEAR ENDING~~~~~~~~~~~~~~~~~DECEMBER 31, <strong>2009</strong>Prepared forPrepared byAmount dueor refundMake checkpayable toMail tax returnand check (ifapplicable) toTELLABS FOUNDATION1415 WEST DIEHL ROAD NO. MS 10NAPERVILLE, IL 60563BLACKMAN KALLICK, LLP10 S. RIVERSIDE PLAZA, 9TH FLOORCHICAGO, ILLINOIS 60606NO AMOUNT IS DUE.NO AMOUNT IS DUE.DEPARTMENT OF THE TREASURYINTERNAL REVENUE SERVICE CENTEROGDEN, UT 84201-0027<strong>Return</strong> must bemailed onor beforeSpecialInstructionsNOVEMBER 15, 2010THE RETURN SHOULD BE SIGNED AND DATED.90094105-20-09

<strong>Form</strong> <strong>990</strong>-T (<strong>2009</strong>) TELLABS FOUNDATION 36-4037547Part III <strong>Tax</strong> Computation35 Organizations <strong>Tax</strong>able as Corporations. See instructions for tax computation.363738923711 01-08-10Controlled group members (sections 1561 and 1563) check here | See instructions and:a Enter your share of the $50,000, $25,000, and $9,925,000 taxable income brackets (in that order):b Enter organization’s share of: (1) Additional 5% tax (not more than $11,750) $c(1) $ (2) $ (3) $(2) Additional 3% tax (not more than $100,000) ~~~~~~~~~~~~~ $Trusts <strong>Tax</strong>able at Trust Rates. See instructions for tax computation. Income tax on the amount on line 34 from:Proxy tax. See instructions ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~39 Total. Add lines 37 and 38 to line 35c or 36, whichever applies Part IV <strong>Tax</strong> and Payments40aForeign tax credit (corporations attach <strong>Form</strong> 1118; trusts attach <strong>Form</strong> 1116) ~~~~~~~~ 40a4142b Other credits (see instructions)cd Credit for prior year minimum tax (attach <strong>Form</strong> 8801 or 8827) ~~~~~~~~~~~~~~eTotal credits. Add lines 40a through 40d ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Other taxes. Check if from: <strong>Form</strong> 4255 <strong>Form</strong> 8611 <strong>Form</strong> 8697 <strong>Form</strong> 8866 Other (attach schedule)43 Total tax. Add lines 41 and 42 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~44 a Payments: A 2008 overpayment credited to <strong>2009</strong> ~~~~~~~~~~~~~~~~~~~ 44ab <strong>2009</strong> estimated tax payments ~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 44bc <strong>Tax</strong> deposited with <strong>Form</strong> 8868 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 44cd Foreign organizations: <strong>Tax</strong> paid or withheld at source (see instructions) ~~~~~~~~~~ 44de Backup withholding (see instructions) ~~~~~~~~~~~~~~~~~~~~~~~~ 44ef Other credits and payments:<strong>Form</strong> 243945464748Total payments. Add lines 44a through 44f ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 45<strong>Tax</strong> due. If line 45 is less than the total of lines 43 and 46, enter amount owed ~~~~~~~~~~~~~~~~~~~ |Overpayment. If line 45 is larger than the total of lines 43 and 46, enter amount overpaid ~~~~~~~~~~~~~~49 Enter the amount of line 48 you want: Credited to 2010 estimated tax |Refunded | 49Part V Statements Regarding Certain Activities and Other Information (See instructions on page 17)1 At any time during the <strong>2009</strong> calendar year, did the organization have an interest in or a signature or other authority over a financial accountYes No(bank, securities, or other) in a foreign country? If YES, the organization may have to file <strong>Form</strong> TD F 90-22.1, Report of Foreign Bank andX2Financial Accounts. If YES, enter the name of the foreign country here |During the tax year, did the organization receive a distribution from, or was it the grantor of, or transferor to, a foreign trust?If YES, see page 5 of the instructions for other forms the organization may have to file. ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ X3 Enter the amount of tax-exempt interest received or accrued during the tax year | $Schedule A - Cost of Goods Sold. Enter method of inventory valuation |N/A1234 abInventory at beginning of year ~~~ 16 Inventory at end of year ~~~~~~~~~~~~Cost of labor~~~~~~~~~~~ 3from line 5. Enter here and in Part I, line 2 ~~~~Additional section 263A costs ~~~ 4a8 Do the rules of section 263A (with respect to5 Total. 5SignHerePaidPreparer’sUse OnlyIncome tax on the amount on line 34 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ |<strong>Tax</strong> rate schedule or Schedule D (<strong>Form</strong> 1041) ~~~~~~~~~~~~~~~~~~~~~~~~~~~Alternative minimum tax~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~General business credit. Attach <strong>Form</strong> 3800 ~~~~~~~~~~~~~~~~~~~~~~Subtract line 40e from line 39 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<strong>Form</strong> 4136 OtherTotal |Estimated tax penalty (see instructions). Check if <strong>Form</strong> 2220 is attached | ~~~~~~~~~~~~~~~~~~~Purchases ~~~~~~~~~~~ 27 Cost of goods sold. Subtract line 6Other costs (attach schedule) ~~~4bAdd lines 1 through 4b the organization? Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true,correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.= =40b40c40d44fproperty produced or acquired for resale) apply to|||35c3637383940e41424346474867YesMay the IRS discuss this return withPage 2the preparer shown below (seeSignature of officer Date Titleinstructions)? X Yes NoPreparer’sDateCheck ifPreparer’s SSN or PTINsignature = DAVID LOWENTHAL 11/10/10 self-employedP00024648Firm’s name (or BLACKMAN KALLICK, LLPyours if selfemployed),10 S. RIVERSIDE PLAZA, 9TH FLOORPhone no.EIN 36-3468829address, andZIP code = CHICAGO, ILLINOIS 60606 (312) 207-1040<strong>Form</strong> <strong>990</strong>-T (<strong>2009</strong>)2616421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU10.0.0.0.0.0.NoX

<strong>Form</strong> <strong>990</strong>-T (<strong>2009</strong>) TELLABS FOUNDATION 36-4037547PageSchedule C - Rent Income (From Real Property and Personal Property Leased With Real Property) (see instr. on pg 18)31. Description of property(1)(2)(3)(4)(1)(2)(3)(a)2.From personal property (if the percentage ofrent for personal property is more than10% but not more than 50%)Rent received or accrued(b) From real and personal property (if the percentageof rent for personal property exceeds 50% or ifthe rent is based on profit or income)3(a)Deductions directly connected with the income incolumns 2(a) and 2(b) (attach schedule)(4)Total0. Total0.(c) Total income. Add totals of columns 2(a) and 2(b). Enter(b) Total deductions.Enter here and on page 1,here and on page 1, Part I, line 6, column (A) | 0. Part I, line 6, column (B) |0.Schedule E - Unrelated Debt-Financed Income (See instructions on page 19)3. Deductions directly connected with or allocable2. Gross income fromto debt-financed property1. Description of debt-financed propertyor allocable to debtfinancedproperty(a) Straight line depreciation (b) Other deductions(attach schedule)(attach schedule)(1)(2)(3)(4)(1)(2)(3)(4)4. Amount of average acquisition5. Average adjusted basis 6. Column 4 divided7. Gross income8. Allocable deductionsdebt on or allocable to debt-financedof or allocable toby column 5reportable (column(column 6 x total of columnsproperty (attach schedule)debt-financed property2 x column 6)3(a) and 3(b))(attach schedule)Enter here and on page 1,Part I, line 7, column (A).Enter here and on page 1,Part I, line 7, column (B).Totals ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ |0. 0.Total dividends-received deductions included in column 8 |0.Schedule F - Interest, Annuities, Royalties, and Rents From Controlled Organizations (See instructions on page 20)Exempt Controlled Organizations1. Name of controlled organization2. 3. 4. 5. Part of column 4 that is 6. Deductions directlyEmployer identification Net unrelated income Total of specified included in the controlling connected with incomenumber(loss) (see instructions) payments made organization’s gross income in column 5%%%%(1)(2)(3)(4)Nonexempt Controlled Organizations7. <strong>Tax</strong>able Income 8. Net unrelated income (loss) 9. Total of specified payments 10. Part of column 9 that is included 11. Deductions directly connected(see instructions) madein the controlling organization’swith income in column 10gross income(1)(2)(3)(4)Add columns 5 and 10.Enter here and on page 1, Part I,line 8, column (A).Add columns 6 and 11.Enter here and on page 1, Part I,line 8, column (B).TotalsJ0. 0.923721 01-08-10<strong>Form</strong> <strong>990</strong>-T (<strong>2009</strong>)2716421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1

<strong>Form</strong> <strong>990</strong>-T (<strong>2009</strong>)Schedule G - Investment Income of a Section 501(c)(7), (9), or (17) Organization(see instructions on page 20)(1)(2)(3)(4)1. Description ofexploited activity1. Description of income2. Amount of income2. Grossunrelated businessincome fromtrade or businessEnter here and onpage 1, Part I,line 10, col. (A).3. Expensesdirectly connectedwith productionof unrelatedbusiness incomeEnter here and onpage 1, Part I,line 10, col. (B).Enter here and on page 1,Part I, line 9, column (A).4. Net income (loss)from unrelated trade orbusiness (column 2minus column 3). If again, compute cols. 5through 7.Page 43. DeductionsTotal deductionsdirectly connected 4. Set-asides 5.and set-asides(attach schedule)(attach schedule)(col. 3 plus col. 4)5. Gross income 6. Expensesfrom activity thatattributable tois not unrelatedcolumn 5business incomeEnter here and on page 1,Part I, line 9, column (B).Totals0. 0.Schedule I - Exploited Exempt Activity Income, Other Than Advertising Income(see instructions on page 21)(1)(2)(3)(4)TELLABS FOUNDATION 36-4037547997. Excess exemptexpenses (column6 minus column 5,but not more thancolumn 4).Enter here andon page 1,Part II, line 26.Totals0. 0. 0.Schedule J - Advertising Income (see instructions on page 21)Part I Income From Periodicals Reported on a Consolidated Basis1. Name of periodical2. Gross3. Directadvertisingadvertising costsincome4. Advertising gainor (loss) (col. 2 minuscol. 3). If a gain, computecols. 5 through 7.5. Circulation 6. Readershipincomecosts7. Excess readershipcosts (column 6 minuscolumn 5, but not morethan column 4).(1)(2)(3)(4)Totals (carry to Part II, line (5)) 0. 0. 0.Part II Income From Periodicals Reported on a Separate Basis (For each periodical listed in Part II, fill incolumns 2 through 7 on a line-by-line basis.)(1)(2)(3)(4)(5)92373101-08-101. Name of periodicalTotals from Part I992. Gross3. Directadvertisingadvertising costsincomeEnter here and onpage 1, Part I,line 11, col. (A).Enter here and onpage 1, Part I,line 11, col. (B).4. Advertising gainor (loss) (col. 2 minuscol. 3). If a gain, computecols. 5 through 7.5. Circulation 6. Readershipincomecosts7. Excess readershipcosts (column 6 minuscolumn 5, but not morethan column 4).0. 0. 0.Enter here andon page 1,Part II, line 27.Totals, Part II (lines 1-5)0. 0. 0.Schedule K - Compensation of Officers, Directors, and Trustees (see instructions on page 21)3. Percent of 4. Compensation attributableTitletime devoted to1. Name2.to unrelated businessbusinessTotal. Enter here and on page 1, Part II, line 14 %%%%90.<strong>Form</strong> <strong>990</strong>-T (<strong>2009</strong>)2816421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1

TELLABS FOUNDATION 36-4037547}}}}}}}}}}}}}}}}}} }}}}}}}}}}~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~FORM <strong>990</strong>-T DESCRIPTION OF ORGANIZATION’S PRIMARY UNRELATED STATEMENT 17BUSINESS ACTIVITY}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}INVESTMENTS IN FLOW THROUGH ENTITIES WHICH GENERATE UNRELATED BUSINESSINCOME.TO FORM <strong>990</strong>-T, PAGE 1~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~FORM <strong>990</strong>-T INCOME (LOSS) FROM PARTNERSHIPS STATEMENT 18}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}DESCRIPTIONAMOUNT}}}}}}}}}}} }}}}}}}}}}}}}}FROM K-1: AMERICAN INFRASTRUCTURE MLP 4,099.FROM K-1: ARTHUR STREET FROM K-1: KINDER MORGAN FROM K-1: MORGANS STANLEY REAL ESTATE FUND IV PASSIVE ACTIVITY LOSS ALLOWED - SEE FORM 8811 }}}}}}}}}}}}}}TOTAL TO FORM <strong>990</strong>-T, PAGE 1, LINE 5 ~~~~~~~~~~~~~~29STATEMENT(S) 17, 1816421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1

<strong>Form</strong>(Rev. April <strong>2009</strong>) OMB No. 1545-1709Department of the TreasuryInternal Revenue Service¥ If you are filing for an Automatic 3-Month Extension, complete only Part I and check this box ~~~~~~~~~~~~~~~~~~~ |¥ If you are filing for an Additional (Not Automatic) 3-Month Extension, complete only Part II (on page 2 of this form).Do not complete Part II unless you have already been granted an automatic 3-month extension on a previously filed <strong>Form</strong> 8868.Part IAll other corporations (including 1120-C filers), partnerships, REMICs, and trusts must use <strong>Form</strong> 7004 to request an extension of timeto file income tax returns.Electronic Filing (e-file). Generally, you can electronically file <strong>Form</strong> 8868 if you want a 3-month automatic extension of time to file one of the returnsnoted below (6 months for a corporation required to file <strong>Form</strong> <strong>990</strong>-T). However, you cannot file <strong>Form</strong> 8868 electronically if (1) you want the additional(not automatic) 3-month extension or (2) you file <strong>Form</strong>s <strong>990</strong>-BL, 6069, or 8870, group returns, or a composite or consolidated <strong>Form</strong> <strong>990</strong>-T. Instead,you must submit the fully completed and signed page 2 (Part II) of <strong>Form</strong> 8868. For more details on the electronic filing of this form, visitwww.irs.gov/efile and click on e-file for Charities & Nonprofits.Type orprintFile by thedue date forfiling yourreturn. Seeinstructions.8868 Application for Extension of Time To File anExempt Organization <strong>Return</strong>| File a separate application for each return.Automatic 3-Month Extension of Time. Only submit original (no copies needed).A corporation required to file <strong>Form</strong> <strong>990</strong>-T and requesting an automatic 6-month extension - check this box and completePart I only ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ |Name of Exempt OrganizationNumber, street, and room or suite no. If a P.O. box, see instructions.1415 WEST DIEHL ROAD, NO. MS 10City, town or post office, state, and ZIP code. For a foreign address, see instructions.NAPERVILLE, IL 60563Check type of return to be filed(file a separate application for each return):Employer identification numberTELLABS FOUNDATION 36-4037547XX<strong>Form</strong> <strong>990</strong><strong>Form</strong> <strong>990</strong>-BL<strong>Form</strong> <strong>990</strong>-EZ<strong>Form</strong> <strong>990</strong>-<strong>PF</strong><strong>Form</strong> <strong>990</strong>-T (corporation)<strong>Form</strong> <strong>990</strong>-T (sec. 401(a) or 408(a) trust)<strong>Form</strong> <strong>990</strong>-T (trust other than above)<strong>Form</strong> 1041-A<strong>Form</strong> 4720<strong>Form</strong> 5227<strong>Form</strong> 6069<strong>Form</strong> 8870MEREDITH HILT¥ The books are in the care of | 1415 WEST DIEHL ROAD NO. MS 10 - NAPERVILLE, IL 60563Telephone No. | (630)-798-2506FAX No. |¥ If the organization does not have an office or place of business in the United States, check this box ~~~~~~~~~~~~~~~~~ |¥ If this is for a Group <strong>Return</strong>, enter the organization’s four digit Group Exemption Number (GEN) . If this is for the whole group, check thisbox | . If it is for part of the group, check this box | and attach a list with the names and EINs of all members the extension will cover.1I request an automatic 3-month (6-months for a corporation required to file <strong>Form</strong> <strong>990</strong>-T) extension of time untilAUGUST 15, 2010 , to file the exempt organization return for the organization named above. The extensionis for the organization’s return for:| X calendar year <strong>2009</strong> or| tax year beginning , and ending .2If this tax year is for less than 12 months, check reason: Initial return Final return Change in accounting period3abcIf this application is for <strong>Form</strong> <strong>990</strong>-BL, <strong>990</strong>-<strong>PF</strong>, <strong>990</strong>-T, 4720, or 6069, enter the tentative tax, less anynonrefundable credits. See instructions.If this application is for <strong>Form</strong> <strong>990</strong>-<strong>PF</strong> or <strong>990</strong>-T, enter any refundable credits and estimatedtax payments made. Include any prior year overpayment allowed as a credit.Balance Due. Subtract line 3b from line 3a. Include your payment with this form, or, if required,deposit with FTD coupon or, if required, by using EFTPS (Electronic Federal <strong>Tax</strong> Payment System).See instructions.3a3b3c$$$0.11,803.0.Caution. If you are going to make an electronic fund withdrawal with this <strong>Form</strong> 8868, see <strong>Form</strong> 8453-EO and <strong>Form</strong> 8879-EO for payment instructions.LHAFor Privacy Act and Paperwork Reduction Act Notice, see Instructions. <strong>Form</strong> 8868 (Rev. 4-<strong>2009</strong>)92383105-26-093116421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1

<strong>Form</strong> 8868 (Rev. 4-<strong>2009</strong>)¥ If you are filing for an Additional (Not Automatic) 3-Month Extension, complete only Part II and check this box ~~~~~~~~~~ |Note. Only complete Part II if you have already been granted an automatic 3-month extension on a previously filed <strong>Form</strong> 8868.¥ If you are filing for an Automatic 3-Month Extension, complete only Part I (on page 1).Part II Additional (Not Automatic) 3-Month Extension of Time. Only file the original (no copies needed).Type orprintFile by theextendeddue date forfiling thereturn. Seeinstructions.Check type of return to be filed (File a separate application for each return):Page 2XEmployer identification numberSTOP! Do not complete Part II if you were not already granted an automatic 3-month extension on a previously filed <strong>Form</strong> 8868.678abcName of Exempt OrganizationTELLABS FOUNDATION 36-4037547Number, street, and room or suite no. If a P.O. box, see instructions.1415 WEST DIEHL ROAD, NO. MS 10City, town or post office, state, and ZIP code. For a foreign address, see instructions.NAPERVILLE, IL 60563<strong>Form</strong> <strong>990</strong><strong>Form</strong> <strong>990</strong>-BLX<strong>Form</strong> <strong>990</strong>-EZ<strong>Form</strong> <strong>990</strong>-<strong>PF</strong><strong>Form</strong> <strong>990</strong>-T (sec. 401(a) or 408(a) trust)<strong>Form</strong> <strong>990</strong>-T (trust other than above)<strong>Form</strong> 1041-A<strong>Form</strong> 4720Balance Due. Subtract line 8b from line 8a. Include your payment with this form, or, if required, depositFor IRS use only8a $with FTD coupon or, if required, by using EFTPS (Electronic Federal <strong>Tax</strong> Payment System). See instructions. 8c $Signature and VerificationUnder penalties of perjury, I declare that I have examined this form, including accompanying schedules and statements, and to the best of my knowledge and belief,it is true, correct, and complete, and that I am authorized to prepare this form.Signature | Title | CPADate |8b<strong>Form</strong> 5227<strong>Form</strong> 6069MEREDITH HILT¥ The books are in the care of | 1415 WEST DIEHL ROAD NO. MS 10 - NAPERVILLE, IL 60563Telephone No. | (630)-798-2506FAX No. |¥ If the organization does not have an office or place of business in the United States, check this box ~~~~~~~~~~~~~~~~ |$<strong>Form</strong> 8870¥ If this is for a Group <strong>Return</strong>, enter the organization’s four digit Group Exemption Number (GEN) . If this is for the whole group, check thisbox | . If it is for part of the group, check this box | and attach a list with the names and EINs of all members the extension is for.4 I request an additional 3-month extension of time until NOVEMBER 15, 2010.5 For calendar year <strong>2009</strong> , or other tax year beginning , and ending .If this tax year is for less than 12 months, check reason: Initial return Final return Change in accounting periodState in detail why you need the extensionTHE INFORMATION NECESSARY TO FILE A COMPLETE AND ACCURATE RETURN IS NOTYET AVAILABLE.If this application is for <strong>Form</strong> <strong>990</strong>-BL, <strong>990</strong>-<strong>PF</strong>, <strong>990</strong>-T, 4720, or 6069, enter the tentative tax, less anynonrefundable credits. See instructions.If this application is for <strong>Form</strong> <strong>990</strong>-<strong>PF</strong>, <strong>990</strong>-T, 4720, or 6069, enter any refundable credits and estimatedtax payments made. Include any prior year overpayment allowed as a credit and any amount paidpreviously with <strong>Form</strong> 8868.3,680.11,803.0.<strong>Form</strong> 8868 (Rev. 4-<strong>2009</strong>)92383205-26-093216421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1

Caution: <strong>Form</strong>s printed from within Adobe Acrobat products may not meet IRS or state taxing agencyspecifications. When using Acrobat 5.x products, uncheck the "Shrink oversized pages to paper size" anduncheck the "Expand small pages to paper size" options, in the Adobe "Print" dialog. When using Acrobat6.x and later products versions, select "None" in the "Page Scaling" selection box in the Adobe "Print" dialog.STATE COPY

TAX RETURN FILING INSTRUCTIONSILLINOIS FORM AG<strong>990</strong>-ILFOR THE YEAR ENDING~~~~~~~~~~~~~~~~~DECEMBER 31, <strong>2009</strong>Prepared forPrepared byAmount dueor refundMake checkpayable toMail tax returnand check (ifapplicable) to<strong>Return</strong> must bemailed onor beforeSpecialInstructionsTELLABS FOUNDATION1415 WEST DIEHL ROAD NO. MS 10NAPERVILLE, IL 60563BLACKMAN KALLICK, LLP10 S. RIVERSIDE PLAZA, 9TH FLOORCHICAGO, ILLINOIS 60606NO PAYMENT REQUIREDNOT APPLICABLEOFFICE OF THE ATTORNEY GENERALCHARITABLE TRUST BUREAU100 WEST RANDOLPH ST., 11TH FLOORCHICAGO, IL 60601-3175PLEASE MAIL AS SOON AS POSSIBLE.FORM AG<strong>990</strong>-IL SHOULD BE SIGNED AND DATED BY THE REQUIREDINDIVIDUAL(S).90094105-20-09

IF THE ANSWER TO ANY OF THE FOLLOWING IS YES, ATTACH A DETAILED EXPLANATION:YESNO1.WAS THE ORGANIZATION THE SUBJECT OF ANY COURT ACTION, FINE, PENALTY OR JUDGMENT? ~~~~~~~~~~~~~~~~ 1.X2.HAS THE ORGANIZATION OR A CURRENT DIRECTOR, TRUSTEE, OFFICER OR EMPLOYEE THEREOF, EVER BEEN CONVICTED BY ANYCOURT OF ANY MISDEMEANOR INVOLVING THE MISUSE OR MISAPPROPRIATION OF FUNDS OR ANY FELONY? ~~~~~~~~~~2.X3.DID THE ORGANIZATION MAKE A GRANT AWARD OR CONTRIBUTION TO ANY ORGANIZATION IN WHICH ANY OF ITS OFFICERS,DIRECTORS OR TRUSTEES OWNS AN INTEREST; OR WAS IT A PARTY TO ANY TRANSACTION IN WHICH ANY OF ITS OFFICERS,DIRECTORS OR TRUSTEES HAS A MATERIAL FINANCIAL INTEREST; OR DID ANY OFFICER, DIRECTOR OR TRUSTEE RECEIVEANYTHING OF VALUE NOT REPORTED AS COMPENSATION? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~3.X4.HAS THE ORGANIZATION INVESTED IN ANY CORPORATE STOCK IN WHICH ANY OFFICER, DIRECTOR OR TRUSTEE OWNS MORETHAN 10% OF THE OUTSTANDING SHARES? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~4.X5.IS ANY PROPERTY OF THE ORGANIZATION HELD IN THE NAME OF OR COMMINGLED WITH THE PROPERTY OF ANY OTHER PERSONOR ORGANIZATION? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~5.X6.DID THE ORGANIZATION USE THE SERVICES OF A PROFESSIONAL FUNDRAISER? (ATTACH FORM IFC)~~~~~~~~~~~~~~~6.X7a.DID THE ORGANIZATION ALLOCATE THE COST OF ANY SOLICITATION, MAILING, ADVERTISEMENT OR LITERATURE COSTSBETWEEN PROGRAM SERVICE AND FUNDRAISING EXPENSES? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~7.X7b.IF "YES", ENTER (i) THE AGGREGATE AMOUNT OF THESE JOINT COSTS $; (ii) THE AMOUNTALLOCATED TO PROGRAM SERVICES $; (iii) THE AMOUNT ALLOCATED TO MANAGEMENT ANDGENERAL $; AND (iv) THE AMOUNT ALLOCATED TO FUNDRAISING $8.DID THE ORGANIZATION EXPEND ITS RESTRICTED FUNDS FOR PURPOSES OTHER THAN RESTRICTED PURPOSES?~~~~~~~~~8.X9.HAS THE ORGANIZATION EVER BEEN REFUSED REGISTRATION OR HAD ITS REGISTRATION OR TAX EXEMPTION SUSPENDED ORREVOKED BY ANY GOVERNMENTAL AGENCY? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~9.X10.WAS THERE OR DO YOU HAVE ANY KNOWLEDGE OF ANY KICKBACK, BRIBE, OR ANY THEFT, DEFALCATION, MISAPPROPRIATION,COMMINGLING OR MISUSE OF ORGANIZATIONAL FUNDS? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~10.X11.LIST THE NAME AND ADDRESS OF THE FINANCIAL INSTITUTIONS WHERE THE ORGANIZATION MAINTAINS ITSTHREE LARGEST ACCOUNTS:MERRILL LYNCH WEALTH MANAGEMENT; ATTN JOHN SCHMITT & ROBERT ZENDER225 WEST WACKER, SUITE 1400CHICAGO, IL 6060612.NAME AND TELEPHONE NUMBER OF CONTACT PERSON: MEREDITH HILT (630)-798-2506ALL ATTACHMENTS MUST ACCOMPANY THIS REPORT - SEE INSTRUCTIONSUNDER PENALTY OF PERJURY, I (WE) THE UNDERSIGNED DECLARE AND CERTIFY THAT I (WE) HAVE EXAMINED THIS ANNUAL REPORT AND THE ATTACHEDDOCUMENTS, INCLUDING ALL THE SCHEDULES AND STATEMENTS AND THE FACTS THEREIN STATED ARE TRUE AND COMPLETE AND FILED WITH THEILLINOIS ATTORNEY GENERAL FOR THE PURPOSE OF HAVING THE PEOPLE OF THE STATE OF ILLINOIS RELY THEREUPON. I HEREBY FURTHER AUTHORIZE ANDAGREE TO SUBMIT MYSELF AND THE REGISTRANT HEREBY TO THE JURISDICTION OF THE STATE OF ILLINOIS.BE SURE TO INCLUDE ALL FEES DUE:1.) REPORTS ARE DUE WITHIN SIXMONTHS OF YOUR FISCAL YEAR END.2.) FOR FEES DUE SEE INSTRUCTIONS.3.) REPORTS THAT ARE LATE ORINCOMPLETE ARE SUBJECT TO A$100.00 PENALTY.PRESIDENT or TRUSTEE (PRINT NAME)SIGNATURE DATETREASURER or TRUSTEE (PRINT NAME)SIGNATURE DATEDAVID LOWENTHAL99810104-24-09 PREPARER (PRINT NAME)SIGNATURE DATE

<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>) TELLABS FOUNDATION 36-4037547 Page 3Part IV Capital Gains and Losses for <strong>Tax</strong> on Investment Income(a) List and describe the kind(s) of property sold (e.g., real estate,(b) How acquired (c) Date acquired (d) Date soldP - Purchase2-story brick warehouse; or common stock, 200 shs. MLC Co.)D - Donation(mo., day, yr.) (mo., day, yr.)1abcdeabcdeabcdeSEE ATTACHED STATEMENT(e) Gross sales price(f) Depreciation allowed(g) Cost or other basis(h) Gain or (loss)(or allowable)plus expense of sale(e) plus (f) minus (g)28,338,347. 28,670,184. Complete only for assets showing gain in column (h) and owned by the foundation on 12/31/69 (l) Gains (Col. (h) gain minus(j) Adjusted basis(k) Excess of col. (i)col. (k), but not less than -0-) or(i) F.M.V. as of 12/31/69Losses (from col. (h))as of 12/31/69over col. (j), if anyIf gain, also enter in Part I, line 72 Capital gain net income or (net capital loss) If (loss), enter -0- in Part I, line 7 ~~~~~~ 23 Net short-term capital gain or (loss) as defined in sections 1222(5) and (6):If gain, also enter in Part I, line 8, column (c).If (loss), enter -0- in Part I, line 8 3Part V Qualification Under Section 4940(e) for Reduced <strong>Tax</strong> on Net Investment Income(For optional use by domestic private foundations subject to the section 4940(a) tax on net investment income.)If section 4940(d)(2) applies, leave this part blank.Was the foundation liable for the section 4942 tax on the distributable amount of any year in the base period?If "Yes," the foundation does not qualify under section 4940(e). Do not complete this part.1 Enter the appropriate amount in each column for each year; see instructions before making any entries.(a) (b) (c)Base period yearsCalendar year (or tax year beginning in) Adjusted qualifying distributions Net value of noncharitable-use assets20082007200620052004rqspmopmoN/A~~~~~~~~~~~~~~~~ Yes X No(d)Distribution ratio(col. (b) divided by col. (c))984,043. 25,376,426. .0387781,714,480. 30,026,037. .0571001,518,123. 28,432,467. .0533941,260,458. 27,213,782. .0463171,314,777. 25,943,277. .05067923Total of line 1, column (d) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 2Average distribution ratio for the 5-year base period - divide the total on line 2 by 5, or by the number of yearsthe foundation has been in existence if less than 5 years~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~3.246268.0492544Enter the net value of noncharitable-use assets for <strong>2009</strong> from Part X, line 5~~~~~~~~~~~~~~~~~~~~~423,405,466.5Multiply line 4 by line 3 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~51,152,813.6Enter 1% of net investment income (1% of Part I, line 27b) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~64,945.7Add lines 5 and 6 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~71,157,758.8Enter qualifying distributions from Part XII, line 4~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~81,181,902.If line 8 is equal to or greater than line 7, check the box in Part VI, line 1b, and complete that part using a 1% tax rate.See the Part VI instructions.923521 02-02-10<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>)616421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1

<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>) TELLABS FOUNDATION 36-4037547 Page 4Part VI Excise <strong>Tax</strong> Based on Investment Income (Section 4940(a), 4940(b), 4940(e), or 4948 - see instructions)1aExempt operating foundations described in section 4940(d)(2), check here | and enter "N/A" on line 1.Date of ruling or determination letter:(attach copy of letter if necessary-see instructions)b Domestic foundations that meet the section 4940(e) requirements in Part V, check here | X and enter 1%14,945.2345678c All other domestic foundations enter 2% of line 27b. Exempt foreign organizations enter 4% of Part I, line 12, col. (b)<strong>Tax</strong> based on investment income. Subtract line 4 from line 3. If zero or less, enter -0- ~~~~~~~~~~~~~~~~~a <strong>2009</strong> estimated tax payments and 2008 overpayment credited to <strong>2009</strong> ~~~~~~~~b Exempt foreign organizations - tax withheld at source ~~~~~~~~~~~~~~~~c <strong>Tax</strong> paid with application for extension of time to file (<strong>Form</strong> 8868) ~~~~~~~~~~~d Backup withholding erroneously withheld ~~~~~~~~~~~~~~~~~~~~~Total credits and payments. Add lines 6a through 6d ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Enter any penalty for underpayment of estimated tax. Check here X if <strong>Form</strong> 2220 is attached ~~~~~~~~~~~~~9 <strong>Tax</strong> due. If the total of lines 5 and 8 is more than line 7, enter amount owed ~~~~~~~~~~~~~~~~~~~~ | 910 Overpayment. If line 7 is more than the total of lines 5 and 8, enter the amount overpaid ~~~~~~~~~~~~~~ | 106,858.11 Enter the amount of line 10 to be: Credited to 2010 estimated tax |6,858. Refunded | 110.Part VII-A Statements Regarding Activities1aDuring the tax year, did the foundation attempt to influence any national, state, or local legislation or did it participate or intervene inYes Noany political campaign? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 1a Xb Did it spend more than $100 during the year (either directly or indirectly) for political purposes (see instructions for definition)? ~~~~~~ 1b XIf the answer is "Yes" to 1a or 1b, attach a detailed description of the activities and copies of any materials published ordistributed by the foundation in connection with the activities.c Did the foundation file <strong>Form</strong> 1120-POL for this year? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 1c X23d Enter the amount (if any) of tax on political expenditures (section 4955) imposed during the year:(1) On the foundation. | $ 0. (2) On foundation managers. | $0.e Enter the reimbursement (if any) paid by the foundation during the year for political expenditure tax imposed on foundationmanagers. | $0.4aDid the foundation have unrelated business gross income of $1,000 or more during the year? ~~~~~~~~~~~~~~~~~~~~~b If "Yes," has it filed a tax return on <strong>Form</strong> <strong>990</strong>-T for this year? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ N/A567of Part I, line 27b~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<strong>Tax</strong> under section 511 (domestic section 4947(a)(1) trusts and taxable foundations only. Others enter -0-) ~~~~~~~~~Add lines 1 and 2~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Subtitle A (income) tax (domestic section 4947(a)(1) trusts and taxable foundations only. Others enter -0-) ~~~~~~~~Credits/Payments:Has the foundation engaged in any activities that have not previously been reported to the IRS? ~~~~~~~~~~~~~~~~~~~~If "Yes," attach a detailed description of the activities.Has the foundation made any changes, not previously reported to the IRS, in its governing instrument, articles of incorporation, orbylaws, or other similar instruments? If "Yes," attach a conformed copy of the changes ~~~~~~~~~~~~~~~~~~~~~Was there a liquidation, termination, dissolution, or substantial contraction during the year? ~~~~~~~~~~~~~~~~~~~~~~If "Yes," attach the statement required by General Instruction T.Are the requirements of section 508(e) (relating to sections 4941 through 4945) satisfied either:¥ By language in the governing instrument, or¥ By state legislation that effectively amends the governing instrument so that no mandatory directions that conflict with the state lawremain in the governing instrument? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the foundation have at least $5,000 in assets at any time during the year? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~If "Yes," complete Part II, col. (c), and Part XV.8aEnter the states to which the foundation reports or with which it is registered (see instructions)ILb If the answer is "Yes" to line 7, has the foundation furnished a copy of <strong>Form</strong> <strong>990</strong>-<strong>PF</strong> to the Attorney General (or designate)of each state as required by General Instruction G? If "No," attach explanation ~~~~~~~~~~~~~~~~~~~~~~~~~9 Is the foundation claiming status as a private operating foundation within the meaning of section 4942(j)(3) or 4942(j)(5) for calendaryear <strong>2009</strong> or the taxable year beginning in <strong>2009</strong> (see instructions for Part XIV)? If "Yes," complete Part XIV~~~~~~~~~~~~~~9 X10 Did any persons become substantial contributors during the tax year? If "Yes," attach a schedule listing their names and addresses 10 X<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>)6a6b6c6d9pnmno11,803.234578234a4b5678b0.4,945.0.4,945.11,803.XXXXXXX92353102-02-10716421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1

<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>) TELLABS FOUNDATION 36-4037547Part VII-A Statements Regarding Activities (continued)1112131415 Section 4947(a)(1) nonexempt charitable trusts filing <strong>Form</strong> <strong>990</strong>-<strong>PF</strong> in lieu of <strong>Form</strong> 1041 - Check here ~~~~~~~~~~~~~~~~~~~~~~~ |and enter the amount of tax-exempt interest received or accrued during the year | 15 N/APart VII-B Statements Regarding Activities for Which <strong>Form</strong> 4720 May Be RequiredFile <strong>Form</strong> 4720 if any item is checked in the "Yes" column, unless an exception applies.Yes No1a During the year did the foundation (either directly or indirectly):(1) Engage in the sale or exchange, or leasing of property with a disqualified person? ~~~~~~~~~~~~~~ Yes X No2(2)(3)(4)(5)(6)Agree to pay money or property to a government official? ( Exception. Check "No"b If any answer is "Yes" to 1a(1)-(6), did any of the acts fail to qualify under the exceptions described in Regulationsc Did the foundation engage in a prior year in any of the acts described in 1a, other than excepted acts, that were not correcteda At the end of tax year <strong>2009</strong>, did the foundation have any undistributed income (lines 6d and 6e, Part XIII) for tax year(s) beginningb Are there any years listed in 2a for which the foundation is not applying the provisions of section 4942(a)(2) (relating to incorrectc If the provisions of section 4942(a)(2) are being applied to any of the years listed in 2a, list the years here.3aAt any time during the year, did the foundation, directly or indirectly, own a controlled entity within the meaning ofsection 512(b)(13)? If "Yes," attach schedule (see instructions)~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the foundation acquire a direct or indirect interest in any applicable insurance contract beforeAugust 17, 2008? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 12 XDid the foundation comply with the public inspection requirements for its annual returns and exemption application? ~~~~~~~~~~~ 13 XWebsite address | WWW.TELLABS.COM/ABOUT/FOUNDATION.SHTMLThe books are in care of | MEREDITH HILT Telephone no. | (630)-798-2506Located at | 1415 WEST DIEHL ROAD NO. MS 10, NAPERVILLE, IL ZIP+4 | 60563Borrow money from, lend money to, or otherwise extend credit to (or accept it from)a disqualified person?~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Furnish goods, services, or facilities to (or accept them from) a disqualified person?Pay compensation to, or pay or reimburse the expenses of, a disqualified person?Transfer any income or assets to a disqualified person (or make any of either available~~~~~~~~~~~~~~~~~~~~~~~~~~~for the benefit or use of a disqualified person)?~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~if the foundation agreed to make a grant to or to employ the official for a period aftertermination of government service, if terminating within 90 days.) ~~~~~~~~~~~~~~~~~~~~~section 53.4941(d)-3 or in a current notice regarding disaster assistance (see page 20 of the instructions)? ~~~~~~~~~~~~~~~Organizations relying on a current notice regarding disaster assistance check here ~~~~~~~~~~~~~~~~~~~~~~|before the first day of the tax year beginning in <strong>2009</strong>?~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<strong>Tax</strong>es on failure to distribute income (section 4942) (does not apply for years the foundation was a private operating foundationdefined in section 4942(j)(3) or 4942(j)(5)):before <strong>2009</strong>? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~If "Yes," list the years | , , ,valuation of assets) to the year’s undistributed income? (If applying section 4942(a)(2) to all years listed, answer "No" and attachstatement - see instructions.) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ N/A| , , ,Did the foundation hold more than a 2% direct or indirect interest in any business enterprise at any timeduring the year? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~b If "Yes," did it have excess business holdings in <strong>2009</strong> as a result of (1) any purchase by the foundation or disqualified persons afterMay 26, 1969; (2) the lapse of the 5-year period (or longer period approved by the Commissioner under section 4943(c)(7)) to disposeof holdings acquired by gift or bequest; or (3) the lapse of the 10-, 15-, or 20-year first phase holding period? (Use Schedule C,<strong>Form</strong> 4720, to determine if the foundation had excess business holdings in <strong>2009</strong>.) ~~~~~~~~~~~~~~~~~~~~~~ N/A4a Did the foundation invest during the year any amount in a manner that would jeopardize its charitable purposes? ~~~~~~~~~~~~~b Did the foundation make any investment in a prior year (but after December 31, 1969) that could jeopardize its charitable purpose thathad not been removed from jeopardy before the first day of the tax year beginning in <strong>2009</strong>? 4b X<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>)XYesYesYesYesYesYesYesXXXXXXNoNoNoNoNoNoNo111b1c2b3b4aPage 5XXXX92354102-02-10816421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1

<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>) TELLABS FOUNDATION 36-4037547 Page 7Part VIIIInformation About Officers, Directors, Trustees, <strong>Foundation</strong> Managers, HighlyPaid Employees, and Contractors (continued)3 Five highest-paid independent contractors for professional services. If none, enter "NONE."(a) Name and address of each person paid more than $50,000 (b) Type of service(c) CompensationNONETotal number of others receiving over $50,000 for professional servicesPart IX-A Summary of Direct Charitable ActivitiesList the foundation’s four largest direct charitable activities during the tax year. Include relevant statistical information such as thenumber of organizations and other beneficiaries served, conferences convened, research papers produced, etc.1 N/A9Expenses00.234Part IX-B Summary of Program-Related InvestmentsDescribe the two largest program-related investments made by the foundation during the tax year on lines 1 and 2.1 N/AAmount23All other program-related investments. See instructions.Total. Add lines 1 through 3J0.<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>)92356102-02-101016421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1

<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>) TELLABS FOUNDATION 36-4037547Part X Minimum Investment <strong>Return</strong> (All domestic foundations must complete this part. Foreign foundations, see instructions.)Page 81 Fair market value of assets not used (or held for use) directly in carrying out charitable, etc., purposes:a Average monthly fair market value of securities ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 1ab Average of monthly cash balances ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 1bcdeFair market value of all other assets ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Total (add lines 1a, b, and c) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Reduction claimed for blockage or other factors reported on lines 1a and1c1d1c (attach detailed explanation) ~~~~~~~~~~~~~~~~~~~~~~ 1e0.23Acquisition indebtedness applicable to line 1 assets ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Subtract line 2 from line 1d~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~234 Cash deemed held for charitable activities. Enter 1 1/2% of line 3 (for greater amount, see instructions) ~~~~~~~~ 45 Net value of noncharitable-use assets. Subtract line 4 from line 3. Enter here and on Part V, line 4 ~~~~~~~~~~ 56 Minimum investment return. Enter 5% of line 5 6Part XIDistributable Amount (see instructions) (Section 4942(j)(3) and (j)(5) private operating foundations and certainforeign organizations check here and do not complete this part.)91 Minimum investment return from Part X, line 6 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~2a<strong>Tax</strong> on investment income for <strong>2009</strong> from Part VI, line 5 ~~~~~~~~~~~ 2a4,945.b Income tax for <strong>2009</strong>. (This does not include the tax from Part VI.) ~~~~~~~ 2bc Add lines 2a and 2b ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~3 Distributable amount before adjustments. Subtract line 2c from line 1 ~~~~~~~~~~~~~~~~~~~~~~~45Recoveries of amounts treated as qualifying distributions~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Add lines 3 and 4 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~6 Deduction from distributable amount (see instructions) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~7 Distributable amount as adjusted. Subtract line 6 from line 5. Enter here and on Part XIII, line 1 Part XII Qualifying Distributions (see instructions)12c3456722,249,906.1,511,988.23,761,894.0.23,761,894.356,428.23,405,466.1,170,273.1,170,273.4,945.1,165,328.0.1,165,328.0.1,165,328.1ab23ab456Amounts paid (including administrative expenses) to accomplish charitable, etc., purposes:Expenses, contributions, gifts, etc. - total from Part I, column (d), line 26 ~~~~~~~~~~~~~~~~~~~~~~Program-related investments - total from Part IX-BAmounts paid to acquire assets used (or held for use) directly in carrying out charitable, etc., purposes~~~~~~~~~Amounts set aside for specific charitable projects that satisfy the:Qualifying distributions. Add lines 1a through 3b. Enter here and on Part V, line 8, and Part XIII, line 4~~~~~~~~~Adjusted qualifying distributions. Subtract line 5 from line 4 ~~~~~~~~~~~~~~~~~~~~~~~~~~~Note.~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Suitability test (prior IRS approval required) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Cash distribution test (attach the required schedule) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<strong>Foundation</strong>s that qualify under section 4940(e) for the reduced rate of tax on net investmentincome. Enter 1% of Part I, line 27b ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~The amount on line 6 will be used in Part V, column (b), in subsequent years when calculating whether the foundation qualifies for the section4940(e) reduction of tax in those years.<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>)1a1b23a3b4561,181,902.0.1,181,902.4,945.1,176,957.92357102-02-101116421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1

<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>)TELLABS FOUNDATION 36-4037547Page 9Part XIIIUndistributed Income (see instructions)12 Undistributed income, if any, as of the end of <strong>2009</strong>:34a Enter amount for 2008 only ~~~~~~~b Total for prior years:aFrom 2004bFrom 2005c From 2006dFrom 2007eFrom 2008f Total of lines 3a through e ~~~~~~~~aApplied to 2008, but not more than line 2a ~bApplied to undistributed income of priorc Treated as distributions out of corpuseRemaining amount distributed out of corpus5 Excess distributions carryover applied to <strong>2009</strong> ~~(If an amount appears in column (d), the same amountmust be shown in column (a).)6 Enter the net total of each column asindicated below:78910a Corpus. Add lines 3f, 4c, and 4e. Subtract line 5~~bPrior years’ undistributed income. Subtractc Enter the amount of prior years’undistributed income for which a notice ofdeficiency has been issued, or on whichthe section 4942(a) tax has been previouslyassessed ~~~~~~~~~~~~~~~dSubtract line 6c from line 6b. <strong>Tax</strong>ableeUndistributed income for 2008. Subtract linef Undistributed income for <strong>2009</strong>. Subtract92358102-02-10Distributable amount for <strong>2009</strong> from Part XI,line 7 ~~~~~~~~~~~~~~~~~, ,Excess distributions carryover, if any, to <strong>2009</strong>:~~~~~~~~~~~~~~~Qualifying distributions for <strong>2009</strong> fromPart XII, line 4: $ 1,181,902.9years (Election required - see instructions) ~(Election required - see instructions)Excess distributions carryover to 2010.aExcess from 2005~bExcess from 2006~c Excess from 2007~dExcess from 2008~eExcess from <strong>2009</strong>~~~dApplied to <strong>2009</strong> distributable amount ~~~line 4b from line 2b ~~~~~~~~~~~amount - see instructions ~~~~~~~~4a from line 2a. <strong>Tax</strong>able amount - see instr.~lines 4d and 5 from line 1. This amount mustbe distributed in 2010 ~~~~~~~~~~Amounts treated as distributions out ofcorpus to satisfy requirements imposed bysection 170(b)(1)(F) or 4942(g)(3) ~~~~Excess distributions carryover from 2004not applied on line 5 or line 7 ~~~~~~~Subtract lines 7 and 8 from line 6a ~~~~Analysis of line 9:(a) (b) (c) (d)Corpus Years prior to 2008 2008 <strong>2009</strong>0.0.0.1,158,245.1,158,245.1,165,328.0.23,657.0.0. 0.0.0.0.0.0.0.0.0.1,141,671.<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>)1216421110 758432 TELLFOU <strong>2009</strong>.04050 TELLABS FOUNDATION TELLFOU1