Q2 2010 - Automotive Industries

Q2 2010 - Automotive Industries

Q2 2010 - Automotive Industries

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

AUTOMOTIVE INDUSTRIES (ISSN 1099-4130)<br />

Volume 189 Number 2<br />

Published Quarterly by <strong>Automotive</strong> <strong>Industries</strong> Ltd • Issue date: <strong>Q2</strong> <strong>2010</strong><br />

3859 Shannon Run, Versailles, KY 40383.<br />

Subscription rates are $88 North America, Rest of the World (Airmail) $168<br />

Periodical postage paid at: Versailles, KY 40383 and at additional mailing offices<br />

Copyright AUTOMOTIVE INDUSTRIES LTD<br />

Canadian Publication Mail Agreement # 41301520.<br />

Return Undeliverable Canadian Addresses to:<br />

P.O. Box 122, Niagara Falls, ON, L2E 6S8, Canada<br />

POSTMASTER: send address changes to <strong>Automotive</strong> <strong>Industries</strong><br />

PO Box 1510, Versailles, KY 40383, USA<br />

<strong>Automotive</strong> <strong>Industries</strong> is published by:<br />

<strong>Automotive</strong> <strong>Industries</strong> Ltd.<br />

Publisher: John Larkin<br />

jal@autoindustry.us<br />

+1 313 262 5702 (IP 5101888888)<br />

Editor: Ed Richardson<br />

edrich@siyathetha.com<br />

+27 (0) 41 582 3750<br />

Editing: Michelle Hardy-Berrington<br />

michelle@siyathetha.com<br />

+27 (0) 41 582 3750<br />

Circulation Management: Dave Sweeney<br />

support@andscirculation.com<br />

+1 859 879 8420<br />

Finance: Ben Adler FCA<br />

ben@autoindustry.us<br />

+44 (0) 20 8458 7130<br />

Press Releases and Advertising Enquiries:<br />

STEVE BARCLAY Engineering & Design<br />

Steve.Barclay@autoindustry.us<br />

+91 9899 763 566 (IP 5101401832)<br />

+00 91 11 434 222 22 EXT 124<br />

NICK PALMEN Engineering & Design<br />

NickPalmen@autoindustry.us<br />

+44 (0) 20 8764 9696 (IP 5101401836)<br />

JAMES HILTON Shows<br />

jah@autoindustry.us<br />

+44 (0) 1142 811 014<br />

DAN THORNTON Engineering & Design<br />

djtinc@autoindustry.us<br />

+ 1 734 676 9135<br />

JON KNOX Fuels & Future Fuels<br />

J.Knox@autoindustry.us<br />

+34 (0) 690 276 463<br />

ALAN TRAN Vehicle Systems - Interior<br />

AlanTran@autoindustry.us<br />

+ 44 20 3129 8361 (IP 5101401831)<br />

ROB WHITE Vehicle Systems<br />

advertising@autoindustry.us<br />

+44 (0) 20 8202 3770 (IP 5101401833)<br />

RON CHARLES Innovation & Sustainable Development:<br />

RonCharles@autoindustry.us<br />

+44 (0) 79 303 84026<br />

CLINTON WRIGHT Environmental Technologies<br />

cew@autoindustry.us<br />

+44 (0) 7852 722 602<br />

JAY GEIMAN Engineering & Design<br />

jgeiman@autoindustry.us<br />

+1 313 262 5702<br />

MICHAEL STEWART Vehicle Systems - Electrical/Electronic<br />

MichaelStewart@autoindustry.us<br />

+44 (0) 7853 499 350<br />

MICHAEL FRANK Emerging Markets<br />

Michael.Frank@autoindustry.us<br />

+1 201 388 1911<br />

ELVIS PAYNE Head of Sports Division<br />

elvispayne@autoindustry.us<br />

+ 44 7824 975 718<br />

Layout: GIA: auto@giastudio.co.za<br />

Subscriptions: orders@autoindustry.us<br />

Renew Subscriptions from<br />

“SUBSCRIBE/RENEW” link at<br />

www.autoindustry.us • www.ai-online.com<br />

PRINTED IN THE USA<br />

BPA Worldwide Member<br />

contents<br />

contents<br />

Editorial – Acting globally, thinking locally .................................................................................. 8<br />

Anx – Secure international connectivity driving efficiencies .......................................................... 10<br />

DSN – Integrating the whole value chain .................................................................................... 14<br />

Remy – Over a billion miles on electric power ............................................................................. 18<br />

Norma – Connecting technologies ............................................................................................. 20<br />

Saint-Gobain Sekurit – Making drivers more comfortable ........................................................... 22<br />

Ford Powertrain – Ford revs up global engine technology ........................................................... 24<br />

Ford NVH – The power of sound ................................................................................................ 28<br />

Brüel & Kjær – Virtual Sound ...................................................................................................... 30<br />

Carl Zeiss – Metrology speeds up to meet consumer demands .................................................. 32<br />

ZygoLOT – Latest developments in surface metrology ............................................................... 34<br />

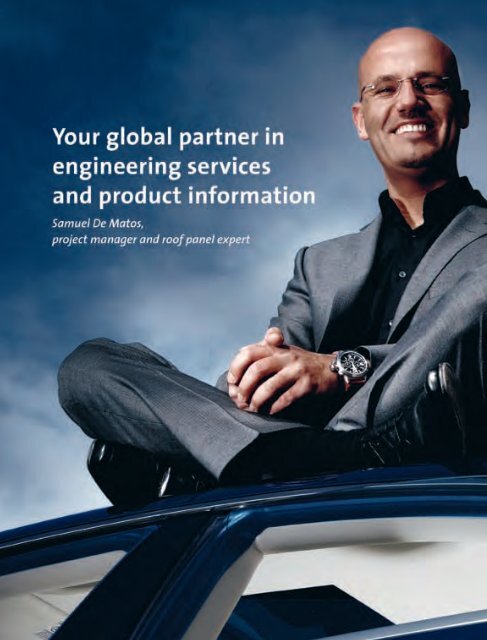

Semcon – Smarter engineering to reduce time to market ........................................................... 36<br />

Aristo – Breakthroughs in catalytic design and production .......................................................... 40<br />

Alantum – Saving costs by turning platinum alloys into foam ..................................................... 42<br />

L&T IES – Imagineering – engineering with imagination ............................................................... 44<br />

MOST Cooperation – MOST goes safety critical ......................................................................... 46<br />

Ruetz System Solutions – Automation speeds up MOST testing ................................................ 50<br />

RELNETyX – Helping newcomers power up MOST .................................................................... 52<br />

Ontorix – MOST on test ............................................................................................................. 54<br />

New driver for AUTOSAR ........................................................................................................... 56<br />

MiX Telematics – Monitoring freight real-time .............................................................................. 58<br />

Wyless – Managing a global wireless network ............................................................................ 60<br />

SVOX – Multilingual cars ............................................................................................................ 64<br />

Chalmers University – No vehicle is an island ............................................................................. 66<br />

CODA – US-Chinese partnership .............................................................................................. 67<br />

Novacast – New die-making technology reduces lead times ...................................................... 68<br />

EFD Induction – Induction heating streamlines production processes ......................................... 70<br />

Adcole – Greener technologies = tighter tolerances .................................................................... 72<br />

Russo & Steele – “Lifestyle” auction for car enthusiasts .............................................................. 76<br />

CS International – 6 Sigma – the bottom line .............................................................................. 80<br />

Reed Exhibitions – Joining aluminum and composite technologies ............................................. 84<br />

India accelerates into world markets .......................................................................................... 86<br />

Tunisia putting itself on the map ................................................................................................. 87<br />

CBI – providing a roadmap into the EU auto market ................................................................... 88<br />

Automechanika – New “Hall 11” for Automechanika Frankfurt .................................................... 90<br />

Audacon – Focus on implementation and use at Automechanika Frankfurt ................................ 92<br />

Federal Mogul – Evolution of brands .......................................................................................... 94<br />

LEGAL DOCUMENT • STATEMENT OF OWNERSHIP, MANAGEMENT AND CIRCULATION • UNITED STATES POSTAL SERVICE<br />

1. Publication Title: <strong>Automotive</strong> <strong>Industries</strong> • 2. Publication number: 1099-4130 • 3. Filing Date: 10-5-2009 • 4. Issue Frequency: Quarterly<br />

5. Number of issues published annually: 4 • 6. Annual Subscription Price: $88.00 • 7. Address: 3859 Shannon Run, Versailles, KY 40383<br />

8. Headquaters address: <strong>Automotive</strong> <strong>Industries</strong> Ltd, 3rd floor Roman House,296 Goldens Green RD London, England, NW119PY, United Kingdom<br />

9. Publisher: John Larkin, <strong>Automotive</strong> <strong>Industries</strong> Ltd, 3rd floor Roman House, 296 Goldens Green RD London, England, NW119PY, United Kingdom<br />

Editor: Ed Richardson, <strong>Automotive</strong> <strong>Industries</strong> Ltd, 3rd floor Roman House, 296 Goldens Green RD London, England, NW119PY, United Kingdom<br />

Mgr Editor: John Larkin, <strong>Automotive</strong> <strong>Industries</strong> Ltd, 3rd floor Roman House, 296 Goldens Green RD London, England, NW119PY, United Kingdom<br />

10. Owner: John Larkin, <strong>Automotive</strong> <strong>Industries</strong> Ltd, 3rd floor Roman House, 296 Goldens Green RD London, England, NW119PY, United Kingdom<br />

11. Known Bondholders: None • 12. Blank • 13. Publication: <strong>Automotive</strong> <strong>Industries</strong> • 14. Issue Date for data: 2nd Qtr 2009<br />

15. Extent and Nature of Circulation Ave copies each issue No. copies Issue Published<br />

During preceeding 12 months nearest to filing Date<br />

a. Total Number of copies 34485 24400<br />

b. Legimate paid and/or requested<br />

(By mail and outside mail)<br />

b1. Individual paid/requested mail Subs as<br />

Stated on PS Form 3541 13852 11907<br />

b2. Copies requested by Employers for Distribution<br />

To Employees Name/Position sataed on PS3541<br />

b3. Sales through Delers/Carriers Outside USPS<br />

b4. Requested copies other USPS mail classes 54 163<br />

c. TOTAL PAID/REQUESTED Circulation 13906 12070<br />

d. Nonrequested Distribution<br />

d1. Nonrequested copies stated on PS3541 12907 10399<br />

d2. Sales through Delers/Carriers Outside USPS<br />

d3. Requested copies other USPS mail classes<br />

e. TOTAL NONREQUESTED DISTRIBUTION 12907 10399<br />

f. TOTAL DISTRIBUTION 26813 22469<br />

g. Copies not Distributed 7622 1931<br />

h. TOTAL 34485 24400<br />

i. Percent Paid/requested circulation 51.9% 53.7%<br />

I certify that all the information furnished on this form is true and complete. AUTOMOTIVE INDUSTRIES • John Larkin, Publisher<br />

4 to read full version of AI stories go to www.ai-online.com

6 to read full version of AI stories go to www.ai-online.com

intro<br />

This edition of <strong>Automotive</strong> <strong>Industries</strong> looks at how suppliers<br />

are helping OEMs meet the often conflicting demands of<br />

consumers and legislators for greener vehicles, lower costs<br />

of ownership and more driving fun.<br />

MOST (Media Oriented Systems Transport) demonstrates what<br />

happens when industry leaders work together on non-competitive<br />

systems. What started as finding ways to allow different media<br />

devices to talk to each other is now powerful and reliable enough<br />

for safety-critical applications.<br />

Pooled resources have kept costs under control,<br />

while speeding up time to market.<br />

MOST is now being touted for use outside<br />

of the auto sector. The now rusty firewall<br />

between automotive technology and the<br />

rest is also being cut through by electric<br />

Editor, Ed Richardson<br />

Acting globally,<br />

thinking locally<br />

vehicle technology, which has seen new<br />

suppliers and manufacturers enter the<br />

field. Tesla is a good example. It is the first<br />

US auto assembler to go public and list in half<br />

a century – using technology which did not exist<br />

10 years ago, or was developed for non-automotive<br />

applications. And Tesla was born in Silicon Valley, not<br />

Detroit, Wolfsburg or Tokyo. Other breakthroughs are being made<br />

thanks to partnerships between US and Chinese companies –<br />

adding another new dynamic to the world auto sector.<br />

Traditional manufacturers of fossil-fuel powered vehicles are<br />

catching up fast – in part because they have opened their doors<br />

to new technologies, suppliers and ideas. As we see in the articles<br />

on Ford and Mercedes in this edition, going global poses some interesting<br />

challenges. Their manufacturing plants around the world<br />

need to all have the same level of support, and preferably the same<br />

suppliers delivering components that are of a uniform quality just in<br />

time to the production line.<br />

Nice idea, but the reality is that consumers differ from market<br />

to market, there is no uniform global legislation on emissions,<br />

safety, or even ownership of the factories making the parts. To<br />

make things even more interesting, new models powered by ever<br />

“greener” engines need to be introduced much quicker than before<br />

– and the pace is getting faster.<br />

Suppliers have responded by developing innovative tools and refining<br />

components. Now OEMs can find out what a vehicle will sound<br />

like inside - while it is still on the drawing board (or CAD<br />

program). Engineers are being helped to make their<br />

designs have both form and function, while reducing<br />

time to market.<br />

Part of the life-cycle, of course, is<br />

manufacturing. Here again, suppliers are<br />

working hard at helping OEMs become<br />

more efficient and drive down costs.<br />

Suppliers like Zeiss are helping drive<br />

up quality and productivity by putting<br />

laboratory-standard measuring equipment<br />

on the floor. Breakthroughs are<br />

also being made in the design of components,<br />

such as Aristo’s new catalytic<br />

converter technology, as well as manufacturing<br />

processes.<br />

All of which would be pretty pointless without<br />

customers. In this edition, we feature companies<br />

that help OEMs better understand their markets.<br />

We also see that the cars will remain wirelessly connected to<br />

their makers, while GSM technology helps track drivers and<br />

freight – and personal devices replace onboard electronics.<br />

Taking a holistic view on how we are going to keep people moving<br />

is Chalmers University, which is looking at ways of integrating<br />

public and personal transport, as well as planning how to<br />

power up fleets of electric vehicles.<br />

And if all of this sounds like hard work (which it is), there are<br />

few better ways to blow out the cobwebs and generally have fun<br />

than taking a muscle car through its paces. You’ll find yours at the<br />

Russo & Steele auction. AI<br />

AUTOMOTIVE INDUSTRIES and Rutgers, The State University of New Jersey, have put<br />

together a digital library of back issues of AI from the early 1900’s (high res and low res) of<br />

approximately 230,000 images of the print publication. This archive, which documents the<br />

birth of the auto industry to the present, is available to AI subscribers.<br />

Go to AI’s homepage www.ai.com.ai and click on the “AI Library” link or visit<br />

www.ai-online.com/100YearLibrary<br />

8 to read full version of AI stories go to www.ai-online.com

innovation<br />

Now, more than ever, the automotive industry depends on<br />

strategic collaboration between manufacturers and suppliers.<br />

In the late 1980s and the early 1990s, most vehicle<br />

design was done by and within OEMs. Collaboration was<br />

a challenge consisting of sharing product information between<br />

internal OEM locations across geographic boundaries<br />

and time zones.<br />

From a technology standpoint, OEMs were putting systems<br />

in place to facilitate simultaneous development and release of<br />

product information from each of the geographies in which they<br />

did business. That paradigm has shifted. Today,<br />

although the time-to-market has been reduced<br />

from 36 months to less than 24 months, more<br />

people are involved in the development of<br />

a vehicle than ever before. To complicate<br />

the matter, the majority of the “hands”<br />

Rich Stanbaugh, President and<br />

CEO of ANXeBusiness Corp.<br />

that touch the design of a vehicle and<br />

its components are outside the four walls<br />

of the company. All of the data needed<br />

to support Product Lifecycle Management<br />

(PLM) must be seamlessly shared between<br />

partners involved in a vehicle program. This<br />

means that intellectual property is continuously<br />

flowing between companies, geographies and time<br />

zones. After the release of the vehicle to manufacturing, partners<br />

must continue to exchange time critical information to coordinate<br />

orders, shipping and manage inventory levels.<br />

The key to enabling the highly interdependent relationships between<br />

OEMs and suppliers is the secure and reliable flow of information.<br />

The stakes are high. Even a brief disruption of eBusiness applications<br />

can impact the bottom line by millions of dollars each minute.<br />

The ANX Network was created by the automotive industry<br />

to solve the automotive collaboration challenge. In 1998, ANX<br />

became the network of choice for exchanging critical and<br />

confidential information within the North American automotive<br />

industry. With over 20 million transactions processed per year<br />

with zero data breaches and zero virus proliferations to the core<br />

network, the ANX was a resounding success.<br />

Over the past decade, the automotive industry has continued to<br />

globalize. In 2009 China became the largest producer of vehicles<br />

in the world. The number of automobile producers with factories<br />

Secure international<br />

connectivity driving<br />

efficiencies By: Steve Barclay<br />

in the United States has tripled since the 1980s to 15 in 2008.<br />

Vertical integration has decreased while the number of alliances and<br />

partnerships between firms in North America, Europe and the rest of<br />

the world continues to grow. Globalization has created new demands<br />

to securely exchange data amongst all of the participants, big and<br />

small, within the automotive value chain.<br />

During this same era, Public Internet connectivity has become<br />

ubiquitous. Data suggests that growth in Internet utilization is<br />

outstripping growth in capacity and that security threats continue<br />

to grow in quantity and sophistication. Cyber criminals stole more<br />

than $1 trillion of intellectual property last year and<br />

that trend continues to grow. Moreover, targeted<br />

cyber attacks such as distributed denial of<br />

service can severely disrupt business-tobusiness<br />

communications. Although<br />

new solutions, such as IPVPNs, have<br />

been developed that provide a level<br />

of security, CIOs have expressed<br />

concern over the rapidly evolving<br />

threat landscape and are viewing<br />

private cloud solutions such as ANX<br />

with renewed interest. Members of the<br />

ANX community exchange information<br />

using a secure, private infrastructure<br />

that’s not vulnerable to threats originating<br />

from the Public Internet. In a recent<br />

survey, over 95% of ANX network customers<br />

indicated they were satisfied with their service.<br />

Those same customers expressed strong interest<br />

in wanting to secure their information exchange with<br />

European partners using their ANX connection. This customer<br />

feedback and the trend toward greater supply chain globalization<br />

lead to the development of ANX 2.0.<br />

ANX 2.0 represents the evolution of the ANX network. Whereas<br />

the original ANX was used to establish secure, private, businessto-business<br />

connections between North American companies,<br />

ANX 2.0 adds the functionality of being an “on-ramp” to other<br />

services. The centerpiece of this enhanced functionality is the<br />

interconnection to the European Network Exchange (ENX). The<br />

ENX Association, governing the communications network and<br />

managed security service of the European automotive industry, has<br />

certified ANX as an ENX Certified Service Provider in record time,<br />

creating a solid foundation for the interconnection and cooperation<br />

with all other ENX CSPs in Europe. ANX and ENX customers can<br />

now establish private connections to more than 1,600 member<br />

companies located across North America, Europe and other parts<br />

of the world. These connections are covered by stringent service<br />

10 to read full version of AI stories go to www.ai-online.com

level agreements for availability, performance and repair that are<br />

unmatched by Public Internet solutions.<br />

“Our customers have told us that integration of the European<br />

and North American automotive communities is important and<br />

would benefit them. ANX and ENX have partnered to provide this<br />

global interconnection as a value-add to our existing customers<br />

at no additional cost. We believe that merging the ANX and<br />

ENX communities while maintaining our stringent requirement for<br />

performance, availability and security creates tremendous value for<br />

our customers,” said Rich Stanbaugh, president and CEO of ANX.<br />

“The automotive industry has always been a leader in process<br />

optimization, supplier integration and joint product development,<br />

even between competitors. Industry standards such as ENX<br />

facilitate such collaboration. Recent challenges and trends lead to<br />

a new level of global collaboration among independent players of<br />

all sizes. Providing them with a single unified networking solution for<br />

all their applications - ranging from simple file transfer to advanced<br />

real-time collaboration - is the objective of our cooperation with<br />

ANX,” said Lennart Oly, managing director of ENX Association.<br />

Other enhancements are being developed as part of ANX 2.0. ANX<br />

customers will be able to use their private ANX access circuit to securely<br />

connect to cloud infrastructure providers and 3G/4G networks. This<br />

expanded capability will keep more eCommerce on the ANX Network<br />

where it is secure and supported by end-to-end SLAs.<br />

ANX has also leveraged its security expertise and private<br />

ownership through One Equity Partners to strategically expand<br />

its managed security offerings. Over the past four years, ANX<br />

has acquired and integrated four innovative managed security<br />

and VPN companies. The expanded ANX product portfolio now<br />

includes B2B transaction management products for the automotive<br />

aftermarket, PLM products for extended supply chain, broadband<br />

and network services capabilities to the entire ANX product<br />

portfolio and specialized managed security services. These include<br />

cloud-based unified threat management services, monitoring and<br />

full management of customer premises security devices, security<br />

assessment services and compliance management services (PCI,<br />

HIPAA, GLBA, SOX). ANX offers these solutions separately or<br />

bundled with their ANX 2.0 connectivity service.<br />

<strong>Automotive</strong> <strong>Industries</strong> asked ANXeBusiness Corp.<br />

President and CEO, Rich Stanbaugh about the benefits of<br />

the recently announced ANX-ENX interconnection.<br />

AI: What is the significance of the ANX-ENX collaboration in<br />

setting up a global automotive data communication standard?<br />

Stanbaugh: The interconnection establishes the technical and<br />

business framework required for secure collaboration between B2B<br />

business partners across North America and Europe. Members<br />

of the ANX and ENX can now use their existing infrastructure to<br />

ENX announces the<br />

interconnection of its network<br />

with that of ANX.<br />

securely collaborate with over 1,600 partners across North America,<br />

Europe and other parts of the world. Keeping data on our networks<br />

improves operational efficiency and prevents data loss and service<br />

disruption caused by threats targeting the Public Internet.<br />

Moreover, the interconnection of ANX and ENX further<br />

strengthens the technology partnership between the industry’s<br />

two most experienced private network overseers. This will lead to<br />

further developments in B2B supply chain standards.<br />

AI: Why is your partnership with the ENX Association important<br />

to ANX and how will it impact your international presence?<br />

Stanbaugh: The interconnection with ENX further establishes<br />

ANX as a global eCommerce platform provider. ANX Network<br />

customers can securely connect to over 1,600 companies across the<br />

world on a high performance, private network at no additional charge.<br />

AI: Tell us how critical your products and services are to<br />

the automotive market. Please give us examples.<br />

Stanbaugh: Our products and services are mission critical.<br />

The automotive industry relies on the ANX Network to support<br />

designing, engineering and manufacturing operations. Purchase<br />

orders are approved, parts are received, payroll is delivered,<br />

insurance claims are settled and credit applications are approved.<br />

Partners use the ANX Network to exchange their most vital<br />

intellectual property and their most time-sensitive data.<br />

AI: What are some of the benefits of the ANX-ENX<br />

partnership to the auto industry?<br />

Stanbaugh: The value of any network is related to the number<br />

of participants on that network. The interconnection of the ANX and<br />

ENX networks nearly doubles the number of member companies<br />

within this business-only community, giving them more opportunities<br />

to share their most private and critical information within a trusted<br />

environment while reducing cost and improving efficiency. North<br />

American and European companies can securely connect to each<br />

other using their existing private connections at no additional cost.<br />

Moreover, the exchange of information is covered by stringent<br />

performance SLAs. The interconnection also makes it faster and<br />

easier to establish secure connections with new partners.<br />

AI: What are some of the challenges ANX will face? And why<br />

is it important for ANX to undertake this at the current time?<br />

Stanbaugh: The global automobile industry must improve<br />

efficiency and reduce costs to continue its worldwide recovery.<br />

Product innovation is critical and reducing the time it takes to develop<br />

new products requires high levels of collaboration. ANX and ENX<br />

have provided their community members with more functionality at the<br />

same cost. This integration expands the collaboration ready network<br />

to hundreds of new potential partners. Our service allows partners<br />

to easily establish secure connectivity so that they can focus on their<br />

core mission of designing and building the best possible product. AI<br />

12 to read full version of AI stories go to www.ai-online.com

innovation<br />

Integrating the<br />

whole value chain By: Nick Palmen<br />

Daimler and Mercedes-Benz first introduced the Daimler<br />

Supplier Network in March 2009. The goal of the DSN was<br />

to ensure that the company’s business practices are sustainable<br />

along the entire value chain. It encourages collaboration<br />

between automobile manufacturers and suppliers<br />

and offers a set framework for successful partnerships.<br />

<strong>Automotive</strong> <strong>Industries</strong> asked Frank W. Deiss, vice<br />

president Procurement Mercedes-Benz Cars & Vans, how<br />

the model was helping the company to establish closer<br />

partnerships with its suppliers.<br />

Deiss: The Daimler Supplier Network (DSN) is a very<br />

comprehensive, state-of-the-art system representing the Daimler<br />

group and its suppliers. Together with my colleagues from the<br />

other two procurement units (Stefan Buchner for Procurement<br />

Daimler Trucks and Buses, and Wendelin Wolbert for International<br />

Procurement Services), I am pleased to say that the DSN has been<br />

well accepted both within our company and by our suppliers.<br />

Frank W. Deiss, vice president Procurement<br />

Mercedes-Benz Cars & Vans, Daimler AG<br />

AI: How is the Daimler Supplier Network structured at<br />

present?<br />

Deiss: The DSN focuses on performance and partnership<br />

on a global perspective. We measure the performance of all<br />

our suppliers by the same method (our external balanced<br />

score card) and criteria. Another common element of the DSN<br />

is the segmentation logic we use to assign each supplier to<br />

the relevant DSN group. These include the supply base as<br />

the foundation, the key suppliers as the middle segment, and<br />

the strategic partners as the top-level group. The idea behind<br />

the segmentation is to ensure a differentiated approach for<br />

the management of these relationships, and to define different<br />

levels of expectations for each group.<br />

AI: What are the principles determining the rating of<br />

a supplier?<br />

Deiss: We use a common external balanced score card<br />

throughout the company, which focuses on the four value drivers of<br />

quality, innovation, logistics, and cost. This measurement is completely<br />

transparent, and all suppliers can access their current performance<br />

evaluation in real-time through our Daimler Supplier Portal.<br />

AI: What target system do you use as a benchmark<br />

in purchasing?<br />

Deiss: For the Procurement Mercedes-Benz<br />

Cars and Vans unit, we’ve successfully used our<br />

target system, REC - the Reference Calculation.<br />

REC allows us to calculate the cost of any given<br />

commodity in an ideal environment. It contains selfadjusting<br />

elements to keep itself up-to-date based<br />

on the current market environment.<br />

AI: What is the role of low-cost country (LCC)<br />

sourcing at the moment?<br />

Deiss: The lower cost that can be achieved when<br />

sourcing in low-cost countries is just one side of the<br />

coin. Our four value drivers are equally important factors<br />

to consider and there’s nothing we would sacrifice just<br />

for costs’ sake. At the same time, LCC sourcing continues to<br />

be one of the areas we have to look at carefully and we will<br />

continue to monitor potentials in these markets. For Daimler,<br />

14 to read full version of AI stories go to www.ai-online.com

with its traditionally strong manufacturing presence in Europe<br />

(particularly Germany), Eastern Europe is the first LCC region<br />

we will be looking at when sourcing for our operations. For<br />

international locations, other regions need to be considered,<br />

such as Mexico for our U.S. operations. In China, we are<br />

working with domestic suppliers and we have successfully<br />

reached the 40% local content requirements for our passenger<br />

car joint venture BBAC in Beijing and our van joint venture FJDA<br />

in Fuzhou.<br />

AI: Do you expect any significant changes in the future?<br />

Deiss: While we will still be looking at LCC throughout the<br />

industry, Daimler and Mercedes-Benz are also concentrating on the<br />

localization of our next C-Class generation which will be produced,<br />

to some extent, in our international manufacturing locations. As<br />

of 2014, the successor of the current C-Class sedan will also be<br />

produced in the U.S. to fulfil local customer demand for this model.<br />

We are moving the production of some of the higher volume models<br />

closer to markets where the vehicles are sold. This is one essential<br />

element that will help us remain competitive and better utilize<br />

growth opportunities. It will also help us to adapt to specific regional<br />

customer requirements faster and with more flexibility.<br />

Within this realignment, our plant in Tuscaloosa, Alabama,<br />

which currently produces the M-, R- and GL-Class, will add the<br />

C-Class and we will amend the existing C-Class capacities in East<br />

London (South Africa) and Beijing (China). For our suppliers, this<br />

The productivity award-winning new assembly<br />

line in Redford, Michigan, for the Detroit Diesel<br />

Corporation engines DD15 and DD13. Updates to<br />

the plant included creating a central warehouse<br />

area with narrow-aisle high bay storage to free up<br />

space for the new line and implementing a Kanban<br />

system for materials procurement.<br />

means that a global footprint is becoming an increasingly important<br />

competitive criterion.<br />

AI: How does your modular strategy help you meet your<br />

targets?<br />

Deiss: We are discovering numerous benefits as we continue<br />

the roll-out of our modular strategy throughout various vehicle<br />

architectures. The standardization of certain modules, which do<br />

not affect the “look and feel” experience of our customers, is<br />

obvious. Our supply base also benefits through extended contract<br />

duration, planning reliability and a stable business model. This<br />

contributes to a long-term partnership with our suppliers.<br />

AI: How have you helped suppliers in the current<br />

financial crisis?<br />

Deiss: We have seen very different pictures when looking at<br />

how suppliers got through the worst of the crisis. The reasons for<br />

this are as different as the companies, and so was our response<br />

to each individual case. We have a very sophisticated set of tools<br />

and processes in our risk management system. The range of<br />

actions on our side varies based on our thorough analysis of the<br />

situation in cooperation with the respective management. The risk<br />

management system was also in place well before the crisis, so<br />

we were not caught off-guard.<br />

AI: What is the role of the suppliers in the success of<br />

Mercedes–Benz, in terms of innovation and new technology?<br />

Deiss: Mercedes-Benz has always been one of the world’s<br />

most admired automotive premium brands, largely due to its<br />

strong reputation for introducing ground-breaking innovations.<br />

Our founding father, Gottlieb Daimler, coined the motto “the best<br />

or nothing” which has guided everything we do. Innovation plays<br />

a pivotal role in the DSN, which ranks innovative ability very highly<br />

and thus offers “fast lanes” for the leading innovators to achieve<br />

strategic partner status quickly. This allows us to work with the<br />

most advanced suppliers in each field – whether they are large<br />

or small, traditional players or even new participants with roots in<br />

another industry. At Daimler, we appreciate the contributions made<br />

by our suppliers because, in the end, our common success is the<br />

result of excellent teamwork in our mission to deliver innovative,<br />

high-quality products with distinctive value to our customers. AI<br />

16 to read full version of AI stories go to www.ai-online.com

innovation<br />

Over a billion miles on<br />

electric power By: Nick Palmen<br />

Electric vehicles have moved rapidly through the concept,<br />

prototype and testing stages to production. Motors produced<br />

by one of the top North American developers and suppliers,<br />

Remy, have already clocked up more than a billion miles in<br />

over 80,000 electric motors on the road today.<br />

Remy manufactures electric propulsion motors for hybrid and<br />

all-electric vehicles, building on its century of experience<br />

in the production of starters and alternators for<br />

over 100 years. The company has 5,500<br />

employees and 23 facilities in 10 countries,<br />

with corporate headquarters in Pendleton,<br />

Indiana. It moved into the electric<br />

Kevin Quinn, general<br />

manager of Remy<br />

Electric Motors.<br />

propulsion segment seven years ago,<br />

as the market for hybrid and electric<br />

vehicles started expanding.<br />

<strong>Automotive</strong> <strong>Industries</strong> (AI) asked Kevin<br />

Quinn, general manager of Remy Electric<br />

Motors to describe the principles behind the<br />

company’s HVH electric motor technology, and<br />

how it helps meet OEM’s specific requirements.<br />

Quinn: The patented Remy HVH (High Voltage Hairpin) electric<br />

propulsion motor technology helps vehicles generate the best fuel<br />

savings and performance through efficient, high power density and<br />

torque. Also, the fact that the Remy motor is compact provides<br />

added placement flexibility with less weight than other motors.<br />

Remy’s motor designs are very efficient in converting electricity to<br />

mechanical work, and can be used as motors or generators in all<br />

kinds of hybrid-electric vehicles. OEMs like the designs because we<br />

have standard package sizes, different kinds of connections and<br />

cooling methods, but always provide them very high performance<br />

in the smallest package size.<br />

AI: You are supplying Daimler with HVH electric motors<br />

for the <strong>2010</strong> Mercedes-Benz ML 450 Hybrid. What was the<br />

original brief?<br />

Quinn: Remy was involved with GM’s 2-mode hybrid program<br />

several years ago when GM saw the benefits of our HVH<br />

technology. At the time, GM and then Daimler-<br />

Chrysler along with BMW had a consortium<br />

to develop and share the transmission and<br />

related technology. After GM launched<br />

the hybrid SUV series, Daimler-Chrysler<br />

developed their version for both the<br />

ML series and arranged to provide a<br />

version to BMW for the ActiveHybrid<br />

X6. Remy was again selected to make<br />

the three electric motor/generators in<br />

this transmission.<br />

AI: What other programs are<br />

you working on at present?<br />

Quinn: Remy’s motors are used<br />

on exciting Amp Electric Vehicles<br />

passenger cars, the graceful Aptera 2e,<br />

and have been selected for the Allison<br />

Transmission next generation medium-duty<br />

hybrid automatic transmission. Our products<br />

are running or pending test in construction,<br />

agricultural, marine, forestry, motorcycle, truck and<br />

automotive applications all over the world.<br />

AI: How is vehicle integration being simplified?<br />

Quinn: The Remy platform starts with some standard families<br />

of motor sizes to simplify development and lead time. We make it<br />

easy to apply the electrical, mechanical and cooling connections<br />

with several standard options. Then we combine the motor/<br />

generator with matched inverter options to create a rapid path to<br />

validated, reliable products. Because we have been doing this for<br />

years, we have developed engineering expertise and knowledge<br />

to assist companies in integrating the motor into their system.<br />

18 to read full version of AI stories go to www.ai-online.com<br />

Aptera’s all-electric passenger<br />

vehicle, a version of which is an<br />

entry in the X PRIZE; both models<br />

use the Remy electric motor

AI: What processes do you employ for testing and validation?<br />

Quinn: There are two proof points for durability: lab testing and<br />

on-road experience. Both take time. Remy has one of the industry’s<br />

largest durability labs, with multiple electric dynamometers used for<br />

combined environmental, electrical, vibration and durability testing.<br />

Remy motors have over 800,000 equivalent miles of stress testing<br />

with no failure. We have set several test standards for in-process<br />

quality assurance to make sure we have every part capable of<br />

maximum life, and we work with our customers to ensure the<br />

Remy motor is fully validated for their application. Additionally, after<br />

nearly 10 years of various production programs and thousands of<br />

vehicles in service, Remy’s latest designs are leading the way on<br />

reliability – with a warranty return rate below 0.01%. These motors<br />

have logged over a billion miles of real-world use.<br />

AI: What applications can a Remy motor be used in?<br />

Quinn: Any type of vehicle and some industrial applications.<br />

Remy has been amazed at the benefits of using HVH motors to<br />

save fuel, reduce emissions and improve performance in a variety<br />

of applications including boats, forestry equipment, construction,<br />

agricultural machinery, military vehicles, motorcycles, highperformance<br />

and race cars.<br />

AI: How is Remy positioned to meet the growing demand<br />

for powerful, reliable, and economical hybrid motors?<br />

Quinn: Remy has seven years experience in the electric<br />

propulsion motor segment. We have existing production capacity<br />

of 100,000 units and plans to double that. Remy has invested<br />

years in developing a proven supply chain and stable, efficient<br />

production processes for quality and Six Sigma consistency.<br />

Because our motors already have been lab-tested and roadproven,<br />

Remy brings knowledge and experience to our customers<br />

“ Remy has been amazed at the benefits<br />

of using HVH motors to save fuel, reduce<br />

emissions and improve performance in<br />

a variety of applications including boats,<br />

forestry equipment, construction, agricultural<br />

machinery, military vehicles, motorcycles,<br />

high-performance and race cars.<br />

”<br />

Remy’s compact, high power and<br />

torque density HVH 250 electric<br />

propulsion motor.<br />

to address their engineering questions and accelerate the rampup<br />

to production.<br />

AI: What motor advancements can be expected of Remy<br />

in the future?<br />

Quinn: We are working on a number of different motor and<br />

electronics cooling approaches for performance, cost and reliability<br />

improvement. There are several unique items in magnetics, winding<br />

and packaging that continue to create more value and customer<br />

excitement. And we’re finalizing development of a larger electric<br />

motor for more demanding applications.<br />

AI: Do you have any plans to expand?<br />

Quinn: We have plans to expand in several directions. First:<br />

Product. We are working on the next evolution of our HVH 250<br />

platform and will launch an HVH 410 version for vehicles needing<br />

more power; Second: Applications. We are working with clients on<br />

some new and interesting applications for powerful motorcycles<br />

to large agricultural and construction equipment to various DOD<br />

vehicles; Third: Capacity. We have plans to double our production<br />

capacity; Fourth: Geography. We are exploring operating and sales<br />

options for Remy electric propulsion motors in Southeast Asia.<br />

AI: How does a DOE grant affect Remy’s plan to support<br />

these markets.<br />

Quinn: The DOE grant awarded to Remy in December 2009<br />

was intended to help Remy accelerate commercialization of the HVH<br />

electric motor technology and put U.S. manufacturers on a level<br />

playing field with the rest of the world in terms of government support<br />

of clean technology. The DOE grant awarded to Remy is starting to<br />

provide capital and to assist with human resource investments as<br />

we continue producing our full line of standard electric motors. This<br />

investment will help us double production capacity, for example. AI<br />

“ Remy’s latest designs are leading the way on reliability –<br />

with a warranty return rate below 0.01%. These motors have<br />

logged over a billion miles of real-world use. ”<br />

<strong>Automotive</strong> <strong>Industries</strong> 19

innovation<br />

Connecting<br />

technologies By: Nick Palmen<br />

New technologies, such as those of hybrid and electric vehicles,<br />

are posing fresh challenges for suppliers of clamps<br />

and fittings to the industry.<br />

“ For the passenger car, truck<br />

and off-highway vehicle<br />

industry, we offer custom-<br />

designed clamps, connectors<br />

and fluid transporting pipe<br />

systems that we design<br />

from our modular system<br />

of components.<br />

”<br />

Thomas Kraus, director Sales and<br />

Application Engineering Western Europe<br />

at the Norma Group<br />

In order to meet the challenges, the Norma Group acquired G.RAY<br />

in early <strong>2010</strong>, a leading North American designer and manufacturer<br />

of heavy duty engineered clamps for use in engine, pump / filtration,<br />

aircraft, commercial vehicle and industrial applications. The acquisition<br />

will help NORMA to further strengthen its presence in North America<br />

and also to extend its product range in international markets. “As the<br />

number one solution provider of engineered joining technologies, the<br />

acquisition of R.G.RAY significantly strengthens NORMA Group’s<br />

product portfolio to the benefit of our customers globally,” said Werner<br />

Deggim, CEO of NORMA Group.<br />

Norma has 24 locations across the globe and believes that<br />

“new connecting technology in combination with innovative pipe<br />

systems are a solution for weight and cost reduction programs for<br />

the cooling systems of future vehicles.”<br />

<strong>Automotive</strong> <strong>Industries</strong> (AI) asked Thomas Kraus, director<br />

Sales and Application Engineering Western Europe at the<br />

Norma Group to describe the company’s portfolio.<br />

Kraus: The company offers approximately 35,000<br />

standard clamping and connecting products<br />

for numerous industries, trades and private<br />

fields of application. Our business unit for<br />

engineered joining technology develops<br />

individual and standardized solutions for<br />

emissions control, cooling, air intake<br />

and induction, ancillary systems and<br />

industrial fluid connectors.<br />

For the passenger car, truck<br />

and off-highway vehicle industry,<br />

we offer custom-designed clamps,<br />

connectors and fluid transporting<br />

pipe systems that we design from<br />

our modular system of components.<br />

We have highly skilled engineers in our<br />

technology centers in Europe, America,<br />

India, China, Japan and Australia who<br />

are able to design custom solutions for the<br />

individual requirements of our customers.<br />

AI: What are Norma’s solutions for future<br />

hybrid or electric-powered vehicles?<br />

Kraus: Norma offers a new range of profile clamps and metal<br />

couplers which can be used to reduce leaks or create leak-free interfaces<br />

in exhaust systems, turbo chargers, EGR systems, catalysts or diesel<br />

particle filters. We also have a new range of permeation-reduced quick<br />

connectors and plastic tubes for fuel systems or engine ventilation.<br />

A range of quick connectors and plastic pipe systems for<br />

water and oil coolant applications is also on the market. It offers a<br />

modular system of mono and multilayer, smooth and corrugated<br />

plastic pipes in combination with an application-specific range of<br />

quick connectors for feed, return, ventilation or filler lines.<br />

AI: What are the advantages of Norma cooling pipe<br />

systems?<br />

Kraus: Due to the modular system of pipes and quick<br />

connectors, we can create a solution for every kind of pipe system.<br />

20 to read full version of AI stories go to www.ai-online.com

Cooling water ventilation pipe. Cooling water pipe with quick connectors.<br />

By replacing the standard technology for water or oil cooling with<br />

our Freeflex tubes and quick connectors, we are able to reduce<br />

the weight of the system by 30 to 50%. These systems would<br />

usually be made up of a combination of elastomer hoses with<br />

metal tubes.<br />

The newly patented Freeflex technology allows us to manufacture<br />

geometries that can’t be done with traditional hose technology.<br />

The materials developed by Norma for the Freeflex technology<br />

have the same flexibility as elastomer hoses but are much lighter<br />

in weight as they have a different density. Our Freeflex and plastic<br />

pipes have thinner walls, the outside diameter is smaller and we<br />

can weld our new quick connectors onto the pipes. This eliminates<br />

the interface pipe to quick connector – offering higher quality and<br />

lower costs through the elimination of an additional clamp, crimp<br />

ring or overmould.<br />

Another advantage is that our quick connectors and pipes are<br />

designed and adjusted to each other, so Norma solutions show<br />

the lowest risk of leakages.<br />

As Norma has more than 60 years of experience in<br />

connecting and joining technology, we can offer customers<br />

both the solutions and related components in one. Because our<br />

customers manufacture their vehicles in various international<br />

plants, the Norma Group production locations are equipped<br />

with a modular tool and machinery system that enables us to<br />

move or share production of quick connectors, clamps and<br />

pipe systems between our plants in Europe, Americas, India<br />

and China. We can therefore avoid high transport costs, and<br />

our production is close to the customer, which has several<br />

additional advantages.<br />

AI: What are the biggest challenges currently facing the<br />

company?<br />

Kraus: The downsizing of engines and more complex<br />

technology has led to the need for more temperature and pressure<br />

solutions. To aid in this, the Norma Group has developed different<br />

base materials for the individual applications which can be adjusted<br />

to the specific requirements of the individual system. Our plastic<br />

pipes can be used in temperatures of up to 180°C and our plastic<br />

quick connectors can be used up to 220°C. For temperatures<br />

above 220°C, we offer metal quick connectors.<br />

The increasing pressure in combination with a higher temperature<br />

is a challenge for each interface between pipe or hose to quick<br />

connector or spigot. We weld our new plastic quick connectors<br />

onto the pipes which reduces the risk of leakage or pull off.<br />

Our new clamps are equipped with flexible elements that<br />

enable the same clamping forces at high and low temperatures<br />

and compensate for the flow of the material.<br />

AI: Which vehicle manufacturers are using Norma coolant<br />

pipes, quick connectors and clamps?<br />

Kraus: I am proud to say that every European OEM is using<br />

Norma standard quick connectors or clamps for their water<br />

cooling or oil cooling applications. Our standard plastic pipe<br />

systems are in use at numerous European passenger car and<br />

truck manufactures<br />

Our new plastic or Freeflex pipe systems are already in use at<br />

PSA, Fiat, Daimler Truck and MAN. Our application engineers are<br />

currently working on numerous international projects at different<br />

OEMs for future hybrid and e-vehicles which will come onto the<br />

market in 2011. AI<br />

“ By replacing the standard technology for water or oil cooling<br />

with our Freeflex tubes and quick connectors, we are able to<br />

reduce the weight of the system by 30 to 50%. ”<br />

Thomas Kraus, director Sales and Application Engineering Western Europe at the Norma Group<br />

<strong>Automotive</strong> <strong>Industries</strong> 21

innovation<br />

There is no “one size fits all” when it comes to powertrains<br />

– particularly for global companies such as Ford.<br />

The use of the word “powertrain” to replace “engine” sums up<br />

the way the market has changed in response to demands from<br />

both consumers and legislators. Today’s “powertrain” could be fired<br />

by, amongst others, gasoline, diesel, biofuels, electricity, hydrogen,<br />

natural gas, methane, compressed air – or any combination of them.<br />

Ford’s current focus is on reducing emissions and fuel<br />

consumption through its EcoBoost technology. Plans call for an<br />

EcoBoost engine to be available in 80% of the company’s global<br />

nameplates and 90% of North American nameplates. About half of<br />

the 1.5 million EcoBoost engines are expected to be sold in North<br />

America, while the rest are to be sold in Europe, South America<br />

and Asia Pacific regions.<br />

One thing is certain - there will all have far-reaching impacts on<br />

the supply chain.<br />

<strong>Automotive</strong> <strong>Industries</strong> (AI) asked Barb Samardzich, vice<br />

president of Powertrain Engineering at Ford Motor<br />

Company, how Ford’s Aligned Business Framework<br />

(ABF) of preferred suppliers affect companies<br />

currently outside the network.<br />

Samardzich: By no means does the<br />

ABF process indicate that the door is closed.<br />

Barb Samardzich, vice president<br />

of Powertrain Engineering,<br />

Ford Motor Company<br />

Ford revs up global<br />

engine technology<br />

By: Ed Richardson<br />

We always evaluate new potential suppliers<br />

into the base. There are many mechanisms for<br />

suppliers to get a foot in the door. One of the most<br />

important and easiest ways to get in the door is with<br />

new technologies. Bring us your new technologies.<br />

What we are looking for with the One Ford programme is<br />

developing one product that we can produce around the globe. We<br />

are looking for a supply base that can come with us on that journey.<br />

AI: What about local suppliers – does globalisation<br />

exclude the smaller local suppliers altogether?<br />

Samardzich: The key is that there is no one right answer for<br />

every region. There is always a set of components where we can<br />

work with the regional supply base. In Europe, China, South Africa<br />

and elsewhere, we work with the regional supplier base.<br />

AI: How involved are the suppliers in R&D for new<br />

technologies, such as EcoBoost?<br />

Samardzich: The door is open. Clearly, we work hand in<br />

hand with turbo supplier, the direct injection supplier, etc.<br />

AI: How does Ford plan to meet the new engine standards<br />

(Tier 4 interim stage 3 B standards)?<br />

Samardzich: Our intent is not just to meet the various regulatory<br />

standards. Our intent is to meet our customer expectations. Customers<br />

are increasingly more environmentally conscious, and are driving<br />

environmental standards equally as hard as the legislators.<br />

AI: Are the Tier 1 suppliers expected to audit further down<br />

the value chain to ensure quality standards are met?<br />

Samardzich: Definitely. We can’t be in a quality class on our<br />

own. We absolutely need the whole supply base to come with<br />

us. We expect Tier 1 suppliers to work with Tier 2 to help them<br />

understand and meet the quality standards. It is in the Tier 1’s best<br />

interest, as it helps optimise cost savings. Every defect (from a<br />

supplier lower down the chain) built into the product is money out<br />

of the door. So, we are absolutely looking for all our suppliers to<br />

work at the same level. Ford has gone down to the Tier 4 level to<br />

help a Tier 1 supplier meet quality standards. We try to get it right<br />

up front so we do not have problems when we start production.<br />

AI: Ford is continuing to develop a range of powertrains<br />

– from engines for muscle cars to electric motors. Why not<br />

standardise in the light of your global One Ford programme?<br />

Samardzich: What we have is a huge variety of<br />

customers purchasing Ford products. We must meet<br />

the needs of all our customers. In general, the<br />

EcoBoost strategy is to downsize the engine and<br />

upsize the performance. There is no sacrifice<br />

on power – our objective is to surprise and<br />

delight with the power the engines produces.<br />

The torque curve is very diesel-like, giving<br />

improved fuel efficiency and performance.<br />

There are also certain subsectors, which<br />

need traditional large-sized engines.<br />

Take, for example, our 6.7-litre diesel for<br />

super duty trucks. If you are working on<br />

a construction site, you need to have it. At<br />

the same time you need the most fuel efficient<br />

product. So, what we are doing, is helping our<br />

customer satisfy the physical requirements of the<br />

working vehicle in order to make a living.<br />

Then there is always the enthusiast, like Mustang owners. They<br />

want to indulge in sporting activities such as drag racing and track<br />

racing, and they like a big V-8. Just like any other segment around<br />

the globe, they have their own preferences. Mustang owners tend<br />

to do a lot of work on their own vehicles, and add on after-market<br />

equipment, so they want technology under the hood that they can<br />

work on. So we put it in for them.<br />

AI: Ford is also committed to the development of electric<br />

power trains. Where does this fit in the organisation in<br />

relation to the gasoline and diesel engines? Will we see<br />

separate ranges, or will a Fiesta come with a diesel/gas/<br />

electric power train option?<br />

Samardzich: An electric power train is still a power train –<br />

and is part of my power train department at Ford. Again, there<br />

is no single answer or solution. A global platform needs a variety<br />

of propulsion systems, depending on public policy, and customer<br />

24 to read full version of AI stories go to www.ai-online.com

preferences. We will see the first manifestation of this over the next<br />

two and a half years, we will have a C-Segment car with a choice<br />

of full hybrid, full electric and conventional propulsion systems.<br />

Once we can offer the full range, it will be up to the marketing<br />

teams to determine the right offerings for a particular market.<br />

AI: What is expected of suppliers in terms of electric<br />

powertrain development?<br />

Samardzich: The same type of thing from suppliers of<br />

existing technology. We are looking for the latest and greatest<br />

technology innovation delivered to our standards of quality.<br />

One of the keys to delivering full electric vehicles is the battery<br />

pack. We are looking at new core technology in terms of the<br />

“We are focused on sustainable technology solutions that<br />

can be used not for hundreds or thousands of cars, but for<br />

millions of cars, because that’s how Ford will truly make a<br />

difference,” says Barb Samardzich, Ford’s vice president of<br />

powertrain engineering.<br />

The technologies include:<br />

Electrification<br />

Ford has committed US$1-billion to build plug-in, hybrid and<br />

battery electric vehicles and a plant that will assemble battery<br />

packs for these vehicles. The Transit Connect Electric is being<br />

launched in <strong>2010</strong>, while the Focus Electric is due in 2011. A<br />

hybrid and a plug-in hybrid will be built off Ford’s global C<br />

TOP LEFT: J Mays, group vice president, Design, and chief<br />

creative officer, Ford Motor Company, unveiled the Ford<br />

Start Concept at the <strong>2010</strong> Beijing Auto Show. The smallestyet<br />

Ford EcoBoost engine, is a 3-cylinder, 1-litre, which is<br />

due to go into production.<br />

BOTTOM LEFT: Ford EcoBoost Engine.<br />

BOTTOM RIGHT: The 2011 Transit Connect Electric will<br />

use a Force Drive electric powertrain manufactured and<br />

integrated by specialty outfitter Azure Dynamics.<br />

cell chemistry and the cooling of the battery pack. So, we are<br />

looking for partnerships through which we can integrate their<br />

technology.<br />

AI: What is the “next big thing” in terms of Ford powertrain<br />

development?<br />

Samardzich: I am just as anxious to see that. One would<br />

have a hard time putting a bet on that as there are so many external<br />

factors. They include the price of fuel, the type of fuel being used<br />

in a region, such as ethanol in Brazil, diesel in Europe, gasoline<br />

in North America, and a case of “wait and see” in China. Right<br />

now, Ford is making sure we are technology capable. The solution<br />

globally is going to be a lot of different answers. AI<br />

SUSTAINABLE TECHNOLOGY<br />

platform, which underpins the Focus. Ford also plans to move<br />

battery pack production from Mexico to Michigan to support<br />

the production of electric and hybrid vehicles.<br />

Six-speed transmissions<br />

By the end of 2012, 98% of Ford North American vehicles will<br />

be equipped with fuel-efficient six-speed transmissions. A sixspeed<br />

transmission can improve fuel economy between 4 and<br />

6%, according to Ford.<br />

Stop/Start systems<br />

By 2014, as many as 20% of Ford’s global nameplates could be<br />

equipped with stop/start systems. Ford says a stop/start system<br />

can reduce fuel consumption and emissions by around 5%,<br />

depending on conditions. AI<br />

26 to read full version of AI stories go to www.ai-online.com

innovation<br />

Sound plays a major role in a customer’s perceived quality<br />

of a vehicle, as well as their enjoyment of the ride. So much<br />

so that Ford has a whole team dedicated to Noise/Vibration/Harshness<br />

(NVH).<br />

Mark Clapper, Technical Leader, Vehicle Powertrain NVH<br />

at Ford discusses sound with <strong>Automotive</strong> <strong>Industries</strong> (AI).<br />

Clapper: Sound quality is used to differentiate brands, define<br />

the brand image, and evoke emotional response. Ford brand<br />

sounds deliver sound quality that “feels right sounds tight” and is<br />

“great to drive and great to sit in”. The focus is on three key areas:<br />

Door opening and closing, interior harmony with chime sound,<br />

and driving experience with powertrain sound.<br />

AI: How do you get powertrains to sing the same tune?<br />

Clapper: When performance is demanded, the powertrain<br />

sound will convey strength, power, responsiveness, and excite<br />

the senses. While of course remaining “exceptionally quiet” for our<br />

non-sporty nameplates.<br />

AI: What new materials achieve this without adding<br />

weight?<br />

Clapper: Materials, such as expandable foam pellets<br />

strategically placed in the doors, headliner and pillars, can improve<br />

sound-deadening efficiency by up to 20%. Interiors are further<br />

Ford’s Virtual Vehicle Sound Simulator, which is being used<br />

to fine-tune sound inside a vehicle’s cabin before it even<br />

exists in physical form.<br />

quieted with hood insulators, inner and outer dash absorbers,<br />

sound-absorbing carpet, improved ceiling baffles, additional sound<br />

absorption in the trunk and new interior and headliner materials.<br />

Other ways Ford engineers have built interior quietness into the<br />

<strong>2010</strong>/2011 line-up include:<br />

• Acoustic laminated windshields<br />

• Improved body/door sealing to reduce wind noise<br />

• Expandable stuffers in the fenders and pillars<br />

The power<br />

of sound By: Ed Richardson<br />

• Constrained layer damping material on the entire floor<br />

• A retuned air induction system for a more refined powertrain<br />

and sound<br />

• All-new acoustic headliners<br />

Ford engineers have also been hard at work to enhance<br />

the powertrain sound to achieve the right level of sound<br />

feedback including:<br />

• Sound generator on the EcoBoost engines that feedback the<br />

engine sound from the air intake system that would otherwise<br />

get lost<br />

• Integrated Sound Tube, which feeds back a fantastic intake<br />

sound on the Mustang GT to deliver a true muscle car<br />

experience<br />

• Finely tuned air intake system and straight-through exhaust<br />

system on the Ford F150 for well balanced powerfulness and<br />

refinement character<br />

AI: What is expected of Ford’s suppliers in terms of NVH?<br />

Clapper: Working with various engineering teams and supplier<br />

partners allows us to be much more specific on part specifications<br />

and targets than we have in the past.<br />

Recent examples include:<br />

• Working with the Ford Exhaust Team and Tenneco on<br />

our F150 exhaust system to deliver improved sound<br />

quality, while delivering improved performance.<br />

The team worked to specific cascaded<br />

targets at multiple load conditions - and<br />

through computer models and system<br />

development, developed unique solutions<br />

satisfying many attributes.<br />

• The Air Intake System team and<br />

suppliers working to shape the sound<br />

of the engine intake system to deliver<br />

appropriate powerful/sporty sounds<br />

and attenuate unwanted moans and<br />

groans in the Ford Fusion, Taurus, F150,<br />

and Mustang. Again, computer tools and<br />

NVH simulation allow for upfront analysis and<br />

balanced attributes.<br />

AI: What is the bottom line?<br />

Clapper: The technology helps us deliver higher<br />

customer satisfaction with quicker development time, reduced<br />

prototypes, reduced cost, and assists us to get it right the first time.<br />

It allows the engineering team to virtually evaluate any drive event<br />

subjectively and objectively to detect both positive sound character<br />

and find and eliminate error states prior to vehicle prototypes. As an<br />

example, in one of recent developments we could evaluate several<br />

mount redesign options in combination with exhaust and intake<br />

systems studies to find the right balance to meet both our quietness<br />

and powerfulness criteria, while also detecting some error states<br />

that would have not been captured in our typical analysis since they<br />

were drive events not in our typical process. AI<br />

28 to read full version of AI stories go to www.ai-online.com

innovation<br />

Virtual sound By: Ron Charles<br />

Sound and vibration levels in vehicles can now be tested<br />

long before the vehicle comes off the CAD program and<br />

onto the road.<br />

NVH Vehicle Simulator technology makes it possible to conduct<br />

virtual vehicle prototyping for sound and vibration characteristics. At<br />

the start of a vehicle program, it is used to understand sound character<br />

preferences of consumers and to set overall vehicle sound quality<br />

targets. During the entire development cycle, design alternatives,<br />

changes and trade-offs can be simulated to demonstrate the impact<br />

on the sound characteristics of the vehicle. Instead of looking at two<br />

numbers or a graph showing the difference, the engineers<br />

and managers can actually drive a vehicle with the<br />

different design alternatives and evaluate them in<br />

a realistic virtual environment.<br />

David Bogema, senior application<br />

engineer, Brüel & Kjær<br />

North America Inc.<br />

One of the first North American car-manufacturers<br />

to use Brüel & Kjær’s PULSE NVH Simulator is<br />

the Ford Motor Company. “Ford uses the PULSE NVH<br />

Vehicle Simulator to eliminate mistakes up front, reduce the need<br />

for prototyping, shorten the time to market, and produce a product<br />

that not only delivers high-end interior quietness, but also provides<br />

vehicle sounds that are more engaging for the customer,” says<br />

Mark Clapper, technical leader for NVH at Ford.<br />

The NVH Vehicle Simulator is available in three basic<br />

configurations – there is the desktop NVH Simulator used in R&D<br />

offices, which helps design the sounds of the vehicle. Another<br />

version is the full-vehicle NVH Simulator, which combines sound,<br />

vibration and visual scenery in a stationary vehicle body. The third<br />

version is the On-Road Vehicle NVH Simulator, which incorporates<br />

the NVH simulator into an actual drivable vehicle. The sound of the<br />

vehicle driven can be changed by modifying various frequencies,<br />

the harmonic balance of various vehicle components and the<br />

balance of various parts of the vehicle sound such as engine, road<br />

and wind noise.<br />

Nissan is currently using the On-Road Simulator for<br />

developing and evaluating the acoustic environment<br />

and acoustic comfort of new vehicles. “With the<br />

On-road Simulator as a core development tool,<br />

Japan, the US and Europe are already sharing<br />

road noise models for global benchmarking<br />

and target setting. By sharing and comparing<br />

data, we can change the global development<br />

process and get more accurate results<br />

with fewer prototypes,” says David Quinn,<br />

manager of NVH Development, Nissan UK.<br />

The vehicles created in the NVH simulator<br />

can be very simple, accurate models of the<br />

sound at the driver’s position; or they can be<br />

very detailed, created from sound and vibration<br />

data of the specific sources of vehicle sound such<br />

as tires, engine, wind, etc. The data used to create these<br />

vehicle models in the NVH Simulator can come from real vehicles,<br />

component tests or CAE results.<br />

Jaguar Land Rover uses the NVH Simulator in their vehicle<br />

development process, incorporating both CAE and measured<br />

data in their virtual vehicles. “Our CAE colleagues really like the<br />

30 to read full version of AI stories go to www.ai-online.com<br />

The Brüel & Kjær<br />

Desktop NVH<br />

Simulator.

NVH Simulator. They can use it to experience the real effects of<br />

their predicted CAE modifications. This is a key capability in the<br />

decision making process,” says Dr. Garry Dunne, senior technical<br />

leader, Vehicle NVH, Jaguar Land Rover.<br />

Another automotive OEM that uses Brüel & Kjær’s solutions<br />

is the FIAT Group which uses the company’s wind tunnel test<br />

programs as well as its most advanced noise-mapping solutions.<br />

“Fiat’s Aerodynamics Department is responsible for the test<br />

programs for exterior as well as interior noise measurements. Our<br />

main objectives in the wind tunnel programs are contributions<br />

to target setting, benchmarking and verification of components,<br />

comparison of alternative components, troubleshooting and<br />

competitor analysis. An important part of our decision to choose<br />

Brüel & Kjær as preferred supplier for the wind tunnel test programs<br />

was the fact that they could provide everything we needed for our<br />

measurements – from microphones and accelerometers to the<br />

most advanced noise mapping solutions,” says Marco Stellato, in<br />

charge of wind tunnel testing at FIAT.<br />

Brüel & Kjær’s noise-mapping solutions include planar and<br />

spherical beamforming, sound intensity, stationary and nonstationary<br />

nearfiled acoustic holography, conformal noise mapping<br />

(mapping radiated sound to complex surfaces), and both indoor<br />

pass-by noise testing and vehicle pass-by noise testing.<br />

Brüel & Kjær has sales offices in 55 countries employing<br />

over 900 people. Last year, Brüel & Kjær acquired Australian<br />

firm, Lochard Ltd, in order to expand its product offerings with<br />

EMS. “Lochard’s NoiseOffice, a suite of managed noise services,<br />

provides an ideal solution to our clients who need to do more with<br />

less,” says Lars Rønn, managing director at Brüel & Kjær.<br />

<strong>Automotive</strong> <strong>Industries</strong> (AI) spoke to David Bogema, senior<br />

application engineer, Brüel & Kjær North America.<br />

AI: Tell us how effective NVH testing is for OEMs to make<br />

decisions in advance of the first physical prototypes.<br />

From the outside listening in<br />

– the view of the full vehicle<br />

simulator from outside.<br />

“<br />

Ford uses the PULSE NVH Vehicle Simulator to eliminate mistakes up front, reduce the need<br />

for prototyping, shorten the time to market, and produce a product that not only delivers high-end<br />

interior quietness, but also provides vehicle sounds that are more engaging for the customer.<br />

”<br />