Bell Industries, Inc. vs. Department of Revenue - Florida Sales Tax ...

Bell Industries, Inc. vs. Department of Revenue - Florida Sales Tax ...

Bell Industries, Inc. vs. Department of Revenue - Florida Sales Tax ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

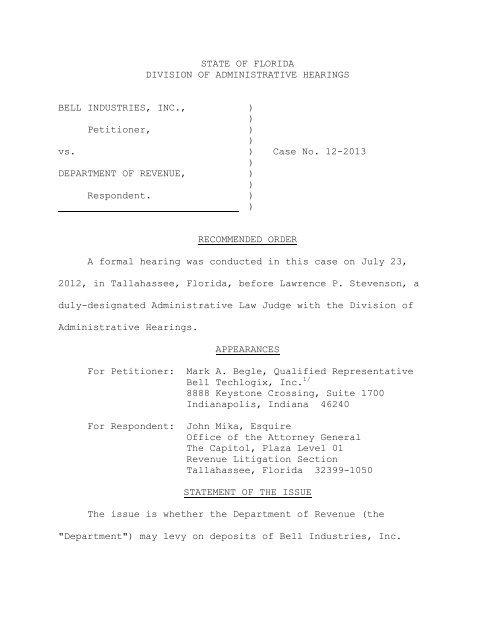

STATE OF FLORIDADIVISION OF ADMINISTRATIVE HEARINGSBELL INDUSTRIES, INC.,Petitioner,<strong>vs</strong>.DEPARTMENT OF REVENUE,Respondent.))))))))))Case No. 12-2013RECOMMENDED ORDERA formal hearing was conducted in this case on July 23,2012, in Tallahassee, <strong>Florida</strong>, before Lawrence P. Stevenson, aduly-designated Administrative Law Judge with the Division <strong>of</strong>Administrative Hearings.APPEARANCESFor Petitioner: Mark A. Begle, Qualified Representative<strong>Bell</strong> Techlogix, <strong>Inc</strong>. 1/8888 Keystone Crossing, Suite 1700Indianapolis, Indiana 46240For Respondent: John Mika, EsquireOffice <strong>of</strong> the Attorney GeneralThe Capitol, Plaza Level 01<strong>Revenue</strong> Litigation SectionTallahassee, <strong>Florida</strong> 32399-1050STATEMENT OF THE ISSUEThe issue is whether the <strong>Department</strong> <strong>of</strong> <strong>Revenue</strong> (the"<strong>Department</strong>") may levy on deposits <strong>of</strong> <strong>Bell</strong> <strong>Industries</strong>, <strong>Inc</strong>.

<strong>Department</strong> timely filed a Proposed Recommended Order onAugust 13, 2012. <strong>Bell</strong> <strong>Industries</strong> did not file a proposedrecommended order.Unless otherwise noted, all statutory references are to<strong>Florida</strong> Statutes (2011).FINDINGS OF FACT1. The <strong>Department</strong> is the agency <strong>of</strong> the state <strong>of</strong> <strong>Florida</strong>charged with the duty to enforce the collection <strong>of</strong> taxes imposedpursuant to chapter 212, <strong>Florida</strong> Statutes, including theauthority to levy against the credits or personal property <strong>of</strong>delinquent taxpayers. § 213.67, Fla. Stat.2. <strong>Bell</strong> <strong>Industries</strong> is a holding company for the operation<strong>of</strong> several operating entities. In early 2007, <strong>Bell</strong> <strong>Industries</strong>purchased Skytel, a telecommunications services company, fromVerizon. The purchased entity was subject the communicationsservices tax set forth in chapter 202, <strong>Florida</strong> Statutes.3. Mark A. Begle, an <strong>of</strong>ficer <strong>of</strong> <strong>Bell</strong> <strong>Industries</strong>, testifiedthat the tax compliance issues undertaken by his company in thispurchase were "quite painful and took a lot <strong>of</strong> time." Mr. Beglestated that the complexity <strong>of</strong> filings under the <strong>Florida</strong>communications services tax necessitated the hiring <strong>of</strong> <strong>Tax</strong>Partners, an outside specialty company based in Atlanta, t<strong>of</strong>ulfill the Skytel tax obligations. It took <strong>Tax</strong> Partners3

several months to get the systems in place to properly file the<strong>Florida</strong> tax forms.4. Mr. Begle acknowledged that his company's initial<strong>Florida</strong> tax returns were late filed.5. After the <strong>Department</strong> received and processed the initialreturns, it sent initial notices to <strong>Bell</strong> <strong>Industries</strong> advising thecompany <strong>of</strong> the late filing penalty and interest amounts due forthe delinquent months. The <strong>Department</strong> sent the initial noticeson August 23, 2007.6. Eventually, the <strong>Department</strong> sent out a Notice <strong>of</strong> FinalAssessment to <strong>Bell</strong> <strong>Industries</strong> for each <strong>of</strong> the two tax periodsfor which the company had filed delinquent returns. The Notice<strong>of</strong> Final Assessment for the reporting periods <strong>of</strong> February 2007through May 2007, was mailed on September 25, 2007. The Notice<strong>of</strong> Final Assessment for the reporting period <strong>of</strong> May 2008, wasmailed on February 6, 2009.7. The <strong>Department</strong>'s Notice <strong>of</strong> Final Assessment <strong>of</strong>fers ataxpayer two routes for contesting an assessment. First, thetaxpayer may commence an informal protest process by submittinga letter requesting review to the <strong>Department</strong> within 20 days <strong>of</strong>the date <strong>of</strong> the assessment. § 213.21, Fla. Stat. and Fla.Admin. Code R. 12-6.0033. Second, the taxpayer may choose tobypass the informal protest process and commence the formal4

appeals process provided by chapter 72, <strong>Florida</strong> Statutes, within60 days <strong>of</strong> the date <strong>of</strong> the assessment.8. <strong>Bell</strong> <strong>Industries</strong> did not timely invoke either method <strong>of</strong>contesting the assessments. Therefore, the assessments becamefinal.9. The <strong>Department</strong> filed a warrant, dated September 2,2008, in Leon County stating that <strong>Bell</strong> <strong>Industries</strong> was indebtedto the <strong>Department</strong> in the amount <strong>of</strong> $23,800.41. 2/Of this amount,$23,780.41 was listed as "penalty." The remaining $20.00 waslisted as a "filing fee." Thus, for all practical purposes, theclaimed amount <strong>of</strong> indebtedness is entirely a penalty.10. <strong>Department</strong> records indicated that the <strong>Department</strong> twicerejected <strong>Bell</strong> <strong>Industries</strong>' requests for compromise or waiver <strong>of</strong>the assessments, on September 14, 2007, and December 19, 2008.11. The <strong>Department</strong> issued a Notice <strong>of</strong> Freeze, datedMarch 5, 2012, to Wells Fargo Bank, a financial institution inPhiladelphia, Pennsylvania. The Notice <strong>of</strong> Freeze instructed thebank that <strong>Bell</strong> <strong>Industries</strong> had a delinquent liability for tax,penalty and interest owed to the <strong>Department</strong> pursuant to section213.67, and that the bank "may not transfer, dispose <strong>of</strong>, orreturn any credits, debts, or other personal propertyowned/controlled by, or owed to, this taxpayer which are in yourpossession or control or become under your possession or controlup to the amount <strong>of</strong> $23,800.41."5

12. On March 15, 2012, Wells Fargo Bank reported to the<strong>Department</strong> that it was holding $23,800.41 in <strong>Bell</strong> <strong>Industries</strong>deposits.13. On March 5, 2012, the <strong>Department</strong> issued a Notice <strong>of</strong>Intent to Levy on credits or personal property belonging to <strong>Bell</strong><strong>Industries</strong>.14. On March 21, 2012, the <strong>Department</strong> issued a Notice <strong>of</strong>Contested Intent to Levy, in acknowledgement that <strong>Bell</strong><strong>Industries</strong> was contesting the <strong>Department</strong>'s intended levy.15. At the hearing, <strong>Bell</strong> <strong>Industries</strong> essentially concededits liability for the amount owed. Mr. Begle, <strong>Bell</strong> <strong>Industries</strong>'representative, credibly testified that the company endeavors tobe timely and in full compliance as regards all <strong>of</strong> its taxobligations.16. Mr. Begle noted that his company sold Skytel in March2008, which led to the termination <strong>of</strong> the relationship with <strong>Tax</strong>Partners and the dismantling <strong>of</strong> the entire management structurerelated to Skytel. Mr. Begle blamed these activities for <strong>Bell</strong><strong>Industries</strong>' slow response, because correspondence from the<strong>Department</strong> regarding these tax issues was being sent topersonnel no longer associated with <strong>Bell</strong> <strong>Industries</strong>. Mr. Beglerequested that these unusual circumstances be taken into accountand that the <strong>Department</strong> consider waiving or negotiating thepenalty at issue in this proceeding.6

17. At the hearing, the <strong>Department</strong> took the position thatsection 213.21 allows the <strong>Department</strong> to negotiate a compromise<strong>of</strong> an assessment <strong>of</strong> tax, interest and penalty, but that once thetime for filing a challenge to the assessment passes, as setforth in <strong>Florida</strong> Administrative Code Rule 12-6.0033, the<strong>Department</strong> no longer has the authority to compromise a claim.Because <strong>Bell</strong> <strong>Industries</strong> failed to file a timely challenge, the<strong>Department</strong> could not accept less than the amount claimed in theNotice <strong>of</strong> Intent to Levy.CONCLUSIONS OF LAW18. The Division <strong>of</strong> Administrative Hearings hasjurisdiction <strong>of</strong> the subject matter <strong>of</strong> and the parties to thisproceeding. §§ 120.569, 120.57(1), and 213.67(7), Fla. Stat.19. The general rule is that the burden <strong>of</strong> pro<strong>of</strong>, apartfrom a statutory directive, is on the party asserting theaffirmative <strong>of</strong> an issue before an administrative tribunal.Young v. Dep't <strong>of</strong> Cmty. Aff., 625 So. 2d 831, 833-834 (Fla.1993); Dep't <strong>of</strong> Transp. v. J.W.C. Co., <strong>Inc</strong>., 396 So. 2d 778, 788(Fla. 1st DCA 1981); Balino v. Dep't <strong>of</strong> HRS, 348 So. 2d 349, 350(Fla. 1st DCA 1977). In this case, the <strong>Department</strong> bears theburden <strong>of</strong> showing its entitlement to levy on the assets <strong>of</strong> <strong>Bell</strong><strong>Industries</strong> by a preponderance <strong>of</strong> the evidence.20. Section 95.091(1)(b), <strong>Florida</strong> Statutes, provides thata tax lien for any tax enumerated in section 72.011 is7

enforceable for 20 years after the last date the tax may beassessed, after the tax becomes delinquent, or after the filing<strong>of</strong> a tax warrant, whichever is later. Chapter 202, <strong>Florida</strong>Statutes, the communications services tax, is one <strong>of</strong> the taxesenumerated in section 72.011. Section 202.35(2) provides thatpenalties imposed by chapter 202 are payable to and collectibleby the <strong>Department</strong> in the same manner as if they were part <strong>of</strong> thetax collected under chapter 202.21. Section 213.67 provides for the administrativegarnishment <strong>of</strong> the assets <strong>of</strong> any taxpayer who owes delinquenttaxes, penalties and interest. <strong>Florida</strong> Administrative CodeRules 12-21.201 through 12-21.205 implement section 213.67 bysetting out the detailed procedure for administrativegarnishment <strong>of</strong> the assets <strong>of</strong> the delinquent taxpayer. The factsfound above establish that the <strong>Department</strong> complied with theterms <strong>of</strong> its implementing rules in providing notice to thetaxpayer <strong>of</strong> its intended actions.22. <strong>Florida</strong> Administrative Code Rule 12-21.202(5) defines"noncompliant taxpayer" to mean "any taxpayer against whom awarrant has been issued by the <strong>Department</strong> for nonpayment <strong>of</strong> anamount due pursuant to any revenue law enumerated in s. 213.05."Chapter 202 is enumerated in section 213.05. The facts foundabove establish that <strong>Bell</strong> <strong>Industries</strong> was a noncomplianttaxpayer.8

23. On March 5, 2012, the <strong>Department</strong> issued a Notice <strong>of</strong>Freeze to Wells Fargo Bank in accordance with rule 12-21.203.24. Also on March 5, 2012, the <strong>Department</strong> issued a Notice<strong>of</strong> Intent to Levy on credits or personal property belonging to<strong>Bell</strong> <strong>Industries</strong> in accordance with rule 12-21.204.25. The <strong>Department</strong> has made a prima facie showing <strong>of</strong> itsentitlement to levy on the assets <strong>of</strong> <strong>Bell</strong> <strong>Industries</strong>.26. <strong>Bell</strong> <strong>Industries</strong> did not contest the <strong>Department</strong>'sentitlement to the levy, but sought to negotiate a compromise <strong>of</strong>the amount <strong>of</strong> the penalty.27. Section 213.21 allows for the compromise <strong>of</strong> anassessed penalty during informal conferences. Rule 12-13.007provides grounds for reasonable cause for compromise <strong>of</strong>penalties. 3/ However, the <strong>Department</strong> contends that rule 12-6.0033(1) prohibits the taxpayer from taking advantage <strong>of</strong> thisprovision for failure to make a timely challenge <strong>of</strong> theassessment.28. Section 213.21(2) & (3)(a) provide:(2)(a) The executive director <strong>of</strong> thedepartment or his or her designee isauthorized to enter into closing agreementswith any taxpayer settling or compromisingthe taxpayer’s liability for any tax,interest, or penalty assessed under any <strong>of</strong>the chapters specified in s. 72.011(1).Such agreements shall be in writing when theamount <strong>of</strong> tax, penalty, or interestcompromised exceeds $30,000 or for lesseramounts when the department deems it9

appropriate or when requested by thetaxpayer. When a written closing agreementhas been approved by the department andsigned by the executive director or his orher designee and the taxpayer, it shall befinal and conclusive; and, except upon ashowing <strong>of</strong> fraud or misrepresentation <strong>of</strong>material fact or except as to adjustmentspursuant to ss.198.16 and 220.23, noadditional assessment may be made by thedepartment against the taxpayer for the tax,interest, or penalty specified in theclosing agreement for the time periodspecified in the closing agreement, and thetaxpayer shall not be entitled to instituteany judicial or administrative proceeding torecover any tax, interest, or penalty paidpursuant to the closing agreement. Thedepartment is authorized to delegate to theexecutive director the authority to approveany such closing agreement resulting in atax reduction <strong>of</strong> $250,000 or less.(b) Notwithstanding the provisions <strong>of</strong>paragraph (a), for the purpose <strong>of</strong>facilitating the settlement and distribution<strong>of</strong> an estate held by a personalrepresentative, the executive director <strong>of</strong>the department may, on behalf <strong>of</strong> the state,agree upon the amount <strong>of</strong> taxes at any timedue or to become due from such personalrepresentative under the provisions <strong>of</strong>chapter 198; and payment in accordance withsuch agreement shall be full satisfaction <strong>of</strong>the taxes to which the agreement relates.(c) Notwithstanding paragraph (a), for thepurpose <strong>of</strong> compromising the liability <strong>of</strong> anytaxpayer for tax or interest on the grounds<strong>of</strong> doubt as to liability based on thetaxpayer's reasonable reliance on a writtendetermination issued by the department asdescribed in paragraph (3)(b), thedepartment may compromise the amount <strong>of</strong> suchtax or interest liability resulting fromsuch reasonable reliance.10

(3)(a) A taxpayer's liability for any taxor interest specified in s. 72.011(1) may becompromised by the department upon thegrounds <strong>of</strong> doubt as to liability for orcollectability <strong>of</strong> such tax or interest. Ataxpayer's liability for interest under any<strong>of</strong> the chapters specified in s. 72.011(1)shall be settled or compromised in whole orin part whenever or to the extent that thedepartment determines that the delay in thedetermination <strong>of</strong> the amount due isattributable to the action or inaction <strong>of</strong>the department. A taxpayer's liability forpenalties under any <strong>of</strong> the chaptersspecified in s. 72.011(1) may be settled orcompromised if it is determined by thedepartment that the noncompliance is due toreasonable cause and not to willfulnegligence, willful neglect, or fraud. Thefacts and circumstances are subject to denovo review to determine the existence <strong>of</strong>reasonable cause in any administrativeproceeding or judicial action challenging anassessment <strong>of</strong> penalty under any <strong>of</strong> thechapters specified in s. 72.011(1). Ataxpayer who establishes reasonable relianceon the written advice issued by thedepartment to the taxpayer will be deemed tohave shown reasonable cause for thenoncompliance. In addition, a taxpayer’sliability for penalties under any <strong>of</strong> thechapters specified in s. 72.011(1) in excess<strong>of</strong> 25 percent <strong>of</strong> the tax shall be settled orcompromised if the department determinesthat the noncompliance is due to reasonablecause and not to willful negligence, willfulneglect, or fraud. The department shallmaintain records <strong>of</strong> all compromises, and therecords shall state the basis for thecompromise. The records <strong>of</strong> compromise underthis paragraph shall not be subject todisclosure pursuant to s. 119.07(1) andshall be considered confidential informationgoverned by the provisions <strong>of</strong> s. 213.053.(Emphasis added).11

29. <strong>Florida</strong> Administrative Code Chapter 12-13, titled"Compromise and Settlement," implements section 213.21. Therules in this chapter are to be "used by the Executive Directoror the Executive Director's designee... in the exercise <strong>of</strong> theauthority to settle and compromise liability for tax, interest,and penalty granted by section 213.21, F.S." Fla. Admin. CodeR. 12-13.001. Rule 12-13.003 sets forth the procedure forrequesting a compromise:(1) Subsections 213.21(2)(a) and (3), F.S.,authorize the Executive Director, or theExecutive Director's designee, to enter intoclosing agreements settling or compromisinga liability for tax, interest, or penaltyunder any <strong>of</strong> the chapters specified insection 72.011(1), F.S.(2)(a) No tax, interest, penalty, orservice fee shall be compromised or settledunless the taxpayer first submits a requestto compromise or settle tax, interest,penalty, or service fees. Such request mustbe in writing if:1. The amount requested to be compromisedis greater than $30,000; or2. The taxpayer asks to submit the requestin writing; or3. The complexity <strong>of</strong> the issue(s) involvedrequires that the taxpayer submit a writtenrequest that explains the issue(s).(b) The <strong>Department</strong> will accept a taxpayer'soral or electronic request for compromise orsettlement, if:1. The request for a compromise is for anamount less than or equal to $30,000; and12

2. The request is not subject to either <strong>of</strong>the criteria discussed in subparagraph 2. or3. <strong>of</strong> paragraph (a) <strong>of</strong> this subsection.(c) The taxpayer must establish in his orher request:1. In regard to tax or interest, doubt asto the taxpayer’s liability for tax orinterest, or actual lack <strong>of</strong> collectability<strong>of</strong> the tax or interest as demonstrated tothe satisfaction <strong>of</strong> the <strong>Department</strong> byaudited financial statements or othersuitable evidence acceptable to the<strong>Department</strong>. Grounds for finding doubt as toliability and doubt as to collectability,respectively, are set forth in furtherdetail in rules 12-13.005 and 12-13.006,F.A.C.2. In regard to penalty, that thenoncompliance was due to reasonable causeand not to willful negligence, willfulneglect, or fraud. The taxpayer shall berequired to set forth the facts andcircumstances which support the taxpayer’sbasis for compromise and which demonstratethe existence <strong>of</strong> reasonable cause forcompromise <strong>of</strong> the penalty or service fee andsuch other information as may be required bythe <strong>Department</strong>.3. In regard to the service fee, when afinancial institution error results in adraft, order, or check being returned to the<strong>Department</strong>, the taxpayer will be required tosubmit to the <strong>Department</strong> a written statementfrom the financial institution. The writtenstatement must give the detail <strong>of</strong> theerror(s) and explain why the financialinstitution was at fault. The statementmust be on the financial institution’sletterhead.4. Grounds for finding reasonable cause areset forth in further detail in Rule 12-13.007, F.A.C.13

30. Rule 12-6.0033 provides:(1)(a) A taxpayer may secure review <strong>of</strong> anassessment issued by the <strong>Department</strong>regarding tax returns, other requiredfilings, and billings by implementing theprovisions <strong>of</strong> this section. When a taxpayerhas pursued review under the provisions <strong>of</strong>either Rule 12-6.002 or 12-6.003, F.A.C., orboth, or has failed to comply with the timelimitations or has exhausted the reviewrights in those rules, the taxpayer shallnot have the right to pursue review underthis section. The assessment procedureunder this rule and review <strong>of</strong> suchassessments regarding tax returns, otherrequired filings, and departmental billingsshall not preclude an audit <strong>of</strong> taxpayerbooks and records, and shall not precludeaudit assessments or other assessments fortax deficiency.(b) To secure review <strong>of</strong> an assessmentregarding tax returns, other requiredfilings, and billings a taxpayer must file awritten protest postmarked or faxed within20 consecutive calendar days (150consecutive calendar days if the assessmentis addressed to a person outside the UnitedStates) from the date <strong>of</strong> issuance on theassessment.(c) Protests postmarked or faxed more than20 consecutive calendar days (150consecutive calendar days if the assessmentis addressed to a person outside the UnitedStates) after the date <strong>of</strong> issuance on theassessment will be deemed late filed, andthe assessment becomes final for purposes <strong>of</strong>Chapter 72, F.S., upon the expiration <strong>of</strong> 20consecutive calendar days (150 consecutivecalendar days if the assessment is addressedto a person outside the United States) afterthe date <strong>of</strong> issuance on the assessment,unless the taxpayer has timely secured awritten extension <strong>of</strong> time within which t<strong>of</strong>ile a protest.14

(d)1. A taxpayer may request an extension<strong>of</strong> time for filing a protest by mailing orfaxing a written request to the address orfax number designated on the assessment. Inorder for the taxpayer's request to beconsidered timely, the request must bepostmarked or faxed within 20 consecutivecalendar days (150 consecutive calendar daysif the assessment is addressed to a personoutside the United States) from the date <strong>of</strong>issuance on the assessment. Each extension<strong>of</strong> time will be for 15 consecutive calendardays. Within a 15 consecutive calendar dayextension period, the taxpayer may submit arequest in writing to the address or faxnumber designated on the assessment for anadditional 15 consecutive calendar dayextension within which to submit a writtenprotest.2. Failure to mail or fax the writtenprotest or failure to mail or fax a writtenrequest for an additional extension within a20 consecutive calendar day extension periodshall result in forfeiture <strong>of</strong> the taxpayer'srights to the proceedings provided by thisrule and the proposed assessment will becomea final assessment for purposes <strong>of</strong> Chapter72, F.S., at the expiration <strong>of</strong> the extendedfiling period.(2)(a) The protest shall be filed bymailing or faxing a written request to theaddress or fax number designated on theassessment, and shall include:1. The taxpayer's name, address, telephonenumber, federal taxpayer identifying number,and account number or audit number (whereappropriate);2. The tax type, the periods, and dollaramount <strong>of</strong> tax, interest, or penaltyprotested;3. A list <strong>of</strong> the unagreed items;15

4. A statement <strong>of</strong> facts and a description<strong>of</strong> any additional information not previouslyavailable that supports the list <strong>of</strong> unagreeditems;5. A statement explaining the law or otherauthority on which the taxpayer’s positionis based;6. A copy <strong>of</strong> the assessment;7. A statement whether oral presentationand argument are requested.(b)1. If the protest does not contain thisrequired information, the taxpayer will benotified in writing by the <strong>of</strong>fice issuingthe assessment that the required informationmust be submitted within 15 consecutivecalendar days. Within this 15 consecutivecalendar day period, the taxpayer may submita request in writing to the <strong>of</strong>fice issuingthe assessment for an additional 15consecutive calendar days within which tosubmit this required information. Within a15 consecutive calendar day extensionperiod, the taxpayer may submit a request inwriting to the <strong>of</strong>fice issuing the assessmentfor an additional 15 consecutive calendarday extension within which to submit thisrequired information.2. Failure to submit this information or torequest an additional 15 consecutivecalendar day extension within either theoriginal 15 consecutive calendar day periodor an additional 15 consecutive calendar dayextension period shall result in issuance <strong>of</strong>a written dismissal <strong>of</strong> the protest andforfeiture <strong>of</strong> the taxpayer's right to theproceedings provided by this rule.3. If the taxpayer either fails to submitthe required information or fails to requestan extension <strong>of</strong> time within which to submitthe required information, the assessment16

shall become a final assessment for purposes<strong>of</strong> Chapter 72, F.S., on the later <strong>of</strong>:a. The date a 15-consecutive calendar dayperiod expires pursuant to this rule; orb. The expiration <strong>of</strong> 20 consecutivecalendar days after the date <strong>of</strong> issuance onthe assessment.(3)(a)1. Upon receipt <strong>of</strong> a complete, timelyfiled written protest, the <strong>of</strong>fice thatissued the assessment will review theprotest and initiate an attempt to resolvethe issues. The <strong>of</strong>fice that issued theassessment may require the <strong>of</strong>ficeoriginating the assessment to provide awritten explanation, report, or narrativesetting forth the basis for the assessment.A copy <strong>of</strong> any explanation, report, ornarrative provided by the originating <strong>of</strong>ficepursuant to this sub-paragraph shall begiven to the taxpayer, if such document isdisclosable pursuant to applicable law.2. If a resolution is not achieved, theprotest will be forwarded to TechnicalAssistance and Dispute Resolution.Technical Assistance and Dispute Resolutionwill review the protest and may require the<strong>of</strong>fice originating the assessment to providea written explanation, report, or narrativesetting forth the basis for the assessment.A copy <strong>of</strong> any explanation, report, ornarrative provided by the originating <strong>of</strong>ficepursuant to this sub-paragraph shall begiven to the taxpayer, if such document isdisclosable pursuant to applicable law. Ifrequested by the taxpayer, an opportunityfor submission <strong>of</strong> additional information andan oral conference will be provided.Conferences are conducted informally inTallahassee, <strong>Florida</strong>, and no transcript <strong>of</strong>the proceedings will be made by the<strong>Department</strong>.17

(b) If a protest is timely filed and thetaxpayer and the <strong>Department</strong> are unable toresolve the disputed issues, a Notice <strong>of</strong>Reconsideration (NOR) shall be issued. Theassessment will become a final assessmentfor purposes <strong>of</strong> Chapter 72, F.S., as <strong>of</strong> thedate <strong>of</strong> issuance on the NOR.(4) If at any time jeopardy conditionsexist, the <strong>Department</strong> may initiateenforcement action under the <strong>Department</strong>'sjeopardy procedures to enforce anassessment.(5) Procedures outlined in this sectionshall be for investigative purposes asspecified in Section 120.57(5), F.S.(Emphasis added).31. Rule 12-6.0033 is titled "Protest <strong>of</strong> AssessmentsIssued by the <strong>Department</strong> Regarding <strong>Tax</strong> Returns, Other RequiredFilings, and Billings." While it is replete with statements <strong>of</strong>limitation such as the underscored provision above, the ruleappears to be self-contained. Failure to timely file a protestconstitutes a forfeiture <strong>of</strong> the right to "pursue review underthis section." The rule does not appear to reach beyond chapter12-6 to limit the authority <strong>of</strong> the <strong>Department</strong>'s ExecutiveDirector to entertain an <strong>of</strong>fer <strong>of</strong> compromise pursuant to section213.21(2)&(3) and chapter 12-13. It makes conceptual sense thatthe Executive Director's discretionary ability to compromise apenalty in accordance with the criteria set forth in rule 12-13.007 would stand apart from the more workaday informal protestand appeal procedure outlined in chapter 12-6.18

32. It is concluded that the <strong>Department</strong> erred in failingto at least consider <strong>Bell</strong> <strong>Industries</strong>' request for compromise <strong>of</strong>the amount owed. <strong>Bell</strong> <strong>Industries</strong> should be given an opportunityto submit a request for settlement or compromise pursuant torules 12-13.003 and 12-13.007. This recommendation does notpurport to make any statement as to the merits <strong>of</strong> the <strong>Bell</strong><strong>Industries</strong> request.33. In summary, the evidence in this case established thatthe <strong>Department</strong> is entitled to levy upon the assets <strong>of</strong> <strong>Bell</strong><strong>Industries</strong> in the amount <strong>of</strong> $23,800.41. However, the evidencealso established that the <strong>Department</strong> should have considered <strong>Bell</strong><strong>Industries</strong>' request to settle or compromise the penaltyassessment.RECOMMENDATIONBased on the foregoing Findings <strong>of</strong> Fact and Conclusions <strong>of</strong>Law, it isRECOMMENDED that the <strong>Department</strong> <strong>of</strong> <strong>Revenue</strong> enter a finalorder finding that the $23,800.41 in the Wells Fargo Bankbelonging to <strong>Bell</strong> <strong>Industries</strong> is subject to the Notice <strong>of</strong> Intentto Levy that the <strong>Department</strong> <strong>of</strong> <strong>Revenue</strong> issued on March 5, 2012,in accordance with section 213.67, <strong>Florida</strong> Statutes, but thatthe levy should not occur until <strong>Bell</strong> <strong>Industries</strong> is provided areasonable period <strong>of</strong> time in which to submit a request for19

settlement or compromise pursuant to <strong>Florida</strong> Administrative CodeRule 12-13.003.DONE AND ENTERED this 27th day <strong>of</strong> August, 2012, inTallahassee, Leon County, <strong>Florida</strong>.SLAWRENCE P. STEVENSONAdministrative Law JudgeDivision <strong>of</strong> Administrative HearingsThe DeSoto Building1230 Apalachee ParkwayTallahassee, <strong>Florida</strong> 32399-3060(850) 488-9675 SUNCOM 278-9675Fax Filing (850) 921-6847www.doah.state.fl.usFiled with the Clerk <strong>of</strong> theDivision <strong>of</strong> Administrative Hearingsthis 27th day <strong>of</strong> August, 2012.1/ENDNOTESA power <strong>of</strong> attorney was filed giving Mr. Begle authority torepresent <strong>Bell</strong> <strong>Industries</strong>, <strong>Inc</strong>., in this matter. At thehearing, Mr. Begle explained that <strong>Bell</strong> <strong>Industries</strong>, <strong>Inc</strong>., is aholding company for several entities, including Mr. Begle'semployer, <strong>Bell</strong> Techlogix, <strong>Inc</strong>. Mr. Begle is the controller for<strong>Bell</strong> Techlogix, <strong>Inc</strong>., and is a corporate <strong>of</strong>ficer <strong>of</strong> <strong>Bell</strong><strong>Industries</strong>, <strong>Inc</strong>., which has no controller or chief financial<strong>of</strong>ficer <strong>of</strong> its own. The <strong>Department</strong> <strong>of</strong> <strong>Revenue</strong> had no objectionto Mr. Begle's acting as the qualified representative for <strong>Bell</strong><strong>Industries</strong>, <strong>Inc</strong>.2/Based on its date, the warrant could only have sought torecover the amount owed for the February through May 2007 taxperiod. However, the amount stated in this warrant is the sameamount listed in the <strong>Department</strong>'s March 5, 2012, Notice <strong>of</strong>Intent to Levy that is the subject <strong>of</strong> this hearing. Documentspresented at the hearing show that the <strong>Department</strong> issued aNotice <strong>of</strong> Freeze to Wells Fargo Bank on October 13, 2011, in theamount <strong>of</strong> $26,178.45. Nonetheless, in this proceeding the20

<strong>Department</strong> will be limited to the amount claimed in the Notice<strong>of</strong> Intent to Levy.3/Rule 12-13.007 provides:(1)(a) The Executive Director or theExecutive Director's designee, as enumeratedin Rule 12-13.004, F.A.C., will make adetermination <strong>of</strong> whether the taxpayer'snoncompliance was due to reasonable causeand not to willful negligence, willfulneglect, or fraud based on the facts andcircumstances <strong>of</strong> the specific case. Thestandard used in this determination shall bewhether the taxpayer exercised ordinary careand prudence and was nevertheless unable tocomply.(b) The exercise <strong>of</strong> ordinary care andprudence may be demonstrated by facts andcircumstances as stated in writing by thetaxpayer. Additionally, in those cases whena <strong>Department</strong> employee has information orknowledge supporting the taxpayer'sassertion <strong>of</strong> ordinary care and prudence, afinding <strong>of</strong> reasonable cause may be basedupon such additional information orknowledge, provided the finding <strong>of</strong>reasonable cause is documented to reflectsuch information or knowledge.(c) When evaluating the facts andcircumstances relevant to penalties assessedas a result <strong>of</strong> an audit, the <strong>Department</strong>shall consider information provided by thetaxpayer in relation to the following:1. Whether the taxpayer has been auditedpreviously, and, if so, whether thepenalties which are the subject <strong>of</strong> thecompromise request result from taxpayeractions that resulted in a specific issuerelateddeficiency assessment during one ormore <strong>of</strong> the previous audits. It is not theintent <strong>of</strong> this subparagraph to apply toinfrequent occurrences <strong>of</strong> human error;21

2. The materiality <strong>of</strong> the tax deficiencyassessed in an audit when considered withinthe context <strong>of</strong> taxes correctly reported andtimely remitted by the taxpayer for the sametax during the same audit period;3. Whether the taxpayer has initiatedcontrols or other actions that will promoteproper future reporting with respect tothose activities which contributed to theaudit deficiency and related penalties; and4. Whether the tax was collected and notremitted to the state by the taxpayer.(d) When evaluating the facts andcircumstances relevant to penalties imposedpursuant to a billing not resulting from anaudit, the <strong>Department</strong> shall consider:1. The timeliness <strong>of</strong> payments made by thetaxpayer during previous reporting periods;2. The materiality <strong>of</strong> the tax deficiency towhich the penalty relates within the context<strong>of</strong> the amount <strong>of</strong> the same taxes correctlyreported and remitted;3. Whether the taxpayer has initiatedcontrols or other actions related to theerrors that resulted in the billing andrelated penalties in order to promote bettercompliance in the future; and4. Whether the tax was collected and notremitted to the state by the taxpayer.(2) Reasonable cause is indicated by theexistence <strong>of</strong> facts and circumstances whichsupport the exercise <strong>of</strong> ordinary care andprudence on the part <strong>of</strong> the taxpayer incomplying with the revenue laws <strong>of</strong> thisstate. Depending upon the circumstances,reasonable cause may exist even though thecircumstances indicate that slightnegligence, inadvertence, mistake, or errorresulted in noncompliance. Consideration22

will be given to the complexity <strong>of</strong> the factsand the difficulty <strong>of</strong> the tax law and theissue involved, and also to the existence orlack <strong>of</strong> clear rules or instructions coveringthe taxpayer’s situation.(3) Ignorance <strong>of</strong> the law or an erroneousbelief as to the need to comply with arevenue law constitutes reasonable causewhen there are facts and circumstances,which indicate ordinary care, and prudencewas exercised by the taxpayer.(a) For example, ignorance <strong>of</strong> the law or anerroneous belief held by the taxpayer is abasis for reasonable cause when the taxpayerhas a limited knowledge <strong>of</strong> business, alimited education, limited experience in<strong>Florida</strong> tax matters, or advice received froma competent advisor was relied upon incomplying with the provisions <strong>of</strong> a revenuelaw.(b) A good faith belief held by a taxpayerwith limited business knowledge, limitededucation, or limited experience with<strong>Florida</strong> tax matters is a basis forreasonable cause when there is reasonabledoubt as to whether compliance is requiredin view <strong>of</strong> conflicting rulings, decisions,or ambiguities in the law.(4) Reliance upon the erroneous advice <strong>of</strong>an advisor is a basis for reasonable causewhen the taxpayer relied in good faith uponwritten advice <strong>of</strong> an advisor who wascompetent in <strong>Florida</strong> tax matters and theadvisor acted with full knowledge <strong>of</strong> all <strong>of</strong>the essential facts. Informal advice,advice based upon insufficient facts, advicereceived in cases where facts weredeliberately concealed, or obviouslyerroneous advice are not grounds forreasonable cause. To establish reasonablecause based upon reliance on the advice <strong>of</strong> acompetent advisor, the taxpayer shalldemonstrate:23

(a) That the taxpayer sought timely advice<strong>of</strong> a person who was competent in <strong>Florida</strong> taxmatters;(b) That the taxpayer provided the advisorwith all <strong>of</strong> the necessary information andwithheld nothing; and(c) That the taxpayer acted in good faithupon written advice actually received fromthe advisor.(5) Reasonable reliance upon the expressterms <strong>of</strong> written advice given by the<strong>Department</strong> establishes reasonable cause whenthe taxpayer shows that the advice wastimely sought from a departmental employeeand that all material facts were disclosed,and that the express terms <strong>of</strong> the advicewere actually followed. "Written advice"for purposes <strong>of</strong> establishing reasonablecause as a basis for compromise <strong>of</strong> penaltiesincludes a writing issued to the sametaxpayer by the <strong>Department</strong> in response tothat taxpayer's request for advice. Thedetermination whether the taxpayer hasreasonably relied on such written advicewill be made in accordance with the criteriafor determining if a taxpayer has reasonablyrelied on a written determination forpurposes <strong>of</strong> compromise <strong>of</strong> tax and interestas set forth in subsection 12-13.005(2),F.A.C.(6) Reliance upon another person to complywith filing requirements, or to obtaininformation, or to properly prepare returnsor reports, is a basis for reasonable cause,depending upon the circumstances.Noncompliance due to nonperformance <strong>of</strong> aministerial-type function, inadvertentmisplacement <strong>of</strong> returns, reports, orinformation, or the failure <strong>of</strong> thetaxpayer's agent to properly prepare or filereturns or reports are each a basis forreasonable cause when the taxpayerestablishes that adequate procedures or24

steps for complying existed; that the personresponsible for performing the functionordinarily performed the task properly; or,that extenuating or unusual circumstancesprevented compliance.(7)(a) Death, illness, or incapacity <strong>of</strong> thetaxpayer is a basis for reasonable causewhen such circumstances directly preventedcompliance or adversely affected thetaxpayer’s ability to comply. Anunexplained or unsupported claim <strong>of</strong>noncompliance due to death, illness, orincapacity is not a basis for reasonablecause. It must be shown that the death,illness, or incapacity directly preventedcompliance, in spite <strong>of</strong> reasonable effortsto comply.(b) Death, illness, or incapacity <strong>of</strong> amember <strong>of</strong> the taxpayer’s immediate family,or <strong>of</strong> a person solely responsible formaintaining information necessary to comply,or <strong>of</strong> a person with sole authority toprepare required returns or reports is abasis for reasonable cause when thenoncompliance resulted directly from such acircumstance, in spite <strong>of</strong> reasonable effortsto comply.(8) Circumstances beyond a taxpayer'sreasonable control, such as acts <strong>of</strong> war,natural disaster, accidental destruction byfire or other casualty, or unavoidableabsence are a basis for reasonable causewhen the taxpayer demonstrates suchcircumstances directly prevented compliance,or adversely affected the taxpayer’s abilityto comply.(9) Reasonable cause shall be presumed toexist whenever a taxpayer voluntarily selfdisclosesliability for tax, interest, orpenalty by contacting the <strong>Department</strong> inwriting to disclose and pay tax and interestdue prior to any contact by the <strong>Department</strong>concerning such liability. The presumption25

does not apply when the taxpayer isregistered with the <strong>Department</strong> or hasroutinely filed returns with the <strong>Department</strong>and the taxpayer's self-disclosure relatesto a delinquency or deficiency that isobvious and would routinely generate abilling if not otherwise self-disclosed.(10) Reasonable cause shall be presumed toexist whenever a taxpayer voluntarily andtimely participates in completion <strong>of</strong> formsprovided to the taxpayer by the <strong>Department</strong>as part <strong>of</strong> a self-audit or self-analysisprogram and promptly remits tax and interestdue pursuant to such self-audit or selfanalysis.(11) Reasonable cause shall be presumed toexist whenever a person who is not otherwiserequired to register as a dealer pursuant toChapter 212, F.S., purchases consumer goodsfor personal use pursuant to a mail ordersale and remits <strong>Florida</strong> use tax andinterest, either voluntarily or in promptresponse to a proposed assessment,assessment, or use tax billing issued by the<strong>Department</strong>.(12) Reasonable cause shall be presumed toexist whenever a person who is not otherwiserequired to register as a dealer pursuant toChapter 212, F.S., purchases tangiblepersonal property and imports same into<strong>Florida</strong> for business purposes and remits<strong>Florida</strong> use tax and interest, eithervoluntarily or in prompt response to aproposed assessment, assessment, or use taxbilling issued by the <strong>Department</strong>.(13) Reasonable cause shall be presumed toexist whenever the penalty at issue relatesto tax or interest which is compromised onthe basis <strong>of</strong> doubt as to liability or doubtas to collectability.(14) Subsections (3) through (13) areintended to provide examples and guidance to26

taxpayers and <strong>Department</strong> employees, butshould not be construed to limit penaltycompromises to only those circumstancesdescribed in such subsections. Penalty maybe compromised whenever the facts andcircumstances demonstrate reasonable cause.COPIES FURNISHED:Mark A. Begle<strong>Bell</strong> <strong>Industries</strong>/<strong>Bell</strong> Techlogix, <strong>Inc</strong>.Suite 17008888 Keystone CrossingIndianapolis, Indiana 46240mbegle@belltechlogix.comJohn Mika, EsquireOffice <strong>of</strong> the Attorney GeneralThe Capitol, Plaza Level 01Tallahassee, <strong>Florida</strong> 32399-1050john.mika@myfloridalegal.comNancy Terrel, General Counsel<strong>Department</strong> <strong>of</strong> <strong>Revenue</strong>Post Office Box 6668Tallahassee, <strong>Florida</strong> 32314-6668terreln@dor.state.fl.usMarshall Stranburg, Interim Executive Director<strong>Department</strong> <strong>of</strong> <strong>Revenue</strong>Post Office Box 6668Tallahassee, <strong>Florida</strong> 32314-6668stranbum@dor.state.fl.usNOTICE OF RIGHT TO SUBMIT EXCEPTIONSAll parties have the right to submit written exceptions within15 days from the date <strong>of</strong> this Recommended Order. Any exceptionsto this Recommended Order should be filed with the agency thatwill issue the Final Order in this case.27