FINAL NEWSLETTER - Gold Financial Pty Ltd

FINAL NEWSLETTER - Gold Financial Pty Ltd

FINAL NEWSLETTER - Gold Financial Pty Ltd

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The <strong>Gold</strong> AdvantageVOLUME 06 ‐ISSUE 01 ‐ July 2012Inside this issue:Welcome Message from CEOUpdate from Ryan BarberUpdate from Peter KuzulniUpdate from Regional Directors<strong>Gold</strong> <strong>Financial</strong> ConferenceOneCare for the mining, oil & gas IndustryBT <strong>Financial</strong> Protection for Homemakers

Welcome Message From the CEOHello to all members of the <strong>Gold</strong> <strong>Financial</strong>family and welcome to a whole new world.Over the past six months we haveundergone many substanal changes and Imust admit there were mes that Iwondered “If we were on the right track”.It all began with closing our office (for thepast six years) in Parkville and relocang toBallarat. We are now well entrenched in thenew office with great facilies and amplesupport staff.Our next challenge was to complete acomprehensive audit on all of our authorizedrepresentaves so that both the advisersand senior management knew exactly whatsteps needed to be taken to be fullycompliant.Naturally it would not be right to subject theadvisers to strong scruny withoutsubjecng ‘head office’ to the same rules.Therefore we engaged Pathway LicenseeServices to come to our offices and conducta comprehensive audit of our enreoperaons and provide us with a wrienreport outlining their recommendaons ofwhat we needed to do to be able to countourselves as a highly professional AFSLicensee of which we can all be proud.One of the biggest challenges that we facedwas to update all our documentaonincluding rewring our ‘Policies andProcedures Manual’. I am pleased to saythat I have signed off on the final version 4July and I am very proud of the newdocument.Special thanks must go to Michael Rowlesand Chris Holcombe from Pathway LicenseeServices. Especially Michael who must haveput over a hundred hours of his me intothis document and of course, Ryan Barberand Peter Kuzulni from <strong>Gold</strong> who have bothworked relessly to ensure that we met ourtarget of updang all <strong>Gold</strong> documentsbefore our new website launch in July.Speaking of the new website, we expect to“flick the switch” on 10 July and I am hopefulthat all members of <strong>Gold</strong> will be happy withthe result. To Gary Sco and his team atBelgair Graphics my hearelt thanks; theyhave shared our dream and worked relesslyto ensure that we now have a website ofwhich we can all be very proud. Well done!THE FUTUREWe can now move forward confident thatwe have a fully compliant infrastructure. Wehave Ryan and Peter working with ouradvisers to ensure that all of their concernsare addressed as they arise. WE will beintroducing an adviser awareness programand will conduct regular Skype trainingsessions for those who want to get involved.We will conduct three professionaldevelopment days per year as well as ournaonal conference. Our next round ofprofessional development days will be: Perth: Monday, 27 August 2012 Adelaide: Wednesday, 29 August 2012 Melbourne: Friday, 31 August 2012I will be speaking al all our PD days and willbring everybody up to date with what ishappening in <strong>Gold</strong>I am also very happy to report that we haveour Preferred Partner agreements in placefor a further 12 months. We have 10Preferred Partners and we have built links totheir individual websites on our new <strong>Gold</strong>website. Their financial assistance ensuresthat we are able to maintain a qualityeducaon and research program.I am very excited about our future. We cannow embark on a new recruing programconfident that we can aract qualitypracces.Over the next couple of weeks, I will befinalising our budget for the nexttwelve months as well as updang ourbusiness plan. Our main form ofcommunicaon moving forward will bethe <strong>Gold</strong> Adviser newsleer which willbe posted in the Adviser ResourceCentre on our website.Finally, I will be entering intodiscussions with various financialinstuons in the hope that I canarrange an ongoing ‘Triparte Financefacility’ to enable our advisers topurchase in‐house pracces.Enjoy your golden futureWarmest regardsBernie TooheyUPCOMING PD DATESPERTH:‐ 27 August 2012ADELAIDE:‐ 29 August 2012MELB:‐ 31 August2012

Directors ReportsEASTERN REGIONMatthew HillsWESTERN REGIONDavid BarnesIt’s hard to believe we are half way through the year already!!Head office in Ballarat is fully funconal and running smoothlyand I think everyone would agree that there has been veryminimal impact to the running of <strong>Gold</strong>’s day to day acvies.Several of our preferred partners have held sessions in theboardroom and we have had very favourable feedback. If youare in the Ballarat area please make sure you call in and sayhello to Bernie, Ryan and myself and check out the office.Updated fact finds and FSG’s have recently been sent throughto all <strong>Gold</strong> advisers. The fact find process obviously covers offthe relevant client informaon and compliance requirements,but it also will provide more business opportunies ifcompleted correctly. To make relevant and appropriaterecommendaons to your client you must “know your client”.Please make sure that the relevant secons of the fact finderare completed comprehensively.Our first PD Day of the year went very well in Melbourne andwas well supported. Confirmaon of our next PD Day willfollow shortly. Don’t forget best dressed!! Please note that alladvisers are required to aend all PD Days. Separate to <strong>Gold</strong>’sPD Days please make an effort to support our preferredpartner’s product updates / road shows. The AFA road show isalso coming up 24 th July in Melbourne. I recently sent an emailto all Vic AR’s advising this and would be happy to coordinate atable at this event. Based on the AFA’s support of <strong>Gold</strong> overmany years it would be great if we could get at least a table of10 together!!There is no doubt business is prey tough at the moment. Thisis when clients need to maintain their policies – not lapse orreduce cover. Keep making the calls, get in front of your clientsand reinforce the need for personal protecon. As we all knowwe have a massive underinsurance problem in Australia sothere are plenty of opportunies to write “new” business.Since January one new adviser Neil Bartoreli, has joinedthe WA team, welcome Neil we hope you will recommend<strong>Gold</strong> to your old dealer team’s advisers.The 2012 <strong>Gold</strong> Conference preparaon is well advanced(See separate conference report)The new <strong>Gold</strong> Fact Find has been introduced by PeterKuzilni and was widely commented on due to its size.(Mainly due to secons not authorized for use by someadvisers) Requests to remove some secons (Shares,Margin lending, SMSF data) into a separate file have beenmade to Peter and a revised doc has been issued, watchthis space for more new developments!Sherryl and David Barnes aended the MDRT conferencein Bangkok Thailand February 2012 and thoroughlyrecommend advisers look at aending the2013Conference in India, log on to hp://www.mdrt.org/2013Experience/ for more informaon.Bernie Toohey held a luncheon at the WA Celc Club inFebruary to brief WA Advisers about the changes to <strong>Gold</strong>slocaon and operaon, all advisers appreciated theupdate. I followed this up on February 24 th with aDirectors Report resulng from our last Board Meeng;our Preferred Partner BT Risk, Peter Brown ran aninteresng “Back to the basics Sales” training session andwas well received.I arranged a Personal Development day which was held onthe 27 th March 2012, all advisers other than BernardMarn (Mother in law deceased) & Neil Bartoreli (Justjoined) aended with all preferred partners other thanZurich presenng. Zurich did aend for the full day andmixed well with our advisers (Also supplied pens/pads forthe day) all feedback has been very posive.A WA <strong>Gold</strong> luncheon/meeng was arranged and held onApril 20 th at the EFYC where Paul Thurbon presented hisACT “<strong>Gold</strong>” Client CRM. In general it was well accepted bythe 12 aendees, if approved by <strong>Gold</strong> could well suit a lotof advisers who currently do not have an electronic database. The price and funconality of ACT are excellent andin my opinion ck most of the compliance areas.Finally it’s been great to see <strong>Gold</strong> advisers helping each otherand sharing their idea’s and informaon in relaon to backoffice systems and procedures, CMS, paperless office etc.The next <strong>Gold</strong> WA Meeng is being held on June 29 th at 11amwith Zurich holding an update followed by a light lunch andinformaon/ideas sharing.

SOUTHERN REGIONBruno StrazdinsThe financial year is rapidly coming to an end and South Australian Advisers have been busily engaged in working both IN and ONtheir business: Aending Product Provider Launches and Updates Implemenng CRM systems into their pracces Subscribing to use Midwinter Soware and/or forming an alliance with a user Aending the March <strong>Gold</strong> PD Day Becoming FoFA readyOur March PD Day was hosted by Zurich, at their Adelaide offices and commenced with a special hearelt presentaon by MichaelMurphy, long standing member of the AFA and a personal friend of Bernie Toohey, whom spoke to us regarding his journey andissues dealing with his Terminal Cancer. A very powerful, personal and sobering talk.Presentaons by our preferred Partners one the day ranged in topics from Economic Updates, Estate Planning, Insurance issuesdealing with FoFA and Compliance.A joint presentaon hosted by both Blackrock and Aberdeen was aended well in May and updated those present with the currentstate of play in the Global Equies and Fixed Interest markets.THE GOLD FINANCIAL CONFERENCE 2011PICTUREGALLERY

THE GOLD FINANCIAL CONFERENCE 2012David Barnes & Tania WalscottPlanning is coming along smoothly for this years conference. Recently we sent an email summarising expected dates and format. Ifyou have any suggesons we welcome your help, this is your conference as much as ours.Our presenters are scheduled, however we are waing unl about August before confirming topics. It is important that the sessionsnot be a repeat of anything you have seen before, so we decided to wait unl aer the mid‐year PD days before confirmingindividual items. Not to menon the ever changing legislave environment keeping us on our toes. We don’t really need to hearabout the superannuaon contribuon cap allowances… that never happened JIn addion to our standard schedule, we are looking to add 2 more scheduled events to our inerary.Formal Arrangement for Spouses on the FridayPartners and Spouses have a free day Friday to shop, tour or relax. As Perth has a very expensive taxi system (and quite a complextransport system), we propose to arrange a dedicated Bus transfer facility for those who wish to parcipate in this slightly moreformal event. Our concept was to select a few locaons in an informal tour, which would allow the partners an opportunity to seesome sights of Perth. Whilst this would be a private cost, it would provide you a days entertainment. We were thinking along thelines of “The Bell Tower”, bus tour of “Kings Park”, Morning Tea in Fremantle, Late Lunch in Subiaco, Harbor Town…Have a talk with your partners and see if they would be interested in this arrangement. If yes, what would they like to see?If your partner wishes to take on Perth themselves that’s fine… we just thought we would offer J An email will be sent shortly withdetails.The Elusive Friday NightAs you all know this is normally an event free night, however we are proposing to organise a bus facility to transfer guests to theBurswood Hotel Complex for an evening of entertainment. Burswood is our one complex that offers a Casino Facility, Restaurants,Pubs and a Night Club. Whilst the evening would be a private cost (and reservaons are a must for dinner) having a dedicated grouptransfer to and from Burswood would extend the conference feel.In order to have these ideas go ahead we would require definite numbers and bus transfer costs to be prepaid. We shall emailthrough the finalised schedules, bus costs, mes, restaurants details etc. in the next few weeks. We look forward to hearing yourresponses and suggesons.Next Milestone – Accommodaon Fee Invoices shall be emailed early July, with payment informaon.

OneCare for the mining, oiland gas industryTailored cover to meet their unique needs.In the mining, oil and gas industry, workers are exposed to risks fewothers have to worry about. But despite the dangers, and theirsubstanal incomes, not many have appropriate levels of proteconagainst death, sickness and injuryOneCare for the mining, oil and gas industryThe mining, oil and gas industry can be a risky business. On top of the day‐to‐day hazards associated with their work environments,workers also face the same health risks as everyone else – like cancer and heart disease.These risks are why life insurance is so important for your mining clients. Unfortunately, occupaonal risks relang to their workenvironment have tradionally made it difficult for many miners and related professionals to get appropriate levels of cover.OnePath is one of the leading providers of life insurance in Australia, offering a broad range of covers under the OneCare productincluding Life, Trauma, Total and Permanent Disability (TPD), Income Protecon and Living Expense. OneCare has been designed toprovide tailored financial protecon for workers in the mining, oil and gas industry – helping you meet the unique insurance needs ofyour client,and their family. Refer to the Product Disclosure Statement (PDS) for full product details.Individual assessment of occupaonsThe OneCare offer caters for 62 mining and 49 oil and gas occupaons. OnePath’s unique approach of individually assessingoccupaons in this industry recognises each occupaon as carrying different risk levels. This ensures your client obtains the mostcomprehensive coverage possible.Subject to successful underwring, cover is available to all underground miners and offshore oil and gas workers if their occupaonappears on the approved occupaon lisng.OneCare has a Mining, Oil and Gas Occupaon guide which is a summary of Income Secure Cover and TPD Cover. For more informaonvisit the Life Risk Tool Box available at Adviser Advantage to download or contact your BDM to obtain a copy.Mining workersOf the 62 mining occupaons, 56 have access to Life Cover, TPD Cover, Trauma Cover and Income Secure Cover – with only 5 ofthese occupaons classed as ‘special risk’. Living Expense Cover is available for the few occupaons that don’t qualify for IncomeSecure Cover.Oil and gas workersOut of the 49 oil and gas occupaons available, 42 have access to Life Cover, TPD Cover, Trauma Cover and Income Secure Cover –with only seven of these occupaons classed as ‘special risk’. Living Expense Cover is available for the small number of occupaonsthat don’t qualify for Income Secure Cover.Income Secure CoverTwo‐er total disability definion OnePath’s Income Secure Cover contains a generous two‐er total disability definion that isinbuilt into the Standard, Comprehensive and Professional offers. Insured persons who are ill or injured can make a full claim if theysasfy either er of the definion.

The first er triggers where the insured is not working and cannot perform ‘one important duty’ of their occupaon. Beware of otherinferior offers in the marketplace that impose the much harsher criteria of not being able to perform ‘important dues’.The second er allows an insured who is unable to work more than 10 hours per week to retain their full monthly benefit whilstworking up to 10 hours a week. This er provides the insured with addional flexibility that OnePath is pleased to make available.Long benefit periodsA ‘to age 65’ benefit period is available for all occupaons qualifying for Income Secure Cover that are not considered ‘special risk’.For professionals and white collar sedentary office workers, a ‘to age 70’ benefit period is also available.Maximum earnings proteconOnePath covers all personal exeron earnings with the excepon of ‘Living Away From Home’, ‘Commute’ or ’Site’ allowances.Income Secure Special RiskFor workers in higher‐risk occupaons, Income Secure Special Risk provides access to a two year or six year benefit period. In fact,your BDM can show you how to combine both and obtain an industry‐leading eight year benefit period for your client.A maximum monthly benefit of $10,000 is also industry‐leading. Unlike other insurers who can cancel or amend a special riskcontract upon annual renewal, the OneCare Special Risk contract is guaranteed renewable – meaning the level of your client’sprotecon cannot be diminished.Remember only five mining and seven oil and gas occupaons are classified as ‘special risk’ with limited benefits. The vast majority of occupaonsqualify for the Standard, Comprehensive and Professional contracts.TPD CoverChoice of ‘any’ and ‘own’ occupaon TPD definionsOnePath provides TPD Cover to all mining, oil and gas occupaons noted in the approved occupaon lisng.MinersOf the 62 mining occupaons listed:50 to 52 occupaons have access to the ‘any occupaon TPD’ definion42 occupaons have access to the ‘any’ and ‘own’ occupaon TPD definionsAll 62 occupaons have access to the ‘non‐working’ TPD definion.Oil and gas workersFor the 49 Oil and Gas occupaons noted:36 to 38 occupaons have access to ‘any’ occupaon TPD definion29 occupaons have access to ‘any’ and ‘own’ occupaon TPD definionsAll 49 occupaons have access to the ‘non‐working’ TPD definion.Paral TPD BenefitThe Paral TPD Benefit recognises the impact a single loss of limb or eye can have on your client’s lifestyle. It will pay a paralpayment of 25% of the sum insured (up to $500,000).The Double TPD Opon (TPD Cover taken with Life Cover)An extra‐cost opon allowing your clients to boost their protecon aer a TPD claim. This means your client’s life coveramount is not reduced by the TPD payment and that all future premiums for that cover are waived.Family Packaging DiscountOneCare offers a group discount between 5% and 10% that’s parcularly relevant for families. The packaging discount is based on

Family Packaging DiscountOneCare offers a group discount between 5% and 10% that’s parcularly relevant for families. The packaging discount is based onthe number of adult lives only, and the discount is applied to all policies and lives insured in the group. There is no need for thefamily members to be on the same policy to achieve this discount.This informaon is current at September 2011 but is subject to change. It is for adviser use only and may only be reproduced with thepermission of OnePath Life Limited (OnePath Life) ABN 33 009 657 176, AFSL 238341. OneCare is issued by OnePath Life and OneCareSuper is issued by OnePath Custodians <strong>Pty</strong> Limited (OnePath Custodians) (ABN 12 008 508 496 AFSL 238 346 RSE L0000673).The informaon provided is of a general nature and does not take into account a customer’s personal needs and financialcircumstances. Customers should consider the appropriateness of the informaon, having regard to their objecves, financialsituaon and needs. Customers should read the Product Disclosure Statement (PDS) available at onepath.com.au and considerwhether this product is right for them. Australia and New Zealand Banking Group Limited (ANZ) (ABN 11 005 357 522) is anauthorised deposit taking instuon (Bank) under the Banking Act 1959 (Cth). OnePath Life and OnePath Custodians are owned byANZ – they are the issuer of the products but are not a Bank. Except as set out in the issuer’s contract terms (including the PDS), theproducts are not a deposit orother liability of ANZ or its related group companies. None of them stands behind or guarantees the issuers.

Protecng homemakers against temporary incapacityMost planners would agree that temporarily losing the capacity to generate income is, more oen than not, likely to result in direfinancial consequences for the family unit. As a result, the convenonal financial planning approach is almost always to ensureincome is covered in the event of temporary incapacity.However, while the main breadwinner generally takes priority, temporary incapacity of a non‐income earning spouse such as ahomemaker can also have a significant financial impact on the family unit. In contrast there is very lile coverage for temporaryincapacity in this segment.To quanfy the impact of a homemaker being temporarily incapacitated, a recent survey esmated the cost of replacing a mother tobe in excess of $75,000 per annum. And if you think about it, who would pick up these pieces...Cooking and preparing mealsCleaning the houseWashing and drying clothesShopping for groceriesCaring for children (feeding, supervising, bathing, dressing, transporng)The following table from the Australian Bureau of Stascs esmates that a female homemaker who is not employed and haschildren under 15, spends around 65 hours per week on unpaid household work. Even with the connuaon of the breadwinner’sincome, there simply wouldn’t be enough hours in the day to make up for the homemaker’s lost me.Female partnernot employedFemale partneremployed parttimeMales(hours and minutes per week)Paid Household Totalwork workFemales(hours and minutes per week)Paid Household Totalwork work52:3 19:57 72:27 0:29 65:13 65:4151:27 51:27 21:21 19:29 50:24 69:53Source: ABS 2006 – Couples with children aged under 15 years where the male partner is employed full meIt is esmated that there is a 1 in 3 chance of a person becoming disabled for more than 3 months before the age of 65 and thedisability resulng in them having no income during this period. Homemakers are likely to experience a similar rate of temporaryincapacity.A significant barrier to obtaining cover for homemakers has always been product limitaon. Homemakers have had access to totaland permanent disablement coverage for some me now, but temporary disability coverage has not been so readily available.Product providers however are now starng to provide soluons. BT for example has this year introduced Income Protecon forHomemakers as part of their Protecon Plans offering. Homemakers who are not working can insure themselves against temporaryincapacity and can receive a monthly benefit of up to $5,000 for up to 2 years, on being unable to perform normal household dues.Given the obvious need in this area, especially with household budgets as ght as they are, other providers are likely to follow suit.A significant barrier to obtaining cover for homemakers has always been product limitaon. Homemakers have had access to totaland permanent disablement coverage for some me now, but temporary disability coverage has not been so readily available.

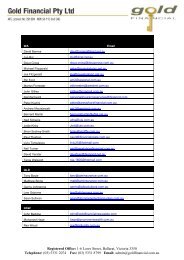

2012 PREFERRED PARTNERSGOLD FINANCIAL PTY LTDAFS Licence Number 291389ABN 50 113 653 946Level 1, 6 Lowe Street,Ballarat VIC 3350PO Box 1300Bakery Hill Mail CentreBallarat VIC 3354Tel: 03 5331 2074Fax: 03 5331 8799Website: www.goldfinancial.com.auEmail: admin@goldfinancial.com.au