schedule a(1) - Four Seasons Hotels and Resorts

schedule a(1) - Four Seasons Hotels and Resorts

schedule a(1) - Four Seasons Hotels and Resorts

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

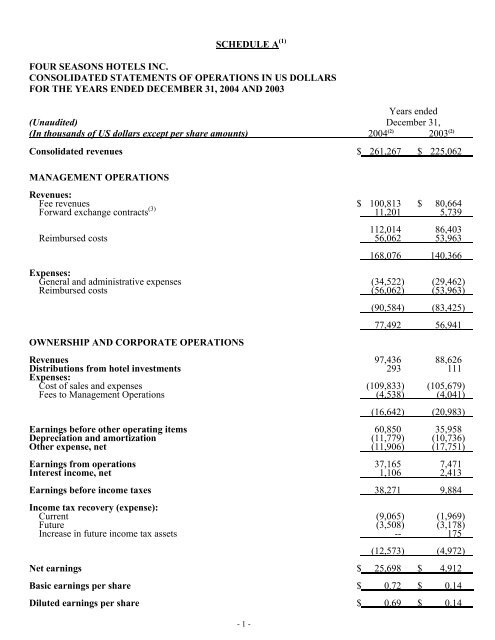

SCHEDULE A (1)FOUR SEASONS HOTELS INC.CONSOLIDATED STATEMENTS OF OPERATIONS IN US DOLLARSFOR THE YEARS ENDED DECEMBER 31, 2004 AND 2003Years ended(Unaudited) December 31,(In thous<strong>and</strong>s of US dollars except per share amounts) 2004 (2) 2003 (2)Consolidated revenues $ 261,267 $ 225,062MANAGEMENT OPERATIONSRevenues:Fee revenues $ 100,813 $ 80,664Forward exchange contracts (3) 11,201 5,739112,014 86,403Reimbursed costs 56,062 53,963- 1 -168,076 140,366Expenses:General <strong>and</strong> administrative expenses (34,522) (29,462)Reimbursed costs (56,062) (53,963)OWNERSHIP AND CORPORATE OPERATIONS(90,584) (83,425)77,492 56,941Revenues 97,436 88,626Distributions from hotel investments 293 111Expenses:Cost of sales <strong>and</strong> expenses (109,833) (105,679)Fees to Management Operations (4,538) (4,041)(16,642) (20,983)Earnings before other operating items 60,850 35,958Depreciation <strong>and</strong> amortization (11,779) (10,736)Other expense, net (11,906) (17,751)Earnings from operations 37,165 7,471Interest income, net 1,106 2,413Earnings before income taxes 38,271 9,884Income tax recovery (expense):Current (9,065) (1,969)Future (3,508) (3,178)Increase in future income tax assets -- 175(12,573) (4,972)Net earnings $ 25,698 $ 4,912Basic earnings per share $ 0.72 $ 0.14Diluted earnings per share $ 0.69 $ 0.14

(1) These consolidated financial statement <strong>schedule</strong>s should be read in conjunction with the ConsolidatedFinancial Statements for that period.(2) The translation from Canadian dollar amounts to US dollar amounts is based on the weighted averageexchange rates of the corresponding quarters. The foreign exchange rates used for the quarters areprovided in the footnotes to Schedules B <strong>and</strong> C.(3) Foreign exchange gains on forward contracts which were recorded as increases in management feerevenues.- 2 -

FOUR SEASONS HOTELS INC.CONSOLIDATED BALANCE SHEETS IN US DOLLARSAS AT DECEMBER 31, 2004 AND 2003As atAs at(Unaudited) December 31, December 31,(In thous<strong>and</strong>s of US dollars) 2004 (1) 2003 (2)ASSETSCurrent assets:Cash <strong>and</strong> cash equivalents $ 226,377 $ 132,099Receivables 81,541 68,582Inventory 1,439 1,678Prepaid expenses 2,981 2,925312,338 205,284Long-term receivables 179,060 152,921Investments in hotel partnerships <strong>and</strong> corporations 131,338 121,973Fixed assets 59,939 58,642Investment in management contracts 181,273 157,591Investment in trademarks <strong>and</strong> trade names 4,424 4,455Future income tax assets 3,711 10,237Other assets 30,064 21,380LIABILITIES AND SHAREHOLDERS’ EQUITY$ 902,147 $ 732,483Current liabilities:Accounts payable <strong>and</strong> accrued liabilities $ 60,415 $ 47,234Long-term obligations due within one year 3,766 2,00264,181 49,236Long-term obligationsShareholders’ equity (3) :253,066 90,932Capital stock 248,980 209,269Convertible notes 36,920 113,031Contributed surplus 8,088 3,593Retained earnings 192,129 169,364Equity adjustment from foreign currency translation 98,783 97,058584,900 592,315$ 902,147 $ 732,483- 3 -

(1) Canadian dollar assets <strong>and</strong> liabilities were translated at December 31, 2004 Canadian dollar to US dollarforeign exchange rate of 1.2036.(2) Canadian dollar assets <strong>and</strong> liabilities were translated at December 31, 2003 Canadian dollar to US dollarforeign exchange rate of 1.2924.(3) Equity transactions were translated to US dollars at the historical exchange rates for 2004 <strong>and</strong> 2003 withopening equity accounts on January 1, 2003 translated at December 31, 2002 Canadian dollar to US dollarforeign exchange rate of 1.5796. Any resulting exchange gain or loss was charged or credited to “Equityadjustment from foreign currency translation”.- 4 -

FOUR SEASONS HOTELS INC.CONSOLIDATED STATEMENTS OF CASH PROVIDED BY OPERATIONS IN US DOLLARSFOR THE YEARS ENDED DECEMBER 31, 2004 AND 2003Years ended(Unaudited) December 31,(In thous<strong>and</strong>s of US dollars) 2004 (1) 2003 (1)Cash provided by (used in) operations:MANAGEMENT OPERATIONSEarnings before other operating items $ 77,492 $ 56,941Items not requiring an outlay of funds 1,701 1,056Working capital provided byManagement Operations 79,193 57,997OWNERSHIP AND CORPORATE OPERATIONSLoss before other operating items (16,642) (20,983)Items not requiring an outlay of funds 943 345Working capital used inOwnership <strong>and</strong> Corporate Operations (15,699) (20,638)63,494 37,359Interest received, net 7,578 7,382Interest paid on redemption ofconvertible notes (25,840) --Proceeds received on termination ofinterest rate swap 9,000 --Current income tax received 546 --Change in non-cash working capital (9,302) 9,156Other (1,082) (6,802)Cash provided by operations $ 44,394 $ 47,095(1) The translation from Canadian dollar amounts to US dollar amounts is based on the weighted averageexchange rates of the corresponding quarters. The foreign exchange rates used for the quarters areprovided in the footnotes to Schedules B <strong>and</strong> C.- 5 -

FOUR SEASONS HOTELS INC.CONSOLIDATED STATEMENTS OF CASH FLOW IN US DOLLARSFOR THE YEARS ENDED DECEMBER 31, 2004 AND 2003Years ended(Unaudited) December 31,(In thous<strong>and</strong>s of US dollars) 2004 (1) 2003 (1)Cash provided by (used in):Operations: $ 44,394 $ 47,095Financing:Issuance of convertible notes 241,332 --Redemption of convertible notes (189,670) --Other long-term obligations includingcurrent portion (83) (152)Issuance of shares 33,870 5,673Dividends paid (2,811) (2,511)Cash provided by financing 82,638 3,010Capital investments:Long-term receivables (16,265) (4,099)Hotel investments (36,135) (5,735)Disposal of hotel investments 38,395 1,109Fixed assets (6,583) (14,246)Investments in trademarks <strong>and</strong> tradenames <strong>and</strong> management contracts (12,135) (1,535)Other assets (8,506) (3,595)Cash used in capital investments (41,229) (28,101)Increase in cash <strong>and</strong> cash equivalents 85,803 22,004Increase in cash <strong>and</strong> cash equivalentsdue to unrealized foreign exchange gain 8,475 5,615Cash <strong>and</strong> cash equivalents,beginning of period 132,099 104,480Cash <strong>and</strong> cash equivalents, end of period $ 226,377 $ 132,099(1) The translation from Canadian dollar amounts to US dollar amounts is based on the weighted averageexchange rates of the corresponding quarters. The foreign exchange rates used for the quarters areprovided in the footnotes to Schedules B <strong>and</strong> C.- 6 -

FOUR SEASONS HOTELS INC.CONSOLIDATED STATEMENTS OF RETAINED EARNINGS IN US DOLLARSFOR THE YEARS ENDED DECEMBER 31, 2004 AND 2003Years ended(Unaudited) December 31,(In thous<strong>and</strong>s of US dollars) 2004 2003Retained earnings, beginning of period $ 169,364 $ 167,141Net earnings 25,698 4,912Dividends declared (2,933) (2,689)Retained earnings, end of period $ 192,129 $ 169,364- 7 -

SCHEDULE B (1)FOUR SEASONS HOTELS INC.CONSOLIDATED STATEMENTS OF OPERATIONS IN US DOLLARSFOR THE QUARTERS OF 2004(Unaudited) 2004(In thous<strong>and</strong>s of US dollars First Second Third <strong>Four</strong>thexcept per share amounts) Quarter (2) Quarter (2) Quarter (2) Quarter (2)Consolidated revenues $ 57,121 $ 71,363 $ 63,259 $ 69,524MANAGEMENT OPERATIONSRevenues:Fee revenues $ 22,607 $ 27,784 $ 25,326 $ 25,096Forward exchange contracts (3) 2,720 2,798 2,625 3,05825,327 30,582 27,951 28,154Reimbursed costs 12,319 13,630 13,943 16,17037,646 44,212 41,894 44,324Expenses:General <strong>and</strong> administrative expenses (8,238) (8,442) (7,856) (9,986)Reimbursed costs (12,319) (13,630) (13,943) (16,170)OWNERSHIP ANDCORPORATE OPERATIONS(20,557) (22,072) (21,799) (26,156)17,089 22,140 20,095 18,168Revenues 20,332 28,106 22,383 26,615Distributions from hotel investments -- 293 -- --Expenses:Cost of sales <strong>and</strong> expenses (26,854) (28,436) (26,223) (28,320)Fees to Management Operations (857) (1,248) (1,018) (1,415)(7,379) (1,285) (4,858) (3,120)Earnings before other operating items 9,710 20,855 15,237 15,048Depreciation <strong>and</strong> amortization (2,751) (2,664) (3,102) (3,262)Other income (expense), net 3,279 (2,216) (18,089) 5,120Earnings (loss) from operations 10,238 15,975 (5,954) 16,906Interest income (expense), net 871 490 (102) (153)Earnings (loss) before income taxes 11,109 16,465 (6,056) 16,753Income tax recovery (expense):Current (2,116) (3,214) 364 (4,099)Future (288) (493) (2,830) 103(2,404) (3,707) (2,466) (3,996)Net earnings (loss) $ 8,705 $ 12,758 $ (8,522) $ 12,757Basic earnings (loss) per share $ 0.25 $ 0.36 $ (0.24) $ 0.35Diluted earnings (loss) per share $ 0.24 $ 0.34 $ (0.24) $ 0.34- 1 -

(1) These consolidated financial statement <strong>schedule</strong>s should be read in conjunction with the ConsolidatedFinancial Statements for that period.(2) The following Canadian dollar to US dollar foreign exchange rates were used to translate the specifiedquarters in 2004: first quarter 2004 – 1.31785; second quarter 2004 – 1.3586; third quarter 2004 –1.30758; <strong>and</strong> fourth quarter 2004 – 1.22033.(3) Foreign exchange gains on forward contracts which were recorded as increases in management feerevenues.- 2 -

FOUR SEASONS HOTELS INC.CONSOLIDATED STATEMENTS OF CASH PROVIDED BY OPERATIONS IN US DOLLARSFOR THE QUARTERS OF 20042004(Unaudited) First Second Third <strong>Four</strong>th(In thous<strong>and</strong>s of US dollars) Quarter (1) Quarter (1) Quarter (1) Quarter (1)Cash provided by (used in) operations:MANAGEMENT OPERATIONSEarnings before other operating items $ 17,089 $ 22,140 $ 20,095 $ 18,168Items not requiring an outlay of funds 390 354 474 483Working capital provided byManagement Operations 17,479 22,494 20,569 18,651OWNERSHIP AND CORPORATE OPERATIONSLoss before other operating items (7,379) (1,285) (4,858) (3,120)Items not requiring an outlay of funds 165 212 275 291Working capital used inOwnership <strong>and</strong> Corporate Operations (7,214) (1,073) (4,583) (2,829)10,265 21,421 15,986 15,822Interest received, net 2,831 1,349 1,987 1,411Interest paid on redemption ofconvertible notes -- -- (25,840) --Proceeds received on terminationof interest rate swap -- -- -- 9,000Current income tax received (paid) (164) (1,095) (827) 2,632Change in non-cash working capital (8,762) (444) (3,888) 3,792Other (447) (91) (219) (325)Cash provided by (used in) operations $ 3,723 $ 21,140 $ (12,801) $ 32,332(1) The following Canadian dollar to US dollar foreign exchange rates were used to translate the specifiedquarters in 2004: first quarter 2004 – 1.31785; second quarter 2004 – 1.3586; third quarter 2004 –1.30758; <strong>and</strong> fourth quarter 2004 – 1.22033.- 3 -

FOUR SEASONS HOTELS INC.CONSOLIDATED STATEMENTS OF CASH FLOW IN US DOLLARSFOR THE QUARTERS OF 20042004(Unaudited) First Second Third <strong>Four</strong>th(In thous<strong>and</strong>s of US dollars) Quarter (1) Quarter (1) Quarter (1) Quarter (1)Cash provided by (used in):Operations: $ 3,723 $ 21,140 $ (12,801) $ 32,332Financing:Issuance of convertible notes -- 241,332 -- --Redemption of convertible notes -- -- (189,670) --Long-term obligations includingcurrent portion 88 (72) (28) (71)Issuance of shares 3,060 5,459 5,032 20,319Dividends paid (1,391) -- (1,420) --Cash provided by (used in) financing 1,757 246,719 (186,086) 20,248Capital investments:Decrease (increase) in restricted cash -- (55,204) 55,204 --Long-term receivables 665 (15,365) 7,317 (8,882)Hotel investments (970) (27,476) (6,181) (1,508)Disposal of hotel investments -- -- 35,977 2,418Fixed assets (3,308) 1,391 (2,252) (2,414)Investments in trademarks <strong>and</strong> tradenames <strong>and</strong> management contracts (278) (8,441) (1,019) (2,397)Other assets (842) (893) (1,130) (5,641)Cash provided by (used in) capital investments (4,733) (105,988) 87,916 (18,424)Increase (decrease) in cash <strong>and</strong> cash equivalents 747 161,871 (110,971) 34,156Increase (decrease) in cash <strong>and</strong> cash equivalentsdue to unrealized foreign exchange gain (loss) 133 (2,228) 2,638 7,932Cash <strong>and</strong> cash equivalents,beginning of period 132,099 132,979 292,622 184,289Cash <strong>and</strong> cash equivalents, end of period $ 132,979 $ 292,622 $ 184,289 $ 226,377(1) The following Canadian dollar to US dollar foreign exchange rates were used to translate the specifiedquarters in 2004: first quarter 2004 – 1.31785; second quarter 2004 – 1.3586; third quarter 2004 –1.30758; <strong>and</strong> fourth quarter 2004 – 1.22033.- 4 -

SCHEDULE C (1)FOUR SEASONS HOTELS INC.CONSOLIDATED STATEMENTS OF OPERATIONS IN US DOLLARSFOR THE QUARTERS OF 2003(Unaudited) 2003(In thous<strong>and</strong>s of US dollars First Second Third <strong>Four</strong>thexcept per share amounts) Quarter (2) Quarter (2) Quarter (2) Quarter (2)Consolidated revenues $ 47,896 $ 57,740 $ 52,620 $ 66,806MANAGEMENT OPERATIONSRevenues:Fee revenues $ 18,883 $ 19,495 $ 19,487 $ 22,799Forward exchange contracts (3) 514 1,490 1,410 2,32519,397 20,985 20,897 25,124Reimbursed costs 12,213 13,278 12,952 15,520- 1 -31,610 34,263 33,849 40,644Expenses:General <strong>and</strong> administrative expenses (6,444) (6,364) (7,236) (9,418)Reimbursed costs (12,213) (13,278) (12,952) (15,520)OWNERSHIP ANDCORPORATE OPERATIONS(18,657) (19,642) (20,188) (24,938)12,953 14,621 13,661 15,706Revenues 17,063 24,606 19,576 27,381Distributions from hotel investments -- -- 111 --Expenses:Cost of sales <strong>and</strong> expenses (25,022) (27,380) (25,611) (27,666)Fees to Management Operations (777) (1,129) (916) (1,219)(8,736) (3,903) (6,840) (1,504)Earnings before other operating items 4,217 10,718 6,821 14,202Depreciation <strong>and</strong> amortization (2,456) (2,906) (2,643) (2,731)Other income (expense), net (8,544) (8,675) (667) 135Earnings (loss) from operations (6,783) (863) 3,511 11,606Interest income, net 452 477 753 731Earnings (loss) before income taxes (6,331) (386) 4,264 12,337Income tax recovery (expense):Current 1,571 (1,258) (128) (2,154)Future (1,389) 632 (958) (1,463)Increase in future income tax assets -- -- -- 175182 (626) (1,086) (3,442)Net earnings (loss) $ (6,149) $ (1,012) $ 3,178 $ 8,895Basic earnings (loss) per share $ (0.18) $ (0.03) $ 0.09 $ 0.25Diluted earnings (loss) per share $ (0.18) $ (0.03) $ 0.09 $ 0.24

(1) These consolidated financial statement <strong>schedule</strong>s should be read in conjunction with the ConsolidatedFinancial Statements for that period.(2) The following Canadian dollar to US dollar foreign exchange rates were used to translate the specifiedquarters in 2003: first quarter 2003 – 1.51077; second quarter 2003 – 1.39863; third quarter 2003 –1.37927; <strong>and</strong> fourth quarter 2003 – 1.3155.(3) Foreign exchange gains on forward contracts which were recorded as increases in management feerevenues.- 2 -

FOUR SEASONS HOTELS INC.CONSOLIDATED STATEMENTS OF CASH PROVIDED BY OPERATIONS IN US DOLLARSFOR THE QUARTERS OF 20032003(Unaudited) First Second Third <strong>Four</strong>th(In thous<strong>and</strong>s of US dollars) Quarter (1) Quarter (1) Quarter (1) Quarter (1)Cash provided by (used in) operations:MANAGEMENT OPERATIONSEarnings before other operating items $ 12,953 $ 14,621 $ 13,661 $ 15,706Items not requiring an outlay of funds 271 172 326 287Working capital provided byManagement Operations 13,224 14,793 13,987 15,993OWNERSHIP AND CORPORATE OPERATIONSLoss before other operating items (8,736) (3,903) (6,840) (1,504)Items not requiring an outlay of funds 6 59 136 144Working capital used inOwnership <strong>and</strong> Corporate Operations (8,730) (3,844) (6,704) (1,360)4,494 10,949 7,283 14,633Interest received, net 2,579 981 2,043 1,779Change in non-cash working capital 8,435 1,887 (2,184) 1,018Other (1,066) (2,983) (1,956) (797)Cash provided by operations $ 14,442 $ 10,834 $ 5,186 $ 16,633(1) The following Canadian dollar to US dollar foreign exchange rates were used to translate the specifiedquarters in 2003: first quarter 2003 – 1.51077; second quarter 2003 – 1.39863; third quarter 2003 –1.37927; <strong>and</strong> fourth quarter 2003 – 1.3155.- 3 -

FOUR SEASONS HOTELS INC.CONSOLIDATED STATEMENTS OF CASH FLOW IN US DOLLARSFOR THE QUARTERS OF 20032003(Unaudited) First Second Third <strong>Four</strong>th(In thous<strong>and</strong>s of US dollars) Quarter (1) Quarter (1) Quarter (1) Quarter (1)Cash provided by (used in):Operations: $ 14,442 $ 10,834 $ 5,186 $ 16,633Financing:Long-term obligations includingcurrent portion 27 (51) (24) (104)Issuance of shares 87 983 1,746 2,857Dividends paid (1,197) -- (1,314) --Cash provided by (used in) financing (1,083) 932 408 2,753Capital investments:Long-term receivables (3,843) (4,465) 1,889 2,320Hotel investments (5,539) 1,401 (1,082) (515)Disposal of hotel investments -- -- 1,109 --Fixed assets (2,569) (997) (90) (10,590)Investments in trademarks <strong>and</strong> tradenames <strong>and</strong> management contracts (143) (315) (670) (407)Other assets (1,722) (636) (993) (244)Cash provided by (used in) capital investments (13,816) (5,012) 163 (9,436)Increase (decrease) in cash <strong>and</strong> cash equivalents (457) 6,754 5,757 9,950Increase in cash <strong>and</strong> cash equivalentsdue to unrealized foreign exchange gain 925 1,142 922 2,626Cash <strong>and</strong> cash equivalents,beginning of period 104,480 104,948 112,844 119,523Cash <strong>and</strong> cash equivalents, end of period $ 104,948 $ 112,844 $ 119,523 $ 132,099(1) The following Canadian dollar to US dollar foreign exchange rates were used to translate the specifiedquarters in 2003: first quarter 2003 – 1.51077; second quarter 2003 – 1.39863; third quarter 2003 –1.37927; <strong>and</strong> fourth quarter 2003 – 1.3155.- 4 -