Savings Race Financial Education Packet - Wright-Patt Credit Union

Savings Race Financial Education Packet - Wright-Patt Credit Union

Savings Race Financial Education Packet - Wright-Patt Credit Union

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Savings</strong> is SecurityWhy Save?<strong>Financial</strong> Security--it's never too late or too early to begin saving for your future! But itdoes take commitment.It's important to save for your future and for emergencies, such as loss of lob or anunexpected illness. <strong>Savings</strong> allows you to obtain the items you need and want withoutsacrificing or borrowing.Maintaining a savings account is also important in obtaining credit. With an accurate goalsetting and a specific action plan, you are on your way to financial security for the future.Set Your GoalsDiscuss with your family the priorities that need to be established. Both short-term andlong-term goals are important to strive for.Long Term Goal Examples:College tuition, new vehicle, new home, or retirementShort Term Goal Examples:Household appliance, clothing, or furnitureDevelop an Emergency FundEstablish an emergency fund first by keeping reserves equal to 3 months or more of yourmonthly expenses. Take no chances with this money. In the event of an emergency, you'llhave money set aside to help you get through the first few months.A recent study showed that fifty percent of the people between the ages of 35 and 49could not come up with $3,000 in three days without borrowing.Develop a <strong>Savings</strong> HabitDesign a savings strategy that will enable you to save beyond your emergency fund. Forexample:Save $50 a month by using direct payroll deposits for automatic savings. What you don'tsee, you won't miss.

Pay yourself first. Take 5 to 10 percent of your check, treat it like another bill, and bankit.Enroll in your company's tax-deferred, 401(k)-type plan. Take advantage of youremployer's retirement programs with stock options, tax-deferred growth, or automaticbond purchases. Seek advice from a Certified <strong>Financial</strong> Planner (CFP) about whatinvestments or saving vehicles would be best for your situation to meet your savingsgoals.Unless there is an extreme emergency, try not to touch your savings. Try to live withinyour means.<strong>Savings</strong> TableBy developing a savings habit, you can watch your savings grow to financial security.Below is a chart tabulating just how quickly your money can add up for you!Investment OpportunitiesWhatever savings vehicle you choose, there is no reason to limit yourself to just one. Thefollowing are several investment opportunities that could help you get well on your way.<strong>Savings</strong> AccountsThese accounts allow you the most flexibility. You may pay into them or withdrawwithout interest rate which varies according to your financial institution. Emergencyfunds should be kept in savings accounts.Money Market Mutual FundsIn these accounts, shares are purchased directly from the company by an agent orinvestment company. The cash of the mutual investors is pooled together and diversifiedthrough an investment portfolio earning a higher interest rate. This is good for long-andshort-term goals.Individual Retirement AccountsIRAs allow you to set aside a percentage of your salary to make tax-deductible paymentsto your own financial institution. You do not pay taxes on this money until you withdrawit. This type of savings is only good for long-term goals.Certificates Of DepositCertificates are fixed time deposits that are payable when your money matures at the endof a specified term ranging from one month to 10 years. Generally, the higher the term,the higher the interest rate. CDs are beneficial for short-and -long-term goals because youpick the length of time.

Where Should I Put My <strong>Savings</strong>?Banks, savings & loans, credit unions, and investment companies all offer savingsoptions. Shop around for interest rates, reliability, methods of computing interest, andinsured funds for safety.<strong>Savings</strong> PitfallsDon't attempt to save by having extra taxes held from your paycheck for a larger refundat tax time. This costs you because the government pays no interest on your money andyou don't have access to it when you may need it.Don't double up on house or insurance payments unless you have savings equal to at leastthree months of expenses.Don't use U.S. <strong>Savings</strong> Bonds for short-term savings. Bonds do not pay the face valuefull amount until the time expires.

Reducing Your Debts1. Prioritize your debts. Debts are directly related to your ability to survive such asmortgages or other secured loans like auto loans should take first priority. If you defaulton these kinds of loans, you can face foreclosure or repossession. If, for example, yourcar is repossessed, it may affect your ability to work and adversely affect your income.Additionally, the car will be sold or auctioned off. If the sale of the car brings in less thanyou owe, you still have to pay the difference! In effect, you could be sitting on the busand still making car payments.2. Use cash for new purchases. Unless you pay off the entire balance every month, youare probably paying interest on new purchases from the date of the purchase. If you stopusing your credit cards all together, you will be able to reduce your debt more quickly.Because of compounded daily interest, it is far better to use cash for the things you needand adjust your budget to accommodate those expenses than to use credit cards and thenstruggle to send large payments.3. Set your own payment. Establish a budget and a tracking system for your income andexpenses. Then you will know how much money you have available for credit payments.This amount must be more than the creditor's minimum payment. Once you haveestablished amounts for each creditor, send your payments in regularly. When smallerbalances are paid off, apply that money toward increasing the payments to your othercreditors.4. Pay more than the minimum amount due. When you compare the finance chargecolumn and the minimum payment column, you realize that most of your payment isgoing toward interest and little goes toward the principle. When you increase yourpayment, the additional funds are applied directly toward the principle. Years ofpayments and thousands of dollars can be cut from the life of a debt simply by adding afew dollars to the payment. For example, if your minimum payment is $25 and $19dollars are going to pay interest, that leaves only $6 for the principle. If you increase yourpayment to $31 this month, it is like making two months payments toward the principleessentiallydoubling your payment. The more you increases your payment, the less youwill ultimately have to pay.Payment Interest Principle$25 $19 $6.00$31 $19 $12.00

5. Pay off higher interest rate cards first. Dedicate more money toward higher interestrate cards because you will ultimately save in interest. It is better to owe $100 on anaccount that has an APR of 14% than to owe $50 to one at 14% and $50 to another at19%. Note if there are cash advances on any accounts. Cash advances usually commandhigher interest rates than balances on purchases. Usually, your creditor will divide thepayment on a percentage basis between the two balances. If you increase your payment,the creditor will divide additional payments along the same guidelines unless you specifyotherwise. For accounts such as this, after you decide how much extra you can send,consider making the minimum payment as usual and write a separate check for the extrafunds. Stipulate in writing that the extra payment is to be applied directly to the principlebalance for cash advances. Verify how the payments were distributed in your futurestatements.6. Pay your bills when you receive them, not when they are due. Most creditors usethe Average Daily Balance method of calculating interest. Reducing the average dailybalance by making your payment sooner will ultimately reduce the amount of interestyou pay.7. Don't accept your creditor's offers to skip payments. Interest continues tocompound while you're skipping your payment. The longer your balance goes without areduction, the more interest you'll pay. If you've established your budget and havescheduled payments, continue to make those payments until the balance is paid off.8. Consider transferring balances to lower rate cards. You may receive offers ofcredit with low-interest teaser rates. These low rates are called teaser rates because theyusually only last for 3 to 9 months. They offer to transfer balances from your other creditcards to theirs with the lower interest rates. In general, an opportunity to pay less interestis a fairly good idea but, if you are considering this step, you must consider more than theteaser interest rate. Examine the contract carefully before you apply for the card.Some More TipsDo your homework -• Prepare a budget; one of the goals should be to pay off your debts.• Cut expenses where possible.• Decide how much extra money you can afford, based on your budget, on yourbills each month. Make sure you have an emergency fund of three months worthof expenses in the bank first. (If you don't have an emergency fund at all, thenstart saving for one month's worth of expenses. Once you obtain that goal, thenwork towards the second and third months' worth. If you try to come up with sucha large sum of money all at one time, it is easy to get distracted or getdiscouraged. You will be more successful if you set obtainable, realistic goals.)

Strategies -• Pay the extra amount available from your budget to your creditors like part of thebill. Do it regularly. If you send what's left over at the end of the month, there willnever be any extra left to send.• Compare the interest rates on your loans. Pay extra on those with the highestinterest rates first.• Shop for cheaper interest rates. Check with your local credit union, bank, or yourlife insurance agent to see if you can take out a loan with a lower interest rate topay off those with higher rates.• Most importantly, STOP CHARGING!

How to Establish <strong>Credit</strong><strong>Credit</strong> is a way of having something now and paying for it later. Many of us want to takeadvantage of flexibility in our spending plans by using credit. It usually isn't free, it's paidfor by interest that varies.Qualifying for credit and proving you're credit worthy will involve your ability to repay,your assets that serve as security, and your attitude toward responsibility. All that may belacking is your credit history - your reliability. Here are suggestions for establishing yourcredit or credit history:Open a checking and savings account at a local financial institution to establish arelationship with them. Make sure you show a savings habit and do not overdraft yourchecking account.Apply for a loan that has collateral. For example, a car loan is many times easier to obtainbecause it is a secured loan. In the event you cannot pay, they can take back the security(car). Unsecured loans, for example charge cards, are of more risk to creditors becausethere is rarely merchandise to take back in the event you can no longer pay.Obtain a cosigner for your first loan or charge card. This will establish a credit history toa credit bureau.Apply for a secured charge account. Make sure you have investigated the institutionbefore you send any money. Be cautious of any one that guarantees a card but requiresup-front money to process the application.If offered a pre-approved credit card through the mail, go ahead and send for it toestablish a credit history.Open a charge account at a local department store with a small balance.Qualifying For <strong>Credit</strong>In reviewing applications for credit, creditors may use a point system called creditscoring or more commonly look for what is called the 4 C's - capacity, capital, character,and conditions. These help creditors analyze their risk for approving the application forcredit.

CapacityDo you have the financial capacity to take on the credit you are seeking? <strong>Credit</strong>ors lookat your income and your current financial obligations to determine if you have thecapacity to handle the additional debt.Capital<strong>Credit</strong>ors are looking for what types of assets and resources you have. Do you haveequity in your home? What is the value of your car? In determining capital, creditors arenot just looking for a means of payment; they seek assurance that a debt could be paidfrom your assets if the need arose.CharacterThis is the most important aspect to the majority of creditors. What has been yourresponsibility in paying your other debts according to the term of the contract? They relyon credit bureau reports to determine your character. They also verify information,provided by you on your application, to determine if you gave accurate information.Conditions<strong>Credit</strong>ors analyze current economic trends to determine if your ability to pay is at risk. Ifstatistics show that your occupation is subject to high unemployment, strikes, layoffs, andseasonal work, it may affect the granting decision or change the terms in your contract.How to get back on track with creditIf you have had problems in the past paying your bills, your credit history has beenaffected. With this in mind, it may be difficult to obtain future credit. The followingsuggestions will help you re-establish your credit:Use a savings account as collateral for an installment loan. You may be able to borrow asmuch as you have in the account, but your prompt repayment will indicate responsibility.Make a larger down payment than required to indicate an interest in the purchase. Acreditor will approve a loan where you have something invested.Have a cosigner who has not had credit problems apply with you for a charge account orloan.Have merchandise financed through a dealer or store where there is collateral for theitem.Discuss getting a credit card with a minimal credit limit from a major department storeuntil you can prove your credit worthiness.Avoid rent-to-own companies that advertise re-establishment of credit by rentingmerchandise. It is not uncommon for the required weekly payments to increase the costof the merchandise 2 or 3 times its normal value. Not only that, but most rent-to-own

companies do not report your credit status to credit bureaus because they are notsubscribing members.According to the Fair <strong>Credit</strong> Reporting Act, you have the right to attach a 100-wordstatement to your credit report. If the circumstances behind your problems are unusual, itmay be helpful to have the added clarification available for potential lenders.

Why live on a budget?By Shelly K. Schwartz • Bankrate.comIf you're like most Americans, your monthly income never goes far enough. Aftershelling out for house payments and groceries, it seems there's little leftover for thingsthat matter most to you -- weekly dinners out, orchestra-row theater seats, a collegesavings plan for your kids.Hate to break it to you, but it's not your salary that's to blame. According to financialexperts, it's a pattern of poor spending choices."When my clients sit down and really look at where their money is going, oftentimes theyare shocked to find it has nothing to do with what's really important to them," says MartinSiesta, a certified financial planner for Compass Wealth Management in Maplewood,N.J. "Five dollars a day on Starbucks, for example, is a big number when you multiply itby 360. That takes away from things you may have been struggling to attain."Life's little extras are well within reach for those who know how to budget.By establishing reasonable spending limits and sticking to them, the average consumercan do far more with less -- without sacrificing daily conveniences, said Jim Tehan, aspokesman for the Myvesta Foundation, a self-help consumer education Web site."Budgeting is all about controlling your finances instead of letting your finances controlyou," Tehan says. "That element of control is going to save you money in the long run."Controlling debt<strong>Financial</strong> mismanagement makes consumers more vulnerable to overspending, whichresults in lower savings and higher credit card debt.Myvesta's 2005 annual <strong>Credit</strong> Card Survey, reports the average American carries $2,328in credit card debt, spread out across 2.9 cards. With interest rates at or above 18 percentfor most cards, that gets expensive. For example, a $5,000 balance on a credit card with18 percent interest would cost you more than $8,000 to pay off if you made only theminimum payments (4 percent)."The amount of money you wind up spending just servicing debt through credit cardinterest could be extra money you could apply towards something else," Siesta says,adding that following a monthly budget can help you both pay down existing debt andprevent impulse spending to begin with.

Cheaper ratesAnother upside to life on a budget is that it forces you to become organized. That, in turn,helps you avoid late payment penalties and improves your credit score. Lenders use yourcredit score to determine how much they should charge you for auto and mortgage loans.It also can affect how much you pay for auto and homeowners insurance.Improve your relationshipA less obvious benefit of budgeting is the positive effect it can have on relationships.According to Siesta, sitting down with your significant other to discuss financial goalshelps prevent money disputes down the road. It also provides a rare opportunity to defineyour own spending philosophies. "Money is a huge source of stress for many couples," hesaid. "The mere act of discussing your finances with a spouse or significant other reallydoes help create better understanding and better relationships."Saving for the futureFinally, learning to live within your means can help you get ahead. By allocating aportion of your monthly budget towards savings, you can simultaneously build aretirement nest egg for your future and a financial safety net for short-term emergencies,in case you or your spouse lose a job or suddenly fall ill."Budgets create financial security, which gives you the ability to withstand the financialsurprises that life throws your way," Tehan said.Budgets are all about financial freedom. Without a plan for saving and spending, you'llnever make the most of your income -- no matter how much money you earn."Budgets are very empowering," Siesta says."They don't lead you away from something. They lead you toward your financial goals."

Jason Alderman’s Practical Money MattersGet your <strong>Financial</strong> Resolutions Back on TrackBy Jason AldermanYou probably began 2008 with the best intentions: lose a few pounds, reduce debt, start savingfor college or retirement. You may have even written New Year's resolutions and startedworking on them. But you get busy, unexpected expenses come up, and suddenly it's summer.Don't despair. There's plenty of time to get back on track. Here are a few suggestions:First, make a budget. Compare what's going out with what's coming in. If your expenses exceedyour income, you'll never get ahead.Track what you spend. For the next few months, write down every penny you spend on rent ormortgage, utilities, groceries, meals out, parking meters, allowances, gas – the works. Don'tforget to add in monthly amounts for periodic bills like your car and homeowner's insurance.Review your list for non–essentials you can trim. A $5–a–day coffee habit costs $1,800 a year;buying a $10 lunch every day will run about $2,500. You could save a fortune by brewing yourown coffee and packing lunch a few days a week. Put those savings toward paying off creditcards and you'll save even more, since you'll reduce the amount of interest accrued on thoseloans.A few other money–saving ideas:• Consolidate errands to save gas• Try generic brand groceries• Investigate using generic drugs and ask if there's a discount for ordering multiple–monthprescriptions by mail• Raise insurance deductibles• Pay down higher–interest credit cards first• Balance your checking account regularly to avoid overdraft charges• Avoid using out–of–network ATMs; take cash back on debit card purchases to avoidforeign ATM fees• Quit smoking – a pack a day habit costs over $1,500 a year• Weatherproof your home and buy energy-efficient appliances• Check out books and DVDs from the library instead of buying themStart saving for retirement. Now. Thanks to compound earnings (where interest earned on yoursavings in turn generates more earnings) the sooner you start saving, the faster your account willgrow. Here's an example:

Say you're 22, earn $30,000 a year and put aside 6 percent of pay until age 65 at an 8 percentaverage annual rate of return. Your $77,400 investment will grow to $619,000 by 65; but waituntil 32 to begin saving and you'll only accumulate $274,000 – a huge difference. If you increasethe percentage of pay saved and factor in annual raises, your savings will skyrocket.Probably the easiest and most tax–effective retirement savings method is your employer's 401(k)or similar plan. Money is deducted from your paycheck before being taxed, which lowers yourtaxable income and thus, your taxes. You aren't taxed until the money is withdrawn at retirement,when your taxable income and tax rate may be much lower.Most companies match a portion of your contributions – commonly 50 percent of your first 3percent of pay saved, or better. That's a 50 percent rate of return, so be sure to contribute at leastenough to take full advantage of the match.If a 401(k) plan isn't available, try a Roth IRA. Although initial contributions are taxed, you'llnever pay taxes on the earnings. The earlier you contribute to a Roth, the bigger your tax savings.Consult a financial professional regarding your personal situation.You've still got several months to end the year on a high note, so start saving now.Jason Alderman directs Visa's financial education programs. Sign up for his free monthly e-Newsletter at www.practicalmoneyskills.com/newsletter.

Lucky 13 emergency savings strategiesBy Cheryl Allebrand • Bankrate.comSaving for emergencies doesn't have to be about painful cutbacks or Draconian spendingmeasures. Sometimes we get so focused on where we're going to find extra money thatwe forget the easy pickings are in setting up good savings strategies. Follow these 13 tipsto save money without even trying.Surefire emergency fund builders1. Autopilot saving and bill pay2. After paying off debt, keep paying yourself3. Enforce 24-hour rule on impulse buys4. Leave the credit cards at home5. Plan ahead, budget for fun6. Make things 'interest'-ing7. Learn to save short-term splurges8. Reward yourself9. Remove the temptation10. Treat it like a friend11. Keep them separated12. Enjoy compounding for a change13. Treat it like taxes1. Autopilot saving and bill payHave your savings automatically deducted from your paycheck before it even hits yourchecking account. It's easy -- most banks will let you set it up online in a matter ofminutes.Set your fixed bills to be deducted as well, either through automated debit or online billpay, so you're not tempted to touch the money. The added bonus is you'll never get hitwith late or missed payment penalties.2. After paying off debt, keep paying yourselfMaybe your finances are tight due to a big car loan or credit card payments. Once you'vepaid off these debts, shift those payments to your emergency fund "bill," says SharonEpperson, author of "The Big Payoff: 8 Steps Couples Can Take to Make the Most oftheir Money -- and Live Richly Ever After." Otherwise, she says, "You know you'llprobably just spend it."Because you're already used to living without the money, you can use the "extra" funds tobuild up an emergency buffer to keep yourself from getting into debt again.3. Enforce 24-hour rule on impulse buysMaybe splurging sounds like a good idea in the moment, but will you feel the same waythe next morning? There aren't many things we truly can't live without and waiting 24

hours before making a purchase will help you avoid shopping hangover. Remember,getting slapped with the bill later is a real buzz kill.4. Leave the credit cards at homeSpending surveys have found that people spend between 12 percent and 50 percent morewhen using a credit card versus cash. To see how much money you'll save by ditching thecards, Ruby Payne, an educator, researcher and author of "A Framework forUnderstanding Poverty," among other titles, recommends leaving your credit card athome. Then every time you don't make a purchase that you normally would have used acredit card for, note the amount. At the end of the month, tally your "potential" purchasesto see how much you've saved; then pat yourself on the back for your virtuousness andshift that money to emergency savings.5. Plan ahead, budget for funAll work and no play is no way for anyone to live, so be realistic when planning yourspending. To make your savings strategy work, you'll need to budget for fun. This willhelp keep you from going overboard when the fun-itch strikes.Setting aside 10 percent of your discretionary income for fun is Epperson's rule. That wayyou know how much money you have to play with. Plan ahead to stretch your dollarsbecause, she warns, "When the money's not there, you don't have the fun."6. Make things interest-ingDraw down no-interest checking accounts and move the money into high-interestsavings. If you can't figure out where to cut back your expenses, this is a good place tolook for extra money, says Epperson. "Most Americans keep too much money inchecking accounts that earn zero percent interest. That money's just wasting time."7. Learn to save short-term splurgesOne trick that Bedda D'Angelo, a Certified <strong>Financial</strong> Planner out of Raleigh, N.C.,recommends, is deferring the latte splurge until you've saved up enough for a massage.This way you're retraining yourself away from giving into immediate gratification andinto saving for your real desires. "It's still pleasure," she says, "but now you're saving forlarger things."8. Reward yourselfAllow yourself little extra perks for reaching savings goals. Taking a vacation withoutplastic is one reward-worthy goal, D'Angelo suggests. "Pretty soon you're going to say 'Ireally like it. I feel so secure with this buffer. I really like having money in the bank,'" shesays.Rewards sweeten the medicine, retraining you to take the smart but tough steps that willensure your financial future. And the cost of the perks is outweighed by new moneysavinghabits.9. Remove the temptation

Maybe skip a trip to the mall and go to a specialty store to pick up the item that's actuallyon your shopping list. Or go to the park for diversion instead of window shopping. It's notfun finding yourself on the wrong side of the window shopping experience, and in mostcases the old adage "out of sight, out of mind" rings true for impulse buys.Dieters don't do well sitting in a bakery sniffing mouthwatering treats all day. Why putyourself in the same position to fail financially?10. Treat it like a friendTreat your emergency fund the way you treat your friends: Don't abuse it and don't use itexcept when needed. Payne suggests this trick when weighing spending decisions. Noone likes a user. If you expect your emergency fund to have your back when troublestrikes, maintain a healthy relationship with your money.11. Keep them separatedIt's important to keep your savings in a different account than the one from which youpay your bills, but maybe a little extra space can be helpful. Epperson suggests keepingchecking and savings accounts at different institutions. This strategy makes your savingsjust slightly less accessible because of the waiting time on fund transfers, and maybe thatlag is just long enough to help you cool off your spending impulse.She points out that unbundling your products gives you the opportunity to take advantageof high-yield accounts offered at online institutions, rather than the low-interest-payingbrick-and-mortar bank where you keep your checking account.12. Enjoy compounding for a changeBeing on the right side of compound interest is a rewarding experience. Instead of thenegative compounding (paying interest on interest) that often occurs with credit cards,you can watch your money grow effortlessly.Earning interest on interest is a powerful tool that most people don't really understand,says Gail MarksJarvis, money columnist and author of "Saving for Retirement (WithoutLiving like a Pauper or Winning the Lottery).""Here's how it works," she says. "Let's say you simply invest $200 this year, and nothingafter that and you earn 10 percent on the money each year. At the end of the year you willhave $220. That's $200, plus the $20 you earned." But here's the powerful part: After fiveyears, the original $200 grows to $322. After 15 years, it mushrooms to $835.Start saving now -- no excuses. Then when you're not able to save or not able to savemuch, your money will still be doing the work for you. The key is to start early formaximum gains.13. Treat it like taxes

Most people are used to having taxes deducted from their paychecks, Payne points out.They accept both the mandatory nature and regularity of the contributions. So it might behelpful to think of saving to your emergency fund as a taxation that benefits you.If you really hate taxes, it may be more helpful to think of your savings as a hassle-freeinsurance policy. The insurance pays out when you need it most.

United States Center for Nutrition 3101 Park Center DriveDepartment of Policy and Promotion Alexandria, VA 22302AgricultureOfficial USDA Food Plans: Cost of Food at Home at Four Levels,U.S. Average, July 2008 1Age-gender groupsThriftyplanLow-costplanWeekly cost 2 Monthly cost 2ModeratecostplanLiberalplanThriftyplanLow-costplanModeratecostplanLiberalplanIndividuals 3Child:1 year 20.70 27.30 31.30 38.00 89.80 118.50 135.70 164.502-3 years 22.00 27.60 33.40 40.60 95.20 119.80 144.90 175.804-5 years 22.90 29.00 35.60 43.40 99.40 125.60 154.40 188.106-8 years 29.10 39.00 48.10 56.60 126.00 168.80 208.30 245.009-11 years 33.80 43.90 55.90 65.80 146.40 190.30 242.20 285.00Male:12-13 years 35.70 49.70 61.50 72.70 154.60 215.30 266.60 315.1014-18 years 37.20 51.60 63.90 74.00 161.40 223.40 276.80 320.8019-50 years 39.80 50.90 63.50 77.20 172.60 220.30 275.20 334.6051-70 years 36.60 48.40 59.00 71.40 158.40 209.80 255.70 309.5071+ years 36.50 47.90 59.30 72.20 158.10 207.70 256.80 312.90Female:12-13 years 35.90 43.60 52.10 63.30 155.50 188.90 226.00 274.2014-18 years 35.70 43.70 52.50 64.50 154.70 189.40 227.50 279.4019-50 years 35.50 44.40 54.30 69.90 153.80 192.50 235.40 303.0051-70 years 35.20 43.40 53.80 64.10 152.60 188.10 233.00 277.7071+ years 34.50 43.10 53.80 64.50 149.50 186.70 232.90 279.50FamiliesFamily of 2: 419-50 years 82.90 104.80 129.60 161.80 359.00 454.10 561.60 701.3051-70 years 79.00 101.00 124.10 149.10 342.10 437.70 537.50 645.80Family of 4:Couple, 19-50 yearsand children⎯2-3 and 4-5 years 120.20 151.90 186.90 231.10 521.00 658.20 809.80 1001.406-8 and 9-11 years 138.20 178.20 221.80 269.50 598.70 772.00 961.10 1167.601 The Food Plans represent a nutritious diet at four different cost levels. The nutritional bases of the Food Plans are the 1997-2005 DietaryReference Intakes, 2005 Dietary Guidelines for Americans, and 2005 MyPyramid food intake recommendations. In addition to cost,differences among plans are in specific foods and quantities of foods. Another basis of the Food Plans is that all meals and snacks areprepared at home. For specific foods and quantities of foods in the Food Plans, see Thrifty Food Plan, 2006 (2007) and The Low-Cost,Moderate-Cost, and Liberal Food Plans, 2007 (2007). All four Food Plans are based on 2001-02 data and updated to current dollars byusing the Consumer Price Index for specific food items.2 All costs are rounded to nearest 10 cents.3 The costs given are for individuals in 4-person families. For individuals in other size families, the following adjustments are suggested:1-person—add 20 percent; 2-person—add 10 percent; 3-person—add 5 percent; 4-person—no adjustment; 5- or 6-person—subtract5 percent; 7- (or more) person—subtract 10 percent. To calculate overall household food costs, (1) adjust food costs for each person inhousehold and then (2) sum these adjusted food costs.4 Ten percent added for family size adjustment.This file may be accessed on CNPP’s home page at: http://www.cnpp.usda.gov. Issued August 2008

Annual BudgetPer MonthSources of IncomeMonthly Amount (Net)Employment (Primary) $Employment (Spouse) $Social Security $Pension $Alimony or Child Support $Commissions $Other $Other $TOTAL MONTHLY INCOME $Summary of ExpensesMonthly AmountHousingMortgage $2 nd Mortgage $Home Equity Loan/Line $Rent $Property Taxes $Condominium Fee $Homeowners/Renters Insurance $House Repairs/Maintenance $Gardening/Pool Service $Other $Other $Total Housing $UtilitiesGas $Oil $Propane $Electricity $Water/Sewer $Trash Removal $Telephone $Cell Phone $Other $Total Utilities $

FoodGroceries $Eating Out Lunch $Dining Out $Coffee/Snacks $Kids Lunch Money $Other $Total Food $TransportationAuto Payment 1 $Auto Payment 2 $Auto Payment 3 $Gasoline $Insurance $Parking Fees/Tolls $Auto Registration/Plates $Public Transportation $Car Repairs/Maintenance $Other $Total Transportation $Health CareHealth Insurance $Prescriptions $Co-pay/Deductibles $Other $Total Health Care $<strong>Education</strong> ExpensesTuition $Books $Student Loans $Room/Board $Day Care $Newspapers/Magazines $Other $Total <strong>Education</strong> $

ClothingPurchases $Laundry $Dry Cleaning $Repairs $Other $Total Clothing $Personal CareBeauty Salon/Hair Cuts $Cosmetics $Manicure/Pedicure $Toiletries $Other $Total Personal Care $EntertainmentCable $Movies $Music $Sports $Hobbies $Internet $Other $Other $Total Entertainment $PetsFood $Vet $Insurance $Grooming $Other $Total Pets $

OtherTobacco $Alcohol $Religion $Charity $Lottery $Vacation $Gifts $Other $Other $Other $Other $Total Other $<strong>Credit</strong> Cards#1 $#2 $#3 $#4 $#5 $Total <strong>Credit</strong> Cards $<strong>Savings</strong>Emergency <strong>Savings</strong> Account $Other $Other $Total <strong>Savings</strong> $TOTAL MONTHLY EXPENSES $SUMMARYTotal Monthly Income $Less - Total Monthly Expenses $Monthly Surplus (Deficit) $

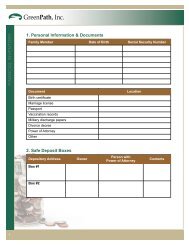

A Wealth of Resources at Your <strong>Credit</strong> <strong>Union</strong>1. FREE <strong>Financial</strong> Counseling – Through WPCU’s partnership with GreenPath, Inc., weoffer members access to free, confidential budget counseling, by appointment, at any ofour 20 member centers or by phone. GreenPath counselors are available by phone onMonday through Thursday from 8 a.m. to 10 p.m. (EST), Friday from 8 a.m. to 7 p.m., andSaturday from 9 a.m. to 1 p.m. To use the phone service, simply call 1-888-893-2713.2. FREE Budget Software – WPCU also offers BudgetSmart, a free software tool that helpsyou establish a budget, track spending, and more. To download BudgetSmart visitwww.wpcu.coop, click on the “Investments & <strong>Financial</strong> Planning” tab, then click “MoneyManagement” on the line below the tabs, and next click “Budgeting” on the column to theleft. The link to the free BudgetSmart software is located on this web page compliments of<strong>Wright</strong>-<strong>Patt</strong> <strong>Credit</strong> <strong>Union</strong> and GreenPath.3. BIG IDEA Evaluator – Your <strong>Credit</strong> <strong>Union</strong> is committed to helping small business growthin the Miami Valley. Our Big Idea Evaluator is a FREE online, 10-minute selfassessment,which matches results to valuable resources to help entrepreneurs prepare for anew business. Just click on the “Small Business Solutions” tab on your WPCU website, andthen click “Resources” on the line below the tabs.4. <strong>Wright</strong>-<strong>Patt</strong>’s FREE Auto Buying Service – Eliminate the need to negotiate with our freeAuto Buying Service! Our experienced auto buying staff will help you find a great price ona new vehicle purchase with one of our preferred dealerships. Many of these dealers offerour members “set-amount-over-invoice pricing,” which eliminates the need for pressure orhaggling. We can further insure a fair deal by providing you the actual dealer cost of the caryou want and the approximate value on your trade. For more information on ourFree Auto Buying Service, call (937) 912-7000 or toll-free (800) 762-0047.5. WPCU Website – Visit Your <strong>Credit</strong> <strong>Union</strong>’s website for more valuable financial resourcesat www.wpcu.coop. You’ll not only find valuable information about exceptional productsand services, but also financial education tools to help you make future financial decisions.Thank you for your membership!