abn amro alternative investment strategies - Fundsupermart.com

abn amro alternative investment strategies - Fundsupermart.com

abn amro alternative investment strategies - Fundsupermart.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

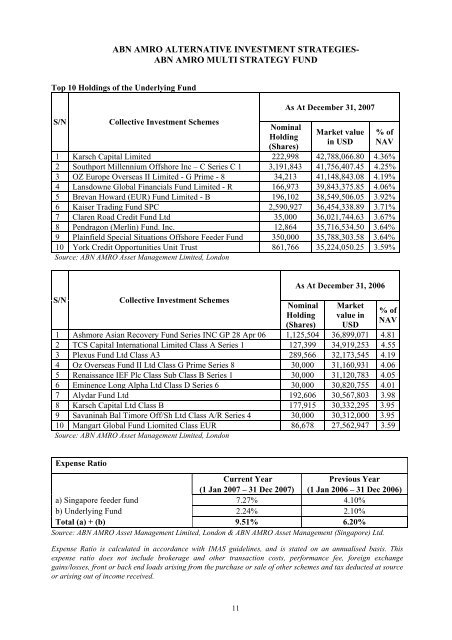

ABN AMRO ALTERNATIVE INVESTMENT STRATEGIES-ABN AMRO MULTI STRATEGY FUNDTop 10 Holdings of the Underlying FundS/NCollective Investment SchemesNominalHolding(Shares)As At December 31, 2007Market valuein USD% ofNAV1 Karsch Capital Limited 222,998 42,788,066.80 4.36%2 Southport Millennium Offshore Inc – C Series C 1 3,191,843 41,756,407.45 4.25%3 OZ Europe Overseas II Limited - G Prime - 8 34,213 41,148,843.08 4.19%4 Lansdowne Global Financials Fund Limited - R 166,973 39,843,375.85 4.06%5 Brevan Howard (EUR) Fund Limited - B 196,102 38,549,506.05 3.92%6 Kaiser Trading Fund SPC 2,590,927 36,454,338.89 3.71%7 Claren Road Credit Fund Ltd 35,000 36,021,744.63 3.67%8 Pendragon (Merlin) Fund. Inc. 12,864 35,716,534.50 3.64%9 Plainfield Special Situations Offshore Feeder Fund 350,000 35,788,303.58 3.64%10 York Credit Opportunities Unit Trust 861,766 35,224,050.25 3.59%Source: ABN AMRO Asset Management Limited, LondonS/NCollective Investment SchemesAs At December 31, 2006NominalHolding(Shares)Marketvalue inUSD% ofNAV1 Ashmore Asian Recovery Fund Series INC GP 28 Apr 06 1,125,504 36,899,071 4.812 TCS Capital International Limited Class A Series 1 127,399 34,919,253 4.553 Plexus Fund Ltd Class A3 289,566 32,173,545 4.194 Oz Overseas Fund II Ltd Class G Prime Series 8 30,000 31,160,931 4.065 Renaissance IEF Plc Class Sub Class B Series 1 30,000 31,120,783 4.056 Eminence Long Alpha Ltd Class D Series 6 30,000 30,820,755 4.017 Alydar Fund Ltd 192,606 30,567,803 3.988 Karsch Capital Ltd Class B 177,915 30,332,295 3.959 Savaninah Bal Timore Off/Sh Ltd Class A/R Series 4 30,000 30,312,000 3.9510 Mangart Global Fund Liomited Class EUR 86,678 27,562,947 3.59Source: ABN AMRO Asset Management Limited, LondonExpense RatioCurrent YearPrevious Year(1 Jan 2007 – 31 Dec 2007) (1 Jan 2006 – 31 Dec 2006)a) Singapore feeder fund 7.27% 4.10%b) Underlying Fund 2.24% 2.10%Total (a) + (b) 9.51% 6.20%Source: ABN AMRO Asset Management Limited, London & ABN AMRO Asset Management (Singapore) Ltd.Expense Ratio is calculated in accordance with IMAS guidelines, and is stated on an annualised basis. Thisexpense ratio does not include brokerage and other transaction costs, performance fee, foreign exchangegains/losses, front or back end loads arising from the purchase or sale of other schemes and tax deducted at sourceor arising out of in<strong>com</strong>e received.11