Defined Benefit Pension Plan SPD - uphs

Defined Benefit Pension Plan SPD - uphs

Defined Benefit Pension Plan SPD - uphs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

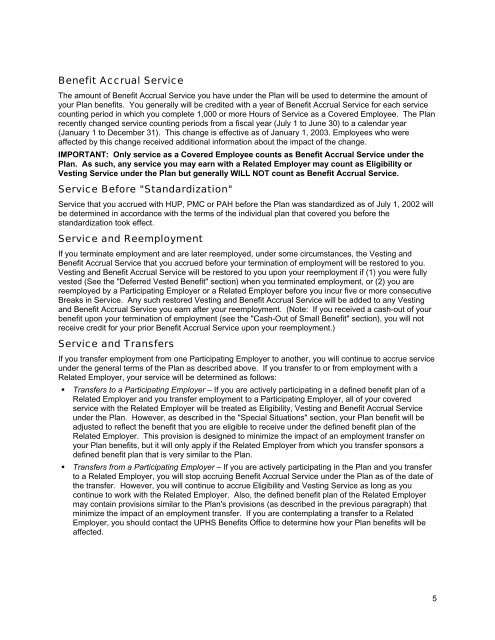

<strong>Benefit</strong> Accrual ServiceThe amount of <strong>Benefit</strong> Accrual Service you have under the <strong>Plan</strong> will be used to determine the amount ofyour <strong>Plan</strong> benefits. You generally will be credited with a year of <strong>Benefit</strong> Accrual Service for each servicecounting period in which you complete 1,000 or more Hours of Service as a Covered Employee. The <strong>Plan</strong>recently changed service counting periods from a fiscal year (July 1 to June 30) to a calendar year(January 1 to December 31). This change is effective as of January 1, 2003. Employees who wereaffected by this change received additional information about the impact of the change.IMPORTANT: Only service as a Covered Employee counts as <strong>Benefit</strong> Accrual Service under the<strong>Plan</strong>. As such, any service you may earn with a Related Employer may count as Eligibility orVesting Service under the <strong>Plan</strong> but generally WILL NOT count as <strong>Benefit</strong> Accrual Service.Service Before "Standardization"Service that you accrued with HUP, PMC or PAH before the <strong>Plan</strong> was standardized as of July 1, 2002 willbe determined in accordance with the terms of the individual plan that covered you before thestandardization took effect.Service and ReemploymentIf you terminate employment and are later reemployed, under some circumstances, the Vesting and<strong>Benefit</strong> Accrual Service that you accrued before your termination of employment will be restored to you.Vesting and <strong>Benefit</strong> Accrual Service will be restored to you upon your reemployment if (1) you were fullyvested (See the "Deferred Vested <strong>Benefit</strong>" section) when you terminated employment, or (2) you arereemployed by a Participating Employer or a Related Employer before you incur five or more consecutiveBreaks in Service. Any such restored Vesting and <strong>Benefit</strong> Accrual Service will be added to any Vestingand <strong>Benefit</strong> Accrual Service you earn after your reemployment. (Note: If you received a cash-out of yourbenefit upon your termination of employment (see the "Cash-Out of Small <strong>Benefit</strong>" section), you will notreceive credit for your prior <strong>Benefit</strong> Accrual Service upon your reemployment.)Service and TransfersIf you transfer employment from one Participating Employer to another, you will continue to accrue serviceunder the general terms of the <strong>Plan</strong> as described above. If you transfer to or from employment with aRelated Employer, your service will be determined as follows:• Transfers to a Participating Employer – If you are actively participating in a defined benefit plan of aRelated Employer and you transfer employment to a Participating Employer, all of your coveredservice with the Related Employer will be treated as Eligibility, Vesting and <strong>Benefit</strong> Accrual Serviceunder the <strong>Plan</strong>. However, as described in the "Special Situations" section, your <strong>Plan</strong> benefit will beadjusted to reflect the benefit that you are eligible to receive under the defined benefit plan of theRelated Employer. This provision is designed to minimize the impact of an employment transfer onyour <strong>Plan</strong> benefits, but it will only apply if the Related Employer from which you transfer sponsors adefined benefit plan that is very similar to the <strong>Plan</strong>.• Transfers from a Participating Employer – If you are actively participating in the <strong>Plan</strong> and you transferto a Related Employer, you will stop accruing <strong>Benefit</strong> Accrual Service under the <strong>Plan</strong> as of the date ofthe transfer. However, you will continue to accrue Eligibility and Vesting Service as long as youcontinue to work with the Related Employer. Also, the defined benefit plan of the Related Employermay contain provisions similar to the <strong>Plan</strong>'s provisions (as described in the previous paragraph) thatminimize the impact of an employment transfer. If you are contemplating a transfer to a RelatedEmployer, you should contact the UPHS <strong>Benefit</strong>s Office to determine how your <strong>Plan</strong> benefits will beaffected.5