Settlement Agreement

Settlement Agreement

Settlement Agreement

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

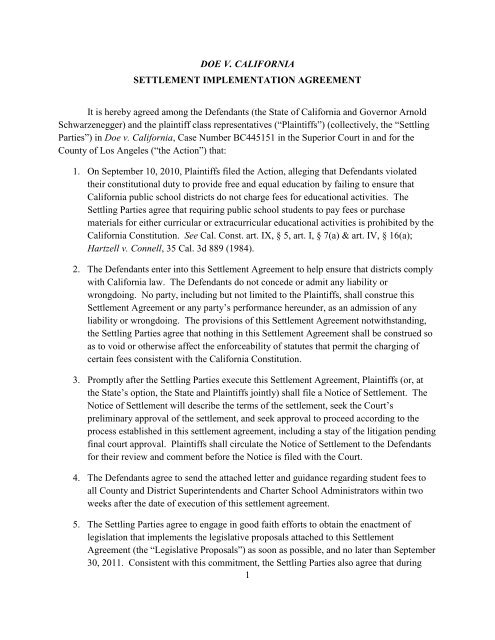

DOE V. CALIFORNIASETTLEMENT IMPLEMENTATION AGREEMENTIt is hereby agreed among the Defendants (the State of California and Governor ArnoldSchwarzenegger) and the plaintiff class representatives (“Plaintiffs”) (collectively, the “SettlingParties”) in Doe v. California, Case Number BC445151 in the Superior Court in and for theCounty of Los Angeles (“the Action”) that:1. On September 10, 2010, Plaintiffs filed the Action, alleging that Defendants violatedtheir constitutional duty to provide free and equal education by failing to ensure thatCalifornia public school districts do not charge fees for educational activities. TheSettling Parties agree that requiring public school students to pay fees or purchasematerials for either curricular or extracurricular educational activities is prohibited by theCalifornia Constitution. See Cal. Const. art. IX, § 5, art. I, § 7(a) & art. IV, § 16(a);Hartzell v. Connell, 35 Cal. 3d 889 (1984).2. The Defendants enter into this <strong>Settlement</strong> <strong>Agreement</strong> to help ensure that districts complywith California law. The Defendants do not concede or admit any liability orwrongdoing. No party, including but not limited to the Plaintiffs, shall construe this<strong>Settlement</strong> <strong>Agreement</strong> or any party’s performance hereunder, as an admission of anyliability or wrongdoing. The provisions of this <strong>Settlement</strong> <strong>Agreement</strong> notwithstanding,the Settling Parties agree that nothing in this <strong>Settlement</strong> <strong>Agreement</strong> shall be construed soas to void or otherwise affect the enforceability of statutes that permit the charging ofcertain fees consistent with the California Constitution.3. Promptly after the Settling Parties execute this <strong>Settlement</strong> <strong>Agreement</strong>, Plaintiffs (or, atthe State’s option, the State and Plaintiffs jointly) shall file a Notice of <strong>Settlement</strong>. TheNotice of <strong>Settlement</strong> will describe the terms of the settlement, seek the Court’spreliminary approval of the settlement, and seek approval to proceed according to theprocess established in this settlement agreement, including a stay of the litigation pendingfinal court approval. Plaintiffs shall circulate the Notice of <strong>Settlement</strong> to the Defendantsfor their review and comment before the Notice is filed with the Court.4. The Defendants agree to send the attached letter and guidance regarding student fees toall County and District Superintendents and Charter School Administrators within twoweeks after the date of execution of this settlement agreement.5. The Settling Parties agree to engage in good faith efforts to obtain the enactment oflegislation that implements the legislative proposals attached to this <strong>Settlement</strong><strong>Agreement</strong> (the “Legislative Proposals”) as soon as possible, and no later than September30, 2011. Consistent with this commitment, the Settling Parties also agree that during1

fiscal years 2010-2011 and 2011-2012 they will not advocate or support any legislativemeasures relating to the Legislature’s consideration of the proposed legislation toimplement the settlement that do not substantially conform to the Legislative Proposals.A legislative measure does not “Substantially Conform” to the Legislative Proposals if itis inconsistent with the language and intent of the Legislative Proposals, including allduties, limitations, and deadlines set forth therein.6. The Settling Parties agree to engage in good faith efforts to obtain the adoption ofregulations that implement the regulatory proposals attached to this <strong>Settlement</strong><strong>Agreement</strong> (the “Regulatory Proposals”) for the 2010-11 Audit Guide pursuant toCalifornia Education Code Section 14502.1 as soon as possible, and no later than March1, 2011. Consistent with this commitment, the Settling Parties also agree that duringfiscal years 2010-2011 and 2011-2012 they will not advocate or support any regulatorymeasures relating to the proposed regulations to implement the settlement that do notsubstantially conform to the Regulatory Proposals. A regulatory measure does not“Substantially Conform” to the Regulatory Proposals if it is inconsistent with thelanguage and intent of the Regulatory Proposals, including all duties, limitations, anddeadlines set forth therein.7. The Plaintiffs shall await the outcome of the efforts to enact the Legislative Proposalsuntil August 31, 2011. If the Legislature has not passed a bill that seeks to implement theLegislative Proposals by August 31, 2011, then, after consultation, the Plaintiffs mayapply to the Court for leave to withdraw from the <strong>Settlement</strong> <strong>Agreement</strong> and to lift thestay of the litigation, and the Defendants will not oppose the dissolution of the stay.8. The Plaintiffs shall await the outcome of the efforts to enact the Regulatory Proposalsuntil March 1, 2011. If regulations that seek to implement the Regulatory Proposals havenot been adopted by the Education Audit Appeals Panel and approved by the Office ofAdministrative Law by March 1, 2011, then, after consultation, the Plaintiffs may applyto the Court for leave to withdraw from the <strong>Settlement</strong> <strong>Agreement</strong> and to lift the stay ofthe litigation, and the Defendants will not oppose the dissolution of the stay.9. No later than October 3, 2011, Plaintiffs shall notify Defendants whether they agree thatthe legislation that has been passed by the Legislature and signed by the Governor (the“Fees Legislation”) Substantially Conforms to the Legislative Proposals and whether theyagree that the regulations adopted by the Education Audit Appeals Panel and approved bythe Office of Administrative Law (the “Fees Regulations”) Substantially Conform to theRegulatory Proposals, which agreement shall not be unreasonably withheld. If thePlaintiffs agree that the Fees Legislation and the Fees Regulations Substantially Conform,they shall promptly take all steps necessary to certify a class for purposes of settlement,wherein the settlement class shall be defined to include all current and future students in2

California public schools who have been or will be required to pay fees or purchasematerials for courses for academic credit up to and including the date on which the Courtgrants final approval of the settlement. Defendants shall provide all reasonablecooperation in the effort to certify the settlement class. Once the class has been certified,Plaintiffs shall submit a motion for final approval of the settlement and dismissal of theAction as provided in this <strong>Settlement</strong> <strong>Agreement</strong>.10. In the event that Plaintiffs believe the Fees Legislation does not Substantially Conform tothe Legislative Proposals and/or the Fees Regulations do not Substantially Conform tothe Regulatory Proposals, they shall engage in consultation (as described in paragraph 12below), giving written notice to Defendants of the alleged deficiencies and providing theDefendants with an opportunity to cure any alleged shortcoming. If the Defendants donot cure the alleged deficiencies, or are unable to cure them, the Plaintiffs may apply tothe Court for leave to withdraw from the <strong>Settlement</strong> <strong>Agreement</strong> and to lift the stay of thelitigation.11. In the event the Court grants final approval of the settlement:a. The Settling Parties agree that plaintiffs and members of the plaintiff class waiveall current and future claims against the Defendants, including but not limited toall claims for declaratory or injunctive relief, that arise from acts or omissionsallegedly attributable to Defendants up to and including the date on which theCourt grants final approval of the settlement, including those claims that were orcould have been pled based on the factual allegations included in the complaintfiled on September 10, 2010.b. The Settling Parties further agree the Action will be dismissed with prejudicesubject to approval by the Court pursuant to California Code of Civil Proceduresection 581, subdivision (k), and that such a dismissal will extinguish all currentand future claims against the Defendants, including but not limited to all claimsfor declaratory or injunctive relief, that arise from acts or omissions allegedlyattributable to Defendants up to and including the date on which the Court grantsfinal approval of the settlement, including those claims that were or could havebeen pled based on the factual allegations included in the complaint filed onSeptember 10, 2010.c. Plaintiffs may request that the Court award to them attorneys’ fees and costs, andthe award of any such fees and costs will be determined by the Court inaccordance with applicable law.3

12. The terms “Defendants” and “Settling Parties” as used in this <strong>Settlement</strong> <strong>Agreement</strong>,including specifically but not limited to paragraphs 1-10, 11(a) and 11(b), and 13-14,shall not include any local public agency or entity, such as a school district or other localeducation agency.13. The Settling Parties shall endeavor in good faith to resolve informally any differencesregarding interpretations of, and compliance with, this <strong>Settlement</strong> <strong>Agreement</strong> prior tobringing such matters to the Court for resolution. However, if any Settling Party fails toperform in a timely manner any act required by this <strong>Agreement</strong>, regardless of the reason,or otherwise acts in violation of any provision of this <strong>Settlement</strong> <strong>Agreement</strong>, theburdened party may, after failure of good faith efforts to resolve the matter, move theCourt to dissolve this <strong>Settlement</strong> <strong>Agreement</strong> and lift the stay on litigation.14. This <strong>Settlement</strong> <strong>Agreement</strong> may be signed in counterparts, and all so executedcounterparts shall constitute the <strong>Settlement</strong> <strong>Agreement</strong>, which shall be binding on theSettling Parties. More than one counterpart of this <strong>Agreement</strong> may be executed by theParties hereto, and each executed counterpart (whether via facsimile, photocopy ororiginal) shall be deemed an original.4

Dated: December ___, 2010PLAINTIFFS JANE DOE, A MINOR, BYHER GUARDIAN AD LITEM, ET. AL.,EACH INDIVIDUALLY AND ON BEHALFOF ALL OTHERS SIMILARLYSITUATIONSBy:Mark D. RosenbaumBrooks M. AllenDavid SappACLU Foundation of SouthernCaliforniaDan MarmalefskySaro BalianDouglas J. BetetaMorrison & Foerster, LLPAlan L. SchlosserJory C. SteeleACLU Foundation of NorthernCaliforniaDavid Blair-LoyACLU Foundation of San Diego &Imperial CountiesAttorneys for Plaintiffs5

Dated: December ___, 2010DEFENDANTS THE STATE OFCALIFORNIA AND ARNOLDSCHWARZENEGGER, IN HIS OFFICIALCAPACITY AS GOVERNOR OF THESTATE OF CALIFORNIABy:Jonathan E. RichDeputy Attorney GeneralEdmund G. Brown Jr.Attorney General of CaliforniaDouglas M. PressSenior Assistant Attorney GeneralRichard T. WaldowSupervising Deputy Attorney GeneralAttorneys for DefendantsDated: December ___, 2010DEFENDANT ARNOLDSCHWARZENEGGER, IN HIS OFFICIALCAPACITY AS GOVERNOR OF THESTATE OF CALIFORNIABy:Daniel P. MaguireDeputy Legal Affairs SecretaryOffice of Governor ArnoldSchwarzenegger6

LEGISLATIVE PROPOSALSProposed amendments to California Education Code Sections 14501, 35186, and 41020 andproposed addition of California Education Code Section 490107

(Bill to be enacted with an urgency clause.)[Proposed amendments are in strikethrough and underlined text.]SEC 1. Section 14501 of the Education Code is amended to read:14501. (a) As used in this chapter, "financial and compliance audit"shall be consistent with the definition provided in the "Standardsfor Audits of Governmental Organizations, Programs, Activities, andFunctions" promulgated by the Comptroller General of the UnitedStates. Financial and compliance audits conducted under this chaptershall fulfill federal single audit requirements.(b) As used in this chapter, "compliance audit" means an auditthat ascertains and verifies whether or not funds provided throughapportionment, contract, or grant, either federal or state, have beenproperly disbursed and expended as required by law or regulation orboth and includes the verification of each of the following:(1) The reporting requirements for the sufficiency of textbooks orinstructional materials, or both, as defined in Section 60119.(2) Teacher misassignments pursuant to Section 44258.9.(3) The accuracy of information reported on the SchoolAccountability Report Card required by Section 33126. Therequirements set forth in paragraphs (1) and (2) and this paragraphshall be added to the audit guide requirements pursuant tosubdivision (b) of Section 14502.1.(4) Compliance with Section 49010 and the “free school guarantee” in Section 5 of Article IXof the California Constitution.SEC 2. Section 35186 of the Education Code is amended to read:35186. (a) A school district shall use the uniform complaintprocess it has adopted as required by Chapter 5.1 (commencing withSection 4600) of Title 5 of the California Code of Regulations, withmodifications, as necessary, to help identify and resolve anydeficiencies related to instructional materials, emergency or urgentfacilities conditions that pose a threat to the health and safety ofpupils or staff, teacher vacancy or misassignment, and intensiveinstruction and services provided pursuant to Section 37254 to pupilswho have not passed one or both parts of the high school exitexamination after the completion of grade 12, and fees, deposits, or other charges related toparticipation in a curricular or extracurricular activity.(1) A complaint may be filed anonymously. A complainant whoidentifies himself or herself is entitled to a response if he or sheindicates that a response is requested. A complaint form shall8

include a space to mark to indicate whether a response is requested.If Section 48985 is otherwise applicable, the response, if requested,and report shall be written in English and the primary language inwhich the complaint was filed. All complaints and responses arepublic records.(2) The complaint form shall specify the location for filing acomplaint. A complainant may add as much text to explain thecomplaint as he or she wishes.(3) Except as provided pursuant to paragraph (4), a complaintshall be filed with the principal of the school or his or herdesignee. A complaint about problems beyond the authority of theschool principal shall be forwarded in a timely manner but not toexceed 10 working days to the appropriate school district officialfor resolution.(4) A complaint regarding any deficiencies related to intensiveinstruction and services provided pursuant to Section 37254 to pupilswho have not passed one or both parts of the high school exitexamination after the completion of grade 12 shall be submitted tothe district official designated by the district superintendent. Acomplaint may be filed at the school district office, or it may befiled at the schoolsite and shall be immediately forwarded to thedesignee of the district superintendent.(b) The principal or the designee of the district superintendent,as applicable, shall make all reasonable efforts to investigate anyproblem within his or her authority. The principal or designee of thedistrict superintendent shall remedy a valid complaint within areasonable time period but not to exceed 30 working days from thedate the complaint was received. The principal or designee of thedistrict superintendent shall report to the complainant theresolution of the complaint within 45 working days of the initialfiling. If the principal makes this report, the principal shall alsoreport the same information in the same timeframe to the designee ofthe district superintendent.(c) A complainant not satisfied with the resolution of theprincipal or the designee of the district superintendent has theright to describe the complaint to the governing board of the schooldistrict at a regularly scheduled hearing of the governing board. Asto complaints involving a condition of a facility that poses anemergency or urgent threat, as defined in paragraph (1) ofsubdivision (c) of Section 17592.72 or fees, deposits, or other charges related to participation in acurricular or extracurricular activity, a complainant who is notsatisfied with the resolution proffered by the principal or thedesignee of the district superintendent has the right to file anappeal to the Superintendent, who shall provide a written report to9

the state board and the complainant no later than 30 working days after the date the complaintwas received describing the basis for the complaint and, as appropriate, a proposed remedy forthe issue described in the complaint. Where a district or school has illegally required a pupil topay a fee, make a deposit, or make a purchase, the Superintendent’s remedy will include, but notbe limited to, requiring the district or school to fully reimburse the pupil with interest.(d) A school district shall report summarized data on the natureand resolution of all complaints on a quarterly basis to the countysuperintendent of schools and the governing board of the schooldistrict. The summaries shall be publicly reported on a quarterlybasis at a regularly scheduled meeting of the governing board of theschool district. The report shall include the number of complaints bygeneral subject area with the number of resolved and unresolvedcomplaints. The complaints and written responses shall be availableas public records.(e) The procedure required pursuant to this section is intended toaddress all of the following:(1) A complaint related to instructional materials as follows:(A) A pupil, including an English learner, does not havestandards-aligned textbooks or instructional materials orstate-adopted or district-adopted textbooks or other requiredinstructional material to use in class.(B) A pupil does not have access to instructional materials to useat home or after school.(C) Textbooks or instructional materials are in poor or unusablecondition, have missing pages, or are unreadable due to damage.(2) A complaint related to teacher vacancy or misassignment asfollows:(A) A semester begins and a teacher vacancy exists.(B) A teacher who lacks credentials or training to teach Englishlearners is assigned to teach a class with more than 20-percentEnglish learner pupils in the class. This subparagraph does notrelieve a school district from complying with state or federal lawregarding teachers of English learners.(C) A teacher is assigned to teach a class for which the teacherlacks subject matter competency.(3) A complaint related to the condition of facilities that posean emergency or urgent threat to the health or safety of pupils orstaff as defined in paragraph (1) of subdivision (c) of Section17592.72 and any other emergency conditions the school districtdetermines appropriate and the requirements established pursuant tosubdivision (a) of Section 35292.5.(4) A complaint related to the provision of intensive instructionand services pursuant to paragraphs (4) and (5) of subdivision (d) ofSection 37254.(5) A complaint related to pupil fees as follows:10

(A) A pupil is charged a fee as a condition for registering for school or classes, or as acondition for participation in any class or extracurricular activity, regardless of whether the classor activity is elective or compulsory or is for credit.(B) A pupil is required to make a security deposit or other required payment for a lock, locker,book, class apparatus, musical instrument, uniform, or other equipment.(C) A pupil is required to purchase materials, supplies, equipment, or uniforms associated witha school curricular or extracurricular activity.(f) In order to identify appropriate subjects of complaint, anotice shall be posted in each classroom in each school in the schooldistrict notifying parents, guardians, pupils, and teachers of thefollowing:(1) There should be sufficient textbooks and instructionalmaterials. For there to be sufficient textbooks and instructionalmaterials each pupil, including English learners, must have atextbook or instructional materials, or both, to use in class and totake home.(2) School facilities must be clean, safe, and maintained in goodrepair.(3) There should be no teacher vacancies or misassignments asdefined in paragraphs (2) and (3) of subdivision (h).(4) Pupils may not be charged fees, including security deposits, or be required to purchaseequipment or materials, to participate in a class or an extracurricular activity.(4) (5) Pupils who have not passed the high school exit examination bythe end of grade 12 are entitled to receive intensive instructionand services for up to two consecutive academic years aftercompletion of grade 12 or until the pupil has passed both parts ofthe high school exit examination, whichever comes first, pursuant toparagraphs (4) and (5) of subdivision (d) of Section 37254. Theinformation in this paragraph, which is to be included in the noticerequired pursuant to this subdivision, shall only be included innotices posted in classrooms in schools with grades 10 to 12,inclusive.(5)(6) The location at which to obtain a form to file a complaint incase of a shortage. Posting a notice downloadable from the InternetWeb site of the department shall satisfy this requirement.(g) A local educational agency shall establish local policies andprocedures, post notices, and implement this section on or beforeJanuary 1, 2005.(h) For purposes of this section, the following definitions apply:(1) "Good repair" has the same meaning as specified in subdivision(d) of Section 17002.(2) "Misassignment" means the placement of a certificated employeein a teaching or services position for which the employee does nothold a legally recognized certificate or credential or the placementof a certificated employee in a teaching or services position that11

the employee is not otherwise authorized by statute to hold.(3) "Teacher vacancy" means a position to which a singledesignated certificated employee has not been assigned at thebeginning of the year for an entire year or, if the position is for aone-semester course, a position to which a single designatedcertificated employee has not been assigned at the beginning of asemester for an entire semester.(4) “Fees, deposits, or other charges related to participation in a curricular or extracurricularactivity” means fees, deposits, or charges imposed on pupils in violation of Section 49010 andthe Free Schools Clause in Article IX, Section 5 of the California Constitution, which requiresthat educational opportunities be provided to all students without regard to their families’ abilityor willingness to pay fees or request special waivers.SEC 3. Section 49010 is added to Article 5.5 of Chapter 6 (Pupil Rights andResponsibilities) of Part 27 of Division 1 of Title 1 of the Education Code, to read:49010. (a) A pupil enrolled in a school shall not be required to pay any fee, deposit, or othercharge in order to participate in an educational activity. All supplies, materials, and equipmentfor curricular and extracurricular activities must be provided to pupils free of charge.(b) A wavier process does not render an otherwise impermissible mandatory fee,charge, or deposit permissible.(c) Districts cannot establish a two tier educational system by defining a minimaleducational standard as the requirement and then offering a second, higher standard that pupilsmay only reach by paying a fee or purchasing additional supplies that the school does notprovide.(d) No school may offer course credit or privileges related to curricular orextracurricular activities in exchange for money or donations of goods or services from the pupilor the pupil’s parents or guardians, and no school may take away course credit or privilegesrelated to curricular or extracurricular activities or punish a pupil because the pupil or the pupil’sparents or guardians did not provide money or donations of goods or services to the school.(e) This section shall not be interpreted to prohibit an entire school, class, sports team,or club from participating in fundraising or to prohibit schools from providing students prizes orother recognition for participating in such activities.(f) This section is declarative of existing law, and shall not be interpreted to prohibitany school district or school from charging a fee, deposit, or other charge otherwise allowed bylaw.(g) For purposes of this section, “educational activity” means any activity whichconstitutes an integral fundamental part of the elementary and secondary education or whichamounts to a necessary element of any school’s activity, including, but not limited to, curricularand extracurricular activities.SEC. 4 Section 41020 of the Education Code is amended to read:12

41020. (a) It is the intent of the Legislature to encourage soundfiscal management practices among local educational agencies for themost efficient and effective use of public funds for the education ofchildren in California by strengthening fiscal accountability at thedistrict, county, and state levels.(b) (1) Not later than the first day of May of each fiscal year,each county superintendent of schools shall provide for an audit ofall funds under his or her jurisdiction and control and the governingboard of each local educational agency shall either provide for anaudit of the books and accounts of the local educational agency,including an audit of income and expenditures by source of funds, ormake arrangements with the county superintendent of schools havingjurisdiction over the local educational agency to provide for thatauditing.(2) A contract to perform the audit of a local educational agencythat has a disapproved budget or has received a negativecertification on any budget or interim financial report during thecurrent fiscal year or either of the two preceding fiscal years, orfor which the county superintendent of schools has otherwisedetermined that a lack of going concern exists, is not valid unlessapproved by the responsible county superintendent of schools and thegoverning board.(3) If the governing board of a local educational agency has notprovided for an audit of the books and accounts of the localeducational agency by April 1, the county superintendent of schoolshaving jurisdiction over the local educational agency shall providefor the audit of each local educational agency.(4) An audit conducted pursuant to this section shall comply fullywith the Government Auditing Standards issued by the ComptrollerGeneral of the United States.(5) For purposes of this section, "local educational agency" doesnot include community colleges.(c) Each audit conducted in accordance with this section shallinclude all funds of the local educational agency, including thestudent body and cafeteria funds and accounts and any other fundsunder the control or jurisdiction of the local educational agency.Each audit shall also include an audit of pupil attendanceprocedures.(d) All audit reports for each fiscal year shall be developed andreported using a format established by the Controller afterconsultation with the Superintendent and the Director of Finance.(e) (1) The cost of the audits provided for by the countysuperintendent of schools shall be paid from the county schoolservice fund and the county superintendent of schools shall transfer13

the pro rata share of the cost chargeable to each district fromdistrict funds.(2) The cost of the audit provided for by a governing board shallbe paid from local educational agency funds. The audit of the fundsunder the jurisdiction and control of the county superintendent ofschools shall be paid from the county school service fund.(f) (1) The audits shall be made by a certified public accountantor a public accountant, licensed by the California Board ofAccountancy, and selected by the local educational agency, asapplicable, from a directory of certified public accountants andpublic accountants deemed by the Controller as qualified to conductaudits of local educational agencies, which shall be published by theController not later than December 31 of each year.(2) Commencing with the 2003-04 fiscal year and except as providedin subdivision (d) of Section 41320.1, it is unlawful for a publicaccounting firm to provide audit services to a local educationalagency if the lead audit partner, or coordinating audit partner,having primary responsibility for the audit, or the audit partnerresponsible for reviewing the audit, has performed audit services forthat local educational agency in each of the six previous fiscalyears. The Education Audits Appeal Panel may waive this requirementif the panel finds that no otherwise eligible auditor is available toperform the audit.(3) It is the intent of the Legislature that, notwithstandingparagraph (2), the rotation within public accounting firms conform toprovisions of the federal Sarbanes-Oxley Act of 2002 (P.L. 107-204;15 U.S.C. Sec. 7201 et seq.), and upon release of the report requiredby the act of the Comptroller General of the United Statesaddressing the mandatory rotation of registered public accountingfirms, the Legislature intends to reconsider the provisions ofparagraph (2). In determining which certified public accountants andpublic accountants shall be included in the directory, the Controllershall use the following criteria:(A) The certified public accountants or public accountants shallbe in good standing as certified by the Board of Accountancy.(B) The certified public accountants or public accountants, as aresult of a quality control review conducted by the Controllerpursuant to Section 14504.2, shall not have been found to haveconducted an audit in a manner constituting noncompliance withsubdivision (a) of Section 14503.(g) (1) The auditor's report shall include each of the following:(A) A statement that the audit was conducted pursuant to standardsand procedures developed in accordance with Chapter 3 (commencingwith Section 14500) of Part 9 of Division 1 of Title 1.(B) A summary of audit exceptions and management improvement14

ecommendations.(C) Each audit of a local educational agency shall include anevaluation by the auditor on whether there is substantial doubt aboutthe ability of the local educational agency to continue as a goingconcern for a reasonable period of time. This evaluation shall bebased on the Statement of Auditing Standards (SAS) No. 59, as issuedby the AICPA regarding disclosure requirements relating to theability of the entity to continue as a going concern.(2) To the extent possible, a description of correction or plan ofcorrection shall be incorporated in the audit report, describing thespecific actions that are planned to be taken, or that have beentaken, to correct the problem identified by the auditor. Thedescriptions of specific actions to be taken or that have been takenshall not solely consist of general comments such as "will implement,""accepted the recommendation," or "will discuss at a later date."(h) Not later than December 15, a report of each local educationalagency audit for the preceding fiscal year shall be filed with thecounty superintendent of schools of the county in which the localeducational agency is located, the department, and the Controller.The Superintendent shall make any adjustments necessary in futureapportionments of all state funds, to correct any audit exceptionsrevealed by those audit reports.(i) (1) Commencing with the 2002-03 audit of local educationalagencies pursuant to this section and subdivision (d) of Section41320.1, each county superintendent of schools shall be responsiblefor reviewing the audit exceptions contained in an audit of a localeducational agency under his or her jurisdiction related toattendance, inventory of equipment, internal control, and anymiscellaneous items, and determining whether the exceptions have beeneither corrected or an acceptable plan of correction has beendeveloped.(2) Commencing with the 2004-05 audit of local educationalagencies pursuant to this section and subdivision (d) of Section41320.1, each county superintendent of schools shall include in thereview of audit exceptions performed pursuant to this subdivisionthose audit exceptions related to use of instructional materialsprogram funds, teacher misassignments pursuant to Section 44258.9,information reported on the school accountability report cardrequired pursuant to Section 33126 and shall determine whether theexceptions are either corrected or an acceptable plan of correctionhas been developed.(3) Commencing with the 2010-11 audit of local education agencies pursuant to this sectionand subdivision (d) of Section 41320.1, each county superintendent of schools shall include inthe review of audit exceptions performed pursuant to this subdivision those audit exceptionsrelated to compliance with Section 49010 and the “free school guarantee” in Section 5 of Article15

IX of the California Constitution and shall determine whether the exceptions are either correctedor an acceptable plan of correction has been developed.(j) Upon submission of the final audit report to the governingboard of each local educational agency and subsequent receipt of theaudit by the county superintendent of schools having jurisdictionover the local educational agency, the county office of educationshall do all of the following:(1) Review audit exceptions related to attendance, inventory ofequipment, internal control, and other miscellaneous exceptions.Attendance exceptions or issues shall include, but not be limited to,those related to revenue limits, adult education, and independentstudy.(2) Review audit exceptions related to school fees pursuant to paragraph (3) of subdivision (i).(2)(3) If a description of the correction or plan of correction hasnot been provided as part of the audit required by this section, thenthe county superintendent of schools shall notify the localeducational agency and request the governing board of the localeducational agency to provide to the county superintendent of schoolsa description of the corrections or plan of correction by March 15.(3)(4) Review the description of correction or plan of correction anddetermine its adequacy. If the description of the correction or planof correction is not adequate, the county superintendent of schoolsshall require the local educational agency to resubmit that portionof its response that is inadequate.(k) Each county superintendent of schools shall certify to theSuperintendent and the Controller, not later than May 15, that his orher staff has reviewed all audits of local educational agenciesunder his or her jurisdiction for the prior fiscal year, that allexceptions that the county superintendent was required to review werereviewed, and that all of those exceptions, except as otherwisenoted in the certification, have been corrected by the localeducational agency or that an acceptable plan of correction has beensubmitted to the county superintendent of schools. In addition, thecounty superintendent shall identify, by local educational agency,any attendance-related audit exception or exceptions involving statefunds, and require the local educational agency to which the auditexceptions were directed to submit appropriate reporting forms forprocessing by the Superintendent.(l) In the audit of a local educational agency for a subsequentyear, the auditor shall review the correction or plan or plans ofcorrection submitted by the local educational agency to determine ifthe exceptions have been resolved. If not, the auditor shallimmediately notify the appropriate county office of education and thedepartment and restate the exception in the audit report. Afterreceiving that notification, the department shall either consult with16

the local educational agency to resolve the exception or require thecounty superintendent of schools to follow up with the localeducational agency.(2) If the auditor determines, in the audit of a local educational agency for a subsequent year,that an exception related to school fees has not been corrected or that the local education agencyhas a new audit exception related to school fees, the auditor shall immediately notify theappropriate county office of education, the Controller, the Superintendent, and the Director of theDepartment of Finance. Based on this notification, the Controller shall withhold one percent ofthe amount authorized to be used for administrative costs [General Administration functioncodes 7000–7999] from the next principal apportionment to the local educational agency, untilsuch time as the agency reimburses all illegally-collected fees, with applicable interest.(m) (1) The Superintendent shall be responsible for ensuring thatlocal educational agencies have either corrected or developed plansof correction for any one or more of the following:(A) All federal and state compliance audit exceptions identifiedin the audit.(B) Any exceptions that the county superintendent certifies as ofMay 15 have not been corrected.(C) Any repeat audit exceptions that are not assigned to a countysuperintendent to correct.(D) All audit exceptions related to school fees. An audit exception related to school fees shallnot be deemed corrected until the local educational agency has, at a minimum, fully reimbursedparents, guardians, and pupils, with interest. The amount of interest shall be calculated based onthe date the fee was collected and the applicable interest rates applied to actual cash held in thelocal education agency's bank.(2) In addition, the Superintendent shall be responsible forensuring that county superintendents of schools and each county boardof education that serves as the governing board of a localeducational agency either correct all audit exceptions identified inthe audits of county superintendents of schools and of the localeducational agencies for which the county boards of education serveas the governing boards or develop acceptable plans of correction forthose exceptions.(3) The Superintendent shall report annually to the Controller onhis or her actions to ensure that school districts, countysuperintendents of schools, and each county board of education thatserves as the governing board of a school district have eithercorrected or developed plans of correction for any of the exceptionsnoted pursuant to paragraph (1).(n) To facilitate correction of the exceptions identified by theaudits issued pursuant to this section, commencing with 2002-03audits pursuant to this section, the Controller shall requireauditors to categorize audit exceptions in each audit report in amanner that will make it clear to both the county superintendent ofschools and the Superintendent which exceptions they are responsible17

for ensuring the correction of by a local educational agency. Inaddition, the Controller annually shall select a sampling of countysuperintendents of schools and perform a followup of the auditresolution process of those county superintendents of schools andreport the results of that followup to the Superintendent and thecounty superintendents of schools that were reviewed.(o) County superintendents of schools shall adjust subsequentlocal property tax requirements to correct audit exceptions relatingto local educational agency tax rates and tax revenues.(p) If a governing board or county superintendent of schools failsor is unable to make satisfactory arrangements for the auditpursuant to this section, the Controller shall make arrangements forthe audit and the cost of the audit shall be paid from localeducational agency funds or the county school service fund, as thecase may be.(q) Audits of regional occupational centers and programs aresubject to the provisions of this section.(r) This section does not authorize examination of, or reports on,the curriculum used or provided for in any local educational agency.(s) Notwithstanding any other provision of law, a nonauditing,management, or other consulting service to be provided to a localeducational agency by a certified public accounting firm while thecertified public accounting firm is performing an audit of the agencypursuant to this section must be in accord with GovernmentAccounting Standards, Amendment No. 3, as published by the UnitedStates General Accounting Office.18

Exhibit – Sample Classroom Notice asAmended by Legislative ProposalsThe Legislative Proposals would add the underlined text in paragraph #4 below.19

Sample Williams Complaints NoticeCDE, T07-005 English, Arial fontPage 20 of 38[California Department of Education][Categorical Programs Complaints Management][Legal and Audits Branch (July 2006)]Parents, Guardians, Pupils, and Teachers:Pursuant to California Education Code Section 35186, you are hereby notified that:1. There should be sufficient textbooks and instructional materials. That means eachpupil, including English learners, must have a textbook or instructional materials, orboth, to use in class and to take home.2. School facilities must be clean, safe, and maintained in good repair.3. There should be no teacher vacancies or misassignments. There should be ateacher assigned to each class and not a series of substitutes or other temporaryteachers. The teacher should have the proper credential to teach the class, includingthe certification required to teach English learners if present.Teacher vacancy means a position to which a single designated certificatedemployee has not been assigned at the beginning of the year for an entire year or, ifthe position is for a one-semester course, a position to which a single designatedcertificated employee has not been assigned at the beginning of a semester for anentire semester.Misassignment means the placement of a certificated employee in a teaching orservices position for which the employee does not hold a legally recognizedcertificate or credential or the placement of a certificated employee in a teaching orservices position that the employee is not otherwise authorized by statute to hold.4. Pupils may not be charged fees, including security deposits, or be required topurchase equipment or materials, to participate in a class or an extracurricularactivity.5. A complaint form may be obtained at the school office, district office, or downloadedfrom the school’s Web site at [district adds Web site address]. You may alsodownload a copy of the California Department of Education complaint form from thefollowing Web site: http://www.cde.ca.gov/re/cp/uc.20

REGULATORY PROPOSALS21

Proposed Addition of Section 198XX.X to Standards and Procedures for Audits of CaliforniaK‐12 Local Education Agencies [Title 5, Div. 1.5, Ch. 3, California Code of Regulations]§ 198XX.X. Student Fee Revenues.(a) For fiscal year 2010-11 and each fiscal year thereafter, perform the following procedures:(1) Determine whether the school district or county office of education has collected revenuederived from fees, deposits, charges or levies issued to students:A. Charges for optional attendance as a spectator at a school or District sponsored activity.(Hartzell, 35 Cal.3d 899, 911, fn. 14).B. Charges for food served to students, subject to free and reduced price meal programeligibility and other restrictions specified in law. (Education Code §§ 38082 and 38084).C. Paying the replacement cost for District books or supplies loaned to a student that the studentfails to return, or that is willfully cut, defaced or otherwise injured, up to an amount not toexceed $10,000. (Education Code §§ 19910-19911 and 48904).D. Charges for required medical and accident insurance for athletic team members, so long asthere is a waiver for financial hardship. (Education Code § 32221).E. Charges for the rental or lease of personal property needed for District purposes, such as capsand gowns for graduation ceremonies (Education Code § 38119).F. Fees for school camp programs, so long as no student is denied the opportunity to participatebecause of nonpayment of the fee. (Education Code § 35335).G. Reimbursement for the direct cost of materials provided to a student for property the studenthas fabricated from such materials for his/her own possession and use, such as wood shop,art, or sewing projects kept by the student. (Education Code § 17551).H. Reimbursement for the actual cost of duplicating public records, student records, or aprospectus of the school curriculum. (Government Code § 6253; Education Code §49091.14).I. Fees for transportation to and from school, and transportation between school and regionaloccupational centers, programs or classes, as long as the fee does not exceed the statewideaverage nonsubsidized cost per student and provided there is a waiver provision based onfinancial need. (Education Code § 39807.5).J. Fees for transportation of pupils to places of summer employment. (Education Code §39837).K. Tuition fees charged to pupils whose parents are actual and legal residents of an adjacentforeign country or an adjacent state. (Education Code §§ 48050-52).L. Tuition fees collected from foreign students attending a District school pursuant to an F-1visa, equal to the full unsubsidized per capita cost of providing education during the period ofattendance. (8 USC § 1184(m)(1)).M. Fees for an optional fingerprinting program for kindergarten or other newly enrolled students,if the fee does not exceed the actual costs associated with the program. (Education Code §32390).N. Fees for community classes in civic, vocational, literacy, health, homemaking, and technicaland general education, not to exceed the cost of maintaining the community classes.(Education Code §§ 51810 and 51815).O. Deposits for band instruments, music, uniforms and other regalia which school bandmembers take on excursions to foreign countries. (Education Code § 38120).22

P. Charges for eye safety devices, at a price not to exceed the district's actual costs, in specifiedcourses or activities in which students are engaged in, or are observing, an activity or the useof hazardous substances likely to cause injury to the eyes. (Education Code § 32033).Q. Fees for field trips and excursions in connection with courses of instruction or school relatedsocial, educational, cultural, athletic, or school band activities, as long as no student isprevented from making the field trip or excursion because of lack of sufficient funds.(Education Code § 35330(b)).R. Medical or hospital insurance for field trips that is made available by the school district.(Education Code § 35331).S. Charges for standardized physical education attire of a particular color and design, but theschool may not mandate that the attire be purchased from the school and no physicaleducation grade of a student may be impacted based on the failure to wear standardizedapparel “arising from circumstances beyond the control” of the student. (Education Code §49066).T. Charging for the parking of vehicles on school grounds. (Vehicle Code § 21113).(b) If the school district or county office of education collected revenue derived from fees,deposits, charges or levies issued to students that are not listed in subparagraphs (A)-(T) ofparagraph (1) of subdivision (a) of this section, include a finding in the Findings andRecommendations section of the audit report showing the full amount of revenue collected andaccrued interest as disallowed.NOTE: Authority cited: Sections 41020 and 41344 of the Education Code and Section 350 of Title Vof the California Code of Regulations.23

Letter and Guidance to be sent to all Countyand District Superintendents and CharterSchool Administrators re: Student Fees24

November [xx], 2010[ADDRESS]Dear Superintendent [xx],As you may know, a group of students recently filed a lawsuit in Los Angeles SuperiorCourt, alleging that many California public schools are illegally charging students mandatoryfees to participate in educational activities. The State of California and I were the onlydefendants named in the suit, Doe, et al. v. State of California, et al., Case No. BC445151 (LosAngeles Superior Court).I am concerned about these allegations, and therefore I ask you to immediately reviewyour district’s policies and the practices of its schools to ensure that students are not charged anyillegal fees.Article IX, Section 5 of the California Constitution states: “The Legislature shall providefor a system of common schools by which a free school shall be kept up and supported in eachdistrict.” In Hartzell v. Connell, 35 Cal.3d 899, 913 (1984), the Supreme Court of Californiaunambiguously held that this provision prohibits public schools from charging mandatory feesfor educational activities.In guaranteeing “free” public schools, article IX, section 5 fixes the precise extentof the financial burden which may be imposed on the right to an education – none.A school which conditions a student’s participation in educational activities uponthe payment of a fee clearly is not a “free school.”Id. at 911. The Court concluded that educational activities include both curricular andextracurricular activities. See id. The Court also flatly rejected the argument that a fee-waiverpolicy allows schools to charge fees for educational activities: “Educational opportunities mustbe provided to all students without regard to their families’ ability or willingness to pay fees orrequest special waivers.” Id. at 913. Thus, whenever a public school offers a curricular orextracurricular program to students, the California Constitution requires that the school provideall materials, supplies, and equipment – whether they are necessary or supplementary to theprogram – to students free of charge.The constitutional prohibition against requiring public school students to pay fees orpurchase materials for educational activities is codified in Education Code § 60070, whichprohibits school officials from requiring students to purchase instructional materials, andreinforced by Title 5, Section 350 of the California Code of Regulations, which prohibits schoolsfrom requiring students to pay any fee, deposit or other charge not specifically authorized by25

law. 1 Public schools may solicit and accept donations from parents or the broader community,so long as the fundraising program is voluntary and contributing is not a requirement forparticipating in an educational activity.My administration is evaluating options to establish a state-level process that will helpidentify impermissible fees to help ensure that districts and schools honor the free schoolsguarantee. I hope that the process we establish will also provide guidance to school districts onhow they can raise additional money to support educational programming without resorting toillegal school fees.In the meantime, I ask you to review your district’s policies, to evaluate your schools’practices, and to ensure that no students in your district are being required to pay fees or topurchase materials or equipment for curricular and extracurricular activities. 2 Please feel free tocontact [xx] if you have any questions.Sincerely,Enclosures1 Although there are a few statutory exceptions authorizing public schools to charge students fees forcertain services or materials, these are narrow and quite limited. For example, schools can charge all students fortransportation to and from school and from summer employment (Education Code §§ 39807.5 & 39837), for foodserved to students (Education Code §§ 38082 & 38204), for lost or damaged school property (Education Code §48904), for school-provided insurance for field trips (Education Code § 35331), and for medical and accidentinsurance for students participating in sports (Education Code § 32221). Schools also may charge students for fieldtrips and science camps, but they cannot prevent a student from participating for non-payment (Education Code §§35330 & 35335). Additionally, if students create items in class and are allowed to take those items home with themas personal property, schools may charge students for the direct cost of materials (Education Code § 17551).Schools also can charge various fees for adult education (Education Code §§ 52612, 52615, & 60410) andcommunity education courses (Education Code §§ 51810 & 51815).None of these exceptions appears to justify the fees alleged in Doe v. State, which include requiringstudents to purchase required text and workbooks for academic courses; charging lab fees for science classes;charging material fees as a condition for enrolling in fine art classes; and requiring students to purchase schoolissuedP.E. uniforms. Additionally, they do not justify charging fees or requiring students to purchase equipment toparticipate in extracurricular activities.2 As you review internal policies and practices with your legal counsel, you may find the enclosed advisoryproduced by the Fiscal Crisis and Management Assistance Team (FCMAT) and the list of other potential resourcesuseful starting points. My office is providing these materials for informational purposes only. The CaliforniaDepartment of Education is in the process of updating its Fiscal Management Advisory 97-02 (dated October 30,1997) regarding “Fees, Deposits, and Other Charges.”26

Letter Enclosure #127

http://www.fcmat.org/stories/storyReader$2261 (as of November 29, 2010)FCMATWhat fees, if any, can be charged to students?Question: The high school and the middle schools are currently charging the student fees listedbelow.$10 Science Lab Fees$40 Cooking class fees$20 Ceramics, Jewelry, Arts, and Wood shop fees$45 Choir class$25 Band classAP exam fees (unknown at this time)These lab fees provide funding for disposable, consumable materials used in each class.Students are allowed (and encouraged) to take home whatever they make/test/produce in theirclasses. Science teachers feel that the science lab fees should be treated as a shop fee so that labfees can be charged just like home economic, jewelry, and wood shop class in accordance withEd Code section 17551.But some teachers think the students should not take any bio-hazardous waste home because ofthe safety reason.In 1992, the board approved the science fees. It is not included in the board policy but anapproval was noted in board minutes. The teachers now understand the free school guaranteebecause I have shared the Fiscal Management Advisory 97-02 but they still feel that they have anapproval to charge certain fees from the board. I don't see any additional funding to offset thecurrent student lab fees but I also don't want any lawsuit from parents.Please advise.Response: The California Constitution provides for a free school system. Since 1874, theCalifornia Supreme Court has interpreted this to mean that this entitles students to be educated atthe public’s expense. Title 5, California Code of Regulations, section 350, specifically states:28

"A pupil enrolled in a school shall not be required to pay any fee, deposit, or othercharge not specifically authorized by law."The State Board of Education has reiterated that no fees are to be charged except wherespecifically authorized by law. This understanding is based on the authority in Article IX,Section 5 of the California Constitution. The Attorney General has also made it clear in many oftheir opinions that school districts cannot levy fees as a condition for participation in any class,whether elective or compulsory. Such unallowable fees include security deposits for locks,lockers, books, class apparatus, musical instruments, uniforms or other equipment. Clearly,students may not be charged fees for participation in either curricular or extracurricularactivities. And, whenever a particular curriculum or extra curricular program is adopted, allsupplies, both necessary and supplemental, must be provided free of charge by the district.The district cannot establish a two tier educational system by defining some minimumeducational standard as the requirement and then tell students that "there is also a second, higherstandard which you can strive for, if you pay for rent, or provide some specified additionalsupplies which the school does not provide."The Education Code specifically authorizes certain fees which are not forbidden by the Code ofRegulations Title 5 prohibition. The following fees can be levied as authorized in the followingEducation Code Sections:Transportation to and from school as it is a non-educational activity. EducationCode section 39807.5o Fees for transportation for extra curricular activities are not legalas it is an integral part of some of these activities. If participationin an extra curricular activity requires transportation and if theschool district provides it, it may not collect fees for it.o By law, school districts must exempt from transportation chargespupils of parents and guardians who are indigent as set forth inrules and regulations adopted by the board. Furthermore, nocharge shall be made for the transportation of disabled students.o The sum of state aid received for home to school transportationand the parent fees collected may not exceed actual operating costof home to school transportation for each fiscal year. EducationCode section 39809.5Transportation of pupils to places of summer employment. Education Codesection 39837Charges for food served to pupils. Education Code sections 38082 (formally39872), and 38084 (formally 39874)29

Sale of materials purchased from the incidental expense account to pupils inclasses for adults if provided in the governing board regulations. The proceeds ofall such sales shall be deposited in that account. Education code section 52615Class materials can be sold to persons enrolled in adult classes. This mayinclude materials necessary for making of articles by students enrolled in adulteducation. The materials shall be sold at no less than the cost to the district. Anyarticle made is then the property of the person who made it. Education codesections 52612, 52615 and 17552Charges can be imposed for textbooks used in adult classes or a refundabledeposit can be imposed on loaned books. Education code section 60410Insurance for field trips. School districts must provide, or make available,medical or hospital insurance for pupils participating on any excursion or fieldtrip, and the cost incurred by the school district "may be paid from the funds ofthe district, or by the insured pupil or his or her parent or guardian." EducationCode section 35331Lost or damaged books or other district supplies. If students fail to returnschool property loaned to the pupil, or willfully cut, deface or otherwise injureschool property, the parent or guardian is liable for all damages not to exceed$10,000. Education Code section 48904o When the minor and parent are unable to pay for the damages orto return the property, the school district or private school shallprovide a program of voluntary work for the minor in lieu ofpayment of monetary damages.Fees for adult school classes. Education Code section 52612.o No fees are allowed for English and citizenship for foreigners,classes in elementary subjects, and classes for which high schoolcredit is granted when taken by a person holding a high schooldiploma.o Adults may be charged a fee but high school students may not,even though they may be enrolled in the same class.o Adults may be charged for all or part of the costs oftransportation. Education Code section 39801.5.Tuition fees charged to pupils whose parents are actual and legal residents of anadjacent foreign country or an adjacent state. Education Code sections 48050,48051 and 4850230

Apprentices shall not be charged fees of any kind in any district providinginstruction under Section 3074 of the Labor Code. Education Code section48053.Materials can be sold to a student for property the student has fabricated fromsuch materials for their own use as long as the price does not exceed direct cost ofthe materials used and provided that the school district governing board hasauthorized such sales pursuant to an adopted board policy. This applies to classessuch as wood shop or sewing where an item is taken home by the students, but notwhen the items remain at school. It also does not apply to food in home economicclasses which is eaten as part of the course work. Education Code section 17551.o This section does not authorize a blanket general fee to covermultiple items nor does it mean an obligation to purchase the item.This section must be read together with the constitutional freeschool guarantee and the statutes requiring schools to providenecessary school supplies and instructional materials. Wheneverstudents fabricate products in a class such as wood shop or sewing,the wood or cloth for such products must be furnished free ofcharge. If the student decides to take a particular item home, thenthe law authorizes the district to sell that item to the student for thecost of the materials. If the student does not want to take an itemhome, then the district would keep the item and cannot charge orotherwise penalize the student.o The school district is recommended to have board adoptedpolicies and guidelines which specify the conditions forimplementing this section, keeping in mind the free schoolguarantee.Fees for an optional fingerprinting program for kindergarten or other newlyenrolled students can be assessed to the parent or guardian who chooses toparticipate. The fee cannot exceed the actual costs associated with the program.Education Code section 32390.Students may be charged fees for community classes in civic, vocational,literacy, health, homemaking, and technical and general education, not to exceedthe cost of maintaining the community classes. Governing boards may expendfrom the district’s general fund any money that is budgeted for communityservices to establish and maintain community service classes. Education Codesections 51810 and 51815o These community classes may be held at any time during theschool year as determined by the governing board. EducationCode section 5181231

o Community courses are not intended to teach required coursesthat K-12 students must complete as part of their instructionalprograms. They usually include classes in music, drama, art,handicraft, science, literature, nature studdy, nature contacting,aquatic sports, athletic and other such classes of general interest tothe community. These classes are primarily intended for adultsand are only open to minors who the governing board believeswould profit from such classes.o Community service classes cannot be used as K-12 summerschool, except for the incidental attendance of students with specialinterest in the subjects being taught.o Schools are lawfully authorized to charge fees for communityservice classes. But, in order to charge a fee for driver’s training,schools must design their driver training programs to becommunity service and not for the benefit of high school students.(This principal would apply to any type of community serviceclass.) Education Code sections 51815 and Driving SchoolAssociation vs. San Mateo School Districts. 11 Cal App 4th(1992), and California Association for Safety Education vs. Brown30 Cal. App 4th (1994)Fees for several statutory child care programs under certain conditions, whileprecluding charges to children’s families whose children are enrolled in the statepreschool program or for services to severely handicapped children. A similarbefore and after school child supervision program is authorized to charge fees toparticipants as long as "no needy child who desires to participate shall be deniedthe opportunity to participate because of inability to pay the fee". Education Codesections 8263(f), 8250(d), 8265, 8487, 8488(b)Actual cost of duplication of public records or student records. The CaliforniaPublic Records Act authorizes public agencies to charge direct costs ofduplication for its records. The direct cost of duplication standard also applies toreproductions of the prospectus of school curriculum. Education Code section49091.14o Direct costs of duplication phrase allows a local agency torecover only the actual cost of copying documents and does notinclude ancillary tasks associated with the retrieval, inspection andhandling of the file from which the copy is extracted. NorthCounty Parents Organization et al vs. Department of Education 23Cal App4th (1994)32

o School districts must specify the cost, if any, which will becharged to the parent for reproducing copies of records in aparental notice upon enrollment and in the annual notification ofparents of their rights required by the Education Code 48980.Education Code 49063(h)Charges for medical and accident insurance for athletic team members who canafford to pay. All members of the athletic team must have such insurance.Education Code section 32221.o Whenever the school board determines that a team member orparent or guardian are financially unable to pay the costs ofinsurance protection, then the governing board shall require thecosts of the protection to be paid either out of funds of the districtor the student body.Fees for field trips and excursions may be charged in connection with courses ofinstruction or school related social, educational, cultural, athletic, or school bandactivities. But, no pupil shall be prevented from making the field trip or excursionbecause of lack of sufficient funds. Education Code section 35330.o The governing board shall coordinate efforts of the communityservice groups to supply funds for pupils in need of them.o No student may be left behind due to insufficient funds, nor maya student be left behind for failing or refusing to participate infund-raisers.Fees for outdoor science camp programs. The fee cannot be mandatory - nopupil shall be denied the opportunity to participate in a school camp programbecause of nonpayment of the fee. Education code section 35335o No student may be left behind due to insufficient funds, nor maya student be left behind for failing or refusing to participate infund-raisers.California law provides "Writing and drawing paper, pens, inks, blackboards, blackboard erasers,crayons, lead pencils and other necessary supplies for the use of the schools shall be furnishedunder direction of the governing boards of the school districts"(Education Code section 38118).Based on this section, the Attorney General has concluded that materials and mechanicaldrawing sets for art classes, cloth for dressmaking classes, wood for carpentry classes, gym suitsand shoes for physical education classes, bluebooks necessary for examinations, and paper onwhich to write a theme or report when such a theme or report is a required assignment must befurnished by school district without charge as necessary supplies. Such supplies appear to besupplies that must be available to students in order to participate in regular classroom work in the33

particular subjects involved. The State Department of Education supports this view. The generalrule as stated by the Attorney General is that "supplies must be furnished free of cost to studentswhen the supplies are what might be termed school supplies and are necessary in order for thestudents to pursue a course of study". So rather than state what materials a school district is notobligated to furnish, the Attorney General limits the discussion to the question above.The Attorney General’s use of term school supplies does exclude those items or materials thatare essential regardless of whether or not the person is a student. For example, a district is notobligated to furnish corrective lenses and clothes as these items are needed whether or not theperson is a student.Also, since school districts are required to furnish necessary supplies, they are also responsiblefor regular upkeep and maintenance of those supplies. Attempts to impose an unconditionalobligation on pupils to maintain and repair school district equipment are too broad. However, astudent may be charged for damage of personal property loaned to a pupil where he or shewillfully cuts, defaces, or otherwise injures the property as a result of pupil misconduct. Thislaw allows the district to impose requirements for proper care and usage and consequent liabilityfor mishandling, but not liability where damage may result from normal wear and tear, or froman intervening cause or a third party.Districts can recommend, and even make available, strictly optional materials for the students’personal benefit. The law allows parents or other individuals as well as school districts todirectly purchase instructional materials from the state adopted lists (Education Code section60310). Also, teachers may make available a list of suppliers for tutorials, books, supplementaleducational materials, or sell inexpensive quality paperback literature for leisure reading.Teachers may encourage students to use appropriate study aids as long as these purchases arestrictly optional and in no way part of the regular instructional program. If such things are notpart of the adopted curriculum or part of an established extracurricular program, and there is nopenalty for failure to use or purchase these materials, such materials are not necessary supplies.The opposite arises, though, when such enrichment literature or materials are used assupplemental instructional material for a class or is an established part of an extracurricularactivity as it then becomes a necessary supply which must be provided or loaned free of charge.Its not whether or not a grade is assigned that is the crucial point. It is the participation thatcounts and whether or not the material used in the instructional or extracurricular activitybecomes a necessary school supply.Basically, the opinions of the Attorney General indicate that charges may not be levied for thefollowing:A deposit in the nature of a guarantee that the district would be reimbursed forloss to the district on account of breakage, damage to, or loss of school propertyAn admission charge to an exhibit, fair, theater or similar activity for instructionor extracurricular purposes when a visit to such places is part of the district’seducational program34

A tuition fee or charge as a condition to enrollment in any class or course ofinstruction, including a fee for attendance in a summer or vacation school, aregistration fee, a fee for a catalog of courses, a fee for an examination in asubject, a late registration or program change fee, a fee for the issuance of adiploma or certificate, or a charge for lodging.Membership fees in a student body or any student organization as a conditionfor enrollment or participation in athletic or other curricular or extracurricularactivities sponsored by the school (ASB cards may be sold to allow discounts orfree entrance to games and social events).Instructional materials must be furnished without charge to elementary and highschool students. Adults may be assessed a charge for books not to exceed theirtrue cost to the district. Education Code sections 60070 and 60410.Fees to enroll and/or participate in activities of career technical studentorganizations which are part of a career technical class or course or instructionoffered for credit. Education Code section 52375.Pupils shall not be charged for transportation associated with activities of careertechnical student organizations which are part of a career technical class or courseof instruction offered for credit when those activities are integral to assisting thepupil to achieve the career objectives of the class or course. Education Codesection 52373o The exception to this is when the transportation is between theregular full time day schools that they would attend and the regularfull time occupational training classes attended by them asprovided by a regional occupational center or program. EducationCode section 39807.5.On April 20, 1984, the Hartzell vs. Connell California Supreme Court decision raised seriousquestions about the imposition of non-statutory fees for extracurricular activities. The leadopinion on this matter is that fees may be charged for activities that are recreational, but not forthose that are educational. Since extracurricular activities are described in the opinion as anintegral component of public education, they are a part of the educational program, and thusmust be free. The court further stated that the "…imposition of fees as a precondition forparticipation in non-statutory educational programs offered by public high school districts on anon-credit basis violates the free school guarantee. The constitutional defect in such fees canneither be corrected by providing waivers to indigent students nor justified by pleading financialhardship." It is also the opinion of CDE and the Hartzell opinion that a school district may notcharge a fee or require students to purchase necessary materials even if the district maintains aspecial fund to assist students with financial need or waives such fee or charge for students withfinancial need as the fee or charge still remains a condition for all other students not beingassisted financially. A fee waiver policy for needy students does not make the fee allowable.35

For the subject of gym or physical education clothes, Education Code section 49066 states that"No grade of a pupil participating in a physical education class may be adversely affected due tothe fact that the pupil does not wear standardized physical education apparel where the failure towear such apparel arises from circumstances beyond the control of the pupil", such as lack ofsufficient funds. The California Department of Education has stated the position that a schooldistrict may require students to purchase their own gym clothes of a district specified design andcolor so long as the design and color are of a type sold for general wear outside of school. Oncethe required gym uniforms become specialized in terms of logos, school name or other similarcharacteristics not found on clothing for general use outside of school, they are consideredschool supplies and the district must provide the uniforms free of charge.In specific answer to your question, FCMAT is not able to provide legal advice, but since youare worried about the current charges, review the information we have provided above and seehow the current charges that are occurring line up with the above information. And, if you haveconcerns about what is truly legal or not legal after reviewing the above, you should check withyour legal counsel. Although staff is mentioning Education Code section 17551, this sectiondoes not allow for fees to be charged up front…basically this code section means that all studentscan make the items regardless of paying fees or material charges, but at the end of the year ifthey want to bring the items home the district can charge for the actual cost of materials inmaking the item. This code does not authorize the class fees up front as all students are entitledto make the same items, whether or not they have money to do so.Also, remember that board policy can be stricter than the law, but the law takes precedence overboard policy if they are in disagreement. Again, this is why you should get your legal counselinvolved.2/13/0736

Letter Enclosure #237

Informational Resources regarding Student Fees in California K-12 Public Schools1) The California Department of Education (CDE) Fiscal Management Advisory 97-02dated October 30, 1997 (which superseded Fiscal Management Advisory 87-03)currently being revised by CDE2) “Guidelines for Student Fees” document produced by the Tulare County Counsel, datedDecember 7, 2004(available at http://wwwstatic.kern.org/gems/fcmat/StudentfeesguidelinesTulareC.pdf asof November 19, 2010)3) San Diego Unified School District’s Guidelines and Resources re: Student Fees:(available at http://www.sandi.net/2182201151777237/ as of November 19, 2010)4) Hartzell v. Connell, 35 Cal.3d 899 (1984)5) California Attorney General Opinion No. 04-501, (September 14, 2004)(available at http://ag.ca.gov/opinions/pdfs/04-501.pdf as of November 19, 2010)6) California Constitution, Article IX, Section 57) California Code of Regulations, Title 5, Section 35038