additional information name of delegate - Euromoney Institutional ...

additional information name of delegate - Euromoney Institutional ...

additional information name of delegate - Euromoney Institutional ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

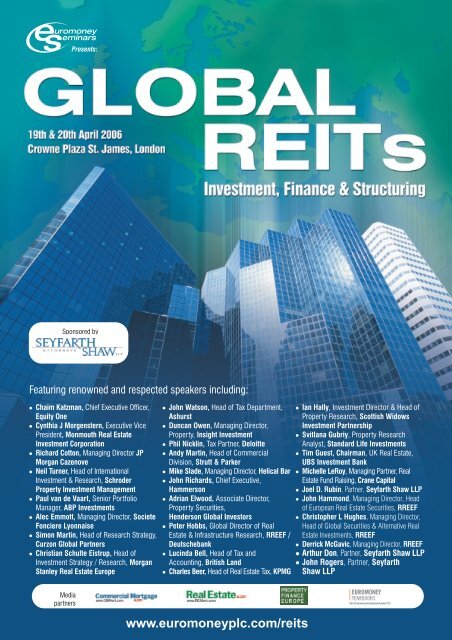

Presents:Sponsored byFeaturing renowned and respected speakers including:●●●●●●●●Chaim Katzman, Chief Executive Officer,Equity OneCynthia J Morgenstern, Executive VicePresident, Monmouth Real EstateInvestment CorporationRichard Cotton, Managing Director JPMorgan CazenoveNeil Turner, Head <strong>of</strong> InternationalInvestment & Research, SchroderProperty Investment ManagementPaul van de Vaart, Senior PortfolioManager, ABP InvestmentsAlec Emmott, Managing Director, SocieteFonciere LyonnaiseSimon Martin, Head <strong>of</strong> Research Strategy,Curzon Global PartnersChristian Schulte Eistrup, Head <strong>of</strong>Investment Strategy / Research, MorganStanley Real Estate Europe●●●●●●●●●●John Watson, Head <strong>of</strong> Tax Department,AshurstDuncan Owen, Managing Director,Property, Insight InvestmentPhil Nicklin, Tax Partner, DeloitteAndy Martin, Head <strong>of</strong> CommercialDivision, Strutt & ParkerMike Slade, Managing Director, Helical BarJohn Richards, Chief Executive,HammersonAdrian Elwood, Associate Director,Property Securities,Henderson Global InvestorsPeter Hobbs, Global Director <strong>of</strong> RealEstate & Infrastructure Research, RREEF /DeutschebankLucinda Bell, Head <strong>of</strong> Tax andAccounting, British LandCharles Beer, Head <strong>of</strong> Real Estate Tax, KPMG●●●●●●●Ian Hally, Investment Director & Head <strong>of</strong>Property Research, Scottish WidowsInvestment PartnershipSvitlana Gubriy, Property ResearchAnalyst, Standard Life InvestmentsTim Guest, Chairman, UK Real Estate,UBS Investment BankMichelle LeRoy, Managing Partner, RealEstate Fund Raising, Crane CapitalJoel D. Rubin, Partner, Seyfarth Shaw LLPJohn Hammond, Managing Director, Head<strong>of</strong> European Real Estate Securities, RREEFChristopher L Hughes, Managing Director,Head <strong>of</strong> Global Securities & Alternative RealEstate Investments, RREEF● Derrick McGavic, Managing Director, RREEF● Arthur Don, Partner, Seyfarth Shaw LLP● John Rogers, Partner, SeyfarthShaw LLPMediapartnerswww.euromoneyplc.com/reits

Dear Colleague,HOW WILL YOU CAPITALISE ON THE GROWTH OF THE GLOBAL REIT MARKET?As you are aware, the anticipated arrival <strong>of</strong> the long awaited UK REIT legislation is welcome news for the global real estateinvestment industry. But much uncertainty remains. The success or failure <strong>of</strong> existing global REITs is not just based on the specificREIT model, but also on the market conditions where the REIT exists. Debate is currently raging on a host <strong>of</strong> issues such as:• How successful will a UK REIT market be in view <strong>of</strong> prescriptive legislation?• Whether the performances <strong>of</strong> global REITs can be compared without comparable tax treaties?• What model is likely to become the industry’s vehicle <strong>of</strong> choice post UK REIT?• Which country will set the REIT industry standard?<strong>Euromoney</strong> Seminars’ inaugural GLOBAL REITs Conference will bring together some <strong>of</strong> the industry’s most active andprolific REIT pr<strong>of</strong>essionals to discuss the answers to the above and much more. Key areas for discussion include:• The pros and cons <strong>of</strong> investing in REITs• REIT financing and REIT structuring• How the UK market can learn from US experiences• How to attract retail investors• Global single and multi-sector REIT performance comparisonsWe have assembled an unrivalled expert line up <strong>of</strong> US REITs, institutional investors, real estate asset managers and propertycompanies to take the audience through this exciting two-day event. Organisations represented include Monmouth RealEstate Investment Corporation, ABP Investments, EPRA, UBS Investment Bank -Real Estate, Standard Life Investments, Société Foncière Lyonnaise, Equity One,JP Morgan Cazenove, Helical Bar, Hammerson, British Land, and many more2006 will be a most significant year for global real estate finance and investment. Don’t miss out on your place in this everevolving market.I look forward to welcoming you to London in April.Yours faithfully,Sarah Gooding, Conference Director - Global REITs +44 20 7779 8673FORTHCOMING EVENTS2nd Annual<strong>Euromoney</strong> PropInvest ASIA PACIFICSeptember 2006, Hong KongThe conference will provide a unique insight into the opportunities provided by theregion’s real estate investment markets. Over 40 <strong>of</strong> global real estate’s most respectedpractitioners will once again come together to share their invaluable practical experiencesand provide you with the <strong>information</strong> and network <strong>of</strong> contacts you need to enable you tobe part <strong>of</strong>, and succeed in, the Asia Pacific real estate boom.6th Annual EuropeanHotel Finance and Investment SummitSeptember 2006, LondonNow in its sixth year this well established summit will provide the ideal opportunity forsenior level executives from hotels, banking, investment and all those involved in theindustry to come together, network and learn about the latest issues and trends currentlyoccurring in the market.For <strong>information</strong> on either <strong>of</strong> these events, please contact +44 20 7779 8673 or email <strong>information</strong>@euromoneyplc.com

CONFERENCE AGENDAGlobal REITsDAYONE19th April 2006 LondonRegistration & C<strong>of</strong>feeChairman’s WelcomeThe Global REIT Market: Overview & Market Forecast• What Makes REITs Attractive To The Investor?• How Does REIT Performance Compare On A Global Scale?• Do REITs Behave Like Property Or Equities?• How Do REIT Returns Compare With Those Of Other Real Estate Securites?• Who Are The Investors In REITs And Why Do They Choose REITs?• Who Benefits Most From REITs?• The Pros & Cons Of Investing In REITs Compared With DirectInvestments & Other Indirect Real Estate Vehicles• The Future Global REIT Market:- Is The Strong Past Performance Of REITs Likely To Continue?- Are Strong Capital Flows Into REITs Likely To Be Sustained?Simon Martin, Head <strong>of</strong> Research Strategy, Curzon Global PartnersPANEL DISCUSSION: What Can The UK Market LearnFrom The US Experience?• Why Have REITs Been So Popular In The US?• How Have REITs Transformed The US Property Market?• What Is The Potential For Continued REIT Growth In The US?• What Are US REITs Investing In? Assessing The World Beyond DirectReal Estate• Which US REITs Have Broken The Mould & What Can European REITsLearn From Them?Michelle LeRoy, Managing Partner, Real Estate Fund Raising,Crane CapitalChaim Katzman, Chief Executive Officer, Equity OneCynthia J. Morgenstern, Executive Vice PresidentMonmouth Real Estate Investment CorporationMorning C<strong>of</strong>feeEXTENDED SESSION: A Global Platform For Investing InReal Estate: RREEF/DB Real Estate: A Case Study• Examining And Comparing Investing In Public Funds, Hard Assets,Equity Vs. Mezzanine Debt In Mature And Emerging Markets• Impact Of New And Proposed REIT Legislation On Global InvestingModerated by: Joel D. Rubin, Partner, Seyfarth Shaw LLPJohn Hammond, Managing Director, Head <strong>of</strong> European Real EstateSecurities, RREEFChristopher L Hughes, Managing Director, Head <strong>of</strong> Global Securities& Alternative Real Estate Investments, RREEFDerrick McGavic, Managing Director, RREEFArthur Don, Partner, Seyfarth Shaw LLPJohn Rogers, Partner, Seyfarth Shaw LLPThe Relative Merits Of REITs VS Other Tax EfficientVehicles• Comparing UK REITs With Other Existing Tax Efficient Vehicles• What Are The Tax Benefits Of Offshore Unit Trusts?• Why Use An Offshore Trust?• What Are The Drawbacks?• The Future For Offshore Trusts In Light Of The New UK REITJohn Watson, Head <strong>of</strong> Tax Department, AshurstLunchPANEL DISCUSSION:Which Model Will Become The Industry’s Vehicle OfChoice Post UK REIT Introduction?• Assessing The Current Range Of Vehicles Competing With The New REIT• Authorised Unit Trusts: How Will They Compete Without A Change InTheir Tax Treatment And Is A Change Likely?• Will We Get An Unlisted REIT?Duncan Owen, Managing Director, Property, Insight InvestmentPhil Nicklin, Tax Partner, DeloitteAndy Martin, Head <strong>of</strong> Commercial Division, Strutt & ParkerPANEL DISCUSSION: Investor Focus: Why Invest In A REIT?• How Do REITs Increase The Overall Performance Of An <strong>Institutional</strong>Portfolio?• Does The Wall Of Capital Heading For Real Estate Combined With TheLack Of Underlying Product Mean There’s Trouble Ahead?• How Should UK REITs Now Feature In Your Real Estate Portfolio?• Why Would A Pension Fund Invest In Any Other Type <strong>of</strong> Unlisted Vehicle?Svitlana Gubriy, Property Research Analyst,Standard Life InvestmentsPaul van de Vaart, Senior Portfolio Manager, ABP InvestmentsNeil Turner, Head <strong>of</strong> International Investment & Research,Schroders Property Investment ManagementAfternoon TeaEXTENDED PANEL DISCUSSION:UK REITs: What’s In Store For The UK Property Industry?• What Do REITs Offer The UK Property Industry?• Who Will Convert To REIT Status?• What Will REITs Invest In?• What Property Might Come To Market?• Can We Expect An Increase In Mergers And Acquisitions?• Which Sectors Are Most Likely To Be Affected?• How Will Private Property Funds And Fund Of Funds Managers Fare InA New UK REIT Market?• Property Companies: Where Do The Threats And Opportunities Lie?• What Might Be The Cost To Other Indirect Funds?• How Will Values Be Affected?Mike Slade, Managing Director, Helical BarJohn Richards, Chief Executive, HammersonAdrian Elwood, Associate Director, Property SecuritiesHenderson Global InvestorsPeter Hobbs, Global Director <strong>of</strong> Real Estate & Infrastructure ResearchRREEF / DeutschebankClose <strong>of</strong> Day One

CONFERENCE AGENDAGlobal REITsDAYTWO20th April 2006Registration & C<strong>of</strong>feeChairman’s WelcomeWhat Should The Considerations Be On DecidingWhether To Convert To REIT Status?• Why Convert?• Why Not Convert?• Who Might Convert First?• How Should Offshore Trusts React?• Likely Future Industry Trends Impacting REIT Companies• How Big Is The Market Likely To Become?• Premium Or Discount To NAV In The UK: What’s Likely And WhyDoes It Matter?Charles Beer, Head <strong>of</strong> Real Estate Tax, KPMGPANEL DISCUSSION:From Property Company To Listed REIT• Managing The Transistion To REIT Status On A Practical Basis• What To Expect• How To Avoid The Pitfalls• How To Cope With The Influence Of The Stock Market• Managing Shareholder Expectations• Innovative Structuring: Who’s Going To Do It And What Will TheStructures Look Like?• What Level Of M&A Activity Is Likely?• How Might The Conversion Charge Be Financed In View Of APrescriptive Maximum Level Of Gearing?Lucinda Bell, Head <strong>of</strong> Tax and Accounting, British LandRosalind Rowe, Director, Real Estate Tax GroupPricewaterhouseCoopersTim Guest, Chairman, UK Real Estate,UBS Investment BankRichard Cotton, Managing Director,JP Morgan CazenoveHow Can The Performances Of Global REITs BeCompared Without A Level Playing Field?• Without Comparable Tax Treaties, How Can European Régimes BeCompetitive As Investment Locations?• Is There An Argument For A Europe-Wide REIT? Should It Be Listed?• Differences Between REIT Models: Was The Success Of The FrenchREIT Due To The Lack Of Restrictions In The Legislation?• Does The Prescriptive Nature Of UK REIT Bode Well For A New UKREIT Industry?• Should A REIT Set A Minimum Level Of Free Float Or A MaximumShareholding Level?• Will The UK See The Free Float That Hasn't Developed Yet In TheFrench Market?Alec Emmott, Managing Director, Societe Fonciere LyonnaiseMorning C<strong>of</strong>feeAdvances Towards A EuroREIT• Why A EuroREIT?• Likely Timescale And Format• Who Is Likely To Invest?• Who Will Convert?REITs & The Retail Investor• How Will REITs Open Up The Commercial Real Estate Markets ToRetail Investors?• How Does A Property Company Manage Shareholder Expectations?• Attracting The Retail Investor• Assessing Optimum Distribution ChannelsIan Hally, Investment Director & Head <strong>of</strong> Property Research,Scottish Widows Investment PartnershipLunchGerman REITs• Realistic Timescale?• Will The UK Situation Now Advance Proceedings?• Will German REITs Attract Overseas Investment And How Will ThisImpact The Real Estate Market In Germany & Beyond?• How Will The Government Claw Back The Lost Revenue?• What’s The Likely Structure Of A German REIT?Christian Schulte EistrupHead <strong>of</strong> Investment Strategy / ResearchMorgan Stanley Real Estate EuropeSingle Sector Or Diversified REITs: The Pros & Cons OfEither For The REIT Company And The Investor• How Can Investors Achive Diversification With Single Sector REITs?• Global Single & Multi Sector REIT Performance ComparisonsChairman’s Closing RemarksClose Of ConferenceSILVER COMPANY PASS £6,000 + VATincludes 4 <strong>delegate</strong> passes and branding as silver sponsor at eventGOLD COMPANY PASS £8,000 + VATincludes 4 <strong>delegate</strong> passes, branding as gold sponsor at event and exhibition standPlease tick the box on the booking form to reserve a COMPANY PASS option

Presents:Conference Code: EBM097GLOBAL REITS19th & 20th April 2006, LondonFive Easy Ways to RegisterBy Telephone +44 (0)20 7779 8673By Fax:By E-Mail:By Post:By Website:Complete and send this registration form to:+44 (0)20 7779 8673<strong>information</strong>@euromoneyplc.comComplete and return the registration formtogether with payment to Alberto Anido,<strong>Euromoney</strong> Seminars, Nestor House,Playhouse Yard, London, EC4V 5EXwww.euromoneyplc.com/reitsMr/Mrs/MsJob titleCompanyDepartmentTelephoneFaxEmailNAME OF DELEGATEPostal AddressREGISTRATION DETAILSIn order for us to process your registration, please supply the following details:Head <strong>of</strong> Department Mr/Mrs/MsJob titleCompanyDepartmentTelephoneEmailFax■ Yes! I would like to receive <strong>information</strong> about futureevents and services via e-mail:ADDITIONAL INFORMATIONNature <strong>of</strong> BusinessBOOK BEFORE 24TH FEBRUARY 2006 TO SAVE £200Received before 24th February 2006 Received after 24th February 2006SaveYes! I want to register on:DateFeeTotal with UK VAT@17.5%FeeTotal with UK VAT@17.5%■ 2 Day Conference19th - 20thApril 2006£999 £1,173.83 £200 £1,199 £1,408.83■ SILVER COMPANY PASS £6,000 + VAT■ GOLD COMPANY PASS £8,000 + VATCancellation Policy: Should you be unable to attend a<strong>name</strong>d substitute may attend in your place at no extracharge. Otherwise a full refund less 20% handling chargewill be returned for all cancellations received in writing byMarch 18th 2006. After this date, there will be no refundson paid invoices. Any invoices still outstanding must bepaid in full. The <strong>Euromoney</strong> <strong>Institutional</strong> Investor PLCVAT registration number in the UK is GB243315784.Data Protection: The <strong>information</strong> you provide will besafeguarded by the <strong>Euromoney</strong> <strong>Institutional</strong> Investor PLCgroup, whose subsidiaries may use it to keep you informed<strong>of</strong> relevant products and services. We occasionally allowreputable companies outside the <strong>Euromoney</strong> II group tomail details <strong>of</strong> products that may be <strong>of</strong> interest to you. Asan international group, we may transfer your data on aglobal basis for the purposes indicated above. If you objectto contact by telephone ■, fax ■ or email ■ please tickthe box beside. If you do not want us to share your<strong>information</strong> with other outside reputable companies, pleasetick the box ■Payment Details:Please use this form as our request for payment. Fax and phone bookings should be made with a creditcard number, or followed up by a posted registration form. Places are only guaranteed by full payment,which must be received before the conference.I will pay by:■ Cheque/bankers draft made payable <strong>Euromoney</strong> <strong>Institutional</strong> Investor PLC■ Invoice to be sent to my company■ Bank transfer to Lloyds Bank, International Banking Division, PO Box 90, 24 Cornhill, London EC3P 3HASort Code: 30-12-18 Euro Account: 599008833Please debit my MASTERCARD ■ VISA ■ EUROCARD ■ AMERICAN EXPRESS ■ DINERS CLUB ■Card Number ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■Expiry Date ..........................................................................with the sum <strong>of</strong> ...................................................Cardholder s signature ......................................................................................................................................Cardholder s <strong>name</strong> ............................................................................................................................................Billing address if different from above: ......................................................................................................................................................................................................................................................................................