Choice Forestry PDS 2012 - WA Blue Gum Project

Choice Forestry PDS 2012 - WA Blue Gum Project

Choice Forestry PDS 2012 - WA Blue Gum Project

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Dear Prospective GrowerI invite you to participate in the <strong>Choice</strong> <strong>Forestry</strong> <strong>Project</strong><strong>2012</strong>.The <strong>Project</strong> will be developed on land in the south-westof Western Australia, which the <strong>Project</strong>’s Independent<strong>Forestry</strong> Expert, Mr Don Spriggins, considers is verysuitable for the Establishment of <strong>Blue</strong> <strong>Gum</strong> plantations.The Responsible Entity has been successful inprocuring an agreement with the very experienced andreputable company W.A. Chip & Pulp Co. Pty Ltd toHarvest and purchase the wood produced by the<strong>Project</strong>. W.A. Chip & Pulp Co. is owned by twoextremely large Japanese companies, MarubeniCorporation and Nippon Paper Industries Co. TheMarubeni Corporation Group owns and manages treeplantations in Western Australia on a large scale and,in the opinion of the <strong>Project</strong> Manager, is an industryleader in plantation establishment and management,log Harvesting and woodchipping. The Marubeni Groupis one of the large Japanese Trading Houses. NipponPaper is among the largest paper manufacturers inJapan, which itself is the second or third largest papermaking country in the world.Every business, including agriculture, involves adegree of risk. The major risks identified by theDirectors have been set out in this Combined ProductDisclosure Statement and Financial Services Guide(“<strong>PDS</strong>”). While the Directors have taken steps toreduce these risks or minimise the adverse impact ofsuch risks in the structuring of the <strong>Project</strong>, by the termsof the contracts to be entered into and by utilising andconsulting leaders in the forestry sector, this <strong>Project</strong>should be considered long term and speculative.This <strong>PDS</strong> is divided into three parts. Part A of this <strong>PDS</strong>is a summary of the key features, rights and obligationsof subscribing to the <strong>Project</strong>. Having regard to thecomplexity of the choice to invest and volume ofrelevant information, Part A attempts to provide a clear,concise and effective disclosure of the main features,rights and obligations. However, current marketexpectations of prospective Subscribers requiresignificant detailed information to be provided to enablepeople to assess their participation in such products.Part B represents this extensive detailed information.Part C of this <strong>PDS</strong> is a Financial Services Guide whichthe Responsible Entity is required to provide toprospective Subscribers. All parts should be read intheir entirety.Please give the <strong>Project</strong> your most carefulconsideration.Yours sincerelyA. H. MayChairmanW.A. <strong>Blue</strong> <strong>Gum</strong> LimitedThe Responsible Entity has paid careful regard toASIC’s Regulatory Guides and to the stated objectivesof the current product disclosure regime.

SectionPage1. DIRECTORY 42. DICTIONARY 5PART A: PRODUCT DISCLOSURE STATEMENT 7PART B: DETAILED INFORMATION 133. WHY BLUE GUM? 143.1 International Markets 143.2 Government Support 153.3 Environmentally Beneficial 153.4 Good Returns 153.5 Growing Demand 163.6 Attributes of the Species 163.7 Diversification of Asset Classes 163.8 Employment Opportunities 164. PROJECT STRUCTURE 175. FEATURES OF THE OFFERING 185.1 Quality of the Land 185.2 Reports 185.3 Experienced and Cutting Edge Operations 185.4 Insurance 185.5 Involvement of Marubeni Corporationand Nippon Paper Industries Co 195.6 Compliance Plan 195.7 Compliance Committee 195.8 Improved Seedlings 195.9 Forward Sale of all the Wood 195.10 Audit of the Compliance Plan 205.11 Experienced <strong>Forestry</strong> Consultant 205.12 The Responsible Entity 20

5.13 Carbon and Environmental Credits and Debits 215.14 Conflicts of Interest 215.15 Uncomplicated Finance 225.16 Complaints by Growers 225.17 Anti-Money Laundering and Counter-TerrorismFinancing Amendment Act 2007 226. INDEPENDENT FORESTRY EXPERT'S REPORT 237. FEES AND OTHER COSTS 288. DIRECTORS OF THE PROJECT MANAGER 339. ADDITIONAL INFORMATION 349.1 Material Contracts 349.2 Inspection of Documents 349.3 Consents of Experts and Disclaimers 349.4 Interests of Directors and Experts 349.5 Interests of the Custodian 359.6 Interests of the <strong>Project</strong> Manager 3510. DETAILS OF PRINCIPAL AGREEMENTS 3610.1 Summary of Constitution 3610.2 Summary of Scheme Property Custody Agreement 3910.3 Summary of the <strong>Project</strong> Management Contract 3910.4 Summary of Sub-lease 4010.5 Summary of Plantation Services Agreement 4210.6 Summary of Wood Purchase Agreement 4210.7 Summary of Joint Venture Agreement (if applicable) 4311. HOW TO PARTICIPATE 4412. APPLICATION FORM 4513. POWER OF ATTORNEY 4914. (IF APPLICABLE) POWER OF ATTORNEY FOR GUARANTEE ANDINDEMNITY WHERE THE APPLICANT IS A COMPANY 5115. APPLICATION FOR FINANCE 53PART C: CHOICE FORESTRY PROJECT <strong>2012</strong> FINANCIAL SERVICES GUIDE 56

Responsible Entity and <strong>Project</strong> ManagerW.A. <strong>Blue</strong> <strong>Gum</strong> LimitedACN 060 179 982Level 21, 385 Bourke StreetMelbourne Victoria 3000CustodianSandhurst Trustees LimitedACN 004 030 737Level 5, 120 Harbour EsplanadeDocklands Victoria 3008Directors of the <strong>Project</strong> ManagerAnthony Henry MayLeon GorrSteven John Smith<strong>Forestry</strong> Contractor<strong>WA</strong>CAP Treefarms Pty Ltd*ACN 009 378 607Level 253 Victoria StBunbury <strong>WA</strong> 6231Independent <strong>Forestry</strong> ExpertDon Spriggins, Dip. For., B. Sc. For.,F.I.F.A., MACFA. RPF11 Wattle StreetBunbury <strong>WA</strong> 6230Solicitors to the <strong>Project</strong> ManagerHerbert GeerLevel 20, 385 Bourke StreetMelbourne Victoria 3000Wood PurchaserW.A. Chip & Pulp Co. Pty Ltd*ACN 008 720 518Level 253 Victoria StBunbury <strong>WA</strong> 6231* Both these companies are ultimately owned byMarubeni Corporation and Nippon Paper Industries Co

In this Product Disclosure Statement, unless the contrary intention appears, the following words have the followingmeanings:Agreement to Sub-leaseApplicantApplication FormApplication FundApplication MoneyASICCompliance PlanConstitutionCorporations ActCustodianDirectorsmeans (when applicable) the agreement to sub-lease between W.A. <strong>Blue</strong><strong>Gum</strong> Limited and the Grower, or in the case of Joint Venture Growers, thesecond Joint Venture Grower, pursuant to which that Grower agrees to takea sub-lease of property on which to Establish Plantations, details of whichare set out in Section 10.4means a person who has duly completed and submitted an Application tothe Responsible Entity Application means a duly completed ApplicationForm pursuant to which an Applicant applies for an Interest in the <strong>Project</strong>means the application form attached to and accompanying this <strong>PDS</strong>means the bank account opened by the <strong>Project</strong> Manager for the purpose ofreceiving all Application Moneysmeans the amount which every Applicant is required to pay for an Interest inthe <strong>Project</strong> (i.e. $10,000 (including GST) per hectare, the minimum amountbeing $20,000 (including GST) being the amount required to Establish 2hectares of plantations and partially pre-pay rent )means the Australian Securities and Investments Commissionmeans the Compliance Plan of the <strong>Project</strong>means the Constitution (as defined in Section 9 of the Corporations Act) ofthe <strong>Project</strong>means the Corporations Act 2001 (Cth)means Sandhurst Trustees Limited ACN 004 030 737 or such othercustodian of the <strong>Project</strong> as may be appointed from time to timemeans the directors of W.A. <strong>Blue</strong> <strong>Gum</strong> Limited ACN 060 179 982, being theResponsible Entity and <strong>Project</strong> ManagerDivision 394 means Division 394 of the ITAA 1997EstablishmentEstablishment Period<strong>Forestry</strong> ContractorGrowerHarvestIndexedInterestITAA 1936ITAA 1997means all silvicultural activities until and including the first planting of thePlantation and the application of fertilisers and herbicides at the time of thefirst planting of the Plantationmeans the period described in Division 394 of the ITAA 1997 ending no laterthan 18 months after the end of the year of income in which the ApplicationMoney is paidmeans <strong>WA</strong>CAP Treefarmsmeans a person who holds an Interest in the <strong>Project</strong> (and in the case ofJoint Venture Growers, both of them) and whose name has been enteredinto the register of Growersmeans the cutting down, felling or logging of trees and the extraction orremoval of the trees so cut down, felled or logged to a loading point,whether conducted as one operation or more than one operation andHarvested and Harvesting have a similar meaningmeans adjusted by the percentage increase (if any) in the Consumer PriceIndex (All Groups, Perth) during the preceding 12 months or during suchother period as may be specifiedmeans the combined interest of a Grower in a Plantation and in thatGrower’s <strong>Project</strong> Agreementsmeans the Income Tax Assessment Act 1936 (Cth)means the Income Tax Assessment Act 1997 (Cth)

Joint Venture AgreementJoint Venture GrowersLoan AgreementMAI<strong>PDS</strong>Plantation Development and Tending PlanPlantationsProceeds Fundmeans the agreement between Joint Venture Growers, details of which areset out in Section 10.7means two Applicants who are participating in the <strong>Project</strong> as Joint VentureGrowers in accordance with a Joint Venture Agreementmeans an agreement between a Grower and Albany Financial Pty Ltd up to80% of the Application Moneymeans Mean Annual Increment being a measure of the rate of growth oftreesmeans this document, other than Part Cmeans the plan for the tending of each Plantation which is to be annexed tothe Plantation Services Agreementmeans the plantations of Tasmanian <strong>Blue</strong> <strong>Gum</strong> tree to be Established onthe <strong>Project</strong> Land to be leased by the Growersmeans the bank account opened by the Responsible Entity for the purposeof receiving all sale proceeds from the sale of the timber<strong>Project</strong> means the <strong>Choice</strong> <strong>Forestry</strong> <strong>Project</strong> <strong>2012</strong> (ARSN 158 182 293)<strong>Project</strong> Agreements<strong>Project</strong> Harvest Date<strong>Project</strong> Land<strong>Project</strong> Management Contract<strong>Project</strong> Manager<strong>Project</strong> PropertyPurchaser (or Wood Purchaser)Responsible EntitySub-leaseSubscriberUncontrolled Eventsmeans the Sub-lease, <strong>Project</strong> Management Contract and Wood PurchaseAgreement and if relevant to a particular Grower, an Agreement to Subleasemeans the date on which the Harvesting of all the trees in the <strong>Project</strong> iscompleted for the first timemeans the land in the south-west of Western Australia between Bunburyand Albany on which the <strong>Project</strong> will be situatedmeans the contract to be entered into by each Grower and the <strong>Project</strong>Manager in relation to the Establishment and tending of the Plantations,details of which are set out in Section 10.3means W.A. <strong>Blue</strong> <strong>Gum</strong> Limited ACN 060 179 982 in its capacity as managerof the <strong>Project</strong>means the scheme property of the <strong>Project</strong> as defined in Section 9 of theCorporations Actmeans W.A. Chip & Pulp Co.means W.A. <strong>Blue</strong> <strong>Gum</strong> Limited ACN 060 179 982 which is named in ASIC’srecord of scheme registration as the responsible entitymeans the sub-lease between W.A. <strong>Blue</strong> <strong>Gum</strong> Limited and each Growerpursuant to which each Grower sub-leases property on which to EstablishPlantations, details of which are set out in Section 10.4means an Applicant who has made payment of the Application Moneymeans an act of God, strike, lock out or other interference with work, wardeclared or undeclared, blockage, disturbance, lightning, fire, drought,earthquake, storm, flood, explosion, government or quasi-governmentrestraint, exploration, prohibition, intervention, direction, or embargo,unavailability or delay in availability of equipment or transport, inability ordelay in obtaining governmental or quasi-governmental approvals,consents, permits, licences, authorities or allocations, or any other causewhether of the kind specifically set out above or otherwise which is notreasonably within the control of the party relying on the Uncontrolled EventW.A. Chip & Pulp Co. means W.A. Chip & Pulp Co. Pty Ltd ACN 008 720 518<strong>WA</strong>CAP Treefarms means <strong>WA</strong>CAP Treefarms ACN 009 378 607<strong>WA</strong>PRES means <strong>WA</strong> Plantation Resources Pty Ltd ACN 094 151 792Wood Purchase Agreementmeans the agreement for the sale of the timber from the Plantations detailsof which are set out in Section 10.6

OverviewProspective Growers are invited to sublease 2 or moreidentifiable allotments of land (1 hectare each), for anestimated 10 year term as part of a commercialTasmanian <strong>Blue</strong> <strong>Gum</strong> (eucalyptus globulus) plantation.Each hectare is likely to contain between 900 and 1,000trees, with an average of about 950.Pulpwood IndustryThe continued reliance on paper and paper products bydeveloped countries and the increased consumption ofthese products by developing countries is leading to anincrease in demand for the raw materials required forpaper production. Hardwood fibre, extracted from <strong>Blue</strong><strong>Gum</strong> is the preferred raw material for the production ofhigh quality paper. In fact, most paper mills require thatsome, if not all, of their timber input be hardwood fibre.The OfferingThe <strong>Project</strong> will consist of about 250 hectares, or more,subject to land of the required quality being available.• Application Money* per hectare: $10,000 (includingGST)Minimum of 2 - $20,000 (including GST)• Ongoing fees per hectare - rent, management andadministration costs: $445.50 (including GST)Minimum of 2 - $891 (including GST) (Indexed)per annum• Other fees:Harvest, transport costs: to be deducted fromHarvest proceedsHarvest supervision fees: 3.3% (including GST) ofnet Harvest proceedsIncentive bonus: 15% of excess return above$18,000 (including GST) (Indexed) per hectareInsurance: approximately 0.7% of insured value(including GST)Credit (or similar) card merchants fee for Growerswho make payments under the <strong>Project</strong> using acredit or similar card (presently 1.25% of theamount paid)Finance available• <strong>Project</strong> term: approximately 10 years• Offer closes: 30 June <strong>2012</strong>* The Application Money consists of the amount necessaryto Establish a plantation and partially prepay the rent,please see Section 7 of this <strong>PDS</strong> for a full explanation ofall fees and charges.BenefitsFull ‘Offtake’ agreement with a ‘Higher Price’ optionThe Harvested timber will be sold to W.A. Chip & Pulp Co.(jointly owned by the Marubeni Corporation and theNippon Paper Industries Co) unless the <strong>Project</strong> Managercan negotiate with any other potential buyers for a higherprice. W.A. Chip & Pulp Co. then has the option of meetingthat higher price.All Operations by Industry ExpertsThe <strong>Project</strong> Manager has contracted noted industryexperts to assist with the operation of the <strong>Project</strong> including<strong>WA</strong>CAP Treefarms as <strong>Forestry</strong> Contractor (jointly ownedby the Marubeni Corporation and the Nippon PaperIndustries Co) and a forestry consultant with extensiveexperience in Western Australia, particularly withTasmanian <strong>Blue</strong> <strong>Gum</strong>.Promoting Ecologically Sound Plantation <strong>Forestry</strong>The establishment of hardwood plantations in Australiareduces the Harvesting pressure on native foreststhroughout the world, particularly on the tropical forests ofAsia and the South Pacific. Additionally, plantations createa sink for greenhouse gasses and help relieve salinity andsoil erosion.Tax EffectivenessA Grower should, upon payment, be entitled to animmediate tax deduction, pursuant to Division 394 of theITAA 1997, being 100% of the total Application Moneypayable. In addition, all the annual or other fees shouldalso be deductible in the respective years of payment.Product rulings to that effect have been applied for to theAustralian Tax Office.Growers should seek independent advice in relation to alltaxation issues.Ongoing Government supportSuccessive Federal Governments have renewed theirbacking of the “2020 Vision” of trebling plantation forestareas in Australia in the period from the mid-1990’s to2020 to 3 million hectares, and the Division 394 taxlegislation was introduced for the explicit purpose ofencouraging more tree plantations.

Date of <strong>PDS</strong>: This <strong>PDS</strong> is dated 15 May <strong>2012</strong>Issued By:W.A. BLUE GUM LIMITEDACN 060 179 982AFS Licence Number: 246264Level 21385 Bourke StreetMelbourne Vic 3000AustraliaTelephone: 1300 888 511Facsimile: (03) 9642 4435Email: info@wabluegum.com.auWebsite: www.wabluegum.com.au<strong>Project</strong> Name: CHOICE FORESTRY PROJECT <strong>2012</strong>ARSN 158 182 293The <strong>Project</strong>:The <strong>Project</strong> involves the Establishment and tending ofTasmanian <strong>Blue</strong> <strong>Gum</strong> (Eucalyptus globulus) plantations forthe Harvesting and sale of timber. The <strong>Project</strong> is amanaged investment scheme registered under theCorporations Act. W.A. <strong>Blue</strong> <strong>Gum</strong> Limited is theResponsible Entity and the <strong>Project</strong> Manager. The <strong>Project</strong>Manager has been involved in forestry operations for over10 years and currently manages thousands of hectares ofeucalypt plantations in Western Australia on behalf ofsubscribers to previous offer documents.Pursuant to the <strong>Project</strong> Agreements the <strong>Project</strong> Managerwill arrange the Establishment, tending, felling andHarvesting of <strong>Blue</strong> <strong>Gum</strong> plantations to be known as the“<strong>Choice</strong> <strong>Forestry</strong> <strong>Project</strong> <strong>2012</strong>”.The duties of the <strong>Project</strong> Manager include the following:• Establishing the Plantations within theEstablishment Period for the purposes of felling andHarvesting; and• tending the Plantations until felling and Harvestingtake place.The <strong>Project</strong> is to be established on land in the south-westof Western Australia between Bunbury and Albany. The<strong>Project</strong> Manager seeks to raise approximately $2,500,000based on the present land availability outlook. The <strong>Project</strong>Manager may accept oversubscriptions, the amount ofwhich will be subject to the availability of land of thedesired quality. Each Grower will sub-lease a specific andidentifiable area of the <strong>Project</strong> Land from the <strong>Project</strong>Manager pursuant to a Sub-lease.The <strong>Project</strong> Manager leases the <strong>Project</strong> Land from variousfarmers or alternatively, sub-leases from W.A. Chip & PulpCo. or <strong>WA</strong>CAP Treefarms. In all instances, the head leasebetween the <strong>Project</strong> Manager and the farmer, oralternatively, the sublease between the <strong>Project</strong> Managerand W.A. Chip & Pulp Co. or <strong>WA</strong>CAP Treefarms is to beregistered with the Office of Titles, Perth therebyprotecting the <strong>Project</strong> Manager’s and ultimately theGrower’s interest in the <strong>Project</strong> Land.Each Grower will enter into <strong>Project</strong> Agreements with the<strong>Project</strong> Manager. The <strong>Project</strong> Agreements consist of aSub-lease (and/or an Agreement to Sub-lease), a <strong>Project</strong>Management Contract and a Wood Purchase Agreement.Where not all the <strong>Project</strong> Land is available for a particularGrower on or before 30 June <strong>2012</strong>, the <strong>Project</strong> Managermay still accept the Grower’s Application subject to a Subleasebeing entered into on behalf of the Grower andlodged for registration by 30 September 2013.In these circumstances, the Grower will be required toenter into an Agreement to Sub-lease with the <strong>Project</strong>Manager.It is anticipated that the <strong>Blue</strong> <strong>Gum</strong> trees Established andmaintained under this <strong>Project</strong> will be available forHarvesting as woodchips in about ten years. However, thetimber may be sold at any time between 2020 and 2024.Under the terms of the Wood Purchase Agreement, W.A.Chip & Pulp Co. will buy the wood unless the <strong>Project</strong>Manager can negotiate better terms with a reputable thirdparty after first allowing the Purchaser the opportunity tomatch the price offered by the other party interested inpurchasing the wood (see Section 10.6 of Part B of this<strong>PDS</strong>). The precise date of purchase will depend upon boththe growing conditions that have existed during the term ofthe <strong>Project</strong> and an assessment by the Purchaser of themarket conditions at the relevant time. It is likely that thedate of purchase will vary from one block of <strong>Project</strong> Landto another.It is a possibility that the whole or part of the wood grownwill be suitable for a higher value use such as flooring. Ifthis turns out to be the case then the Growers and thePurchaser will decide together on the best way to dealwith the grown wood. It cannot be predicted with anyaccuracy whether (and, if so, to what extent) it would bewise or necessary to allow a longer rotation in order totake advantage of the higher value. This <strong>PDS</strong> ignorescompletely the possibility of a use with a higher value thanas woodchips.All net income on the sale of a Grower's interest in thePlantations (plus any carbon and environmental credits)will be paid progressively to the Custodian for distributionto each Grower. The proceeds from the sale of the woodwill be pooledand the net proceeds distributed to Growerson a pro rata basis, i.e. in the same proportion that thenumber of hectares held by each Grower bears to the totalof all hectares comprising the <strong>Project</strong>.If unforeseen expenses in relation to things such asfertiliser and/or insect issues arise, the <strong>Project</strong> Manager isentitled to convene a meeting of all Growers. The Growersmay, by majority vote, agree to meet such expenses, inwhich case these expenses will be borne between all theGrowers in proportion to the number of hectares held inthe <strong>Project</strong> by each Grower.It is the intention of the <strong>Project</strong> Manager to terminate the<strong>Project</strong> upon the distribution of the proceeds from the firstHarvesting of the Plantations. The <strong>Project</strong> may continuefor the period ending up to 15 years after the date of thelast acceptance by the <strong>Project</strong> Manager of an Applicationfrom an intending Grower unless otherwise determined bythe <strong>Project</strong> Manager or the Growers.

Joint Venture Growers:Two applicants may participate in the <strong>Project</strong> as JointVenture Growers. Under this arrangement, the first JointVenture Grower is responsible for all activities associatedwith the Establishment of the Plantation and the feespayable in respect of those activities and amounts payablein the application year (including pre-paid rent) and thesecond Joint Venture Grower is responsible for ongoingrent, management and administration fees payable in allsubsequent years. Joint Venture Growers will be entitledto one half of the proceeds of sale of the timber from thePlantations.Each Joint Venture Grower will be responsible for theirportion (being 40% for the first Joint Venture Grower and60% for the second Joint Venture Grower) of all insurance,Harvesting, transportation and supervision costs andincentive fees payable out of the proceeds of the sale ofthe timber.Throughout this Product Disclosure Statement, anyreference to a Grower includes a reference to JointVenture Growers.Benefits:Benefits of the <strong>Project</strong> include:(a)(b)(c)(d)(e)The soil characteristics and rainfall conditions of the<strong>Project</strong> Land has independently been assessed asbeing of superior quality for <strong>Blue</strong> <strong>Gum</strong> plantations.The <strong>Project</strong> Manager has selected improvedseedlings which analysis indicates can be expectedto produce in the vicinity of over 20% more wood(in dry weight terms) than trees grown fromaverage native forest seed.The <strong>Project</strong> Manager has negotiated a woodpurchase agreement with W.A.Chip & Pulp Co.,another company owned by Marubeni Corporationand Nippon Paper Industries Co. The Harvestedtimber will be sold to W.A. Chip & Pulp Co. at anagreed price provided that, if the <strong>Project</strong> Manageris able to negotiate a higher price with a genuinethird party, the <strong>Project</strong> Manager will be free to sellthe timber to that third party unless W.A. Chip &Pulp Co. matches the offer.The Board of the <strong>Project</strong> Manager includesDirectors with extensive forestry expertise andproven performance in the management of <strong>Blue</strong><strong>Gum</strong> plantations. Two of the Directors have over 25years experience in the growing of softwood andhardwood plantations. The <strong>Project</strong>'s principal<strong>Forestry</strong> Contractor, <strong>WA</strong>CAP Treefarms, is ownedby Marubeni Corporation, a Japanese companywhich is one of the world’s leading trading housesand the largest customer for pulpwood fromWestern Australia since 1976 together with NipponPaper Industries Co, one of Japan’s largest papermaking companies. In addition, the <strong>Project</strong>Manager has engaged one of Australia's leadingforesters to assist in the supervision of the <strong>Forestry</strong>Contractor.The <strong>Project</strong> Manager consults with and is advisedby leading forestry experts, employs soundsilvicultural and environmental practices and(f)(g)(h)(i)Risks:engages a leading forestry company to provideforestry services.The pooling of receipts from the sale of wood bothspreads the risk to each Grower and, at the sametime, results in a more significant market presenceat the time of selling the Wood.The possibility of significant financial gains beforeand after income tax is taken into account.Tax deductibility of the costs of the <strong>Project</strong>.The Federal Government is committed to thesupport and the expansion of the Australianplantation forestry industry, as confirmed in“Plantations for Australia: The 2020 Vision”, whichencourages the increase of plantation forest areasin Australia over a 25 year period to 3 millionhectares.The <strong>Project</strong> is long term and, accordingly, speculative innature and is subject to the risks of such an undertakingincluding (but not limited to):(a)(b)Market risks such as:(i)(ii)(iii)(iv)(v)changes in demand and price for timber dueto economic downturn, global and Australiancompetition and consumer productrequirements and preferences;oversupply of timber products to relevantmarkets;changes in pulp technologies;distributor consolidation and rationalisation;andchanges in price for business inputs such aslabour and materials;Regulatory risks such as:(i)(ii)(iii)(iv)(v)(vi)obtaining all necessary government andregulatory approvals;access to infrastructure (eg power, irrigation,transport, water);changes in government and regulatorylegislation and requirements (e.g. taxation);changes in levies, duties and imposts;the failure to obtain or the withdrawal ofProduct Rulings that have been applied forconcerning the taxation treatment for the<strong>Project</strong> by the Australian Taxation Office orsubsequent non compliance with the termsof the Product Ruling; andwithdrawal of this <strong>PDS</strong> or the <strong>Project</strong>Manager’s Australian Financial Serviceslicence by ASIC for non compliance with theConstitution, Compliance Plan and/orCorporations Act;

(c)(d)(e)Agricultural risks such as:(i)(ii)(iii)(iv)(v)(vi)(vii)(viii)(ix)(x)natural disasters, climatic variance, fire,windstorms, flooding and other acts of God;insect and vermin infestations andagricultural diseases;quarantine restrictions and regulations inAustralia and globally;suitability of seedlings;suitability of forestry techniques;environmental impact and obligations andregulations imposed by the government andother bodies;accessing and adapting Harvesting andprocessing technology and technologiesgenerally;regulatory approval;misinterpreting transportation andHarvesting requirements and locations; andmisinterpreting soil, climatic, water and othersite conditions.Financial risks such as:(i)(ii)(iii)(iv)ability to achieve assumed yields and prices;price and cost movements;changes in the Australian exchange rate andforeign currency exchange rates; andinterest rate variations;Other risks such as:(i)(ii)(iii)(iv)(v)the solvency and cash flow position of the<strong>Project</strong> Manager, the <strong>Project</strong> Manager’sassociates, subcontractors and otherrelevant parties;default by the <strong>Project</strong> Manager, the <strong>Project</strong>Manager’s associates, subcontractors andother relevant parties under the materialagreements;loss of key staff;Uncontrolled Events; andthe Applicants’ ability to pay their annualcontributions.The <strong>Project</strong> Manager has endeavoured to minimise theserisks as far as possible by arranging particularlyappropriate sites for the Plantations and by engagingexperts as prominent and independent as the <strong>Forestry</strong>Contractor and the forestry consultant to provide theservices mentioned in Sections 5.5 and 5.11 of Part B ofthis <strong>PDS</strong> respectively.Fees and Other Costs:Refer to Section 7of this <strong>PDS</strong>.Growers contribute a minimum of $20,000 (including GST)(being the amount necessary to Establish 2 hectares ofplantations at $10,000 (including GST) per hectare andthereafter in multiples of $10,000 (including GST) (foreach extra hectare). There is no restriction on themaximum initial contribution that a Grower may make.Taxation Information (General)Division 394 of the ITAA 1997 contains a specificdeduction provision for contributions to forestry schemes.In projects operating under this legislation, there is nolonger a requirement for taxpayers to demonstrate thatthey are “carrying on a business” in order to access thededuction or that the amount paid is of a revenue nature.Division 394 provides that initial investors in forestrymanaged investment schemes will receive a tax deductionequal to 100% of their paid contributions (both initial andongoing) and subsequent investors will receive a taxdeduction for their ongoing contributions to forestryschemes, provided that the <strong>Project</strong> Manager will spend anamount equivalent in net present value terms, to at least70% of the amounts paid by Growers on Establishing,tending and felling trees for Harvesting (“70% DFE rule”).In addition to the 70% DFE rule, there are also otherrequirements such as:(a)(b)(c)(d)the entity claiming the deduction must be a Growerin a forestry scheme whose purpose is Establishingand tending trees for felling only in Australia;a Grower does not have day-to-day control over theoperation of the scheme;the trees intended to be Established in accordancewith the scheme have all been Established within18 months of the end of the income year in whichthe first payment is made by a Grower;the initial participant must hold an interest in the<strong>Project</strong> for at least four years.Division 394 also contains some specific items which arenot eligible for inclusion in the 70% DFE Rule.Interest and borrowing costs paid by a Grower will not becovered by Division 394 and should continue to bedeductible under the relevant provisions of the ITAA 1936and the ITAA 1997 (eg, Sections 8-1 and 25-25 of theITAA 1997, respectively), provided the relevant tests forthose provisions are met.Where a Grower disposes of interests within 4 years, anydeduction obtained by that Grower under Division 394 willbe reversed in the income years claimed.Where two Applicants apply as Joint Venture Growers thefirst Joint Venture Grower should be entitled to a deductionfor the cost of Establishing the Plantation and up frontpayments of rent i.e. the $10,000 (including GST) perhectare which will be paid pursuant to the <strong>Project</strong>Management Contract and for interest on any borrowedfunds used to finance its contribution, when incurred. Thesecond Joint Venture Grower should be entitled todeductions for ongoing payments of rent, managementand administration fees and for interest on any borrowed

funds used to finance its ongoing costs, when incurred.Both Joint Venture Growers should be entitled todeductions for their proportion of insurance, Harvesting,supervision, transportation and incentive fees.Under Division 394 the <strong>Project</strong> Manager will have thefollowing obligations:(a)(b)if trees are not planted within 18 months of the endof the income year when the Application Moneywas paid by a Grower (i.e. 31 December 2013),within 3 months after the end of that 18 monthperiod, to give the Commissioner of Taxation thestatement required under Division 394 in relation toreasons why this condition was not satisfied; andto use its best endeavours to keep records for thelife of the <strong>Project</strong> plus 5 years.It is possible that there will be further changes in taxationor other legislation which may have a positive, oralternatively a negative, effect upon the <strong>Project</strong>.A Product Ruling for this <strong>Project</strong> has been applied for fromthe Australian Taxation Office and copies of the ProductRuling will be available free of charge from the <strong>Project</strong>Manager or from the Australian Taxation Office(www.ato.gov.au) after it is issued.The Tax Laws Amendment (2009 Budget Measures No. 2)Act 2009 (Cth) came into force in December 2009. Theintention of the Act (among other things) is to amend the‘non-commercial losses rules’ in relation to individuals withan ‘adjusted’ taxable income of $250,000 or more. Thenon commercial losses rules will now not apply toindividuals with an adjusted taxable income of $250,000 ormore only if they can satisfy the Australian Tax Office,based on an objective expectation, that the businessactivity will produce assessable income greater thanavailable deductions within a commercially viable periodfor the industry concerned. The Australian Tax Office hasalways exercised a very similar discretion in its previousProduct Rulings and it is anticipated that the ProductRulings applied for by the Responsible Entity for this<strong>Project</strong> will continue to provide this result.A Product Ruling issued by the Australian Taxation Officeis only a ruling on the application of taxation law and is inno way expressly or impliedly a guarantee or endorsementof the commercial viability of the <strong>Project</strong>, of the soundnessor otherwise of the <strong>Project</strong>, or of the reasonableness orcommerciality of any fees charged in connection with the<strong>Project</strong>. Further, a Ruling is only binding on theCommissioner if the <strong>Project</strong> is implemented in the specificmanner provided in that Product Ruling.However, it is possible that the law may be amended atany time or that the interpretation thereof by the Courtsmay alter. If any deduction claimed by a Grower isdisallowed by the Commissioner of Taxation, penalties andinterest may be imposed.Growers will be liable to pay to the <strong>Project</strong> Manager anamount equivalent to the whole of the GST liability (if any)of the <strong>Project</strong> Manager in respect of supplies made toeach Grower under the <strong>Project</strong> Agreements. However,provided that a Grower has an Australian BusinessNumber and receives a tax invoice in relation to thepayment, the Grower should be able to obtain a credit orrefund in relation to any GST component paid because theGrower is likely to be carrying on an “enterprise” within themeaning of the GST legislation.Growers should seek independent advice in relation to alltaxation issues.Uncomplicated Finance:All participating Growers may borrow up to 80% of theApplication Money from Albany Financial Pty Ltd, companyassociated with the <strong>Project</strong> Manager. Amounts borrowedare to be repaid in monthly instalments by way of directdebit over the period ending on 15 June 2017. Eachinstalment is of both principal and interest.Interest is charged on the reducing principal at anindicative interest rate of 12.75% per annum (see Section5.15 of Part B of this <strong>PDS</strong>). There is no loan establishmentfee payable in respect of this finance package.Growers will not be required to submit any financialinformation in order to obtainthis finance. No security (otherthan a charge over the Grower’s interest in the <strong>Project</strong> andthe proceeds of sale of wood) will be required.Dispute Resolution:The Constitution has an internal complaints handlingprocedure requiring the <strong>Project</strong> Manager to provide writtendetails of the procedure which includes endeavouring toprovide a final response in respect of a complaint within 45days of receiving the complaint. Section 5.16 of Part B ofthis <strong>PDS</strong> provides a summary of the complaints handlingprocedure.If a Grower is not satisfied with the outcome of the internalcomplaints handling procedure then the matter can bereferred to the <strong>Project</strong> Manager’s external disputeresolution scheme, the Financial Ombudsman ServiceLimited. The <strong>Project</strong> Manager is a member of that scheme.Ethical Considerations:The extent to which labour standards or environmental,social, or ethical considerations were, are and will beconsidered by the <strong>Project</strong> Manager in the selection,retention or realisation of the investment are:(a)(b)(c)(d)<strong>Blue</strong> gum plantations offer significant environmentalbenefits including:(i)(ii)(iii)(iv)the mitigation of carbon dioxide emissions;the lowering of water tables to amelioratesalinity;the improvement of soil structure anddrainage; andeffective wildlife corridors for native fauna.The <strong>Project</strong> Manager will have regard to the FairWork Act 2009 (Cth), industrial awards and industrystandards affecting its employees.The <strong>Project</strong> Manager has assumed that anysubcontractor will have regard to the Fair Work Act2009 (Cth), industrial awards and industry standardsaffecting the subcontractor’s employees.The <strong>Project</strong> Manager will have regard to thedirections of the government bodies and otherregulations affecting the <strong>Project</strong> Land.

(e)(f)(g)The <strong>Project</strong> Manager has chosen the south-westregion of Western Australia for its climate, soil andrainfall conditions. Most of the relevant localCouncils have actively encouraged the region as acentre of forestry expertise with excellentinfrastructure and a skilled labour force suitable toachieving the objectives of the <strong>Project</strong>.The Establishment of Plantations usually reducesthe risk of fire. In most cases, <strong>Blue</strong> <strong>Gum</strong> plantationfires spread far more slowly than grass, crop ornative bush fires under the same conditionsresulting in less area being burnt. The risk ofdamage by fire is further minimised by the <strong>Project</strong>Manager through its maintenance of access roadsand firebreaks and its procedures for early firedetection and suppression.The <strong>Project</strong> Manager is committed to providing bestpractice forestry and to ensuring compliance withthe Code of Practice for Timber Plantations inWestern Australia and other relevant national andinternational industry standards.Commissions:The <strong>Project</strong> Manager may pay commissions not exceeding10% in total of the Application Money to eligibleintermediaries. This amount may be paid over a period ofone or more years.Secondary Markets:Division 394 enables Growers to trade interests in forestryschemes through a secondary market.Under Division 394, deductibility of Growers’ contributionswill not be affected if Growers dispose of their interests inthe <strong>Project</strong> prior to Harvest but have held the interests inthe <strong>Project</strong> for at least 4 years from the end of the financialyear in which Growers made a first payment to the <strong>Project</strong>Manager.A market value pricing rule will apply for existing interestsin forestry schemes that are traded by Growers.Growers should seek independent advice in relation to thetaxation treatment of subsequent Growers in thesecondary market.Continuous Disclosure:The <strong>Project</strong> Manager, as Responsible Entity, will besubject to regular and continuous reporting and disclosureobligations if interests in the <strong>Project</strong> are ED securities.Interests in the <strong>Project</strong> will be ED securities if 100 or morepeople hold interests in the <strong>Project</strong>.No Cooling Off Period:Due to the nature of the <strong>Project</strong> there is no cooling offperiod for Applicants.No Minimum Subscription for the <strong>Project</strong>:There is no minimum subscription required for the <strong>Project</strong>to commence.Application:Applications can only be made on the attached ApplicationForm and are accepted by the <strong>Project</strong> Manager in itsabsolute discretion.Closing Date:The <strong>Project</strong> Manager will not accept Applications receivedafter 30 June <strong>2012</strong>.AFS Licence:Refer to Section 5.12 of this <strong>PDS</strong>.ASIC:ASIC takes no responsibility for the content of this <strong>PDS</strong>.Further Information:Copies of this <strong>PDS</strong> and documents specified in the <strong>PDS</strong> orrequired by law may be obtained or inspected at suchreasonable times as agreed by contacting the <strong>Project</strong>Manager.Copies of the following documents lodged with ASIC inrelation to the <strong>Project</strong> may be obtained or inspected bycontacting ASIC:(a)(b)the annual financial report; andif the interests are ED securities, any:(i)(ii)half-yearly financial report; andcontinuous disclosure notices.

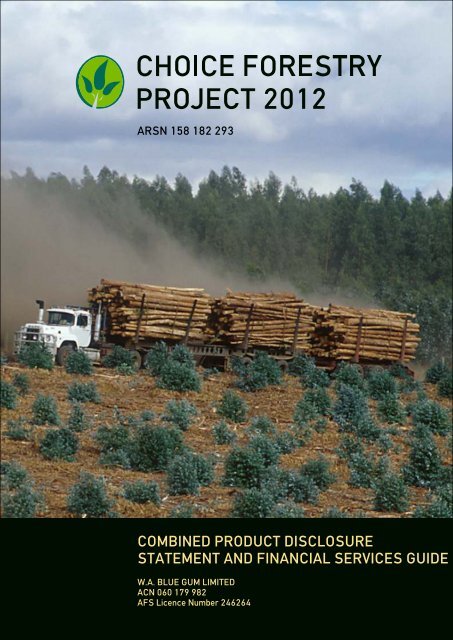

PART B: DETAILED INFORMATIONIMPORTANT NOTICEThis <strong>PDS</strong> relates to the offer of Interests in the registeredmanaged investment scheme known as the <strong>Choice</strong><strong>Forestry</strong> <strong>Project</strong> <strong>2012</strong> ARSN 158 182 293. Applications forInterests can only be made on the Application Formattached to or accompanying this <strong>PDS</strong>.This <strong>PDS</strong> does not constitute an offer or invitation in anyjurisdiction or to any person where, or to whom, it wouldbe unlawful to make an offer or invitation. Persons whocome into possession of this <strong>PDS</strong> should seek advice onand observe any restrictions on accepting an offer ordistributing this <strong>PDS</strong>. Any failure to comply mightconstitute a violation of applicable securities laws. While aforeign applicant is entitled to invest in the <strong>Project</strong>, anApplication may need to be made to the ForeignInvestment Review Board for approval.This is an important document and you should read itcarefully. In particular you should consider the risk factorsset out in Part A of this <strong>PDS</strong> that could affect theperformance of the <strong>Project</strong>. You should carefully considerthese factors in light of your personal circumstances(including your financial and taxation circumstances). Youmay wish to consult your stockbroker, accountant,independent financial advisor or lawyer.No person guarantees the success of the <strong>Project</strong> nor anyparticular financial outcome from participation in the<strong>Project</strong> nor the taxation consequences of participating inthe <strong>Project</strong>.Some words in this <strong>PDS</strong> have defined meanings. Thedefinitions appear in the dictionary in Section 2 exceptthose that appear in Section 10 (Details of PrincipalAgreements) which are defined by reference to theparticular agreement. Financial amounts are in AustralianDollars unless otherwise specified.Photographs used in this <strong>PDS</strong> are for illustrative purposesonly. They do not represent the proposed <strong>Project</strong>.This <strong>PDS</strong> does not constitute an offer in any jurisdictionother than Australia.

3.1 International MarketsIn 2008 a most substantial increase in <strong>Blue</strong> <strong>Gum</strong>woodchip price was negotiated between Australiansuppliers and Japanese buyers which led to a verylarge increase in the net royalty payable to growersof <strong>Blue</strong> <strong>Gum</strong> trees in Australia. Notwithstanding theglobal financial crisis, the same price wasmaintained throughout 2009, 2010 and 2011. The<strong>Project</strong> Manager believes that there is reason foroptimism regarding further increases by the timethe trees in the <strong>Project</strong> are Harvested.The suitability of plantations of <strong>Blue</strong> <strong>Gum</strong> inWestern Australia for supplying the internationalmarket is evidenced by the interest shown by anumber of major Asian trading houses and papercompanies in establishing plantations to securetheir supplies. Over 250,000 hectares of <strong>Blue</strong> <strong>Gum</strong>plantations have already been successfullyestablished in Western Australia by a variety ofcompanies, thereby providing a platform for thisindustry. Western Australia has more <strong>Blue</strong> <strong>Gum</strong>plantations than any other State.Growers' wood will be sold either for manufactureinto woodchips for sale to pulp and papercompanies or for a higher value use. The MarubeniGroup and Nippon Paper Industries Co aresignificant importers and users of Australianhardwood chips from plantations (to an everincreasing extent) and native forest (to an everdecreasing extent). A number of sources suggestthat hardwood woodchip prices will remain stable inreal terms over the short to medium term.Not only is Australia in a good geographical positionto supply hardwood woodchip to the Asian market,because competitors for the Asian market arefurther away from Asia than Australia and thereforesuffer the cost of extra transport to the Asianmarket, Western Australia is closer to Asia thanother parts of Australia where <strong>Blue</strong> <strong>Gum</strong> is growncommercially. Demand in the Asian market isexpected to grow strongly in the medium term andthe <strong>Project</strong> Manager predicts a shortfall in thatmarket of five million cubic metres per annum byabout 2020.In 2002, China imported hardwood chips fromAustralia for the first time. As the result of a loggingban now operating in China, domestic hardwoodchips supplies remain limited and it is expected thatthere will be a growing market in that country.China’s hardwood chip imports are expected to risefrom approximately 1.1 million tonnes in 2007 to 3.5million tonnes in <strong>2012</strong>.Paper production in China has trebled since 1990and the Chinese market has now surpassed Japanas the second largest paper making country in theworld in absolute terms.China currently consumes approximately 50 milliontonnes of paper per year. Research indicates thereis a direct correlation between economic growthand demand for paper products. China which hasaveraged more than 8% growth for the past 26years, has an enormous potential for demand ofpaper products. It is estimated that the 2011imports to China will reach approximately sevenmillion tonnes equating to a 37% increase on the2010 figures. It has also been reported that therehas been record woodchip imports into China withthe first 10 months of 2011 already equalling morethan the entire 2010 import volume. In addition tothe increase in volume, the <strong>Project</strong> Managerexpects that the average value for importedwoodchip will also continue to increase as the pricein the third quarter of 2011 was 22% higher than in2010. Hence, it is expected that the continuinggrowth and development of China will havemassive implications for world trade and forestproducts trade in particular. This suggests apossible new export market for Australianwoodchips.China is installing many very large paper makingmills which contain the most cutting edgetechnology. In order to best exploit the potentialefficiency of these mills they require the highestquality fibre inputs, particularly <strong>Blue</strong> <strong>Gum</strong> which willreplace inferior species which make up the bulk ofChina’s imports to date.Japan is one of the world’s major market forwoodchips and Australia is its principal supplier. In2009, Japan imported approximately 15.1 millioncubic metres of hardwood chips of which Australiasupplied about 40%. Japan uses hardwoodwoodchip imported from Australia for the productionof writing and printing paper. Over the past fewyears there has been a downward trend in thevolume of woodchip exports from the United Statesto Japan as they are consumed domestically. Also,significant environmental pressure due to currentHarvests being almost exclusively from nativeforests has resulted in reduced production volumes.Consequently, Australian woodchip exports toJapan have increased.In recent years Australia’s major competition intothe Japanese market has been from Chile andSouth Africa. It appears that supply from both thosecountries into Japan is likely to fall. Chile now hasnew and large milling facilities at home and willcontinue to use more of its tree fibre for domesticproduction of paper for ultimate sale into NorthAmerica. South Africa has a reduced supplybecause of water and other limitations.It is suggested that Japan’s dependence onimported woodchips would likely result in itswillingness to pay higher premiums on the supply ofwoodchips as plantation grown Eucalypts fromSouth America and South Africa are consumeddomestically or marketed to North America.

It is predicted that there is sound prospect forhardwood woodchip demands in Asia, and Australiacan look forward to growth in emerging marketssuch as China and re-emerging demand fromJapan.Indonesia is also a potential market given the largeincrease in its milling capacity in recent years whichmay not be able to be supplied by local resources.There is a shortfall of wood fibre in Indonesia,which has opened the market for Australia andother exporters of wood fibre in Asia.There is also current discussion about thepossibility of the Indian economy starting toemerge.The domestic market prospects for hardwoodplantations in Western Australia are enhanced bythe possible development of a future domestic pulpand paper industry based on the plantations.There are good export facilities at the Bunbury portthat have been used for over 25 years.Additionally, export facilities at the Albany portcommenced operation in March 2002. The land inthis <strong>Project</strong> will be situated within a commerciallyviable distance from one or the other of these ports.Given Australia’s increasing hardwood plantationsupply volumes, its expanding distribution abilitiesand close proximity to Asia, Australia is wellpositioned to have continued success in thehardwood woodchip market.3.2 Government SupportFederal Governments of both persuasions haveoften renewed their backing for the “2020 Vision” oftrebling plantation forest areas in Australia in theperiod from the mid-1990’s to 2020 to 3 millionhectares. Under this policy, a targeted average of80,000 hectares is required to be planted eachyear.In this context, the Division 394 legislationregarding taxation of forestry was introduced for theexclusive purpose of encouraging further plantationgrowth in order to reduce reliance on both nativeforests and overseas imports (see Part A: GeneralTaxation Information).3.3 Environmentally BeneficialAs well as providing excellent market prospects,participation in a <strong>Blue</strong> <strong>Gum</strong> plantation also hasmany local environmental benefits. Also, theestablishment of hardwood plantations in Australiareduces the Harvesting pressure on native foreststhroughout the world, particularly on the tropicalforests of Asia and the South Pacific.The rapid growth of hardwood plantations requiresthe trees to fix large amounts of carbon fromcarbon dioxide, contributing to the reduction of thisgreenhouse gas in the atmosphere. <strong>Blue</strong> <strong>Gum</strong>plantations will also serve to slow or reverse theeffects of salination in the agricultural areas ofWestern Australia. The replacement of pasture withplantations returns the water usage pattern closerto that of native forests which can alleviatesalination problems downstream from the plantationand prevent salination within the plantation itself.It has been estimated that by 2022 (which is thearound the time that the Harvesting of the treesgrown in the <strong>Project</strong> is likely to take place) that over75% of hardwood woodchips in Australia will bederived from plantations rather than native forest.There has been a sharp decrease in the amount ofnative forest available in Australia for woodproduction, with a fall in excess of 30% in respectof the 11 years to 2008.A biomass plant has recently been established inthe south-west of Western Australia. Such a plantwill most probably require fibre resulting fromtimber Harvesting operations. Accordingly, it ispossible that some additional revenue will bederived by Growers. The use of biomass is anexample of electricity production from renewableresources and is environmentally beneficial.There is signification use of this method to produceenergy across Europe.3.4 Good ReturnsIn addition to the suitability of the species for paperproduction, good returns to the Subscriber arepossible due to the high growth rates achievable inthe sites selected for the <strong>Project</strong> in the south-westof Western Australia. Such sites are virtually notavailable in other states or in other parts of WesternAustralia. In fact, such sites are extremely hard toobtain even in the south-west of Western Australia.The plantations to be Established are expected tobe amongst the fastest growing in Australia and inthe opinion of the <strong>Project</strong> Manager, will rivalplantations grown elsewhere in the world. Growthrates are maximised by the implementation ofsilvicultural techniques (especially in relation to theoptional use of fertiliser) which have beendeveloped over more than a decade of researchand development and by using geneticallyimproved seedlings that have been especiallyselected.Given the number of variables involved, it is notpossible to forecast future cashflows and returns toGrowers with any certainty. Anticipated events maynot occur exactly as expected or unforeseencircumstances may arise which are outside thecontrol of the <strong>Project</strong> Manager. As a result, theDirectors have elected not to provide forecastreturns for the <strong>Project</strong>.Each Grower’s net return is calculated by grosssales less all costs and the <strong>Project</strong> Manager’sincentive fee.Other risks and factors as set out on pages 10 to 12of this <strong>PDS</strong> may also affect a Grower’s return. It isrecommended that professional advice be obtainedwhen considering the possible <strong>Project</strong> returns andto assist in determining whether the participation inthe <strong>Project</strong> is suitable to you.

3.5 Growing DemandThe growing of <strong>Blue</strong> <strong>Gum</strong> plantations in WesternAustralia has resulted from the increasing demandfor pulp and paper products worldwide. There is anincreasing gap between world demand and supplyof wood fibre. Asia is the largest fibre deficit regionin the world. Asia is also the main focus for growthin fibre demand for pulp and paper.Continued reliance on paper and paper products bydeveloped countries and the increasedconsumption of these products by developingcountries is leading to an increase in demand forthe raw materials required for paper production.The Asian region is projected to account forapproximately 40% of the total increase in worlddemand by about 2015. Hardwood fibre, extractedfrom <strong>Blue</strong> <strong>Gum</strong> is a preferred raw material for theproduction of high quality paper. In fact, most millsrequire that some, if not all, of their timber input behardwood fibre.The increase in demand for hardwood fibre must beviewed in conjunction with the growing awarenessof the importance of preservation of native foreststhroughout the world, including Australia.3.6 Attributes of the Species<strong>Blue</strong> <strong>Gum</strong> has an international reputation as one ofthe best species for paper production due to itsshort, narrow fibres, high strength and low chemicalrequirements for bleaching because of its lightcolouring.As <strong>Blue</strong> <strong>Gum</strong> has a shorter Harvest time(approximately 10 years) and a pulp yield verymuch higher than wood fibre from native mixed-ageand mixed-species, plantation grown <strong>Blue</strong> <strong>Gum</strong>attracts a premium price.3.7 Diversification of Asset ClassesWell-managed agribusiness ventures are businessopportunities outside of the traditional assetclasses. They do not normally follow the cycles inthe property and share markets. Accordingly, theymay be suitable for people who want to diversifytheir portfolio.3.8 Employment Opportunities<strong>Blue</strong> <strong>Gum</strong> projects are generally supported by thecommunities in which they are grown as theyencourage employment and regional growth.According to the Bureau of Rural Sciences , “thepresence of processing facilities in regional areascan help to reduce or prevent population decline byproviding an alternative source of employment”.The study also shows that over time newbusinesses are established in the regions toprovide goods and services to the growingplantation sector.

GrowersConstitution<strong>Project</strong> ManagementAgreementSub-lease<strong>WA</strong> <strong>Blue</strong> <strong>Gum</strong> Limited(Responsible Entityand <strong>Project</strong> Manager)SchemePropertyCustodyAgreementSandhurst TrusteesLimited (Custodian)PlantationOperationsWood SalesFinance<strong>Forestry</strong>SupervisionPlantationServicesAgreementWoodPurchaseAgreementLoanAgreementAgreementfor theprovision ofConsultingServices<strong>WA</strong>CAPTreefarms Pty Ltd*(<strong>Forestry</strong>Contractor)<strong>WA</strong> Chip & Pulp CoPty Ltd*(Wood Purchaser)Albany FinancialPty Ltd(Lender)ConsultingForester*Both these companies are ultimately owned by Marubeni Corporation and Nippon Paper Industries Co.

The particular attractive features of the <strong>Choice</strong> <strong>Forestry</strong><strong>Project</strong> <strong>2012</strong> are as follows:5.1 Quality of the LandGrowers will sub-lease from the <strong>Project</strong> Managerland situated in the south-west of Western Australiain areas which have both high rainfall, deep fertilesoils and close proximity to ports (within a radius ofapproximately 100 kilometres). The sites have beenselected based on their suitability for use asplantations for <strong>Blue</strong> <strong>Gum</strong>.Sites with such close proximity to ports, higherrainfall and deep, fertile soils are rare and hard tocome by, which means that the <strong>Project</strong> will ofnecessity be conducted on a small and “boutique”basis.As the plantings of <strong>Blue</strong> <strong>Gum</strong>s in Australia hasexpanded, it has been noted that it becamenecessary for many companies to establish andplant in more marginal land. The <strong>Project</strong> Managerhas steadfastly refused to follow this trend, as to doso is entirely inconsistent with its policy ofmaximising each Grower’s ultimate returns.The <strong>Project</strong> Manager uses rigorous site selectiontechniques and protocols to identify land ofexceptionally high quality. The small scale ofoperations has the advantage of enabling the<strong>Project</strong> Manager to select sites which may nototherwise have been considered by largercompanies, offering a competitive advantage in siteacquisition.The land offered to be sub-let to Growers under this<strong>PDS</strong> has an anticipated yield of wood that is muchhigher than is usually found in projects offered forpublic subscription. The land is targeted to have aweighted average MAI of approximately 34 cubicmetres per hectare per annum using certainassumptions. Whether this will be achieved issubject to a number of factors including soil type,rainfall and any climatic changes between the timeof Establishment and Harvesting.There is a direct correlation between the MAI ofland and the anticipated returns to Growers.Land which has an MAI which is say, 33%, higherthan other land will be likely to yield to a Grower agross return at the end of the <strong>Project</strong> 33% greaterthan the other block of land and an even larger netreturn, especially when it is appreciated that manyof the expenses are fixed rather than variable andthat Harvesting costs are usually cheaper per unitof wood on higher productivity sites.In order to treat all Growers equitably, the proceedsof the Harvest will be pooled between all Growersparticipating in this <strong>Project</strong> in proportion to the sizeof the respective subscriptions.5.2 ReportsThe <strong>Project</strong> Manager will provide Growers with areport following completion of the planting of thePlantations setting out the areas which have beenplanted with <strong>Blue</strong> <strong>Gum</strong> trees in accordance with thePlantation Development and Tending Plan.Thereafter, the <strong>Project</strong> Manager will report to theGrowers no later than 30 November in each yeardetailing any changes to the PlantationDevelopment and Tending Plan, the actualoperations performed on the land, details regardingthe health and vigour of the Plantations and anyother matter which may affect the performance orviability of the Plantations.In addition, a consulting forester will provide aseparate professional report at least annually, andat other times if necessary.5.3 Experienced and Cutting Edge Operations<strong>WA</strong>CAP Treefarms has been engaged by the<strong>Project</strong> Manager to supply and to plant the <strong>Blue</strong><strong>Gum</strong> seedlings and tend the Plantations. Under theterms of the Wood Purchase Agreement (refer toSection 10.6), W.A. Chip & Pulp Co. will Harvestand buy all the wood unless the <strong>Project</strong> Managercan negotiate better terms with a reputable thirdparty.<strong>WA</strong>CAP Treefarms has been growing hardwoodplantations in Western Australia since the late1980’s and currently owns or manages in that stateand in the Green Triangle region of Victoria andSouth Australia about 40,000 hectares of globulusplantations. It has established approximately60,000 hectares.<strong>WA</strong>PRES is a leader in the Western Australianplantation and wood chip export industry. <strong>WA</strong>PRESis certified to Australian <strong>Forestry</strong> Standard AS 4708and International Standard ISO 14001:Environmental Management Systems. On 1 March2011 <strong>WA</strong>PRES was granted <strong>Forestry</strong> StewardshipCouncil (FSC) certification for Chain-of-Custody(CoC) and Controlled Wood (CW), demonstratingits compliance with the highest social andenvironmental standards. <strong>WA</strong>PRES forestry staffalso use state of the art procedures developedthrough its membership of the Industry PestManagement Group and the <strong>Forestry</strong> Co.-operativeResearch Centre. The <strong>Project</strong> is able to take the fullcommercial advantage of the certifications.5.4 InsuranceEvery Grower is required to insure his Plantationsevery year against fire, if such insurance isavailable at a reasonable cost determined by the<strong>Project</strong> Manager. In recent years theannualpremium has been at a rate of about 0.7% of

the insured value. It is possible that in the future thepremiums will be more expensive. The <strong>Project</strong>Manager will use its best endeavours to arrangesuch insurance at the best price and will be entitledto charge a fee equivalent to 10% of the premiumfor this service. As the trees mature the value of thePlantations is expected to rise.(a)(b)(c)Paul Luntz M.Comm. (Wits), CA, RegisteredTax Agent, Registered Company Auditor(Chairman);Manish Sundarjee B.Acc, CA, FPA (Aff); andAnthony Henry May B.Ec. LL.B.A decision will be made separately each year as tothe insured value, which may be less than the fullmarket value. However, the <strong>Project</strong> Manager willendeavour to ensure that the insured value will notbe less than $5,000 per hectare.5.5 Involvement of Marubeni Corporation andNippon Paper Industries Co<strong>WA</strong>CAP Treefarms and W.A. Chip & Pulp Co. areboth owed by the Marubeni Corporation andNippon Paper Industries Co. These companies,through their holding company, <strong>WA</strong>PRES, own andmanage tree plantations in Western Australia on alarge scale and, in the opinion of the <strong>Project</strong>Manager, are industry leaders in plantationestablishment and management, log Harvestingand woodchipping. Marubeni Corporation andNippon Paper Industries Co have not been involvedin the preparation of this <strong>PDS</strong>. They areindependent parties (see also Section 10.3).5.6 Compliance PlanThe <strong>Project</strong> is regulated by Chapter 5C of theCorporations Act.Accordingly, the Responsible Entity’s operationsand business activities are subject to both the<strong>Project</strong>’s Constitution and Compliance Plan. Bothdocuments have been lodged with ASIC inaccordance with the requirements of theCorporations Act.The Compliance Plan outlines how the ResponsibleEntity will operate the <strong>Project</strong> to ensure that itcomplies with the Corporations Act, the Constitutionand any other operating requirements set down bythe board of Directors of the Responsible Entity.The principal purpose of the Compliance Plan is toensure that the interests of Growers are protected.The Compliance Plan sets out the systems andmethods by which the Board of Directors, itsofficers, agents and employees will ensure that the<strong>Project</strong> and the Responsible Entity continue tocomply with the Corporations Act and theConstitution and to continually monitor and reviewsuch compliance.All Growers are entitled to obtain a copy of theCompliance Plan free of charge from the registeredoffice of the Responsible Entity.5.7 Compliance CommitteeThe Responsible Entity has established aCompliance Committee in accordance with theterms of the Compliance Plan. The ComplianceCommittee members are:Paul Luntz and Manish Sundarjee are externalmembers of the Compliance Committee.The Compliance Committee is scheduled to meet atleast once every quarter and is responsible formonitoring the extent to which the ResponsibleEntity observes, performs and complies with itsduties and obligations pursuant to the Constitution,the Corporations Act and the Compliance Plan.The Compliance Committee is required to report tothe Board of Directors of the Responsible Entityany findings of the Committee in relation to anyfailure by the Responsible Entity to comply with theCompliance Plan, any inadequacy in theCompliance Plan and any recommendations forchanges that the Committee considers should bemade to the Compliance Plan, any breach oralleged breach of the Corporations Act involving the<strong>Project</strong> and any breach or alleged breach of theprovisions of the Constitution. If the ComplianceCommittee is of the view that the Board of Directorshas not taken and does not propose to takeappropriate action to deal with a matter reported tothe Board of Directors by the Committee under theCompliance Plan, the Committee must report thatmatter to ASIC as soon as practicable.5.8 Improved SeedlingsAn analysis of nearly 70,000 trees grown from seedcollected throughout a range of <strong>Blue</strong> <strong>Gum</strong> trees hasshown that significant gains can be made bygrowing trees from seeds collected from the bestnative forest locations. Trees grown from seedscollected in the best five native forest locations canbe expected to produce up to over 20% more wood(in dry weight terms) than trees grown from theaverage native forest seeds.The <strong>Project</strong> Manager has made arrangements for<strong>WA</strong>CAP Treefarms to supply the <strong>Project</strong> entirelywith high quality seedling stock (scientificallyimproved but not genetically modified) beingproduced by <strong>WA</strong>CAP Treefarms which are readyfor planting in <strong>2012</strong>.5.9 Forward Sale of all the WoodThe Harvested timber will be sold to W.A. Chip &Pulp Co. (jointly owned by the MarubeniCorporation and the Nippon Paper Industries Co)but allowing the <strong>Project</strong> Manager to negotiate withany other potential buyers for a higher price. W.A.Chip & Pulp Co. then has the right to match thesebetter terms, in which case W.A. Chip & Pulp Co.will be the buyer. The market for <strong>Blue</strong> <strong>Gum</strong> isusually competitive and there does not appear tobe any reason why this will change at the time ofHarvest.

5.10 Audit of the Compliance Plan(a)(b)The auditor:(a)(b)Both the financial and compliance audits areconducted on an annual basis; andThe auditor must, as soon as possible, notifyASIC and the Compliance Committee inwriting if the auditor has reasonable groundsto suspect that a contravention of theCorporations Act has occurred in relation tothe <strong>Project</strong> and believes that thecontravention has not been and will not beadequately dealt with by commenting on it inthe auditor's report or bringing it to theattention of the Responsible Entity.has a right of access at all reasonable timesto all of the books and records of the <strong>Project</strong>and the Compliance Committee; andmay require an officer of the ResponsibleEntity or a member of the ComplianceCommittee to give the auditor informationand explanations for the purposes of theaudit.5.11 Experienced <strong>Forestry</strong> ConsultantA forestry consultant with very extensive experiencein the growing of Tasmanian <strong>Blue</strong> <strong>Gum</strong> has beenengaged to provide independent and professionaladvice to the <strong>Project</strong> Manager on an ongoing basis,including advice on the management of theplantations and marketing of the timber.5.12 The Responsible EntityThe <strong>Project</strong> Manager is the Responsible Entity ofthe <strong>Project</strong> and is responsible for the operation andmanagement of the <strong>Project</strong>. The Responsible Entityis an unlisted public company.The Responsible Entity was granted its AustralianFinancial Services Licence on 22 December 2003.The Responsible Entity’s Australian FinancialServices Licence was varied by ASIC on:(d)(e)(f)(g)28 May 2010 to permit the ResponsibleEntity to act as the responsible entity foranother project (which is not proceeding atpresent) and to add an additional“responsible manager”;23 May 2011 to permit the ResponsibleEntity to act as the responsible entity for theW.A. <strong>Blue</strong> <strong>Gum</strong> <strong>Project</strong> 2011 ARSN 150 828283 and the <strong>Choice</strong> <strong>Forestry</strong> <strong>Project</strong> 2011ARSN 150 830 121;3 April <strong>2012</strong> to permit the Responsible Entityto act as the responsible entity for the W.A.<strong>Blue</strong> <strong>Gum</strong> <strong>Project</strong> <strong>2012</strong> ARSN 156 425 286;and15 May <strong>2012</strong> to permit the ResponsibleEntity to act as the responsible entity for the<strong>Project</strong>.The Responsible Entity, in its own capacity,maintains a cash deposit to ensure that it meets thefinancial requirements under its Australian FinancialServices Licence including the minimum nettangible asset requirement of $50,000.Copies of the audited annual financial reports ofResponsible Entity are available from ASIC or bycontacting Responsible Entity.The Responsible Entity operates the <strong>Project</strong>through a discretionary trust known as the W.A.<strong>Blue</strong> <strong>Gum</strong> Management Trust (“Trust”). TheResponsible Entity is the trustee of the Trust andreceives the income from Growers in the Schemein its capacity as trustee of the Trust. It also meetsthe expenses of the Scheme from this income.Accordingly the Responsible Entity receives allamounts payable by Growers in its capacity astrustee of the Trust. The Responsible Entity holdsthese funds as trustee on the terms of the trustdeed (referred to below) and utilises these funds tomeet expenses of the Scheme. Where the Trustmakes a profit in a particular period, theResponsible Entity has the power to distributethose amounts to beneficiaries in the Trust.(a)(b)(c)5 August 2004 to authorise the ResponsibleEntity, in addition to operating the <strong>Project</strong>, toprovide general product financial advice forinterests in the <strong>Project</strong> to wholesale andretail clients;9 June 2006 to ensure consistency with theextension of the “12 month rule” under theTax Laws Amendment (2005 Measures No.5) Act 2005 (Cth) and to incorporate themost current standard licence conditions thatapply to licensees;6 February 2008 to extend the maximumperiod for registering members’ interests inthe land to 15 months from the end of theincome year in which the member firstinvests in the <strong>Project</strong> and to incorporate themost current standard licence conditions thatapply to licensees;Harvest income is held by the Custodian in adedicated bank account and does not form part ofthe income or assets of the Trust.The Responsible Entity does not believe its statusas trustee of the Trust creates any conflict ofinterest with its duties as responsible entity of the<strong>Project</strong>. The Responsible Entity notes that Growersin the Scheme are independent and separate to theTrust, and do not become beneficiaries in the Trust.As well as the financial statements of theResponsible Entity, in its own capacity, accountsare also prepared and audited annually which showthe income and expenses of the Trust.Copies of the audited annual financial reports forthe Trust are also available by contacting TheResponsible Entity.