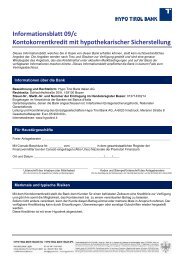

HYPO TIROL BANK AG

HYPO TIROL BANK AG

HYPO TIROL BANK AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SummaryThe following constitutes the summary (the "Summary") of the essential characteristics and risksassociated with the Issuer and the Notes to be issued under the Programme. This Summary should be readas an introduction to this Prospectus. Any decision by an investor to invest in the Notes should be based onconsideration of this Prospectus as a whole including the documents incorporated by reference, anysupplement to the Prospectus and the Final Terms. Where a claim relating to the information contained inthis Prospectus, any supplement to the Prospectus and the Final Terms is brought before a court, theplaintiff investor might, under the national legislation of such court, have to bear the costs of translating theProspectus, any supplement to the Prospectus and the Final Terms before the legal proceedings areinitiated. Civil liability attaches to the Issuer who has tabled this Summary including any translation thereof,and has applied or will apply for its notification, but only if this Summary is misleading, inaccurate orinconsistent when read together with the other parts of this Prospectus.The following Summary does not purport to be complete and is taken from and qualified in its entirety by theremainder of this Prospectus and, in relation to the terms and conditions of any particular Tranche of Notes,the Final Terms.Summary regarding the NotesMaturitiesForm of NotesDenominationNotes without principalamountPfandbriefeSuch maturities as may be agreed between the Issuer and the relevantDealer(s) and as indicated in the Final Terms, subject to such minimum ormaximum maturities as may be allowed or required from time to time by therelevant regulatory authority or any laws or regulations applicable to the Issueror to the relevant specified currency.Any Notes, the proceeds of which are to be accepted by the Issuer in theUnited Kingdom, which must be redeemed before the first anniversary of thedate of their issue, shall (a) have a redemption value of not less thanGBP 100,000 (or an amount of equivalent value denominated wholly or partlyin a currency other than Sterling), and (b) provide that no part of any such Notemay be transferred unless the redemption value of that part is not less thanGBP 100,000 (or such an equivalent amount).Notes may be issued in bearer or registered form.Notes will be issued in such denominations as may be agreed between theIssuer and the relevant Dealer(s) and as indicated in the applicable FinalTerms save that the minimum denomination of the Notes will be, if in euro,EUR 1,000, and if in any currency other than euro, an amount in such othercurrency nearly equivalent to EUR 1,000 at the time of the issue of the Notes.Notes may also be issued without principal amount. Notes without principalamount give the right to acquire any transferable securities or to receive acash amount, as a consequence of their being converted or the rightsconferred by them being exercised (where the Issuer is not the issuer ofunderlying securities or an entity belonging to the group of the Issuer).Pfandbriefe may be issued as Mortgage Pfandbriefe (Hypothekenpfandbriefe)or Public Pfandbriefe (Öffentliche Pfandbriefe).Mortgage Pfandbriefe and Public Pfandbriefe constitute recourse obligationsof the Issuer. They are secured or "covered" by separate pools of mortgageloans (in the case of Mortgage Pfandbriefe) or public loans (in the case ofPublic Pfandbriefe), the sufficiency of which is determined by the Austrian ActConcerning Pfandbriefe and Related Bonds of Public Law Credit Institutions(Gesetz über die Pfandbriefe und verwandten Schuldverschreibungenöffentlich-rechtlicher Kreditanstalten) and monitored by an independenttrustee appointed pursuant to the Mortgage Bank Act(Hypothekenbankgesetz).6