ALUMINIUM - Gulf Aluminium Council

ALUMINIUM - Gulf Aluminium Council

ALUMINIUM - Gulf Aluminium Council

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

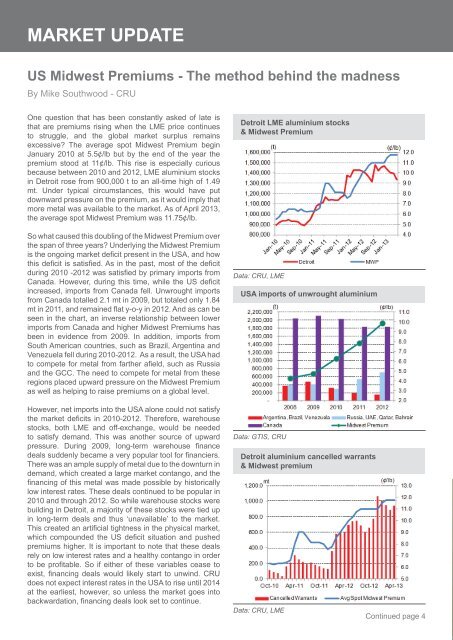

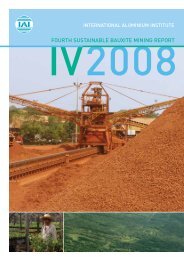

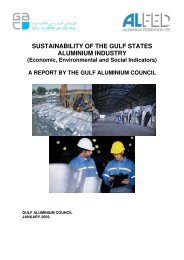

MARKET UPDATEUS Midwest Premiums - The method behind the madnessBy Mike Southwood - CRUOne question that has been constantly asked of late isthat are premiums rising when the LME price continuesto struggle, and the global market surplus remainsexcessive? The average spot Midwest Premium beginJanuary 2010 at 5.5¢/lb but by the end of the year thepremium stood at 11¢/lb. This rise is especially curiousbecause between 2010 and 2012, LME aluminium stocksin Detroit rose from 900,000 t to an all-time high of 1.49mt. Under typical circumstances, this would have putdownward pressure on the premium, as it would imply thatmore metal was available to the market. As of April 2013,the average spot Midwest Premium was 11.75¢/lb.So what caused this doubling of the Midwest Premium overthe span of three years? Underlying the Midwest Premiumis the ongoing market deficit present in the USA, and howthis deficit is satisfied. As in the past, most of the deficitduring 2010 -2012 was satisfied by primary imports fromCanada. However, during this time, while the US deficitincreased, imports from Canada fell. Unwrought importsfrom Canada totalled 2.1 mt in 2009, but totaled only 1.84mt in 2011, and remained flat y-o-y in 2012. And as can beseen in the chart, an inverse relationship between lowerimports from Canada and higher Midwest Premiums hasbeen in evidence from 2009. In addition, imports fromSouth American countries, such as Brazil, Argentina andVenezuela fell during 2010-2012. As a result, the USA hadto compete for metal from farther afield, such as Russiaand the GCC. The need to compete for metal from theseregions placed upward pressure on the Midwest Premiumas well as helping to raise premiums on a global level.However, net imports into the USA alone could not satisfythe market deficits in 2010-2012. Therefore, warehousestocks, both LME and off-exchange, would be neededto satisfy demand. This was another source of upwardpressure. During 2009, long-term warehouse financedeals suddenly became a very popular tool for financiers.There was an ample supply of metal due to the downturn indemand, which created a large market contango, and thefinancing of this metal was made possible by historicallylow interest rates. These deals continued to be popular in2010 and through 2012. So while warehouse stocks werebuilding in Detroit, a majority of these stocks were tied upin long-term deals and thus ‘unavailable’ to the market.This created an artificial tightness in the physical market,which compounded the US deficit situation and pushedpremiums higher. It is important to note that these dealsrely on low interest rates and a healthy contango in orderto be profitable. So if either of these variables cease toexist, financing deals would likely start to unwind. CRUdoes not expect interest rates in the USA to rise until 2014at the earliest, however, so unless the market goes intobackwardation, financing deals look set to continue.Detroit LME aluminium stocks& Midwest PremiumData: CRU, LMEUSA imports of unwrought aluminiumData: GTIS, CRUDetroit aluminium cancelled warrants& Midwest premiumData: CRU, LMEContinued page 4