U.S. Bank Pension Plan Summary Plan Description

U.S. Bank Pension Plan Summary Plan Description

U.S. Bank Pension Plan Summary Plan Description

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

U.S. <strong>Bank</strong> <strong>Pension</strong> <strong>Plan</strong> SPD Effective January 2011<br />

OVERVIEW<br />

The U.S. <strong>Bank</strong> <strong>Pension</strong> <strong>Plan</strong> (the "<strong>Plan</strong>") is an important part of your total compensation. It<br />

allows you to earn a monthly retirement income based on your pay and years of service. The<br />

<strong>Plan</strong> offers flexible retirement dates, a variety of payment options and survivor benefits. Plus,<br />

these benefits cost you nothing. U.S. <strong>Bank</strong> pays the full cost. When you combine your U.S.<br />

<strong>Bank</strong> <strong>Pension</strong> <strong>Plan</strong> benefits with social security and your savings in the U.S. <strong>Bank</strong> 401(k) Savings<br />

<strong>Plan</strong>, you are well on your way to a secure retirement.<br />

Effective November 15, 2009, participation in the <strong>Plan</strong> was frozen so that no new participants<br />

became entitled to benefits in the <strong>Plan</strong>. On and after November 15, 2009, employees who satisfy<br />

the eligibility requirements of the U.S. <strong>Bank</strong> 2010 Cash Balance <strong>Plan</strong> will become participants in<br />

that plan with an opportunity to receive pay and interest credits. The U.S. <strong>Bank</strong> 2010 Cash<br />

Balance <strong>Plan</strong>, a component of the <strong>Plan</strong>, is referenced in Appendix I to the <strong>Plan</strong>.<br />

This <strong>Summary</strong> is one of two summaries for the <strong>Plan</strong>. This summary describes benefits earned by<br />

individuals who elected to continue accruing benefits under the final average pay formula of the<br />

<strong>Plan</strong> and the benefit accrued by individuals prior to January 1, 2010. The other summary<br />

describes the pay and interest credits participants earn under the U.S. <strong>Bank</strong> 2010 Cash Balance<br />

<strong>Plan</strong>, which is the benefit accrued by those who were not participants in the <strong>Plan</strong> as of<br />

November 15, 2009 and by those who elected or were defaulted into the U.S. <strong>Bank</strong> 2010 Cash<br />

Balance <strong>Plan</strong> as of January 1, 2010.<br />

Relationship to Prior <strong>Plan</strong>s<br />

The <strong>Plan</strong> is the result of the merger of the Firstar Employees' <strong>Pension</strong> <strong>Plan</strong> and the U.S. Bancorp<br />

Cash Balance <strong>Pension</strong> <strong>Plan</strong>. If you earned a benefit under either of those plans, your total<br />

retirement benefit will be the sum of your benefit earned prior to January 1, 2002 (sometimes<br />

referred to as the “A” portion of your benefit) and your benefit earned after January 1, 2002<br />

(sometimes referred to as the “B” portion of your benefit). If you first began earning pension<br />

benefits on or after January 1, 2002, you will only have the "B" benefit. For Mercantile<br />

employees, the "B" portion began January 1, 2003.<br />

Information about Prior <strong>Plan</strong> Benefits<br />

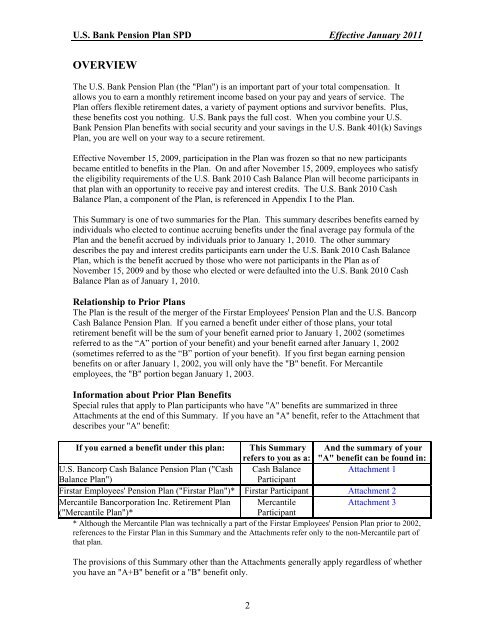

Special rules that apply to <strong>Plan</strong> participants who have "A" benefits are summarized in three<br />

Attachments at the end of this <strong>Summary</strong>. If you have an "A" benefit, refer to the Attachment that<br />

describes your "A" benefit:<br />

If you earned a benefit under this plan: This <strong>Summary</strong> And the summary of your<br />

refers to you as a: "A" benefit can be found in:<br />

U.S. Bancorp Cash Balance <strong>Pension</strong> <strong>Plan</strong> ("Cash Cash Balance<br />

Attachment 1<br />

Balance <strong>Plan</strong>")<br />

Participant<br />

Firstar Employees' <strong>Pension</strong> <strong>Plan</strong> ("Firstar <strong>Plan</strong>")* Firstar Participant Attachment 2<br />

Mercantile Bancorporation Inc. Retirement <strong>Plan</strong> Mercantile<br />

Attachment 3<br />

("Mercantile <strong>Plan</strong>")*<br />

Participant<br />

* Although the Mercantile <strong>Plan</strong> was technically a part of the Firstar Employees' <strong>Pension</strong> <strong>Plan</strong> prior to 2002,<br />

references to the Firstar <strong>Plan</strong> in this <strong>Summary</strong> and the Attachments refer only to the non-Mercantile part of<br />

that plan.<br />

The provisions of this <strong>Summary</strong> other than the Attachments generally apply regardless of whether<br />

you have an "A+B" benefit or a "B" benefit only.<br />

2