Annual Financial Statements 2008 of Bank Austria

Annual Financial Statements 2008 of Bank Austria

Annual Financial Statements 2008 of Bank Austria

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

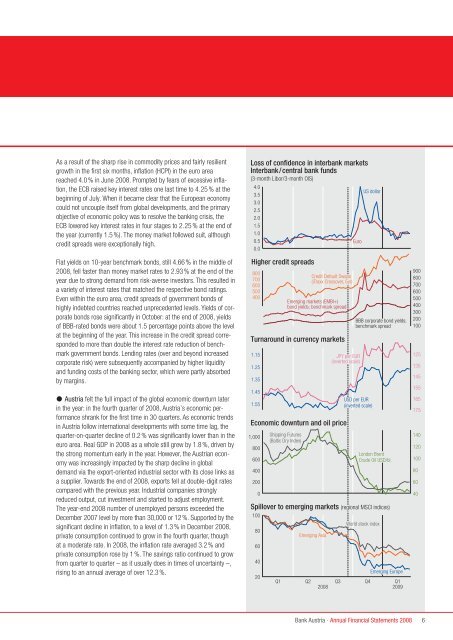

As a result <strong>of</strong> the sharp rise in commodity prices and fairly resilient<br />

growth in the first six months, inflation (HCPI) in the euro area<br />

reached 4.0 % in June <strong>2008</strong>. Prompted by fears <strong>of</strong> excessive inflation,<br />

the ECB raised key interest rates one last time to 4.25 % at the<br />

beginning <strong>of</strong> July. When it became clear that the European economy<br />

could not uncouple itself from global developments, and the primary<br />

objective <strong>of</strong> economic policy was to resolve the banking crisis, the<br />

ECB lowered key interest rates in four stages to 2.25 % at the end <strong>of</strong><br />

the year (currently 1.5 %). The money market followed suit, although<br />

credit spreads were exceptionally high.<br />

Flat yields on 10-year benchmark bonds, still 4.66 % in the middle <strong>of</strong><br />

<strong>2008</strong>, fell faster than money market rates to 2.93 % at the end <strong>of</strong> the<br />

year due to strong demand from risk-averse investors. This resulted in<br />

a variety <strong>of</strong> interest rates that matched the respective bond ratings.<br />

Even within the euro area, credit spreads <strong>of</strong> government bonds <strong>of</strong><br />

highly indebted countries reached unprecedented levels. Yields <strong>of</strong> corporate<br />

bonds rose significantly in October: at the end <strong>of</strong> <strong>2008</strong>, yields<br />

<strong>of</strong> BBB-rated bonds were about 1.5 percentage points above the level<br />

at the beginning <strong>of</strong> the year. This increase in the credit spread corresponded<br />

to more than double the interest rate reduction <strong>of</strong> benchmark<br />

government bonds. Lending rates (over and beyond increased<br />

corporate risk) were subsequently accompanied by higher liquidity<br />

and funding costs <strong>of</strong> the banking sector, which were partly absorbed<br />

by margins.<br />

� <strong>Austria</strong> felt the full impact <strong>of</strong> the global economic downturn later<br />

in the year: in the fourth quarter <strong>of</strong> <strong>2008</strong>, <strong>Austria</strong>’s economic performance<br />

shrank for the first time in 30 quarters. As economic trends<br />

in <strong>Austria</strong> follow international developments with some time lag, the<br />

quarter-on-quarter decline <strong>of</strong> 0.2 % was significantly lower than in the<br />

euro area. Real GDP in <strong>2008</strong> as a whole still grew by 1.8 %, driven by<br />

the strong momentum early in the year. However, the <strong>Austria</strong>n economy<br />

was increasingly impacted by the sharp decline in global<br />

demand via the export-oriented industrial sector with its close links as<br />

a supplier. Towards the end <strong>of</strong> <strong>2008</strong>, exports fell at double-digit rates<br />

compared with the previous year. Industrial companies strongly<br />

reduced output, cut investment and started to adjust employment.<br />

The year-end <strong>2008</strong> number <strong>of</strong> unemployed persons exceeded the<br />

December 2007 level by more than 30,000 or 12 %. Supported by the<br />

significant decline in inflation, to a level <strong>of</strong> 1.3 % in December <strong>2008</strong>,<br />

private consumption continued to grow in the fourth quarter, though<br />

at a moderate rate. In <strong>2008</strong>, the inflation rate averaged 3.2 % and<br />

private consumption rose by 1 %. The savings ratio continued to grow<br />

from quarter to quarter – as it usually does in times <strong>of</strong> uncertainty –,<br />

rising to an annual average <strong>of</strong> over 12.3 %.<br />

Loss <strong>of</strong> confidence in interbank markets<br />

Interbank/central bank funds<br />

(3-month Libor/3-month OIS)<br />

4.0<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

Higher credit spreads<br />

800<br />

700<br />

600<br />

500<br />

400<br />

Turnaround in currency markets<br />

1.15<br />

1.25<br />

1.35<br />

1.45<br />

1.55<br />

Economic downturn and oil price<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

80<br />

60<br />

40<br />

20<br />

Shipping Futures<br />

(Baltic Dry Index)<br />

Credit Default Swaps<br />

(iTraxx Crossover, 5yr)<br />

Emerging markets (EMBI+)<br />

bond yields; benchmark spread<br />

Euro<br />

US dollar<br />

BBB corporate bond yields;<br />

benchmark spread<br />

Spillover to emerging markets (regional MSCI indices)<br />

100<br />

Emerging Asia<br />

JPY per EUR<br />

(inverted scale)<br />

USD per EUR<br />

(inverted scale)<br />

London Brent<br />

Crude Oil USD/bl.<br />

World stock index<br />

Emerging Europe<br />

Q1 Q2 Q3 Q4 Q1<br />

<strong>2008</strong> 2009<br />

<strong>Bank</strong> <strong>Austria</strong> · <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2008</strong><br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

125<br />

135<br />

145<br />

155<br />

165<br />

175<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

6