Annual Reports - Indraprastha Gas Limited

Annual Reports - Indraprastha Gas Limited

Annual Reports - Indraprastha Gas Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4. Estimated amount of contracts remaining to be executed on capital account and not provided for (net of advances)<br />

Rs 701,143,333 (previous year Rs 639,812,199).<br />

5. The Company has installed CNG Stations on land leased from various Government Authorities under leases for periods<br />

ranging from one to five years. However, assets constructed/installed on such land are depreciated generally at the rates<br />

specified in Schedule XIV to the Companies Act, 1956, as the management does not foresee non-renewal of the above<br />

lease arrangements by the Authorities.<br />

6. Deposits from customers of natural gas, refundable on termination/alteration of the gas sales agreements, are considered<br />

as long term funds.<br />

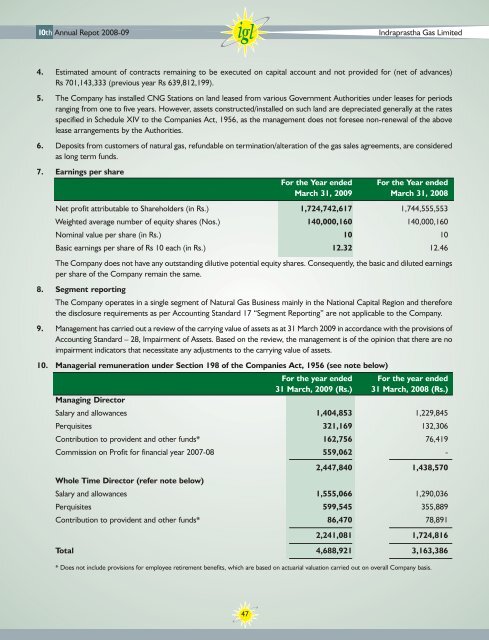

7. Earnings per share<br />

47<br />

For the Year ended For the Year ended<br />

March 31, 2009 March 31, 2008<br />

Net profit attributable to Shareholders (in Rs.) 1,724,742,617 1,744,555,553<br />

Weighted average number of equity shares (Nos.) 140,000,160 140,000,160<br />

Nominal value per share (in Rs.) 10 10<br />

Basic earnings per share of Rs 10 each (in Rs.) 12.32 12.46<br />

The Company does not have any outstanding dilutive potential equity shares. Consequently, the basic and diluted earnings<br />

per share of the Company remain the same.<br />

8. Segment reporting<br />

The Company operates in a single segment of Natural <strong>Gas</strong> Business mainly in the National Capital Region and therefore<br />

the disclosure requirements as per Accounting Standard 17 “Segment Reporting” are not applicable to the Company.<br />

9. Management has carried out a review of the carrying value of assets as at 31 March 2009 in accordance with the provisions of<br />

Accounting Standard – 28, Impairment of Assets. Based on the review, the management is of the opinion that there are no<br />

impairment indicators that necessitate any adjustments to the carrying value of assets.<br />

10. Managerial remuneration under Section 198 of the Companies Act, 1956 (see note below)<br />

For the year ended For the year ended<br />

31 March, 2009 (Rs.) 31 March, 2008 (Rs.)<br />

Managing Director<br />

Salary and allowances 1,404,853 1,229,845<br />

Perquisites 321,169 132,306<br />

Contribution to provident and other funds* 162,756 76,419<br />

Commission on Profit for financial year 2007-08 559,062 -<br />

2,447,840 1,438,570<br />

Whole Time Director (refer note below)<br />

Salary and allowances 1,555,066 1,290,036<br />

Perquisites 599,545 355,889<br />

Contribution to provident and other funds* 86,470 78,891<br />

2,241,081 1,724,816<br />

Total 4,688,921 3,163,386<br />

* Does not include provisions for employee retirement benefits, which are based on actuarial valuation carried out on overall Company basis.