Yapı Kredi Investor Presentation

Yapı Kredi Investor Presentation

Yapı Kredi Investor Presentation

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Banking sector is yet underpenetrated…BRANCHES PERMLN INHABITANTS540Eurozone200692Turkey2006(LOANS+DEPOSITS)/GDPUNDERPENETRATED BANKING MARKET IN TERMS OF BOTH INDIVIDUALBANKING PRODUCTS AND SME LENDING78.5%40.4%4%15.7%7.7%4%5.5%1%Mortgages Consumer loans (1) Credit cards (1)MUTUAL FUNDS/GDP4%INSURANCE PREMIUMS/GDPUK (2005)Eurozone (2005)Turkey (2006)SME CASH LOANS/GDP (2)USA71%UK12.5%Germany18.1%214%89%UKGerm.Hung.25%11%11%USGerm.Cze9.1%6.8%4%UKItalyFrance17.1%17.0%16.7%Eurozone2006Turkey2006Turkey3.8% Turkey2006 year end figures for Turkey, Hungary and Czech while 2005 year end figures the rest.(1) For personal loans, EU figures exclude professional loans, which make up another 10% of GDP; for credit cards, outstanding balances to GDP used. Source: YKB team analysis, TBA, BRSA,Merrill Lynch1.7%Turkey3.8%(2) Based on companies below 3 million USD turnover. Source: KOSGEB, SIS, McKinsey5

AgendaMacroeconomic & Banking EnvironmentYKB’s Competitive Positioning9M 2007 Results (BRSA Bank-only)Strategic GuidelinesAnnex7

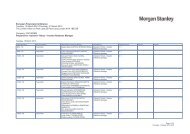

Yapı <strong>Kredi</strong> at a glanceFINANCIAL HIGHLIGHTS(BRSA Bank-Only Figures in YTL, 30 Sep 2007)Total Assets (bln) 47.9Performing Loans (net, bln) 25.2Deposits (bln) 31.5Extensive distribution network of 661* brancheswith over 11% market share in top 10 citiesin TurkeyMutual Funds (bln) 4.8Number of Credit Cards (mln) 5.4Number of Customers (mln) 14.0Number of Branches 661Number of ATMs 1,873Number of Employees 13,712Paid-in in Capital (mln(mln) 3,149 (1)* Including 1 off-shore branch in Bahrain(1) 3,427 mln YTL as of 26 October 20078

Strong franchise with unique competitive advantagesLARGE NETWORK & LEADING BRANDLEADERSHIP IN KEY SEGMENTS/PRODUCTSSEGMENT FOCUSED ORGANISATION ALREADY IN PLACEUnique competitive advantagesHIGH SOLID RISK PROFILEQUALITY REVENUE GENERATION...... WITH LARGE CUSTOMER BASE NOT YET FULLY EXPLOREDFOCUS ON EFFICIENCY AND CUSTOMER SERVICESTRONG SHAREHOLDERS9

Segment focused organisationDivisionalised structure……with leading product factories and networksL• No 1 in credit cards (25%) & non-cash loans (18%)• Mcap: Euro 8.3 blnNO 1 PLAYER IN THE MARKETCreditCardsRetail Private Corporate CommercialProductFactories• #1 in Factoring (market share: 20%)• 5.4 M cards• 230K POS• 156 directsales force• 516 branches• 2,743 RMs• 1,723 ATMs• 21 branches• 213 RMs• 8 branches• 73 RMs• 116 branches (1)• 457 RMsL• #1 in Leasing (market share: 21%)• Mcap: Euro 773 mlnLEADING POSITIONMassAffluentInt’l Operations• #2 in Mutual Funds (market share: 19%)UpperMassSMEHNWUHNW• YK Nederland• YK Moscow• YK Azerbaijan• #3 in Private Pension Funds (market share:16%)• #6 in Brokerage (market share: 4%)L• #7 in Non-life Insurance (market share: 6%)• Mcap: Euro 467 mlnHNW= High Net WorthUHNW=Ultra High Net Worth(1) Including 2 Free Zone branches10Market shares as of 30 Sep2007, market capitalisations as of 31 Dec 2007L= Listed

AgendaMacroeconomic & Banking EnvironmentYKB’s Competitive Positioning9M 2007 Results (BRSA Bank-only)Strategic GuidelinesAnnex12

9M2007 Key Highlights:Another quarter of consistent post-merger growth &profitability improvement• YTL 632 mln of bank-only net income (87% YoY (1) and 9% QoQ) with bank-only ROE of 25% (+7 ppts up YoY (1) ). YTL 721mln of consolidated net income (after minorities)• Healthy revenue growth of 18% YoY (1)(2) , another quarter of solid fee &commission growth (15% QoQ)• Positive growth trend in all almost segments of loans (especially SME & Consumer) and deposits with market share gainsin general purpose loans (+26% QoQ) accelerated by launch of CARMA (3) project• Further improvement in CAR to 12.9%• Leadership in credit cards maintained with outstanding volume market share up to 25.3% (+0.1 ppts QoQ)• Completed project for the reconstruction of Turkey’s largest credit card platform, WORLD, on 5 Nov• Announced credit card brand sharing agreement with Vakıfbank on 7 Nov, largest partnership in terms of numberof credit cards (WORLD total: in excess of 8.5 mln) and issuing volume• Cost/Income down to 61% (1)(2) in 9M07 (-5 ppts YoY (1) ) (51% if cost base adjusted for IFRS)• NPL ratio down to 6.6% (-0.2 ppts vs 2Q) with 82.4% NPL provisioning coverage• 23 new branch openings in 3Q07 totalling 53 YTD, in line with accelerated branch opening plan (total: 661). 721additional recruitments YTD in 2007 to support the plan• Secured one-year USD 800 mln syndicated loan on 24 Sept with an all-in cost of Libor + 47.5 bps (down from 52.5 bpslast year) through the participation of 31 international banks• Completed 1st phase of KFS restructuring on 26 Oct with the transfer of YK Leasing, YK Factoring and YK Azerbaijanshares from KFS to YKB. Increase of KFS ownership in YKB to 81.8% (+1.6%)(1) In comparison with 9M06 YKB pro-forma merged bank figures normalized for the financial cost of stake increase and sub-loan as well as some minor accounting policy applications.(2) Adjusted to exclude loan write-off effects mainly due to Superonline stake sale in 2Q07 and non-core fixed 13 asset sale gain/loss in 3Q07(3) Centralized Automated Risk Management Approach

Solid quarterly track record in profitability improvement338+87%632Net Income (mln YTL)188 213 232+7 ppts18%35% ontangibleequity25%ROE (3)22%38% ontangibleequity25% 27%9M06N9M071Q07 2Q07 3Q079M069M071Q07 2Q07 3Q07-5 pptsCost / Income (2)Net Income / Av.RWA66%61%60% 61% 60%+87 bps54% (1) 51% (1) 51% (1)51% (1) 51% (1)1.51%2.38%2.32% 2.41% 2.41%9M06N9M071Q07 2Q07 3Q079M06N9M071Q07 2Q07 3Q079M06N: As per BRSA financial reports, the 2006 figures refer to pre-merger YKB. For comparison, throughout the presentation, 2006 figures have been stated as pro-forma for the merged bank (YKB andKoçbank) normalized for the financial cost of stake increase and sub-loan as well as some minor accounting 14policy applications.9M06 figures not adjusted for the effects of corporate tax rate decrease from 30% to 20% due to change in taxlegislation in 2Q06 (1) Cost base adjusted by provision expenses of pension fund and Worldcard points for comparisonwith IFRS guidance. (2) Adjusted to exclude loan write-off effects mainly due to Superonline stake sale in 2Q07 and noncorefixed asset sale gain/loss in 3Q07 (3) ROE calculations based on beginning of year equity.

Increased commercial focus in the network acceleratinggrowth with selective market share gainsTotal Loans (mln YTL)TL Loans (mln YTL)Market Shares* (%)11% YoY12%22,504 22,33125,20424,0355%16%17,80016,53915,349 15,0508%2006 1Q07 2Q07 3Q07FC Loans (mln USD)21%6,2765,194 5,389 5,8487%4Q06 1Q07 2Q07 3Q07Loans 10.2% 9.6% 9.8% 9.8%TL loans 9.9% 9.2% 9.4% 9.2%FC loans 11.0% 10.7% 10.9% 11.1%Deposits 10.3% 9.2% 9.8% 9.6%28Dec10.2%9.4%12.0%9.4%2006 1Q07 2Q07 3Q07Total Deposits (mln YTL)6% YoY1%31,12728,87031,741 31,517-1%2006 1Q07 2Q07 3Q072006 1Q07 2Q07 3Q07TL Deposits (mln YTL)13%18,117 18,28416,1671%15,7392006 1Q07 2Q07 3Q07FC Deposits (mln USD)3%10,85910,62711,2159,7196%2006 1Q07 2Q07 3Q07TL Dep. 8.7% 8.1% 8.8% 8.7%FC Dep. 12.9% 11.0% 11.4% 11.3%Non-cashloans20.2%18.7% 18.8% 18.0%(*) Excluding accruals, based on weekly BRSA data8.6%10.7%17.6%• Slight decrease (-1%) in totaldeposits QoQ, mainly driven by3% decrease in FC deposits (in YTLterms) due to appreciating YTLUSD/YTL exchange rates -- 2006: 1.378, 1Q07: 1.351, 2Q07: 1.282, 3Q07: 1.18015

Healthy revenue growth (+18% YoYA (2) ) and cost control(+8% YoYA (2) ) continuing(mln YTL)9M069M07 YoY %Total Revenues2,184 2,068 2,691 +23% +30%Net Interest Income 1,307 1,191 1,451 +11% +22%Non-Interest Income 877 877 1,240 +41% +41%o/w Fees & Comm.9M06NOperating Costs (1,362) (1,362) (1,737) +27% +27%HR costs (447) (447) (574) +28% +28%Non-HR costs (915) (915) (1,163) +27% +27%Core Non-HR (1) (576) (576) (845) +47% +47%Operating Income 822 705954+16%YoY %Normalized629 629726 +15% +15%+35%Provisions (267) (211) (186) -30% -12%Pre-tax Income 555 495768 +38% +55%Net Income 387 338632 +63% +87%+18%Total Revenues (2)+8%Operating Costs (2)+1%Core Non-HR(2)(1) Including depreciation and excluding HR related costs (such as management bonuses, ETB, and vacation rights ) and pension fund and bonus point provisions(2) Adjusted to exclude loan write-off effects mainly due to Superonline stake sale in 2Q07 and non-core fixed 16asset sale gain/loss in 3Q07. For a detailedexplanation, please see slide 47

Improved revenue mix with higher share of interestincome (+22% YoYN) and fees (+15% over 2Q)Composition of Revenues (mln YTL)Trading Inc.Dividend. Inc.Other Oper. Inc.30%2,0682%2%8%140%15%2,6913%1%15%27%2,4333% 2%5%30%Net Fees & Commissions (mln YTL)225.1 239.1210.5 211.313%15%275.2Net Fees &Commissions30%Net InterestIncome58%22%54%60%3Q06N 4Q06N 1Q07 2Q07 3Q0722% increase in3Q07 vs 3Q06N9M06N 9M07 9M07A• In 9M07, net interest income increased by 22% YoY and fees & commissions increased by 22% in 3Q07 vs.3Q06 (15% vs 2Q07), mainly driven by credit cards and asset management fees.• Higher share of fee income in total revenues vs the peer average and the sector(1) Adjusted to exclude loan write-off effects mainly due to Superonline stake sale in 2Q07 and non-core fixed asset sale gain/loss in 3Q07(2) Peers adjusted for one-off gains in 9M0717(1)

Strengthened interest income with a diverse mix......heavy in higher margin SME and consumer loansComposition of Interest Income (mln YTL)Cash Loans by SBU*LargeMedium Consumer (3) SME (4) Credit Cards PrivateCorporate (1) Corporate (2)Other3,4406%28% YoY25%40%4,4096%28%20063Q0725%27%23%27%Corporate (50%, down 2 ppts vs 06YE)11% 10% 26% 1%11% 12% 26% 1%Retail (50%, up 2 ppts vs 06YE)SecuritiesFC LoansYTL Loans26%10%58%6%27%8%58%Total Loans (mln YTL) TL Loans (mln YTL)12% YTD 16% YTD11%25,20422,741 22,331 24,03520%17,8005%14,855 15,050 16,5398%FC Loans (mln USD)21% YTD7%6,2765,8775,389 5,8487%9M06N9M073Q06 1Q07 2Q07 3Q073Q06 1Q07 2Q07 3Q073Q06 1Q07 2Q07 3Q07• Share of retail in total cash loans increased to 50% (+2ppts vs YE06) mainly driven by increased focus on consumer and SME• Differentiated and dedicated approach to SMEs resulted in increased weight of SME’s in total cash loans up to 12% (+2 ppts vs YE06)• 26% of cash loans constituted by highest yielding credit cards(*) MIS data (commercial bank only)18(1) Loans extended to companies with annual turnover of above 50 mln USD(2) Loans extended to companies with annual turnover between 3 – 50 mln USD(3) Loans extended to individuals (housing, auto and general purpose loans)(4) Loans extended to companies with annual turnover less than 3 mln USD

Heavier weight of loans (+7 ppts vs YE06), reduced weightof securities (-7 ppts vs YE06) in total assetsNon IEAsOther IEAsSecurities (1)Loans92%Composition of Assets (mln YTL) TL/FC Breakdown of Assets (mln YTL)45,940 46,744 47,803 47,9172%8% 8% 8% 8%14% 13% 13% -1% 12%28% 31% 29% -8% 27%92%50% 48% 50% 53%0.2% +2% inUSD terms5%FCTL43% 42% 40% -6% 38%4%57% 58% 60% 62%3Q06 1Q07 2Q07 3Q073Q06 1Q07 2Q07 3Q073Q06 2006 1Q07 2Q07 3Q07TL Loans/Loans (2) 65% 68% 67% 68% 70%TL IEAs/IEAs 55% 53% 55% 57% 60%Loans (2) /Deposits 75% 71% 77% 75% 79%• IEAs remain high at 92%• 103 mln YTL of non-core realestate has been disposedout of first tranche portfolioannounced on 12 July, withfurther disposal expected in4Q & 08• Increase in TL IEAs in totalIEAs to 60%, +3 ppts vs. 2Q,driving margins higher• Share of loans in total assetsincreased to 53%, up 3 pts vs.2Q07; further shrinkage insecurities portfolio to 27% (-2ppts vs. 2Q)• 70% of total loansconstituted by less riskyhigher margin TL loans vs. FCloans• Further room forimprovement inloans/deposits ratio (79%)(1) Securities including derivative accruals.(2) Performing loans19

96% of securities portfolio invested in HTM in line withstable revenue generation and limited capital at risk23% YTDAvailableFor SaleTrading13,382Securities Compositionby Type (mln YTL)14,654 13,7548%12,7045% 3% 2% 2%2% 2%4% 2%FCSecurities Compositionby Currency (mln YTL)54% 52% 51% 50%(26%FLOATING)(20%FLOATING)(21%FLOATING)(21%FLOATING)Held-tomaturity91% 95% 96% 96%YTL46% 48% 49% 50%(47%FLOATING)(54%FLOATING)(69%FLOATING)(75%FLOATING)3Q06 1Q07 2Q07 3Q073Q06 1Q07 2Q07 3Q07• Strong focus on risk management• Derivatives allowed only for hedging purpose; options allowed only for client-driven transactionsimmediately fully hedged• No FX speculative open positions allowed ; VaR limits, stop loss, max open position monitored on a dailybasis• Securities declined by 23% YTD due to redemptions of short term bonds; share of securities in total assetsshrunk by 2 ppts vs 2Q to 27%20

Continuing positive trend in consumer loan marketshares, especially in general purpose loans (+26% QoQ)CreditCards14% YoYAutoGen.PurposeHousingComposition of ConsumerLoans & Credit Cards (mln YTL)8,2927%8%19%66%13% YTD8,1776%8%19%66%8,8465%9%20%66%7%9,4535%10%21%64%3Q06 1Q07 2Q07 3Q07Note: Consumer loans are those loans granted to individuals only(1) Centralized Automated Risk Management ApproachHousing Loans (mln YTL)26% YTD25%1,561 1,591 1,73512%1,9513Q06 1Q07 2Q07 3Q07Gen. Purpose Loans (mln YTL)42% YTD47%96166976465426%3Q06 1Q07 2Q07 3Q07Auto Loans (mln YTL)13% YTD20%587486 468 4690.2%3Q06 1Q07 2Q07 3Q0721Consumer loans-Housing- Gen. Purpose-AutoMarket Shares *1Q075.6%6.8%3.4%8.1%2Q075.5%6.8%3.4%8.1%(*) Excluding accruals, based on weekly BRSA data3Q075.7%7.0%3.8%8.2%28 Dec6.2%7.3%4.6%8.9%• Consistent quarterly increase in allconsumer loan market shares• Consumer loan growth in Q3 mainlydriven by above sector growth ingeneral purpose (26% vs 2Q) andhousing loans (12% vs 2Q)• Growth in general purpose loans mainlydue to the successful implementationof the CARMA (1) project through preapprovedlimits for ~1.3 mln existingcustomers• 64% share of credit cards in retail loans,down from 66% in 2Q

Long-standing leadership position in credit cards maintainedNo of CCsMarket ShareIssuing VolumeMarket Share (quarterly)2006 1Q072Q073Q0719.7% 19.3%19.3%19.0%(1)23.5% 23.7% 23.4%# of credit cards (2)# of merchants5,098,115 5,164,730 5,328,742168,235 174,332 185,8255,418,236193,631# of POS194,400 174,332 218,603229,8044Q06 1Q07 2Q07 3Q071Q07 2Q07 3M asof OctCC Turnover (mln YTL, cum.)Revolving RatioCard Activation RatioFraud/Volume28,009 6,997 15,25129.6% 31.80% 29.40%84.0% 84.0% 86.7%0.022% 0.015% 0.015%4.20% 4.20% 4.35%23,70930.20%86.0%0.010%4.77%Credit Card Outstanding (mln YTL)Mkt share:(CE)KoçbankYKB27.0% 26.3% 25.4% (2) 25.2% 25.3%5519 5,584 5,6026,0725,8793%98% 10% YoY3Q06 4Q06 1Q07 2Q07 3Q07YKBMkt. ShareAdvantageChurn Rate (3) (As of Sep 2007)Market Share vs Closest CompetitorNumberof CCs19.0% (1) AcquiringVolume21.6%IssuingVolume23.4%CCsOutstanding25.3%-166 bps+ 170 bps+ 178 bps+ 390 bps(1) Excluding the estimated Maximum-card issuance of Ziraat to the existing customers. Including: 18.5%(2) Excluding virtual cards. Total # of credit cards including virtual cards: 6,568,048.(3) Card terminations based on customer requests.22

Completion of project to reconstruct Turkey’s largest creditcard platform, WORLD, through “can-do” philosophy• First not only in Turkey but also globally• New system structured under one card and one brand under theumbrella of WORLD• End of “card inflation” in wallets• “Can-do” philosophy– Interactive, customized program architecture – one or more clubsand programs easily loaded into any credit card– 6 new clubs, 4 new programs offering different services and addedvalue, able to evolve in parallel to changing customer preferences– Quick, easy and practical solutions for consumers regardless ofincome level or social class• No additional costs for unnecessary features• End of CRM phase, transition to CMR dimension (Customer ManagedRelationship)Changing the paradigm and approach in the industry,defining the standards of the future23

Strong and diversified liability structure with solid depositbase and international funding capacity and accessComposition of Liabilities(mln YTL)Composition of Customer Assets(mln YTL)Market Sharein Mutual Funds20.7% 19.1% 19.3% 19.9%SHERepos (2)FundsBorrowed (3)45,940 46,74447,803 47,9175%9% 11% 11%10%6%7% 8% 8% 8%2%2% 2%7% 8%13% -2% 13%11% 13%MutualFunds (4)Assets UnderCustody48,3867%10%21%46,157 46,1478%2%10%10%20%19%3%2%3%14%47,3082%10%21%1Q07 2Q07 3Q07 Oct-07Repo (2) • 19.9% market shareFC Deposit (5)28%28%30%-3%28%Others (1) TL Deposit (5)Deposits (4)65%62%66%-1%66%34%34%39%1%39%in mutual funds (#2player) with thereturn of positivetrend3Q06 1Q07 2Q07 3Q073Q06 1Q07 2Q07 3Q07• 3% increase inmutual funds in Q3over Q224(1) Includes pension fund deficit of 447 mln YTL and 574 mln YTL accounted respectively in 3Q06 and 3Q07(2) Including bank repos(3) Includes domestic and international borrowings (incl. securitizations and sub-loans)(4) Excluding pension funds and other DPM (5) Including bank deposits

Consistently strong fee & commission growth driven byleading positions in credit cards, asset managementand non-cash loansFees & Commission Income(mln YTL)PaidNet9M06N 185 629 8149M075%193 72615% 13%Net Fees & Commissions/ Total Revenues (1)30% 30%9M06N32% 27%3Q06N 1Q07Received91929%2Q07ANet Fees & Commissions/ Opex (1)46% 49%9M06NCumulativeCumulative9M07A9M0744% 45%2Q06N 1Q07QuarterlyQuarterly47%2Q07A34%3Q07A56%3Q07AComposition ofFees & Commission ReceivedAsset Mng.10%(3)Other 25%CreditCards 51%CC Fee and CommissionCashWithdrawal12%Other 1%Interchange38%Cash Loans4%Non CashLoans 11%Overlimit11%Annual Fee12%Merchant 26%• 15% YoY growth in fee andcommission income (15%QoQ)• Healthy composition of feeand commission incomederived from leadingpositions in credit cards,asset management andnon-cash loans• 51% of total fee andcommission incomegenerated by credit cards• Further room fordiversification andexpansion in fee incomedue to cash-loan growthpotential• Contribution of fee &commission income to totalrevenues at 30% (1)• Fees & commissions cover112% of HR related costs (2)(1) Adjusted to exclude loan write-off effects mainly due to Superonline stake sale in 2Q07 and non-core fixed asset sale gain/loss in 3Q07(2) Including HR-related Non-HR costs25(3) Includes fees and comms. from banking transactions such as money transfers, background enquiry fees for loan applications, insurance etc.

NIM improved to 4.6% due to better mix9M07 Net RevenuesRetail 14%Private 3%SME 10%Retail 21%MediumCorporate22%(1)Other 25%SME 14%LargeCorporate 6%Credit Cards26% MediumCorporate14%3Q07 Customer VolumesPrivate 14%LargeCorporate24%(2)Credit Cards9%NIM9.0%4.6%(3)Revenues / Average IEAs7.6%5.2%7.2% 7.7%4.1%4.2%7.9%4.5%7.2%4.2%8.4%4.5%9.0%4.6%1Q 2Q 3Q 4Q 2006 1Q07 2Q07 3Q079M07 - Annual Revenues / Average IEAs*ow/ NIM:4.4%Quarterly(4)8.1%YKBAnnual7.6%Quarterlyow/ NIM:4.7%(*) After adjusting revenues for the excess capital base vs. 12% CAR as the benchmark(excess capital * avg. annual interbank rate). Peers adjusted for one-off gains in 9M07(4)Peer Avg.(5)6.9%* ow/ NIM:4.1%(6)• 26% of revenuesgenerated by mostprofitable credit cardbusiness• Sum of retail and SMEsegments generate 28%of revenues and 31%volumes (2)• Consistent quarterlyincrease in NIM furtherimproving to 4.6% in 3Q(up from 4.5% in 2Q and4.2% in 1Q)• Revenues/IEAs up to9.0% in 3Q driven bygrowth in higher marginproducts/segments(credit cards, SME loans)• Higher ratio ofRevenues/IEAs (8.1%) vspeer average in 9M07(1) Treasury, work out and other(2) Cash loans + Non cash loans + Deposits + Asset under Management + Assets under Custody. 26(Only commercial bank driven values)(3) Excluding dividends 8.5%(4) Normalized(5) If adjusted by provision reversals mainly from Superonline stake sale: 7.7%(6) If adjusted by non-core fixed asset sale gain/loss: 7.5%

Costs under control despite branch expansionHRHR Related Non-HR (1)Other Non-HR (2)Core Non-HR (3)Total Costs (mln YTL)1,36244785 76254576+8%+28%-11%-5%+1%1,475 (4)574242583• Total costs (4) increased to 1,475 (5) mln YTL in9M07, up 8% YoY, mainly affected by salaryadjustment in 1H07 and branch expansion• Total HR costs (including HR related non-HR)increased 22% YoY, mainly driven byaccelerated branch network expansion• 2% decrease in total non-HR costs due to strictcost management• Opex/average assets improved +231 bps in9M07A (4) vs. same period last yearTotalNon-HR:Opex / Average Assets-2% YoY 3.3%3.0%9M06N9M07A(4)9M06N9M07A(4)(1)HR related non-HR includes MBO (Management by Objectives – Results driven bonus scheme), ETB and vacation rights27(2)Includes provision expenses for pension fund and world card points(3) Including depreciation and excluding HR related costs (such as management bonuses, ETB, andvacation rights ) and pension fund and bonus point provisions(4) Adjusted to exclude loan write-off effects mainly due to Superonline stake sale in 2Q07 and non-core fixed asset sale gain/loss in 3Q07(5) If not adjusted: 1,737 mln YTL

Branch expansion in line with planYKB’s Domestic Branch NetworkNew Branch Openings• 661 branches (1) in 67 cities as of 30 Sept 2007• 11% market share in top 10 cities• 64% of branch network concentrated in top 4 cities# of Branches2007 target ~ 80•Year to Date (net) 53•Ankara 5•Istanbul 6•Izmir 5•Others 372008 target ~160Total number of branches to reach by end-2009:~1,000• Announced the agressive branch expansion plan in July 07• Target is to open 350 branches (vs. previous target of 100)• 53 branches already opened YTD out of a target of 80 for 07 as of Sept 07• 721 additional recruitments YTD in 2007 to support the plan, ~410 more expected in 4Q07(1) Including one off-shore branch in Bahrain28

NPL ratio down to 6.6% (-0.2 ppt vs 2Q), confirmingstrong focus on asset qualityNPL RatioCoverage RatioGrossNetNPL Watch Loan Standard Total81.8% 82.4%7.2% 7.5%6.8%6.6%7.0% (1) 6.5% (1) 6.3% (1)1.5% 1.6% 1.4% 1.2%11.1%11.4%2.0% 1.8%8.1%7.4%2006 1Q07 2Q07 3Q07 2006 1Q07 2Q07 3Q07 2006 3Q07 2006 3Q07 2006 3Q07 2006 3Q07• Significant drop in gross NPL ratio QoQ by 0.2 ppts to 6.6% with further room to improve• NPL coverage ratio at 82.4% (remaining 19.5% collateralized) and total coverage ratio constantat 7.4%• Watch loan coverage at 11.4% and standard coverage at 1.8%, highlighting a moreconservative approach vs. the market(1) Excluding the impact of the new regulation related to participations of Bank’s29

From operating income to net income9M2007(mln YTL)35% YoYN13% QoQ• Provision on noncoresubsidiaries ofYTL 52 mln• Other provisions ofYTL 5 mln• Current tax expense ofYTL -214 mln• Deferred tax incomeof YTL +77 mln12957137+87% YoYN+9% QoQ954• Specificprovisions ofYTL 118 mln• Generalprovisions ofYTL 11 mln632OperatingIncomeLoan LossProvisionsOther Provisions Taxes Net Income30

AgendaMacroeconomic & Banking EnvironmentYKB’s Competitive Positioning9M 2007 Results (BRSA Bank-only)Strategic GuidelinesAnnex31

Strategy focused on ensuring accelerated growth,profitability and efficiencyKEY OBJECTIVES• Leadership in the higherreturn on capital andgrowthsegments/businesses• Strong investment innetwork developmentand customer satisfaction• Efficient cost/income,most effective sales forceand outstanding riskmanagementKEY STRATEGIC GUIDELINESFOCUS ON 4 MAIN BUSINESS TARGETS:• Expand branch network significantly• Reinforce leadership in Credit Cards• Growth in SME Banking on the back of underpenetrated SMEmarket• Bring individuals segment towards higher profitability through: reactivating dormant/low activity client base increasing penetration through cross selling expanding consumer lending mainly throughdevelopment of the mortgage market and relaunchingefficiency programsIn addition:• Continue to expand Private Banking leveraging on strongmutual funds position• Selective growth in Commercial and Corporate Banking32

Accelerated branch openings expected to providestronger value creation• Number of branches is rapidly expanding….• … with room for further expansion: 500 newbranches and 11,000 employees in ‘06• … 500 new branches and 10,640 employeesfurther added to the sector as of Sept 07 YTDYAPI KREDİ IS READY TO EXPLOIT THIS POTENTIAL2002 2006• Strong capability and drive of YKB to reach break-evenNO OF BRANCHES IN TURKEY6,1066,849• Favorable market conditions in terms of branch profitability• Accelerated branch openings of up to 350 branches in 3 yearsunder consideration vs existing plan of 1007,366Sept 07BRANCH PENETRATIONCorrelation = 90%NLTR, 2006UKCH0 10 20 30 40GDP per capitaGermanyFranceItalyBRANCH PROFIT ANDVOLUMES: BENCHMARKINGBelgiumSpainPortugalTurkey ‘06Retailprofit/branchEUR Thousands163134309241383334431Retail volumes/branchEUR Million22194231295668133

Profitable growth in SME banking with a differentiatedapproach on the back of underpenetrated marketSME LENDING (1) AS % OF TOTAL BANK LOANS+2ppts13%11%2007F 2009SME REVENUES AS % OF TOTAL BANK REVENUES+3ppts19%16%2007F 2009# of Active SME CLIENTS+136K503K367K2007F 2009YKB’s Differentiated SME Approach:• Fast and Outstanding Service for SMEs• Dedicated service model with 1100 specialized micro and macro RMs• Simplified proprietary credit underwriting process already developedand in use for 2 years (SMILE)• Bundled product offerings with insurance coverage, working capitaland asset based financing options (leasing)• Unique offering in the market through disbursement of Grant Programs whichare supplied by national and international institutions• In 2006, 5 mln Euros of EU funds granted to 51 SMEs• In 2007, 289 new projects totaling 34 mln Euros in process up-to-date.Expected approval ratio: 80%• Specialized consultancy services free of charge: Basel II meetings, SME fairs,services for Chambers of Commerce, Anatolia Meetings, value creatingonline platform, first in Turkey (www.kobiline.com)• 3,200 SMEs reached through Anatolia Meetings in 2007• 96 customized loan agreements signed with Chambers ofCommerce and Trade Associations• Activation of low activity client base• Target to reach ~500K active clients by end-2009(1) YKB’s SME definition: Loans extended to companies with annual turnover less than 3 mln USD34

Further room for profitability in individuals segmentCROSS-SELL RATIO (1) (%)1.382.34• Expand customer base through reactivation ofdormant/low activity clients• 8.3 mln dormant clients• ~100K clients activated on a monthly basis in 2007YKB3.3BenchmarkINDIVIDUAL LOAN GROWTH (Bln YTL)x26.82007F 2009NO OF TRANSACTIONS BY CHANNEL (%)Branch 35 2421Internet 20ATM 38 50Other 7 5Jan 07 Dec 08(1) Product ownership per customer(2) Lending to individuals (includes general purpose loans, auto loans, housing loans)• Increase penetration through aggressive cross-selling(current cross-sell ratio

Focus on mortgages as another key driverPOTENTIAL OF MORTGAGE MARKETIN TURKEY43%10% 10%5% 4%EU-25 Hungary Czech Poland Turkey• 79% growth in 2006, 33% YTD (1)• Home ownership ratio in Turkey: 68%(58% in Istanbul)• Low existing quality of housing stock 33% above 25 years old 40% needs to be renewedMORTGAGES EXPECTED TO TAKE OFF WITH INTERESTRATE REDUCTIONInterest rate30%20%10%2006 2008 2010 2015Mortgages/GDP16%12%8%4%YKB STRATEGY ON MORTGAGESKEY BUSINESS CHALLENGESFOR BANKS ADRESSED BY NEWMORTGAGE REGULATION• Introduction of variable ratesand up to 2% pre-paymentpenalty• Establishment of secondarymarket for the securitisationof mortgages• Faster collection ofcollateral, shortenedforeclosure process• Product and channel differentiation, leveraging also onstate-of-the art CRM potential• Efficient credit process, lean and fast response,cross-selling• Focusing on origination, tailoring for securitization needsMortgages increase cross-sell to existingcustomers and bring new clients to YKB:In 2006, 70% of mortgages were issued toexisting customers while 30% to new clients(1) As of 16 November 2007Mortgage penetrations for EU-25, Hungary, Czech and Poland are as of 2005 while Turkey as of 2006.36

2007 IFRS Financial Guidance2007 Banking Sector Growth Forecasts 2007 Yapı <strong>Kredi</strong> PerformanceKey Focus AreasAssets17% SECTOROUTPERFORMFurther increase in IEAs (sale of ~400 mln YTLnon-core real estate)Loans24% SECTOROUTPERFORMLess capital absorbing products/reinforceleadership in cardsDeposits16% SECTOROUTPERFORMRemix towards demand deposits and lowercost funding baseMutual Funds18% SECTOROUTPERFORMMaintain leadership position in mutual fundsRevenues10% SECTOROUTPERFORMHigh double digit growth in all key segments,aiming to increase market share2005-2008 IFRS Targets at KFS Level (3 Year Plan)Total Revenues~13%(1)ROE > 20%AUM (Mutual Funds)~14%(1)Cost/Income< 50%Average RWA~20%(1)CAR> 12%# of Branches~745Cost of Risk~ 0.9%(1) 2005-2008 CAGR37

AgendaMacroeconomic & Banking EnvironmentYKB’s Competitive Positioning9M 2007 Results (BRSA Bank-only)Strategic GuidelinesAnnex38

Further improvement in CAR driven by healthyrevenue generation strengthening the capital baseAcquisitionand openingadjustmentsCARNo major impact on equity due toMerger withSub-loan of May-June 2006 market turmoil.Koçbank€500 mln (1) Decrease in CAR mainly driven byone-off deferred tax effect due todecrease in corporate tax from 30%Transfer fromto 20%.Turkcell gainto Tier 13.6%7.2%11.7%9.3%10.5%12.0%12 months ahead ofthe original plan12.3%13.0%Sub-loan of €200 mln (3)absorbing operationalrisk introduced in June12.6%12.9%CapitalBase(mln YTL)2,2912,1682,3041,415803(2)4,737 4,9373,785 4,037 4,1502,3853Q05 4Q05 1Q06 2Q06 3Q06 3Q06 4Q06 1Q07 2Q07 3Q07Pre-merger YKB stand aloneYKB + KBPro-forma(1) Additional €350 mln sub-loan added to Koçbank’s Tier 2 Capital(2) Excluding adjustment for the effects of corporate tax rate decrease from 30% to 20% due to change in 39 tax legislation in 2Q06.(3) €200 mln sub-loan added to YKB’s Tier 2 capital in June 2007Post-mergerYapı <strong>Kredi</strong>

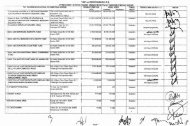

KFS Restructuring Process aims to move the financialsubsidiaries under YKBPre-KFSRestructuringUCILKoç LGroupBANK L Leasing Factoring Yatırım NV Azerbaijan50% 50%KFS80.2%59.5% 35.3% 67.2% 99.8%73.1% LL25.740.5%%64.7%45%8% 12% 12.7% 87.3%99.8% 65.4% 100% 74% 11.1% PortfoyRussia GermanyHoldingSigortaYatırımBVOrt L99.9%EmeklilikAfter Phase IUCIL50% 50%~82%64.7%BANK L99.8% 100% 74%* 11.1%Holding LRussiaSigortaYatırımBVOrt99.9%EmeklilikKFS12.7%45%LKoçGroup35.3%LYatırımPortfoy87.3%NV67.2%32.8%98.9% 99.9% 99.8%LLeasing Factoring AzerbaijanKey process milestones:• 21/06/07 First approval of BRSA• 18/07/07 First Extraordinary General Assembly• 23/07/07 Announcement of exchange ratio of 91.90% for thetransfer of YK Leasing, YK Factoring and YK Azerbaijan• 21/08/07 Second BRSA approval• 13/09/07 Second Extraordinary General Assembly• 26/10/07 Completion of Phase I - Share exchange between YKB & KFS• 11/01/08 Cash acquisition of YK NV following approval from Dutchregulatory authorities• 15/02/08 Completion of Phase II - Final target structure reached throughthecash acquisition of YK Yatırım following approval from CMBAfter Phase II(Finalized TargetStructure)LUCI50% 50%KFS81.8%BANKLKoçLGroupToday~98.9% ~99,8% 100% 100%~100%~ 74% *Leasing LHoldingAzerbaijanRussiaYatırımSigorta LB.V.~99.9%67.2% ~ 11.1% ~87,3% ~12% ~ 99,9%32.8%LFactoringNVYatırımOrtPortfoyEmeklilik~45%LListed40* YKB’s total stake (direct and indirect) in YK Sigorta is 93.9% through 74.01% YKB, 7.95% YK Factoring & 11.99% YK Yatırım

Target structure of KFS Restructuring reached followingcompletion of Phase II in February 2008Base financials for KFS RestructuringYKB Book Value: 3,526 mln YTL Valuation: 8,775 mln YTLNAV(YTL mln)Valuation(YTL mln)KFS StakeKFS Stake(YTL mln)774 mln YTL valueadded to YKBfollowing phase 1YKB’s Post-KFSRestructuringStake1st Phase: Share ExchangeYK Leasing (listed)*453 831 73.10% 60725.74% 98.85%YK Factoring133 243 59.47% 14540.48% 99.95%YK Azerbaijan14 21.9 99.80% 220%99.80%2nd Phase: Cash AcquisitionYK Yatırım (inc. YK Portföy)311 450 mln $ 35.28% 159 mln. $ 64.72% 99.98%YK NV 239 145 mln € 67.24% 98 mln. € 32.76% 100.00%* YK Leasing’s Mcap as of 31 March was 1,264 mln YTLNote:Base financials for YK Leasing, YK Factoring & YK Azerbaijan as of 31 March 07Base financials for YK Yatırım as of 30 June 07, for YK Netherlands as of 31 July 07YKB’s Pre-KFSRestructuringStakeImpact of KFS Restructuring:• More transparency for the market due to full consolidation of all subs under listed YKB• More efficient allocation of capital - increase in CAR of 2-2.5% and absorption of Basel II impact• No more cross shareholdership - clearer chain of control; no duplication of functions• Increase in ownership by KFS of YKB by 1.6% from 80.2% to 81.8%First Phase: Valuation reports of YKB, YK Leasing, YK Factoring, YK Azerbaijan prepared by Deloitte and independently audited by PWC. In addition, evaluation by an independent court expert was carried out. All necessary approvalssecured from CMB and BRSA. Combination of methods used for the valuation of the subs. such as the “discounted cash flow”, “net asset value”, “market capitalization” and “comparable company”. First phase completed through share41exchange on 26 Oct. 07. Second Phase: Valuation reports of YK Yatırım & YK N.V. prepared by Deloitte and Ernst & Young, respectively.

From bank-only net income to consolidated net income9M2007(mln YTL)2966118(1)127631848721Bank-onlyNet IncomePerformance ofSubsidiariesDividendEliminationsOtherConsolidationAdjustmentsNet IncomebeforeMinoritiesMinoritiesConsolidatedNet IncomeYK Sigorta 9%YK Portföy 1%YK Yatırım 2%YK Factoring 1%YK Leasing 4%Composition of YK Group RevenuesYK Emeklilik 3%Other 2%YKB 78%• 78% of total consolidated revenuesgenerated by the Bank• Of the 22% coming from subsidiaries,the two biggest contributors areinsurance (12% (2) ) and leasing (4%)businesses42(1) Mainly from profit elimination of the share purchase of YK Portföy from YK Emeklilik(2) Including YK Sigorta (non-life) and YK Emeklilik (life & private pension)

Continued focus on diversification and improving quality ofdeposit base; share of retail deposits increased to 68% (+4ppts vs YE06)TL Deposits (mln YTL)13%18,117 18,284Deposits by SBU (1) (Mln YTL)FCTLTL/FC Breakdown ofDeposits (mln YTL)6%-1%31,74129,860 31,51728,87046%54 %45%55%43%57%42%58%3Q06 1Q07 2Q07 3Q0716,180 15,7391%3Q06 1Q07 2Q07 3Q07TimeDemandFC Deposits (mln USD)10%10,195 9,71910,627 11,2156%3Q06 1Q07 2Q07 3Q07Demand Dep./Total Deposits81% 83% 84% 84%19% 17% 16% 16%3Q06 1Q07 2Q07 3Q07PrivateRetailSMEMedium Corp.Large Corp.22% 24%34% 35%8%15%9%16%21% 16%2006 9M07Retail (68%) Corporate (32%)• +1% increase in TL deposits and+6% increase in FC deposits (inUSD terms) QoQ• Total deposits decreased by aslight 1% due to exchange rateeffect• Further room for improvement indemand deposits/total deposits(16%). As a result, cost of fundingexpected to improve(1) MIS data (Commercial bank only)USD/YTL exchange rates -- 2006: 1.378, 1Q07: 1.351, 2Q07: 1.282, 3Q07: 1.18043

Efficient organisational structure with outstanding localand international managerial talentBOARD OFDIRECTORSINTERNAL CONTROLRISK(2)MANAGEMENTINTERNAL AUDIT(1)CHIEF EXECUTIVE OFFICER(CEO)CORPORATEIDENTITY ANDCOMMUNICATIONCHIEF OPERATINGOFFICER(1)(COO)PRIVATEBANKING ANDINTERNATIONALACTIVITIESRETAILBANKINGCREDIT CARDSANDCONSUMERLENDINGCORPORATEBANKINGCOMMERCIALBANKINGTREASURYOPERATIONSALTERNATIVEDISTRIBUTION CHANNELSORGANIZATIONFINANCIAL PLANNING,ADMINISTRATION ANDCONTROL (CFO)HRLOGISTICS ANDCOST MANAGEMENT(2)CREDIT MANAGEMENTITLEGAL44(1) Position covered by Executive Board Member(2) Under Chief Risk Officer (CRO) at KFS Group levelOrganizational structure updated as of May 2007

YKB – 3Q 2007 Summary P&L (BRSA Bank-only)(mln YTL) 1Q06N (1) 2Q06N (2) 3Q06N (2) 1Q07 2Q07 3Q07 YoYN (1)%QoQ%Total Revenues684677707786914990+40+8Operating Expenses(434)(478)(450)(473)(612)(651)+45+6Gross Operating Profit249199257313302339+32+13Provisions(75)(93)(42)(84)(37)(64)+53+69Pre-tax Profit174106215229264276+28+5Tax(67)(152)63(41)(51)(44)-169-13Net Profit107(47)278188213232-17+8(1) YKB merged bank figures normalized for the financial cost of stake increase and sub-loan as well as some minor accounting policy applications.(2) YKB merged bank figures normalized for some minor accounting policy applications45

YKB -3Q 2007 Summary Balance Sheet (BRSA Bank-only)(mln YTL)3Q064Q061Q072Q07 3Q07 YTD % YoY %QoQ %AssetsLoansSecurities45,94022,74112,81748,88722,50416,47046,74422,33114,65447,80324,03513,75447,91725,20412,704-2+12-23+4+11-1(1)Fixed Assets & Participations 2,921 3,069 3,016 3,099 3,035 -1 +4+0+5-8-2Deposits 29,860 31,127 28,870 31,741 31,517 +1 +6Repos 3,320 3,357 3,601 1,012 1,037 -69 -69Borrowings 5,264 6,159 6,207 6,277 6,138 +0 +17Equity 3,149 3,344 3,526 3,826 4,050 +21 +29-1+2-2+6Assets under Management (2) 5,895 6,145 5,665 5,958Assets under Custody10,299 8,927 9,258 8,733Non-cash Loans 14,444 15,342 14,571 14,7216,0539,94714,562-1+11-5+3-3+1+2+14-1(1) Including YTL 979 mln amount of goodwill(2) Assets under management includes mutual funds, pension fund, DPM and mutual funds sold by YK Yatırım 46

Explanation regarding major extraordinary factorsaffecting 2Q07 and 3Q07 results2Q07 and 3Q07 figures have been adjusted to neutralize the impact of extraordinary factorsaffecting quarterly P&L2007 Adjustments:Extraordinary Costs (included in non-HR costs)• Loss regarding loan write-offs mainly from Superonline (2Q07)• Non-core fixed asset sale losses (3Q07)Total (262) mln YTL(104) mln YTL(158) mln YTLExtraordinary Income (included in other income)• Loan loss provision reversals related to loan write-offs mainlyfrom Superonline (2Q07)• Non-core fixed asset sale gain and impairment reversals (3Q)Total 258 mln YTL89 mln YTL169 mln YTL47

Koç Financial Services (KFS) is an integrated and wellcapitalized financial services providerYTL billion, Unaudited IFRS Consolidated Figures,Sep 200750% 50%Total Assets 54.8Deposits 33.7Net Cash Loans 28.4Loans/Deposits, % 84AuM (1) 6.1Total Revenues 2.8Net Consolidated Profit (mln) 857Credit Cards (#, mln) 5.4Customers (#, mln) (2) 14.0Branches (3) 712Employees 16,184PARTNERS SHARE A COMMON VISION AND GOALKFS significantly grows its financial operations,network and market share as a result of a focusedcommercial growth plan and a conservative riskprofile approach, under the guidance of a stronglocal management team and with the dedicatedstrategic support of UniCreditValue creation will be driven by revenuegrowth, cost and risk control48(1) Including mutual funds, pension funds and other DPM(2) Excluding subsidiaries(3) Of which Yapı <strong>Kredi</strong> Bank 661 and KFS subs 51

…and a proven positive track record during its first four yearsKFS - Combined Net Profit mln YTLKFS - ROE (Consolidated) - %23192002 (1) 200326520043602005+25% +21% 857+2 ppts75526 (2) +3 ppts276886252424 252321 (4)New KFS1New KFS2005N 2006 9M06N 9M07 2002 (1) 2003 2004 2005 2005N 2006 9M06N 9M07KFS - NPL Ratio - %KFS - Cost / Income - % (3)11.711.18.34.97.1-0.8 ppts6.36.1-0.2 ppts5.9664847 4657-5 ppts5257-8 ppts49New KFSNew KFS2002 (1) 2003 2004 2005 2005 20069M069M072002 (1) 2003 2004 2005 2005N 20069M06N9M07IFRS Figures, 9M07 unauditedN = Normalized for the one-off deferred tax,cost of acquisition and sub-loanNew KFS = KFS Including merged Yapı <strong>Kredi</strong> 49(1) Pro-forma; NPL adjusted for a transfer done in May 2003(2) Based on normalized Equity (net of 1 bln Euro for Yapı <strong>Kredi</strong> acquisition)(3) Revenues netted by monetary loss(4) Calculated as combined normalized profit on consolidated equity

The KFS Group comprises Yapı <strong>Kredi</strong>, its domestic productfactories and international subsidiariesLL50%50%81.8%L94% 6 L99%100% 100% 7 100% 4100% 4 87.3%100% 3100% 1L100% 5100%69% 21.Through 35.3% in YK Yatırım which is holding87.3% in YK Portföy2.Through 64.7% in YK Yatırım which holds87.3% in YK Portföy; 12.7% direct YKB3.Through 67.24% YKB, YK Holding BV 32.76%4.Through 99.84% YKB, 0.16% YKL5.Through 99.93%YKS, 0.04% YKF, 0.04% YKY6.Through 74.01% YKB, 7.95% YKF, 11.99% YKY7.Through 99.8% YKB, 0.1% YKL, 0.1% YKYOther YKB subsidiaries:(1.) Yapı <strong>Kredi</strong> Investment Trust. Ownership: YKB:11.1%, YK Yatırım: 45%,Free Float: 44%(2.) BCP (Banque de Commerce et de Placements). Ownership: YKB:31%, Free Float: 69%(3.) Yapı <strong>Kredi</strong> Koray (REIT). Ownership: YKB: 30%, Free Float: 45%,Others: 25% (Non-financial sub. Not consolidated)(4.) YK Kültür-Sanat Yayıncılık (Culure, art and publishing). Ownership:YKB: 100% (Non-Financial sub. Not Consolidated)L= Listed= % ownership50

For enquiries please contact:Yapı <strong>Kredi</strong> <strong>Investor</strong> Relationsyapikredi_investorrelations@yapikredi.com.trPhone: +90 212 339 7647 or 7640 or 7323Fax: +90 212 339 610351