Q3 2012 - SDM Financial Statements r48 - Shoppers Drug Mart

Q3 2012 - SDM Financial Statements r48 - Shoppers Drug Mart

Q3 2012 - SDM Financial Statements r48 - Shoppers Drug Mart

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

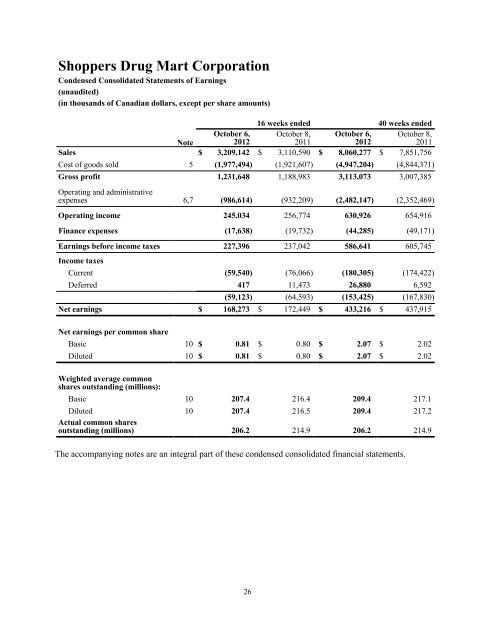

<strong>Shoppers</strong> <strong>Drug</strong> <strong>Mart</strong> CorporationCondensed Consolidated <strong>Statements</strong> of Earnings(unaudited)(in thousands of Canadian dollars, except per share amounts)16 weeks ended 40 weeks endedOctober 6, October 8, October 6, October 8,Note<strong>2012</strong>2011<strong>2012</strong>2011Sales $ 3,209,142 $ 3,110,590 $ 8,060,277 $ 7,851,756Cost of goods sold 5 (1,977,494) (1,921,607) (4,947,204) (4,844,371)Gross profit 1,231,648 1,188,983 3,113,073 3,007,385Operating and administrativeexpenses 6,7 (986,614) (932,209) (2,482,147) (2,352,469)Operating income 245,034 256,774 630,926 654,916Finance expenses (17,638) (19,732) (44,285) (49,171)Earnings before income taxes 227,396 237,042 586,641 605,745Income taxesCurrent (59,540) (76,066) (180,305) (174,422)Deferred 417 11,473 26,880 6,592(59,123) (64,593) (153,425) (167,830)Net earnings $ 168,273 $ 172,449 $ 433,216 $ 437,915Net earnings per common shareBasic 10 $ 0.81 $ 0.80 $ 2.07 $ 2.02Diluted 10 $ 0.81 $ 0.80 $ 2.07 $ 2.02Weighted average commonshares outstanding (millions):Basic 10 207.4 216.4 209.4 217.1Diluted 10 207.4 216.5 209.4 217.2Actual common sharesoutstanding (millions) 206.2 214.9 206.2 214.9The accompanying notes are an integral part of these condensed consolidated financial statements.26

<strong>Shoppers</strong> <strong>Drug</strong> <strong>Mart</strong> CorporationCondensed Consolidated <strong>Statements</strong> of Comprehensive Income(unaudited)(in thousands of Canadian dollars)October 6,<strong>2012</strong>16 weeks ended 40 weeks endedOctober 8,2011October 6,<strong>2012</strong>October 8,2011Net earnings $ 168,273 $ 172,449 $ 433,216 $ 437,915Other comprehensive income (loss), net of taxEffective portion of changes in fair value of hedgeson equity forward derivatives (net of tax of $43 and$1 (2011: $33 and $17)) 123 93 2 (54)Net change in fair value of hedges on equityforward derivatives transferred to earnings (net oftax of $13 and $32 (2011: $31 and $142)) 36 78 86 359Other comprehensive income, net of tax 159 171 88 305Total comprehensive income $ 168,432 $ 172,620 $ 433,304 $ 438,220The accompanying notes are an integral part of these condensed consolidated financial statements.27

<strong>Shoppers</strong> <strong>Drug</strong> <strong>Mart</strong> CorporationCondensed Consolidated Balance Sheets(unaudited)(in thousands of Canadian dollars)October 6,<strong>2012</strong>December 31,2011October 8,2011NoteCurrent assetsCash $ 53,070 $ 118,566 $ 76,456Accounts receivable 436,372 493,338 437,540Inventory 2,105,908 2,042,302 1,983,765Income taxes recoverable — — 13,759Prepaid expenses and deposits 97,894 41,441 62,945Total current assets 2,693,244 2,695,647 2,574,465Non-current assetsProperty and equipment 7 1,711,297 1,767,543 1,724,018Investment property 16,264 16,372 11,937Goodwill 2,541,527 2,499,722 2,498,637Intangible assets 318,522 281,737 274,004Other assets 8,450 18,214 18,873Deferred tax assets 20,151 21,075 23,045Total non-current assets 4,616,211 4,604,663 4,550,514Total assets $ 7,309,455 $ 7,300,310 $ 7,124,979Current liabilitiesBank indebtedness $ 255,007 $ 172,262 $ 240,939Commercial paper 8 262,974 — —Accounts payable and accrued liabilities 1,017,725 1,109,444 957,247Income taxes payable 29,526 26,538 —Dividends payable 9 54,679 53,119 53,815Current portion of long-term debt 8 449,683 249,971 249,817Provisions 12,493 12,024 13,874Associate interest 159,042 152,880 138,901Total current liabilities 2,241,129 1,776,238 1,654,593Long-term liabilitiesLong-term debt 8 247,131 695,675 695,487Other long-term liabilities 530,101 520,188 482,718Provisions 4,476 1,701 1,854Deferred tax liabilities 11,830 38,678 17,228Total long-term liabilities 793,538 1,256,242 1,197,287Total liabilities 3,034,667 3,032,480 2,851,880Shareholders' equityShare capital 9 1,443,207 1,486,455 1,505,152Treasury shares 9 (3,076) (4,735) (12,611)Contributed surplus 11 10,682 10,246 10,062Accumulated other comprehensive loss (30,126) (30,214) (8,338)Retained earnings 2,854,101 2,806,078 2,778,834Total shareholders' equity 4,274,788 4,267,830 4,273,099Total liabilities and shareholders' equity $ 7,309,455 $ 7,300,310 $ 7,124,979The accompanying notes are an integral part of these condensed consolidated financial statements.28

<strong>Shoppers</strong> <strong>Drug</strong> <strong>Mart</strong> CorporationCondensed Consolidated <strong>Statements</strong> of Changes in Shareholders' Equity(unaudited)(in thousands of Canadian dollars)NoteShareCapitalTreasurySharesContributedSurplusAccumulatedOtherComprehensiveLossRetainedEarningsBalance as at December 31, 2011 $ 1,486,455 $ (4,735) $ 10,246 $ (30,214) $ 2,806,078 $ 4,267,830Total comprehensive income — — — 88 433,216 433,304Dividends 9 — — — — (165,613) (165,613)Share repurchases 9, 10 (43,745) (3,076) — — (215,655) (262,476)Treasury shares cancelled 9 (810) 4,735 — — (3,925) —Share-based payments 11 — — 615 — — 615Share options exercised 11 1,297 — (179) — — 1,118Repayment of share-purchaseloans 10 — — — — 10Balance as at October 6, <strong>2012</strong> $ 1,443,207 $ (3,076) $ 10,682 $ (30,126) $ 2,854,101 $ 4,274,788TotalBalance as at January 1, 2011 $ 1,520,558 $ — $ 11,702 $ (8,643) $ 2,579,018 $ 4,102,635Total comprehensive income — — — 305 437,915 438,220Dividends 9 — — — — (162,552) (162,552)Share repurchases 9, 10 (16,623) (12,611) (75,547) (104,781)Share-based payments 11 — — (1,394) — — (1,394)Share options exercised 11 1,210 — (246) — — 964Repayment of share-purchaseloans 7 — — — — 7Balance as at October 8, 2011 $ 1,505,152 $ (12,611) $ 10,062 $ (8,338) $ 2,778,834 $ 4,273,099The accompanying notes are an integral part of these condensed consolidated financial statements.29

<strong>Shoppers</strong> <strong>Drug</strong> <strong>Mart</strong> CorporationCondensed Consolidated <strong>Statements</strong> of Cash Flows(unaudited)(in thousands of Canadian dollars)Cash flows from operating activities30NoteOctober 6,<strong>2012</strong>16 weeks ended 40 weeks endedOctober 8,2011October 6,<strong>2012</strong>October 8,2011Net earnings $ 168,273 $ 172,449 $ 433,216 $ 437,915Adjustments for:Depreciation and amortization 98,068 91,354 242,759 225,692Finance expenses 17,638 19,732 44,285 49,171(Gain) loss on sale or disposal of property and equipment (11,382) (2,467) (9,057) 1,164Share-based payment transactions 79 128 615 (1,394)Recognition and reversal of provisions, net 2,566 2,900 14,230 9,480Other long-term liabilities 2,231 1,483 1,932 6,780Income tax expense 59,123 64,593 153,425 167,830336,596 350,172 881,405 896,638Net change in non-cash working capital balances 12 (30,428) (59,453) (104,699) (65,611)Provisions used (6,486) (5,083) (10,986) (8,166)Interest paid (13,585) (17,589) (46,819) (48,950)Income tax paid (52,256) (59,683) (169,777) (169,432)Net cash from operating activities 233,841 208,364 549,124 604,479Cash flows from investing activitiesProceeds from disposition of property and equipment 43,213 34,229 50,709 39,518Business acquisitions 4 (83,209) (405) (96,157) (6,657)Deposits 5,476 (410) (28,922) (875)Acquisition and development of property and equipment (64,613) (103,524) (174,368) (241,982)Acquisition and development of intangible assets (14,180) (20,329) (39,546) (36,643)Other assets 424 5,598 1,212 805Net cash used in investing activities (112,889) (84,841) (287,072) (245,834)Cash flows from financing activitiesRepurchase of own shares 9 (94,416) (92,170) (264,135) (92,170)Proceeds from exercise of share options 406 358 1,118 964Repayment of share-purchase loans — — 10 7Bank indebtedness, net (16,189) (5,483) 82,708 31,967Issuance (repayment) of commercial paper, net 8 39,000 — 263,000 (128,000)Repayment of long-term debt 8 — — (250,000) —Revolving term debt, net — — (152) —Repayment of financing lease obligations (910) (688) (2,206) (1,555)Associate interest 11,410 9,641 6,162 (92)Dividends paid 9 (55,154) (54,369) (164,053) (157,664)Net cash used in financing activities (115,853) (142,711) (327,548) (346,543)Net increase (decrease) in cash 5,099 (19,188) (65,496) 12,102Cash, beginning of period 47,971 95,644 118,566 64,354Cash, end of period $ 53,070 $ 76,456 $ 53,070 $ 76,456The accompanying notes are an integral part of these condensed consolidated financial statements.

SHOPPERS DRUG MART CORPORATIONNotes to the Condensed Consolidated <strong>Financial</strong> <strong>Statements</strong>(unaudited)(in thousands of Canadian dollars, except per share data)1. GENERAL INFORMATION<strong>Shoppers</strong> <strong>Drug</strong> <strong>Mart</strong> Corporation (the “Company”) is a public company incorporated and domiciled in Canada,whose shares are publicly traded on the Toronto Stock Exchange. The Company’s registered address is 243 ConsumersRoad, Toronto, Ontario, M2J 4W8, Canada.The Company is a licensor of 1,237 <strong>Shoppers</strong> <strong>Drug</strong> <strong>Mart</strong> ® /Pharmaprix ® full-service retail drug stores across Canada.The <strong>Shoppers</strong> <strong>Drug</strong> <strong>Mart</strong> ® /Pharmaprix ® stores are licensed to corporations owned by pharmacists (“Associates”).The Company also licenses or owns 57 <strong>Shoppers</strong> Simply Pharmacy ® /Pharmaprix Simplement Santé ® medical clinicpharmacies and six Murale TM beauty stores. In addition, the Company owns and operates 63 <strong>Shoppers</strong> Home HealthCare ® stores. In addition to its store network, the Company owns <strong>Shoppers</strong> <strong>Drug</strong> <strong>Mart</strong> Specialty Health NetworkInc., a provider of specialty drug distribution, pharmacy and comprehensive patient support services, and MediSystemTechnologies Inc., a provider of pharmaceutical products and services to long-term care facilities.The majority of the Company’s sales are generated from the <strong>Shoppers</strong> <strong>Drug</strong> <strong>Mart</strong> ® /Pharmaprix ® full-service retaildrug stores and the majority of the Company’s assets are used in the operations of these stores. As such, the Companypresents one operating segment in its consolidated financial statement disclosures. The revenue generated by<strong>Shoppers</strong> Simply Pharmacy ® /Pharmaprix Simplement Santé ® , MediSystem Technologies Inc., and <strong>Shoppers</strong> <strong>Drug</strong><strong>Mart</strong> Specialty Health Network Inc. is included with prescription sales of the Company’s retail drug stores. Therevenue generated by <strong>Shoppers</strong> Home Health Care ® and Murale TM is included with the front store sales of theCompany’s retail drug stores.2. BASIS OF PREPARATIONStatement of ComplianceThese condensed consolidated financial statements have been prepared in accordance with International AccountingStandard 34, “Interim <strong>Financial</strong> Reporting” (“IAS 34”), as issued by the International Accounting Standards Board(“IASB”). They have been prepared using the accounting policies that were described in Note 3 to the Company’sannual consolidated financial statements as at and for the 52 weeks ended December 31, 2011, except as describedin Note 3(a) to these condensed consolidated financial statements.These condensed consolidated financial statements should be read in conjunction with the Company’s 2011 annualfinancial statements.These condensed consolidated financial statements were authorized for issuance by the Board of Directors of theCompany on November 13, <strong>2012</strong>.31

SHOPPERS DRUG MART CORPORATIONNotes to the Condensed Consolidated <strong>Financial</strong> <strong>Statements</strong>(unaudited)(in thousands of Canadian dollars, except per share data)3. SIGNIFICANT ACCOUNTING POLICIES(a)New Accounting Standards(i)Deferred Taxes – Recovery of Underlying AssetsThe IASB has issued an amendment to IAS 12, “Income Taxes” (“IAS 12 amendment”), which introduces anexception to the general measurement requirements of IAS 12 in respect of investment properties measured atfair value. The IAS 12 amendment is effective for annual periods beginning on or after January 1, <strong>2012</strong>. TheIAS 12 amendment did not have an impact on the Company’s results of operations, financial position ordisclosures.(b)New Standards and Interpretations not yet AdoptedA number of new standards, amendments to standards, and interpretations have been issued but are not yeteffective for the financial year ending December 29, <strong>2012</strong> and, accordingly, have not been applied in preparingthese condensed consolidated financial statements:(i)<strong>Financial</strong> Instruments – DisclosuresThe IASB has issued an amendment to IFRS 7, “<strong>Financial</strong> Instruments - Disclosures” (“IFRS 7”), requiringincremental disclosures regarding transfers of financial assets. This amendment to IFRS 7 is effective for annualperiods beginning on or after July 1, 2011. The Company will apply the amendment to its <strong>2012</strong> annual financialstatement disclosures and does not expect the implementation to have a significant impact on the Company’sdisclosures.(ii)<strong>Financial</strong> InstrumentsThe IASB has issued a new standard, IFRS 9, “<strong>Financial</strong> Instruments” (“IFRS 9”), which will ultimately replaceIAS 39, “<strong>Financial</strong> Instruments: Recognition and Measurement” (“IAS 39”). The replacement of IAS 39 is amulti-phase project with the objective of improving and simplifying the reporting for financial instruments andthe issuance of IFRS 9 is part of the first phase of this project. IFRS 9 uses a single approach to determinewhether a financial asset or liability is measured at amortized cost or fair value, replacing the multiple rules inIAS 39. For financial assets, the approach in IFRS 9 is based on how an entity manages its financial instrumentsin the context of its business model and the contractual cash flow characteristics of the financial assets. IFRS 9requires a single impairment method to be used, replacing multiple impairment methods in IAS 39. For financialliabilities measured at fair value, fair value changes due to changes in an entity’s credit risk are presented inother comprehensive income. IFRS 9 is effective for annual periods beginning on or after January 1, 2015 andmust be applied retrospectively. The Company is assessing the impact of IFRS 9 on its results of operations,financial position and disclosures.32

SHOPPERS DRUG MART CORPORATIONNotes to the Condensed Consolidated <strong>Financial</strong> <strong>Statements</strong>(unaudited)(in thousands of Canadian dollars, except per share data)3. SIGNIFICANT ACCOUNTING POLICIES (continued)(vii)Separate <strong>Financial</strong> <strong>Statements</strong>The IASB has issued a revised standard, IAS 27, “Separate <strong>Financial</strong> <strong>Statements</strong>” (“IAS 27”), which containsthe accounting and disclosure requirements for investments in subsidiaries, joint ventures and associates whenan entity prepares separate (non-consolidated) financial statements. IAS 27 is effective for annual periodsbeginning on or after January 1, 2013 and must be applied retrospectively. IAS 27 will not have an impact onthe Company’s consolidated results of operations, financial position and disclosures.(viii)Investments in Associates and Joint VenturesThe IASB has issued a revised standard, IAS 28, “Investments in Associates and Joint Ventures” (“IAS 28”),which prescribes the accounting for investments in associates and sets out the requirements for the applicationof the equity method when accounting for investments in associates and joint ventures. IAS 28 is effective forannual periods beginning on or after January 1, 2013 and must be applied retrospectively. The Company isassessing the impact of IAS 28 on its results of operations, financial position and disclosures.(ix)Presentation of <strong>Financial</strong> <strong>Statements</strong> – Other Comprehensive IncomeThe IASB has issued an amendment to IAS 1, “Presentation of <strong>Financial</strong> <strong>Statements</strong>” (the “IAS 1 amendment”),to improve consistency and clarity of the presentation of items of other comprehensive income. A requirementhas been added to present items in other comprehensive income grouped on the basis of whether they may besubsequently reclassified to earnings in order to more clearly show the effects the items of other comprehensiveincome may have on future earnings. The IAS 1 amendment is effective for annual periods beginning on or afterJuly 1, <strong>2012</strong> and must be applied retrospectively. The Company is assessing the impact of the IAS 1 amendmenton its presentation of other comprehensive income.(x)Post-Employment BenefitsThe IASB has issued amendments to IAS 19, “Employee Benefits” (“IAS 19”), which eliminates the option todefer the recognition of actuarial gains and losses through the “corridor” approach, revises the presentation ofchanges in assets and liabilities arising from defined benefit plans and enhances the disclosures for definedbenefit plans. IAS 19 is effective for annual periods beginning on or after January 1, 2013 and must be appliedretrospectively. The Company is assessing the impact of IAS 19 on its results of operations, financial positionand disclosures.(xi)<strong>Financial</strong> Instruments - Asset and Liability OffsettingThe IASB has issued amendments to IFRS 7 and IAS 32, “<strong>Financial</strong> Instruments: Presentation” (“IAS 32”),which clarify the requirements for offsetting financial instruments and require new disclosures on the effect ofoffsetting arrangements on an entity’s financial position. The amendments to IFRS 7 are effective for annualperiods beginning on or after January 1, 2013 and must be applied retrospectively. The amendments to IAS 32are effective for annual periods beginning on or after January 1, 2014 and must be applied retrospectively. TheCompany is assessing the impact of the amendments to IFRS 7 and IAS 32 on its results of operations, financialposition and disclosures.34

SHOPPERS DRUG MART CORPORATIONNotes to the Condensed Consolidated <strong>Financial</strong> <strong>Statements</strong>(unaudited)(in thousands of Canadian dollars, except per share data)4. BUSINESS ACQUISITIONSParagon Pharmacies LimitedOn August 1, <strong>2012</strong>, the Company acquired substantially all of the assets of Paragon Pharmacies Limited (“Paragon”)for a cash purchase price of $72,059. The acquisition included 19 retail pharmacies and three central fill pharmaciesin British Columbia, Alberta, and Manitoba.The acquisition of Paragon will increase the Company's retail presence in western Canada and provide a platformfor the Company's MediSystem Technologies Inc. (“MediSystem”) business to enter the British Columbia andManitoba markets. In addition, this acquisition is consistent with the Company's stated growth objectives in retailpharmacy and long-term care.The following table summarizes the consideration paid for Paragon, and the amounts recognized for the assetsacquired and liabilities assumed at the acquisition date.Fair value of net assets acquired as at acquisition dateCash $ 43Accounts receivable (gross amount of $4,751, net of allowance of $430) 4,321Inventory 7,906Prepaid expenses 611Property and equipment 4,929Prescription files 20,000Customer relationships 8,000Accounts payable and accrued liabilities (1,245)Net assets acquired 44,565Goodwill 27,494Total cash purchase price 72,059Cash acquired (43)Purchase price, net of cash acquired $ 72,016The goodwill arising from this acquisition reflects the expected future growth potential arising from increasedprescription script counts and the synergies expected following the integration of Paragon, as well as the opportunityto introduce the MediSystem business into two new provinces. The Company expects that $20,620 of the acquiredgoodwill will be deductible for tax purposes.The Company has incurred acquisition-related costs of $797 relating primarily to external legal fees, consulting fees,and due diligence costs. These costs have been recognized within operating and administrative expenses in thecondensed consolidated statements of earnings.The results of operations of Paragon have been included in the condensed consolidated financial statements fromAugust 1, <strong>2012</strong>, the date of acquisition. The acquisition has added approximately $11,000 to the Company's salessince acquisition. If the acquisition had occurred on January 1, <strong>2012</strong>, the Company estimates that for the 40 weeksended October 6, <strong>2012</strong>, sales would have increased by approximately $52,000 to $8,112,277.35

SHOPPERS DRUG MART CORPORATIONNotes to the Condensed Consolidated <strong>Financial</strong> <strong>Statements</strong>(unaudited)(in thousands of Canadian dollars, except per share data)4. BUSINESS ACQUISITIONS (continued)Other Business AcquisitionsIn the normal course of business, the Company acquires the assets or shares of pharmacies. The total cost of theseacquisitions during the 16 and 40 weeks ended October 6, <strong>2012</strong> of $11,193 and $24,141 (2011: $495 and $6,960)was allocated primarily to goodwill and other intangible assets based on their fair values. The goodwill acquiredrepresents the benefits the Company expects to receive from the acquisitions. For acquisitions during the 40 weeksended October 6, <strong>2012</strong>, the Company expects that $5,667 (2011: $38) of acquired goodwill will be deductible fortax purposes.The values of assets acquired and liabilities assumed have been determined at the acquisition date using fair values.The intangible assets acquired are composed of prescription files.The operations of the acquired pharmacies have been included in the Company’s results of operations from the dateof acquisition.5. COST OF GOODS SOLDDuring the 16 and 40 weeks ended October 6, <strong>2012</strong>, the Company recorded $14,556 and $38,099 (2011: $11,098and $32,603) as an expense for the write-down of inventory as a result of net realizable value being lower than costin cost of goods sold in the condensed consolidated statements of earnings.During the 16 and 40 weeks ended October 6, <strong>2012</strong> and October 8, 2011, the Company did not reverse any significantinventory write-downs recognized in previous periods.6. EMPLOYEE BENEFITS EXPENSEEmployee benefits expense, recognized within operating and administrative expenses, is as follows:October 6,<strong>2012</strong>16 weeks ended 40 weeks endedOctober 8,2011October 6,<strong>2012</strong>October 8,2011Wages and salaries $ 444,341 $ 423,627 $ 1,102,173 $ 1,049,970Restructuring charge 11,664 — 11,664 —Statutory deductions 51,630 48,035 136,376 128,343Expenses related to pension and benefits 2,633 2,001 6,585 5,003Share-based payment transactions 455 1,718 4,165 715$ 510,723 $ 475,381 $ 1,260,963 $ 1,184,031During the 16 weeks ended October 6, <strong>2012</strong>, the Company recorded a restructuring charge of $12,754 (pre-tax)arising primarily from the rationalization of the Company's central office functions reflected in employee benefitsexpense above.36

SHOPPERS DRUG MART CORPORATIONNotes to the Condensed Consolidated <strong>Financial</strong> <strong>Statements</strong>(unaudited)(in thousands of Canadian dollars, except per share data)7. DEPRECIATION AND AMORTIZATION EXPENSEThe components of the Company’s depreciation and amortization expense, recognized within operating andadministrative expenses, are as follows:October 6,<strong>2012</strong>16 weeks ended 40 weeks endedOctober 8,2011October 6,<strong>2012</strong>October 8,2011Property and equipment $ 70,386 $ 74,605 $ 192,423 $ 191,438Investment property 107 86 257 220Intangible assets 15,839 13,974 40,131 34,619$ 86,332 $ 88,665 $ 232,811 $ 226,277These amounts include net gains and losses on the disposition of property and equipment and intangible assets andany impairment losses recognized by the Company. During the 16 and 40 weeks ended October 6, <strong>2012</strong>, the Companyrecognized a net gain of $11,593 and $9,584 on the disposal of property and equipment, investment property andintangible assets (2011: net gain of $2,609 and net loss of $829). During the 16 and 40 weeks ended October 6, <strong>2012</strong>and October 8, 2011, the Company did not recognize any impairment losses on property and equipment or intangibleassets.Sale-Leaseback TransactionsDuring the 16 and 40 weeks ended October 6, <strong>2012</strong>, the Company sold certain real estate properties for net proceedsof $42,801 and $48,638 (2011: $33,050 and $38,284), respectively, and entered into leaseback agreements for thearea used by the Associate-owned stores. The leases have been accounted for as operating or financing leases asappropriate. During the 16 and 40 weeks ended October 6, <strong>2012</strong>, the Company realized gains on disposal of $12,475and $12,475, respectively, which were recognized immediately in net earnings and included in depreciation expense.During the 16 and 40 weeks ended October 8, 2011, the Company realized gains on disposal of $8,595 and $8,705,respectively, of which $5,139 and $5,250, respectively, were deferred under financing lease treatment. Deferred gainsare presented in other long-term liabilities and are amortized over lease terms of 15 to 20 years.8. LONG-TERM DEBTOn January 6, <strong>2012</strong>, the Company filed with the securities regulators in each of the provinces of Canada, a final shortform base shelf prospectus (the “Prospectus”) for the issuance of up to $1,000,000 of medium-term notes. Subjectto the requirements of applicable law, medium term notes can be issued under the Prospectus for up to 25 monthsfrom the date of the final receipt. No incremental debt was incurred by the Company as a result of this filing.On January 20, <strong>2012</strong>, $250,000 of three-year medium-term notes, were repaid in full, along with all accrued andunpaid interest owing on the final semi-annual interest payment. The repayment was financed with a combinationof available cash and commercial paper issued under the Company’s commercial paper program. The net debtposition of the Company remained substantially unchanged as a result of this refinancing activity.37

SHOPPERS DRUG MART CORPORATIONNotes to the Condensed Consolidated <strong>Financial</strong> <strong>Statements</strong>(unaudited)(in thousands of Canadian dollars, except per share data)9. SHARE CAPITALNormal Course Issuer BidOn February 9, <strong>2012</strong>, the Company renewed its normal course issuer bid providing for the repurchase, for cancellation,of up to 10,600,000 of its common shares, representing approximately 5.0% of the Company’s then outstandingcommon shares. Repurchases will be effected through the facilities of the Toronto Stock Exchange (the “TSX”)and may take place over a 12-month period ending no later than February 14, 2013. Repurchases will be made atmarket prices in accordance with the requirements of the TSX. The Company has entered into an automatic purchaseplan with its designated broker to allow for purchases of its common shares during certain pre-determined black-outperiods, subject to certain parameters as to price and number of shares. Outside of these pre-determined black-outperiods, shares will be purchased at the Company’s discretion, subject to applicable law. The Company’s previousnormal course issuer bid, which was implemented on February 10, 2011 and expired on February 14, <strong>2012</strong>, providedfor the repurchase, for cancellation, of up to 8,700,000 of its common shares, representing approximately 4.0% ofthe Company’s then outstanding common shares.During the 16 and 40 weeks ended October 6, <strong>2012</strong>, the Company purchased and cancelled 2,127,900 and 6,250,900(2011: 2,376,600 and 2,376,600) common shares, respectively, under its normal course issuer bid programs at a costof $88,539 and $259,400 (2011: $92,170 and $92,170), respectively. The premium paid over the average book valueof the shares repurchased of $73,643 and $215,655 (2011: $75,547 and $75,547), respectively, has been charged toretained earnings. The Company purchased an additional 75,000 (2011: 314,800) shares during the period at a costof $3,076 (2011: $12,611). These shares were cancelled subsequent to the end of the period. The cost of these latterpurchases is recorded as treasury shares in Shareholders’ equity at the end of the period. During the 12 weeks endedMarch 24, <strong>2012</strong> and the 16 weeks ended October 6, <strong>2012</strong>, the Company cancelled the 115,900 and 147,400 shares,respectively, that were recognized as treasury shares at the end of each preceding reporting period. The cancelledshares were charged to share capital and retained earnings accordingly.DividendsOn November 13, <strong>2012</strong>, the Board of Directors declared a dividend of 26.5 cents per common share payableJanuary 15, 2013 to shareholders of record as of the close of business on December 31, <strong>2012</strong>.The following table provides a summary of the dividends declared by the Company:Declaration Date Record Date Payment DateDividend per CommonShareFebruary 9, <strong>2012</strong> March 30, <strong>2012</strong> April 13, <strong>2012</strong> 0.265April 26, <strong>2012</strong> June 29, <strong>2012</strong> July 13, <strong>2012</strong> 0.265July 18, <strong>2012</strong> September 28, <strong>2012</strong> October 15, <strong>2012</strong> 0.265November 13, <strong>2012</strong> December 31, <strong>2012</strong> January 15, 2013 0.265February 10, 2011 March 31, 2011 April 15, 2011 0.250April 27, 2011 June 30, 2011 July 15, 2011 0.250July 21, 2011 September 30, 2011 October 14, 2011 0.250November 9, 2011 December 30, 2011 January 13, <strong>2012</strong> 0.25038

SHOPPERS DRUG MART CORPORATIONNotes to the Condensed Consolidated <strong>Financial</strong> <strong>Statements</strong>(unaudited)(in thousands of Canadian dollars, except per share data)10. EARNINGS PER COMMON SHAREBasic Net Earnings per Common ShareThe calculation of basic net earnings per common share at October 6, <strong>2012</strong> was based on net earnings for the 16 and40 weeks ended October 6, <strong>2012</strong> of $168,273 and $433,216 (2011: $172,449 and $437,915), respectively, and aweighted average number of shares outstanding (basic) of 207,387,919 and 209,357,014 (2011: 216,434,411 and217,055,029), respectively. The weighted average number of shares outstanding (basic) is calculated as follows:Weighted Average Shares Outstanding (Basic)October 6,<strong>2012</strong>16 weeks ended 40 weeks endedOctober 8,2011October 6,<strong>2012</strong>October 8,2011Issued shares, beginning of the period 208,414,470 217,473,716 212,475,597 217,452,068Effect of share options exercised 9,530 41,625 17,900 36,702Effect of treasury shares cancelled (147,400) — (115,900) —Effect of shares repurchased (888,681) (1,079,179) (3,020,183) (431,672)Effect of share purchase loans — (1,751) (400) (2,069)Weighted average number of sharesoutstanding, end of the period 207,387,919 216,434,411 209,357,014 217,055,029Diluted Net Earnings per Common ShareThe calculation of diluted net earnings per common share at October 6, <strong>2012</strong> was based on net earnings for the 16and 40 weeks ended October 6, <strong>2012</strong> of $168,273 and $433,216 (2011: $172,449 and $437,915), respectively, anda weighted average number of shares outstanding after adjustment for the effects of all dilutive potential shares of207,413,109 and 209,383,090 (2011: 216,507,614 and 217,150,383), respectively. The weighted average numberof shares outstanding (diluted) is calculated as follows:Weighted Average Shares Outstanding (Diluted)October 6,<strong>2012</strong>16 weeks ended 40 weeks endedOctober 8,2011October 6,<strong>2012</strong>October 8,2011Weighted average number of sharesoutstanding (basic), end of the period 207,387,919 216,434,411 209,357,014 217,055,029Potentially dilutive share options 25,190 73,203 26,076 95,354Weighted average number of sharesoutstanding (diluted), end of the period 207,413,109 216,507,614 209,383,090 217,150,383The average market value of the Company’s shares for purposes of calculating the effect of dilutive stock optionswas based on quoted market prices for the period that the stock options were outstanding. Anti-dilutive stock optionshave been excluded.39

SHOPPERS DRUG MART CORPORATIONNotes to the Condensed Consolidated <strong>Financial</strong> <strong>Statements</strong>(unaudited)(in thousands of Canadian dollars, except per share data)11. SHARE-BASED PAYMENTSThe Company established stock option and other share-based payment plans for certain employees and members ofits Board of Directors, as described in Note 26 to the Company’s 2011 annual financial statements.During the 16 and 40 weeks ended October 6, <strong>2012</strong>, the Company recognized the following compensation expenseassociated with stock options issued under the employee and director plans in operating and administrative expenses:Net expenses (reversal) associated with:October 6,<strong>2012</strong>16 weeks ended 40 weeks endedOctober 8, October 6, October 8,2011 <strong>2012</strong> 2011Options granted in 2006 $ — $ — $ — $ (921)Options granted in 2010 (65) 48 (35) (673)Options granted in 2011 114 80 409 200Options granted in <strong>2012</strong> 30 — 241 —Total net expenses (reversal) recognized in operating andadministrative expenses $ 79 $ 128 $ 615 $ (1,394)Included in the amounts above for the 16 and 40 weeks ended is a reversal of compensation expense of $204 and$204 (2011: $nil and $1,715), respectively, as a result of the departure of certain management personnel.Employee Stock Option PlanOptions issued to certain employees have an exercise price per share of no less than the fair market value on the dateof the option grant. These options include awards for shares that vest based on the passage of time, performancecriteria, or both.The following is a summary of the status of the employee Share Incentive Plan (“share plan”) and changes to itduring the current and prior financial periods:Options oncommonshares40 weeks endedOctober 6, <strong>2012</strong> October 8, 2011Weightedaverageexercise priceper shareOptions oncommonsharesWeightedaverageexercise priceper shareOutstanding, beginning of period 380,877 $ 40.23 803,492 $ 39.53Granted 134,950 40.21 83,312 40.81Exercised (41,491) 27.17 (98,648) 10.87Forfeited/cancelled including repurchased (70,891) 41.07 (566,072) 45.38Outstanding, end of period 403,445 $ 41.42 222,084 $ 37.83Options exercisable, end of period 97,211 $ 40.84 99,998 $ 32.3640

SHOPPERS DRUG MART CORPORATIONNotes to the Condensed Consolidated <strong>Financial</strong> <strong>Statements</strong>(unaudited)(in thousands of Canadian dollars, except per share data)11. SHARE-BASED PAYMENTS (continued)Range of exercise pricesNumber ofoptionsoutstandingOutstanding OptionsWeightedaveragecontractuallife (years)Weightedaverageexerciseprice pershareOctober 6, <strong>2012</strong>Exercisable OptionsNumber ofexercisableoptionsWeightedaverageexerciseprice pershare$23.48 - $26.57 2,738 0.90 25.86 2,738 25.86$29.30 - $36.41 17,414 1.10 33.02 17,414 33.02$40.21 - $44.09 383,293 5.40 41.90 77,059 43.13403,445 5.18 $ 41.42 97,211 $ 40.84Options grantedIn February <strong>2012</strong> and 2011, the Company granted awards of time-based options under the share plan to certain seniormanagement, with one-third of such options vesting each year.In November 2011, the Company granted an award of time-based options under the share plan to the Company’sChief Executive Officer, with one-fourth of such options vesting each year.The following assumptions were used in the Black-Scholes option-pricing model to calculate the fair value for thoseoptions granted in February of each year:February,<strong>2012</strong>November,2011February,2011Fair value per unit at grant date 5.40 5.89 6.32Share price $ 40.21 $ 42.28 $ 40.81Exercise price $ 40.21 $ 42.28 $ 40.81Valuation assumptions:Expected life 5 years 5 years 5 yearsExpected dividends 2.64% 2.37% 2.45%Expected volatility (based on historical share price volatility) 19.79% 19.86% 19.32%Risk-free interest rate (based on government bonds) 1.50% 1.39% 2.63%Upon the termination of an option holder’s employment, all unexercisable options expire immediately and exercisableoptions expire within 180 days of the date of termination. The share plan provides that the Company may pay, incash, certain terminated option holders the appreciated value of the options to cancel exercisable options.Subject to certain prior events of expiry, such as termination of employment for cause, all exercisable options expireon the seventh anniversary of the date of grant.41

SHOPPERS DRUG MART CORPORATIONNotes to the Condensed Consolidated <strong>Financial</strong> <strong>Statements</strong>(unaudited)(in thousands of Canadian dollars, except per share data)11. SHARE-BASED PAYMENTS (continued)Restricted Share Unit PlanIn February <strong>2012</strong> and 2011, the Company made grants of restricted share units (“RSUs”) under the Company’srestricted share unit plan (“RSU Plan”) and, for certain senior management, grants of RSUs combined with grantsof stock options under the Company’s share plan.During the 16 and 40 weeks ended October 6, <strong>2012</strong>, the Company awarded nil and 280,106 RSUs (2011: nil and193,474 RSUs), respectively, at a grant date fair value of $40.21 (2011: $40.81), which vest 100% after three years.During the 16 weeks ended October 6, <strong>2012</strong>, the Company cancelled 57,683 RSUs as a result of the departure ofcertain management personnel in the quarter. During the 40 weeks ended October 8, 2011, the Company cancelled80,537 RSUs as a result of the departure of certain management personnel in the first quarter of 2011.As at October 6, <strong>2012</strong>, there were 556,704 RSUs outstanding (2011: 384,090 RSUs).During the 16 and 40 weeks ended October 6, <strong>2012</strong>, the Company recognized compensation expense of $377 and$3,551 (2011: $1,476 and $3,806), respectively, associated with the RSUs granted during the year, and reversedcompensation expense of $1,283 and $1,283 (2011: $nil and $1,428), respectively, as a result of the cancellation ofpreviously granted RSUs.The Company entered into cash-settled equity forward agreements to limit its exposure to future price changes inthe Company’s share price for the Company’s RSUs granted in 2010 and 2011. These agreements mature in December<strong>2012</strong> and December 2013. A percentage of the equity forward derivatives, related to unearned RSUs, has beendesignated as a hedge.12. NET CHANGE IN NON-CASH WORKING CAPITAL BALANCESOctober 6,<strong>2012</strong>16 weeks ended 40 weeks endedOctober 8,2011October 6,<strong>2012</strong>October 8,2011Accounts receivable $ 25,156 $ (24,586) $ 69,839 $ (5,451)Inventory (105,438) (81,296) (54,647) (25,960)Prepaid expenses (11,507) (5,652) (34,114) 6,382Accounts payable and accrued liabilities 61,361 52,081 (85,777) (40,582)$ (30,428) $ (59,453) $ (104,699) $ (65,611)13. SUBSEQUENT EVENTOn October 26, <strong>2012</strong>, the Company’s existing $725,000 revolving term credit facility that was to mature on December10, 2015, was amended to extend the maturity date by one year to December 10, 2016. The credit facility is availablefor general corporate purposes, including backstopping the Company’s $500,000 commercial paper program.42

SHOPPERS DRUG MART CORPORATIONExhibit to the Condensed Consolidated <strong>Financial</strong> <strong>Statements</strong> (unaudited)Earnings Coverage Exhibit to the Condensed Consolidated <strong>Financial</strong> <strong>Statements</strong>52 weeks ended October 6, <strong>2012</strong>:Earnings coverage ratio 14.59 timesThe earnings coverage ratio is equal to earnings (before finance expenses and income taxes) divided by financeexpenses. Finance expenses include finance expense capitalized to property and equipment.43