The Ultimate Hedge Fund Salesperson - 3PM - Third Party ...

The Ultimate Hedge Fund Salesperson - 3PM - Third Party ...

The Ultimate Hedge Fund Salesperson - 3PM - Third Party ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

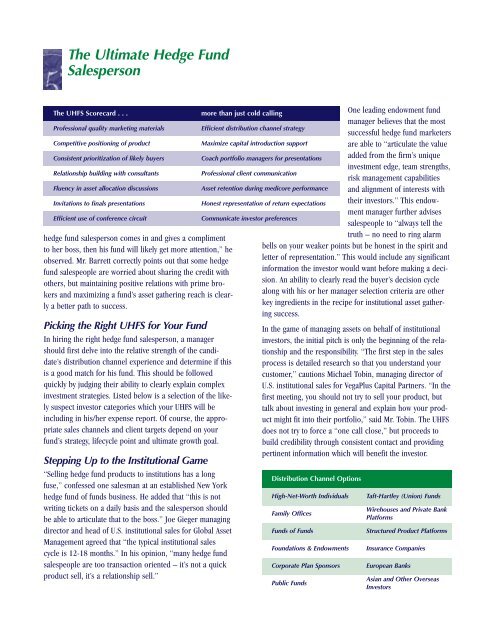

<strong>The</strong> <strong>Ultimate</strong> <strong>Hedge</strong> <strong>Fund</strong><strong>Salesperson</strong><strong>The</strong> UHFS Scorecard . . .Professional quality marketing materialsCompetitive positioning of productConsistent prioritization of likely buyersRelationship building with consultantsFluency in asset allocation discussionsInvitations to finals presentationsEfficient use of conference circuithedge fund salesperson comes in and gives a complimentto her boss, then his fund will likely get more attention,” heobserved. Mr. Barrett correctly points out that some hedgefund salespeople are worried about sharing the credit withothers, but maintaining positive relations with prime brokersand maximizing a fund’s asset gathering reach is clearlya better path to success.Picking the Right UHFS for Your <strong>Fund</strong>In hiring the right hedge fund salesperson, a managershould first delve into the relative strength of the candidate’sdistribution channel experience and determine if thisis a good match for his fund. This should be followedquickly by judging their ability to clearly explain complexinvestment strategies. Listed below is a selection of the likelysuspect investor categories which your UHFS will beincluding in his/her expense report. Of course, the appropriatesales channels and client targets depend on yourfund’s strategy, lifecycle point and ultimate growth goal.Stepping Up to the Institutional Game“Selling hedge fund products to institutions has a longfuse,” confessed one salesman at an established New Yorkhedge fund of funds business. He added that “this is notwriting tickets on a daily basis and the salesperson shouldbe able to articulate that to the boss.” Joe Gieger managingdirector and head of U.S. institutional sales for Global AssetManagement agreed that “the typical institutional salescycle is 12-18 months.” In his opinion, “many hedge fundsalespeople are too transaction oriented – it’s not a quickproduct sell, it’s a relationship sell.”more than just cold callingEfficient distribution channel strategyMaximize capital introduction supportOne leading endowment fundmanager believes that the mostsuccessful hedge fund marketersare able to “articulate the valueadded from the firm’s uniqueinvestment edge, team strengths,risk management capabilitiesand alignment of interests withtheir investors.” This endowmentmanager further advisessalespeople to “always tell thetruth – no need to ring alarmbells on your weaker points but be honest in the spirit andletter of representation.” This would include any significantinformation the investor would want before making a decision.An ability to clearly read the buyer’s decision cyclealong with his or her manager selection criteria are otherkey ingredients in the recipe for institutional asset gatheringsuccess.In the game of managing assets on behalf of institutionalinvestors, the initial pitch is only the beginning of the relationshipand the responsibility. “<strong>The</strong> first step in the salesprocess is detailed research so that you understand yourcustomer,” cautions Michael Tobin, managing director ofU.S. institutional sales for VegaPlus Capital Partners. “In thefirst meeting, you should not try to sell your product, buttalk about investing in general and explain how your productmight fit into their portfolio,” said Mr. Tobin. <strong>The</strong> UHFSdoes not try to force a “one call close,” but proceeds tobuild credibility through consistent contact and providingpertinent information which will benefit the investor.Coach portfolio managers for presentationsProfessional client communicationAsset retention during medicore performanceHonest representation of return expectationsCommunicate investor preferencesDistribution Channel OptionsHigh-Net-Worth IndividualsFamily Offices<strong>Fund</strong>s of <strong>Fund</strong>sFoundations & EndowmentsCorporate Plan SponsorsPublic <strong>Fund</strong>sTaft-Hartley (Union) <strong>Fund</strong>sWirehouses and Private BankPlatformsStructured Product PlatformsInsurance CompaniesEuropean BanksAsian and Other OverseasInvestors