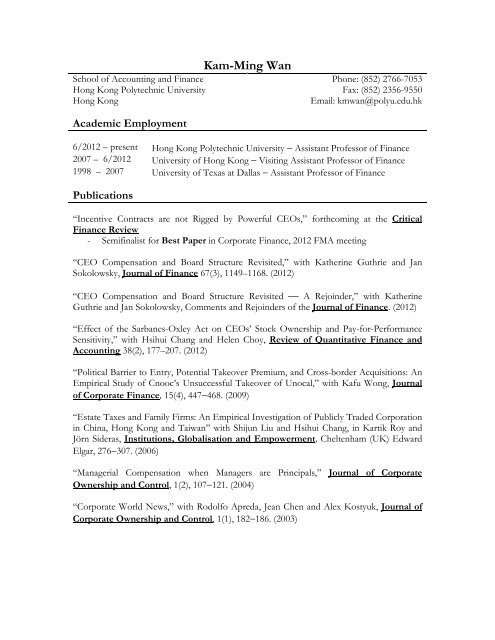

Kam-Ming Wan

Kam-Ming Wan

Kam-Ming Wan

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Kam</strong>-<strong>Ming</strong> <strong>Wan</strong> Page 3Honors and AwardsFaculty Staff Development Scheme, HK PolyU 2013Nominee for the Faculty’s Outstanding Teacher Award, HKU 2009-2010, 2011-2012Nominee for Sloan Dissertation Fellowship 1997Nominee for UCLA Dissertation Year Fellowship 1997Departmental Teaching Assistantship, UCLA 1994-1998Academic Presentations“Incentive Contracts are not Rigged by Powerful CEOs,” presented at- PolyU Mini Conference on Executive Compensation, June 2013, Hong Kong- FMA, October 2012, Atlanta, Georgia- China International Conference in Finance, July 2012, Chongqing, China- PolyU Summer Research Camp in Finance, July 2012, Hong Kong“Sniping to Manipulate Closing Prices in Call Auctions: Evidence from the Hong KongStock Exchange,” will present at- FMA, October 2012, Atlanta, Georgia- China International Conference in Finance, July 2012, Chongqing, China- 19 th Conference on the Theories and Practices of Securities and FinancialMarkets, December 2011, Kaohsiung, Taiwan“The Effect of Accelerated Filing Requirement of the Sarbanes-Oxley Act on InsiderTrading,” presented at- AsLEA, July 2011, Hong Kong, Hong Kong“CEO Compensation and Board Structure: Revisited,” presented at- AsLEA, July 2011, Hong Kong, Hong Kong- FMA, October 2010, New York City, New York (by co-author)“Independent Directors, Executive Pay, and Firm Performance,” presented at- FMA European Meeting, June 2005, Zurich, Switzerland- FMA, October 2003, Denver, Colorado- European FMA, June 2003, Helsinki, Finland“The Effect of Insider Restricted Equity on the Choice of Exchange: An Empirical Study ofthe NYSE Listing Choices of NASDAQ Firms,” presented at- 10 th Conference on the Theories and Practices of Securities and FinancialMarkets, December 2001, Kaohsiung, Taiwan- FMA, October 2001, Toronto, Canada- WEA, June 1998, Lake Tahoe, NV“Do Ownership and Firm Performance Proxies Matter? An Empirical Study of theRelation of Ownership Structure and Firm Performance,” presented at- 12 th Annual Australasian Finance and Banking conference, December 1999,Sydney, Australia

<strong>Kam</strong>-<strong>Ming</strong> <strong>Wan</strong> Page 4Invited Presentations: Renmin University of China (2012); Hong Kong PolytechnicUniversity (2012); Hong Kong Baptist University (2012); Hong Kong Lingnan University(2012); University of Texas at Dallas (2011); City University of Hong Kong (2011);University of Hong Kong (2010); Drexel University (2009); University of Texas at Dallas(2009); Syracuse University (2007); University of California at Los Angeles (2006); Universityof Hong Kong (2006); Hong Kong Institute for Monetary Research (2006); University ofTexas at Arlington (2003); Federal Reserve Bank of Dallas (2003); Southern MethodistUniversity (1999); and University of Texas at Dallas (1998)Professional ServiceAd-hoc Referee: Journal of Finance, Journal of Financial Markets, The Financial Review,Journal of Banking and Finance, Journal of Applied Economics, and Research GrantsCouncil of Hong Kong.Discussant: The 2013 CityU International on Corporate Finance and Financial Markets(2011); The 2011 CityU International Conference on Corporate Finance and FinancialMarkets (2011); The SRT China Business and Economics Conference at HKU (2010); FMAEuropean Meeting (2005); European FMA (2003); 10 th Conference on the Theories andPractices of Securities and Financial Markets (2001)Workshop Committee Member: School of Accounting and Finance, PolyU, 6/2012-presentDatabase Committee Member: School of Accounting and Finance, PolyU, 9/2012-presentService Council Member: School of Accounting and Finance, PolyU, 9/2012-presentOrganizing Committee Member: Mini Conference on Executive Compensation, School ofAccounting and Finance, PolyU, 6/2013Section Chair: 12 th Annual Australasian Finance and Banking Conference (1999)Workshop Coordinator: Department of Finance, UT-Dallas, 1999-2005Recruiting Committee Member: Department of Finance, UT-Dallas, 2000-2005Dissertation Committee Member: Yi <strong>Wan</strong>g (Finance), UT-Dallas, 2000Research InterestsCorporate Governance/FinanceFinancial RegulationMarket MicrostructureExecutive CompensationInsider TradingIndustrial Organization

<strong>Kam</strong>-<strong>Ming</strong> <strong>Wan</strong> Page 5Courses TaughtMarket Microstructure (PhD, M. Fin., & UG)Financial Management (MBA)Investment (UG)Financial Statement Analysis (UG)Introduction to Intermediate Accounting (UG)Business Economics (MBA)Microeconomic Analysis (M. Econ.)Introduction to Economics (UG)ReferencesProfessor Hsihui Chang, KPMG Endowed Professor of Accounting, LeBow College ofBusiness, Drexel University, Matheson Hall 400G, 3141 Chestnut StreetPhiladelphia, PA 19104-2875, Phone: (215) 895-6979, email: hc336@drexel.edu.Professor Harold Demsetz, Professor Emeritus, Department of Economics, UCLA, Box951477, Los Angeles, CA 90095-1477, Phone: (310) 825-3651, email:hdemsetz@econ.ucla.edu.Professor Avanidhar Subrahmanyam, Goldyne and Irwin Hearsh Professor of Finance,Anderson Graduate School of Management, UCLA, C4.18 Entrepreneurs Hall, Los Angeles,CA 90095-1481, Phone: (310) 825-5355, email: subra@anderson.ucla.edu.Professor Wing Suen, Chair Professor of Economics, School of Economics and Finance,K.K. Leung Building, The University of Hong Kong, Pokfulam Road, Hong Kong, Phone:(852) 2857-8505, email: wsuen@econ.hku.hk.Professor Harold Zhang, Full Professor of Finance, Department of Finance, School ofManagement, The University of Texas at Dallas, Richardson, TX 75083, Phone: (972) 883-4777, email: harold.zhang@utdallas.edu