Nycomed Annual Report 2008 - Takeda Pharmaceuticals ...

Nycomed Annual Report 2008 - Takeda Pharmaceuticals ...

Nycomed Annual Report 2008 - Takeda Pharmaceuticals ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

a<strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><strong>Nycomed</strong><strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><strong>Nycomed</strong> S.C.A. SICARCOMPANy PROFILE | CEO LETTER | MANAGEMENT REPORT | PRODUCTS | PIPELINE | CORPORAT

cONteNts04 Company Profile05 CEO Letter06 Management <strong>Report</strong>16 Products20 Pipeline22 Corporate Governance30 Financial Statements84 ContactsE GOVERNANCE | FINANCIAL STATEMENTS | CONTACTS

2 <strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>Financial Highlightsand Key Figures2006 2005pro forma 2005 2) (12 months)<strong>2008</strong> 2007 2006 1) (unaudited) (8 months) (unaudited) 2004Europe 1,623.8 1,702.7 526.2 1,651.3 326.4 482.5 435.4Russia/CIS 329.9 268.4 221.9 221.8 105.7 150.7 98.8LASA-CAN 449.9 548.1 - 491.5 - - -<strong>Nycomed</strong> US (specialities) 272.3 219.4 - 202.0 - - -US Out-licensing 337.2 436.1 - 471.6 - - -International Sales/Export 261.2 240.6 98.9 211.3 60.9 89.1 81.6Contract Manufacturing/Other 73.7 82.1 22.9 144.9 14.9 25.2 28.8total net turnover 3,348.0 3,497.4 869.9 3,394.4 507.9 747.5 644.6Cost of sales 884.6 959.6 349.9 905.6 266.3 369.3 284.6Gross profit 2,463.4 2,537.8 520.1 2,488.8 241.6 378.2 360.0Operating income (EBIT) 352.0 353.8 46.0 217.2 -36.8 -16.5 52.9Net financial items -475.7 -76.5 -156.1 -361.0 -75 -88.7 -67.4Net result -77.9 235.4 -83.4 -97.8 -86.5 -81.0 5.6EBITDA 1,142.8 997.1 168.0 869.1 44.6 90.5 126.3Adjusted EBITDA 1,207.6 1,222.2 180.8 933.0 110.7 156.7 129.3Balance sheetTotal assets 7,972.3 8,390.7 9,176.5 9,176.5 2,350.7 2,350.7 1,486.9Change in working capital -111.8 24.5 -41.1 -17.1 -35.2 -58.1 -12.2Capital expenditures 4) -175.8 -200.9 -30.3 -121.3 -16.6 -20.7 -27.1Total equity 1,321.3 1,380.6 1,232.4 1,232.4 819.4 819.4 548.8cash flowOperating activities 494.7 475.8 -64.0 519.9 16.8 20.7 51.0Sale/purchase of business activities -238.0 -68.5 -4,089.3 -4,089.3 -748.3 -784.5 24.0Other investing activities -171.0 -135.7 -53.3 -130.4 -29.4 -39.9 -76.1Financing activities -65.7 -460.3 4,837.9 -114.4 807.6 827.3 -14.2Net cash flow 20.0 -188.7 631.2 275.1 46.7 23.6 -15.3ratiosGross profit margin 73.6% 74.1% 59.8% 74.9% 47.6% 50.6% 55.8%EBITDA margin 34.1% 28.5% 19.3% 25.6% 8.8% 12.1% 19.6%Adjusted EBITDA margin 36.1% 34.9% 20.8% 27.5% 21.8% 21.0% 20.1%Number of employees 11,657 11,683 3,821 12,741 3) 3,252 3,252 3,019See inside back cover for definition of key figures and financial ratios.1) 29 December 2006 the <strong>Nycomed</strong> Group acquired Altana Pharma AG.2) 9 May 2005 the <strong>Nycomed</strong> Group (<strong>Nycomed</strong> Holdings ApS) was acquired by <strong>Nycomed</strong> A/S.3) Increase in employees due to the acquisition of Altana Pharma AG in 2006.4) Includes additions for property, plant, equipment and intangibles.

<strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>3Recent Achievements>Pivotal 12-month studies in patients with symptomatic chronicobstructive pulmonary disease (COPD) met the primaryendpoints for Daxas ® .><strong>Nycomed</strong> acquired US company Bradley <strong>Pharmaceuticals</strong> tobecome a leading speciality pharmaceutical player in dermatologyin the US market.>Collaboration with Immunomedics giving <strong>Nycomed</strong> exclusive,worldwide rights to develop, manufacture and commercialise thesubcutaneous formulation of Veltuzumab for the treatment of allnon-cancer indications.>At the end of <strong>2008</strong>, <strong>Nycomed</strong> signed a contract with EffRx.The licensing agreement on EffRx’s drug Alendronateeffervescent gives <strong>Nycomed</strong> exclusive rights from 2009 todevelop, manufacture and commercialise the effervescentformulation of Alendronate for the treatment of osteoporosis.>Alvesco ® gained FDA approval in the US and <strong>Nycomed</strong> grantedSepracor the exclusive development, marketing andcommercialisation rights for Ciclesonide in the US.><strong>Nycomed</strong> granted Baxter exclusive rights to market and distribute<strong>Nycomed</strong>’s TachoSil ® patch for the US market.>Optimisation of European manufacturing network to improvecompetitiveness.>Joint venture with our Indian partner Zydus Cadila expanded toalso cover the production of active pharmaceutical ingredients(APIs).><strong>Nycomed</strong> established its own marketing and sales organisation inVenezuela extending the company’s presence to all four of thelargest Latin American pharmaceutical markets.>Following a strategic decision to discontinue R&D activity inoncology, <strong>Nycomed</strong> transferred some projects to 4SC AG and itspreclinical anti-cancer programme to Bayer Schering Pharma.Total Net Turnover Adjusted ebitDa Number of employees(€ million) (€ million)3,5003,0002,5002,0001,5001,0005001,20090060030012,0009,0006,0003,0002004* 2005* 2006* 2007 <strong>2008</strong> 2004* 2005* 2006* 2007 <strong>2008</strong> 2004* 2005* 2006* 2007 <strong>2008</strong>Altana Pharma<strong>Nycomed</strong>*combined proforma non-audited, figures of Altana Pharmaand <strong>Nycomed</strong> before acquisition of Altana PharmaNet turnover by region(€ million)Sales of key products(€ million)<strong>2008</strong>13.4 %449.9LASA-CAN 9.9 %329.9Russia/CIS48.5 %1,623.8Europe2.2 %73.7Contract Manufacturing/Other10.1 %337.2US Out-licensing8.1 %272.3<strong>Nycomed</strong> US(specialities)7.8 %261.2International Sales/ExportPRoduct theRAPEUTIC AREA SALES <strong>2008</strong> SALES 2007 GROWTHPantoprazole Gastroenterology 1,314 1,685 -22.0%Calcium D 3 Osteoporosis 112 94 +17.7%Actovegin ® Neurology 103 92 +11.2%TachoSil ® Tissue management 87 64 +35.7%Alvesco ® Respiratory diseases 48 38 +25.8%Preotact ® Osteoporosis 45 18 +145.7 %Xefo ® Pain 38 31 +22.1%Matrifen ® Pain 28 18 +48.1%

4<strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> 2007Company Profile><strong>Nycomed</strong> at a glance<strong>Nycomed</strong> is a privately owned, global, market-drivenpharmaceutical company with a differentiated portfolioof branded medicines in gastroenterology, respiratoryand inflammatory diseases, pain, osteoporosis and tissuemanagement. An extensive range of OTC productscompletes the portfolio.<strong>Nycomed</strong> has strong platforms in Europe and in fastgrowingmarkets such as Russia/CIS and Latin America.In-licensing is a cornerstone of the company’s growthstrategy and <strong>Nycomed</strong> actively seeks partnerships in itscore areas as well as throughout the value chain.Our VisionOur vision is to become the preferred pharmaceuticalcompany by being responsive, reliable and focusingon results.Our MissionOur mission is to bring medicines that matter topatients and healthcare providers.Company Profile | | CEO letter | | Management <strong>Report</strong> | | Key products | Pipeline | | Corporate | Governance | Financial | Statements | Contacts | |

<strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>5CEO Letter>VerysatisfyingWell positioned for 2009<strong>2008</strong> has been a very satisfying year for<strong>Nycomed</strong>. Our key products continue theirabove-average growth, and Pantoprazoleperforms very well outside the United Statesand Canada. Most of our home markets alsoachieved results above expectations.Moreover, we were able to reduce our costbase further which allowed us to completethe year with favourable earnings results.Even though we see signs of the currenteconomic situation in some pharmaceuticalmarkets, this has had only a minor impacton <strong>Nycomed</strong>’s performance during the fullyear.We are rapidly moving ahead with thepreparations for the European and UnitedStates regulatory filing of Daxas ® (Roflumilast),our treatment of chronic obstructivepulmonary disease (COPD), which hasshown encouraging results in the pivotalstudies. And we have initiated the searchfor a commercialisation partner for theUnited States. By in-licensing Veltuzumaband effervescent Alendronate we havemade significant additions to our pipeline.The integration restructuring showed itsfull cost-saving effect in <strong>2008</strong>. Togetherwith the ongoing optimisation of ourmanufacturing network, this increases ourcompetitiveness and strengthens us forthe future.For 2009, we are well prepared to managePantoprazole as its substance patent expiresin Europe – and expect it to remain ourlargest single product in the longer term.At the same time, our growth will continueto originate from our key products, fromnew product launches like Daxas ® andsustained high growth in Russia/CIS andLatin America. Furthermore, we will bestrengthening our position in Asia in thecoming years by exploiting opportunities foracquisitions or partnerships.Current world economic conditionsmake predictions difficult, but we arewell positioned for the future and remainconfident that we can deliver anothergood performance in 2009.Håkan BjörklundChief Executive Officer (CEO)

6<strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>Management <strong>Report</strong>>Management <strong>Report</strong>OVERALL PERFORMANCEThe twelve months of <strong>2008</strong> have been verysatisfactory for <strong>Nycomed</strong>. Adjusted EBITDAamounted to € 1,207.6 million which is slightlybelow 2007. Total revenue decreased by4.3% to € 3,348.0 million compared to€ 3,497.4 million in 2007. In local currencytotal net turnover decreased by 1.5%.The decrease in revenue is mainly due todecreased sales of Pantoprazole in the UnitedStates to our partner Wyeth <strong>Pharmaceuticals</strong>as a result of the “at-risk” launch of genericPantoprazole. Revenue for <strong>2008</strong> is alsoimpacted by an execution payment of€ 100.9 million received from our partnerSepracor in connection with granting theexclusive development and marketing rightsfor the Ciclesonide product family in theUnited States.Revenue growth based on normalisedrevenue figures reflecting the underlying andongoing business activities amounts to 4.1%for <strong>2008</strong> compared to 2007. In local currency,revenue growth based on normalised revenuefigures amounts to 4.3%. Normalisation ofrevenue comprises adjustments of decreasedsales of Pantoprazole in the United States andCanada, the execution payment from theout-licensing agreement with Sepracor, theacquisition of Bradley <strong>Pharmaceuticals</strong> anddisposals of business activities and otherminor adjustments. Adjusting for the sameeffects and the disposal of the oncologypipeline, normalised adjusted EBITDA grewby 34.7% in <strong>2008</strong> compared to 2007.Most of our markets performed well andabove our expectations for <strong>2008</strong>. Sales inRussia/CIS grew by 30.8% in local currency.Despite price reductions in many of ourmarkets for Pantoprazole, sales developedsatisfactorily as a result of strong volumegrowth. Excluding the United States andCanada, we experienced total volumegrowth for <strong>2008</strong> of approximately 15.7% forEurope and rest of the world. Sales of ourkey products also performed according to ourexpectations and developed positively, witha growth of approximately 17.2% (17.8% inlocal currency) compared to 2007. Otherproducts and local product portfolios in totalshowed a growth of approximately 1.2%(10.4% in local currency).The growth in normalised adjusted EBITDAas stated above is impacted by the favourabledevelopment in our markets, however,significant decreased research anddevelopment costs also led to an increase innormalised adjusted EBITDA. This is a resultof the change in the R&D model and thefollowing restructuring in 2007. Thedecreased research and development costscomprise personnel-related costs as well asclinical project costs. Total marketing andsales costs increased slightly in <strong>2008</strong>compared to 2007. This is impacted bythe acquisition of Bradley <strong>Pharmaceuticals</strong>.Excluding this acquisition, marketing andsales expenses were slightly below the levelof 2007. Regionally, marketing and sales costsincreased in our emerging markets, whilemarketing and sales costs decreased in otherregions in general. Cost saving measuresfrom the 2007 restructuring prove to have asustainable positive effect on adjustedEBITDA.REGIONAL PERFORMANCEMost of our markets performed well andabove our expectations throughout <strong>2008</strong>even though the financial crisis added someuncertainty to our business environmentprimarily related to the emerging markets. In<strong>2008</strong> the strongest growth was seen inGreece with an increase of 42.1% over 2007due to the strong performance of the newlylaunched Preotact ® and also Pantoprazole.Russia/CIS continued its strong growthshowing an increase of 23.2% in Euro andmore than 30.0% in local currency. Also Italyand most of our Eastern European countriesincreased sales considerably in <strong>2008</strong>. Despiteprice reductions in many of our markets forPantoprazole, sales reached our expectationsdue to strong volume growth. Excluding theUS and Canada we saw total volume growthof approximately 15.7% for Europe and restof the world. Sales of other key productsdeveloped satisfactorily in <strong>2008</strong> and were onor above our expectations with Preotact ® ,TachoSil ® , Calcium D 3, Alvesco ® , Xefo ® andMatrifen ® showing growth of 20.0% or more.EuropeTotal European revenues declined by 4.6%in <strong>2008</strong> compared to 2007. The decline isprimarily related to France, Germany, Spainand the United Kingdom due to lower pricesfor Pantoprazole and the divestiture ofcertain business areas such as imaging andsome smaller franchises in Switzerland.Excluding sales from these businesses wehad growth in Europe of approximately0.3% in <strong>2008</strong>.Company Profile | CEO letter | Management <strong>Report</strong> | products | Pipeline | Corporate Governance | Financial Statements | Contacts

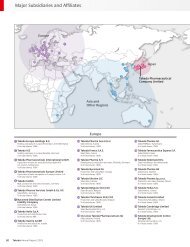

<strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> 7<strong>Nycomed</strong>´s sales and operating income derives from the following regionsEurope 1 – Denmark, Norway, Sweden,Finland, Belgium and the Baltic States.Europe 2 – Germany, France, Italy,Netherlands, Austria, Poland and SwitzerlandEurope 3 – Greece, United Kingdom,Portugal, Romania, Spain, Czech Republic,Hungary, Ireland, Croatia and SlovakiaLASA-CAN – Argentina, Mexico, Brazil,South Africa and CanadaRussia/CISInternational Sales/Export – Asia,Australia, China, India, Japan and otherexport countries<strong>Nycomed</strong> US (Specialities)US Out-licensingThis includes Wyeth Business, Sepracor andAngiox one time execution paymentsContract Manufacturing<strong>Nycomed</strong> outsources its excess capacity on<strong>Nycomed</strong> plants to manufacture products orcomponents for external partners.<strong>Nycomed</strong>´s segments reflect the structureof our management and sales organisation,our systems of internal financial reporting,and the predominant source of risk andreturn of the business.net turnover by region(€ million)40003,497.43,348.0Full year Full year Percentage€ million <strong>2008</strong> 2007 Change change3000Europe 1Europe 1 367.5 366.9 0.6 0.2%Europe 2 957.2 1,013.2 -56.0 -5.5%Europe 2Europe 3 299.1 322.6 -23.5 -7.3%2000Europe 3LASA-CAN 449.9 548.1 -98.2 -17.9%<strong>Nycomed</strong> US 272.3 219.4 52.9 24.1%LASA-CANRussia/CIS 329.9 268.4 61.5 22.9%1000<strong>Nycomed</strong> USRussia/CISInternational Sales/Export 261.2 240.6 20.6 8.6%US Out-licensing 337.2 436.1 -98.9 -22.7%International Sales (Export)Contract Manufacturing/Other 73.7 82.1 -8.4 -10.2%02007<strong>2008</strong>US Out-licensingContract Manufacturing3,348.0 3,497.4 -149.4 -4.3%

8<strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>Management <strong>Report</strong>>Italy increased sales in <strong>2008</strong> by 12.9% eventhough prices for Pantoprazole werevoluntarily lowered by almost 40.0% in thefourth quarter of 2007. Eastern Europeancountries continue to develop satisfactorily;Greece had strong growth of more than40.0% while the Scandinavian countries hadno or low single digit growth.Europe 1<strong>2008</strong> revenues in Europe 1 increased by0.2% compared to 2007 with Norway andSweden hit by the negative currency impactand Denmark by the parallel import ofPantoprazole and generic competition. Thisregion was negatively influenced by therepatriation of the Bracco imaging businessin Belgium and by TrioBe in Norway. Excludingthese businesses growth was approximately3.6% year on year.The Baltics saw the highest sales ever inDecember, which was due to an upcomingsubstantial increase in value added tax forpharmaceuticals in January causing stockpilingby patients and wholesalers. Totalannual sales were 1.1% lower than in 2007primarily due to an early termination of thedistribution contract by Dansk Droge.Full year performance for Denmark showeda decline in sales of 0.8% from 2007 to <strong>2008</strong>.<strong>2008</strong> sales were hit by intensified genericcompetition on some key products and theparallel import of Pantoprazole since thesummer.Finland showed growth in sales in <strong>2008</strong>of 5.6% compared to 2007. A smallerproduction issue was overcome in themiddle of the year and strong sales, e. g. ofCircadin ® , were achieved.Total sales for Sweden increased by 0.4% in<strong>2008</strong> compared to 2007, while in localcurrency the increase was approximately2.0%. The increase in sales is mainly drivenby the Rx portfolio, Matrifen ® due to noimpact from the exchange decision (substitution)and a price increase on Calcium D 3. Also theOTC and generic portfolios performed well.Belgium sales declined by 2.3% from 2007to <strong>2008</strong>. Excluding the loss of the imagingbusiness, Belgium showed growth of morethan 6.0%. We saw strong performance ofPantoprazole and Zurcale ® while Circadin ®sales were disappointing despite a stronguptake in the last quarter. The OTC productswere below expectations mainly due to thebad performance of recently introducedproducts. Delays in the launch of the lineextension and strong competition in generalhave also negatively influenced ourperformance.<strong>2008</strong> sales in Norway were 3.6% below 2007while in local currency the decline wasapproximately 1.0%. TachoSil ® performedunder our expectations while our OTCproduct, Nycoplus ® had a very successful year.Europe 2Europe 2 had a very strong performance in<strong>2008</strong> and delivered above expectations eventhough total revenues declined by 5.5%.Excluding the divestment of low-marginbusinesses and the imaging franchises inWestern European markets, the region showedgrowth of approximately 1.0%. Both Italyand Poland showed strong growth whilethe sales development in Germany wasflat despite a major price cut in Pantoprazolein June.From a portfolio standpoint Pantoprazolewas again the key contributor and salesexceeded our expectations and were evenslightly above an already dynamic 2007,compensated by strong growth in consumptiondespite the marked price decreasesthroughout the area. Pantoprazole continuesto be strongly challenged by the costcontainment measurements of the localhealthcare systems.Sales in Austria showed a decline of 0.2%compared to 2007. This was primarily due tothe launch of several Pantoprazole genericsin September, which were withdrawn fromthe market in November after a preliminarycourt decision. Pantoprazole remains thebest selling brand by far in the Austrianpharmaceutical market.In France the net sales <strong>2008</strong> decreased by8.8% compared to 2007. The decline wasaffected by the repatriation by Bracco of theimaging business. Excluding this, sales increasedby approximately 1.0%. At the end of theyear Inipomp ® , a sizeable Pantoprazole brandof approximately € 150.0 million marketsales and out-licensed so far to Sanofi, wasrepatriated. With respect to the contractwith Sanofi, upon the termination of thecontract on 31 December <strong>2008</strong>, Sanofigranted <strong>Nycomed</strong> an exclusive, sub-licensable,royalty-bearing licence to use the trademarkInipomp ® .<strong>2008</strong> sales in Germany declined by 14.4%compared to 2007. The overall top linedecrease is explained by the loss of theimaging franchise. Excluding this, Germanyshowed a decline of approximately 1.0%.The key driver in this development wasPantoprazole, growing in <strong>2008</strong> despite areference price cut of 27.0% in June <strong>2008</strong>.The underlying strong increase in consumptionwas mainly triggered by successfully gainingpatients for Pantoprazole from otherproton-pump-inhibitor (PPI) treatments.Italy recorded strong growth of 12.9% in<strong>2008</strong> compared to 2007. As earlier statedPantoprazole started with a 40.0% voluntaryprice cut from October 2007, which provedto be the adequate brand strategy. This ledto a significant market share increase ofPantoprazole in the PPI consumption andthereby over-compensated the price decrease.However, part of the local Pantoprazoledynamic is also due to increased parallelexports. Preotact ® also showed strong growthin <strong>2008</strong>.Company Profile | CEO letter | Management <strong>Report</strong> | products | Pipeline | Corporate Governance | Financial Statements | Contacts

<strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> 9Sales in the Netherlands declined by14.2% in <strong>2008</strong>. However, this was due tostrongly increased Pantoprazole parallelimports. From a local sell-out standpointthe Pantoprazole performance was andstill is robust.Poland showed strong performance in <strong>2008</strong>and increased sales by 30.0% compared to2007. The major growth driver was Alvesco ®with significant sales but also Pantoprazoleremained at a high level despite genericcompetition.Sales in Switzerland declined by 14.0% in<strong>2008</strong>. The decrease is explained by twofactors, a 20.0% price cut in Pantoprazole inearly <strong>2008</strong> and the divestment of two lowmargin franchises, namely a generic oncologyand a diagnostic line. Pantoprazole sell-outperformance is still strong, loss of exclusivitywill occur in June 2010 only.Europe 3Europe 3 showed a decline in revenues in<strong>2008</strong> compared to 2007 of 7.3%. Strongfull year performers were Greece, the CzechRepublic and Romania while Spain, the UKand Portugal saw a decline in revenues.Greece showed an increase in sales of42.1% in <strong>2008</strong> over 2007. Pantoprazoleperformed very well, and Preotact ® showedstrong growth with an increase in sales ofapproximately 75.0% over 2007. Other newlylaunched products are showing good growth.For Romania sales increased by 28.1% in<strong>2008</strong>. Actovegin ® in particular deliveredabove expectations, Xefo ® tripled sales in<strong>2008</strong> but also Controloc ® increasedconsiderably despite the loss of exclusivity.Sales in <strong>2008</strong> in Croatia increased by11.6% compared to 2007 even thoughwe saw intensified generic competitionon Pantoprazole and hospital savingsinitiatives that reduced our hospital sales.We saw an increase in sales in <strong>2008</strong> of24.0% compared to 2007 in the CzechRepublic. The OTC portfolio in general andCalcichew ® in particular had a strong year,while the Bracco imaging business sufferedfrom price erosion, not fully offset byvolume increase.Sales increased by 1.2% in <strong>2008</strong> in Slovakia.During the year sales were impacted bywholesaler IT problems, stock reductionsand many of our products were hit by pricecuts.In Ireland sales increased by 7.7% in <strong>2008</strong>compared to 2007. Protium ® deliveredaccording to expectations even though itwas negatively influenced by parallel imports.<strong>2008</strong> sales in the United Kingdom declinedby 42.4% compared to 2007. This is primarilydue to the parallel import of Protium ® ontop of a gradual decline due to in-classgeneric substitution driven by payers.In <strong>2008</strong> sales in Portugal declined by 18.3%compared to 2007. The main reasons beingour decision not to launch Matrifen ® , thedelay of the TachoSil ® launch and stock-outsituations on Faktu. Pantoprazole reached ourexpectations.In Spain <strong>2008</strong> sales declined by 14.1% comparedto 2007 primarily due to a 30.0% price cuton Pantoprazole in February <strong>2008</strong>. Preotact ®<strong>2008</strong> sales showed strong growth and almostdoubled compared to 2007 while TachoSil ®showed growth of almost 60.0%. TachoSil ®sales suffered from hospital cost containmentmeasures during the year.In Hungary sales declined by 14.3% in <strong>2008</strong>primarily due to a price cut on Pantoprazoleoral form of 44.0% which squeezed thegeneric Pantoprazole penetration. Ebrantil ®showed strong performance while Alvesco ®sales were slightly below our expectations.Latin America, South Africaand CanadaThe region showed a decline in revenues of17.9% in <strong>2008</strong> compared to 2007 primarilydue to the generic impact on Pantoprazolein Canada and a negative development inexchange rates. Adjusting for the genericimpact of Pantoprazole in Canada and thenegative exchange deviation the regionshowed growth of approximately 4.0%.<strong>2008</strong> sales in Canada declined by 42.5%primarily due to the generic impact ofPantoprazole in April <strong>2008</strong>. Furthermore,Alvesco ® , Omnaris ® and Resultz ® showedsales below our expectations.Sales in South Africa declined by 12.2% in<strong>2008</strong> compared to 2007. This is primarilydue to negative exchange rate movements.Adjusting for this South Africa showed agrowth of approximately 8.0%. Xefo ® andthe OTC business performed well.Sales in Brazil declined by 0.3% in <strong>2008</strong>compared to 2007. Adjusting for the negativecurrency impact, Brazil showed a growth ofapproximately 1.0%. Sales of Neosaldina ® ,Pantoprazole oral, Dramin ® and Kaloba ® arestill driving sales although Kaloba ® is behindthe previous year due to seasonality whileour OTC franchise suffered in the latter partof the year.

10 <strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>Management <strong>Report</strong>>Total sales in Mexico declined by 1.3% in <strong>2008</strong>compared to 2007 and recovered strongly inthe second half of the year, after a weakstart in <strong>2008</strong>. We had very strong Decembersales. Currency developed negatively andexcluding this negative impact Mexicoshowed an increase in sales of approximately7.0% in <strong>2008</strong>.Sales in Argentina increased by 10.9% in <strong>2008</strong>compared to 2007 with strong performancein our key products. The financial crisis hitArgentina in the third quarter increasing theinterest rate to approximately 35.0% forcingthe wholesalers to reduce inventories. Inlocal currency sales increased approximately20.0% in <strong>2008</strong>.Russia/CISTotal revenues in Russia/CIS increased by22.9% in <strong>2008</strong> compared to 2007. However,adjusting for the negative exchange rateimpact the increase reached more than 30.0%.Sales developed according to expectations inall countries except for Georgia while Asia,Belorussia, Russia and Ukraine showed goodgrowth. Russia constitutes approximately70.0% of total sales in this region.Actovegin ® continues to be the biggest productin Russia/CIS and we have seen strong growthof Concor ® , Glucophage ® , Cardiomagnyl ® ,Warfarin, Xymelin TM , Ceraxon ® and Curosurf ® .The financial crisis hit Russia/CIS and theextension of payment terms with thedistributors is an ongoing discussion for allsuppliers in the region. The situation inUkraine is difficult and the pharmaceuticalbusiness, like other business areas, almoststopped in December.International Sales/Export(Asia, Australia, China, Japan and OtherExport Countries)Total revenues of international sales/exportincreased by 8.6% in <strong>2008</strong> compared to2007. All regions contributed to the growthled by Asia and China.Despite the turbulence in the market inmid-<strong>2008</strong> Australia showed an increase insales of 2.4% in <strong>2008</strong> compared to 2007.The increase was primarily led by Somac ® ,which increased by approximately 6.0% overlast year, increasing market share to morethan 20.0%, and also by Alvesco ® .Total sales to China in <strong>2008</strong> increased by51.0% (more than 50.0% in local currency)compared to 2007; primarily led by the strongperformance of Pantoprazole both IV andtablets, Actovegin ® and Calcium D 3.Asia showed an increase in sales ofapproximately 9.0% in <strong>2008</strong> compared to2007 primarily driven by the strongperformance of South Korea and Malaysia.Key products TachoSil ® , Alvesco ® andZycomb ® continue to deliver according to plan.The Middle East/Africa increased sales in<strong>2008</strong> by approximately 17.0% over 2007despite the delay in deliveries, thepostponement of import licences and newfinancial restrictions in Iran and Pakistan.Market sales continue to grow in line withour targets. Pantoprazole and Xefo ®continued their strong performance.<strong>2008</strong> sales of our exports to EU/otherexport countries increased approximately7.0% over 2007 with Pantoprazole, TachoSil ®and Xefo ® as the main drivers. Turkeycontinued to show strong growth.Sales in Japan increased approximately1.0% in <strong>2008</strong> compared to 2007.<strong>Nycomed</strong> USRevenues of <strong>Nycomed</strong> US Inc. increased by24.1% in <strong>2008</strong> compared to 2007. In localcurrency the increase was almost 40.0%primarily as a result of the acquisition ofBradley <strong>Pharmaceuticals</strong> in the beginningof the year.Adjusting for Bradley <strong>Pharmaceuticals</strong>,revenue shows a loss of 6.8% (4.3% in localcurrency).Fougera continues to experience destockingin the wholesale distribution and retailchannels due to the economic conditions inthe United States. PharmaDerm weekly andmonthly TRx data continue to showincreases in promoted products, the salesshortfall is mainly attributable to the destockingat the wholesale and retail levels.US Out-licensingUS out-licensing sales decreased by 22.7%or € 98.9 million with respect to last year.Sales of Protonix ® (Pantoprazole) wereadversely affected by the “at-risk” launch ofgeneric Pantoprazole tablets in the UnitedStates by Teva <strong>Pharmaceuticals</strong> USA, Inc. on21 December 2007, and the subsequent“at-risk” launch of Sun PharmaceuticalIndustries’ generic Pantoprazole tablets.On 29 January <strong>2008</strong>, <strong>Nycomed</strong> and itslicense holder Wyeth announced the USlaunch of their own generic version ofProtonix ® tablets. <strong>Nycomed</strong> and Wyethremain convinced of the validity andenforceability of their patent and willcontinue to vigorously pursue litigation.Total revenues from the sale of Protonix ® inthe United States declined by 53.2% in <strong>2008</strong>compared to 2007.Contract ManufacturingSales from contract manufacturing decreasedby 10.2% in <strong>2008</strong> compared to 2007. Fullyear 2007 sales were extraordinarilyimpacted by non-recurring fees and thedisposal of inventory in connection with thetermination of the contract with Bracco.Adjusting for this we saw growth in salesin <strong>2008</strong> of 19.6%.Company Profile | CEO letter | Management <strong>Report</strong> | Key products | Pipeline | Corporate Governance | Financial Statements | Contacts

<strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>11Income statement financials01.01.<strong>2008</strong> 01.01.200731.12.<strong>2008</strong> 31.12.2007 PercentageKEY FIGURES € million € million changeNet sales 3,191.8 3,450.3 -7.5%Royalties/other income 1) 156.2 47.1 231.6%Net turnover 3,348.0 3,497.4 -4.3%Cost of Sales -880.9 -906.6 -2.8%Amortisation of fair value adjustments on inventories from acquisitions 2) -3.7 -53.0 -93.0%Total cost of sales -884.6 -959.6 -7.8%gross Profit 2,463.4 2,537.8 -2.9%Sales and Marketing expenses -916.2 -934.6 -2.0%thereof disposal of activities and other non-recurring items 22.0 -4.6 -578.3%Amortisation of fair value adjustments on patents and rights from acquisitions 3) -646.0 -531.8 21.5%total sales and marketing expenses -1,562.2 -1,466.4 6.5%Research and Development expenses -224.7 -284.5 -21.0%Administration expenses -257.2 -259.1 -0.7%Integration/Restructuring costs -67.3 -174.0 -61.3%Operating Income 352.0 353.8 -0.5%Gross Profit Margin 2) 73.6% 74.1% -0.7%EBITDA 4) 1,142.8 997.1 14.6%EBITDA margin 34.1% 28.5% 19.7%Adjusted EBITDA 4) 1,207.6 1,222.2 -1.2%Adjusted EBITDA margin 36.1% 34.9% 3.2%1) Royalties are not disclosed separately from Other Income because the amount is not material to <strong>Nycomed</strong>.2) Cost of sales for December YTD 2007 includes € 53.0 million write-off of inventory step-up in connection with the purchase price allocation related to the acquisition of former Altana Pharma AG. The gross profitmargin stated above has been adjusted for this non-cash and non-recurring write-off of inventory step-up.3) Amortisation for 2007 is impacted by the application of purchase price allocation in connection with the acquisition of Altana Pharma AG as a result of the fair value adjustments to the values of currently marketedproducts and development projects. Amortisation for December <strong>2008</strong> YTD includes € 56,6 million as an extraordinary amount for the termination of the Venticute project.4) EBITDA means net income plus net financial items, income taxes, depreciation of tangible assets and amortisation of intangible assets. Adjusted EBITDA includes certain unusual or non-recurring items. EBITDA andadjusted EBITDA are not measurements of performance under IFRS but are key measures used in order to have a more comprehensive analysis of <strong>Nycomed</strong>´s operating performance and ongoing business and ability toservice our debt.NET TURNOVERTotal net turnover decreased by € 149.4million or 4.3% to € 3,348.0 million in <strong>2008</strong>from € 3,497.4 million in 2007. In localcurrency total net turnover decreased by 1.5%.The main reason for the decline in netturnover is decreased sales of Pantoprazolein the United States to our partner Wyeth<strong>Pharmaceuticals</strong> as a result of the “at-risk”launch of generic Pantoprazole. This is partlyoff-set by an execution payment of € 100.9million received from our partner Sepracorin connection with granting the exclusivedevelopment and marketing rights for theCiclesonide product family in the UnitedStates. As stated previously in the OverallPerformance section, turnover growth basedon normalised turnover figures reflecting theunderlying and ongoing business activitiesamounts to 4.1% for <strong>2008</strong> compared to2007. In local currency turnover growthbased on normalised turnover figuresamounts to 4.3%.Please refer to the section on page 6for more details on regional revenueperformance.COST OF SALESCost of Sales for <strong>2008</strong> decreased by€ 25.7 million to € 880.9 million, a decreaseof 2.8%. This excludes the amortisation of fairvalue adjustments on inventories from theacquisition of Altana Pharma of € 53.0 millionin 2007.GROSS PROFITThe gross profit for <strong>2008</strong>, excluding theimpact of the write-off of inventorystep-up, decreased by € 127.3 million, or4.8% to € 2,463.4 million. The total grossprofit margin decreased from 74.1% in 2007to 73.6% in <strong>2008</strong>. The decrease in grossprofit and gross profit margin is primarilydue to the decline in sales of Pantoprazolein the United States partly off-set by afavourable product mix in <strong>2008</strong>.SALES AND MARKETING EXPENSESSales and marketing expenses excludingamortisation of fair value adjustmentsdecreased by € 18.4 million, or 2.0%, from€ 934.6 million in 2007 to € 916.2 millionin <strong>2008</strong>.

12<strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>Management <strong>Report</strong>>Sales and marketing expenses are influencedby the disposal of activities and other nonrecurringitems. In <strong>2008</strong>, sales and marketingexpenses are positively impacted by22.0 million income mainly relating to thedisposal of the oncology business. Excludingthis effect, the sales and marketing expensesdeviation with respect to last year is € 8.2million or 0.9%. Sales and marketingexpenses were impacted by the acquisition ofBradley <strong>Pharmaceuticals</strong>, entailing highersales and marketing expenses in the UnitedStates compared to 2007. Excluding thisacquisition, marketing and sales expenseswere slightly below the level of 2007.Regionally, marketing and sales costs increasedin our emerging markets, Latin Americaand Russia/CIS, whereas marketing andsales expenses decreased in Europe andin the central marketing functions.In amortisation of fair value adjustmentson patents and rights from acquisitions<strong>Nycomed</strong> recognised an impairment loss of€ 56.6 million for the development projectin progress of Venticute, due to negativeresults for clinical trials classified.RESEARCH AND DEVELOPMENTEXPENSESTotal research and development expensesdecreased by € 59.8 million, 21.0%,compared to 2007, from € 284.5 million in2007 to € 224.7 million in <strong>2008</strong>. This is aresult of the change in the R&D model andthe following restructuring in 2007. Thedecreased research and development costsare comprised of personnel-related costs aswell as decreased project costs for clinicaldevelopment programmes. The decline inproject costs for clinical development wasprimarily related to Ciclesonide as a result ofthe transfer to Sepracor and the terminationof the Venticute project. Capitalisation ofdevelopment costs in <strong>2008</strong>, not impactingthe income statement, mainly comprises thecapitalisation of the Daxas ® developmentcost of € 29.5 million and a milestonepayment of € 25.6 million in connection withthe in-licensing of Veltuzumab from ourpartner Immunomedics. In addition, otherdevelop ment costs for Instanyl ® , Preotact ®and Optesia ® and the development of thegenerics portfolio in the United States werecapitalised.ADMINISTRATION ExPENSESTotal administration expenses were slightlybelow the expenses in 2007, a decrease of0.7%. In most of our markets administrationexpenses were at the same level as in 2007or slightly below and in the central functionscomprised by Central IT, Human Resources,Corporate Finance, Corporate Communication,Legal, Insurances and other central serviceareas the costs decreased slightly comparedto 2007 in total.OPERATING INCOMEOperating income for <strong>2008</strong> amounted to€ 352.0 million compared to € 353.8 millionin 2007.NET FINANCIAL ITEMSTotal net financial items for <strong>2008</strong> amountedto an expense of € 475.7 million compared toan expense of € 76.5 million in 2007, anincrease of € 399.2 million. The <strong>2008</strong> netfinancial items comprised interest incomeand other financial income of € 23.3 million(€ 22.3 million in 2007), third party interestexpenses of € 348.9 million, (€ 395.1 millionin 2007) net loss from derivatives of€ 117.1 million (net gain of € 17.0 million in2007). The <strong>2008</strong> net loss from derivativesincluded a € 20.9 million gain from the buybackof own debt. Furthermore total netfinancial items for <strong>2008</strong> comprised anunrealised foreign exchange loss of € 247.0million (after a gain of € 305.8 million in 2007),which related to the revaluation of US Dollardenominated debt. The currency revaluationexposure of the US Dollar debt was partiallyfixed by currency swaps. In <strong>2008</strong> <strong>Nycomed</strong>entered into cross currency swaps for anamount of € 1,500.0 million at an averageUSD/€ exchange rate of 1,5208. Due to amajor amount of unrealised gain, it has beendecided to restrike the swaps at an averageof 1,28275 generating a gain of € 227.2 million.Finally net financial items also comprised theamortisation of financing fees of € 16.1 million(€ 25.8 million in 2007) and other financialexpenses of € 5.7 million (€ 5.6 million in 2007).TAX EXPENSEIncome tax benefit for the year was€ 45.7 million in <strong>2008</strong> compared to anincome tax expense of € 41.9 million for2007. The increase in income tax benefitof € 87.6 million was mainly due to adecrease in income before tax which wentfrom an income of € 277.3 million in 2007 toa loss of € 123.6 million in <strong>2008</strong>. The netincome tax benefit for <strong>2008</strong> was effectedby a tax income of € 5.8 million relating tothe change in tax rates. The comparablenumber for 2007 was a tax income of€ 134.5 million, which mainly related to areduction in deferred tax on the step-upvalue of intangible fixed assets due to adecrease in the tax rate. In addition the netincome tax benefit for <strong>2008</strong> was effectedby tax income of € 9.3 million relating toprior year adjustments. The comparablenumber for <strong>2008</strong> was a tax expense of€ 31.3 million, which mainly related to areversal of deferred tax assets concerning taxloss carry forwards in Denmark. Finally theincrease in tax benefit was effected by the neteffect of differences in local tax rates, thenon-deductible loss on the sale of shares,withholding tax, non-deductible expensesand other permanent differences.NET ResultNet result for <strong>2008</strong> amounted to € -77.9million compared to € 235.4 million in 2007.LIQUIDITYCash flow from operating activities showedan inflow of € 494.7 million during <strong>2008</strong>compared to an inflow of € 475.8 million in2007. The increase in cash flow fromoperating activities is primarily related tolower interest payments on debt and significantlower income tax payments. The impactfrom these areas more than off-set thenegative cash flow impact from workingcapital comprising trade working capital(inventories, trade receivables and tradepayables) and other current assets andother current liabilities.Cash flow from investing activities showedan outflow of € 409.1 million mainly derivedfrom the acquisition of Bradley <strong>Pharmaceuticals</strong>,which contributed € 232.0 million in total. Thenet outflow related to tangible and intangibleassets was equivalent to € 171.0 million.Purchases of intangible assets, amounting to€ 119.5 million mainly refer to the followingprojects: Daxas ® (€ 29.5 million) andImmunomedics (€ 25.6 million).Company Profile | CEO letter | Management <strong>Report</strong> | products | Pipeline | Corporate Governance | Financial Statements | Contacts

<strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> 13Purchases of tangible assets amount to€ 56.3 million. The negative impact from theoutflow for the purchase of fixed assets ispartially offset by the disposal of tangiblesand intangibles for about € 4.8 million.Cash flow from financing activities showedan outflow of € 65.7 million. An amount of€ 248.3 million relates to the payment ofinstalments on senior debt facilities at theend of June and December amounting to€ 185.8 million in total and the payment ofa cash sweep of € 62.5 million at the end ofMarch <strong>2008</strong>. In addition, the cash flow fromfinancing activities is impacted by € 33.9million as part of the acquisition of owndebt during the month of December <strong>2008</strong>.The re-strike of the cross currency swapsgenerated an inflow of € 227.2 million.CAPITAL RESOURCES<strong>Nycomed</strong> expects to generate significantcash flow to support the strategy andservicing of debt in 2009 as well.As of the end of December <strong>2008</strong>, <strong>Nycomed</strong>had a cash position of € 496.7 millioncompared to a cash position of € 484.2 millionat the end of 2007.As of the end of December <strong>2008</strong>, <strong>Nycomed</strong>had a total senior debt of € 4,576.8 million(excluding the local debt of € 6.8 millionand the effect of the outstanding financingfees of € 70.4 million), compared to€ 4,751.4 million at the end of 2007(excluding the local debt of € 20.5 millionand the effect of the outstanding financingfees of € 86.8 million).<strong>Nycomed</strong> has committed facilities of€ 450.0 million under the in-licensing/restructuring facility, of which € 125.0 millionhave been drawn. In addition, <strong>Nycomed</strong>has a revolving facility of € 250.0 million,which remains un-drawn.Subsequent EventsAcquisition of remaining 50% of<strong>Nycomed</strong> Madaus Pty, LtdOn 18 December <strong>2008</strong>, <strong>Nycomed</strong> signedthe contract for the acquisition of theremaining 50.0% of the shares in <strong>Nycomed</strong>Madaus Pty, Ltd, a company engaged in thecommercialisation of pharmaceuticalproducts in the territory of South Africa,Swaziland, Lesotho, Namibia, Botswana andIndian Ocean Islands and other countries.<strong>Nycomed</strong> already owns 50.0% of thecompany’s shares. The agreement is subjectto the approval of the competitionauthorities of the Republic of South Africawhich needs to approve the acquisitionby the close of the transaction before1 June 2009. Further information is disclosedin note 1 “Business Combination”.Effervescent Alendronate in-licensingagreement with EffRx strengthensosteoporosis portfolio<strong>Nycomed</strong> and the US based EffRx signed alicensing agreement on EffRx’ drug EX101(effervescent Alendronate) for thetreatment of osteoporosis. Under theagreement, <strong>Nycomed</strong> will receive theexclusive rights to develop, manufacture andcommercialise the effervescent formulationof Alendronate for the treatment ofosteoporosis in a large number of countriesworldwide. EX101 presents a significantenhancement to <strong>Nycomed</strong>’s osteoporosisportfolio.Expanded indication for <strong>Nycomed</strong>’sTachoSil ®On 18 February 2009, <strong>Nycomed</strong> receivedan expanded indication for TachoSil ® , itsinnovative surgical patch, from the EuropeanMedicines Agency (EMEA). TachoSil ® wasapproved for haemostasis (control ofbleeding) in surgery. With the newexpanded indication, it becomes the firstand only dual action patch approved forhaemostasis, tissue sealing as well as forsuture support in vascular surgery.Positive CHMP opinion for OTCpresentation of PantoprazoleOn February 19, 2009, <strong>Nycomed</strong>’sPANTOZOL Control ® (Pantoprazole 20mg)received a positive opinion from theEuropean Medicines Agency’s (EMEA)Committee for Medicinal Products forHuman Use (CHMP), recommending thegranting of a marketing authorisation forPANTOZOL Control ® . PANTOZOL Control ®is intended for short-term treatment ofreflux symptoms (e.g. heartburn, acidregurgitation) in adults as a medicalproduct not subject to medical prescription.Interest rate risk hedge for 2009During January and February 2009 <strong>Nycomed</strong>entered into new interest rate swaps with aduration of eighteen months starting from31 March 2009. The recent interest rateswap agreements cover approximately 65.0%of <strong>Nycomed</strong>’s total interest rate risk.Outlook for 2009The total development in net turnover from<strong>2008</strong> to 2009 will be dependent on thesituation in the US market in connectionwith the launch of generic Pantoprazoleand the expiry of the substance patent forPantoprazole in certain European countries.As in other industries, the current economicsituation is expected to influence certainmarkets.Based on current market conditions, and thecurrent development in the currency market,we feel very confident that we will be ableto fulfil our obligations towards our loandocumentation and covenants in the future.All these statements are based on currentplans, estimates and projections. By theirnature, the above-mentioned forwardlookingstatements involve inherent risksand uncertainties, both general and specific.<strong>Nycomed</strong> states that different factors maycause actual results to significantly differfrom those contained in the abovementionedforward-looking statements.

14 <strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>Management Statement>Management StatementToday we approved the <strong>Annual</strong> <strong>Report</strong> of <strong>Nycomed</strong> S.C.A. SICARfor the period 1 January <strong>2008</strong> – 31 December <strong>2008</strong>.In our opinion, the <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>gives a true and fair view of the Group’sfinancial position, cash flows and resultsof operations.The <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> has been preparedin accordance with International Financial<strong>Report</strong>ing Standards (IFRS) as adopted bythe EU. We consider that the accountingpolicies used to compile the <strong>Annual</strong> <strong>Report</strong><strong>2008</strong> are appropriate.We recommend that the <strong>Annual</strong> <strong>Report</strong><strong>2008</strong> is approved at the <strong>Annual</strong> GeneralMeeting.Luxembourg, 27 February 2009Approved by the Board of Directors of the General Partner, <strong>Nycomed</strong> S.A.Toni Weitzberg, ChairmanKristoffer MelinderThompson DeanHåkan BjörklundCarl-Gustaf JohanssonColin TaylorNewton AguiarCompany Profile | CEO letter | Management <strong>Report</strong> | products | Pipeline | Corporate Governance | Financial Statements | Contacts

<strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> 15Independent Auditor’s <strong>Report</strong>To the management of <strong>Nycomed</strong> S.C.A. SICAR Sociétéen Commandite par Actions LuxembourgREPORT ON THE CONSOLIDATEDFINANCIAL STATEMENTSFollowing our appointment by theManagement, we have audited theaccompanying consolidated financialstatements of <strong>Nycomed</strong> S.C.A. SICARwhich comprise the consolidated balancesheet as at 31 December <strong>2008</strong>, and theconsolidated income statement,consolidated statement of changes inequity and the consolidated cash flowstatement for the year then ended anda summary of significant accountingpolicies and other explanatory notes.Management’s responsibility for theconsolidated financial statementsThe Management is responsible for thepreparation and fair presentation of theseconsolidated financial statements inaccordance with International Financial<strong>Report</strong>ing Standards (IFRS) as adopted bythe European Union. This responsibilityincludes: designing, implementing andmaintaining internal control relevant tothe preparation and fair presentation ofconsolidated financial statements that arefree from material misstatement, whetherdue to fraud or error; selecting and applyingappropriate accounting policies; and makingaccounting estimates that are reasonablein the circumstances.Responsibility of the“réviseur d’entreprises”Our responsibility is to express an opinionon these consolidated financial statementsbased on our audit. We conducted ouraudit in accordance with InternationalStandards on Auditing as adopted by the“Institut des Réviseurs d’Entreprises”.Those standards require that we complywith ethical requirements and plan andperform the audit to obtain reasonableassurance whether the consolidated financialstatements are free from materialmisstatement.An audit involves performing procedures toobtain audit evidence about the amountsand disclosures in the consolidated financialstatements. The procedures selected dependon the judgement of the “réviseurd’entreprises”, including the assessment ofthe risks of material misstatement of theconsolidated financial statements, whetherdue to fraud or error. In making those riskassessments, the “réviseur d’entreprises”considers internal control relevant to theentity’s preparation and fair presentation ofthe consolidated financial statements inorder to design audit procedures that areappropriate in the circumstances, but not forthe purpose of expressing an opinion on theeffectiveness of the entity’s internal control.An audit also includes evaluating theappropriateness of accounting policiesused and the reasonableness of accountingestimates made by the Management, aswell as evaluating the overall presentationof the consolidated financial statements.We believe that the audit evidence wehave obtained is sufficient and appropriateto provide a basis for our audit opinion.OpinionIn our opinion, the consolidated financialstatements give a true and fair view of thefinancial position of <strong>Nycomed</strong> S.C.A. SICARas of 31 December <strong>2008</strong>, and of its financialperformance and its cash flows for the yearthen ended in accordance with InternationalFinancial <strong>Report</strong>ing Standards (IFRS) asadopted by the European Union.<strong>Report</strong> on other legal andregulatory requirementsThe consolidated management report,which is the responsibility of theManagement, is consistent with theconsolidated financial statements.Luxembourg, 27 February 2009ERNST & YOUNGSociété AnonymeRéviseur d’entreprisesOlivier Jordant

16 <strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>Products>A differentiated portfolioof branded medicinesA comprehensive range of productsdesigned to meet specific needs.> Focus on gastroenterology, respiratoryand inflammatory diseases, pain,osteoporosis and tissue management> Extensive range of OTC products> New products coming both fromexternal resources and own research> Global products as growth drivers> Strong local brands<strong>Nycomed</strong> provides branded medicinesfor hospitals, specialists and generalpractitioners, as well as over-the-counter(OTC) medicines. Our key areas of activityare gastroenterology, respiratory andinflammatory diseases, pain, osteoporosisand tissue management. In all theseareas we aim to develop and marketproducts with medical utility.We have strong brands globally, locallyand regionally, opening up all sorts ofopportunities. Our international portfoliopromises rapid development through organicgrowth, life-cycle initiatives and in-licensing.Impressive regional portfolios continue toshow strong growth and include prescriptionproducts like Actovegin ® in Russia/CISand OTC products such as Neosaldina ®in Brazil.Gastrointestinal<strong>Nycomed</strong>’s gastrointestinal offer is led byPantoprazole, the company’s most successfulmedicine that, since its launch in 1994,has been used to treat over 750 millionpatients. It is indicated for the treatment ofacid-related gastrointestinal disorders and isalso used in combination with antibiotics totreat Helicobacter pylori, the cause of mostgastric and duodenal ulcers. In addition tothe prescribed version, <strong>Nycomed</strong> launchedan OTC presentation of Pantoprazole inAustralia in <strong>2008</strong>. A European launch isplanned for 2009. The portfolio in this areais strengthened by products like Riopan ®(Magaldrate) for heartburn and acid-inducedgastrointestinal problems. It is availableover the counter in a number of countries,as are well established OTC liver remedieslike Hepatalgina ® /Eparema ® .Company Profile | CEO letter | Management <strong>Report</strong> | products | Pipeline | Corporate Governance | Financial Statements | Contacts

<strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> 17Respiratory diseasesWe are augmenting our establishedrespiratory portfolio with new treatmentoptions for rapid growth areas like hayfever and asthma. And with the scheduledlaunch of Daxas ® in 2010 (see Pipeline),we will bring a new approach for treatingchronic obstructive pulmonarydisease (COPD).Bronchial asthma is a growing indicationwhich already counts more than 300 millionsufferers around the world. Alvesco ®(Ciclesonide), an inhaled corticosteroid hasa novel mechanism of action which providesgood tolerability. Similarly, Omnaris ® nasalspray – also based on Ciclesonide – treatsseasonal and perennial allergic rhinitis(hay fever).Another strong <strong>Nycomed</strong> brand in thistherapeutic area is the OTC nasaldecongestant Zymelin ® (Xylometazoline)that is widely available throughout Easternand Northern Europe.Pain<strong>Nycomed</strong>’s pain portfolio has a solid baseof existing products, which is to be furtherenhanced by the introduction of newproducts like Instanyl ® and Optesia ®(see Pipeline). It addresses a comprehensiverange of patient needs, from everydayaches and pains, through to chronic andsevere pain capable of destroying thepatient’s quality of life.Foremost for the category of aches andpains is Neosaldina ® , Brazil’s preferredOTC analgesic. In the Nordic region ourIbuprofen line goes by the well knownbrand of Ibumetin ® . For severe, chronicpain, Matrifen ® transdermal fentanylpatches give cancer patients a convenientoption that has been shown to inducefewer side effects compared to morphinetablets and other oral formulations ofopioid analgesics.In a further category of pain relief is Xefo ® ,a non-steroidal anti-inflammatory drug(NSAID) that comes in a variety offormulations to treat mild to severe painin conditions like rheumatic indicationswith inflammation. Xefo ® Rapid is a quickrelease version that has been specificallydesigned to deal with acute pain.

18 <strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>Products>OsteoporosisOsteoporosis places a significant burden onboth the individual sufferer and society as awhole. Current under-diagnosis, combinedwith a persistent demand for improvedquality of life from an aging population, canonly increase the need for effective interventions.An innovative biotech approach toosteoporosis treatment, Preotact ® rebuildsbone and reduces the risk of fractures.With Preotact ® , we further enhance ourosteoporosis portfolio and complement ourCalcium D 3range. Preotact ® is prescribedfor post-menopausal women at high riskof fractures. Clinical studies show that itstimulates the growth of new bone, therebyreducing fractures. It is the only product inthis category that does not need permanentcold storage, so that compliance is assured,even when patients are away from home.For the prevention and treatment of calciumand vitamin D deficiencies the Calcium D 3range is used as an adjunct to specificosteoporosis treatment. The Calcium D 3portfolio comprises a growing variety ofstrengths, flavours and combinations thatare available OTC and on prescription. InEurope, <strong>Nycomed</strong> is market leader withCalcichew ® D 3. Other <strong>Nycomed</strong> tradenames for Calcium D 3products includeCalcimagon ® , Orocal ® and Calcigran ® .In January 2009, <strong>Nycomed</strong> receivedexclusive rights from EffRx to develop,manufacture and commercialise in a largenumber of countries worldwide the firsteffervescent formulation of Alendronatefor the treatment of osteoporosis.Alendronate effervescent is a significantaddition to <strong>Nycomed</strong>’s osteoporosisportfolio.Tissue managementThe key product in <strong>Nycomed</strong>´s tissuemanagement portfolio, TachoSil ® , is aready-to-use surgical patch developed toassist surgeons to achieve fast and reliablebleeding and sealing control. TachoSil ® isa collagen patch coated with the humancoagulation factors fibrinogen and thrombinand is indicated for supportive treatmentin surgery to improve haemostasis andtissue sealing as well as for suture supportin vascular surgery. When moistened,the coagulation factors are activated,gluing the collagen patch to the tissueand effectively controlling bleeding aswell as air and body fluid leaks.Company Profile | CEO letter | Management <strong>Report</strong> | products | Pipeline | Corporate Governance | Financial Statements | Contacts

<strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> 19OTC (over-the-counter)<strong>Nycomed</strong> is the world’s 15 th largest providerof over-the-counter (OTC) medicines.Our OTC business is well positioned tooutperform the big OTC players. We alreadydo in several emerging markets. 40% of ourOTC sales currently come from the two highgrowth markets of CIS and Brazil; and ourOTC sales in emerging markets are growingfour times faster than those of developedmarkets.One of the top drivers is Calcichew ® D 3,which is already an outstanding performerin the calcium supplement market. <strong>Nycomed</strong>also provides a range of OTC products inthe areas of cold relief, gastrointestinal relief,vitamins/minerals supplements, analgesicsand allergy medications. These productsare either owned by us or in-licensed.The global OTC business unit coordinates<strong>Nycomed</strong>’s OTC strategy. Key elementsin the global programme are branding atconsumer level and a targeted customerapproach, taking into account the specificneeds of pharmacists.OTC BRAND LEADERSCalcium D 3Global (Calcichew ® D 3,Calcimagon ® )Zymelin ® Europe and CISRiopan ®Europe andLatin AmericaSanostol ® Europe andLatin AmericaNeosaldina ® BrazilHepatalgina ® / Argentina/BrazilEparema ®Ibumetin ® EuropePantoprazole OTC Global (PantozolControl ® , Somac ® )PRESCRIPTION MEDICINESActovegin ®Alvesco ®Calcichew ® D 3Circadin ®Ebrantil ®Matrifen ®Omnaris ®PantoprazolePreotact ®TachoSil ®Xefo ®Central and peripheralblood flow disturbancesAsthmaOsteoporosisInsomniaArterial hypertensionSevere chronic cancer painAllergic rhinitisAcid-relatedgastrointestinal diseasesOsteoporosisGeneral tissue sealingChronic painPantoprazole is marketed under several brands e.g.Controloc ® , Pantoloc ® , Pantozol ® , Protonix ® , Zurcal ® .

20 <strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>Pipeline>Together for medicinesthat matter<strong>Nycomed</strong>’s innovative R&D partnership modelprovides a flexible and scalable way of working.> New R&D model is based on partnerships- New ideas from biotech,academia and pharma> Streamlined in-licensing process supportsefficient evaluation and negotiation- Co-development across alldevelopment stages> Focus on medical utility- Differentiated products thataddress unmet needs> What patients, physicians andpayers value<strong>Nycomed</strong>’s clinical pipeline is filled withprojects from our own research as wellas in-licensed co-development projects.Our principal objective is to focus ourefforts where we can ultimately make thebiggest difference in terms of added valuefor patients, physicians and payers bycovering unmet medical needs.Working across a broad range of indicationareas, we are able to combine focusedin-house research and development effortswith in-licensed projects that both accelerateand add value to our development of newproducts. While our in-house expertise isstrongest in the areas of gastroenterology,respiratory and inflammatory diseases andpain, we are open to partnerships beyondthese areas.We plan for the majority of R&D projectsto originate outside the company. Newprojects are welcome from all sources, includingbiotech, pharmaceutical companiesand academia.Our flexible set-up means that we canwork effectively with suitable partners atevery stage of development and we arefully equipped to add value to our partners’projects. With 1,100 researchers we providefull R&D capabilities from early stagedevelopment right through to life-cyclemanagement. Our commercial operationshave extensive experience in both generalpractitioner and specialist markets. We alsohave recognised strength in navigating theEuropean and US regulatory system.<strong>Nycomed</strong>’s R&D is organised to meetspecific needs for partnering projects andthe way we are structured ensures thatexternal projects have the same, or evenhigher priority. We concentrate on our corecompetencies and when applicable we useexternal support for specialist activities likeclinical research. That way, we can quicklyramp up resources as required to processprojects. This scalable structure means thatwe are not limited to specific indications. Ifwe come across a new medicine or therapywhich promises to improve patient quality oflife, then we have the flexibility to adaptour resources and activities to accommodateits development.Upcoming productsDaxas ®Chronic obstructive pulmonary disease(COPD) remains a significant area of unmetmedical need. It is a progressive and irreversiblelung disease that restricts breathing. Accordingto World Health Organisation (WHO)estimates, 80 million people have moderateto severe COPD worldwide.Around 5% of all deaths globally can beattributed to COPD and the WHO predictsthat total deaths could increase by morethan 30% in the next 10 years unless urgentaction is taken to reduce causal risk factors,especially smoking.Daxas ® (Roflumilast) is a phosphodiesterase-4(PDE4) inhibitor that is being developedto treat the underlying inflammationin COPD and related inflammatory diseases.It could be both the first PDE4 inhibitorand the first orally administered anti-inflammatorytreatment for COPD patients.As a once-daily, non-steroidal anti-inflammatorytreatment, Daxas ® offers theopportunity for a new approach to the treatmentof COPD. The results from two pivotal12-month studies showed positive effects onexacerbation rates and pulmonary function(FEV1). Two supporting six-month studiesconfirmed the efficacy of Daxas ® when usedwith standard bronchodilator treatments.Daxas ® has been developed by <strong>Nycomed</strong>and we are filing for marketing authorisationin Europe, the US and Japan in 2009. Daxas ®is partnered for co-development withMitsubishi Tanabe Pharma Co. in Japan. Thecommercialisation of Daxas ® in the UnitedStates will also take place through a partner.Once approved, Daxas ® has the potential tobecome a significant brand for <strong>Nycomed</strong>.Instanyl ®Nearly half of all early-stage cancer patientsand up to 90% in later stages suffer thesudden onset of brief but acute ‘breakthrough’pain. This refers to intermittentflare-ups that overcome the patient’s regularpain medication. The unpredictability andCompany Profile | CEO letter | Management <strong>Report</strong> | products | Pipeline | Corporate Governance | Financial Statements | Contacts

<strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> 21severity of these attacks can have a highlydeleterious effect on the patient’s moraleand quality of life. Sufferers need somethingthat will give immediate relief. Instanyl ® isan intranasally applied Fentanyl spray thathas been developed in-house by <strong>Nycomed</strong>.It is intended for managing breakthroughpain in adult cancer patients.Nasal Fentanyl has a profile that will providepatients with a rapid onset of action andadequately short duration, closely matchingthe typical breakthrough pain episode.Instanyl ® was filed for EU approval inDecember 2007. <strong>Nycomed</strong> plans to launchInstanyl ® during the second half of 2009.Two in-licensing examplesOptesia ®At present, there is no standard regimenfor post-operative pain treatment. Painmanagement is generally achieved with acombination of different drugs, such as nonsteroidalanti-inflammatory drugs (NSAIDs),paracetamol, opioids and short-acting localanaesthetics (wound infiltration and nerveblocks). However, NSAIDs on their own areoften inadequate analgesics for moderateand severe pain, while opioids can causeserious side effects and local anaestheticsonly last for a few hours.Optesia ® (Saber-bupivacaine) addressesthis unmet medical need for long-termpost-operative pain relief in a number ofsurgical procedures. Bupivacaine blockssensory nerve impulse conduction to thebrain’s cortex and is slowly released fromthe administered drug to provide longlastingpain relief.Optesia ® is in-licensed from Durect Corp.and is currently in phase II clinical development.<strong>Nycomed</strong> has the commercial rightsfor Europe, Russia, CIS, Australia and anumber of Latin American countries.Veltuzumab<strong>Nycomed</strong> and Immunomedics are collaboratingon Veltuzumab, a humanised anti-CD20antibody that is currently undergoing clinicaltrials in cancer and autoimmune diseases.Anti-CD20 antibodies target B-cells, whichplay an important role in the productionof autoantibodies and are the major causeof various autoimmune diseases, includingrheumatoid arthritis (RA).<strong>Nycomed</strong> is developing Veltuzumab forrheumatoid arthritis as the primary indication.Under the agreement with Immunomedics, wehave exclusive, worldwide rights to develop,manufacture and commercialise the subcutaneousformulation of Veltuzumab for thetreatment of all non-cancer indications.Veltuzumab is currently in phase II clinical trials.Clinical development pipeline features promising projectsPhase I Phase II Phase III RegistrationRoflumilast dermalAtopic dermatitis/ psoriasisOptesia ®Incision-related painPartner: DurectImagify ®Cardiovascular imagingPartner: AcusphereInstanyl ®Breakthrough painPDE4 inhibitorInflammationVeltuzumabRheumatoid arthritisPartner: ImmunomedicsTeduglutideShort bowel syndromePartner: NPSDaxas ® , COPDPartner Japan: MitsubishiTanabe PharmaCiclesonide HFA nasalAllergic rhinitisPartner: SepracorAlendronate effervescentOsteoporosisPartner: EffRxOur pipeline is built from our own research and through co-developments with partners. Co-development with partners

22 <strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>Corporate Governance>Corporate GovernanceAs a privately owned company, we haveobligations to our financial stakeholders. Inaccordance with our financial arrangements,we prepare financial reports that complywith set standards.CORPORATE STRUCTURE<strong>Nycomed</strong> S.C.A. SICAR was establishedon 30 November 2006 in Luxembourg.<strong>Nycomed</strong> S.A. is the general partner companyand the sole manager in <strong>Nycomed</strong> S.C.A.SICAR and is, therefore, formally themanagement of the <strong>Nycomed</strong> Group. TheBoard of Directors in the general partnercompany consists of the individuals listed inthe Board of Directors section. The Boardis elected at the <strong>Annual</strong> General Meeting.The Board appoints and supervises theExecutive Committee, and oversees theCompany’s performance and results. Dailymanagement is carried out by the ExecutiveManagement Committee. In addition tothe Executive Management and the AuditCommittee, there are three othercommittees:• The Development Portfolio Committeedecides which projects enter development.It also reviews development projects andmakes decisions on developmentprogrammes and levels of investment.• The Licensing Committee determines thein- and out-licensing strategy, approveslicensing opportunities and reviews theperformance of licensing partnerships.• The Commercialisation and LifecycleManagement Committee reviews anddecides on Lifecycle Management (LCM)plans, agrees on LCM projects and decideson global strategy and launch plans for keyproducts.<strong>Nycomed</strong> has an independent internal auditfunction which reports directly to the<strong>Nycomed</strong> Audit Committee which approvesthe functions charter, audit plan and budget.The internal audit function providesindependent and objective assurance withregard to internal controls and governance.All subsidiaries are internally audited, withaudit visits occurring at least every secondyear.SHAREHOLDERSThere are two classes of shares. Thereare no differences in voting rights andall shareholders are entitled to have mattersconsidered at the <strong>Annual</strong> General Meeting.For details of management incentiveprogrammes, please refer to the FinancialStatements section.Company Profile | CEO letter | Management <strong>Report</strong> | products | Pipeline | Corporate Governance | Financial Statements | Contacts

<strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> 23As at 31 December <strong>2008</strong>, the following shareholdersheld more than 5% of the collective shareholding:Share Share ownershipShareholders ownership (fully diluted)Nordic Capital 42.7% 39.6%• Nordic Capital V, L.P. 24.0% 22.3%• Nordic Capital VI, Alpha LP 8.3% 7.7%• Nordic Capital VI, Beta LP 9.7% 9.0%• Other co-investors (less than 5% ownership) 0.7% 0.6%Credit Suisse (DLJMB) 25.9% 24.0%• DLJ Offshore Partners III, C.V. 18.0% 16.7%• Other co-investors (less than 5% ownership) 7.9% 7.3%Coller International Partners 9.7% 9.0%• Coller International Partners IV Limited as nominee for Coller International Partners 5.3% 4.9%IV-D, L.P., Coller International Partners IV-E, L.P. and Coller German Investors GmbH & Co. KG• Other co-investors (less than 5% ownership) 4.4% 4.1%Avista 6.6% 6.1%• ACP Nycom Holdings, LLC 6.6% 6.1%Others (less than 5% ownership) 15.1% 21.3%

24 <strong>Nycomed</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>Corporate Governance>Risk Management<strong>Nycomed</strong> operates in a highly competitiveand regulated business area. Specific risks areinherent in our product range and businessmodel of in-licensing products.Risk Management ProcessOverseen by its Risk Management Committee,representing senior managers from all functionsof the group, <strong>Nycomed</strong> implements asystematic, integrated process to continuallyassess a wide range of functional andcross-functional risks and opportunities. TheIntegrated Risk Management approach increasesour ability to assess and understand functionalrisks as well as the interaction on the crossfunctionallevel.All functions go through a risk assessment.This assessment includes risk identification,analysis, estimation and prioritising. All riskassessments take likelihood as well as potentialimpact on the business into account. Impactsare quantified and assessed in terms ofpotential financial loss and reputationaldamage.Significant risks are reported to the RiskOffice together with action plans onhow to manage these risks. <strong>Report</strong>ed risksare consolidated into a group Risk Register.This information is presented to theRisk Management Committee, whichchallenges the overall risk and actionprofile.The process is linked to the strategicplanning process and considers bothfinancial and non-financial risks.Financial risksFinancial risks at <strong>Nycomed</strong> are managedcentrally. The overall objectives and policiesfor <strong>Nycomed</strong>’s financial risk managementare outlined in a Treasury Policy.The Group does not engage in financialtransactions or risk exposures that are notrelated to the hedging of underlying businessdriven risk. Only transactions that are justifiedfrom a hedging perspective are allowed.Consequently, <strong>Nycomed</strong> does not enter intospeculative positions.<strong>Nycomed</strong>, is currently impacted by currencyfluctuations, which could have an impact onprofits. We use derivatives with the aim oflimiting losses from fluctuations in theexchange rate of the Euro against othercurrencies, especially the US Dollar, theMexican Peso, the Brazilian Real, NorwegianKroner, Japanese Yen or the Canadian Dollar.Only forward exchange deals, currencyswaps and simple currency options are used.These were transacted exclusively withbanks that have defined credit ratings.Currency risk related to debtA part of the outstanding debt in <strong>Nycomed</strong>is denominated in US Dollar in order tomitigate the current cash flow and theUS Dollar value of <strong>Nycomed</strong> in a potentialexit. With the purpose of preserving a partof the unrealised gain on this part of the debtwe entered into four cross currency swapsduring the first half of <strong>2008</strong>. In Novemberwe re-struck the swaps, with the effect ofrealisation part of the unrealised gain.In December <strong>2008</strong>, <strong>Nycomed</strong> invested partof the cash in buying back its own debt. Thenominal value of the bought back debt is€ 54.8 million.Foreign exchangeThe Group’s main objective is to reduce,where it is deemed appropriate to do so,fluctuations in earnings and cash flowsassociated with the changes in marketforeign currency rates.Currency risk can be classified in twocategories: transaction risk and translationrisk. The Group’s transaction risk primarilyrelates to the potential change in value offuture operations and cash flows resultingfrom changes in currency rates. Translationrisk is related to the translating of potentialchange in carrying value of assets andliabilities in foreign currencies. We are mainlyexposed with regard to US Dollars, CanadianDollars, Brazilian Real, Mexican Pesos, RussianRoubles, Norwegian Kroner, Danish Kronerand Japanese Yen.Company Profile | CEO letter | Management <strong>Report</strong> | products | Pipeline | Corporate Governance | Financial Statements | Contacts