HM-OA-5774 - AvMed

HM-OA-5774 - AvMed

HM-OA-5774 - AvMed

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

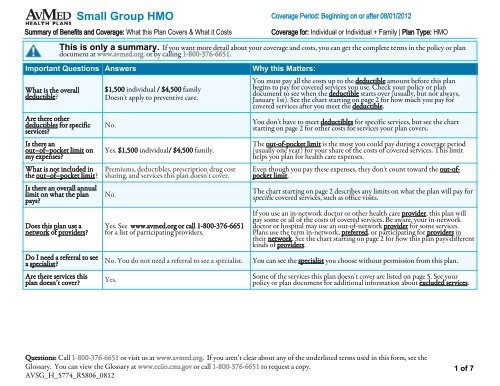

Small Group <strong>HM</strong>O Coverage Period: Beginning on or after 08/01/2012Summary of Benefits and Coverage: What this Plan Covers & What it CostsCoverage for: Individual or Individual + Family | Plan Type: <strong>HM</strong>OThis is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plandocument at www.avmed.org. or by calling 1-800-376-6651.Important Questions AnswersWhat is the overalldeductible?Are there otherdeductibles for specificservices?Is there anout–of–pocket limit onmy expenses?What is not included inthe out–of–pocket limit?Is there an overall annuallimit on what the planpays?Does this plan use anetwork of providers?Do I need a referral to seea specialist?Are there services thisplan doesn’t cover?$1,500 individual / $4,500 familyDoesn't apply to preventive care.No.Yes. $1,500 individual/ $4,500 family.Premiums, deductibles, prescription drug costsharing, and services this plan doesn't cover.No.Yes. See www.avmed.org or call 1-800-376-6651for a list of participating providers.No. You do not need a referral to see a specialist.Yes.Why this Matters:You must pay all the costs up to the deductible amount before this planbegins to pay for covered services you use. Check your policy or plandocument to see when the deductible starts over (usually, but not always,January 1st). See the chart starting on page 2 for how much you pay forcovered services after you meet the deductible.You don't have to meet deductibles for specific services, but see the chartstarting on page 2 for other costs for services your plan covers.The out-of-pocket limit is the most you could pay during a coverage period(usually one year) for your share of the costs of covered services. This limithelps you plan for health care expenses.Even though you pay these expenses, they don't count toward the out-ofpocketlimit.The chart starting on page 2 describes any limits on what the plan will pay forspecific covered services, such as office visits.If you use an in-network doctor or other health care provider, this plan willpay some or all of the costs of covered services. Be aware, your in-networkdoctor or hospital may use an out-of-network provider for some services.Plans use the term in-network, preferred, or participating for providers intheir network. See the chart starting on page 2 for how this plan pays differentkinds of providers.You can see the specialist you choose without permission from this plan.Some of the services this plan doesn't cover are listed on page 5. See yourpolicy or plan document for additional information about excluded services.Questions: Call 1-800-376-6651 or visit us at www.avmed.org. If you aren’t clear about any of the underlined terms used in this form, see theGlossary. You can view the Glossary at www.cciio.cms.gov or call 1-800-376-6651 to request a copy.AVSG_H_<strong>5774</strong>_R5806_08121 of 7

Small Group <strong>HM</strong>O Coverage Period: Beginning on or after 08/01/2012Summary of Benefits and Coverage: What this Plan Covers & What it CostsCoverage for: Individual or Individual + Family | Plan Type: <strong>HM</strong>O• Copayments are fixed dollar amounts (for example, $15) you pay for covered health care, usually when you receive the service.• Coinsurance is your share of the costs of a covered service, calculated as a percent of the allowed amount for the service. For example, ifthe plan’s allowed amount for an overnight hospital stay is $1,000, your coinsurance payment of 20% would be $200. This may change ifyou haven’t met your deductible.• The amount the plan pays for covered services is based on the allowed amount. If an out-of-network provider charges more than theallowed amount, you may have to pay the difference. For example, if an out-of-network hospital charges $1,500 for an overnight stay andthe allowed amount is $1,000, you may have to pay the $500 difference. (This is called balance billing.)• This plan may encourage you to use <strong>AvMed</strong> Network providers by charging you lower deductibles, copayments and coinsuranceamounts.Common MedicalEventIf you visit a healthcare provider’s officeor clinicIf you have a testServices You May NeedPrimary care visit to treat aninjury or illnessYour Cost If You Usean <strong>AvMed</strong> NetworkProvider$25 copay/ visit Not CoveredSpecialist visit $50 copay/ visit Not CoveredOther practitioner office visitPreventive care/screening/immunizationDiagnostic test (x-ray, bloodwork)Imaging (CT/PET scans,MRIs)$25 copay/ visit for allergyinjections; $75 copay/course of allergy skintestingYour Cost IfYou Use anOut of NetworkLimitations & ExceptionsProviderAdditional charges will apply for non-preventiveservices performed in the physician's office.Additional charges will apply for non-preventiveservices performed in the physician's office.Not CoveredOffice visit cost sharing also applies.No Charge Not Covered ----------------------None----------------------$50 copay/ test afterdeductible; no charge forblood work at capitatedlabs$150 copay/ test afterdeductibleNot CoveredNot CoveredCharges for office visits will also apply if services areperformed in a physician's office.Charges for office visits will also apply if services areperformed in a physician's office. Certain servicesrequire prior authorization.Questions: Call 1-800-376-6651 or visit us at www.avmed.org. If you aren’t clear about any of the underlined terms used in this form, see theGlossary. You can view the Glossary at www.cciio.cms.gov or call 1-800-376-6651 to request a copy.AVSG_H_<strong>5774</strong>_R5806_08122 of 7

Common MedicalEventIf you need drugs totreat your illness orconditionMore informationabout prescriptiondrug coverage isavailable atwww.avmed.org.If you have outpatientsurgeryIf you need immediatemedical attentionIf you have a hospitalstaySmall Group <strong>HM</strong>O Coverage Period: Beginning on or after 08/01/2012Summary of Benefits and Coverage: What this Plan Covers & What it CostsServices You May NeedGeneric drugsPreferred brand drugsNon-preferred brand drugsSpecialty drugsFacility fee (e.g., ambulatorysurgery center)Physician/surgeon feesEmergency room servicesEmergency medicaltransportationUrgent careFacility fee (e.g., hospital room)Your Cost If You Usean <strong>AvMed</strong> NetworkProvider$15 copay/prescription(retail);$37.50 copay/prescription (mail order)$45 copay/prescription(retail);$112.50 copay/prescription (mail order)$75 copay/ prescription(retail); $187.50 copay/prescription (mail order)Your Cost IfYou Use anOut of NetworkLimitations & ExceptionsProviderNot CoveredNot CoveredNot CoveredRetail copay applies per 30-day supply. Covers up toa 90-day supply from retail pharmacies; 60-90 daysupply via mail order. Certain drugs require priorauthorization.Brand additional charge may apply. Certain drugsrequire prior authorization.Brand additional charge may apply. Certain drugsrequire prior authorization.25% coinsurance up to amax out-of-pocket of$250/ prescription (retail) Not Covered Not available via mail order. Brand additional chargemay apply. Certain drugs require prior authorization.$250 copay/ visit afterdeductibleNot CoveredNo charge after deductible Not Covered$200 copay/ visit afterdeductibleCoverage for: Individual or Individual + Family | Plan Type: <strong>HM</strong>OSame as <strong>AvMed</strong>networkCharges for office visits will also apply if services areperformed in a physician's office. Prior authorizationrequired.Charges for office visits will also apply if services areperformed in a physician's office. Prior authorizationrequired.<strong>AvMed</strong> must be notified within 24-hours ofinpatient admission following emergency services oras soon as reasonably possible.$150 copay/ one way after Same as <strong>AvMed</strong>deductiblenetwork----------------------None----------------------$40 copay/ visit at urgent $60 copay/ visit atcare facility; $25 copay/ urgent care facility ----------------------None----------------------visit at retail clinic or retail clinic$250 copay/ day, first 5days per admission afterdeductible; 100% coverageNot Covered Prior authorization required.thereafterPhysician/surgeon fee No charge after deductible Not Covered Prior authorization required.Questions: Call 1-800-376-6651 or visit us at www.avmed.org. If you aren’t clear about any of the underlined terms used in this form, see theGlossary. You can view the Glossary at www.cciio.cms.gov or call 1-800-376-6651 to request a copy.AVSG_H_<strong>5774</strong>_R5806_08123 of 7

Common MedicalEventIf you have mentalhealth, behavioralhealth, or substanceabuse needsIf you are pregnantIf you need helprecovering or haveother special healthneedsIf your child needsdental or eye careSmall Group <strong>HM</strong>O Coverage Period: Beginning on or after 08/01/2012Summary of Benefits and Coverage: What this Plan Covers & What it CostsServices You May NeedMental/Behavioral healthoutpatient servicesMental/Behavioral healthinpatient servicesYour Cost If You Usean <strong>AvMed</strong> NetworkProviderYour Cost IfYou Use anOut of NetworkLimitations & ExceptionsProvider$25 copay/ visit Not Covered Limited to 20 visits per calendar year.$250 copay/ day, first 5days per admission afterdeductible; 100% coveragethereafterNot CoveredLimited to 30 days per calendar year. Priorauthorization required.Substance use disorderoutpatient servicesNot Covered Not Covered ----------------------None----------------------Substance use disorder inpatientservicesNot Covered Not Covered ----------------------None----------------------Prenatal and postnatal care $25 copay/ 1st visit only Not Covered Subsequent visits at no charge.Delivery and all inpatientservices$250 copay/ day, first 5days per admission afterdeductible; 100% coveragethereafterNot Covered Prior authorization required.Home health care$50 copay/ visit afterdeductibleNot CoveredLimited to 60 visits per calendar year. Approvedtreatment plan required.Rehabilitation services$25 copay/ visit afterdeductibleNot CoveredHabilitation services Not Covered Not CoveredCoverage for: Individual or Individual + Family | Plan Type: <strong>HM</strong>OLimited to 30 visits per calendar year for physical,occupational & speech therapy combined; 18 visitsper calendar year for cardiac rehab.This plan does not cover treatment for AutismSpectrum Disorder.Limited to 20 days post-hospitalization per calendaryear. Prior authorization required.Limited to $2,000 per calendar year for DME andOrthotics combined.Skilled nursing care$150 copay/ day afterdeductibleNot CoveredDurable medical equipment$100 copay/ episode ofillness after deductibleNot CoveredHospice service$150 copay/ day afterdeductibleNot Covered Physician certification required.Eye exam $25 copay/ visit Not Covered Eye exams to determine the need for sight correction.Glasses Not Covered Not Covered ----------------------None----------------------Dental check up Not Covered Not Covered ----------------------None----------------------Questions: Call 1-800-376-6651 or visit us at www.avmed.org. If you aren’t clear about any of the underlined terms used in this form, see theGlossary. You can view the Glossary at www.cciio.cms.gov or call 1-800-376-6651 to request a copy.AVSG_H_<strong>5774</strong>_R5806_08124 of 7

Small Group <strong>HM</strong>O Coverage Period: Beginning on or after 08/01/2012Summary of Benefits and Coverage: What this Plan Covers & What it CostsExcluded Services & Other Covered Services:Services Your Plan Does NOT Cover (This isn’t a complete list. Check your policy or plan document for other excluded services.)• Acupuncture • Habilitation Services • Private-Duty Nursing• Bariatric Surgery • Hearing Aids • Routine Eye Care (Adult)• Child Dental Check Up • Infertility Treatment • Routine Foot Care• Child Glasses • Long-Term Care • Substance Use Disorder Services• Cosmetic Surgery •Non-Emergency Care When TravelingOutside the U.S.• Weight Loss Programs• Dental Care (Adult)Other Covered Services (This isn’t a complete list. Check your policy or plan document for other covered services and your costs for theseservices.)• Chiropractic CareYour Rights to Continue Coverage:If you lose coverage under the plan, then, depending upon the circumstances, Federal and State laws may provide protections that allow you to keep healthcoverage. Any such rights may be limited in duration and will require you to pay a premium, which may be significantly higher than the premium you pay whilecovered under the plan. Other limitations on your rights to continue coverage may also apply.For more information on your rights to continue coverage, contact the plan at 1-800-376-6651. You may also contact your state insurance department, theU.S. Department of Labor, Employee Benefits Security Administration at 1-866-444-3272 or www.dol.gov/ebsa, or the U.S. Department of Health andHuman Services at 1-877-267-2323 x61565 or www.cciio.cms.gov.Your Grievance and Appeals Rights:If you have a complaint or are dissatisfied with a denial of coverage for claims under your plan, you may be able to appeal or file a grievance. For questionsabout your rights, this notice, or assistance, you can contact <strong>AvMed</strong>'s Member Services Department at 1-800-376-6651. For plans subject to ERISA, you mayalso contact the U.S. Department of Labor, Employee Benefits Security Administration at 1-866-444-3272 or www.dol.gov/ebsa, or the U.S. Department ofHealth and Human Services at 1-877-267-2323 x61565 or www.cciio.cms.gov.Language Access ServicesPara obtener asistencia en Español, llame al 1-800-882-8633Coverage for: Individual or Individual + Family | Plan Type: <strong>HM</strong>O–––––––––––––––––––To see examples of how this plan might cover costs for a sample medical situation, see the next page.–––––––––––––––––––Questions: Call 1-800-376-6651 or visit us at www.avmed.org. If you aren’t clear about any of the underlined terms used in this form, see theGlossary. You can view the Glossary at www.cciio.cms.gov or call 1-800-376-6651 to request a copy.AVSG_H_<strong>5774</strong>_R5806_08125 of 7

Small Group <strong>HM</strong>O Coverage Period: Beginning on or after 08/01/2012Summary of Benefits and Coverage: What this Plan Covers & What it CostsCoverage for: Individual or Individual + Family | Plan Type: <strong>HM</strong><strong>OA</strong>bout these CoverageExamples:These examples show how this plan mightcover medical care in given situations. Usethese examples to see, in general, how muchfinancial protection a sample patient mightget if they are covered under different plans.This is not acost estimator.Don’t use these examples toestimate your actual costs underthis plan. The actual care youreceive will be different from theseexamples, and the cost of that carewill also be different.See the next page for importantinformation about these examples.Having a baby(normal delivery)Amount owed to providers: $7,540Plan pays $5,590Patient pays $1,950Sample care costs:Hospital charges (mother) $2,700Routine obstetric care $2,100Hospital charges (baby) $900Anesthesia $900Laboratory tests $500Prescriptions $200Radiology $200Vaccines, other preventive $40Total $7,540Patient pays:Deductibles $1,500Copays $300Coinsurance $0Limits or exclusions $150Total $1,950Managing type 2 diabetes(routine maintenance ofa well-controlled condition)Amount owed to providers: $5,400Plan pays $4,020Patient pays $1,380Sample care costs:Prescriptions $2,900Medical Equipment and Supplies $1,300Office Visits and Procedures $700Education $300Laboratory tests $100Vaccines, other preventive $100Total $5,400Patient pays:Deductibles $0Copays $1,300Coinsurance $0Limits or exclusions $80Total $1,380Questions: Call 1-800-376-6651 or visit us at www.avmed.org. If you aren’t clear about any of the underlined terms used in this form, see theGlossary. You can view the Glossary at www.cciio.cms.gov or call 1-800-376-6651 to request a copy.AVSG_H_<strong>5774</strong>_R5806_08126 of 7

Small Group <strong>HM</strong>O Coverage Period: Beginning on or after 08/01/2012Summary of Benefits and Coverage: What this Plan Covers & What it CostsQuestions and answers about the Coverage Examples:What are some of theassumptions behind theCoverage Examples?• Costs don’t include premiums.• Sample care costs are based on nationalaverages supplied by the U.S. Departmentof Health and Human Services, andaren’t specific to a particular geographicarea or health plan.• The patient’s condition was not anexcluded or preexisting condition.• All services and treatments started andended in the same coverage period.• There are no other medical expenses forany member covered under this plan.• Out-of-pocket expenses are based only ontreating the condition in the example.• The patient received all care from innetworkproviders. If the patient hadreceived care from out-of-networkproviders, costs would have been higher.What does a Coverage Exampleshow?For each treatment situation, the CoverageExample helps you see how deductibles,copayments, and coinsurance can add up. Italso helps you see what expenses might be leftup to you to pay because the service ortreatment isn’t covered or payment is limited.Does the Coverage Examplepredict my own care needs?û No. Treatments shown are just examples.The care you would receive for thiscondition could be different based onyour doctor’s advice, your age, howserious your condition is, and many otherfactors.Does the Coverage Examplepredict my future expenses?û No. Coverage Examples are not costestimators. You can’t use the examples toestimate costs for an actual condition.They are for comparative purposes only.Your own costs will be differentdepending on the care you receive, theprices your providers charge, and thereimbursement your health plan allows.Coverage for: Individual or Individual + Family | Plan Type: <strong>HM</strong>OCan I use Coverage Examplesto compare plans?ü Yes. When you look at the Summary ofBenefits and Coverage for other plans,you’ll find the same Coverage Examples.When you compare plans, check the“Patient Pays” box in each example. Thesmaller that number, the more coveragethe plan provides.Are there other costs I shouldconsider when comparingplans?ü Yes. An important cost is the premiumyou pay. Generally, the lower yourpremium, the more you’ll pay in out-ofpocketcosts, such as copayments,deductibles, and coinsurance. You shouldalso consider contributions to accountssuch as health savings accounts (HSAs),flexible spending arrangements (FSAs) orhealth reimbursement accounts (HRAs)that help you pay out-of-pocket expenses.Questions: Call 1-800-376-6651 or visit us at www.avmed.org. If you aren’t clear about any of the underlined terms used in this form, see theGlossary. You can view the Glossary at www.cciio.cms.gov or call 1-800-376-6651 to request a copy.AVSG_H_<strong>5774</strong>_R5806_08127 of 7