NOTES TO AND FORMING PART OF THE UNCONSOLIDATED FINANCIAL STATEMENTSFOR THE YEAR ENDED DECEMBER 31, 201113. OTHER ASSETSNote 2011 2010------- (Rupees in '000) -------Income / mark-up accrued in local currency 11,595,686 11,753,658Income / mark-up accrued in foreign currency 1,675,153 1,181,88913,270,839 12,935,547Advance taxation - net of provision for taxation 13.1 3,091,744 3,686,910Receivable from staff retirement funds 99,182 66,595Receivable on account of encashment of savings certificates 18,892 43,086Receivable in respect of derivative transactions 18,033 31,121Receivable from other banks against telegraphic transfers and demand drafts 817,422 1,219,425Unrealized gain on forward foreign exchange contracts 13.3 1,671,007 1,178,254Branch adjustment account 345,007 -Unrealized gain on derivative financial instruments 19.4.1 & 23.2 394,924 693,675Advance against Murabaha 31,039 -Suspense accounts 338,017 224,948Stationery and stamps on hand 162,521 151,528Non banking assets acquired in satisfaction of claims 13.4 584,337 -Advances, deposits, advance rent and other prepayments 898,851 727,888Others 1,872,750 1,139,56323,614,565 22,098,540Provision held against other assets 13.2 (2,777,829) (2,352,444)Other assets (net of provisions) 20,836,736 19,746,09613.1The Income Tax returns of the <strong>Bank</strong> have been filed up to the tax year 2011 (accounting year ended December 31,2010) and were deemed to be assessed under section 120 of the Income Tax Ordinance, 2001 (the Ordinance).The tax authorities have issued amended assessment orders for the tax years 2003 to 2011 (accounting years endedDecember 31, 2002 to 2010) determining additional tax liability of Rs.8,060 million, which has been fully paid as requiredunder the law, except for a portion of Rs.222 million unpaid against the tax year 2011 as it is not yet due. For the taxyears 2004 to 2009, appeals have been decided by the Commissioner of Inland Revenue [CIR(A)] by allowing relief oncertain issues, while the tax years 2003 and 2010 remain pending before the CIR(A). For the tax year 2011, the <strong>Bank</strong> isin the process of filing an appeal before the CIR(A). For tax years 2004 to 2007, appeals have been decided by theAppellate Tribunal Inland Revenue (ATIR), while the tax years 2008 and 2009 remain pending before the ATIR. For taxyears 2004 to 2007, the ATIR has allowed relief on certain issues, and to give appeal effect, a refund order of Rs.1,340million was issued. For the remaining matters, the <strong>Bank</strong> has filed a reference application before the High Court of Sindh.The management is confident that the appeals will be decided in favor of the <strong>Bank</strong>.Under the Seventh Schedule to the Ordinance, banks are allowed to claim provisions against advances upto 5% of totaladvances for consumer and small and medium enterprises and upto 1% of total advances for other advances. Amountsabove these limits are allowed to be claimed in future years. As at December 31, 2011 the <strong>Bank</strong> has booked a deferredtax asset of Rs. 3,200 million ( 2010: 2,574 million) in respect of provisions in excess of the above mentioned limits.The <strong>Bank</strong> also carries a tax asset amounting to Rs.4,114 million (December 31, 2010: Rs.5,454 million), representingdisallowance of provisions against advances and off balance sheet obligations, for the periods prior to the applicability ofthe Seventh Schedule. The management, in consultation with its tax advisor, is confident that these would be allowed tothe <strong>Bank</strong> at appellate levels.The tax returns for Azad Kashmir (AK) Branches have been filed for tax years 2005 to 2011 (accounting years endedDecember 31, 2004 to 2010) under the provisions of section 120(1) read with section 114 of the Ordinance, and incompliance with the terms of the agreement between banks and the Azad Kashmir Council in May 2005. The returns filedare considered as deemed assessment orders under the law.The tax returns for overseas branches (for UAE, Qatar, Yemen and New York) have been filed up to the accounting yearended December 31, 2010 under the provisions of the laws prevailing in the respective countries, and are deemed asassessed unless opened for reassessment.22

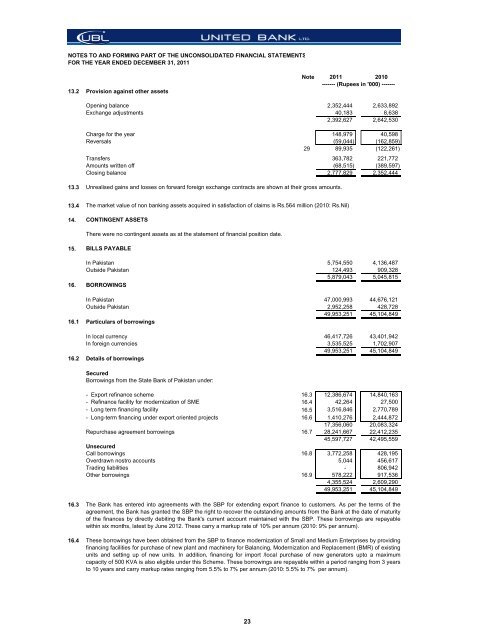

NOTES TO AND FORMING PART OF THE UNCONSOLIDATED FINANCIAL STATEMENTSFOR THE YEAR ENDED DECEMBER 31, 201113.2 Provision against other assetsNote 2011 2010------- (Rupees in '000) -------Opening balance 2,352,444 2,633,892Exchange adjustments 40,183 8,6382,392,627 2,642,530Charge for the year 148,979 40,598Reversals (59,044) (162,859)29 89,935 (122,261)Transfers 363,782 221,772Amounts written off (68,515) (389,597)Closing balance 2,777,829 2,352,44413.3Unrealised gains and losses on forward foreign exchange contracts are shown at their gross amounts.13.4 The market value of non banking assets acquired in satisfaction of claims is Rs.564 million (2010: Rs.Nil)14. CONTINGENT ASSETSThere were no contingent assets as at the statement of financial position date.15. BILLS PAYABLEIn Pakistan 5,754,550 4,136,487Outside Pakistan 124,493 909,3285,879,043 5,045,81516. BORROWINGSIn Pakistan 47,000,993 44,676,121Outside Pakistan 2,952,258 428,72849,953,251 45,104,84916.1 Particulars of borrowingsIn local currency 46,417,726 43,401,942In foreign currencies 3,535,525 1,702,90749,953,251 45,104,84916.2 Details of borrowingsSecuredBorrowings from the State <strong>Bank</strong> of Pakistan under:- Export refinance scheme 16.3 12,386,674 14,840,163- Refinance facility for modernization of SME 16.4 42,264 27,500- Long term financing facility 16.5 3,516,846 2,770,789- Long-term financing under export oriented projects 16.6 1,410,276 2,444,87217,356,060 20,083,324Repurchase agreement borrowings 16.7 28,241,667 22,412,23545,597,727 42,495,559UnsecuredCall borrowings 16.8 3,772,258 428,195Overdrawn nostro accounts 5,044 456,617Trading liabilities - 806,942Other borrowings 16.9 578,222 917,5364,355,524 2,609,29049,953,251 45,104,84916.3The <strong>Bank</strong> has entered into agreements with the SBP for extending export finance to customers. As per the terms of theagreement, the <strong>Bank</strong> has granted the SBP the right to recover the outstanding amounts from the <strong>Bank</strong> at the date of maturityof the finances by directly debiting the <strong>Bank</strong>'s current account maintained with the SBP. These borrowings are repayablewithin six months, latest by June 2012. These carry a markup rate of 10% per annum (2010: 9% per annum).16.4 These borrowings have been obtained from the SBP to finance modernization of Small and Medium Enterprises by providingfinancing facilities for purchase of new plant and machinery for Balancing, Modernization and Replacement (BMR) of existingunits and setting up of new units. In addition, financing for import /local purchase of new generators upto a maximumcapacity of 500 KVA is also eligible under this Scheme. These borrowings are repayable within a period ranging from 3 yearsto 10 years and carry markup rates ranging from 5.5% to 7% per annum (2010: 5.5% to 7% per annum).23