Food for thought - Bridgepoint Capital

Food for thought - Bridgepoint Capital

Food for thought - Bridgepoint Capital

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

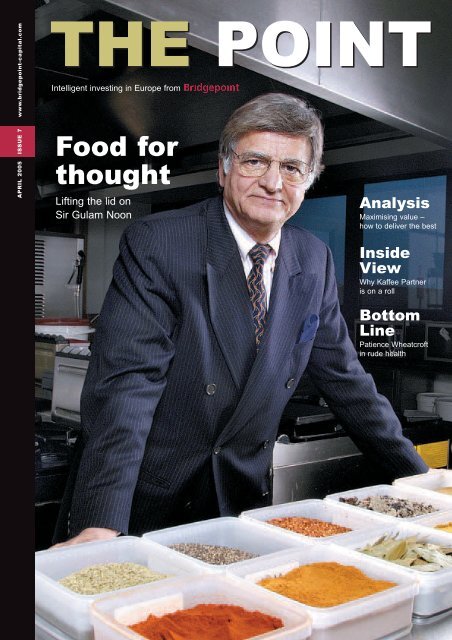

APRIL 2005 ISSUE 7 www.bridgepoint-capital.comTHE POINTIntelligent investing in Europe from<strong>Food</strong> <strong>for</strong><strong>thought</strong>Lifting the lid onSir Gulam NoonAnalysisMaximising value –how to deliver the bestInsideViewWhy Kaffee Partneris on a rollBottomLinePatience Wheatcroftin rude health

April 2005

ContentsAPRIL 2005 ISSUE 7News 4<strong>Bridgepoint</strong> investmentsand exits across EuropeSpotlight 7BAPS and the art ofcollective purchasingAnalysis 8Maximising value – howPublished by: Bladonmore Media LtdPublisher: Richard RivlinEditor: Joanne Hartprivate equity firms workto deliver returnsFace to Face 12Sir Gulam Noonon the secretsof successInside View 14Kaffee Partner goes fromstrength to strengthSector Watch 16Searching <strong>for</strong>nuggets in theretail industryMaking the Most 20Hammering homeat auctions and thelatest upwardlymobile toyBottom Line 22Are spas a lotof hot air?www.bladonmore.comReproduction, copying or extracting by any means of thewhole or part of this publication must not be undertakenwithout the written permission of the publishers.The views expressed in The Point are not necessarilythose of <strong>Bridgepoint</strong>.THE POINTEDITORIALMarket conditions <strong>for</strong> private equity investment in Europe haverarely been better than in recent years. Investment activity hasbeen fuelled by a powerful combination of low interest rates,relatively benign economies, an absence of competition fromindustrial acquirers and a ready supply of debt (at increasinglyaggressive multiples, somewhat worryingly). The overallnumbers <strong>for</strong> 2004 speak <strong>for</strong> themselves: record volumes inEurope <strong>for</strong> buyout activity with the number of middle marketdeals in particular up by 40 per cent.How long these conditions will be maintained is a matter <strong>for</strong>debate. What matters is continued focus and clarity of strategyto maximise the value of our investments. Why, and moreimportantly, how this is done, is explored in our regular Analysispiece on page 8. Sometimes there are quick routes to createvalue, at other times there are not. True value is of courserealised when we exit a business and successful exits aregenerally achieved by a combination of factors ranging fromthe strong operational and commercial skills of a company’smanagement team to the focus we bring through sectorknowledge and track record.Since the last issue of The Point, <strong>Bridgepoint</strong> has had anactive time, as much on the successful sale of businesses ason the new investment front. Last year, we made 15 major exitsfrom <strong>Bridgepoint</strong>-backed companies and returned over e 700million to our investors. We also made eight new investmentsin Austria, Spain and the UK. Highlights of that activity arereviewed in our regular news pages 4 to 7.People who make up the management teams we back are vitalto the per<strong>for</strong>mance of our investments. In this issue, we look attwo businesses – one in the UK and one in Germany. Sir GulamNoon is chairman of Noon Products, part of WT <strong>Food</strong>s (see page12). Aself-made man, he has found the private equity culture apleasant surprise. Andreas Ost, chief executive of Kaffee Partnerin Germany (see page 14), is similarly discovering the benefits ofexpanding his company alongside a private equity partner.As investors, we work with the teams we back to carry out thestrategy agreed when we first invest. Inevitably, external factorscan impact a company’s ability to implement that strategy whichis why sector experience in good and bad markets can becrucial. On page 16, we take a look at the UK consumer sector –in particular retail – where, despite the doomsayers, we identifythe trends in consumer behaviour that point to areas of potentialopportunities. It is precisely this type of insight – from years ofworking in a market, building up sector and local countryknowledge – that will always be essential, particularly during atime of buoyant activity.William Jackson is managing partner of <strong>Bridgepoint</strong>www.bridgepoint-capital.comDeliveryis thekeyTHE POINT 3

NEWSThe POINT ExpressAttendo’s looking healthyTaking care: <strong>Bridgepoint</strong> is supporting Attendo’s expansion plans .<strong>Bridgepoint</strong> has acquired a majority shareholding in Attendo,the Sweden-based provider of care services to the elderly anddisabled.The firm has purchased 100 per cent of the capital fromAttendo’s principal shareholders in a deal that values the careservices business at SEK2.2 billion (€245 million).Attendo has a strong position in the Nordic countries, wherethe market <strong>for</strong> elderly and disabled care is estimated at SEK115billion in Sweden alone. The company has a presence in otherEuropean countries too and plans to expand its operations in anumber of markets, supported by <strong>Bridgepoint</strong>’s expertise andexperience in the nursing home sector.“With <strong>Bridgepoint</strong> as the principal owner, we will have anexcellent opportunity to maintain the strong growth that Attendohas achieved. We will now begin to exploit new growth marketsmore actively,” says Henrik Borelius, president and CEO of Attendo.<strong>Bridgepoint</strong> intends to be an active supporter of Attendo’sexpansion plans. “The company is still in a strong developmentphase,” says Graham Oldroyd, who is responsible <strong>for</strong><strong>Bridgepoint</strong>’s operations in the Nordic region. “To enableAttendo to respond effectively to market opportunities,<strong>Bridgepoint</strong> will work closely with the existing management,providing support through our European network, ourexperience and our capital. Working with existing management,we will be able to ensure that the business has everything itneeds <strong>for</strong> continued strong expansion.”First on credit sideUK debt purchase and collectionbusiness 1 st Credit is poised <strong>for</strong> furtherexpansion, after completing a <strong>Bridgepoint</strong>backedmanagement buyout.The company is keen to consolidateits position in the UK market andexpand into Europe.“With a new funding structurein place, we are about to enter avery exciting next stage in thedevelopment of 1 st Credit. Inaddition to consolidating ourposition in the UK market, we will betargeting acquisitions with the help of<strong>Bridgepoint</strong>’s network,” says 1 st Creditchief executive Mike Cleary.The company was founded in 2001and has grown exponentially, buyingand collecting distressed debtportfolios from credit providers such asbanks and building societies, creditcard companies, car and consumerfinance companies, retailers andutilities. A third of its business is in thearea of sales ledger management,consulting and outsourced creditmanagement.More than £5 billion of debt is nowpassed to collection agencies in the UKeach year and the market <strong>for</strong> outsourceddebt has grown by more than 70 per centover the past two years.“ 1 st Credit stands out among thecompetition, thanks to a strong andexperienced management team that haschanged its marketplace to become numberone in debt purchasing,” says AndrewBurgess, director of <strong>Bridgepoint</strong> in London.“The company has over 800,000 accountsunder management with a face value ofmore than £900 million.”<strong>Bridgepoint</strong> bought the business<strong>for</strong> £72 million from privateequity firm Gresham.Barclays provided seniordebt. Mezzanine financecame from Intermediate<strong>Capital</strong> Group.See Analysis page 8.Taking credit: (l to r) Richard Storey, Mike Cleary,Najib Nathoo and Charles Holland4 THE POINT

NEWSItaly’s SEA motors ahead<strong>Bridgepoint</strong> has recently acquired SEA,one of Europe’s largest manufacturers ofbranded motor caravans. In less than fiveyears, the company has become the largestproducer of motor caravans in Italy and thethird largest in Europe, with a market shareof 15 per cent. Founded in 2000 by chiefexecutive Ermes Fornasier, the companyhas made three large acquisitions in Italyand built up a significant market share inFrance, Germany and Spain.“SEA has outper<strong>for</strong>med its marketover the past three years, thanks to themanagement of Ermes Fornasier, a highlydriven entrepreneur with strategic vision,and Pierluigi Alinari, one of the leadingEuropean players in the motor caravanmarket,” says Guido Belli, partnerresponsible <strong>for</strong> <strong>Bridgepoint</strong>’s investmentactivities in Italy.The European market <strong>for</strong> motorcaravans is predicted to grow strongly overthe next five years, driven by favourabledemographics and increasing financialresources and leisure time. SEA motorcaravans retail <strong>for</strong> between €20,000and €80,000.“Our competitiveness isa result of the emphasis weplace on the price andquality of our products andthe development of servicelevels aligned to the needsof the dealer network andour ultimate customers,”says Fornasier. “With<strong>Bridgepoint</strong> as our newmedium-term financialpartner, we have one of themost experienced private equityoperators in Europe. This will allow SEAto take an important next step <strong>for</strong>ward inits sector.”Com<strong>for</strong>table ride: SEA has outper<strong>for</strong>med itsmarket over last three yearsCarter & Carter’s LSEoffer oversubscribedHMY offthe shelfCarter & Carter , a UK-based providerof outsourced support services to globalvehicle manufactures, successfully listedon the main board of the London StockExchange in February 2005. The offeringwas oversubscribed and the shares werepriced at 235p apiece, valuing the businessat £78.4 million.A proportion of the funds raised wasused to pay down existing shareholders,including <strong>Bridgepoint</strong>, which held a 46per-cent stake. <strong>Bridgepoint</strong> firstinvested £6.7 million in Carter & Carterin January 2001.“We are pleased with investor interestin the flotation of Carter & Carter,” said<strong>Bridgepoint</strong> partner Michael Davy. “TheDriving <strong>for</strong>ce: Carter & Carter chief executive Philip Cartercompany has grown tremendously since<strong>Bridgepoint</strong> first invested four years agoand we wish the team every success in itscontinued development.”“We are delighted at the investorresponse to our flotation. It will not onlyraise our corporate profile, but enable thegroup to maintain its total commitmentto client service excellence, whilstretaining and attracting the qualitypeople that have helped us build thebusiness we have today,” says Carter &Carter chief executive Phillip Carter.Rothschilds acted as sponsor andfinancial adviser to the flotation withABN Amro Rothschild acting asbookrunner and underwriter and HoareGovett as broker.<strong>Bridgepoint</strong> has sold Hermès MétalYudigar, the European market leader inthe design, production and supply ofshelving systems to the food and nonfoodretail sectors.The business has expandedconsiderably since it was acquired by<strong>Bridgepoint</strong> in April 2000. It now turnsover €300 million, 60 per cent of whichcomes from its French market base.HMY also has a substantial presencein Spain, following the successfulintegration of Spanish market leaderYudigar into the business.“Under <strong>Bridgepoint</strong>’s ownership wewere able to consolidate our operationsand integrate our newly acquiredSpanish business,” says Joël Goulet,president of HMY.<strong>Bridgepoint</strong> received corporate financeadvice from Downer & Company andlegal advice from Linklaters. HMY wassold to private equity firm Sagard. Thecompany’s management will reinvest inthe business, retaining a stake of morethan 20 per cent.THE POINT 5

NEWSSPOTLIGHTEuropean growthThe European buyout marketexperienced record volumes lastyear, with the mid-market showingparticularly strong growth.According to the latest EuropeanBuyout Review published byInitiative Europe and <strong>Bridgepoint</strong>,the total value of European buyoutsrose 22 per cent to €76.6 billion lastyear and the number of dealsincreased by 17 per cent to 480transactions.The value of transactions in the€50 million to €500 millioninvestment range increased by morethan 60 per cent to €31.2 billionand the volume of deals was up 40per cent in the year.The value of the UK market sawan increase <strong>for</strong> the first time inthree years and the German marketshowed further signs of recovery.The Nordic region remainedbuoyant and growth was particularlyrobust in Norway.The most popular type of transactionwas the disposal of non-coreassets by a European parent. Thenumber of public-to-private dealsdeclined, having surged in 2003.Healthy support<strong>for</strong> CAS Services<strong>Bridgepoint</strong> has strengthenedits presence in the healthcaresector with the purchase of CASServices and MDS International,two companies that work togetherto provide clinical support software.CAS provides the systems andIT support <strong>for</strong> NHS Direct,which offers health in<strong>for</strong>mationand advice over the telephone tothe general public in England. Thesystem handles more than 6.5million calls annually and hasestablished a reputation as avalued public service.CAS began providing thesoftware in 2000 andsubsequently expanded intoScotland and Wales. It has alsowon recent tenders to providesoftware under license toShare of buyouts by region(Volume) 2000-2004UK &Ireland39%Southern Europe9%Source: Initiative EuropeNordic12%France18%Benelux7%Germany15%The value of these deals rose,however, by 11 per cent.There was also a strong increasein secondary buyouts. The totalvalue of these transactions rose 68per cent last year, to more than€2.4 billion.“The mid-market saw significantgrowth last year and we believethis trend is likely to continue wellinto 2005,” says Kevin Reynolds,the partner responsible <strong>for</strong><strong>Bridgepoint</strong>’s investment activityin the UK.consortia in Greece and Portugal.“NHS Direct, supported byCAS, has contributed to amoreefficient utilisation of existinghealthcare resources. This modelhas applications elsewhere in theworld and CAS has first moveradvantage,” says <strong>Bridgepoint</strong>partner Rob Moores.<strong>Bridgepoint</strong> has been joined inthis transaction by theinternational investmentinstitutions Allco Finance Groupand Benchmark <strong>Capital</strong>.“This plat<strong>for</strong>m will allow us tobroaden the applications and rollout our services to more nationaland international customers,particularly in Europe, US andAustralasia,” says CAS chiefexecutive Robert Thompson.BAPS – an update<strong>Bridgepoint</strong> set up its collective purchasingscheme BAPS almost four years ago. EmmaDe Vita discovers a real success story thathas been widely adopted not just by<strong>Bridgepoint</strong> businesses but externally tooSometimes it’s the small things that make thedifference. The <strong>Bridgepoint</strong> Affinity PurchasingScheme is a case in point. Set up four years ago by<strong>Bridgepoint</strong> director Patrick Fox, the programmeenables companies to purchase collectively in anefficient manner, driving down non-strategic costs andultimately improve profitability.Originally set up <strong>for</strong> <strong>Bridgepoint</strong> portfolio businesses,the scheme has proved so successful that 11 other UKprivate equity houses have signed up to it. This bringsthe total number of participatory businesses to 300,only a third of which belong to <strong>Bridgepoint</strong>. Clearly,themore companies that adopt the scheme, the morebeneficial it becomes, since increased volume providesgreater cost-savings.Within <strong>Bridgepoint</strong> the scheme is voluntary,thougha large number of portfolio companies in the UK haveused some aspect of it to achieve cost-savings oneveryday items such as photocopiers, IT, healthcareand stationery.Cost savings of between 10 per centand 30 per cent are typically achieved, thoughreductions can be as high as 50 per cent. Justcomparing what a supplier normally charges with aBAPS supplier’s price can be enough to obtain costsavingsthrough negotiation.Of course, BAPS cannot trans<strong>for</strong>m a weak companyinto a strong one but it does encourage management tofocus on every aspect of the business, and it can delivervaluable time as well as cost savings. Typically, <strong>for</strong>example, a portfolio company may experienceinefficiencies in dealing with multiple suppliers. Thiscreates an unproductive paper chase of hundreds ofinvoices. BAPS can help eliminate this process.<strong>Bridgepoint</strong> is now keen to widen its supplier base.Already sharing its preferred supplier lists withportfolio companies, it actively explores new productsand services <strong>for</strong> consideration. One <strong>Bridgepoint</strong>portfolio company, <strong>for</strong> example, suggested looking atcarpet suppliers. BAPS did, and cost savings will bemade across the board. Another new and importantprocurement area <strong>for</strong> 2005 is waste management, wherethere are particularly big price differentials betweensuppliers. Healthcare and life insurance continue to bevery popular <strong>for</strong> BAPS, as does Microsoft licensing,which have had a 90 per cent take-up.Naturally, price is not everything. With stationery <strong>for</strong>example, it could be just as important <strong>for</strong> companies tohave a local supplier who can deliver quickly rather thana cheaper supplier based at the other end of the country.The BAPS scheme is flourishing and portfoliocompanies are delighted with the cost-savings andadministrative efficiencies achieved.Emma De Vita is Brainfood Editor of Management TodayTHE POINT 7

ANALYSIS: PRIVATE EQUITYWorkingPrivate equity firms achievesuccess by maximising value.Grant Ringshaw discovershow it is doneTothe outside world,it may seem as if privateequity is an easy game toplay – buying and sellingbusinesses and ef<strong>for</strong>tlesslymaking a turn inthe process. The harshreality is very different.Creating value is achallenging and timeconsumingprocess, involvingstrategic <strong>thought</strong>,radical action and plentyof hard work. “The dayswhen you could buysomething, stick theinvestment in the bottomdrawer and hope that thatthe price/earnings ratios wouldgo up and give you a fat profit are longgone,” says <strong>Bridgepoint</strong> partner KevinReynolds.“You have tomake sure businesses aremanaged better and you really have towork the assets,” he adds.Certainly, the appetite <strong>for</strong> buyouts8 THE POINTremains undiminished. Last year alone, thevalue of European buyouts rose 22 per centto €76.6 billion and in the past sevenyears, private equity firms’ holdings in UKcompanies have surged from £23 billion to£80 billion.The trend has partly been fuelled by theavailability ofaf<strong>for</strong>dable debt fromthe bank sector. Bank debtnow accounts <strong>for</strong> around 50 percent of the financing <strong>for</strong> the averageleveraged buyout deal – the highestlevel in ten years.Such an environment does notmake life easy and over the pastdecade, it has become increasinglydifficult to buy under-priced assets.In addition, a three-year bearmarket between 2000 and 2003made it virtually impossible touse one ofthe most tried and tested exit routes –flotation on the stock market – at least <strong>for</strong>some private equity houses. Instead, theindustry has had to seek out a wider rangeof potential buyers and secondary buyoutshave become commonplace.It may be more challenging to achieve a

ANALYSIS: PRIVATE EQUITYto deliverTools of the trade• Improving operationalefficienciessuccessful exit but there is increasingpressure to do so as debt needs to be paiddown, equity needs to earn a decent returnand funds set over a fixed period duringwhich they hold an asset, normally up tofive years.In simple terms, there are three ways toachieve these targets. Companies candevelop existing markets, access new onesand make operational improvements.Generally, all three issues are addressed.“We bought the French perfumerygroup Nocibé in October 2002 andquickly identified three growthopportunities. We wanted to increase salesby opening more shops, we wanted tomake acquisitions and we wanted toimprove profitability,” explains ValérieTexier, <strong>Bridgepoint</strong> partner in Paris.With funding and guidance from<strong>Bridgepoint</strong>, Nocibé has since opened anumber of stores and last month bought achain of pharmacies, with strongrepresentation in central Paris.Companies need todevelop existingmarkets, access newones and makeoperationalimprovements“We have also addressed theprofitability issue, looking at specificaspects of the business each year. In 2003,we focused on gross margin and workingcapital. In 2004, we focused on increasingfootfall and this year we are looking atemployee productivity. We work activelywith management towards achieving theseaims,” Texier adds.In many cases, the management team isthe first operational issue that a privateequity firm needs to address. But merelybeing under private equity ownership canencourage managers to focus more keenly.“When managers have a stake in thebusiness and know they will share in itssuccess, that acts as a real incentive,particularly with businesses that have <strong>for</strong>merlybeen a non-core part of a large conglomerateor a state-owned entity,” says Alok Sharma,director of corporate finance at EnskildaSecurities.“It also adds value when private equityfirms bring in experienced seniorindustrialists to chair their businesses sothey can assist in implementing strategicmeasures,” he adds.<strong>Bridgepoint</strong> appoints independentchairmen to its portfolio businesses. Thefirm also has a policy of being representedon the board by two non-executivedirectors. The aim is to strike the rightbalance, giving executives sufficient reinto run their businesses effectively.Sometimes, more direct involvement isrequired. Last year, <strong>for</strong> example,<strong>Bridgepoint</strong> helped recruit a chairman,finance director and merchandisingdirector <strong>for</strong> the shoe retailer Faith, evenbe<strong>for</strong>e it bought the company.“We were prepared to invest, but wealso wanted to see how the business wouldper<strong>for</strong>m under a different management,”says Kevin Reynolds, partner responsible<strong>for</strong> <strong>Bridgepoint</strong>’s UK investment activity.“Construction of the management team isone of the areas where we can have mostinfluence.”Family-owned firms are often anattractive area <strong>for</strong> private equity firms. Butthey present their own particularmanagement issues.“You often find that the culture hasbeen key to their success. You have tomake sure that you don’t throw the babyout with the bath water. If you get it rightit can be very rewarding,” says Reynolds.Valérie Texier: “We look at specific aspects of the business each year”• Finding the rightmanagement• Setting keyper<strong>for</strong>manceindicators• Reviewing financial systems• Developing markets• Targeting acquisitionsManagement aside, improvements canalso be made in areas such as workingcapital and purchasing.Financial system reviews and keyper<strong>for</strong>mance indicators are crucial tooand are normally put in place within 100days of a business acquisition. Given thestructure of private equity deals, businessesoften need to manage theirworking capital better to finance thedemands of a leveraged transaction andpay down the debt.A further way to maximise value is toimprove operating margins. Last July,<strong>Bridgepoint</strong> bought Pets At Home, the155-strong chain that sells pet foods andaccessories as well as small animals. Inrecent months, the company has boostedmargins by sourcing more products fromthe Far East. Higher margin own brandedproducts are also under consideration andthe chain has increased expenditure onmarketing and brand development.Operational improvements are clearlyessential but they are only part of thechallenge. Fierce competition <strong>for</strong> goodassets has <strong>for</strong>ced private equity firms tobecome more focused too.“To get an edge firms are concentratingon certain sectors. They are building up amarket knowledge which allows them tounderstand an industry in depth,” saysHoward Leigh, chief executive ofCavendish Corporate Finance.“Private equity firms are generallyTHE POINT 9

ANALYSIS: PRIVATE EQUITYable to look at businesses with a fresh perspective and inmany cases apply the lessons learned through earlier investmentsin the same sector,” says Sharma.Greater market knowledge also allows private equity firms toseek out new ways of developing their portfolio businesses.One approach is the buy-and-build strategy, where the privateequity house acquires a company as a plat<strong>for</strong>m <strong>for</strong> further deals.In December 2000 <strong>for</strong> example, <strong>Bridgepoint</strong> boughtALcontrol, a Dutch analytical services company <strong>for</strong> the foodand environmental sectors. In less than four years ALcontrolmade nine acquisitions, moving it from a cottage industry to aservice-orientated business capable of servicing customersthroughout Europe. Last November, <strong>Bridgepoint</strong> soldALcontrol to Candover, making a return of five times itsoriginal investment. The buy and build approach can lead to farThe real attraction of buy andbuild is that it can trans<strong>for</strong>m abusiness. The underlying rule isthat any investment has to workon a stand-alone basisbigger deals than the original investment. In 2003, <strong>Bridgepoint</strong>bought Safestore <strong>for</strong> £40 million. Just eight months later,Safestore acquired Mentmore <strong>for</strong> £210 million, in a deal fundedby <strong>Bridgepoint</strong>.Buy-and-build strategies cannot be undertaken lightlyhowever. “The problem is that once you have done the first dealyou have to pull off the second and the third and so on. If youareinvesting in a fragmented sector you should be able to knock overthe deals, but it does not always work,” says John Cole, a corporatefinance partner at accountancy firm, Ernst & Young.Reynolds explains: “The real attraction of buy and build is thatit can trans<strong>for</strong>m a business, but the underlying rule is that anyinvestment has to work on a stand-alone basis.”Texier agrees: “Originally, we <strong>thought</strong> Nocibé should expandbeyond France. We looked all across Europe but currently wehave concluded that there is no country where we could make areally profitable acquisition.”Sometimes, however, international expansion is extremelyproductive. Last November, <strong>Bridgepoint</strong> bought SEA, a leadingmaker of branded motor caravans. Though the Italian companyhas already expanded into France, Germany and Spain, itsprincipal markets, it also plans to move into other markets acrossEurope and is currently assessing a number of targets.By developing a domestic business into a group withinternational operations, private equity firms can increase theiroptions when it comes to a sale. As Reynolds explains: “One ofthe key objectives is to buy at local prices and develop a businessso you can sell at global prices.”Such an aim is not easy. But private equity firms that focus ontheir businesses and work creatively and constructively withthem still achieve excellent returns. The difference now is thatmaximising value requires more input than ever be<strong>for</strong>e.Private equity firms attempt to maximisevalue from the moment they make anacquisition, as <strong>Bridgepoint</strong>’s approachtowards 1st Credit reveals<strong>Bridgepoint</strong> recently acquired the debt purchase and collectionservices company, 1 st Credit, <strong>for</strong> £72 million.The company buys and manages distressed debt portfolios,purchasing the debt from financial services companies such asbanks and building societies, credit card lenders and loan providers.Although the business only completed a management buyout afew months ago, it has already begun to work constructively with<strong>Bridgepoint</strong> to effect change in certain key areas.The biggest change has been the launch of a far-reachingproject to improve efficiency and implement new systems. Thescheme, led by 1 st Credit commercial director Najib Nathoo and<strong>Bridgepoint</strong> director John Davison, aims to design andimplement industry best practice. It covers a range of issuesfrom enhancing processes to improving the way that debtportfolios are profiled.<strong>Bridgepoint</strong> has helped us focuson making things happen. We areaiming to complete a project thatwould normally take two to threeyears in six months“<strong>Bridgepoint</strong> has helped us to kick the tires, think more broadlyand focus on making things happen. We have moved a long way in ashort time – what we are aiming to do is complete a project whichwould normally take two to three years in six months,” says Nathoo.The project will not only ensure 1 st Credit is run moreeffectively, but will make it more attractive to bidders when it isultimately sold.In addition, <strong>Bridgepoint</strong>’s status and the scale of its business havehelped improve 1 st Credit’s access to funding. And the company’smanagement has been working with <strong>Bridgepoint</strong> on new ways toanalyse and price its debt.<strong>Bridgepoint</strong>’s reputation in the financialservices market has also boosted 1 stCredit’s credibility. “This is a keyissue when you are dealing with thesensitive issue of collecting debton behalf of clients,”says Nathoo.Grant Ringshaw is deputy City editor of the Sunday Telegraph10 THE POINT

PROFILEFACETOFACEHungry <strong>for</strong> successSir Gulam Noon has been in business <strong>for</strong> 50 years and is now chairman of NoonProducts, part of <strong>Bridgepoint</strong>-owned WT <strong>Food</strong>s. Joanne Hart finds out how Noonmoved from selling sweets in Bombay to making curry <strong>for</strong> millions in the UKSir Gulam Noon was 34 years oldwhen he left India <strong>for</strong> the first time. Hisdestination was England. By his ownadmission, he immediately fell in lovewith the country.“I liked the culture, I liked the softnessand the law and order was fantastic. Youcould leave your key under the mat in themorning and it would still be there in theevening,” he says.At the time, Noon was already asuccessful businessman in Bombay,running the family firm, Royal Sweets,and several other enterprises. But hewanted tospread his wings. Despite hismother’s misgivings, he moved to Britainand set to work.“I began my first business here in theearly seventies and brought my motherover in 1974,” he explains.Noon prospered in the UK, but it wasnot until the 1980s that he was inspired tofound the business that has made himfamous – and extremely rich.“In life, most successful people canenvisage what is coming next. I saw thatthe Indian food on offer in the Britishsupermarket was insipid and badly packaged.I wouldn’teat it. I <strong>thought</strong> if I coulddo it properly,it might become a nichemarket. In that sense, I was wrong – it hasbecome mainstream,” he says.Noon initially took his idea tothe US,arriving in 1980 and leaving four years later.“We were way ahead of our time. TheUS market is still not ready <strong>for</strong> chilledIndian food. I lost a lot of money and in1984 I returned to England,” he says.Undeterred by his American experience,Noon began tothink about doing the samething in the UK. Noon Products tookshape in 1987 and was soon supplying BirdsEye, Sainsbury’s and Waitrose. Five yearslater, the company was turning over £15million and employing 250 people.“Then disaster struck. My wholefactory burnt down. Grown men andwomen were crying as I reached theplant,” says Noon.A combination of indomitable spiritand good business sense kept thecompany alive.“From the beginning, I determined thatthis business would be based aroundsupplying only a few companies, all ofwhich we nurture,” says Noon.The philosophy has stood him in goodstead, particularly during difficult times.“When the factory burnt down,customers called up personally to com<strong>for</strong>tme,” says Noon.The supermarkets supported Noonduring this period, but his own acumenhelped too.“Back then, I also had two confectioneryplants. I converted one of theminto Noon Products and started back inbusiness. Within three weeks, we were at40 per cent capacity. Soon afterwards, wehad it up to80 per cent. Then in March1995 I found another factory.By August ofthat year, it was up and running. I wasworking from seven in the morning untillate at night,” says Noon.His diligence paid off. By 1999, NoonProducts was turning over £40 million ayear and employing 600 people.“I was not getting any younger, Iwanted to make sure thebusiness was in safehands, I wantedsome moreprofessionalism in thecompany and I wanted tocash in,” Noon explains.London-listed foodgroup WT <strong>Food</strong>sprovided an elegant solution,acquiring NoonProducts <strong>for</strong> £50 million.Three years later, whenNoon himself was 65, WTexecuted a management buyout,backed by <strong>Bridgepoint</strong>.“Initially, when I heardthat a private equity firm wascoming on board, I was verysceptical. But I have tosay Ihad blinkers on at that point.My apprehension was completelyunjustified. <strong>Bridgepoint</strong> hasbeen very constructive andthe people have alwaysbeen open-minded andprepared to listen,”says Noon.At the timeof theCAREERPROFILEName: Sir Gulam Noon Dateof birth: 24th January 1936Nationality: British Country of origin: IndiaFamily: Married with two daughters and one grand-daughterEducation: High school in Bombay, which I left aged 16First job: Working <strong>for</strong> Royal Sweets, afamily business foundedby my grandfather in 1902Greatest success: Noon ProductsBiggest mistake: Be<strong>for</strong>e I started Noon, I tried to do the same thingin the US. The idea was be<strong>for</strong>e its time and I lost a lot of moneyCar: I love cars and I love technology so I have just bought aMaserati Quattroporte. I also drive a BentleyLife ambition: I have been in business since the age of 17. Now Iwant to plough my energy into charity and give the essence of myexperience to my adopted country12 THE POINT

PROFILEIn life, most successful people canenvisage what is coming next. I saw thatthe Indian food on offer in the Britishsupermarket was insipid and badlypackaged. I<strong>thought</strong> if I could do itproperly,it might become a niche marketMBO, Noon was chairman andmanaging director of NoonProducts, which he describes as“the jewel in the crown” of WT<strong>Food</strong>s. In late 2003, he steppedaside from the day-to-dayrunning of Noon, following theappointment of WT <strong>Food</strong>s executiveJohn Duffy as MD. Now,Noon is non-executive chairman ofthe business he founded anddescribes himself as “an ambassador<strong>for</strong> the company”.He is not unhappy with thearrangement: “I don’t miss the olddays at all. John and I work closelytogether and he has done a splendidjob. I still come in every day fromlunchtime till early evening and sometimes<strong>for</strong> longer,” he explains.Noon Products now operates acrossthree plants in the west London boroughof Ealing. It is the biggest employer in thedistrict, with up to1,200 workers at peakperiods, producing 250,000 chilled Indianmeals every day.“We supply Sainsbury’s,Waitrose, Safeway (now partWhen I heard that aprivate equity firmwas coming on board,I was very sceptical.But I have to say Ihad blinkers on atthat point. Myapprehension wascompletely unjustifiedof Morrison), Morrison and Wetherspoonin the UK. We also export to Germanyand Belgium. We would like to think thatour current customers will grow and wewill grow with them. And we are, ofcourse, looking <strong>for</strong> new customers,” saysNoon.The business currently makes morethan 100 different dishes, each of themtried out in a special Development andTesting Kitchen annex. Noon himself isan able cook.“I have learnt from our chefs. I canrustle up a meal very quickly,not just <strong>for</strong>my family,but <strong>for</strong> 30 people if need be,”he says.For Noon, preparing meals is not,however, as much as apassion as cricket.He has been playing since he was tenyears old and still bats <strong>for</strong> the companyteam from time totime. He also attendsas many live matches as he can andwatches it on television when time and hiswife permit.“Even when I have just come back froma match, I still like tosee the highlightson television. My wife shouts at me: ‘Youhave just been tosee the match’ but Ilove watching it again,” says Noon.Noon is one of Britain’s best-knownAsian businessmen, renowned <strong>for</strong> bringingIndian food into our homes. He alsocreated one of Britain’s best-loved Indiandishes, chicken tikka massala.“Noon Products started off makingfrozen food and our first dish waschickentikka makhanwala. I realised thatmakhanwala was a bit of a tongue-twister<strong>for</strong> the British, so Ichanged it to chickentikka massala. Massala just means ‘spices’,but the name stuck,” says Noon.The rest, as they say, is history.Joanne Hart is editor of The PointFACETOFACETHE POINT 13

INSIDE VIEWFull of beansAndreas Ost began working at Kaffee Partner while training to bea lawyer. Now he runs the company. Hans-Jürgen Schneidervisited the hands-on entrepreneur in Lower SaxonyOn the phone, Dr. Andreas Ost promised tosend a company driver topick me up fromOsnabrück railway station. And when I arrived at the station, aman was standing there asarranged, holding a Kaffee Partner brochure. But this was no company driver. It was Ost himself.The driver was otherwise engaged so Ost took the wheel into his own hands.There is no doubt that Ost is the driving <strong>for</strong>ce behind Kaffee Partner, which supplies coffeevending machines and drinking water fountains to businesses throughout Germany. The companyis a market leader in its field with 240 employees. It was founded by Ost’s father more than 30years ago and Ost worked in the business while still a student.“My earnings were intended to help me through law school,” he says.Ost later gained a doctorate in international fiscal law but discovered that he preferred beingan entrepreneur. Nonetheless, his studies stood him in goodstead and he soon added training in wholesale andexport commerce.Ost remembers the early days very well. Father andson supplied their first ten vending machines to staffrooms in nearby schools. But they soon diversifiedand in the early 1980s targeted hairdressers, lawyersand small offices – with increasing success.In1984, Ost’s father passed away and Ost becamehead of the business. He determined to stick to thecompany’s founding philosophy, under whichclients are partners and treatedaccordingly. At an earlyOst and his fathersupplied their first tenvending machines to staffrooms in nearby schools14 THE POINT

INSIDE VIEWOst believes his greatest achievement is KaffeePartner’s face-to-face sales <strong>for</strong>ce. Marketing isfocused on medium-sized businesses and thebusiness has perfected its sales techniquestage, he enlisted the help of MichaelKoch, a friend from his student days. Kochhandled the bookkeeping so Ost couldconcentrate on sales and marketing. Morethan 30 years later, Koch is still at KaffeePartner, as is Dr Thomas Lengerke, thethird long-standing partner in the successfulteam.The executive trio shares the managementof three operating companies, all ofwhich sit under the umbrella holdingcompany Kaffee Partner. Kaffee PartnerOst Automaten sells vending machines <strong>for</strong>freshly-brewed coffee. Kaffee PartnerShop sells coffee, tea, chocolate, biscuitsand a variety of mugs and cups. WellTecsells drinking fountains.The company owes its success to aconstant focus on innovation. Many yearsago, Ost commissioned the development offilter-coffee vending machines that ensuredeach cup was freshly-brewed. Now hismachines provide fashionable Italianspecialities such as espresso, cappuccinoand latte macchiato. But clients are notobliged to buy their coffee from KaffeePartner. The company supplies all the majorbrands but Ost believes that treating clientsas partners means leaving them a freechoice of supplier.In recent years, Kaffee Partner’s drinkingfountains have become increasinglypopular too. The company traditionallysupplied small and mid-sized companiesbut it has now begun to expand the clientbase to include hospitals and GermanArmy barracks. The fountains serve still orsparkling German tap water, which hasbeen filtered, sterilised and cooled.No appliance in the company’s range isstraight off the peg. The Kaffee Partnermotto is: “Don’tstint on the appliances” soall the vending machines are developed inhouseand are manufactured according tostringent quality controls.Ost believes his greatest achievement isthe national face-to-face sales <strong>for</strong>ce that hehimself set up. Marketing is focused onsmall- and medium-sized businesses andthe business has perfected its sales technique.First, clients are made aware oftheir needs; then their needs are definedand finally, the deal is closed. Ost puts themarket capacity in Germany alone at amillion companies, with between five and200 employees each. He believes there isimmense growth potential even withoutbig corporations, who place large-scaleorders, but expect to see equally largerebates.“Cheap prices, cheap clients,” says Ost.He prefers to maintain good marginsand concentrate on smaller clients. Thecompany has 50 state-of-the-art vehiclesto provide fast on the ground service but30 per cent of all client queries areprocessed effectively by phone.“We offer an end-to-end system that isgrowing steadily and has no real competitionin the domestic market,” says Ost.For all his success, the elegantly dressed49 year-old has stuck tohis roots in ruralLower Saxony, the heartland of mediumsizedGerman businesses.“Large cities do not offer me anygeographical advantages,” says Ost.Now he believes the time is right toexpand beyond Germany, with the help of<strong>Bridgepoint</strong>, whose support he sought outhimself back in 2002. In future, Ost wouldlike tospend more time relaxing with hisfamily and pursuing sports such as riding,tennis and badminton. But there is nodoubt that the engine driving KaffeePartner willcontinue torun at full throttle<strong>for</strong> quite a while to come.Hans-Jurgen Schneider is a corporate communicationsconsultant in Germany

UK RETAILSECTORWATCHWhat’s in store?According to some retailers, the glory daysof the High Street are well and truly over.But, <strong>for</strong> the discerning private equity buyer,there are still some good businesses outthere. Jonathan Prynn reportsRetailers are a sensitive bunch.Endlessly at the mercy of factors beyondtheir control, they seem to live and die bylast week’s sales figures. One bad week andthey fear imminent ruin. One awkwardChristmas and they predict a completecollapse in consumer confidence.Right now, however, the industry has alot to be sensitive about. As with anymarket, the sector is driven by the basiclaws of supply and demand. And in thecase of the High Street, the balance isshifting on both fronts.Hit by the doublewhammy of reduceddemand andincreased supply,there is a growingdivide betweenwinners and loserson the High StreetShoppers have not completely lostinterest in what the stores have to offerbut consumer demand has begun toslacken. Stock is unlikely to fly off theshelves this year in quite the same way as itdid in the first few months of 2004.16 THE POINTIn addition, there has been an explosionin retail capacity. This has intensifiedcompetition and driven down margins.“Millions of square feet have been addedto the retail space. Competition has <strong>for</strong>cedmany retailers to cut their prices by twopercentage points,” says Richard Hyman,chairman of Verdict Research.“Wages, rent and electricity have allrisen in the UK too, pushing retail costsup by an average of 4 per cent. What thatmeans is that some retailers are facing a 6per cent margin hit,” he adds.Certain retailers have found the newenvironment harder to live with thanothers. Iconic names such as Boots, Marks& Spencer and Sainsbury’s seemperennially to be in difficulty as their chiefexecutives struggle to regain customers’loyalty. Meanwhile, the British RetailConsortium, which speaks <strong>for</strong> thousandsof retailers, claims consumers are beingdriven away from the shops by fears aboutspiralling debt, pensions and a housingmarket crash.So where does that leave prospects <strong>for</strong>investment in the sector? Are the glorydays of retailing really coming to an end?Doom-mongers say yes, but some recentstatistics tell a different story. Last year,retail spending in Britain was a shadeunder £250 billion, or around £670 milliona day. Put another way, this was more thanthe entire economy of one of the UK’sbiggest trading partners, Holland.Nor can it be said that Britain’sobsession with shopping has completelyvanished. The extraordinary ‘sofa riot’ atthe opening of Ikea’s new Edmontonbranch in February may not have beenterribly attractive but it was a tellingindication of the central part thatshopping plays in Britain. The store had tobe closed to prevent severe injury or worseas shoppers rushed to claim bargains fromthe Swedish home store.Many commentators believe that theretail sector is undergoing some deepseatedstructural changes. Hit by thedouble whammy of reduced demand andincreased supply, there is a growing dividebetween winners and losers on the HighStreet. Spotting the winners is not madeeasier by the fact that many companies donot want to draw attention to themselvesby bragging of their success.“Take last Christmas,” says Hyman. “Onthe one hand you had companies like M&Swhich did badly and were keen to say howtough the environment was because ithelped to get them off the hook. At theother end of the spectrum you had Tescowhich had a fantastic season, but wantedto play it down because if they were seento be doing really well, people mightnotice and think they must have beenscrewing somebody.”Most economists predict that theoverall outlook is reasonable. Retailgrowth is still expected to reach at least 3.5

UK RETAILper cent this year, not stratospheric, butfar from disastrous.Within the big macro numbers however,there will always be a myriad of shiftingpatterns and trends. According to GuyWeldon, the partner responsible <strong>for</strong>consumer investments at <strong>Bridgepoint</strong>, thetrick is to spot and ride the social trendsthat will deliver spectacular top andbottom line growth <strong>for</strong> a particularcompany.He says: “In the mid-to-late nineties <strong>for</strong>example, you had the health-club boom asCompetition has<strong>for</strong>ced manyretailers to cut theirprices by twopercentage pointswhile costs haverisen by an averageof 4 per centwe all got more worried about our fitness.In food you have got the desire <strong>for</strong>everything to be convenient, yet highquality. In pubs, you now have the smokingban – so you have to work out how to turnthat to your advantage.”He gives the example of Molton Brown,which makes personal care products andhas successfully ridden two consumerwaves – the growth in spending on wellbeingand pampering products and thedesire of those people with highdisposable income to buy into niche luxurybrands.Clearly, the trick is to back the rightretail horses, to spot how an evolvingsociety affects the way people spendmoney. Some analysts believe that we arein the throes of an intriguing shift inconsumer attitudes. According to JustinWorsley, founder of the Sense consumerconsultancy, the era when low cost andvalue were in the ascendancy may becoming to an end.“Since around 1999, consumer marketshave been very cost focused. You have seenthe rise of airlines such as easyJet and therise of retailers like Tesco on the basis oftheir low prices,” he explains.“People have been taught to chooseeverything based on price As a result,companies have not been able to chargeconsumers as much, so the history of thepast five years has often been one ofdeclining profitability. But now lots ofconsumers who have gone down the lowcost route are thinking - ‘yes wellsometimes it worked, but you know,sometimes it really didn’t.’ So you areseeing a rise in consumer awareness aboutpaying a little bit extra <strong>for</strong> something thatgoes smoothly – something where youpress the button and it just works,” headds.Worsley cites the revival in the <strong>for</strong>tunesof well-established blue chip names such asBT and BA as evidence of this return toreassuring reliability after the low costrevolution of the past half-decade.That is not to say that low cost will goaway, rather that consumers will mix andmatch low cost with quality to give them ashopping experience that is bothaf<strong>for</strong>dable and one which delivers quality.Worsley points out: “In the supermarketsector you have two overwhelming successstories; one is Tesco, which providesdecent products at a low price and theother is Waitrose, which had a fabulousChristmas and a tremendous back end ofthe year. It is the same in clothing. Thesame people who go to Matalan to buy thecheap knickers, T-shirts and vests that noonewill see will also shop at Armani <strong>for</strong>the brand.”Of course, these tectonic retail shiftshave to combine with deal-makingopportunities be<strong>for</strong>e the private equityinvestor becomes interested. Fortunately,the supply of opportunities is lookingparticularly healthy just now. As Weldonpoints out: “The consumer space has beenvery fertile <strong>for</strong> M&A over the past three tofour years. There are willing buyers andwilling sellers out there.”According to Verdict’s Hyman, theTHE POINT 17

UK RETAILdemand <strong>for</strong> ever lower prices and thepressure that has put on companies hasalso helped to create opportunities.“Retailers are having to run faster, givebetter deals and offer a higher level ofservice. Competition in the market hasnever been more intense. This means thatmany publicly quoted companies need thekind of financial change that is quite hardto do in the spotlight of a publicquotation,” he suggests.“For example, in New Look you have acompany that always felt under-rated bythe City. It went private and itsper<strong>for</strong>mance has been increasingly turbochargedever since. It had one of the bestper<strong>for</strong>mances over Christmas and by thetime it comes back to the market it will bea bigger, stronger company,” he adds.The trick is to backthe right retailhorses, to spothow our evolvingsociety affectsthe way we spendmoneyRetail is attractive too because value canbe added to a business very rapidly. Thecombination of decent, like-<strong>for</strong>-like toplinegrowth with an improvement in thegross margin and a squeeze on workingcapital, is particularly beneficial.As Weldon explains: “You can have ahuge impact in a short space of time in away you can’t with other sectors.”So, even if the British consumer isfeeling a touch more cautious than a fewyears ago, there seems little reason <strong>for</strong>undue pessimism. Most people are in workand better off than they have ever been.Debt is high, but our ability to service andjuggle it is not seriously in question.Shopping has become a leisure pursuit inits own right, no longer just a means to anend. The endlessly fickle and demandingconsumer is simply too big, too powerfuland too important to the economy to beallowed to feel miserable. And consumersvote too. For private equity investors, thatis all good news.Pets at Home is living proof that pockets of theretail market are alive and well. The companyoperates in a niche area and sales are boomingNot all consumers come on two legs. One of the biggest success stories ofrecent years has thrived on the back of Britain’s well-known love of animals. Thereare 7.5 million cats, 6.1 million dogs and more than a million hamsters kept as pets inthe UK, and most of them will be cosseted and cherished by their owners.But until recently, most pets supplies came from dingy, back street pet-shops. Nowthe £2.3 billion a year market is dominated by the Pets at Home chain, which hasmore than 160 superstores around the country. The business was founded in 1991 byAnthony Preston, a Manchester-based businessman who started out in his family’swholesale hardware business.Preston spotted that the pet market was just as fragmented as the hardware sector,but less vulnerable to competition from retail chains. In 1984, the family companybought a small petwholesaler with sales ofjust £300,000. Sevenyears later, Prestonopened the first standalonePets at Home storein Chester. Two furtherstores followed, inRotherham and Chester.The <strong>for</strong>mat provedhugely appealing. By1999, Pets at Home wasstrong enough toswallow its main rival,the more southernPetsMart, in a £25.6million deal. The storesare typically around10,000 square feet atedge-of-town sites withplenty of parking andin-store events.Last year Preston andhis family decided tosell the company to <strong>Bridgepoint</strong>.Animal instinct: Guy Weldon, left, and Adrian Willetts, right, of <strong>Bridgepoint</strong>with Matthew Davies, chief executive of Pets at Home, whose like-<strong>for</strong>-likesales were up 14 per cent in 2004Pets at Home is now expanding at a rate of around 15 to 20 new openings a yearand hopes, ultimately, to have 300 stores in Britain. Like-<strong>for</strong>-like sales were up 14 percent in 2004 and growth was 10 per cent over Christmas alone.With <strong>Bridgepoint</strong> on the board, new rigour has been applied to sourcing andproperty management. Suppliers have been consolidated and there has been adrive towards higher margin pet accessories such as baskets, kennels, winterjackets and even ‘puppy training’ pads as well as premium brand dog and cat foods.Although the stores do not sell cats and dogs, smaller animals, such as rabbits,budgies and fish are available. Sales of live animals account <strong>for</strong> only about 4 percent of the chain’s total sales.Says <strong>Bridgepoint</strong> partner Guy Weldon: “Pets at Home stores are adestination<strong>for</strong>mat (over 90 per cent of store visitors plan their trip and arrive by car), but theyalso enjoy strong convenience characteristics – average visit frequency is high whilstconvenience and range are cited as the two most important reasons <strong>for</strong> visiting.”Jonathan Prynn is Consumer Affairs editor, Evening Standard18 THE POINT

Why aren’t you flying private?There is no debate about whether flying privately is more productive. You control when, where and with whom you fly. You avoidcheck-ins, connections and unpredictable delays. And you replace it with more meetings, more sales and more time with clients.The only debate is “how it looks.” But with NetJets, there is no waste. You only pay <strong>for</strong> the hours you use. You have guaranteedavailability with 10 hours notice, simultaneous access to multiple aircraft and a truly global solution. NetJets is about the properuse of executives’ time. And with the Corporate Card, flying with NetJets is now easier than ever.To find out more, call +44 (0)20 7590 5120 or email thepoint@netjets.com.NetJets Europe is the marketing agent of NetJets Transportes Aéreos S.A., an EU Air Carrier.

MAKING THE MOSTTHE POINT guideAnd so to bidBidding at auction can befast, furious and slightlyfrightening. Clare Robertsexplains how to do it properlyThe search <strong>for</strong> high-yielding investmentshas prompted a growing interestin auction houses. Investors hope thatproducts bid <strong>for</strong> in an auction willprovide them with a diversified portfolioand a bit of excitement. And there aresome enticing examples of fabulousreturns in the market.In 1970, publishing magnate MalcolmForbes began to collect Victorian art,which was relatively unfashionable atthe time. One of his first purchases wasGoodbye on the Mersey by Tissot. He paid£2,520 in 1970 and sold it <strong>for</strong> £831,650last February.ALandseer hunting scenewhich cost Forbes £187,000 in 1983 wasrecently sold <strong>for</strong> £1.27 million, anauction record <strong>for</strong> the artist. Victorianart is now in demand and Forbes hasbenefited handsomely.New funds are being created specificallytobuy art asan investment and a number ofacademic studies have been produced thatanalyse pricing trends and compare themwith other investments. But however usefulthese studies may be as aguide they are nosubstitute <strong>for</strong> detailed knowledge built upby experience.It is very important to get the necessaryin<strong>for</strong>mation be<strong>for</strong>e buying art andantiques at any level. First, talk to expertsin the field. The auction business is basedon trust so it is in specialists’ interest toguide buyers and sellers honestly and <strong>for</strong>the long-term. A buyer now is a seller intwenty years’ time, so relationships arevery important.When it comes to auction tactics, thequality and provenance of a work is critical.Whether buying an Impressionistpainting or football memorabilia, researchinto quality, background and the positionof the piece in the market is key.You donot need tospend hundreds of thousandsof pounds to make a good value purchasethat might turn into asolid investment.The major auction houses offer morethan 80 different collecting categories –from Old Master paintings and ModernArt to wine, cars and silver ships. But,whatever the category, the mostfrequently asked question is – whatmakes one work priceless and anotherworth only a couple of hundred pounds?Value is established by such criteria asthe creator of the piece, its previousowner and its condition. In the end,however, it comes down to supply anddemand. Estimates printed in saleroomcatalogues are merely guidelines. Thefinal price only emerges once theauctioneer’s hammer has come down.Many works have proved they canmaintain their appeal in financial as well asaesthetic terms. But buyers should first and<strong>for</strong>emost bid <strong>for</strong> what they love, want tolivewith and will enjoy – no matter what.Clare Roberts works <strong>for</strong> Christie’sTeam playerDuring a tidy-upthe other week, Icame across the deadremnants of my veryfirst mobile phone.Whilst not exactlythe 80s brick thatMichael Douglasuses in the filmWall Street , it wascertainly achunky pieceof kit – and allit could dowas make andreceive calls.By contrast,my current sleekAny gadget freak worthy of the name knows thatiPods are so last century. Tim Brown explainshandset, a Treo 600, is a phone, anorganiser, an emailer, a web browser, agames machine, a digital camera, a voicerecorder, an mp3 player and even anemergency torch. Frankly,anyone whosemobile is just a phone today is stranded inthe Dark Age.Similarly, it is slightly bizarre thatpeople are still interested in buying thingslike the iPod, even in its latest, smallestincarnation, the Shuffle. A few years ago,I admit, a product like the Shuffle wouldhave had me drooling. But now it’s just anmp3 player, albeit a good one. MeanwhilePalmOne are releasing a new Treo, the650. This improves on the 600 bydoubling the screen resolution, addingBluetooth and a removable battery.Thememory is non-volatile, so data will beretained even if the battery is completelydrained. For music lovers, since both the600 and 650 have a slot <strong>for</strong> special (securedigital) memory cards, you can have up to1Gb of mp3s available at any one time,giving you ten hours of portable music.There were some issues with the qualityof the 600 model but early reports on the650 would seem to indicate that theseproblems have been addressed. For theultimate in convergence the 650 willaccept a global positioning system (GPS)module in its SD slot. This even comeswith specialist software <strong>for</strong> golfers,capable of accurately assessing coursedistances – and, of course, you can listen tomusic while you play...Tim Brown is managing director of Imperfect Pictures20 THE POINT

to smarter livingMAKING THE MOSTChic and cheerfulMilan may be Italy’s financialcentre, but it is viewed by many asone of the country’s ugliest cities.Not true, says Nicol DegliInnocenti Dynes – visitors justhave to know where to goThe quadrilatero d’oro is Milan’s heart. Inthis golden quadrangle, serious-looking men inimpeccable suits rub shoulders with impossiblythin and beautiful models. Everyone looks busy,everyone is rushing. The pace of life is faster inMilan and the city’s gaze seems to be fixedbeyond the Alps (a mere 20 minutes tothe north)rather than toward Rome (a six-hour drive south).Undoubtedly grey and polluted, Milan is also fullof hidden beauty.One of its grandest treasures is the FourSeasons hotel, a <strong>for</strong>mer monastery complete withcloistered courtyard and original frescoes.Undoubtedly grey andpolluted, Milan is also fullof hidden beautySituated in via Gesu, it is in the heart of theshopping district and a favourite with models anddesigners. Visitors to Milan with a taste <strong>for</strong> morecontemporary styles should try the Spadari orThe Gray. The <strong>for</strong>mer offers minimalist roomsand lots of modern art. The latter is a brand newboutique hotel in which each of the 21 rooms is adesign statement. Visitors who prefer antiques toplasma screens and cosy com<strong>for</strong>t to designerinteriors will adore the Antica Locanda Solferino,an 11-room hotel in Brera artists’ district.On the food front, Milan has a distinctivecuisine, including such delights as cassoeula, athick soup made with pork and cabbage, andhot zabaglione, a delectable concoction of eggyolk, sugar and sweet Marsala wine. For thebest in traditional fare go to TrattoriaMilanese, a cheerful place with checkedtablecloths, or the romantic Antica Trattoriadella Pesa. For an expensive but memorablemeal, head toBoeucc, an elegant restaurant inthe heart of the city centre.A place that has built its reputation on fashion,innovation and design cannot af<strong>for</strong>d torest on itsculinary laurels – new restaurants offering moreadventurous food are constantly opening. <strong>Food</strong>and fashion often mingle, as in the case of Milan’strendiest and most sophisticated new Japaneserestaurant, Nobu, housed inside GiorgioArmani’s Superstore. An even more unusual anddecidedly decadent combination is on offer atEnoteca Wine & Chocolate, which as the namesuggests is devoted tofinding the perfect matchbetween wine and chocolate.A place that has built itsreputation on fashion,innovation and designcannot af<strong>for</strong>d to rest onits culinary laurelsAfter dark, the trendiest area is the Navigli,dotted with bars, cafes and restaurants that neverclose, such as Biciclette, a <strong>for</strong>mer bicycle depot.A more relaxing alternative is the bar of thebrand new Park Hyatt hotel, which has floor-toceilingglass walls opening on tothe Galleria, amagnificent 19th Century covered walkway.Known as Milan’s sitting room, The Galleria isthe best place tocontemplate life at the end ofyet another busy day in Milan.Nicol Degli Innocenti Dynes is correspondent <strong>for</strong> Il Sole 24 OreHotelsFour SeasonsVia Gesu 8Tel: 02.77088www.fourseasons.com/milanSpadariVia Spadari 11Tel: 02.72002371www.spadarihotel.comThe Grayvia San Raffaele 26Tel: 02.7208951www.hotelthegray.comAntica Locanda Solferinovia Castelfidardo 2Tel: 02.6570129www.anticalocandasolferino.itThe Park Hyattvia Tommaso Grossi 1Tel: 02.88211234http://milan.park.hyatt.comRestaurants/BarsTrattoria Milanesevia Santa Marta 11Tel: 02.86451991Antica Trattoria della Pesaviale Pasubio 10Tel: 02.6555741BoeuccPiazza Belgioioso 2Tel: 02.76020224Nobuvia Manzoni 31Tel: 02.72318645Enoteca Wine & ChocolateForo Buonaparte 63Tel: 02.862626Le Biciclettevia Torti corner ofConca del NaviglioTel: 02.8394177THE POINT 21

OPINIONThe bottom lineA healthy scepticismOnce they were reserved <strong>for</strong> the seriously ill and ailing. Now, no modern daymember of the chattering classes feels complete unless they have recentlyspent some time detoxing in a spa. Patience Wheatcroft wonderswhatever happened to the old-fashioned beach holidaySpa? Humbug! I can enjoy a soothing massage as muchas the next sybarite, but the current obsession with closetingoneself in cool white temples to worship the body is asoverdone as the Kilroy-Silk tan.And the real cool-hunters have already moved on. Theynow head to spas that specialise in pushing guests to theirphysical and mental limits, fuelled with only the mostpunitive of rations. It may be their idea of a restorativebreak from stressed-out City life, but it doesn’t come closeto being mine.There are as many interpretations of the term ‘spa’ asthere are of ‘hedge fund’, but the latter almost certainlyoffers better prospects of producing positive long-termresults. The essence of the spa idea is not new: people havedunked themselves in mud or sought out hot springs fromthe time when they needed occasionally to throw off theskins in which they had been clad <strong>for</strong> many months, perishthe <strong>thought</strong>. Turkish baths, saunas and imaginative easternhead rubbing rituals have had their place in society <strong>for</strong>centuries. But as modern man, and even more so modernwoman, has become increasingly wealthy and self obsessed,the concept has been taken to extremes.First came the ‘health farm’. As a recipe <strong>for</strong> makingmoney, charging overweight people large amounts ofcash to stay in hotels and be starved, it takes somebeating. That one of the companies quickest tospot the potential was a brewer, indicates alaudable grasp of how to create business opportunityand then exploit it. First you help peopletowards an unhealthy lifestyle, then youcharge extortionate amounts to helpthem take off the excess poundscaused by that lifestyle.En<strong>for</strong>cing slimming regimes onthose who were incapable of doing so<strong>for</strong> themselves was the main purposeof those early health farms - but themodern spa comes dressed up assomething very different. It is nolonger just about looks but a changeof lifestyle. The sales pitch is thatthose who spend most of theirtime trying to keep up with thestress of high-tech living needto escape every so often andrecharge their batteries.Two weeks on a beach usedto be considered aperfectly appropriate wayto do this – but not anymore. Those who pridethemselves on beingstressed, wearing the pressureof their day-to-day lives asproudly as they wear their ‘Make Poverty History’ wristband,believe that they need much more than relaxation to replacethe daily grind.So they head <strong>for</strong> exotic locations only to shut themselvesaway from the natural beauty and indulge in the latestexcitements dreamed up by those with the ability to spot thegullible from distance. The treatments on offer come maskedin a the sort of shameless mumbo jumbo that would impressthe most loquacious snake-oil salesman.How about having hot glasses applied to one’s back, togive the appearance of someone who has just fallen victim toa particularly nasty bout of mumps? This particular pleasure,called ‘cupping’ has been publicised by Gwynneth Paltrow, noless. ‘Ear candling’ is also on offer (although why anyoneshould go beyond their doctor to have their auditoryequipment tampered with is beyond me) and any number ofdifferent ‘ologies’, from kinesiology to reflexology, feature onthe modern spas’ menus. <strong>Food</strong>, on the other hand, does not– unless you count raw vegetables and wheatgrass.For those who feel that spending a week or two encased inthe obligatory snowy white towelling robe is not sufficientcontrast to their normal life, there are now moreextreme spa experiences available. These go beyonddemanding subservience at the hands of othersand insist on active participation.Gruelling regimes of long country hikesfollowed by protracted yoga sessions areavailable <strong>for</strong> those who want them. Onesatisfied customer of such an establishmenthappily reported that the only foodoffered on the first day was a three-day-oldbread roll. The idea, apparently, was torecondition the digestive system, but BasilFawlty would surely have noted its positiveimpact on hotel housekeeping.After a week or two of being subjected tosuch harsh treatment, victims are supposedto head home renewed and determined tocontinue with their new, healthy lifestyle.But there was nothing to stop themcutting down on the alcohol and doinga little gentle exercise be<strong>for</strong>e theyheaded to the spa. A few days ofimposed discipline will not changepermanently what they cannot change <strong>for</strong>themselves.On the other hand, a few days on abeautiful beach, enjoying a goodnovel and contemplating theexcellent dinner that lies aheadcan be a truly revivingexperience. And it need noteven be expensive.Patience Wheatcroft is Business editor of The Times22 THE POINT

GEN 4 TRAVELWWW.TUMI.COMFINE LEATHER GOODSTRAVEL AND BUSINESS ACCESSORIES170 PICCADILLY, MAYFAIR, LONDON020.7493.4138

“News<strong>Bridgepoint</strong>’s latest transactionsacross Europe. Page 4AnalysisIntense competition has increased pressure onprivate equity firms to deliver strong returns.Now,more than ever, the industry needs tomaximise value. Page 8THE POINTIN SIXTYSECONDSFace to FaceSir Gulam Noon on cricket, curry andentrepreneurship. Page 12Inside ViewKaffee Partner and Dr Andreas Ost –a winning combination. Page 14Sector WatchRetail success is more elusive thanit was but there are still dealsto be found. Page 16Making the MostHow to do well at auctions and be chicand cheerful in Milan. Page 20Bottom LineLetting off steam on spas.Page 22”THE POINT<strong>Bridgepoint</strong> 101 Finsbury Pavement, London EC2A 1EJTel: 0044 (0)20 7374 3500www.bridgepoint-capital.com<strong>Bridgepoint</strong> <strong>Capital</strong> Ltd is authorised and regulated by the Financial Services Authority