employer handbook - Council on International Educational Exchange

employer handbook - Council on International Educational Exchange

employer handbook - Council on International Educational Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

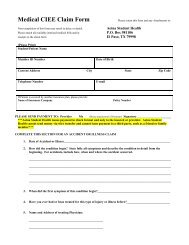

d. Box 4: Leave blank.<br />

e. Box 5: Enter “1”. There are no<br />

excepti<strong>on</strong>s to this.<br />

f. Box 6: Write “NR” to indicate<br />

N<strong>on</strong>resident Alien status.<br />

g. Box 7: Leave blank. N<strong>on</strong>residents<br />

cannot claim “Exempt”.<br />

h. Box 8 – 10: Leave blank.<br />

i. Sign and date the form.<br />

Additi<strong>on</strong>al Withholdings:<br />

Federal Withholdings for<br />

Work & Travel USA Participants<br />

The Internal Revenue Service has new<br />

procedures for calculating the amount<br />

of federal income tax withholding <strong>on</strong><br />

the wages of n<strong>on</strong>resident aliens like<br />

CIEE sp<strong>on</strong>sored Work & Travel USA<br />

participants. N<strong>on</strong>resident aliens are no<br />

l<strong>on</strong>ger required to request additi<strong>on</strong>al<br />

withholdings in Box 6 <strong>on</strong> Form W-4.<br />

Instead of this requirement, <str<strong>on</strong>g>employer</str<strong>on</strong>g>s<br />

are required to apply a new procedure.<br />

Under this procedure <str<strong>on</strong>g>employer</str<strong>on</strong>g>s add an<br />

amount to the n<strong>on</strong>resident participants<br />

wages as described <strong>on</strong> pages 15-16 of<br />

the IRS Publicati<strong>on</strong> 15, Circular E (Re-<br />

vised January 2008 http://www.irs.gov/<br />

pub/irs-pdf/p15.pdf) for calculating the<br />

income tax withholding for each payroll<br />

period. Please note, the amounts added<br />

under this chart are added to wages<br />

solely for calculating income tax withholding.<br />

Chart amounts should not be<br />

included in any box <strong>on</strong> the employee’s<br />

Form W-2 and does not increase the income<br />

tax liability of the employee.<br />

Example<br />

Following is an example that illustrates<br />

the Additi<strong>on</strong>al Withholdings procedure<br />

change. This example uses the<br />

Wage Bracket Method for calculating<br />

federal withholdings and is the most<br />

comm<strong>on</strong> method used by <str<strong>on</strong>g>employer</str<strong>on</strong>g>s.<br />

Please be aware that if you use the<br />

Percentage Method for calculating<br />

withholdings CIEE recommends that<br />

you c<strong>on</strong>tact the IRS or a tax professi<strong>on</strong>al<br />

if you have questi<strong>on</strong>s.<br />

NOTE: The table referred to in this example<br />

can be found in the IRS Publicati<strong>on</strong><br />

15, Circular E (Revised January<br />

2008) (http://www.irs.gov/pub/irs-pdf/<br />

p15.pdf) <strong>on</strong> page 36.<br />

• Work & Travel USA participant earns<br />

$500.00 in <strong>on</strong>e week.<br />

• Employer pays employees <strong>on</strong> a<br />

weekly basis.<br />

• The <str<strong>on</strong>g>employer</str<strong>on</strong>g> adds $51.00 to the<br />

participant’s wages.<br />

• The taxable amount becomes<br />

$551.00.<br />

• Employer scrolls down the weekly<br />

payroll table and finds the range<br />

the student’s wage falls into.<br />

In this case it is between $550.00<br />

and $560.00<br />

• Employer scrolls across the top<br />

of the payroll table and locates<br />

the column for <strong>on</strong>e withholding<br />

allowance. J-1’s always are allowed<br />

<strong>on</strong>ly <strong>on</strong>e allowance.<br />

• Employer finds intersecti<strong>on</strong> at<br />

$59.00 and that is the federal tax<br />

withholding.<br />

• Participant’s wages after federal<br />

withholding is:<br />

$500.00 - $59.00 = $441.00<br />

Legal Opini<strong>on</strong>: J-1 Visa Holders and Social Security<br />

February 13, 2004<br />

Stevan Trooboff<br />

President and Chief Executive Officer<br />

<str<strong>on</strong>g>Council</str<strong>on</strong>g> <strong>on</strong> Internati<strong>on</strong>al Educati<strong>on</strong>al <strong>Exchange</strong><br />

Dear Stevan:<br />

• Important: We are now using<br />

the participant’s actual wage at<br />

this step!<br />

• Employer will still need to calculate<br />

applicable state and local taxes.<br />

After Your Workers<br />

Return Home<br />

Internati<strong>on</strong>al participants that worked<br />

at your business during the year will<br />

need a W-2 Form in order to file their<br />

US tax returns. We recommend that<br />

before your workers depart for their<br />

home countries, you c<strong>on</strong>firm with<br />

them the best address to which these<br />

forms should be sent. This extra step<br />

will help to avoid frustrati<strong>on</strong> come<br />

next tax seas<strong>on</strong>.<br />

CIEE recommends www.taxback.com<br />

for participants who are seeking assistance<br />

with their tax returns.<br />

You have asked me to determine whether J-1 visa holders may commence work<br />

with their <str<strong>on</strong>g>employer</str<strong>on</strong>g>s if they have not yet received a social security number or<br />

card. I am pleased to report that the Internal Revenue Service’s (IRS) regulati<strong>on</strong>s<br />

clearly permit such employees to commence working before they have<br />

received, or even applied for, their social security cards from the Social Security<br />

Administrati<strong>on</strong> (SSA).<br />

The Federal Insurance Compensati<strong>on</strong> Act (FICA) exempts J-1 visa holders from<br />

paying social security taxes. 26 U.S.C. § 3121(b)(19) (2000). The requirement that<br />

each such employee obtain a social security number is for the <str<strong>on</strong>g>employer</str<strong>on</strong>g>’s re-<br />

16 <str<strong>on</strong>g>Council</str<strong>on</strong>g> <strong>on</strong> Internati<strong>on</strong>al Educati<strong>on</strong>al <strong>Exchange</strong> Work & Travel USA<br />

17