The Nation's 50 Largest Apartment Owners and 50 Largest ...

The Nation's 50 Largest Apartment Owners and 50 Largest ...

The Nation's 50 Largest Apartment Owners and 50 Largest ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

A SPECIAL SUPPLEMENT TO NATIONAL REAL ESTATE INVESTOR<br />

2012<br />

<strong>The</strong> Nation’s <strong>50</strong><br />

<strong>Largest</strong> <strong>Apartment</strong><br />

<strong>Owners</strong> <strong>and</strong> <strong>50</strong><br />

<strong>Largest</strong> <strong>Apartment</strong><br />

Managers

A boutique brokerage platform dedicated<br />

to serving the needs of institutional <strong>and</strong><br />

major private multifamily investors.<br />

NoHo 14<br />

North Hollywood, CA<br />

Price: $73,905,000<br />

Units: 180<br />

Manzanita Gate <strong>Apartment</strong> Homes<br />

Reno, NV<br />

Price: Confidential<br />

Units: 324<br />

Retreat at Chelsea Park<br />

Selma, TX<br />

Price: Confidential<br />

Units: 324<br />

A Sampling of Marquee Closed Transactions<br />

Parkside <strong>Apartment</strong> Homes<br />

Sunnyvale, CA<br />

Price: Confidential<br />

Units: 192<br />

<strong>The</strong> Mark Pasadena<br />

Pasadena, CA<br />

Price: $21,000,000<br />

Units: 84<br />

Mar Lago Village<br />

Plantation, FL<br />

Price: $26,<strong>50</strong>0,000<br />

Units: 216<br />

www.InstitutionalPropertyAdvisors.com<br />

<strong>The</strong> Varsity (Student Housing)<br />

College Park, MD<br />

Price: Confidential<br />

Units: 258<br />

Town Place <strong>Apartment</strong>s<br />

Middletown, CT<br />

Price: $18,600,000<br />

Units: 166<br />

Toledo Club <strong>Apartment</strong>s<br />

North Port, FL<br />

Price: Confidential<br />

Units: 346

Delivered through a leading<br />

team of Institutional<br />

<strong>Apartment</strong> Advisors<br />

STANFoRD W. JoNeS<br />

Northern California<br />

(6<strong>50</strong>) 391-1774<br />

sjones@ipausa.com<br />

PHiLiP A. SAGLiMbeNi<br />

Northern California<br />

(6<strong>50</strong>) 391-1796<br />

psaglimbeni@ipausa.com<br />

SALVAToRe S. SAGLiMbeNi<br />

Northern California<br />

(6<strong>50</strong>) 391-1797<br />

ssaglimbeni@ipausa.com<br />

GReGoRy S. HARRiS<br />

Southern California<br />

(310) 706-4407<br />

gharris@ipausa.com<br />

RoNALD Z. HARRiS<br />

Southern California<br />

(213) 943-1900<br />

rharris@ipausa.com<br />

STeWART i. WeSToN<br />

Southern California<br />

(562) 257-1270<br />

sweston@ipausa.com<br />

PeTeR K. KATZ<br />

Phoenix<br />

(602) 687-6775<br />

pkatz@ipausa.com<br />

ExPErIENCE � ExPErtISE � ExECutIoN<br />

WiLL bALTHRoPe<br />

texas<br />

(972) 755-5160<br />

wbalthrope@ipausa.com<br />

STeVe b. WiTTeN<br />

Northeast/Mid-Atlantic<br />

(203) 672-3320<br />

switten@ipausa.com<br />

ViCToR W. NoLLeTTi<br />

Northeast/Mid-Atlantic<br />

(203) 672-3321<br />

vnolletti@ipausa.com<br />

JAMie b. MAy<br />

Central, North <strong>and</strong> West Florida<br />

(813) 387-4860<br />

jbm@ipausa.com<br />

eVAN P. KRiSToL<br />

South Florida<br />

(954) 245-3459<br />

ekristol@ipausa.com<br />

STiLL HuNTeR, iii<br />

South Florida<br />

(954) 245-3<strong>50</strong>2<br />

shunter@ipausa.com

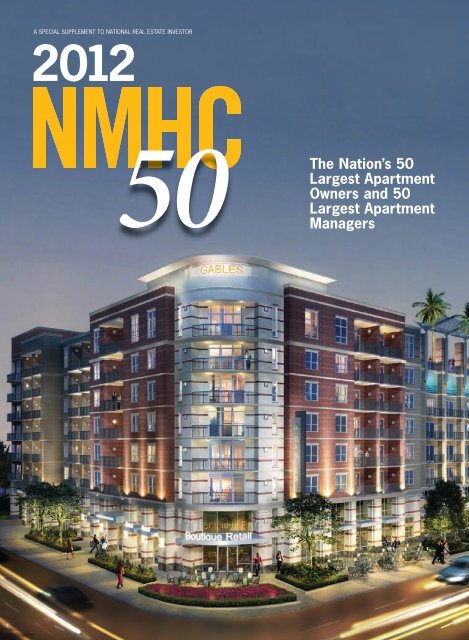

ON THE COVER: <strong>The</strong><br />

327 rental units at luxury<br />

apartment community<br />

Gables Tanglewood,<br />

40 San Felipe Street,<br />

Houston, Texas, will be<br />

ready for occupancy in<br />

2013.<br />

A SPECIAL SUPPLEMENT TO NATIONAL REAL ESTATE INVESTOR<br />

NATIONAL REAL ESTATE INVESTOR is pleased to present the 22nd annual<br />

NMHC <strong>50</strong>, the National Multi Housing Council’s authoritative ranking of the nation’s<br />

<strong>50</strong> largest apartment owners <strong>and</strong> <strong>50</strong> largest apartment managers. For more than two<br />

decades, the NMHC <strong>50</strong> has been a key resource for industry observers. <strong>The</strong> top owner<br />

<strong>and</strong> manager lists, <strong>and</strong> the analysis that accompanies them, have provided the only<br />

historical benchmark against which to measure industry trends <strong>and</strong> concentration.<br />

Based in Washington, D.C., the National Multi Housing Council provides leadership<br />

for the apartment industry. NMHC’s members are the principal officers of the larger<br />

<strong>and</strong> more prominent apartment firms <strong>and</strong> include owners, developers, managers,<br />

financiers <strong>and</strong> service providers.<br />

<strong>The</strong> Council focuses on the four key areas of federal advocacy, strategic business<br />

information, industry research <strong>and</strong> public affairs. Through its federal advocacy program,<br />

the Council targets such issues as capital markets, housing policy, energy <strong>and</strong><br />

environmental affairs, tax policy, fair housing, building codes, technology, human<br />

resources, rent control <strong>and</strong> more.<br />

For those interested in joining the apartment industry’s leadership, NMHC welcomes<br />

inquiries to its Washington office at (202) 974-2300, or you can visit NMHC’s web site<br />

at www.nmhc.org.<br />

Contents<br />

Introduction ..................................................................................... 2<br />

2012 <strong>Apartment</strong> <strong>Owners</strong>hip ............................................................. 4<br />

2012 <strong>Apartment</strong> Management .......................................................... 6<br />

Top <strong>Apartment</strong> Firms Strategically Pursue Surging Rental Market ...... 8<br />

<strong>The</strong> Anatomy of a Br<strong>and</strong> Strategy .................................................. 16<br />

Show Me the Money Managers ....................................................... 19<br />

On a Path of Growth ...................................................................... 22<br />

NMHC Officers .............................................................................. 28<br />

NMHC Board of Directors Executive Committee .............................. 28<br />

NMHC Board of Directors .............................................................. 32<br />

NMHC Advisory Board ................................................................... 42<br />

2 NMHC <strong>50</strong> APRIL 2012

A SPECIAL SUPPLEMENT TO NATIONAL REAL ESTATE INVESTOR<br />

2012 <strong>Apartment</strong> <strong>Owners</strong>hip<br />

NATIONAl MUlTI HOUSINg COUNCIl <strong>50</strong><br />

(<strong>50</strong> <strong>Largest</strong> U.S. <strong>Apartment</strong> <strong>Owners</strong> as of January 1, 2012)<br />

UNITS UNITS<br />

2012 2011 OWNED OWNED CORPORATE<br />

RANK RANK COMPANY 2012 2011 OFFICER HQ CITY STATE<br />

1 1 Boston Capital 157,423 158,947 Jack Manning Boston MA<br />

2 2 Centerline Capital Group 1<strong>50</strong>,000 152,600 Rob Levy New York NY<br />

Boston Financial Investment<br />

3 3 Management, LP 140,077 145,454 Ken Cutillo Boston MA<br />

SunAmerica Affordable Housing<br />

4 4 Partners Inc. 134,882 141,113 Douglas S. Tymins Los Angeles CA<br />

5 6 PNC Real Estate 126,260 123,462 Todd Crow Portl<strong>and</strong> OR<br />

6 5 Equity Residential 119,743 129,604 David J. Neithercut Chicago IL<br />

7 14 Hunt Companies, Inc. 114,712 62,109 Woody Hunt El Paso TX<br />

8 8 National Equity Fund, Inc. 106,772 107,138 Joseph Hagan Chicago IL<br />

<strong>The</strong> Richman Group Affordable<br />

9 10 Housing Corporation 98,770 94,925 Richard Paul Richman Greenwich CT<br />

Enterprise Community<br />

10 9 Investment, Inc. 97,822 96,195 Charles R. Werhane Columbia MD<br />

11 7 Aimco 93,630 110,943 Terry Considine Denver CO<br />

12 11 Archstone 73,955 81,613 R. Scot Sellers Englewood CO<br />

13 12 Alliant Capital, Ltd. 71,220 65,245 Brian Goldberg Woodl<strong>and</strong> Hills CA<br />

14 13 Camden Property Trust 66,997 63,316 Richard J. Campo Houston TX<br />

15 15 UDR, Inc. 57,743 58,796 Thomas W. Toomey Highl<strong>and</strong>s Ranch CO<br />

16 18 AvalonBay Communities, Inc. 57,426 54,579 Tim Naughton Arlington VA<br />

17 16 Edward Rose & Sons 56,385 56,025 Warren Rose Farmington Hills MI<br />

18 17 Pinnacle Family of Companies 52,655 55,932 Stan Harrelson Dallas TX<br />

19 20 WNC & Associates, Inc. 51,224 52,134 Wilfred N Cooper, Jr. Irvine CA<br />

20 21 Invesco Real Estate 51,125 <strong>50</strong>,567 Michael Kirby Dallas TX<br />

21 24 MAA 49,407 46,306 H. Eric Bolton, Jr. Memphis TN<br />

22 33 <strong>The</strong> Related Companies 48,967 35,637 Jeff Blau New York NY<br />

23 22 Forest City Residential Group, Inc. 48,482 47,384 Ronald A. Ratner Clevel<strong>and</strong> OH<br />

24 19 J.P. Morgan Asset Management 47,587 52,000 Jean Anderson New York NY<br />

25 25 JRK Property Holdings, Inc. 47,398 43,912 Jim Lippman Los Angeles CA<br />

4 NMHC <strong>50</strong> APRIL 2012

UNITS UNITS<br />

2012 2011 OWNED OWNED CORPORATE<br />

RANK RANK COMPANY 2012 2011 OFFICER HQ CITY STATE<br />

26 23 Lincoln Property Company 47,245 46,<strong>50</strong>7 Tim Byrne Dallas TX<br />

Raymond James Tax Credit<br />

27 29 Funds, Inc. 46,572 43,035 Ronald Diner St. Petersburg FL<br />

28 Newcomer TIAA-CREF 46,489 NA* Thomas Garbutt New York NY<br />

29 27 Michaels Development Company 45,425 44,843 Robert J. Greer Marlton NJ<br />

Steven D. Bell <strong>and</strong><br />

30 28 Bell Partners Inc. 44,931 43,265 Jonathan D. Bell Greensboro NC<br />

Irvine Company <strong>Apartment</strong><br />

31 26 Communities 44,545 43,791 Kevin Baldridge Irvine CA<br />

32 31 DRA Advisors LLC 42,515 41,111 David Luski New York NY<br />

33 32 Home Properties, Inc. 41,951 38,861 Edward J. Pettinella Rochester NY<br />

Holiday Retirement Corp./<br />

34 Newcomer Colson & Colson 37,076 36,859 Jack Callison Salem OR<br />

35 36 Lindsey Management Co., Inc. 35,628 34,088 James E. Lindsey Fayetteville AR<br />

36 37 Colonial Properties Trust 33,975 33,569 Thomas H. Lowder Birmingham AL<br />

37 45 Berkshire Property Advisors 33,847 27,906 Frank Apeseche Boston MA<br />

38 34 Sentinel Real Estate Corporation 33,<strong>50</strong>0 35,000 John H. Streicker New York NY<br />

39 40 BH Equities LLC 33,205 30,172 Harry Bookey Des Moines IA<br />

40 41 UBS Realty Investors LLC 32,983 27,452 Matthew Lynch Hartford CT<br />

41 42 Essex Property Trust, Inc. 32,753 29,146 Michael Schall Palo Alto CA<br />

42 39 Concord Management Limited 32,467 32,313 Edward O. Wood, Jr. Maitl<strong>and</strong> FL<br />

Westdale Real Estate Investment<br />

43 38 & Management 32,296 32,592 Joseph G. Beard Dallas TX<br />

44 Newcomer Weidner <strong>Apartment</strong> Homes 31,551 20,<strong>50</strong>8 Jack O’Connor Kirkl<strong>and</strong> WA<br />

45 Newcomer Heitman LLC 26,490 21,941 Maury Tognarelli Chicago IL<br />

46 48 Highridge Costa Investors, LLC 26,416 26,335 Michael A. Costa Gardena CA<br />

47 35 Empire American Holdings, LLC 25,859 34,939 Eli Feller Montvale NJ<br />

48 49 BRE Properties, Inc. 25,192 25,174 Constance B. Moore San Francisco CA<br />

49 46 AEW Capital Management, LP 24,891 27,556 Jeffrey Furber Boston MA<br />

<strong>50</strong> 43 <strong>The</strong> Bascom Group, LLC 24,877 28,851 Jerome Fink Irvine CA<br />

*TIAA-CREF did not provide 2011 unit data.<br />

A SPECIAL SUPPLEMENT TO NATIONAL REAL ESTATE INvESTOR<br />

APRIL 2012 NMHC <strong>50</strong> 5

A SPECIAL SUPPLEMENT TO NATIONAL REAL ESTATE INVESTOR<br />

2012 apartment Management<br />

NaTIONal MUlTI HOUSINg COUNCIl <strong>50</strong><br />

(<strong>50</strong> <strong>Largest</strong> U.S. <strong>Apartment</strong> Managers as of January 1, 2012)<br />

UNITS UNITS<br />

2012 2011 MaNaged MaNaged CORPORaTe<br />

RaNK RaNK COMPaNY 2012 2011 OFFICeR HQ CITY STaTe<br />

1 1 Greystar Real Estate Partners LLC 192,711 187,360 Robert A. Faith Charleston SC<br />

2 2 Riverstone Residential Group 170,341 162,182 Walt Smith Dallas TX<br />

3 4 Lincoln Property Company 144,033 133,425 Tim Byrne Dallas TX<br />

4 3 Pinnacle Family of Companies 138,638 151,367 Stan Harrelson Dallas TX<br />

5 5 Equity Residential 119,743 129,604 David J. Neithercut Chicago IL<br />

6 7 WinnCompanies 91,920 84,817 Samuel Ross Boston MA<br />

7 6 Aimco 88,530 116,491 Terry Considine Denver CO<br />

8 8 Archstone 77,997 81,613 R. Scot Sellers Englewood CO<br />

9 9 Camden Property Trust 67,217 63,536 Richard J. Campo Houston TX<br />

Steven D. Bell <strong>and</strong><br />

10 10 Bell Partners Inc. 65,205 60,182 Jonathan D. Bell Greensboro NC<br />

11 11 FPI Management Inc. 63,002 58,604 Dennis Treadaway Folsom CA<br />

<strong>Apartment</strong> Management<br />

12 Newcomer Consultants, LLC 59,856 52,059 Greg Wiseman Midvale UT<br />

13 12 UDR, Inc. 57,743 58,340 Thomas W. Toomey Highl<strong>and</strong>s Ranch CO<br />

14 14 AvalonBay Communities, Inc. 57,426 54,579 Tim Naughton Arlington VA<br />

15 15 Alliance Residential Company 56,952 48,520 Bruce Ward Phoenix AZ<br />

16 13 Edward Rose & Sons 56,385 56,025 Warren Rose Farmington Hills MI<br />

17 Newcomer* Hunt Companies, Inc. 51,281 34,792 Woody Hunt El Paso TX<br />

18 18 MAA 49,407 46,306 H. Eric Bolton, Jr. Memphis TN<br />

19 17 Fairfield Residential Company LLC 49,053 46,851 Chris Hashioka San Diego CA<br />

20 16 <strong>The</strong> ConAm Group of Companies 46,700 47,400 Brad Forrester San Diego CA<br />

21 23 BH Management Services, Inc. 45,907 41,641 Nicholas H. Roby Des Moines IA<br />

22 22 JRK Property Holdings, Inc. 45,422 41,934 Jim Lippman Los Angeles CA<br />

23 36 <strong>The</strong> Related Companies 44,289 34,439 Jeff Blau New York NY<br />

Westdale Real Estate Investment<br />

24 20 & Management 43,883 44,765 Joseph G. Beard Dallas TX<br />

*Due to changes in reporting, Hunt Companies, Inc. appears for the first time on the top managers list; however, Hunt subsidiary LEDIC Management Group, Inc. ranked No. 48 on the 2011 managers list.<br />

6 NMHC <strong>50</strong> APRIL 2012

A SPECIAL SuPPLEMENT TO NATIONAL REAL ESTATE INVESTOR<br />

UNITS UNITS<br />

2012 2011 MaNaged MaNaged CORPORaTe<br />

RaNK RaNK COMPaNY 2012 2011 OFFICeR HQ CITY STaTe<br />

25 27 Home Properties, Inc. 41,951 38,861 Edward J. Pettinella Rochester NY<br />

26 26 Michaels Development Company 41,597 39,575 Robert J. Greer Marlton NJ<br />

27 24 <strong>The</strong> Laramar Group, LLC 41,235 40,521 Thomas Klaess Denver CO<br />

28 25 Village Green 39,<strong>50</strong>0 40,000 Jonathan Holtzman Detroit/Chicago MI<br />

29 31 Multifamily Management Services 39,100 35,800 Jeffrey Goldstein Suffern NY<br />

Irvine Company <strong>Apartment</strong><br />

30 28 Communities 38,914 38,220 Kevin Baldridge Irvine CA<br />

31 29 Gables Residential 36,896 38,105 David D. Fitch Atlanta GA<br />

32 37 Forest City Residential Group, Inc. 36,053 34,096 Ronald A. Ratner Clevel<strong>and</strong> OH<br />

33 35 Lindsey Management Co., Inc. 35,980 34,440 James E. Lindsey Fayetteville AR<br />

34 40 <strong>The</strong> Lynd Company 35,095 32,875 A. David Lynd San Antonio TX<br />

35 39 Colonial Properties Trust 34,681 34,275 Thomas H. Lowder Birmingham AL<br />

36 19 Milestone Management, L.P. 34,439 45,896 Steve Lamberti Dallas TX<br />

37 38 McKinley, Inc. 34,056 33,922 Albert M. Berriz Ann Arbor MI<br />

38 46 Essex Property Trust Inc. 33,924 30,317 Michael Schall Palo Alto CA<br />

39 32 Sentinel Real Estate Corporation 33,<strong>50</strong>0 35,000 John H. Streicker New York NY<br />

40 <strong>50</strong> Berkshire Property Advisors 32,536 28,085 Frank Apeseche Boston MA<br />

41 41 Concord Management Limited 32,467 32,313 Edward O. Wood, Jr. Maitl<strong>and</strong> FL<br />

42 34 Asset Plus Companies 32,302 34,887 Michael S. McGrath Houston TX<br />

43 Newcomer Weidner <strong>Apartment</strong> Homes 31,551 20,<strong>50</strong>8 Jack O’Connor Kirkl<strong>and</strong> WA<br />

44 30 Capstone Real Estate Services, Inc. 31,044 36,884 James W. Berkey Austin TX<br />

45 45 <strong>The</strong> John Stewart Company 30,637 30,534 Jack D. Gardner San Francisco CA<br />

46 47 <strong>The</strong> Bozzuto Group 30,529 32,276 Thomas S. Bozzuto Greenbelt MD<br />

47 42 CAPREIT, Inc. 30,040 31,000 Dick Kadish Rockville MD<br />

48 Newcomer Harbor Group International 28,686 22,000 Jordan Slone Norfolk VA<br />

49 44 Morgan Properties 28,118 30,625 Mitchell L. Morgan King of Prussia PA<br />

<strong>50</strong> Newcomer Orion Real Estate Services, Inc. 27,573 26,570 Kirk Tate Houston TX<br />

APRIL 2012 NMHC <strong>50</strong> 7

Top <strong>Apartment</strong> Firms<br />

Strategically Pursue<br />

Surging Rental Market<br />

By Mark Obrinsky, Vice President of Research <strong>and</strong> Chief Economist,<br />

National Multi Housing Council<br />

OvERviEw<br />

<strong>Apartment</strong> Market<br />

Dem<strong>and</strong> for apartment residences continued to surge<br />

in 2011 as more households decided that renting was<br />

a better fit for their lifestyles, needs <strong>and</strong> budgets than<br />

owning. Overall, the renter share of households rose to<br />

34.0 percent at year-end, the highest level in almost<br />

14 years. Net absorption among investment-grade<br />

apartments posted the best back-to-back years since<br />

the boom of 1999-2000, while the occupancy rate<br />

A sPECIAL suPPLEMENt tO NAtIONAL REAL EstAtE INVEstOR<br />

DEVELOPMENT | FINANCE | CONSTRUCTION | MANAGEMENT<br />

American Campus Communities is a $4.5 billion real<br />

estate investment trust (REIT) traded on the NYSE<br />

(symbol: ACC). Since 1993 we have structured <strong>and</strong><br />

closed more than $6 billion of student housing transactions. With business expertise<br />

in project design <strong>and</strong> development, asset acquisition, <strong>and</strong> management services,<br />

we are the nation’s premier owner <strong>and</strong> operator of quality student housing.<br />

AMERICANCAMPUS.COM<br />

NMHC <strong>50</strong> PROFilE 2012<br />

Portfolio Size:<br />

No. of <strong>Apartment</strong>s Owned 3,003,341<br />

No. of <strong>Apartment</strong>s Managed 2,776,045<br />

Minimum Entry Threshold:<br />

No. of <strong>Apartment</strong>s Owned 24,877<br />

No. of <strong>Apartment</strong>s Managed 27,573<br />

rose 110 basis points (bps) from the fourth<br />

quarter of last year to almost 95 percent,<br />

an indication of solid recovery from the<br />

Great Recession.<br />

New supply remained sparse. <strong>The</strong> historically<br />

low level of multifamily starts in<br />

2009 <strong>and</strong> 2010 led to low completions in<br />

2011. However, starts rebounded significantly,<br />

suggesting completions should ramp<br />

up in 2012, with stronger deliveries likely for<br />

2013 <strong>and</strong> beyond. Even so, the level of new<br />

multifamily construction in 2011 was barely<br />

half of the average annual pace from 1997<br />

to 2006. NMHC’s most recent Quarterly<br />

Survey of <strong>Apartment</strong> Market Conditions<br />

showed that although new development<br />

activity was widespread, starts lagged—<br />

only one-fifth of respondents indicated that<br />

groundbreaking had accelerated. What’s<br />

more, almost half of respondents indicated<br />

that new development was considerably<br />

below dem<strong>and</strong>. New construction financing<br />

remained an obstacle in many markets,<br />

along with outdated zoning codes, unnecessary<br />

regulations <strong>and</strong> “NIMBY” groups.<br />

<strong>The</strong> boom in renters combined with<br />

the near-bust in supply led to strong<br />

rent growth. Same-store asking rents<br />

APRIL 2012

$13,860,000<br />

Branchwood Towers<br />

Clinton, MD<br />

Freddie Mac Affordable<br />

Refinance<br />

$10,680,000<br />

Carrollton Oaks<br />

Carrollton, TX<br />

Fannie Mae DUS<br />

Acquisition<br />

Working together.<br />

With diverse expertise encompassing all components of<br />

the real estate capital structure, CW differentiates itself<br />

by harnessing its vast resources to develop the most<br />

successful, client specific solutions.<br />

$25,700,000<br />

Monterra <strong>Apartment</strong>s<br />

Cooper City, FL<br />

Freddie Mac Affordable<br />

Construction<br />

$24,7<strong>50</strong>,000<br />

Pembrook Club<br />

Gurnee, IL<br />

Fannie Mae DUS<br />

Acquisition<br />

For more information, contact:<br />

CWCAPITAL.COM<br />

Fannie Mae – Freddie Mac – FHA – Life Co – Bridge – Conduit – Mezz<br />

$15,700,000<br />

Waterview <strong>Apartment</strong>s<br />

Benicia, CA<br />

Freddie Mac CME<br />

Refinance<br />

$5,800,000<br />

Towers on Greenwood<br />

Seattle, WA<br />

Life Company<br />

Refinance<br />

Ellen Kantrowitz | FHA<br />

781.707.9309 | ekantrowitz@cwcapital.com<br />

Donald King | Fannie Mae & Freddie Mac<br />

781.707.9494 | dking@cwcapital.com

were up by almost five percent in 2011 nationally,<br />

surpassing the previous peak. Adjusted<br />

for inflation, however, real rents were still<br />

seven percent below the level of 4Q2006.<br />

<strong>Apartment</strong> transaction volume continued to<br />

grow in 2011, climbing 54 percent higher than<br />

2010 <strong>and</strong> more than tripling 2009 levels. Indeed,<br />

at nearly $54 billion, volume surpassed 2004<br />

levels, the last year before the condo conversionfueled<br />

boom. <strong>Apartment</strong> prices have risen sharply<br />

since the trough—the national average is up<br />

25 percent to 35 percent by most measures—<br />

<strong>and</strong> recent transactions show that many class-A<br />

properties in prime locations have even surpassed<br />

their previous peak. Cap rates eased a bit further<br />

last year to 6.5 percent, around <strong>50</strong> bps lower than<br />

the peak two years earlier.<br />

Top <strong>50</strong> <strong>Owners</strong> <strong>and</strong> Managers<br />

<strong>The</strong> total number of apartments owned by firms<br />

in the NMHC <strong>50</strong> owners list is 8.2 percent greater<br />

than the number managed by the Top <strong>50</strong> managers,<br />

the largest difference in six years. In line with<br />

the previous three years, the mean <strong>and</strong> median<br />

portfolios among apartment owners are also<br />

larger than the mean <strong>and</strong> median management<br />

portfolios. But once again, the top management<br />

firm has a larger portfolio than the top owner<br />

firm, <strong>and</strong> the entry threshold for NMHC <strong>50</strong><br />

managers is higher than that for the NMHC <strong>50</strong><br />

owners. Most firms are bunched together in a<br />

relatively small b<strong>and</strong>: 30 of the top management<br />

firms have between 30,000 <strong>and</strong> <strong>50</strong>,000 apartments,<br />

as do 24 firms on the owners list.<br />

<strong>Apartment</strong> <strong>Owners</strong>hip<br />

Boston Capital topped the NMHC <strong>50</strong> owners<br />

list for the third consecutive year. (<strong>The</strong> firm<br />

also marked its 21st straight year among the<br />

Top 10 owners.) <strong>The</strong> next three spots were<br />

unchanged as well: Centerline Capital Group,<br />

Boston Financial Investment Management<br />

LP <strong>and</strong> SunAmerica Affordable Housing<br />

ApArTMeNT OwNers<br />

<strong>Largest</strong> portfolio Growth <strong>Apartment</strong>s<br />

Hunt Companies, Inc. + 52,603<br />

<strong>The</strong> Related Companies + 13,330<br />

Weidner <strong>Apartment</strong> Homes + 11,043<br />

Camden Property Trust + 5,975<br />

Berkshire Property Advisors + 5,941<br />

A SPECIAL SuPPLEMENT To NATIoNAL REAL ESTATE INvESToR<br />

TOp 10 ApArTMeNT OwNer FirMs<br />

rank/Company No. of<br />

<strong>Apartment</strong>s<br />

1 Boston Capital 157,423<br />

2 Centerline Capital Group 1<strong>50</strong>,000<br />

3 Boston Financial Investment Management, LP 140,077<br />

4 SunAmerica Affordable Housing Partners, Inc. 134,882<br />

5 PNC Real Estate 126,260<br />

6 Equity Residential 119,743<br />

7 Hunt Companies, Inc. 114,712<br />

8 National Equity Fund, Inc. 106,772<br />

9 <strong>The</strong> Richman Group Affordable Housing Corporation 98,770<br />

10 Enterprise Community Investment, Inc. 97,822<br />

NMHC <strong>50</strong> OwNers* Overview<br />

Number of <strong>Apartment</strong>s Owned<br />

Top 10 1,246,461<br />

Second 10 632,360<br />

Top 25 2,120,662<br />

Second 25 882,679<br />

Top <strong>50</strong> 3,003,341<br />

portfolio size Measures<br />

Mean 60,067<br />

Median 47,322<br />

No. 1 firm 157,423<br />

No. <strong>50</strong> firm 24,877<br />

share of National <strong>Apartment</strong> stock<br />

Top 10 7.1%<br />

Top 25 12.1%<br />

Top <strong>50</strong> 17.1%<br />

* Changes in ownership definition <strong>and</strong> company response make historical comparisons difficult.<br />

Partners Inc. PNC Real Estate moved up a notch to round out<br />

the top five, while Equity Residential moved down one spot to<br />

No. 6. Hunt Companies, Inc. appears in the Top 10 list for the first<br />

time, coming in at No. 7. Rounding out the Top 10 this year are the<br />

same firms from last year, although <strong>The</strong> Richman Group Affordable<br />

Housing Corporation <strong>and</strong> Enterprise Community Investment Inc.<br />

swapped order.<br />

Four of the Top 10 owner firms increased their portfolios in<br />

Moving Up in rank slots<br />

<strong>The</strong> Related Companies + 11<br />

Berkshire Property Advisors + 8<br />

Hunt Companies, Inc. + 7<br />

MAA + 3<br />

10 NMHC <strong>50</strong> APRIL 2012

More than $17 Billion of Multi-Housing<br />

Value Creation in 2011<br />

CBRE was once again the leading market-maker for the multi-housing industry in 2011. We’ve been the #1<br />

investment sales apartment broker for 10 years running*, <strong>and</strong> the only commercial real estate brokerage with<br />

Fannie Mae, Freddie Mac <strong>and</strong> HUD FHA direct lending capabilities. We continue to create value for investors<br />

as the most robust facilitator of multi-housing capital markets transactions in the United States.<br />

*Source: Real Capital Analytics<br />

CBRE Multi-Housing Group<br />

Market Insight. Capital Access. Execution.<br />

www.cbre.com/mhg<br />

360 West Hubbard<br />

Chicago, IL<br />

$140,<strong>50</strong>0,000<br />

Equity Raise/<br />

Construction Financing<br />

H191 Portfolio<br />

Seattle Metro<br />

$155,342,000<br />

Freddie Mac<br />

Fixed Rate Financing<br />

<strong>The</strong> Alex<strong>and</strong>er<br />

Alex<strong>and</strong>ria City, VA<br />

$75,925,000<br />

Investment Sale<br />

Gr<strong>and</strong>Marc at<br />

Westberry Place<br />

Fort Worth, TX<br />

$54,336,722<br />

Student Housing<br />

Investment Sale

2011. Hunt Companies, Inc. had the biggest net<br />

gain with a pickup of 52,603 apartments, largely<br />

a result of the purchase of Capmark Financial<br />

Group’s affordable housing portfolio. Equity<br />

Residential shed the largest number of apartments,<br />

downsizing their holdings to the tune of<br />

9,861 units. Thirty-two of the 2012 NMHC <strong>50</strong><br />

owner firms were net acquirers last year, adding<br />

a total of 143,200 apartments to their portfolios.<br />

By contrast, 17 were net sellers, dropping 78,098<br />

units.* On balance, these firms grew by a combined<br />

total of 65,102 units.<br />

This year’s <strong>50</strong> largest firms own 2.4 percent more<br />

apartments than last year’s Top <strong>50</strong>, a growth rate<br />

right in line with the average for the past five years.<br />

For the second year in a row, Hunt Companies, Inc.<br />

posted the biggest increase, which moved them<br />

into the Top 10 for the first time. <strong>The</strong> Related Companies<br />

made the biggest jump up the rankings list, shooting up 11<br />

places to the No. 22 slot. For the fourth straight year, Aimco<br />

remains the biggest net seller, trimming its portfolio by<br />

17,313 units—a strategy that moved the company out of the<br />

*Totals do not add up to <strong>50</strong>; TIAA-CREF did not provide 2011 unit data.<br />

REITs in the Rankings<br />

<strong>The</strong> number of REITs on the 2012 NMHC <strong>50</strong><br />

owners list is unchanged from the previous<br />

two years. Total apartment holdings by REITs<br />

in the NMHC <strong>50</strong> decreased for the ninth consecutive<br />

year. At 1.6 percent, however, it was the smallest<br />

decline since 2006. As in past years, the drop<br />

had more to do with company-specific strategies<br />

than with the character of the REIT model. In fact,<br />

seven REITs grew their portfolios, but this was outweighed<br />

by downsizing at Aimco, Equity Residential<br />

<strong>and</strong>, to a much lesser extent, UDR, Inc.<br />

In principle, apartment owners could be ranked<br />

not only by the number of apartments owned<br />

but also by the value of those apartments.<br />

While capturing such data is impractical, there<br />

is an alternative measure available for public<br />

companies, namely total capitalization. While not<br />

perfect—ownership of non-apartment assets can<br />

substantially affect overall firm value—it provides<br />

a useful perspective on relative size among apartment<br />

firms.<br />

A SPECIAL SUPPLEMENT To NATIoNAL REAL ESTATE INvESToR<br />

TOp 10 ApARTMENT MANAGEMENT FIRMS<br />

Rank/Company No. of<br />

<strong>Apartment</strong>s<br />

Managed<br />

1 Greystar Real Estate Partners, LLC 192,711<br />

2 Riverstone Residential Group 170,341<br />

3 Lincoln Property Company 144,033<br />

4 Pinnacle Family of Companies 138,638<br />

5 Equity Residential 119,743<br />

6 WinnCompanies 91,920<br />

7 Aimco 88,530<br />

8 Archstone 77,997<br />

9 Camden Property Trust 67,217<br />

10 Bell Partners Inc. 65,205<br />

Top 10 for the first time since 1997.<br />

Roughly eight out of 10 Top <strong>50</strong> owners have market-rate<br />

apartments in their portfolios while exactly half own tax-<br />

credit properties or other subsidized properties. Eighteen<br />

firms have senior housing apartments; of those, five have<br />

more than 20,000 senior apartments. <strong>The</strong> NMHC <strong>50</strong> owners<br />

are geographically diversified: 90 percent have properties<br />

ApARTMENT REIT SIzE ANd RANk<br />

Rank Total Cap Rank<br />

Units Among Capitalization Among<br />

Owned REITs ($ millions) REITs<br />

Equity Residential 119,743 1 26,424 1<br />

Aimco 93,630 2 8,221 4<br />

Camden Property Trust 66,997 3 7,028 6<br />

UDR, Inc. 57,743 4 9,680 3<br />

AvalonBay Communities, Inc. 57,426 5 16,218 2<br />

MAA 49,407 6 4,075 9<br />

Home Properties, Inc. 41,951 7 5,893 7<br />

Colonial Properties Trust 33,975 8 3,656 10<br />

Essex Property Trust, Inc. 32,753 9 7,368 5<br />

BRE Properties, Inc. 25,192 10 5,521 8<br />

Note: Company total capitalization sums (1) market value of shares outst<strong>and</strong>ing, including<br />

operating partnership units; (2) the value of perpetual preferred stock; <strong>and</strong> (3) the book value of<br />

total debt outst<strong>and</strong>ing. Capitalization estimates for December 31, 2011, were provided by Stifel<br />

Nicolaus & Company, Inc.<br />

12 NMHC <strong>50</strong> APRIL 2012

ApArtMeNt MANAGeMeNt by tier<br />

3,000<br />

2,<strong>50</strong>0<br />

Top 10<br />

Top 25<br />

Top <strong>50</strong><br />

2,776.0<br />

Hunt Companies, Inc. registered the largest<br />

portfolio gain, adding 16,489 units. Five<br />

other firms also had portfolio gains of more<br />

2,000<br />

1,925.6<br />

than 8,000 units. <strong>The</strong> Related Companies<br />

made the biggest jump in the rankings, up 13<br />

2,000<br />

slots to No. 23. Berkshire Property Advisors<br />

1,156.3 also made a double-digit move, climbing<br />

1,<strong>50</strong>0<br />

10 places to the No. 40 position. Overall,<br />

1,000<br />

firms on this year’s management list added a<br />

combined 61,628 apartments to their portfo-<br />

<strong>50</strong>0<br />

1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012<br />

lios, as 34 companies grew compared to the<br />

16 firms that shed assets.<br />

<strong>The</strong> total number of apartments managed<br />

by the Top <strong>50</strong> companies is the<br />

highest on record. <strong>The</strong> share of the entire<br />

in the South Atlantic region <strong>and</strong> 64 percent have properties apartment stock under management by the NMHC <strong>50</strong> rose<br />

in New Engl<strong>and</strong> while each of the other seven regions has to 15.8 percent, also a new high. Both the mean <strong>and</strong> the<br />

properties owned by 78 percent to 86 percent of the firms on median rose <strong>and</strong> set new all-time highs. <strong>The</strong> minimum size<br />

the NMHC <strong>50</strong> ownership list.<br />

needed to make it into the Top <strong>50</strong> edged down a bit from last<br />

year’s record, but at 27,573 units is still the second-highest<br />

<strong>Apartment</strong> Managers<br />

threshold since the rankings began.<br />

Stability was the theme at the top of the NMHC manage- Concentration trends were mixed last year. <strong>The</strong> portment<br />

list. For the fourth consecutive year, the same firms folios of the 10 largest firms make up 41.7 percent of the<br />

made up the Top 10. Greystar Real Estate Partners LLC Top <strong>50</strong>, down from 43 percent last year—the group’s lowest share<br />

remains in the top spot for the second straight year, while in 18 years. <strong>Apartment</strong>s managed by the next 10 firms (No.<br />

Riverstone Residential Group kept its second place ranking. 11 through No. 20 in the rankings) rose to 19.7 percent from<br />

Lincoln Property Company (No. 3) <strong>and</strong> Pinnacle Family 18.6 percent a year ago. <strong>The</strong> percentage marks a sizable share but<br />

of Companies (No. 4) switched places—the only ranking is below 2005’s high-water mark of 20.8 percent.<br />

change among the Top 10.<br />

All of the Top <strong>50</strong> firms manage market-rate apartments.<br />

<strong>The</strong>re were five new firms on the management list In addition, 32 companies have Low-Income Housing Tax<br />

this year, two of which debuted in the Top 20. <strong>Apartment</strong> Credit (LIHTC) properties in their portfolios—<strong>and</strong> of those,<br />

Management Consultants LLC (No. 12) was a first-time 19 also manage non-LIHTC affordable properties. Eighteen<br />

survey respondent, while Hunt Companies, Inc. (No. 17) firms have senior housing apartments under management,<br />

consolidated its reporting, including former Top <strong>50</strong> manager although only Pinnacle Family of Companies has more than<br />

LEDIC under its umbrella this year. <strong>The</strong> other newcom- 20,000 such units. <strong>The</strong> South Atlantic region is home to properers—Weidner<br />

<strong>Apartment</strong> Homes (No. 43), Harbor Group ties from 44 of the Top <strong>50</strong> managers, the most of any region. At<br />

International (No. 48) <strong>and</strong> Orion Real Estate Services Inc. the other end of the spectrum, 23 of the Top <strong>50</strong> manage proper-<br />

(No. <strong>50</strong>)—rode portfolio increases to a Top <strong>50</strong> ranking. ties in the New Engl<strong>and</strong> region.<br />

Units (thous<strong>and</strong>s)<br />

ApArtMeNt MANAGers<br />

<strong>Largest</strong> portfolio Growth <strong>Apartment</strong>s<br />

Hunt Companies, Inc. + 16,489<br />

Weidner <strong>Apartment</strong> Homes + 11,043<br />

Lincoln Property Company + 10,608<br />

<strong>The</strong> Related Companies + 9,8<strong>50</strong><br />

Alliance Residential Company + 8,432<br />

Riverstone Residential Group + 8,159<br />

A sPECIAL sUPPLEmEnT To nATIonAL REAL EsTATE InvEsToR<br />

Moving Up in rank slots<br />

<strong>The</strong> Related Companies + 13<br />

Berkshire Property Advisors + 10<br />

Essex Property Trust, Inc. + 8<br />

<strong>The</strong> Lynd Company + 6<br />

Forest City Residential Group, Inc. + 5<br />

14 NMHC <strong>50</strong> APRIL 2012

NMHC <strong>50</strong> MaNagers<br />

Number of apartments<br />

Managed 2012 2011 2010 2009 2008 2007 2006<br />

Top 10 1,156,335 1,171,167 1,195,881 1,224,042 1,194,108 1,106,880 1,051,603<br />

Second 10 547,805 <strong>50</strong>5,197 496,740 487,528 523,614 498,472 469,786<br />

Top 25 1,925,592 1,885,014 1,890,933 1,915,170 1,930,162 1,810,315 1,703,865<br />

Second 25 8<strong>50</strong>,453 837,880 798,786 754,002 797,946 770,885 680,091<br />

Top <strong>50</strong> 2,776,045 2,722,894 2,689,719 2,669,172 2,728,108 2,581,200 2,383,956<br />

Portfolio size Measures<br />

Mean 55,521 54,458 53,794 53,383 54,562 51,624 47,679<br />

Median 41,774 39,788 37,767 37,871 40,578 40,010 33,1<strong>50</strong><br />

No. 1 firm 192,711 187,360 183,877 185,219 195,888 209,412 197,774<br />

No. <strong>50</strong> firm 27,573 28,085 26,845 23,730 25,852 25,277 22,<strong>50</strong>0<br />

share of National apartment stock<br />

Top 10 6.6% 6.7% 6.9% 7.0% 6.9% 6.4% 6.0%<br />

Top 25 11.0% 10.8% 10.9% 11.0% 11.1% 10.4% 9.7%<br />

Top <strong>50</strong> 15.8% 15.6% 15.5% 15.3% 15.7% 14.8% 13.6%<br />

MetHodology<br />

A SpeciAl SuppleMeNT To NATioNAl reAl eSTATe iNveSTor<br />

<strong>The</strong> National Multi Housing Council (NMHC) partnered with Kingsley Associates to h<strong>and</strong>le the NMHC <strong>50</strong> survey process (though<br />

NMHC remains solely responsible for any errors). To compile the NMHC <strong>50</strong> lists, both organizations gather names of owners <strong>and</strong><br />

managers from as wide a range of sources as possible, <strong>and</strong> staff from each firm complete the survey online. Over the years, improved<br />

outreach <strong>and</strong> increased publicity associated with the rankings have resulted in more firms responding to the survey.<br />

For the purposes of this survey, investment fund managers are treated as owners only if they retain substantial equity in the apartment<br />

property or if they maintain effective responsibility <strong>and</strong> decision-making over the investment property. Similarly, tax credit<br />

syndicators <strong>and</strong> franchisers are regarded as owners only if they retain a fiduciary responsibility. (When firms function strictly as<br />

advisers rather than investors, they are not regarded as owners.)<br />

<strong>The</strong> rankings do not distinguish between partial <strong>and</strong> full ownership. Some firms own sizable apartment properties through joint<br />

ventures in which their share could range anywhere from 1 to 99 percent. Others are primarily the sole owners of their apartments.<br />

In principle, it would be desirable to account for partial ownership—treating <strong>50</strong> percent ownership of 100 apartments as equivalent<br />

to full ownership of <strong>50</strong> units, for example. In practice, it is not feasible to make such distinctions.<br />

<strong>The</strong> survey excludes condominiums, cooperatives, hotel rooms, nursing homes, hospital rooms, mobile homes <strong>and</strong> houses with<br />

rental units. Rental housing for seniors (age-restricted apartments) is included, although assisted living <strong>and</strong> congregate care facilities<br />

are not. Finally, since we measure industry concentration by comparing the Top <strong>50</strong> owners <strong>and</strong> managers against the nation’s entire<br />

apartment stock, only U.S. apartments are included.<br />

At times, a firm may debut on the NMHC <strong>50</strong> at a high level. Generally, this means the firm is responding to the survey for the first<br />

time, rather than an indication of an outsized portfolio gain—although that, too, happens on occasion. Nonetheless, despite many<br />

improvements <strong>and</strong> everyone’s best efforts, the process remains imperfect: It relies on both accurate reporting <strong>and</strong> surveying of the<br />

complete universe, both of which can be fraught with problems.<br />

<strong>The</strong>re are two caveats in comparing the lists over time. First, the definition was refined in 2006 to eliminate those investment fund<br />

managers with neither substantial equity nor effective control over the investment property. Second, occasionally firms that have<br />

previously been among the Top <strong>50</strong> owners or managers have not responded to the NMHC survey. When that occurs, companies<br />

appear on the list that otherwise might not have been large enough. In addition, this affects the total number of apartments owned<br />

by the Top <strong>50</strong> firms, as well as other measures of concentration such as the mean <strong>and</strong> median portfolio size. (Note that this did not<br />

affect the management list.) For these reasons, year-to-year comparisons must be made with great care.<br />

Note: In some cases, newly introduced policies prohibited firms from sharing the kind of information needed for these rankings.<br />

April 2012 NMHC <strong>50</strong> 15

<strong>The</strong> Anatomy of a<br />

Br<strong>and</strong> Strategy<br />

Changing demographics lead some apartment firms to pursue new br<strong>and</strong><br />

segmentation strategies.<br />

By Bill Gloede<br />

GenerATion Y enerGY: AvalonBay’s AVA<br />

communities target the highly social, super-connected<br />

echo boomer demographic.<br />

A sPeCIAL suPPLement to nAtIonAL ReAL estAte InVestoR<br />

When Arlington, Va.-based AvalonBay<br />

Communities, Inc. announced in<br />

December that it was splitting its communities<br />

into three distinct br<strong>and</strong>s, many in the<br />

industry took the news as a sign that the apartment<br />

rental industry had fully shaken off the<br />

dust from the downturn. With rents <strong>and</strong> renewals<br />

rising, business was back on a growth track,<br />

<strong>and</strong> the future looked promising. Not only were<br />

consumers beginning to question the value of<br />

homeownership, but Generation Y’s throngs of<br />

echo boomers were coming of age, creating a<br />

huge, emerging demographic market for apartment<br />

rentals. Not since the upscale rental segment<br />

took off back in the late 1990s had there been such<br />

a clearly defined marketing opportunity.<br />

Under AvalonBay’s new structure, the company’s<br />

core br<strong>and</strong>, Avalon, will continue as the company’s<br />

flagship. Located in bigger urban <strong>and</strong> suburban<br />

markets, Avalon communities will include<br />

high-end amenities <strong>and</strong> services <strong>and</strong> continue as<br />

the publicly traded REIT’s primary growth engine<br />

through new development, according to the company’s<br />

Senior Vice President for Br<strong>and</strong> Strategy<br />

Kurt Conway. <strong>Apartment</strong>s will be larger <strong>and</strong><br />

include premium finishes, lighting, appliances<br />

<strong>and</strong> amenities.<br />

<strong>The</strong> second br<strong>and</strong> in AvalonBay’s portfolio,<br />

called Eaves by Avalon, will include communities<br />

located in mostly suburban locations <strong>and</strong> target<br />

more cost-conscious, value-oriented renters.<br />

<strong>The</strong> final br<strong>and</strong> is dubbed AVA, partly<br />

because, as Conway puts it, “<strong>The</strong> word ‘AVA’<br />

underscores the br<strong>and</strong>’s social elements. After<br />

all, it’s a person’s name.” <strong>The</strong> br<strong>and</strong> is squarely<br />

targeted to the highly social, super-connected<br />

Generation Y demographic. <strong>The</strong>se communities<br />

will be in transit-friendly <strong>and</strong> urban settings<br />

in “energized neighborhoods,” as Conway calls<br />

them. Properties will feature smaller apartments<br />

16 nMHC <strong>50</strong> APRIL 2012

April 2012<br />

A speciAl A speciAl supplement to nAtionAl to nAtionAl reAl estAte investor<br />

as well as units more conducive to roommate living.<br />

Conway points to a new AVA community under construction<br />

in the H-Street district of Washington, D.C., as representative<br />

of the new br<strong>and</strong>. Situated in an emerging youthful,<br />

walkable neighborhood, the property offers Generation Y<br />

residents ready access to transit, nightlife, galleries <strong>and</strong> restaurants.<br />

<strong>Apartment</strong>s range from 4<strong>50</strong> square feet for a studio<br />

to 5<strong>50</strong>- to 6<strong>50</strong>-sq.-ft. one-bedrooms <strong>and</strong> roommate-friendly<br />

units in the 7<strong>50</strong>- to 1,0<strong>50</strong>-sq.-ft. range.<br />

While the br<strong>and</strong>s are new for the company, which ranked<br />

No. 16 on the NMHC <strong>50</strong> <strong>Owners</strong> list <strong>and</strong> No. 14 on the<br />

NMHC <strong>50</strong> Managers list, the underlying strategy is really<br />

reflective of something the company’s been doing for the<br />

past 25 years—investing in locations where people want<br />

to live. “[We’re] focusing on the best performing markets<br />

<strong>and</strong> submarkets in the U.S, <strong>and</strong> within these markets, we<br />

are putting the right product that best matches customer<br />

needs,” Conway says.<br />

But while some in the industry see new br<strong>and</strong>ing strategies<br />

similar to AvalonBay’s as an extension of existing target<br />

marketing efforts, others disagree, arguing that the industry,<br />

in general, has placed more emphasis on the transaction <strong>and</strong><br />

the property than the end user, or resident.<br />

Jonathan Holtzman, chairman <strong>and</strong> CEO of Farmington<br />

Hills, Mich.-based Village Green, which<br />

ranked No. 28 on the NMHC <strong>50</strong> Managers<br />

list, would agree that the apartment<br />

industry, in general, has been behind the<br />

curve in terms of consumer segmentation.<br />

However, he points out that some<br />

companies’ strategies aimed at capturing<br />

Generation Y’s attention aren’t so much<br />

new as newly launched. As he explains it,<br />

somewhat diplomatically, “<strong>The</strong> apartment<br />

business has historically been behind the<br />

retail, hospitality <strong>and</strong> food industries. <strong>The</strong><br />

fact that some companies are now acting<br />

like this is a fresh idea is not respectful of<br />

apartment firms that have had br<strong>and</strong>ing<br />

since the 1960s.”<br />

For example, Holtzman says Village<br />

Green, which now owns or manages<br />

approximately 40,000 apartments in<br />

16 states, adopted a br<strong>and</strong> strategy after<br />

witnessing the growth “of this company<br />

called Holiday Inn.” It was the<br />

first br<strong>and</strong>ed chain of motels, <strong>and</strong> it<br />

grew, quickly, to a dominant position<br />

in the industry. Along with Village<br />

Green in the move to br<strong>and</strong>ing back<br />

then, says Holzman, were Oakwood,<br />

now Oakwood Worldwide, <strong>and</strong> Post<br />

“[We’re] focusing on the best<br />

performing markets <strong>and</strong><br />

submarkets in the u.s, <strong>and</strong><br />

within these markets, we are<br />

putting the right product that<br />

best matches customer needs.”<br />

— Kurt conway, AvalonBay communities, inc.<br />

Properties. And even before them, the LeFrak Organization.<br />

Holtzman’s take on the industry reflects his background; he<br />

is the third generation of his family to run the company, which<br />

was founded by his gr<strong>and</strong>father in 1919. When the first wave<br />

of br<strong>and</strong>ing <strong>and</strong> segmentation took place in the 1960s, he says,<br />

the apartment companies that bought in were asking the same<br />

question: “How can you call an urban high-rise building with<br />

BUILDING<br />

COMMUNITY<br />

BUILDS VALUE.<br />

Occupancy. Rent Values. Retention.<br />

Regardless of your 2012 focus,<br />

ours continues to be delivering<br />

ROI through community.<br />

Call 877.785.2963 or visit<br />

CARESprogram.org<br />

Check out the new<br />

CARESprogram.org.<br />

New Look, Same Focus.

high rents the same name as a 20-year-old garden apartment<br />

community in the suburbs? No other industry would<br />

do that.”<br />

So, in 1989, company executives decided to do something<br />

different. Rather than market their properties based on<br />

their location, amenities <strong>and</strong> rent levels, which is what most<br />

firms were doing, executives moved to launch two distinct<br />

br<strong>and</strong>s. Village Green became a single br<strong>and</strong>, made up of<br />

A SPecIAL SuPPLeMeNt to NAtIoNAL ReAL eStAte INveStoR<br />

live, work, play: Generation Y’s housing preferences are driving<br />

apartment firms toward urban, transit-oriented development like this<br />

community by Somerset Development, located three subway stops from<br />

Midtown Manhattan in Wood-Ridge, N.J.<br />

DEVELOPMENT | FINANCE | CONSTRUCTION | MANAGEMENT<br />

American Campus Communities is a $4.5 billion real<br />

estate investment trust (REIT) traded on the NYSE<br />

(symbol: ACC). Since 1993 we have structured <strong>and</strong><br />

closed more than $6 billion of student housing transactions. With business expertise<br />

in project design <strong>and</strong> development, asset acquisition, <strong>and</strong> management services,<br />

we are the nation’s premier owner <strong>and</strong> operator of quality student housing.<br />

AMERICANCAMPUS.COM<br />

older, suburban garden apartment complexes; Village<br />

Park became a new br<strong>and</strong> characterized by apartments<br />

with cathedral ceilings, in-unit washers <strong>and</strong> dryers,<br />

fireplaces, pools <strong>and</strong> clubhouses aimed at increasingly<br />

affluent baby boomers closer in to urban cores.<br />

And that trend continued through the decades to<br />

follow. In the late 1990s, company executives rolled<br />

out the City br<strong>and</strong> as Village Green began building<br />

environmentally friendly urban apartments with ready<br />

access to transit, featuring isl<strong>and</strong> kitchens, upscale<br />

appliances, upgraded flooring <strong>and</strong> bathrooms <strong>and</strong><br />

rooftop pools. In the early 2000s, the company unveiled<br />

its Regents Park br<strong>and</strong>, which targets an older, upscale<br />

demographic looking for a more suburban setting. <strong>The</strong><br />

company also added fifth br<strong>and</strong> aimed at the corporate<br />

relocation <strong>and</strong> temporary housing market that offers wellappointed,<br />

furnished shorter-term rentals.<br />

However, some apartment executives remain skeptical of<br />

the long-term value <strong>and</strong> effectiveness of a multi-br<strong>and</strong> strategy.<br />

Greensboro, N.C.-based Bell Partners, No. 30 on the<br />

NMHC <strong>50</strong> <strong>Owners</strong> list <strong>and</strong> No. 10 on the NMHC <strong>50</strong> Managers<br />

list, markets properties using its core br<strong>and</strong> proposition,<br />

“apartment living at its best.” <strong>The</strong> tagline is trademarked<br />

<strong>and</strong> used across its entire portfolio in<br />

conjunction with micro-br<strong>and</strong>s created<br />

for individual communities. This strategy<br />

reflects a view that apartments are<br />

largely commodity products, <strong>and</strong> each<br />

community offers apartments designed<br />

to address unique tastes <strong>and</strong> needs.<br />

“<strong>The</strong> consumers own the br<strong>and</strong>, <strong>and</strong><br />

they define what that br<strong>and</strong> st<strong>and</strong>s for,”<br />

says Kevin Thompson, senior vice president<br />

of marketing for Bell.<br />

For Bell, “apartment living at its<br />

best,” is a blanket marketing strategy<br />

that can just as easily define a 595-sq.ft.<br />

studio at Bell Park Central in Dallas<br />

or a two-bedroom, two-bath suite at<br />

the Bell Midtown in Nashville or even<br />

a 1,<strong>50</strong>0-sq.-ft. three-bedroom, twobath<br />

family apartment at Bell Preston<br />

Reserve in Cary, N.C.<br />

Bell’s strategy is more akin to a<br />

mass marketer than those of Village<br />

Green <strong>and</strong> AvalonBay. Think Ford.<br />

Every Ford is called a Ford. Every<br />

Bell apartment is called a Bell apartment.<br />

That’s by design, according to<br />

Thompson. “We should always be cautious<br />

before we do br<strong>and</strong> extensions,”<br />

he says. “You can easily cannibalize<br />

your core br<strong>and</strong>.”<br />

18 NMHC <strong>50</strong> APRIL 2012

A speciAl A speciAl supplement to nAtionAl to nAtionAl reAl reAl estAte investor<br />

Show Me the Money Managers<br />

institutional managers continue to make their place in the apartment business<br />

next to traditional owners.<br />

By Bill Goede<br />

<strong>The</strong> apartment rental business has long been a good place<br />

to park money. Depending on economic conditions, of<br />

course, it usually offers steady returns on capital <strong>and</strong><br />

relatively stable asset value, which is a tough combination<br />

to match in, say, the stock markets. This continued stable<br />

performance is causing the rental business’ mix to change as<br />

more investment management companies, attracted by the<br />

potential yields, join the ranks of more traditional owners.<br />

According to an analysis of data collected for the NMHC Top<br />

<strong>50</strong>, investment management firms are an increasing presence<br />

among the largest apartment owners in the U.S. <strong>The</strong> number<br />

of such companies among the Top <strong>50</strong> has nearly doubled from<br />

four in 2008 to seven this year, with TIAA-CREF, the financial<br />

services <strong>and</strong> retirement giant that takes its abbreviated moniker<br />

from Teachers Insurance <strong>and</strong> Annuity Association (TIAA)<br />

<strong>and</strong> College Retirement Equities Fund (CREF), making its first<br />

appearance on the list. TIAA-CREF debuted on the Top <strong>50</strong><br />

owners list at No. 28.<br />

To the investment management companies that have been<br />

active in the industry for a while, this comes as no surprise,<br />

especially given the nature of the recent recession <strong>and</strong> concomitant<br />

crash of the homeownership market.<br />

“<strong>The</strong> sector is attractive because there’s a good income<br />

return, it doesn’t have a long lead time to develop <strong>and</strong> it’s<br />

attractive to a large number of investors,” says Jean Anderson,<br />

New York-based managing director for J.P. Morgan Asset<br />

Management, which ranked No. 24 on the top owners list.<br />

“And it certainly has been a property type that’s rebounded<br />

quickly from the recession.”<br />

“What has fueled the strength in the apartment rental<br />

industry over the past three years is the housing crisis,” says<br />

Paul Michaels, managing director of No. 20-ranked Invesco<br />

Real Estate in Dallas. “<strong>The</strong>re’s been this huge flight to rental<br />

properties. <strong>The</strong> buzz in the industry is apartments.”<br />

Andrew McCulloch, an analyst who follows the apartment<br />

sector for Green Street Advisors in Newport Beach, Calif.,<br />

cites the still-ailing market for single-family homes, demographic<br />

factors that signal strength in the rental market for<br />

years to come, a relative dearth of new supply owing to construction<br />

slowdowns during the recession <strong>and</strong> the relatively<br />

low cost of debt as primary drivers of this interest.<br />

“It’s easy to see why investment managers like apartments,”<br />

he says.<br />

Dan Fasulo, managing director at Real Capital Analytics<br />

in New York who tracks the commercial real estate sector,<br />

agrees. “Multifamily is in full-fledged recovery right now,” he<br />

reports, <strong>and</strong>, given that, says the increasing interest in the sector<br />

among investment managers “doesn’t surprise me. Real<br />

estate looks good versus some of the other alternatives; multifamily<br />

looks good versus other commercial property sectors.<br />

It looks awfully rosy versus the other prospects.”<br />

New apartment construction is near historic lows.<br />

“there’s been this huge flight to<br />

rental properties. the buzz in<br />

the industry is apartments.”<br />

— paul michaels, invesco real estate<br />

According to the Commerce Department, housing permits<br />

nationally for buildings with five or more units plunged from<br />

359,000 in 2007 to 295,400 units in 2008 to 121,100 in 2009<br />

before rising to 135,300 in 2010 <strong>and</strong> 176,400 last year. <strong>The</strong><br />

2009 <strong>and</strong> 2010 numbers were the lowest since the government<br />

began tracking this type of data back in 1959.<br />

“<strong>The</strong> developers <strong>and</strong> lenders hit the brakes very early in<br />

the cycle,” Fasulo explains. “Looking back, this is going to be<br />

some of the slowest growth we’ve seen for multifamily construction<br />

in the post-war period.”<br />

But then there’s that return. According to the National<br />

Council of Real Estate Investment Fiduciaries, which has<br />

since 1984 been tracking what it calls a composite total rate<br />

of return on investment for apartments owned at least in part<br />

by tax-exempt, institutional investors, there have been only<br />

eight quarters of negative returns through the end of 2011, six<br />

of them during the recession of 2008-2009. In 2011, average<br />

annualized returns rose to 15.5 percent.<br />

<strong>The</strong> other primary driver of interest in multifamily is<br />

demographics. <strong>The</strong> so-called Echo Boom generation, also<br />

known as Generation Y or the Millennial Generation, is entering<br />

the prime rental market demographic of 18 to 30 years<br />

April 2012 NMHC <strong>50</strong> 19

old, many of them carrying record levels of education debt,<br />

which could keep them renting longer than previous generations.<br />

Add to that the millions of former homeowners<br />

who have returned or will return to the rental market as the<br />

national homeownership rate fell from a high of 69.4 percent<br />

in 2004 to 66.0 percent in 2011, the biggest drop in that<br />

metric since the Great Depression according to the Census<br />

Bureau. Coupled with the relative lack of new supply, these<br />

factors continue to keep rents <strong>and</strong> renewals steady.<br />

Still, investment management owners are keeping a wary<br />

eye on supply. “As long as supply remains in check, multifamily<br />

is going to be a great place to be,” says Invesco’s<br />

Michaels.<br />

J. P. Morgan’s Anderson echoes that sentiment. “Overall,<br />

the trends are very positive,” she says, but then asks, “How<br />

may units will be delivered two or three years from now?”<br />

Invesco, for one, is turning cautious on some markets,<br />

among them Seattle, Austin <strong>and</strong> Washington, D.C., which,<br />

not coincidentally, are areas that held up relatively well during<br />

the housing bust. He also believes there could be a supply<br />

surge in Boston. “People have to start to look at [markets]<br />

more closely,” says Michaels. “Two or three years from now,<br />

you might start to see supply exceeding dem<strong>and</strong>.”<br />

However, he isn’t expecting to see that happen in New York<br />

A sPecIAL suPPLeMenT To nATIonAL ReAL esTATe InvesToR<br />

“[<strong>The</strong> apartment sector]<br />

certainly has been a property<br />

type that’s rebounded quickly<br />

from the recession.”<br />

— Jean Anderson, J.P. Morgan Asset<br />

Management<br />

or Southern California, where dem<strong>and</strong> continues to outstrip<br />

supply, in New York because of lack of developable l<strong>and</strong> <strong>and</strong><br />

in Southern California due to the length <strong>and</strong> difficulty of the<br />

permitting process. Anderson is likewise optimistic on JP<br />

Morgan markets, which are mostly gateway cities, including<br />

New York, San Francisco <strong>and</strong> the so-called Gold Coast on the<br />

Hudson River in New Jersey.<br />

Still, that caution will hardly dampen interest in multi-<br />

family among investment managers, Michaels believes. “I<br />

think [the rental market] is so good that people are still looking<br />

at the glass half full,” he says.<br />

PROPERTY TAXES<br />

When your fair share<br />

is neither fair<br />

nor your share.<br />

Your property tax is based on mass appraisals. That often results in your paying an<br />

unfair share of taxes. Members of American Property Tax Counsel are recognized<br />

leaders in developing ways to reduce taxes, as well as expertly h<strong>and</strong>ling<br />

the reappraisal <strong>and</strong> tax reduction process from the administrative<br />

level through trials <strong>and</strong> appeals. Our national network of 100 of<br />

the nation’s top property tax lawyers has the local expertise to help<br />

ensure you don’t pay one penny more than your fair share. Contact<br />

us toll free at 1-877-TAX-APTC (829-2782) or www.APTCNET.com.<br />

AmericAn ProPerty tAx counsel<br />

Smart, Aggressive Property Tax Advocacy<br />

20 NMHC <strong>50</strong> APRIL 2012

RAISING EQUITY + SUPPORTING AFFORDABLE HOUSING = CREATING JOBS<br />

NATIONAL EQUITY FUND, INC.<br />

120 South Riverside Plaza, 15Th Fl. Chicago, Illinois 60606-3908<br />

P 312.360.0400<br />

WWW.NEFINC.ORG

On a Path of Growth<br />

Top apartment firms outline strategies for making the most of a<br />

promising market in 2012.<br />

By Hortense Leon<br />

As the economy sidestepped a double dip <strong>and</strong> began to<br />

firm up through 2010, its measured recovery set the<br />

stage to make 2011 a turning point for the apartment<br />

industry. Suddenly dem<strong>and</strong> for rental units outpaced limited<br />

new supply <strong>and</strong> capital was flowing more freely to the sector.<br />

Market dynamics had shifted in such a way that apartment<br />

firms saw rents climb rather substantially, a key signal that<br />

the apartment market had indeed turned around.<br />

“We expect to see 5 percent to 7 percent increases in net<br />

rents in many markets [in 2012],” says Nicholas Roby, president<br />

of BH Management Services (No. 21 on the NMHC <strong>50</strong><br />

Manager’s list) <strong>and</strong> vice chair of the equities division of BH<br />

Equities (No. 39 on the NMHC <strong>50</strong> <strong>Owners</strong> list). “This is a big<br />

improvement over the zero market rent growth <strong>and</strong> concessions<br />

of a half a month’s free rent or more, that were common<br />

a couple of years ago.”<br />

With opportunity like that dangling<br />

like a carrot in front of a hungry apartment<br />

industry, apartment firms are trying<br />

to come up with the best strategies to<br />

capture as much of the dem<strong>and</strong> growth<br />

as they can, while it lasts. <strong>The</strong> industry’s<br />

runway for growth could shorten in 2013<br />

<strong>and</strong> 2014, making 2012 a critical year for<br />

NMHC <strong>50</strong> executives to continue to execute<br />

new initiatives <strong>and</strong> complete transactions,<br />

better positioning their companies<br />

for longer-term success. But finding the<br />

right strategy can be challenging in an<br />

improving market, as apartment firms<br />

wrestle with which opportunities to pursue—<strong>and</strong><br />

which to let fall by the wayside.<br />

Some Will Build<br />

<strong>The</strong> economic <strong>and</strong> housing recession has<br />

kept the apartment industry in a chronic<br />

state of under-production. Through 2011,<br />

there were 167,300 multifamily apartments<br />

started (5+ unit properties), a little<br />

more than half of the new units the industry<br />

should produce a year.<br />

However, greater access to capital is<br />

starting to accelerate new development.<br />

APRIL 2012<br />

A sPecIAL suPPLemenT To nATIonAL ReAL esTATe InvesToR<br />

San Francisco<br />

Irvine<br />

Office Locations<br />

Seattle<br />

San Diego<br />

Greystar Presence<br />

According to a January NMHC Quarterly Survey of apartment<br />

market conditions, 53 percent of respondents reported<br />

a substantial pick-up in l<strong>and</strong> acquisition <strong>and</strong> the lining up of<br />

financing <strong>and</strong> securing of building permits, although actual<br />

construction starts appeared to lag. An additional 20 percent<br />

of respondents reported that developers had been breaking<br />

ground on new projects at a rapid clip.<br />

“We have doubled our development pipeline this year,”<br />

says Ric Campo, chairman <strong>and</strong> CEO of the Houston-based<br />

Camden Property Trust (No. 14 on the owners’ list <strong>and</strong> No. 9<br />

on the managers’ list).<br />

<strong>The</strong> company currently has about 2,300 apartments under<br />

construction at a cost of about $400 million <strong>and</strong> another<br />

520 units under construction, at a cost of $113 million, with<br />

joint-venture partners. Campo says in the near term the<br />

Las Vegas<br />

Phoenix<br />

Denver<br />

Dallas<br />

Austin Austin<br />

San Antonio<br />

Houston<br />

Chicago<br />

Atlanta<br />

Tampa<br />

Charlotte<br />

Charleston<br />

Corporate Headquarters<br />

Orl<strong>and</strong>o<br />

Boston<br />

Washington<br />

D.C.<br />

Ft. Lauderdale

company plans to start construction on an additional 3,000<br />

units in Tampa, Fla.; Orl<strong>and</strong>o; Washington, D.C.; Denver <strong>and</strong><br />

Southern California, among other locations.<br />

“We felt that the fact that there hasn’t been any apartment<br />

development in the last several years [would result in] pentup<br />

dem<strong>and</strong>,” he says.<br />

At Denver-based UDR, Inc. for example, president <strong>and</strong><br />

CEO Tom Toomey reports that his company (No. 15 on the<br />

owners’ list <strong>and</strong> No. 13 on the managers’ list) is currently<br />

investing $1.1 billion in building about 3,000 apartment units<br />

<strong>and</strong> redeveloping another 3,000.<br />

Warren Rose, CEO of Farmington Hills, Michigan-based<br />

Edward Rose & Sons, is another apartment owner looking to<br />

take advantage of burgeoning rental dem<strong>and</strong>, an improving<br />

economy <strong>and</strong> more access to capital. His company (No. 17<br />

on the owners’ list <strong>and</strong> No. 16 on the managers’ list) is on<br />

track to develop 800 to 1,000 new units this year. This is the<br />

first significant development the company has done since the<br />

beginning of the recession in 2008, says Rose. And running<br />

counter to other expansion strategies at work in the market,<br />

which focus on only gateway markets on the East <strong>and</strong> West<br />

coasts, Rose says the new units will be in markets in Illinois,<br />

Indiana, Iowa, Michigan, Nebraska, Ohio, South Carolina<br />

<strong>and</strong> Wisconsin.<br />

Tesora <strong>Apartment</strong>s<br />

$20,874,000<br />

Las Vegas, NV<br />

Commercial Real Estate Finance<br />

Atlanta | Bethesda | Chicago | Dallas | Irvine<br />

Nashville | New Orleans | New York | Walnut Creek<br />

A sPecIAL suPPLement to nAtIonAL ReAL estAte InvestoR<br />

Financing America’s Future<br />

“We have<br />

doubled our<br />

development<br />

pipeline this year.<br />

We felt that the<br />

fact that there hasn’t been any<br />

apartment development in the<br />

last several years [would result<br />

in] pent-up dem<strong>and</strong>.”<br />

— Ric campo, camden Property trust<br />

For as much as a limited supply of new apartment product<br />

is driving new development, the acceleration in apartment<br />

construction also reflects anticipated dem<strong>and</strong> as the almost<br />

80 million-strong Generation Y comes of<br />

age. Camden’s Campo says, “Of the 3.8<br />

million new jobs that have been created<br />

since the bottom of the recession, twothirds<br />

have gone to people under 34 who<br />

are mobile <strong>and</strong> more likely to be apartment<br />

dwellers [than other generations].”<br />

Ronald Ratner, president of the<br />

Clevel<strong>and</strong>-based Forest City Residential<br />

Group, Inc. (No. 23 on the owners’ list<br />

<strong>and</strong> No. 32 on the managers’ list), says<br />

the industry is building with that demographic<br />

in mind. “Everyone today is<br />

looking at building smaller product,”<br />

designed to appeal to the tastes <strong>and</strong> budgets<br />

of a younger group of urban professionals,<br />

he says.<br />

Others Will Buy<br />

But building a property from the ground<br />

up takes time—anywhere from 18 months<br />

to 30 months in many markets—<strong>and</strong> some<br />

apartment companies are wont to wait.<br />

Consequently, many apartment companies<br />

seek to grow not only organically<br />

through development but also through<br />

acquisitions of both individual properties<br />

<strong>and</strong> larger portfolios.<br />

In fact, 2011 was a hot year for<br />

APRIL 2012

apartment trades, according to Real Capital Analytics. More<br />

than 3,<strong>50</strong>0 properties changed h<strong>and</strong>s last year, representing<br />

a 49 percent increase in volume from 2010. Moreover,<br />

appetite for portfolio deals also grew; roughly $9.6 billion<br />

in assets traded in portfolio transactions in 2011, more than<br />

double the value of portfolio deals in 2010.<br />

Jack O’Connor, chief operating officer at Kirkl<strong>and</strong>, Wash.based<br />

Weidner <strong>Apartment</strong> Homes (No. 42 on the managers’<br />

list <strong>and</strong> No. 44 on the owners’ list) says his company takes a<br />

balanced approach to growth. “We grow our business about<br />

half through acquisition <strong>and</strong> half through new construction,”<br />

he says. “We expect to have 10 percent to 15 percent<br />

more units (between 3,000 <strong>and</strong> 5,000) completed <strong>and</strong>/or<br />

acquired by the end of 2012. This is our yearly target, but<br />

there can be bumps in the road.”<br />

REITs UDR, Inc. <strong>and</strong> Equity Residential (No. 6 on the<br />

owners’ list <strong>and</strong> No. 5 on the managers’ list) have been two of<br />

the most aggressive acquirers in recent years. UDR’s Toomey<br />

says that, during the financial crisis, his company made few<br />

acquisitions but started buying more assets again in late<br />

2010, when UDR, Inc. purchased about $400 million worth<br />

of properties. In 2011, the company bought $1.8 billion in<br />

apartment properties.<br />

But bigger isn’t necessarily better when it comes to navigating<br />

the next phase of the apartment cycle.<br />

For as much as companies are pursuing<br />

choice properties to add to their portfolio,<br />

many are also strategically shedding<br />

other assets in an effort to optimize their<br />

portfolios.<br />

BH Equities, for one, is focusing on<br />

acquiring relatively new product in the<br />