SECURED LOAN HDB MORTGAGE POLICIES/8 - OCBC Bank

SECURED LOAN HDB MORTGAGE POLICIES/8 - OCBC Bank

SECURED LOAN HDB MORTGAGE POLICIES/8 - OCBC Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

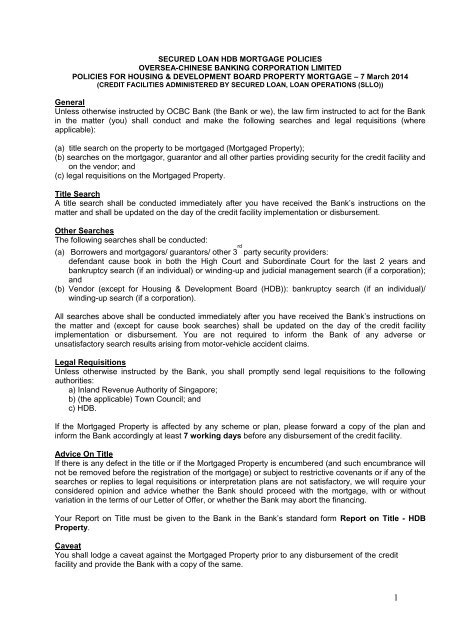

<strong>SECURED</strong> <strong>LOAN</strong> <strong>HDB</strong> <strong>MORTGAGE</strong> <strong>POLICIES</strong>OVERSEA-CHINESE BANKING CORPORATION LIMITED<strong>POLICIES</strong> FOR HOUSING & DEVELOPMENT BOARD PROPERTY <strong>MORTGAGE</strong> – 7 March 2014(CREDIT FACILITIES ADMINISTERED BY <strong>SECURED</strong> <strong>LOAN</strong>, <strong>LOAN</strong> OPERATIONS (SLLO))GeneralUnless otherwise instructed by <strong>OCBC</strong> <strong>Bank</strong> (the <strong>Bank</strong> or we), the law firm instructed to act for the <strong>Bank</strong>in the matter (you) shall conduct and make the following searches and legal requisitions (whereapplicable):(a) title search on the property to be mortgaged (Mortgaged Property);(b) searches on the mortgagor, guarantor and all other parties providing security for the credit facility andon the vendor; and(c) legal requisitions on the Mortgaged Property.Title SearchA title search shall be conducted immediately after you have received the <strong>Bank</strong>’s instructions on thematter and shall be updated on the day of the credit facility implementation or disbursement.Other SearchesThe following searches shall be conducted:(a) Borrowers and mortgagors/ guarantors/ other 3 rd party security providers:defendant cause book in both the High Court and Subordinate Court for the last 2 years andbankruptcy search (if an individual) or winding-up and judicial management search (if a corporation);and(b) Vendor (except for Housing & Development Board (<strong>HDB</strong>)): bankruptcy search (if an individual)/winding-up search (if a corporation).All searches above shall be conducted immediately after you have received the <strong>Bank</strong>’s instructions onthe matter and (except for cause book searches) shall be updated on the day of the credit facilityimplementation or disbursement. You are not required to inform the <strong>Bank</strong> of any adverse orunsatisfactory search results arising from motor-vehicle accident claims.Legal RequisitionsUnless otherwise instructed by the <strong>Bank</strong>, you shall promptly send legal requisitions to the followingauthorities:a) Inland Revenue Authority of Singapore;b) (the applicable) Town Council; andc) <strong>HDB</strong>.If the Mortgaged Property is affected by any scheme or plan, please forward a copy of the plan andinform the <strong>Bank</strong> accordingly at least 7 working days before any disbursement of the credit facility.Advice On TitleIf there is any defect in the title or if the Mortgaged Property is encumbered (and such encumbrance willnot be removed before the registration of the mortgage) or subject to restrictive covenants or if any of thesearches or replies to legal requisitions or interpretation plans are not satisfactory, we will require yourconsidered opinion and advice whether the <strong>Bank</strong> should proceed with the mortgage, with or withoutvariation in the terms of our Letter of Offer, or whether the <strong>Bank</strong> may abort the financing.Your Report on Title must be given to the <strong>Bank</strong> in the <strong>Bank</strong>’s standard form Report on Title - <strong>HDB</strong>Property.CaveatYou shall lodge a caveat against the Mortgaged Property prior to any disbursement of the creditfacility and provide the <strong>Bank</strong> with a copy of the same.1

(b) We require at least 7 working days for execution and return of the documents. Please arrange tocollect the executed documents from us thereafter. The <strong>Bank</strong> will cease to notify law firms on thecollection of executed documents.(c) Should there be any amendments made on the legal documents for the following fields, theyshould be counter-signed by the Borrowers/ Mortgagors without fail: Borrower(s)/ Mortgagor(s) name Borrower(s)/ Mortgagor(s) NRIC and Passport No Property Address MM No.(d) If any other amendments are made other than the items mentioned in (c), it has to becountersigned by the lawyer without fail.All mortgage and security or related documents for execution must be forwarded to the <strong>Bank</strong> under the<strong>Bank</strong>’s standard letter form Execution of Legal Documents (Mortgage).Stamping of Security DocumentsPlease confirm that all security documents have been duly stamped to the maximum.Difference Between Purchase Price and LoanIf the housing loan is to be used to finance the purchase of the Mortgaged Property, you are required toensure that the difference between the purchase price and the housing loan is actually paid or will bepaid by the mortgagor(s)/ borrower(s) on or before the first disbursement of the housing loan.Your written instruction/ advice to the <strong>Bank</strong> to disburse the housing loan or any part thereof shall bedeemed and relied upon by the <strong>Bank</strong> as your confirmation that this condition has been or will be fulfilledon completion.Please note that you are required to ensure that the Borrower(s) makes the requisite cash downpayment as required under the Monetary Authority of Singapore’s Notice 632 on Housing Loans.Further, you are to ensure that such cash down payment is made in compliance with all rules,regulations, guidelines, notices, circulars or requirements of the Monetary Authority of Singapore or otherrelevant authority. In particular, without limiting the foregoing, please note that we rely on you to ensurethat the amount of cash equity required to be paid by the Borrower(s) towards the purchase of theMortgaged Property as stated in our Letter of Offer is accurate. If any revision or amendment is requiredto be made to such cash equity amount, you are required to inform us of the same immediately.Power of AttorneyYou are to confirm and highlight to the <strong>Bank</strong> (where applicable) that the attorney(s) appointed pursuantto the relevant Power of Attorney is authorised to act on behalf of the mortgagor(s)/ borrower(s)/guarantor(s)/ third party security provider(s) (as the case may be) on the purchase, borrowing or suchother transaction to which the Power of Attorney relates before any disbursement of the credit facilityFacility DisbursementPrior to any disbursement of the credit facility, you shall:(a) ensure that it is in order for the <strong>Bank</strong> to disburse or implement the credit facilities or part thereof;(b) ensure that the amount requested for disbursement is correct, and where applicable, such amountwill be used in accordance with the respective purposes specified in our Letter of Offer (in the case ofpurchase, such amount shall be paid directly to the vendor on completion and if the MortgagedProperty is subject to an existing mortgage which mortgage shall be discharged on completion, suchamount shall be paid directly to the existing mortgagee);(c) ensure and confirm that all pre-conditions to disbursement (whether general or specific) as stipulatedin the <strong>Bank</strong>’s Letter of Offer and/ or otherwise advised by us from time to time prior to disbursementhave been fulfilled;(d) confirm the exact amount required to redeem an existing mortgage;(e) ensure that the disbursement of the housing loan is in accordance with the schedule of payment inthe <strong>HDB</strong> Agreement of Lease or Option to Purchase (where applicable);3

(f) ensure that all security documents have been duly executed by the mortgagor(s)/ borrower(s)/guarantor(s)/ third party security provider(s);(g) confirm that, where there is a condition in the <strong>Bank</strong>’s letter of offer for mortgagor(s) to hold theMortgaged Property as joint tenants, this is complied with;(h) ensure that the title to the Mortgaged Property is in order and update searches on completion or priorto release of funds;(i) ensure that all legal requisitions replies (where applicable) are satisfactory and in order; and(j) ensure that updated bankruptcy/ winding up/ judicial management/ defendant cause book searches(where applicable) in both High Courts and Subordinate Courts are satisfactory prior to your releaseof the funds.(k) ensure that the stamp duty on Option to Purchase/Sale & Purchase Agreement has been paid priorto release of funds (copy of Certificate of Stamp Duty to be forwarded to <strong>Bank</strong> prior to disbursement).Upon receipt of your advice/ instructions for disbursement/ implementation of the credit facility or partthereof, we will proceed with the disbursement/ implementation of the credit facilities or part thereof in fullreliance of your professional advice/ instructions and on the understanding that you have discharged theaforesaid duties prior to such advice/ instructions for disbursement/ implementation.We require at least 7 working days for disbursement of the credit facilities or part thereof.All instructions for disbursement must be given to the <strong>Bank</strong> under the <strong>Bank</strong>’s standard letter form(Facility Disbursement).With effect from 26 Oct 2009, collection of Cashier’s Order for Loan Disbursements will be at thefollowing location:Oversea-Chinese <strong>Bank</strong>ing Corporation LimitedLoan Operations – Loan Administration31 Tampines Avenue 4#01-01/03 <strong>OCBC</strong> Tampines Centre TwoSingapore 529680In the event that you are given an additional Cashier’s Order which has been issued in the names of theborrower(s) in relation to the package that the borrower(s) has/ have accepted, you are to ensure thatthe Cashier’s Order is only given to the borrower/s after the completion of the purchase and themortgage of the Property.In the event of cancellation or postponement of the completion, you are to also ensure that the entireCashier’s Order(s) that have been delivered to you are returned to the bank by the next working day.Legal Cost SubsidyWhere legal costs subsidy is payable by the <strong>Bank</strong>, payment of your legal fees and disbursements will bemade only upon receipt by the <strong>Bank</strong> of the following documents:(a) all original title deeds and mortgage/ mortgage in escrow and Deed of Assignment to the MortgagedProperty and any other security documents; and(b) original tax invoice addressed to <strong>OCBC</strong> <strong>Bank</strong> Ltd.4

Safekeep of DocumentsAll **Title deeds for the Mortgaged Property and security documents must be forwarded to SLLOfor safekeeping in one batch within 2 months from the date of first disbursement of the creditfacility or the release for the perfection of the mortgage-in-escrow, whichever is applicable.Please use the <strong>Bank</strong>’s standard letter form (Safe-Keeping of Title Deeds and SecurityDocuments)**Title deedsFor completed properties –Mortgage with Certificate of Stamp Duty and LeaseFor properties under construction – Deed of Assignment with Certificate of Stamp Duty,Agreement to Lease with Certificate of Stamp duty (applicable for BTO) and Sales & PurchaseAgreement with Certificate of Stamp Duty (applicable for DBSS)Important Note:(a) Please do not submit documents that are not relevant to the transaction nor documents thatare not set out in the relevant letter of offer. Such actions on your part result in unnecessaryexpense on our end and we may take steps to recover such costs from you.(b) Payment of your invoices will be delayed and returned if the title deeds and the securitydocuments are not in order.(c) Invoices will be returned for reissuance if there are discrepancies in the invoice.Perfection of MortgageYou shall use the <strong>Bank</strong>’s standard letter form (Release of Documents) to request for any release of theMortgage-in-Escrow and/ or any other documents for the perfection of the <strong>Bank</strong>’s mortgage. TheMortgage and/ or any security related documents must be forwarded to SLLO for safekeeping in onebatch within 2 months from the date of final disbursement of the credit facility using the <strong>Bank</strong>’s standardform for safekeeping of Title Deeds and security documents.RedemptionYou shall give notice of redemption in the <strong>Bank</strong>’s standard letter form (Notice of Redemption/ Requestfor Revised Redemption Statement).The <strong>Bank</strong> will only provide a total of ONE preliminary statement and ONE final redemption statement foreach completion date. Please request for the final redemption statement ONE WEEK before theproposed redemption date. In the event that you require an additional redemption statement other thanthe two redemption statements mentioned above OR require the statement earlier, please indicate thereason and provide the <strong>Bank</strong> at least 1 week’s advance notice.With effect from 26 Oct 2009, collection of Legal Documents, unless otherwise advised, will be at thefollowing location:Oversea-Chinese <strong>Bank</strong>ing Corporation LimitedLoan Operations – Loan Administration31 Tampines Avenue 4#01-01/03 <strong>OCBC</strong> Tampines Centre TwoSingapore 529680Please use the <strong>Bank</strong>’s standard letter form (Notice of Redemption/ Request for Revised RedemptionStatement) for any request for revised redemption statement.You shall ensure that discharge documents are in order for the <strong>Bank</strong>’s execution.You will be responsible to ensure that the security is not released until all outstanding on theaccount has been settled in full. In the event that the balance outstanding to the <strong>Bank</strong> is beingsettled not solely by way of a Cashier’s Order, our prior written consent must be obtained beforethe mortgage is discharged.5

All discharge documents for execution must be forwarded to the <strong>Bank</strong> under the <strong>Bank</strong>’s standard letterform (Execution of Legal Documents (Redemption).The Cashier’s Order for full settlement of the account must be hand-delivered to SLLO latest by thenext working day following the completion date at the following specified times:- Between 9.00am to 10.00am on weekdays (Mondays to Fridays), including the eve ofNew Year, the eve of Chinese New Year and the eve of Christmas.Cashier’s Order received after the above specified times shall be deemed to be received on the nextworking day whereupon interest shall accrue accordingly.All title and security documents to the Mortgaged Property and any executed discharge document mustbe returned to the <strong>Bank</strong> in the event that the redemption is aborted for any reason.Repayment of Bridging Loan/ Short Term LoanPlease use the <strong>Bank</strong>’s standard letter form (Repayment of Bridging Loan/ Short Term Loan) for anyrepayment of Bridging Loan or Short Term Loan.WebsiteAll standard forms referred to in this Policy are available in the <strong>Bank</strong>’s website athttp://www.ocbc.com/me/loans/legaldoc.shtm. Please send all standard letters to Loan Operations -Secured Loan in triplicate.6