Savills plc 2012 Annual Report - (PDF) - Investor relations

Savills plc 2012 Annual Report - (PDF) - Investor relations

Savills plc 2012 Annual Report - (PDF) - Investor relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

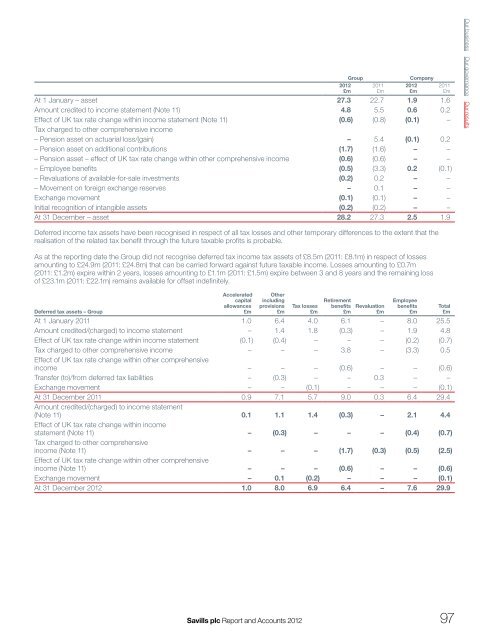

Group<strong>2012</strong>£m2011£mCompany<strong>2012</strong>£mAt 1 January – asset 27.3 22.7 1.9 1.6Amount credited to income statement (Note 11) 4.8 5.5 0.6 0.2Effect of UK tax rate change within income statement (Note 11) (0.6) (0.8) (0.1) –Tax charged to other comprehensive income– Pension asset on actuarial loss/(gain) – 5.4 (0.1) 0.2– Pension asset on additional contributions (1.7) (1.6) – –– Pension asset – effect of UK tax rate change within other comprehensive income (0.6) (0.6) – –– Employee benefits (0.5) (3.3) 0.2 (0.1)– Revaluations of available-for-sale investments (0.2) 0.2 – –– Movement on foreign exchange reserves – 0.1 – –Exchange movement (0.1) (0.1) – –Initial recognition of intangible assets (0.2) (0.2) – –At 31 December – asset 28.2 27.3 2.5 1.92011£mOur business Our governance Our resultsDeferred income tax assets have been recognised in respect of all tax losses and other temporary differences to the extent that therealisation of the related tax benefit through the future taxable profits is probable.As at the reporting date the Group did not recognise deferred tax income tax assets of £8.5m (2011: £8.1m) in respect of lossesamounting to £24.9m (2011: £24.8m) that can be carried forward against future taxable income. Losses amounting to £0.7m(2011: £1.2m) expire within 2 years, losses amounting to £1.1m (2011: £1.5m) expire between 3 and 8 years and the remaining lossof £23.1m (2011: £22.1m) remains available for offset indefinitely.Deferred tax assets – GroupAcceleratedcapitalallowances£mOtherincludingprovisions£mTax losses£mRetirementbenefits£mRevaluation£mEmployeebenefits£mAt 1 January 2011 1.0 6.4 4.0 6.1 – 8.0 25.5Amount credited/(charged) to income statement – 1.4 1.8 (0.3) – 1.9 4.8Effect of UK tax rate change within income statement (0.1) (0.4) – – – (0.2) (0.7)Tax charged to other comprehensive income – – – 3.8 – (3.3) 0.5Effect of UK tax rate change within other comprehensiveincome – – – (0.6) – – (0.6)Transfer (to)/from deferred tax liabilities – (0.3) – – 0.3 – –Exchange movement – – (0.1) – – – (0.1)At 31 December 2011 0.9 7.1 5.7 9.0 0.3 6.4 29.4Amount credited/(charged) to income statement(Note 11) 0.1 1.1 1.4 (0.3) – 2.1 4.4Effect of UK tax rate change within incomestatement (Note 11) – (0.3) – – – (0.4) (0.7)Tax charged to other comprehensiveincome (Note 11) – – – (1.7) (0.3) (0.5) (2.5)Effect of UK tax rate change within other comprehensiveincome (Note 11) – – – (0.6) – – (0.6)Exchange movement – 0.1 (0.2) – – – (0.1)At 31 December <strong>2012</strong> 1.0 8.0 6.9 6.4 – 7.6 29.9Total£m<strong>Savills</strong> <strong>plc</strong> <strong>Report</strong> and Accounts <strong>2012</strong> 97