BBSR 2001 Annual Report - Bermuda Institute of Ocean Sciences

BBSR 2001 Annual Report - Bermuda Institute of Ocean Sciences

BBSR 2001 Annual Report - Bermuda Institute of Ocean Sciences

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

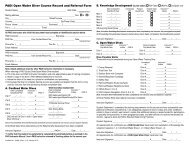

NOTES TO FINANCIAL STATEMENTS CONTINUED7. Sponsored ProjectsApproximately 45% and 50% <strong>of</strong> the Station’s operation revenues in <strong>2001</strong> and 2000, respectively, were awards for sponsored projects. The awards provide forrecovery <strong>of</strong> both direct and indirect costs. The indirect costs covered by the awards are generally determined as a negotiated or agreed-upon percentage <strong>of</strong> directcosts with certain exclusions. Indirect costs recovered from all sponsored projects during <strong>2001</strong> and 2000 were $992,274 and $1,133,614, respectively. Theserecoveries reduced management and general expenses as reported in the statement <strong>of</strong> activities.8. Investment Return and Spending PolicyThe Station’s Board <strong>of</strong> Trustees has authorized a policy permitting a spending rate <strong>of</strong> up to 5% <strong>of</strong> the average market value <strong>of</strong> its portfolio at the previous threefiscal year ends. This policy is designed to provide a predictable flow <strong>of</strong> funds to support operations. In <strong>2001</strong> and 2000 investment returns <strong>of</strong> $215,081 and$205,131, respectively, were spent for operations in accordance with this policy.The following summarizes the Station’s investment return and spending for the year ended December 31, <strong>2001</strong> and 2000:9. Contributions Receivable<strong>2001</strong>TemporarilyUnrestricted Restricted TotalInterest and dividends $ 53,815 $ 70,094 $ 123,909Net depreciation in fair value<strong>of</strong> investments (61,947) (77,317) (139,264)Net loss on investments $ (8,132) $ (7,223) $ (15,355)Investment return spenton operations $ 91,188 $ 123,893 $ 215,0812000TemporarilyUnrestricted Restricted TotalInterest and dividends $ 89,728 $ 195,217 $ 284,945Net depreciation in fair value<strong>of</strong> investments (53,933) (130,626) (184,559)Net return on investments $ 35,795 $ 64,591 $ 100,386Investment return spenton operations $ 105,114 $ 100,017 $ 205,131Contributions receivable at December 31, <strong>2001</strong> and 2000 are expected to be collected as follows:December 31<strong>2001</strong> 2000Amount expected to be collected in:One year or less $ ,762,861 $ ,664,920Years two through five ,874,667 ,691,339Thereafter ,010,000 ,015,0001,647,528 1,371,259Less discount (5% in <strong>2001</strong> and8% in 2000) to present value , (63,623) , (76,528)$ 1,583,905 $ 1,294,73130