annual-and-sustainability-report-2014

annual-and-sustainability-report-2014

annual-and-sustainability-report-2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

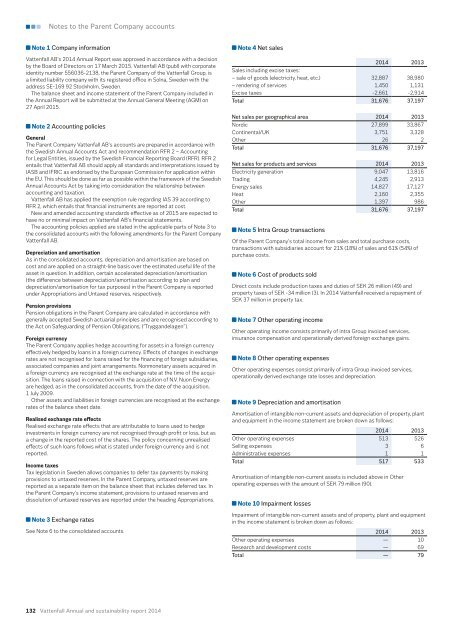

Notes to the Parent Company accountsNote 1 Company informationVattenfall AB's <strong>2014</strong> Annual Report was approved in accordance with a decisionby the Board of Directors on 17 March 2015. Vattenfall AB (publ) with corporateidentity number 556036-2138, the Parent Company of the Vattenfall Group, isa limited liability company with its registered office in Solna, Sweden with theaddress SE-169 92 Stockholm, Sweden.The balance sheet <strong>and</strong> income statement of the Parent Company included inthe Annual Report will be submitted at the Annual General Meeting (AGM) on27 April 2015.Note 2 Accounting policiesGeneralThe Parent Company Vattenfall AB’s accounts are prepared in accordance withthe Swedish Annual Accounts Act <strong>and</strong> recommendation RFR 2 – Accountingfor Legal Entities, issued by the Swedish Financial Reporting Board (RFR). RFR 2entails that Vattenfall AB should apply all st<strong>and</strong>ards <strong>and</strong> interpretations issued byIASB <strong>and</strong> IFRIC as endorsed by the European Commission for application withinthe EU. This should be done as far as possible within the framework of the SwedishAnnual Accounts Act by taking into consideration the relationship betweenaccounting <strong>and</strong> taxation.Vattenfall AB has applied the exemption rule regarding IAS 39 according toRFR 2, which entails that financial instruments are <strong>report</strong>ed at cost.New <strong>and</strong> amended accounting st<strong>and</strong>ards effective as of 2015 are expected tohave no or minimal impact on Vattenfall AB’s financial statements.The accounting policies applied are stated in the applicable parts of Note 3 tothe consolidated accounts with the following amendments for the Parent CompanyVattenfall AB.Depreciation <strong>and</strong> amortisationAs in the consolidated accounts, depreciation <strong>and</strong> amortisation are based oncost <strong>and</strong> are applied on a straight-line basis over the estimated useful life of theasset in question. In addition, certain accelerated depreciation/amortisation(the difference between depreciation/amortisation according to plan <strong>and</strong>depreciation/amortisation for tax purposes) in the Parent Company is <strong>report</strong>edunder Appropriations <strong>and</strong> Untaxed reserves, respectively.Pension provisionsPension obligations in the Parent Company are calculated in accordance withgenerally accepted Swedish actuarial principles <strong>and</strong> are recognised according tothe Act on Safeguarding of Pension Obligations, (“Trygg<strong>and</strong>elagen”).Foreign currencyThe Parent Company applies hedge accounting for assets in a foreign currencyeffectively hedged by loans in a foreign currency. Effects of changes in exchangerates are not recognised for loans raised for the financing of foreign subsidiaries,associated companies <strong>and</strong> joint arrangements. Nonmonetary assets acquired ina foreign currency are recognised at the exchange rate at the time of the acquisition.The loans raised in connection with the acquisition of N.V. Nuon Energyare hedged, as in the consolidated accounts, from the date of the acquisition,1 July 2009.Other assets <strong>and</strong> liabilities in foreign currencies are recognised at the exchangerates of the balance sheet date.Realised exchange rate effectsRealised exchange rate effects that are attributable to loans used to hedgeinvestments in foreign currency are not recognised through profit or loss, but asa change in the <strong>report</strong>ed cost of the shares. The policy concerning unrealisedeffects of such loans follows what is stated under foreign currency <strong>and</strong> is not<strong>report</strong>ed.Income taxesTax legislation in Sweden allows companies to defer tax payments by makingprovisions to untaxed reserves. In the Parent Company, untaxed reserves are<strong>report</strong>ed as a separate item on the balance sheet that includes deferred tax. Inthe Parent Company’s income statement, provisions to untaxed reserves <strong>and</strong>dissolution of untaxed reserves are <strong>report</strong>ed under the heading Appropriations.Note 3 Exchange ratesSee Note 6 to the consolidated accounts.Note 4 Net sales<strong>2014</strong> 2013Sales including excise taxes:– sale of goods (electricity, heat, etc.) 32,887 38,980– rendering of services 1,450 1,131Excise taxes -2,661 -2,914Total 31,676 37,197Net sales per geographical area <strong>2014</strong> 2013Nordic 27,899 33,867Continental/UK 3,751 3,328Other 26 2Total 31,676 37,197Net sales for products <strong>and</strong> services <strong>2014</strong> 2013Electricity generation 9,047 13,816Trading 4,245 2,913Energy sales 14,827 17,127Heat 2,160 2,355Other 1,397 986Total 31,676 37,197Note 5 Intra Group transactionsOf the Parent Company’s total income from sales <strong>and</strong> total purchase costs,transactions with subsidiaries account for 21% (18%) of sales <strong>and</strong> 61% (54%) ofpurchase costs.Note 6 Cost of products soldDirect costs include production taxes <strong>and</strong> duties of SEK 26 million (49) <strong>and</strong>property taxes of SEK -34 million (3). In <strong>2014</strong> Vattenfall received a repayment ofSEK 37 million in property tax.Note 7 Other operating incomeOther operating income consists primarily of intra Group invoiced services,insurance compensation <strong>and</strong> operationally derived foreign exchange gains.Note 8 Other operating expensesOther operating expenses consist primarily of intra Group invoiced services,operationally derived exchange rate losses <strong>and</strong> depreciation.Note 9 Depreciation <strong>and</strong> amortisationAmortisation of intangible non-current assets <strong>and</strong> depreciation of property, plant<strong>and</strong> equipment in the income statement are broken down as follows:<strong>2014</strong> 2013Other operating expenses 513 526Selling expenses 3 6Administrative expenses 1 1Total 517 533Amortisation of intangible non-current assets is included above in Otheroperating expenses with the amount of SEK 79 million (90).Note 10 Impairment lossesImpairment of intangible non-current assets <strong>and</strong> of property, plant <strong>and</strong> equipmentin the income statement is broken down as follows:<strong>2014</strong> 2013Other operating expenses — 10Research <strong>and</strong> development costs — 69Total — 79132 Vattenfall Annual <strong>and</strong> <strong>sustainability</strong> <strong>report</strong> <strong>2014</strong>