view - Western Desert Resources

view - Western Desert Resources

view - Western Desert Resources

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

WESTERNDESERTRESOURCESlimitedANNUAL REPORT 2010

CONTENTSPageChairman’s Report 1A B N 4 8 1 2 2 3 0 1 8 4 8Managing Director’s Report 2Re<strong>view</strong> of Exploration Projects 4Schedule of Tenements 15Financial Report 16Directors’ Declaration 72Independent Auditor’s Report 73ASX Additional Information 75Corporate Directoryinside cover

CHAIRMAN’SREPORTWESTERN DESERT RESOURCES LIMITEDDear fellow shareholders,The past year has been one ofcontrolled growth and consolidationfor your Company.As a result of Mick Billing’sresignation in January 2010, I wasasked to step up, in a caretaker’s role,to the position of Non ExecutiveChairman of the Company. It is a roleI have enjoyed immensely and I amgrateful for the support given by eachof the Directors. On behalf of theBoard, I wish to thank Mick Billing forhis contribution in assisting in theearly developmental stages of ourCompany as we began to establishcredibility in the market-place.In June of this year WDR furtherstrengthened our Board of Directorswith the appointment of Phil Lockyerwho brings to our company a wealthof experience, particularly in theestablishment of mining proceduresand infrastructure in new miningoperations. Welcome to Phil.During the year your Board has beenencouraged by the results of ourexploration activities, particularly atthe Roper Bar project, NorthernTerritory, cumulating in ourannouncement in the latter part of2009 in which an inaugural JORCcompliant mineral resource wasestablished from a very limiteddrilling season. It is expected to buildsolidly upon those results over thenext few months as further areas atRoper Bar are drilled and infilldrilling takes place.The major structural event that hasoccurred in the company’s operationsduring the year has been the buy-outof our Joint Venture partner, Itochu,in what is <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong>major focus, the Roper Bar project.We believe the buy-back will prove tobe of significant benefit to ourshare-holders as our drillingprograms continue to indicatematerial growth in our already proveniron ore resource. Somewhatunfortunately, the value of the buyback in our Balance Sheet does notreflect the exploration monies spentby Itochu on the project, due to theexisting Accounting Standards,however I feel sure that <strong>Western</strong><strong>Desert</strong> shareholders will certainlyreap the benefit of the low priced buyback in years to come.These are exciting times for ourcompany and we are now welladvanced in developing ourpre-feasibility study with initialprojections looking very good. OurManaging Director, Norm Gardnerwill elaborate on progress madeduring the year on both Roper Barand our other projects.To ensure your Company has thenecessary cash resources to meet itson-going commitments, amountstotalling $11.9 million, before costs,were raised during the year as newcapital. The make-up of this total wasthe successful renounceable rightsissue at 40 cents realizing $8.6 million,which closed in December 2009, withthe balance comprising the exerciseof options throughout the yearamounting to $2 million and aplacement to sophisticated investorsof $1.3 million during July, 2009.The Company is currently consideringoptions for new capital raisings to fundfurther exploration activity and thedevelopment of the Roper Bar projectfor 2011.The Company also raised $0.75 millionfrom the sale of its Manganesetenements during the year.Looking forward, the Company is alsoexamining the feasibility of splittingout our non iron ore projects fromWDR to enable WDR to concentrate onits primary objective of becoming amajor iron ore producer and exporter.This is still a work in progress and willultimately require shareholderapproval if it is to proceed.I wish to take this opportunity ofthanking our loyal and patientshareholders for your continuedsupport as the Company endeavoursto bring to you a worthy investmentproject.Finally, I wish to formally recognisethe outstanding contribution by ourMD, Norm Gardner, for his energeticendeavours in steering the companytowards its major goal of establishinga significant iron ore mine in the NT.My thanks also go to our explorationsupport team led by our ExplorationManager, John Fabray, and to ourCompany Secretary/Chief FinancialOfficer, Laurie Ackroyd and his team,for their tireless input behind thescenes.David ClokeActing Chairperson.1

MANAGINGDIRECTOR’SREPORTNorm GardnerManaging Director2010 is proving to be more of thesame as far as the market sentimentis concerned. However at <strong>Western</strong><strong>Desert</strong> <strong>Resources</strong> we are becomingvery confident in the ability of ourRoper Bar Iron Ore project to deliverup a mining prospect in the near future.We finished last calendar year with abang including excellent drillingresults and ultimately 3 resourcestotalling over 115,000,000 tonsincluding 7,000,000 tons of DirectShipping Ore from a very limiteddrilling program.WDR had a very successful underwrittencapital raising (renounceablerights issue) late last year offeringcurrent shareholders the opportunityto participate; the Company wasdelighted with the response andsupport shown with nearly 90%participation. Our timing was mostfortunate; for little did we know thenthat the Mining Industry as a wholewould get embroiled in the politicalturmoil surrounding the Government’splans to introduce significanttax imposts on the industry as itsreward for aiding the country insurviving the Global Financial Crisisvirtually unscathed. This has had astrong negative effect towardsinvestment across our industry. To bepositive however, I firmly believe thata solid project will receive marketsupport and I strongly feel that RoperBar will fall into that category.It was a long wait for WDR to get backinto our Roper Bar project area dueto an unusually long and late wetseason. However we have madehuge progress behind the scenes withdesktop studies. We have finalised andpresented a robust scoping study andfinancial model and are continuing tomake further progress relating tometallurgical test work.We have also secured additionalground adjacent to our MountainCreek iron ore project through a JointVenture with Tianda <strong>Resources</strong>(Australia) Pty Ltd.The big news for WDR this year is thebuyback of Roper Bar from Itochu;regaining 100% control enables us toconsolidate the Iron Ore assets andoffer a significantly larger package topotential investors. WDR has alsosecured the Marketing rights to theoff take which adds potentiallysignificant value to our project. Itwould be remiss of me not to publiclythank Itochu for their involvement ingetting the project underway and fortheir assistance by way of significantlyfunding the exploration costs alongthe way.This year we expect to prove upenough Direct Shipping Ore to give theconfidence to move full steam intoFeasibility Studies and progress fromexploration to development.Because of the high expectation fromdrilling we have committed toEnvironmental Studies and negotiationswith Traditional Owners forcompensation have started.Applications for Mining Leases havealso been submitted.2

WESTERN DESERT RESOURCES LIMITEDI would like to thank all of ourshareholders for their loyalty; it canbe a long time waiting for resultshowever we are using our bestendeavours to ensure we maintainsome continuity of news flow.I would also like to thank our staffand contractors who have continuedto provide great results during oftentrying times.For now it will be onwards andupwards as we continue to bring ourRoper Bar project towardsdevelopment and ultimately miningand export.ROPER BAR IRON ORE PROJECT - OUTCROP OF IRONSTONE AT AREA DNorm GardnerManaging DirectorAs at the time of writing this reportwe are starting to get an influx ofdrilling results that will ultimatelyextend all of our resource bases andadd new resources to areas previouslyuntested.There is no doubt that our project stillhas significant areas untested and wedo not yet know if we have tested allof the best areas of mineralisation;we have concentrated on outcroppingareas and will be looking at magneticdata from field work this year to plandrilling for the coming months.The Company is also looking forwardto further testing of Area’s A, B, C andthe Mountain Creek/ Tianda areas.There is expectation that these areas,as well as some under cover locations,have the capacity to significantlyenhance our resource base.WDR is also re<strong>view</strong>ing a number ofcorporate options to ensure ourshareholders get the best possibleexposure to value through our currentprojects. We will continue to look forprojects that will enhance our portfolioand investigate all opportunities forpotential growth in our main projectsRoper Bar and Mountain Creek.3

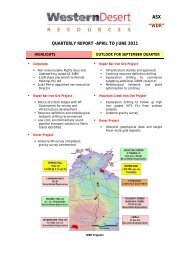

REVIEW OFEXPLORATIONPROJECTSROPER BARIRON ORE PROJECT(IRON ORE – NORTHERN TERRITORY)WDR Iron Ore Pty Ltd 100%The Roper Bar project consists of sixtenements (EL 24307, EL 24655, EL24944, EL 25672, EL 26759 and EL26992), which are located about300km east of Katherine and 40kmfrom the Gulf of Carpentaria.In July 2010 WDR purchased theItochu 20% interest for a cashconsideration of $2.75 million. Itochualso relinquished its marketing rightsas a result of the transaction. WDRcurrently owns 100% of the project.Hematite mineralisation occurswithin the Sherwin Formation (SIM)of the Mesoproterozoic Roper BarGroup. The mineralisation is hostedby oolitic sandstones and the SIM canbe up to 20m thick.LOCATION OF PRINCIPAL COMPANY INTERESTSLOCATION OF THE ROPER BAR IRON ORE PROJECT – NORTHEN TERRITORYThe micrograph shows a typicalsection from a hematitic mineralisedzone. The round oolitic grains areclearly visible surrounded by a matrixconsisting of quartz, fine hematiteand siderite.4

WESTERN DESERT RESOURCES LIMITEDThe exploration program for 2009included airborne magnetic surveys,gravity surveys, geological mappingand resource drilling.RC drilling commenced in the projectarea on 2nd July 2009 and finishedduring October 2009 with 303 holescompleted for a total of 10,760 metres.Drilling was carried out in Areas D, Eand F and resource estimates for theseareas were carried out by AMCConsultants Pty Ltd.The results of this work indicated thatthere was an Inferred Mineral Resourceof 117Mt at a grade of 39%Fe in thethree areas tested (see table below).Within the Inferred Mineral Resourceof 14Mt at 49%Fe at area F East thereis a higher grade DSO component of7Mt at 59%Fe.DEFINED MINERAL RESOURCES AT ROPER BAR PROJECTThe 2010 exploration program wasdelayed for a number of weeks due tolate heavy wet season rainfall whichdamaged the main unsealed accessroute to the site along the SavannahWay. Field activities commenced in lateJuly and drilling started in early August.Two RC percussion drilling rigs havebeen drilling resource definition holesin Area E South and on the westernend of Area F West.Gravity surveying has been completedover Area F West and Area E East. Theresults from the work in Area E Eastindicate that there is a prospective highgrade zone in the area which will betested by drilling this year.5

ROPER BARIRON ORE PROJECT(IRON ORE – NORTHERN TERRITORY)The planned drilling program ofapproximately 25,000 metres includesresource definition drilling in Areas FEast, E East, E South and D, andexploration drilling in Areas B, C andG. It is hoped that this work will lead toresource estimates in all of theseareas. The current exploration targetfor the Roper Bar project is 600-800 Mtat a grade of greater than 40%Fe.PROPOSED ROPER BAR EXPLORATION TARGETS FOR 20106

WESTERN DESERT RESOURCES LIMITEDROPER BAR IRON ORE PROJECT -TOWARDS THE FUTUREWhilst the study currently utilisesgrades and recovery as at the time ofwriting our report we expect that therewill be continuous improvement of theprocess which will significantly enhanceand optimise the financial modelassociated with the project.WDR is also progressing a number ofitems in parallel to ensure we canmeet our time lines; long lead itemssuch as Environmental Impact Studyhave commenced as have applicationsfor mineral leases over the mine siteand infrastructure areas. WDR willcontinue to keep shareholdersinformed as we meet milestone datesand further progress is achieved.A scoping study has been finalisedwhich defines the project into2 development stages.(a) Mining and trans-shipment ofDirect Shipping Ore (“DSO”) hasbeen determined and therequirements for site preparationand regional infrastructureidentified. <strong>Western</strong> <strong>Desert</strong> is nownegotiating compensationarrangements with the TraditionalOwners in conjunction with theNorthern Land Council. We havehigh expectation that timelines canbe reached with DSOexported within 2 years.(b) Initial capital and operating costsindicate a robust low capital entryinto the Iron Ore market.Infrastructure developed duringthis stage will be further utilisedwith the concept of introducing anIron Ore concentrate from lateryears during project development.The concept for ore beneficiation iscurrently undergoing trials. Individualcomponents of the process includinggravity separation and flotation havebeen applied with encouraging results.This process will be continually refinedover the next 6 months.MINERAL RESOURCEAt 30th June 2010 Inferred Mineral<strong>Resources</strong> at the Roper Bar Iron OreProject stood at:The Mineral <strong>Resources</strong> were calculatedat a lower 30% Fe cut-off.DEPOSIT TONNES Fe SiO2 P Al2O3 LOI(Mt) (%) (%) (%) (%) (%)Area D 90.7 37.2 31.5 0.008 3.15 9.6Area E 12.3 44.0 24.6 0.01 1.8 8.8Area F 14.2 49.5 22.0 0.01 3.2 2.5TOTAL 117.2 39.4 29.6 0.01 3.0 8.6The Mineral <strong>Resources</strong> statement is based on information compiled by SharronSylvester who is a full-time employee of AMC Consultants Pty Ltd and aMember of the Australian Institute of Geoscientists and has sufficientexperience that is relevant to the style of mineralisation and type of depositunder consideration to qualify as a Competent Person as defined in the JORCCode (2004). Sharron Sylvester consents to the inclusion of this information inthe form and context in which it appears.7

MOUNTAIN CREEKPROJECT(IRON ORE – NORTHERN TERRITORY)WDR Iron Ore Pty Ltd – 100% EL 27143,earning up to 70% in EL 25688 from Tianda<strong>Resources</strong> (Australia) Pty LtdThe Mountain Creek Project liesimmediately to the north west of theRoper Bar Iron Ore Project andconsists of one granted tenement (EL27143) owned 100% by WDR and EL25688 owned by Tianda Australia PtyLtd (Tianda) in which WDR can earn a70% interest.LOCATION OF MOUNTAIN CREEK AND TIANDA PROJECTSWork commenced on this new projectduring 2009. A detailed airbornemagnetic survey was flown and agravity survey was completed adjacentto the Hells Gate Hinge Line. A programof reconnaissance rock chip samplingand geological mapping was alsocarried out. Sherwin Formation (SIM)was identified and rock chip sampledin the south eastern part of EL 27143.Samples from zones of hematiticmineralisation returned values of up to62% Fe. The SIM was also identified bythe gravity and magnetic data.8

WESTERN DESERT RESOURCES LIMITEDAREA PROSPECTIVE FOR IRON ORE – MOUNTAIN CREEK PROJECTFurther work is planned for 2010 including an airborne magnetic survey over theTianda EL, extending the gravity surveys and exploratory RC percussion drilling ofthe SIM adjacent to the Hells Gate Hinge Line.9

ROVER PROJECT(GOLD/COPPER – NORTHERN TERRITORY)TNG Ltd 49% – WDR Base Metals Pty Ltd51% currently earning 80%The Rover Project is a joint venturebetween WDR Base Metals Pty Ltd(WDR) and Tennant Creek Gold Pty Ltd(TNG), in which WDR has currentlyearned 51% and has the right to earn80%. It covers an area of 3,100 squarekilometres south-west of TennantCreek, and includes granted licencesEL 24471 and EL 25581.During 2009 and 2010 explorationactivities were concentrated on EL25581 which is located immediatelyeast of the Rover 1 prospect owned byWestgold <strong>Resources</strong> Ltd.DIAMOND DRILLING AT EAST ROVER – JUNE 2010Rover 1 is a significant gold and copperdiscovery with a current JORC resourceof 2.4Mt (Indicated and Inferred) at4g/t Au and 1.5% Cu.Adelaide <strong>Resources</strong> Ltd are alsoexploring the Rover 4 prospect andhave recently announced intersectionsof 3m at 7.8 g/t Au and 1.3%Cu, and 3mat 1.4%Cu. The primary targets for theRover joint venture are ironstonedeposits similar to Rover 1 and Rover 4containing gold and copper.10

WESTERN DESERT RESOURCES LIMITEDLOCATION OF DRILLHOLES – EAST ROVERA drilling programme consisting ofseven RC percussion holes wascompleted in February 2010. Poorweather led to the work beingterminated early. Seven holes werecompleted with only three reaching theplanned target depths (holes ERRC001,3 and 7). The remaining 4 holesencountered very strong water flows inWiso Basin sediments which overliethe prospective Proterozoic rocks andcould not be finished to the planneddepths. Three holes (ERRC002, 005and 006) were deepened by diamonddrilling during May/June 2010. All ofthe holes intersected a similarsequence of volcanic or volcaniclasticorigin probably belonging to the FlynnSubgroup which is younger than theprospective Warramunga Formation.Interesting phosphate values werereported from the basal MontejinniLimestone in the Wiso Basin sequencewhich overlies the basement rocks inthis area. Values of up to 7m at 4.5%P2O5 from a downhole depth of 97m inhole ERRC005 were found. Furtherwork will be undertaken to discoverwhether economic zones of phosphatemineralisation occur close to thesurface within the Rover project.11

SPRING HILL PROJECT(GOLD – NORTHERN TERRITORY)WDR Gold Pty Ltd – 100%Gold Price - $Aus/Oz& $US/Oz16001400120010008006004002000Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10GOLD PRICE12The project consists of two grantedtenements (EL22957 and ML23812) andis located about 200km south east ofDarwin in the Top End of theNorthern Territory.Interest in the Spring Hill project hasincreased with the rise in the price ofgold to historical highs. Historicaltestwork suggested a reasonablerecovery using heap leach with orecrushed to 12mm. As new processes ingold leach technology evolve, the companycontinues to re<strong>view</strong> the options for optimalcommercialisation of the deposit.A program of reconnaissancescintillometer traversing wasundertaken over the Spring Hill project.Further work is warranted given theproximity of Spring Hill to theThundelarra discoveries and thesimilarity in the geology of the two areas.

WESTERN DESERT RESOURCES LIMITEDLIMBA PROJECT(URANIUM AND BASE METALS – NORTHERN TERRITORY)Red <strong>Desert</strong> Minerals Pty Ltd – 100%Red <strong>Desert</strong> Minerals Pty Ltd – 100%This project consists of one grantedexploration licences (EL 25402). Twotenements (EL 25373 and EL 25554)were surrendered during the year. Thearea is prospective for uranium andbase metals.An EM survey was flown with ahelicopter-based GeosolutionsREPTEM time domain system onnorth-south lines spaced at 200m overthe northern part of EL 25402. Theaim of the survey was to delineate anybedrock conductors associated withsulphide mineralisation within theIllogwa Schist Zone. This major shearzone is located in the northern part ofthe EL and is 3km wide and strikeseast-west for a distance of morethan 25km.Mithril <strong>Resources</strong> Ltd have used EMmethods to locate zones of sulphidemineralisation on their adjoiningtenements to the east of EL 25402.Further work is required to test the EMtargets delineated by the survey.13

MUSGRAVE PROJECT(BASE METALS/GOLD – NORTHERN TERRITORY)Joint venture with various partiesThe Musgraves project consists offarm-in agreements over six explorationlicence applications owned by TNG Ltdand Ferrum Crescent Ltd (formerlyWashington <strong>Resources</strong> Ltd). Thesetenements are located on AboriginalFreehold land in the south westerncorner of the Northern Territory.Initial meetings were held with theTraditional Owners at Mutitjulu andDocker River during the year andpreliminary indications are that therewill be approval for access negotiationsto take place.Unless otherwise stated the informationin this report that relates to ExplorationResults, Mineral <strong>Resources</strong> or OreReserves is based on informationcompiled by John Fabray who is amember of the Australasian Instituteof Mining and Metallurgy. Mr Fabray isa full time employee of <strong>Western</strong> <strong>Desert</strong><strong>Resources</strong> Ltd and has sufficientexperience relevant to the styles ofmineralisation under considerationand to the subject matter of the reportto qualify as a Competent Person asdefined in the 2004 edition of theAustralasian Code for the Reporting ofExploration Results, Mineral <strong>Resources</strong>and Ore Reserves (JORC code). MrFabray consents to the inclusion in thereport of the matters based on hisinformation in the form and context inwhich they occur.Information in this report describinghistorical production figures andassays has been derived from open filecompany reports in the public domain.14

WESTERN DESERT RESOURCES LIMITEDProject Name Tenement Tenement Name Area Registered Holder or Nature & % JointSq km Applicant Company's Interest Venture PartnerRoper Bar EL 24307 Roper Bar North 278.50 WDR Iron Ore Pty Ltd 100%Roper Bar EL 24665 Roper Bar Ext. 610.00 WDR Iron Ore Pty Ltd 100%Roper Bar EL 24944 Roper Bar East 392.30 WDR Iron Ore Pty Ltd 100%Roper Bar EL 25672 Roper Bar 1 129.20 WDR Iron Ore Pty Ltd 100%Roper Bar EL 26759 St.Vidgeon Sth 767.90 WDR Iron Ore Pty Ltd 100%Roper Bar EL 26992 Roper Bar South 99.19 WDR Iron Ore Pty Ltd 100%Mountain Creek EL 27143 Mountain Creek 1026.94 WDR Iron Ore Pty Ltd 100%Tianda JV EL 25688 Tianda 99.47 Tianda <strong>Resources</strong> (Aust) 0 (a) Tianda <strong>Resources</strong> (Aust)Pty LtdPty LtdRover JV EL 24471 Explorer 913.43 TNG Limited 51% (b) TNG LimitedRover JV EL 25581 Rover 1170.00 TNG Limited 51% (b) TNG LimitedRover JV ELA 25882 McLaren Creek 1207.00 TNG Limited 51% (b) TNG LimitedRover JV ELA 25587 Gosse River 82.00 TNG Limited 51% (b) TNG LimitedNuPower JV EL 25338 Burt Plain 405.80 WDR Base Metals Pty Ltd 100% NuPower <strong>Resources</strong> LtdNuPower JV EL 25657 Clough's Dam 672.40 WDR Base Metals Pty Ltd 100% NuPower <strong>Resources</strong> LtdLimbla EL 25402 Limbla 4 364.80 Red <strong>Desert</strong> Minerals Pty Ltd 100%Spring Hill MLN 23812 Spring Hill ML 10.35 WDR Gold Pty Ltd 100%Spring Hill EL 22957 Spring Hill EL 36.57 WDR Gold Pty Ltd 100%Tennant Creek MLC 624 Hopeful Star 0.05 WDR Gold Pty Ltd 100%Tennant Creek MLC 632 Hopeful Star 0.03 WDR Gold Pty Ltd 100%Tennant Creek MLC 625 Golden Mile 0.08 WDR Gold Pty Ltd 100%Tennant Creek MCC 1035 M18 0.18 WDR Gold Pty Ltd 100%Tennant Creek MCC 1112 M19 0.34 WDR Gold Pty Ltd 100%Tennant Creek MCC 1113 M19 0.40 WDR Gold Pty Ltd 100%Tennant Creek MCC 1117 M19 0.40 WDR Gold Pty Ltd 100%Tennant Creek MCC 1118 M19 0.36 WDR Gold Pty Ltd 100%Tennant Creek MCC 1119 M19 0.16 WDR Gold Pty Ltd 100%Tennant Creek MCC 1120 M19 0.25 WDR Gold Pty Ltd 100%Tennant Creek MCC 1040 M20 0.20 WDR Gold Pty Ltd 100%Tennant Creek MCC 1041 M20 0.30 WDR Gold Pty Ltd 100%Tennant Creek MCC 1089 M29 0.36 WDR Gold Pty Ltd 100%Tennant Creek MCC 1090 M29 0.40 WDR Gold Pty Ltd 100%Tennant Creek MCC 1091 M29 0.40 WDR Gold Pty Ltd 100%Tennant Creek MCC 1092 M29 0.40 WDR Gold Pty Ltd 100%Tennant Creek MCC 1093 M29 0.40 WDR Gold Pty Ltd 100%Tennant Creek MCC 1094 M29 0.40 WDR Gold Pty Ltd 100%Tennant Creek MCC 1095 M29 0.40 WDR Gold Pty Ltd 100%Antrim 5 EL 27458 Beetaloo 544.00 WDR Base Metals Pty Ltd 100%Antrim 5 EL 27459 Toudinny Creek 544.00 WDR Base Metals Pty Ltd 100%Antrim 5 EL 27475 Bundara Creek 543.00 WDR Base Metals Pty Ltd 100%Antrim 8 EL 27472 Larrimah East 395.00 WDR Gold Pty Ltd 100%Antrim 8 EL 27473 Maryfield East 297.00 WDR Gold Pty Ltd 100%(a) The company has the right to earn up to a 70% interest in the project.(b) The Company is earning the right to earn an 80% interest and has met the 51% milestone target and that interest is to transferred to the company.15

FINANCIALREPORTFor year ended 30 June 2010CONTENTSPageDirectors’ Report 17Auditor’s Independence Declaration 32Corporate Governance Statements 33Consolidated Statementof Comprehensive Income 37Consolidated Statement of Financial Position 38Consolidated Statement of Change in Equity 39Consolidated Statement of Cash Flows 41Notes to Financial Statements 42Directors’ Declaration 72Independent Auditor’s Report 73ASX Additional Information 7516

WESTERN DESERT RESOURCES LIMITEDDIRECTORS’ REPORTThe Directors present this directors report and theattached annual financial report of <strong>Western</strong> <strong>Desert</strong><strong>Resources</strong> Limited for the financial year ended 30 June2010. In order to comply with the provisions of theCorporations Act 2001, the Directors report as follows:Directors and OfficersThe names and details of the directors and officers ofthe company during or since the end of the financialyear are:David John Cloke FCA - Non-Executive Director andappointed Chairman 20th January 2010David is a founding Director of the company, and wasCompany Secretary until June 2007. He was a partnerwith Deloitte’s for 30 years and has had over 40 years’experience in the accounting profession in Australia andCentral Africa. He was Managing Partner of Deloitte’sthree offices in the Northern Territory and a member ofthat partnership’s national management board inAustralia. He has a strong audit background and was thelead partner responsible for the audits of national andinternational mining companies.He is Finance Director for a substantial propertycompany in the Northern Territory.Norm has an in depth knowledge of the constructionrequirements of the mining industry. He has also beeninvolved in a number of successful property developments.He is also a director of AIM and ASX listed company ThorMining PLC.Graham John Bubner BSc (Hons)Non-Executive DirectorGraham is a founding Director of the company. Grahamgraduated from Adelaide University with a doublegeology/geophysics degree in 1976, and a first classHonors’ degree in geophysics the following year. Hegained experience in exploration for multiple commoditiesincluding base metals, precious metals, uranium,diamonds, iron ore and coal throughout west-centralAustralia with CRA Exploration Pty Ltd for 16 years.During this time he participated in major discoveries,such as diamonds at Argyle and uranium at Kintyre.Four years in the Middleback Ranges on Eyre Peninsulawith first BHP Billiton Limited and then Onesteel Limitedafforded specific experience in exploration for iron ore.He is a member of the Australian Society of ExplorationGeophysicists, Society of Economic Geologists and theAustralian Institute of GeoscientistsMichael Robert Billing BBus ASANon-Executive Chairman (Resigned 13th January, 2010)Mick Billing was appointed a director in February 2007.Mr Billing resigned his position as a director andChairman on 13th January, 2010.Norman Wayne GardnerManaging DirectorNorm Gardner is a founding Director of the company,which was incorporated in October 2006. Norm establishedand is sole owner of a concrete construction businessbased in the Northern Territory. His company has beeninvolved in significant mining projects in the NorthernTerritory, South Australia and <strong>Western</strong> Australia,including development and operation of the backfillplant at the Granites Gold Mine.17

DIRECTORS’ REPORTMichael Kevin AshtonNon-Executive DirectorMick was a founding Director of the company and heldthis position until April 2007. He was appointed analternate Director of the company in May 2007, and wassubsequently appointed a Director of the company inAugust 2008. He owns a timber manufacturing businesslocated in South Australia and is a major shareholder ina successful exploration drilling company located inVictoria, which has both Australian and internationalactivities. Mick has extensive knowledge and experiencein the exploration and mining industries, which datesback 40 years.He is also a director of AIM and ASX listed companyThor Mining PLC.Phillip Clive LockyerNon Executive Director (Appointed 1st June, 2010)Phil Lockyer has more than 40 years experience in theminerals industry and has held managerial positions innickel, gold, lead and zinc operations, includingmanagerial positions with WMC <strong>Resources</strong> Limited; asExecutive Director of Operations and Projects forDominion Mining Limited; and as Executive Director ofOperations for Resolute Limited. A graduate from theWA School of Mines (Mining Engineering) and the formerBallarat School of Mines (Metallurgy), Mr Lockyer iscurrently Chairman of the Minerals and Energy ResearchInstitute of W.A. and is non-executive Director ofSt Barbara Limited, Focus Minerals Limited, CGA MiningLimited and Swick Mining Services Limited.Laurie AckroydChief Financial Officer/Company SecretaryMr. Laurie Ackroyd was appointed as Chief FinancialOfficer and Company Secretary in April 2009. Laurie is anaccountant with over 45 years experience in the buildingservices, manufacturing and transportation industrieswhere he has held Director and Senior financial executiveand Company Secretarial positions.Mr Ackroyd also carries out the role of Chief FinancialOfficer and Company Secretary for Thor Mining PLC,which is listed on the United Kingdom AlternativeInvestment Market (“AIM”) and the ASX, pursuant to aservices agreement between the <strong>Western</strong> <strong>Desert</strong><strong>Resources</strong> Limited and Thor Mining PLC.Directorships of other listed companiesName Company Period of DirectorshipN W Gardner Thor Mining PLC Since April 2008M K Ashton Thor Mining PLC Since April 2008P C Lockyer St Barbara Limited Since December 2006Focus Minerals Limited Since December 2005CGA Mining Limited Since January 2009Swick Mining Services Limited Since February 2008Mr Lockyer is a Chartered Professional (Management) ofthe Australian Institute of Mining and Metallurgy and aFellow of the Australian Institute of Company Directors.He will stand for election as a Director of WDR at theCompany’s AGM to be held in November, 2010.18

WESTERN DESERT RESOURCES LIMITEDPrincipal ActivitiesThe principal continuing activity of the consolidated entityis the exploration for iron ore, gold, base metals, uraniumand other economic mineral deposits, and thedevelopment of Mining Operations at the Roper Barproject, Northern Territory.Financial ResultsThe net result of operations for the year was a loss afterincome tax of $2,034,540 (2009: $7,078,377).DividendsNo dividends were paid or declared since the start of thefinancial year, and the Directors do not recommend thepayment of dividends in respect of the financial year.Re<strong>view</strong> of Operationsa) Over<strong>view</strong>During the year the consolidated entity carried outexploration on its tenements and applied for oracquired additional tenements with the objective ofidentifying iron ore, manganese, uranium, gold,base metals and other economic mineral deposits.In respect of the Roper Bar, Northern Territory ironore project the consolidated entity has sought toquantify the level of resources located to date at theproject site and to commence preliminary work todevelop a mining and exporting operation.b) Re<strong>view</strong> of Operations durring the yearIn August 2009 the consolidated entity announcedthe first of a number of Drill results which confirmedextensive hematitic Ironstone mineralisation fromArea D at the Roper Bar project, Northern Territory.A few days later the consolidated entity furtherannounced significant high grade assay results fromArea F, Roper Bar project which gave the firstindication of possible Direct Shipping Ore from withinthe project area.In September 2009 the consolidated entity advisedthat new drill results from Area D confirmed acontinuation of the extensive hematitic ironstonemineralisation at the Roper Bar Iron Ore project andfurther intersections of Direct Shipping Ore.The same month the consolidated entity announced amajor expansion of its Northern Territory Iron Orefootprint which had been expanded by the gaining ofthe 1,000 square kilometer Mountain Creek explorationlicense EL27143 which is situated to the north west ofthe emerging Roper Bar project, on the <strong>Western</strong> edgeof the Gulf of Carpentaria.During October 2009, the consolidated entityannounced new drilling and assay results that againextended the high grade mineralisation in Area F ofthe Roper Bar project. Further good news followedfrom the initial results obtained from Area E of theproject with the locating of significant intersections ofhematite mineralisation which demonstrated a levelof thickness greater than observed in previousdrilling. In a most successful month for the companyon 20th October 2009 the consolidated entityannounced a 90 million tonne inaugural JORCcompliant mineral resource estimate from the verylimited areas drilled and assayed to date. Additionalannouncements to the market kept investorsinformed of additional drilling results through toDecember, 2009.In late December, 2009 the combined JORC compliantresource from Areas D, E and F was increased to 116million tones.The consolidated entity announced that it would sellits 45% interest in Manganese exploration tenementsat Gladstone, Queensland and at McArthur River,Northern Territory to Genesis <strong>Resources</strong> Limited fora cash consideration of $750,000 concluding the saleon 26th November 2009.19

DIRECTORS’ REPORTb) Re<strong>view</strong> of Operations ... continuedWith the need to develop the Roper Bar project areaadditional funding of the consolidated entity wasrequired. The consolidated entity announced itsintentions to the market on 9th November 2009 byinforming that a renounceable pro-rata rights issueentitlement would be made to all shareholders onthe basis of one new share for every five shares heldon the record date. Pricing was set at 40 cents pershare which represented a 32% discount to thevolume weighted average price during the 5 tradingdays prior to the announcement. Documents toshareholders were mailed on 30th November2009.The rights issue was most successful in that21,380,713 new shares were issued pursuant to therights issue raising over $8.5 million. In addition, topermit the holders of options to participate in therights issue, further monies were received for theexercise price. All monies were received prior to theChristmas break and the new shares were listed fortrading immediately after Christmas. The Directorsappreciated the level of support shown by existingshareholders with valid acceptances for over 85% ofthe rights entitlements. <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong>Limited also received a significant number ofapplications for the shortfall comprising of 8,249,282shares. Due to the high level of support for the rightsissue the shortfall applications were largely unableto be accommodated and the additional monies werereturned to shareholders just prior to Christmas.In December 2009 the consolidated entity announcedthat significant rock chip results had been receivedfrom the Mountain Creek project giving furtherencouragement to increasing the level of resourcewithin the Roper Bar iron ore province.Work commenced on the East Rover Gold/Copperproject near Tennant Creek during December 2009 inpreparation for drilling late January 2010.Subsequently, adverse weather conditions led to anearly termination of the program following thetesting of seven magnetic targets. A further diamonddrilling program commenced in June, 2010.20The New Year brought the resignation of theconsolidated entity’s inaugural chairman Mr. MickBilling who wished to pursue personal interestselsewhere. The Board of Directors conveyed theirthanks and appreciation to Mick for his guidance andleadership over the previous 3 years and in particularthe transition of the consolidated entity through theIPO process.The consolidated entity announced in February, 2010that it has entered into a contractual relationship withTianda <strong>Resources</strong> (Australia) Pty Ltd for a farm-inand joint venture over Exploration License 25688. TheTianda tenement is strategically close to WDR’sMountain Creek iron ore project. The agreementprovides for WDR to spend $850,000 on explorationwithin 3 years. On successful completion of the farm-inWDR will acquire a 70% interest in the tenement anda joint venture is to be formed.In early May, 2010 <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong>announced a significant step in its history in that ithad negotiated to buy back the 20% interest owned byItochu of the Roper Bar iron ore project tenementsallowing WDR to regain 100% control. Theconsideration of $2.75 million was payable in cashand subsequently settled on 16th June, 2010.During the year of re<strong>view</strong> the consolidated entity hascontinued exploration for gold, base metals anduranium on tenements at its Spring Hill and Limblaproject areas in the Northern Territory.Mr. Phil Lockyer, a highly experienced metallurgistand mining executive, was appointed to the Board on1st June, 2010 as a non-executive Director and willtake a special interest in the development of theRoper Bar iron ore project.The consolidated entity continues to hold itsinvestment in Thor Mining PLC. While Thor continuesto hold its flagship project, the Molyhil molybdenum/tungsten deposit some 220 kilometres north east ofAlice Springs, it has added to its portfolio with a 51%interest in the Dundas Gold project situated withinthe Albany-Fraser Province at the margin of <strong>Western</strong>Australia’s gold rich Archaean Yilgarn Craton.The Chairman’s report and the Managing Director’s reportare contained in the Annual Report and contain acomprehensive re<strong>view</strong> of operations.

WESTERN DESERT RESOURCES LIMITEDChanges in State of AffairsDuring the financial year there was no significant changein the state of affairs of the consolidated entity other thanthat referred to in the financial statements or notesthereto.Subsequent EventsIn late July, 2010 the Company informed the market ofits drilling plans for the season ahead at the Roper Barand Mountain Creek iron ore projects. The drillingprogram had been considerably delayed due to extremewet conditions earlier in the year which washed outroads and restricted access to site.At the date these financial statements were approved,the Directors were not aware of any significant postbalance sheet events other than those set out in thenotes to the financial statements. The company hasmade announcements since the close of the financialyear of drilling activities and results in the normalcourse of business and as required pursuant to the ASXrules and disclosure obligations.Environmental DevelopmentsThe consolidated entity carries out exploration activitieson its properties in the Northern Territory. No miningactivity has been conducted by the consolidated entity onits properties. The consolidated entity’s exploration operationsare subject to environmental regulations underthe various laws of, the Northern Territory and theCommonwealth. While its exploration activities to datehave had minimal environmental impact, the consolidatedentity has adopted a best practice approach in satisfactionof the regulations of relevant government authorities.Future DevelopmentsDisclosure of information regarding likely developmentsin the operations of the consolidated entity in futurefinancial years and the expected results of thoseoperations is likely to result in unreasonable prejudice tothe consolidated entity. Accordingly, this information hasnot been disclosed in this report.Directors and Officers ShareholdingsThe following table sets out each director and officer’srelevant interest in shares in the company as at the dateof this report.Listed Options Unlisted OptionsFully paid to acquire to aquireDirectors & ordinary shares ordinary shares ordinary sharesOfficers Number Number NumberD J Cloke 2,426,998 126,363 1,000,000-N W Gardner 6,621,966 - 1,000,000G J Bubner 4,209,191 249,760 1,000,000P C Lockyer - - -M K Ashton 14,056,440 354,611 1,000,000L Ackroyd - - 700,00027,314,595 730,734 4,700,000The above table includes shares held by related parties of directors.Share options granted to directors and seniormanagementDuring and since the end of the financial year anaggregate 1,200,000 share options were granted to thefive highest remunerated officers of the company(Directors: nil) as part of their remuneration:Number ofDirectors Number ordinaryand Senior of options shares undermanagement granted Issuing entity optionSenior ManagementJ F Fabray 200,000 <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Ltd 200,000R Howard 500,000 <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Ltd 500,000B Sando 200,000 <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Ltd 200,000C Gaughan 100,000 <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Ltd 100,000L Ackroyd 200,000 <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Ltd 200,000Remuneration Report (Audited)This report outlines the remuneration arrangements inplace for directors and other key management personnelof <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Limited.21

DIRECTORS’ REPORTDirector and other Key Management Personnel DetailsThe following persons acted as Directors of the companyduring the financial year:D J Cloke (Non-executive Director and appointedActing Chairman 20th January 2010)M R Billing (Non-executive Chairman)Resigned 13th January, 2010N W Gardner (Managing Director)G J Bubner (Non-executive Director)P C Lockyer (Non-executive Director)Appointed 1st June, 2010M K Ashton (Non-executive Director)The following persons are Key Management Personnel ofthe Company:J F Fabray (Exploration Manager)R L Howard (Project Manager – Iron Ore)Appointed 23rd November 2009B G Sando (Supervising Geologist)C J Gaughan (Senior Project Geologist)L Ackroyd (Chief Financial Officer / CompanySecretaryRelationship between the Remuneration Policy andCompany PerformancesThere is no link between the consolidated entity’sperformance and the setting of remuneration except asdiscussed below in relation to options granted to directorsand key management personnel. No bonuses have beenpaid by the consolidated entity during the year.Remuneration PhilosophyThe performance of the consolidated entity relies on thequality of its Directors and other key managementpersonnel and therefore the consolidated entity mustattract, motivate and retain appropriately qualifiedindustry personnel.The consolidated entity embodies the following principleswithin its remuneration framework:• provide industry competitive rewards to attract andretain high calibre Directors and key managementpersonnel;• link executive rewards to shareholder value (by thegranting of options); and• ensure total remuneration is competitive by marketstandards.Performance is measured through the monitoring ofachievement goals set by the Directors from time to timewhich include, but are not limited to, financial budgets,exploration work carried out and other key strategicoutcomes.Compensation PolicyDue to its size, the consolidated entity does not have aremuneration committee. The compensation of executivesand non-executive Directors is re<strong>view</strong>ed by the Boardwith the exclusion of the Director concerned. Thecompensation of other key management personnel isre<strong>view</strong>ed by the Board.The Board assesses the appropriateness of the natureand amount of remuneration of such persons on a periodicbasis by reference to relevant employment marketconditions with the overall objective of ensuring maximumshareholder benefit from retention of high quality directorsand other key management personnel. External adviceon remuneration matters is sought whenever the Boarddeems it necessary.Performance ConditionsPerformance conditions are determined by the Directorsin consultation with the Managing Director. The Directorshave determined that after consideration of industrypractice in circumstances where recognition of soundachievement should not only be recognised but alsowarrants further incentive, the Board considers thegranting of non-listed options to Directors and other keymanagement personnel as responsible practice.22

WESTERN DESERT RESOURCES LIMITEDThe table below sets out summary information about theconsolidated entity’s earnings and movements inshareholders wealth for the four years since incorporation.30 June 2010 30 June 2009 30 June 2008 30 June 2007Revenue - - - -Net loss before tax $2,034,540 $7,078,377 $3,025,962 $68,859Net loss after tax $2,034,540 $7,078,377 $3,229,820 $68,859Share price at start of year $0.12 $0.22 $0.24 -Share price at end of year $0.31 $0.12 $0.22 $0.24Basic earnings per share in cents (1.60) (8.40) (4.93) (2.03)Diluted earnings per share in cents (1.60) (8.40) (4.93) (2.03)Non-executive Director RemunerationThe Board seeks to set remuneration of non-executiveDirectors at a level which provides the company with theability to attract and retain high calibre Directors, whilstincurring a cost which is appropriate at this stage of thecompany’s development. Currently, the Directors fee isset at $45,000 per annum plus the statutory superannuationcontribution. In addition certain Directors receiveamounts as set out in consultancy agreements with theconsolidated entity and a related entity associated withthose Directors. Details of service agreements with allnon-executive Directors are set out below.In addition, non-executive Directors are entitled to be paidreasonable travelling, accommodation and other expensesincurred as a consequence of their attendance at meetingsof Directors or otherwise in the execution of their dutiesas Directors.Managing Director and RemunerationThe company aims to reward the Managing Director witha level and mix of remuneration commensurate with hisposition and responsibilities within the consolidatedentity to:• align the interests of the Managing Director withthose of shareholders; and• ensure total remuneration is competitive by marketstandards.standards.The company also has a services agreement with arelated entity associated with and controlled byMr. N W Gardner, detail of which is set out in the ServicesAgreement section.23

DIRECTORS’ REPORTSummary of amounts paid to Key Management PersonnelThe following table discloses the compensation of thekey management personnel of the Group during the year.2010 Consultancy Salary and Post Employment Share Options Exercise Price Expiry Date Options Totalfor Personal Fees. Superannuation Granted during (based upon Benefit.Services the year* Black-Scholesformula)*$ $ $ No. $ Date $ $Directors:M R Billing 92,750 25,229 2,271 - - - - 120,250N W Gardner 184,575 45,128 3,545 - - - - 233,248G J Bubner 169,464 38,555 3,470 - - - - 211,489D J Cloke - 39,055 3,515 - - - - 42,570M K Ashton - 38,555 3,470 - - - - 42,025P C Lockyer - 3,750 338 - - - - 4,088Key Personnel:J F Fabray - 187,500 16,875 200,000 0.60 31/12/12 38,340 242,715R Howard - 97,026 8,732 500,000 0.60 31/12/12 95,300 201,058B Sando - 96,667 8,700 200,000 0.60 31/12/12 45,100 150,467C Gaughan - 146,991 13,229 100,000 0.60 31/12/12 19,170 179,390L Ackroyd - 157,500 14,175 200,000 0.60 31/12/12 38,340 210,0152010 Total 446,789 875,956 78,320 1,200,000 236,250 1,637,315*Options are granted at an exercise price above the existing share price as at the dateof grant. The value of options granted during the period has been calculated byreference to the Black-Scholes formula method.Amounts paid to Directors in the above table include amounts paid pursuant to ServiceAgreements which is also identified separately under the heading of “Service Agreements”and which is paid to related parties of the Directors.No Director or Senior Management person appointed during the period received apayment as part of their consideration for agreeing to hold the position.24

WESTERN DESERT RESOURCES LIMITED2009 Consultancy Salary and Post Employment Share Options Exercise Price Expiry Date Value of Options TotalFees. Superannuation Granted during (based upon Benefitthe year*Black-Scholesformula)*$ $ $ No. $ Date $ $Directors:M R Billing 96,520 47,800 4,541 - - - 188,798 337,659N W Gardner 190,650 - - - - - 188,798 379,448A W Mackie 60,000 2,676 241 - - - - 62,917G J Bubner 133,125 32,110 2,890 - - - 188,798 356,923D J Cloke 3,500 36,190 2,890 - - - 188,798 231,378M K Ashton - 29,434 2,650 - - - 188,798 220,882Key Personnel:J F Fabray - 175,000 15,750 500,000 0.18 30/09/11 63,650 254,400R Howard - - - - - - - -B Sando - - - - - - - -C Gaughan - 102,050 9,184 400,000 0.18 30/09/11 17,920 129,154L Ackroyd - 31,417 2,828 500,000 0.11 23/04/12 43,650 77,895M J Kitchin 54,225 - - - - - - 54,2252009 Total 538,020 456,677 40,974 1,400,000 1,069,210 2,104,881*Options are granted at an exercise price above the existing share price as at the dateof grant. The value of options granted during the period has been calculated by theBlack-Scholes formula method.Amounts paid to Directors in the above table included amounts paid pursuant toService Agreements which are also identified separately under the heading of “ServiceAgreements” and which is paid to related parties of the Directors.Service AgreementsThe consolidated entity entered into service agreementswith Messrs Billing, Gardner, Bubner, Mackie, Kitchenand Cloke on 2 May 2007. These agreements have no fixedterm and may be terminated by either party giving threemonths notice in writing. There are no minimum paymentsspecified in the agreements.Details of payments, which are made to related entitiescontrolled by Director and Officers, pursuant to serviceagreements during the year are set out below:Director Current Terms Amount paid or Amount paid orpayablepayable2010 2009$ $M R Billing $1000 per day for each day in excess of 2 days within a month 92,750 96,520N W Gardner $1200 per day for each day in excess of 2 days within a month 184,575 190,650G J Bubner $1200 per day for each day in excess of 2 days within a month 169,464 133,125D J Cloke $1200 per day for each day in excess of 2 days within a month - 3,500A W Mackie - - 60,000SecretaryM J Kitchin - - 54,225Total 446,789 538,020The payments reported above are also shown inNote 26 – Related party disclosures25

DIRECTORS’ REPORTEmployee share option plan<strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Limited operates anownership-based scheme for executives and senioremployees of the consolidated entity. In accordance withthe provision of the plan, as approved by shareholders ata previous annual general meeting, executives and senioremployees with the consolidated entity may be grantedoptions to purchase parcels of ordinary shares at anexercise price as determined at the time by the directors.Each employee share option converts into one ordinaryshare of <strong>Western</strong> <strong>Desert</strong> Australia Limited on exercise.No amounts are paid or payable by the recipient onreceipt of the option. The options carry neither rights todividend nor voting rights. Options may be exercised atany time from the date of vesting to the date of their expiry.The number of options granted is calculated in accordancewith the performance based formula approved byshareholders at a previous annual general meeting. Theoptions granted expire within 2 to 4 years of their issue,or one month of the resignation of the executive or senioremployee, whichever is the earlier.During the financial year, the following share-basedpayment arrangements were in existence.Options series Grant date Expiry date Quantity Grant date Vesting datefair value(1) Issued 31 March 2009 31 March 2009 30 September 2011 300,000 0.0448 Vests at date of grant(2) Issued 27 April 2009 27 April 2009 23 April 2012 500,000 0.0873 Vests at date of grant(3) Issued 20 November 2009 20 November 2009 31 December 2012 200,000 0.2255 Vests at date of grant(4) Issued 16 December 2009 16 December 2009 31 December 2012 500,000 0.1906 Vests at date of grant(5) Issued 20 January 2010 20 January 2010 31 December 2012 600,000 0.1917 Vests at date of grantThere are no further services or performance criteriathat need to be met in relation to options granted underservices (1) - (5) before the benefit interest vests inthe recipient.26

WESTERN DESERT RESOURCES LIMITEDThe following grants of share-based payment compensation to senior management relate to the current financial year:During the financial year% ofName Option series No. granted No. vested % of grant % of grant compensation forvested forfeited the yearconsistingof optionsJ F Fabray (5) Issued 20 January 2010 200,000 200,000 100 0 15.8%R Howard (4) Issued 16 December 2009 500,000 500,000 100 0 47.4%B Sando (3) Issued 20 November 2009 200,000 200,000 100 0 30.0%C Gaughan (5)Issued 20 January 2010 100,000 100,000 100 0 10.7%L Ackroyd (5)Issued 20 January 2010 200,000 200,000 100 0 18.3%During the year, the following directors and senior management exercised options that were granted to them as part oftheir compensation. Each option converts into one ordinary share of <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Limited.Name No. of options exercised No. of ordinary shares Amount paid Amount unpaidof <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong>Limited issuedDirectors:M R Billing 1,583,334 1,583,334 $ 283,924 $nilG J Bubner 583,333 583,333 $121,774 $nilD J Cloke 583,333 583,333 $121,774 $nilM K Ashton 583,333 583,333 $145,833 $nilNW Gardner 963,599 963,599 $214,282 $nilKey Personnel:J F Fabray 700,000 700,000 $111,075 $nilC Gaughan 100,000 100,000 $18,000 $nil27

DIRECTORS’ REPORTThe following table summarises the value of optionsgranted, exercised or lapsed during the financial yearto directors and senior management:Value of options Value of options Value of optionsgranted at the exercised at lapsed at thegrant date (i) the exercise date of lapsedate $DirectorsM R Billing $Nil 283,924 $NilN W Gardner $Nil 214,282 $NilD J Cloke $Nil 121,774 $NilM K Ashton $Nil 145,833 $NilG J Bubner $Nil 121,774 $NilKey PersonnelJ F Fabray $38,340 111,075 $NilR Howard $95,300 $Nil $NilB Sando $45,100 $Nil $NilC Gaughan $19,170 18,000 $NilL Ackroyd $38,340 $Nil $NilOptions Issued as Remuneration for the Year Ended30 June 2010The company issued options to key managementpersonnel during the year as part of their remuneration.No ordinary shares were issued during the year toDirectors or other key management personnel other thanas a consequence of exercising options.Movement in options granted to Directors and keypersonnel during the year were:-(i) The value of options granted during the period is recognised incom pensation at the date of the grant, in accordance with Australianaccounting standards.(ii) No options granted to directors and senior management lapsedduring the year.28

WESTERN DESERT RESOURCES LIMITEDMovement in options granted to Directors and key personnel during the year were:-Opening Balance 01/07/2009 Options Exercised during the year Options Granted during the year 2 Balance Held30/06/2010 2Listed Unlisted Quantity Expiry Date Price 3 Quantity Expiry Date Price Listed UnlistedDirectors:M R Billing 1 33,667 1,583,334 1,583,334 30/06/10 0.208755 1 -M K Ashton 354,611 1,583,333 583,333 30/06/10 0.25 354,611 1,000,000N W Gardner 380,265 1,583,334 583,334 30/06/10 0.25 - 1,000,000380,265 30/11/11 0.18P C Lockyer - - - -G J Bubner 249,760 1,583,333 583,333 30/06/10 0.208755 249,760 1,000,000D J Cloke 126,363 1,583,333 583,333 30/06/10 0.208755 126,363 1,000,000Sub-Total 1,144,666 7,916,667 4,296,932 730,734 4,000,000Key Personnel:J F Fabray - 500,000 500,000 30/09/11 0.142150 200,000 31/12/12 0.60 - 200,000200,000 200,000 30/06/11 0.20000 - - -R Howard - - - - - 500,000 31/12/12 0.60 - 500,000B Sando - - - - - 200,000 31/12/12 0.60 - 200,000C Gaughan - 400,000 100,000 30/09/11 0.180000 100,000 31/12/12 0.60 - 400,000L Ackroyd - 500,000 - - - 200,000 31/12/12 0.60 - 700,000Sub-Total - 1,600,000 800,000 1,200,000 2,000,000Total Directors &Key Personnel 1,144,666 9,516,667 5,096,932 1,200,000 730,734 6,000,0001 As Mr M Billing resigned as a Director 13th January, 2010 the balance of listed options has not been included in the Sub Totaland Total columns above.No options granted to Directors or Senior Management lapsed during the year.2 Options granted during the year and those held by Directors and Senior Management vest in the individual at date of grant.3 The exercise price of options has been reduced as a result of the terms of the Renounceable Rights issue of December 2009which was not available to option holders.Meetings of DirectorsThe number of meetings of the company’s Board of Directors attended by each director during the year ended30 June 2010 was:2010 Meetings held while Meetings attended Meetings held while Meetings attendedin office 2009/2010 yearin office 2008/2009 yearM R Billing 1 6 6 11 11N W Gardner 14 14 11 11P C Lockyer 2 1 1 - -G J Bubner 14 14 11 11D J Cloke 14 12 11 11M K Ashton 14 14 11 111 Mr M R Billing resigned as a Director 13th January, 2010.2 Mr P C Lockyer was appointed 1st June, 2010.Due to its size and activities the company does nothave any separate board committees.29

DIRECTORS’ REPORTNon-Audit ServicesThe Board of Directors is satisfied that the provision ofthe non-audit services during the year is compatible withthe general standard of independence for auditorsimposed by the Corporations Act 2001. The directors aresatisfied that the services disclosed below did notcompromise the external auditor’s independence for thefollowing reasons:• All non-audit services are re<strong>view</strong>ed and approved bythe board prior to commencement to ensure they donot adversely affect the integrity and objectivity of theauditor; and• The nature of the services provided do not compromisethe general principles relating to auditor independencein accordance with APES 110: Code of Ethics forProfessional Accountants set by the AccountingProfessional and Ethical Standards Board.The following fees for non-audit services were paid to theexternal auditors during the period ended 30 June 2010:• Strategic Development Re<strong>view</strong>.$58,800 (2009: Nil)• Advice concerning grant of options to Directors$ 3,150 (2009: Nil)Options on issue at date of this report:(a) Unlisted Options:Grant Date Date of Expiry Face Exercise Adjusted Exercised Lapsed during 2010 Quantity 2009 QuantityPrice Exercise Price 1 during the year the year under option under Option30- Apr-2007 30-Jun-2010 $0.25 $0.208755 3,275,000 475,000 - 3,750,00028-May-2007 30-Jun-2010 $0.25 $0.208755 2,000,000 - - 2,000,00023-Jul-2007 30-Jun-2011 $0.25 $0.208755 1,500,000 - - 1,500,00025-Feb-2008 30-Jun-2011 $0.20 $0.208755 220,000 - - 220,00025-Sep-2008 30-Nov-2013 $0.20 $0.162150 1,000,000 - 4,000,000 5,000,00025-Sep-2008 30-Sep-2011 $0.18 $0.142150 850,000 100,000 - 950,00031-Mar-2009 30-Sep-2011 $0.18 $0.142150 100,000 - 400,000 500,00027-Apr-2009 23-Apr-2012 $0.11 $0.072150 50,000 - 500,000 550,00020-Aug-2009 30-Nov-2011 $0.18 $0.18 100,000 - 400,000 -20-Nov-2009 31-Dec-2012 $0.60 $0.60 - - 200,000 -16-Dec-2009 31-Dec-2012 $0.60 $0.60 - - 500,000 -20-Jan-2010 31-Dec-2012 $0.60 $0.60 - - 600,000 -1 The exercise price of options has been reduced as a result of the termsof the Renounceable Rights issue of December 2009, which was notavailable to option holders.9,095,000 575,000 6,600,000 14,470,00030

WESTERN DESERT RESOURCES LIMITEDChanges in State of Affairs(b) Listed Options:Grant Date Date of Expiry Face Exercise Adjusted Exercised Lapsed during 2010 Quantity 2009 QuantityPrice Exercise Price 1 during the year the year under option under Option18-Jul-2008 30-Nov-2011 $0.18 $0.142150 924,515 0 1,465,402 2,389,9171 The exercise price of options has been reduced as a result of the termsof the Renounceable Rights issue of December 2009, which was notavailable to option holders.Indemnification of Officers and AuditorsDuring the period the company arranged insurancecover and paid a premium for directors, the CompanySecretary and all executive offers of the company and ofits related body corporates in respect of indemnityagainst third party liability. In accordance with theterms and conditions of the insurance policy, theamount of the premium paid has not been disclosed onthe basis of confidentiality, as is permitted underSection 300 (9) of the Corporations Act 2001.Auditor’s Independence DeclarationThe auditor’s independence declaration is included onpage 32 of the financial report.Signed at Adelaide this 29th day of September 2010 inaccordance with a resolution of the directors madepursuant to S298(2) of the Corporations Act 2001.The company has not otherwise, during or since thefinancial period, indemnified or agreed to indemnify anofficer or auditor of the company or of any related bodycorporate against a liability incurred by an officer orauditor.D J ClokeActing ChairpersonN W GardnerDirectorProceedings on Behalf of the CompanyNo person has applied for leave of Court to bringproceedings on behalf of the company or intervene inany proceedings to which the company is a party for thepurpose of taking responsibility on behalf of the companyfor all or part of those proceedings. The company wasnot a party to such proceedings during the year.31

CORPORATE GOVERNANCE STATEMENT<strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> LimitedABN 48 122 301 848In March 2003 the Australian Stock Exchange CorporateGovernance Council (“ASXCGC”) released its best practicerecommendations based on ten core principles forcorporate governance. These recommendations werenot intended to be prescriptions to be followed by all ASXlisted companies, but rather guidelines designed toproduce an efficiency, quality or integrity outcome. TheCorporate Governance Council has recognised that a“one size fits all” approach to Corporate Governance isnot required. Instead, it states aspirations of best practicefor optimising corporate performance and accountabilityin the interests of shareholders and the broader economy.A company may consider that a recommendation is notappropriate to its particular circumstances and hasflexibility to not adopt it and explain why.<strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Limited to date has notadopted the ASXCGC best practice recommendationsother than those specifically identified and disclosedbelow because the Board believes that it cannot justifythe necessary cost given the size and early stage of itslife as a listed exploration company. However the Boardis committed to ensuring that appropriate CorporateGovernance practices are in place for the proper directionand management of the Company.This statement outlines the main Corporate Governancepractices of the Company disclosed under the principlesoutlined in the ASXCGC including those that comply withbest practice that, unless otherwise disclosed, were inplace during the whole of the financial year ended 30June 2010.Principle 1: Lay solid foundations for managementand oversightRole of the BoardThe Board is governed by the Corporations Act 2001, ASXlisting rules and a formal constitution.The Board’s primary role is the protection andenhancement of shareholder value.Board processes and managementThe Board has an established framework for themanagement of the company including a system of internalcontrol, a business risk management process andappropriate ethical standards.The Board appoints a Managing Director with responsibilityfor the day to day management of the Company includingmanagement of financial, physical, and human resources,development and implementation of risk management,internal control and regulatory compliance policies andprocedures, recommending strategic direction and planningfor the operations of the business and the provision ofrelevant information to the Board.Principle 2: Structure the Board to add valueComposition of the BoardThe names of the Directors of the Company and terms inoffice at the date of this Statement together with theirexperience and expertise are set out in the Directors’Report section of this report. The directors’ terms in officeare considered appropriate in <strong>view</strong> of the fact that thecompany listed in July 2007.The composition of the Board consists of five directors ofwhom four, including the Chairman, are non-executives.Mr Cloke’s role as acting Chairman of the Board is separatefrom that of the managing Director, Mr Gardner who isresponsible for the day to day management of theCompany and is in compliance with the ASXCGC bestpractice recommendation that these roles not be exercisedby the same individual.The Company’s constitution stipulated that the number ofdirectors must be at least three. The Board may at anytime appoint a director to fill a casual vacancy. Directorsappointed by the Board are subject to election byshareholders at the following annual general meeting andthereafter Directors (other than the Managing Director)are subject to re-election at least every three years.The Board takes responsibility for the overall CorporateGovernance of the Company including its strategicdirection, management goal setting and monitoring,internal risk control, risk management and financialreporting.33

CORPORATE GOVERNANCE STATEMENTThe Board has not established a nominations committeebecause of the small size of both the Board and theCompany. The Board believes however in the renewal ofmembers to ensure the ongoing vitality of the Company,and will seek to recruit additional members as appropriate.All Directors are entitled to take such legal advice asthey require at any time, and from time to time, on anymatter concerning or in relation to their rights, duties,and obligations as directors in relation to the affairs ofthe Company.Principle 3: Promote ethical and responsibledecision makingEthical standardsThe Company aims for a high standard of corporategovernance and ethical standard by Directors andemployees.Directors are expected to use skills commensurate withtheir knowledge and experience to increase the value ofCompany assets. Directors must also maintain strictconfidentiality in relation to Company mattersAll Directors are required to provide the Company withdetails of all securities registered in the Director’s nameor an entity in which the Director has a relevant interestwithin the meaning of section 9 of the Corporations Act2001 and details of all contracts, other than contracts towhich the Company is a party to which the Director is aparty or under which the Director is entitled to a benefit,and that confer a right to call for or deliver shares in theCompany and the nature of the Director’s interest underthe contract.Directors are required to disclose to the Board anymaterial contract in which they may have an interest.In accordance with section 195 of the Corporations Act2001, a director having a material personal interest inany matter to be dealt with by the Board, will not bepresent when that matter is considered by the Boardand will not vote on that matter.available to the market. Section 1043A of the CorporationsAct 2001 also prohibits the acquisition and disposal ofsecurities where a person possesses information that isnot readily available and which may reasonably beexpected to have a material effect on the price of thesecurities if the information was generally available. Inparticular, trading in Company securities is prohibitedwithin 3 days prior to, and one day following materialannouncements to ASX.Principle 4:Financial ReportsSafeguard integrity in financial reportingThe Managing Director and Chief Financial Officer providea certificate to the Board regarding the Financial Reportsproviding a true and fair <strong>view</strong> in accordance with accountingstandards.Audit Committee<strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Limited was not a Companyrequired by ASX Listing Rule 12.7 to have an AuditCommittee during the year, although it is a best practicerecommendation of the ASXCGC. Those activities,normally the responsibility of an audit committee, areundertaken by the Board as a whole.Principle 5:Continuous DisclosureMake timely and balanced disclosureThe Company operates under the continuous disclosurerequirements of the ASX Listing Rules and ensures thatall information, apart from information which isconfidential, and ASX has not formed the <strong>view</strong> that theinformation has ceased to be confidential, which may beexpected to affect the value of the Company’s securitiesor influence investment decisions is released to the marketin order that all investors have equal and timely access tomaterial information concerning the Company. Thisinformation is made publicly available on the Company’swebsite following release to the ASX.Trading in the Company’s SecuritiesDirectors, officers and employees are not permitted totrade in securities of the Company at any time whilst inpossession of price sensitive information not readily34

WESTERN DESERT RESOURCES LIMITEDPrinciple 6:Respect the rights of shareholdersPrinciple 7:Recognise and manage riskCommunication with shareholdersThe Board aims to ensure that shareholders are informedof all major developments affecting the Company’s state ofaffairs. In accordance with the ASXCGC best practicerecommendations, information is communicated toshareholders as follows:• The annual financial report which includes relevantinformation about the operations of the Companyduring the year, changes in the state of affairs of theentity and details of future developments, in additionto other disclosures required by the CorporationsAct 2001;• The half yearly financial report is to be lodged withthe Australian Stock Exchange and AustralianSecurities and Investments Commission and sent toall shareholders who request it;• Notifications relating to any proposed majorchanges in the Company which may impact on shareownership rights that are submitted to a vote ofshareholders;• Notices of all meetings of shareholders;• Publicly released documents including the full textof notices of meetings and explanatory materialmade available on the Company’s internet web-siteat www.westerndesertresources.com.au ; and• Disclosure of the Company’s Corporate Governancepractices and communications strategy on theinternet web-site.The Board encourages full participation of shareholdersat the Annual General Meeting to ensure a high level ofaccountability and identification with the Company’sstrategy and goals. Important issues are presented tothe shareholders as single resolutions. The externalauditor of the Company is also invited to the AnnualGeneral Meeting of shareholders and is available toanswer any questions concerning the conduct,preparation and content of the auditor’s report.Pursuant to Section 249K of the Corporations Act 2001the external auditor is provided with a copy of the noticeof meeting and related communications received byshareholders.Risk Assessment and ManagementThe Board recognises that there are inherent risksassociated with the Company’s operations includingmineral exploration, environmental, title, native title, legal,and other operational risks. The Board endeavours tomitigate such risks by continually re<strong>view</strong>ing the activities ofthe Company in order to identify key business andoperational risks and ensuring that they are appropriatelyassessed and managed.Principle 8:Performance EvaluationEncourage enhanced performanceThe Board evaluates the performance of the ManagingDirector on a regular basis and encourages continuingprofessional development.Principle 9:Remuneration PolicyRemunerate fairly and responsiblyThe Company’s Constitution specifies that the total amountof remuneration of non-executive Directors shall be fixedfrom time to time by a general meeting. The currentmaximum aggregate remuneration of non-executivedirectors is set at $250,000 per annum. Directors mayapportion any amount up to this maximum amountamongst the non- executive directors as they determine.Directors are also entitled to be paid reasonable travelling,accommodation and other expenses incurred inperforming their duties as directors.The remuneration of the Managing Director is determinedby the Board as part of the terms and conditions of hisengagement which are subject to re<strong>view</strong> from time to time.The remuneration of employees is determined by theManaging Director subject to the approval of the BoardFurther details of Directors’ and executives/officers’remuneration, superannuation and retirement paymentsare set out in the Directors’ Report.35

CORPORATE GOVERNANCE STATEMENTPrinciple 10:stakeholdersCode of ConductRecognise the legitimate interests ofThe Company requires all its directors and employees toabide by the highest standards of behaviour, businessethics, and in accordance with the law. In dischargingtheir duties, Directors of the Company are required to:• Act in good faith and in the best interests of theCompany;• Exercise care and diligence that a reasonable personin that role would exercise;• Exercise their powers in good faith for a properpurpose and in the best interests of the Company;• Not improperly use their position or informationobtained through their position to gain a personaladvantage or for the advantage of another person tothe detriment of the Company;• Disclose material personal interests and avoidactual or potential conflicts of interests;• Keep themselves informed of relevant Companymatters;• Keep confidential the business of all directorsmeetings; and• Observe and support the Board’s CorporateGovernance practices and procedures.Departures from the Principles and RecommendationsIn accordance with ASX Listing Rule 4.10.3, this CorporateGovernance Statement discloses the extent to which<strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Limited has followed thePrinciples and Recommendations by detailing thePrinciples and Recommendations that have not beenadopted by the consolidated entity and the reasons whythey have not been adopted. With the exception of thedepartures detailed below, the corporate governancepractices of <strong>Western</strong> <strong>Desert</strong> were compliant with thePrinciples and Recommendations throughout the Period.Recommendation Notification of Departure Explanation for Departure2.4 The board should The <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> The <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Board considers that aestablish a nomination Board has not established a separate nomination committee is not necessary for thecommittee. nomination committee. consolidated entity given its current size and complexity.The full Board is responsible for the duties and responsibilitiestypically delegated to a nomination committee.4.2 The audit committee should be The <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Board has not The <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Board considers that astructured so that it: not established an audit committee. separate audit committee is not necessary for the• consists only of non-executive consolidated entity given its current size and complexity.directors;The full Board is responsible for the duties and• consists of a majority of responsibilities typically delegated to a audit committee.independent directors;• is chaired by an independentchair, who is not chair of theboard; and• has at least 3 members8.1 The board should establish The <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Board has At this early stage of the consolidated entity’s developmenta remuneration committee. not established a remuneration committee the full Board acts as the consolidated entity’sremuneration committee.36

WESTERN DESERT RESOURCES LIMITEDConsolidated statement of comprehensive income for the year ended 30 June 2010ConsolidatedCompany2010 2009 2010 2009NOTE $ $ $ $Continuing operationsRevenue 5 750,000 2,008,390 - 2,008,390Less Cost of sales - (433,327) - (433,327)750,000 1,575,063 - 1,575,063Other Income and expenditures:Other income 6 350,068 300,833 350,068 300,833Interest on bank deposits 7 302,848 65,716 302,848 65,716Exploration expense written off/ (recovered) (682,251) (4,102,405) 210,900 (2,227,555)Impairment of intercompany loans - - (143,151) (1,874,850)Salaries and wages (400,260) (355,762) (400,260) (355,762)Directors fees (158,207) (148,964) (158,207) (148,964)Shareholder relations (300,427) (168,935) (300,427) (168,935)Corporate consulting expenses (546,652) (697,219) (546,652) (697,219)Other administration expenses (134,304) (187,425) (134,304) (187,425)Occupancy expenses (158,331) (138,897) (158,331) (138,897)Depreciation (146,373) (49,668) (146,373) (49,668)Share based payments (268,720) (1,014,423) (268,720) (1,014,423)Impairment of investments (188,200) (1,768,644) (339,677) (2,140,222)Share of associates loss (453,731) (387,647) - -Loss before income tax expense 8 (2,034,540) (7,078,377) (1,732,286) (7,062,308)Income tax expense/ (benefit) 9 - - (944,000) -Loss for the period attributable to members (2,034,540) (7,078,377) (788,286) (7,062,308)Other Comprehensive IncomeShare of the comprehensive income of associate 302,254 16,069 - -Other Comprehensive Income for the Period (Net of Tax) 302,254 16,069 - -Total Comprehensive Loss for the Period (Net of Tax)attributable to members (1,732,286) (7,062,308) (788,286) (7,062,308)Earnings per shareBasic (cents per share) 10 (1.60) (8.40)Diluted (cents per share) (1.60) (8.40)The above income statement should be read in conjunction with the accompanying notes.37