zain saudi arabia

zain saudi arabia

zain saudi arabia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

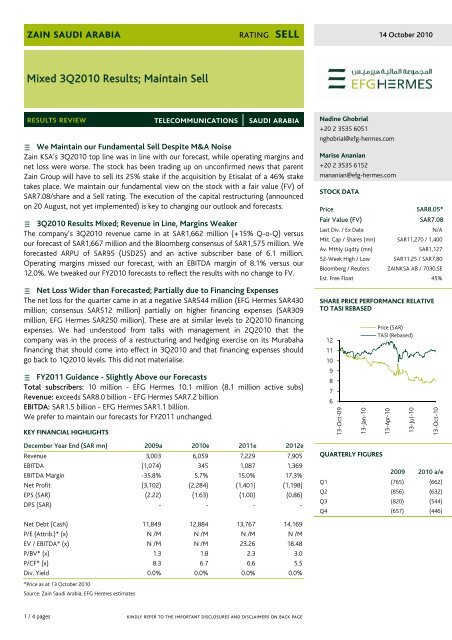

<strong>zain</strong> <strong>saudi</strong> <strong>arabia</strong> rating sell 14 October 2010Mixed 3Q2010 Results; Maintain Sellresults reviewWe Maintain our Fundamental Sell Despite M&A NoiseZain KSA’s 3Q2010 top line was in line with our forecast, while operating margins andnet loss were worse. The stock has been trading up on unconfirmed news that parentZain Group will have to sell its 25% stake if the acquisition by Etisalat of a 46% staketakes place. We maintain our fundamental view on the stock with a fair value (FV) ofSAR7.08/share and a Sell rating. The execution of the capital restructuring (announcedon 20 August, not yet implemented) is key to changing our outlook and forecasts.3Q2010 Results Mixed; Revenue in Line, Margins WeakerThe company’s 3Q2010 revenue came in at SAR1,662 million (+15% Q-o-Q) versusour forecast of SAR1,667 million and the Bloomberg consensus of SAR1,575 million. Weforecasted ARPU of SAR95 (USD25) and an active subscriber base of 6.1 million.Operating margins missed our forecast, with an EBITDA margin of 8.1% versus our12.0%. We tweaked our FY2010 forecasts to reflect the results with no change to FV.Net Loss Wider than Forecasted; Partially due to Financing ExpensesThe net loss for the quarter came in at a negative SAR544 million (EFG Hermes SAR430million; consensus SAR512 million) partially on higher financing expenses (SAR309million, EFG Hermes SAR250 million). These are at similar levels to 2Q2010 financingexpenses. We had understood from talks with management in 2Q2010 that thecompany was in the process of a restructuring and hedging exercise on its Murabahafinancing that should come into effect in 3Q2010 and that financing expenses shouldgo back to 1Q2010 levels. This did not materialise.FY2011 Guidance - Slightly Above our ForecastsTotal subscribers: 10 million - EFG Hermes 10.1 million (8.1 million active subs)Revenue: exceeds SAR8.0 billion - EFG Hermes SAR7.2 billionEBITDA: SAR1.5 billion - EFG Hermes SAR1.1 billion.We prefer to maintain our forecasts for FY2011 unchanged.KEY FINANCIAL HIGHLIGHTSNadine Ghobrial+20 2 3535 6051nghobrial@efg-hermes.comMarise Ananian+20 2 3535 6152mananian@efg-hermes.comSTOCK DATAPriceSAR8.05*Fair Value (FV)SAR7.08Last Div. / Ex DateN/AMkt. Cap / Shares (mn) SAR11,270 / 1,400Av. Mthly Liqdty (mn)SAR1,12752-Week High / Low SAR11.25 / SAR7.80Bloomberg / Reuters ZAINKSA AB / 7030.SEEst. Free Float 45%SHARE PRICE PERFORMANCE RELATIVETO TASI REBASED12111098713-Oct-0913-Jan-10Price (SAR)TASI (Rebased)13-Apr-1013-Jul-1013-Oct-10telecommunications │ <strong>saudi</strong> <strong>arabia</strong>6December Year End (SAR mn) 2009a 2010e 2011e 2012eRevenue 3,003 6,059 7,229 7,905EBITDA (1,074) 345 1,087 1,369EBITDA Margin -35.8% 5.7% 15.0% 17.3%Net Profit (3,102) (2,284) (1,401) (1,198)EPS (SAR) (2.22) (1.63) (1.00) (0.86)DPS (SAR) - - - -QUARTERLY FIGURES2009 2010 a/eQ1 (765) (662)Q2 (856) (632)Q3 (820) (544)Q4 (657) (446)Net Debt (Cash) 11,849 12,884 13,767 14,169P/E (Attrib.)* (x) N /M N /M N /M N /MEV / EBITDA* (x) N /M N /M 23.26 18.48P/BV* (x) 1.3 1.8 2.3 3.0P/CF* (x) 8.3 6.7 6.6 5.5Div. Yield 0.0% 0.0% 0.0% 0.0%*Price as at 13 October 2010Source: Zain Saudi Arabia, EFG Hermes estimates1 / 4 pages kindly refer to the important disclosures and disclaimers on back page

<strong>zain</strong> <strong>saudi</strong> <strong>arabia</strong> 14 October 2010telecommunications │ <strong>saudi</strong> <strong>arabia</strong>FIGURE 1: ZAIN KSA 3Q2010 ACTUAL AND FORECAST INCOME STATEMENTSAR million, unless otherwise stated3Q09a 1Q10a 2Q10a 3Q10a Q-o-Q Y-o-Y 3Q10e Var. FY10eTotal Revenue 825 1,094 1,450 1,662 15% 101% 1,667 -0.3% 6,059COGS (583) (710) (842) (950) (884) (3,502)Gross Profit 243 384 608 712 17% 193% 784 -9.1% 2,558Gross Profit Margin 29.4% 35.1% 41.9% 42.8% 47.0% 42.2%Distribution & Marketing Costs (454) (376) (470) (500) (1,874)General & Admin. Costs (88) (79) (81) (83) (339)EBITDA (299) (70) 57 135 200 345EBITDA Margin -36.3% -6.4% 3.9% 8.1% 12.0% 5.7%Depreciation & Amortisation (369) (365) (372) (370) (380) (1,477)EBIT (668) (435) (314) (235) (180) (1,132)Net Financing Expenses (152) (227) (317) (309) (250) (1,152)Profit before Taxes (820) (662) (632) (544) (430) (2,284)Provision for Zakat - - - - - -Net Income (820) (662) (632) (544) (430) (2,284)EPS (SAR) (0.59) (0.47) (0.45) (0.39) (0.31) (1.63)Source: Zain KSA, EFG Hermes estimates2 / 4 pages

EGYPT SALES TEAMLocal call center 16900cc-hsb@efg-hermes.comUAE SALES TEAMcall center+971 4 306 9333uaerequests@efg-hermes.comKSA SALES TEAMcall center+800 123 4566RiyadhCallCenter@efg-hermes.comRiyadhTraders@efg-hermes.comRESEARCH MANAGEMENTCairo General + 20 2 35 35 6140UAE General + 971 4 363 4000efgresearch@efg-hermes.comHead of Western Institutional SalesMohamed Ebeid+20 2 35 35 6054mebeid@efg-hermes.comWestern Institutional SalesJulian Bruce+971 4 363 4092jbruce@efg-hermes.comDirector of Client RelationshipMazen Matraji+9661 279 8640mmatraji@EFG-HERMES.comHead of ResearchWael Ziada+20 2 35 35 6154wziada@efg-hermes.comLocal Institutional SalesAmr El Khamissy+20 2 35 35 6045amrk@efg-hermes.comHead of GCC Institutional SalesAmro Diab+971 4 363 4086adiab@efg-hermes.comClient RelationshipKhalid S. Al-Bihlal+9661 279 8670kalbihlal@efg-hermes.comHead of Publ. and DistributionRasha Samir+20 2 35 35 6142rsamir@efg-hermes.comGulf HNW SalesChahir Hosni+971 4 363 4090chosni@efg-hermes.comUAE Retail SalesReham Tawfik+971 4 306 9418rtawfik@efg-hermes.comDISCLOSURESWe, Nadine Ghobrial and Marise Ananian, hereby certify that the views expressed in this document accurately reflect our personal views about the securities andcompanies that are the subject of this report. We also certify that neither we nor our spouses or dependants (if relevant) hold a beneficial interest in the securitiesthat are traded in the Tadawul stock exchange. EFG Hermes Holding SAE hereby certifies that neither it nor any of its subsidiaries owns any of the securities thatare the subject of this report.Funds managed by EFG Hermes Holding SAE and its subsidiaries (together and separately, "EFG Hermes") for third parties may own the securities that are thesubject of this report. EFG Hermes may own shares in one or more of the aforementioned funds or in funds managed by third parties. The authors of this reportmay own shares in funds open to the public that invest in the securities mentioned in this report as part of a diversified portfolio over which they have nodiscretion. The Investment Banking division of EFG Hermes may be in the process of soliciting or executing fee earning mandates for companies that are either thesubject of this report or are mentioned in this report.DISCLAIMERThis Research has been sent to you as a client of one of the entities in the EFG Hermes group. This Research must not be considered as advice nor be acted upon byyou unless you have considered it in conjunction with additional advice from an EFG Hermes entity with which you have a client agreement.Our investment recommendations take into account both risk and expected return. We base our long-term fair value estimate on a fundamental analysis of thecompany's future prospects, after having taken perceived risk into consideration. We have conducted extensive research to arrive at our investmentrecommendations and fair value estimates for the company or companies mentioned in this report. Although the information in this report has been obtained fromsources that EFG Hermes believes to be reliable, we have not independently verified such information and it may not be accurate or complete. EFG Hermes doesnot represent or warrant, either expressly or implied, the accuracy or completeness of the information or opinions contained within this report and no liabilitywhatsoever is accepted by EFG Hermes or any other person for any loss howsoever arising, directly or indirectly, from any use of such information or opinions orotherwise arising in connection therewith. Readers should understand that financial projections, fair value estimates and statements regarding future prospects maynot be realized. All opinions and estimates included in this report constitute our judgment as of this date and are subject to change without notice. This researchreport is prepared for general circulation to the clients of EFG Hermes and is intended for general information purposes only. It is not intended as an offer orsolicitation or advice with respect to the purchase or sale of any security. It is not tailored to the specific investment objectives, financial situation or needs of anyspecific person that may receive this report. We strongly advise potential investors to seek financial guidance when determining whether an investment isappropriate to their needs.

GUIDE TO ANALYSISEFG Hermes investment research is based on fundamental analysis of companies and stocks, the sectors that they are exposed to, as well as the country andregional economic environment.Effective 16 December 2009, EFG Hermes changed its investment rating approach to a three-tier, long-term rating approach, taking total return potential togetherwith any applicable dividend yield into consideration.In special situations, EFG Hermes may assign a rating for a stock that is different from the one indicated by the 12-month expected return relative to thecorresponding fair value.For the 12-month long-term ratings for any investment covered in our research, the ratings are defined by the following ranges in percentage terms:Rating Potential Upside (Downside) %Buy Above 15%Neutral (10%) and 15%Sell Below (10%)EFG Hermes policy is to update research reports when appropriate based on material changes in a company’s financial performance, the sector outlook, the generaleconomic outlook, or any other changes which could impact the analyst’s outlook or rating for the company. Share price volatility may cause a stock to moveoutside of the longer-term rating range to which the original rating was applied. In such cases, the analyst will not necessarily need to adjust the rating for the stockimmediately. However, if a stock has been outside of its longer-term investment rating range consistently for 30 days or more, the analyst will be encouraged toreview the rating.COPYRIGHT AND CONFIDENTIALITYNo part of this document may be reproduced without the written permission of EFG Hermes. The information within this research report must not be disclosed toany other person if and until EFG Hermes has made the information publicly available.CONTACTS AND STATEMENTSBackground research prepared by EFG Hermes Holding SAE. Report prepared by EFG Hermes Holding SAE (main office), Building No. B129, Phase 3, Smart Village,KM 28, Cairo-Alexandria Desert Road, Egypt 12577, Tel +20 2 35 35 6140 | Fax +20 2 35 37 0939 which has an issued capital of EGP 1,939,320,000.Reviewed and approved by EFG Hermes KSA (closed Joint Stock Company) which is commercially registered in Riyadh with Commercial Registration number1010226534, and EFG Hermes UAE Limited, which is regulated by the DFSA and has its address at Level 6, The Gate, DIFC, Dubai, UAE. The information in thisdocument is directed only at institutional investors. If you are not an institutional investor you must not act on it.bloomberg efgh reuters pages .efgs .hrms .efgi .hfismcap .hfidomefghermes.com