The Black-Scholes Options Pricing Model Lecture 9

The Black-Scholes Options Pricing Model Lecture 9

The Black-Scholes Options Pricing Model Lecture 9

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

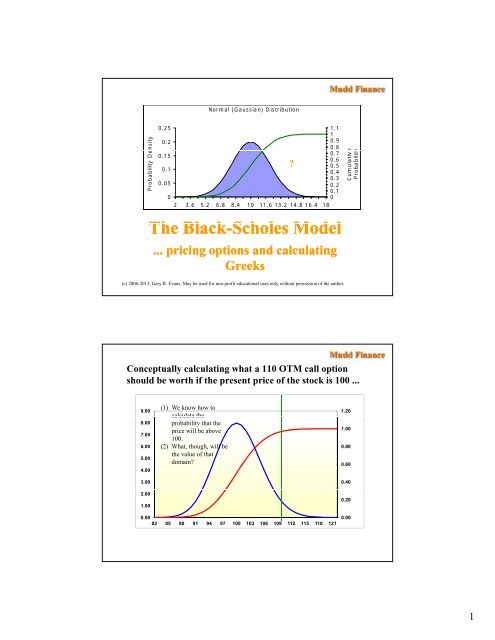

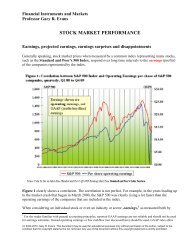

Normal (Gaussian) DistributionProbability De ensity0.250.20.150.10.0501.110.90.80.70.6?0.50.40.30.20.102 3.6 5.2 6.8 8.4 10 11.6 13.2 14.8 16.4 18<strong>The</strong> <strong>Black</strong>-<strong>Scholes</strong> ShlMdl<strong>Model</strong>... pricing options and calculatingGreeks(c) 2006-2013, Gary R. Evans. May be used for non-profit educational uses only without permission of the author.eCumulativeProbabilityConceptually calculating what a 110 OTM call optionshould be worth if the present price of the stock is 100 ...9.008.007.006.005.004.003.002.001.00(1) We know how tocalculate theprobability that theprice will be above100.(2) What, though, will bethe value of thatdomain?1.201.000.800.600.400.200.000.0082 85 88 91 94 97 100 103 106 109 112 115 118 1211

How <strong>Black</strong>-<strong>Scholes</strong> works ...<strong>The</strong> <strong>Black</strong>-<strong>Scholes</strong> model is used to price European options(which assumes that they must be held to expiration) and relatedcustom derivatives. It takes into account that you have the optionof investing in an asset earning the risk-free interest rate.It acknowledges that the option price is purely a function of thevolatility of the stock's price (the higher the volatility the higherthe premium on the option).<strong>Black</strong>-<strong>Scholes</strong> treats a call option as a forward contract to deliverstock at a contractual price, which is, of course, the strike price.<strong>The</strong> Essence of the <strong>Black</strong>-<strong>Scholes</strong> Approach• Only volatility matters, the mu (drift) is not important.• <strong>The</strong> option's premium will suffer from time decay as weapproach expiration (<strong>The</strong>ta in the European model).• <strong>The</strong> stock's underlying volatility contributes to the option'spremium (Vega).• <strong>The</strong> sensitivity of the option to a change in the stock'svalue (Delta) and the rate of that sensitivity (Gamma) isimportant [these variables are represented mathematicallyin the <strong>Black</strong>-<strong>Scholes</strong> DE, next lecture].• Option values arise from arbitrage opportunities in a worldwhere you have a risk-free choice.2

<strong>The</strong> <strong>Black</strong>-<strong>Scholes</strong> <strong>Model</strong>: European <strong>Options</strong>365C SN( d ) Ke N( d )C = theoretical call valueS = current stock priceN = cumulative standardnormal probability dist.t = days until expirationK = option strike pricer = risk free interest rate daily stock volatility1 r tdd12lnln22SK r365 22SK r365 2d d t2 1ttNote: Hull's version (13.20) uses annual volatility. Note the difference.ttBreaking this down ...365C SN ( d ) Ke N ( d)dln r t1 2This term discounts the price of the stock at which you will have theright to buy it (the strike price) back to its present value using therisk-free interest rate. Let's assume in the next slide that r = 0.1 2SK r365 2t tDividing by this term (the standard deviation of stock's dailyvolatility adjusted for time) turns the distribution into a standardnormal distribution with a standard deviation of 1.3

... or simplifying it someCP SPd1dSTR 1d 2This is the absolutelog growth thdifference... assume that rbetween the strikeis 0 and t is 1:price and the stockprice.We are calculatingthe cumulativeprobability to thisstandard normalpoint.2ln SP STR 2This normalizes it tostandard normal (thenumerator is now“number of standarddeviations.”μ is zero so this isthe log-normal zeromean adjustmentC S N( d1) K N( d2)... and some more(assuming r to be 0)This term, our x of two slides ago, represents the spread in continuousgrowth terms between the stock price and the strike price, and whennormalized by the denominator, the spread as the number of standarddeviations. For example, if S = 110 and K = 100 and volatility = 10%, thenthis terms equals 9.5%, or about one standard deviation. x > 0 for itm callsand otm puts and x < 0 for otm calls and itm puts.d1ln2SKr365 2tThis term has the effect ofremoving the bias.td2ln2SK r365 2tt4

Using the <strong>Black</strong>-<strong>Scholes</strong> <strong>Model</strong><strong>The</strong>re are variations of the <strong>Black</strong>-<strong>Scholes</strong> model that prices for dividend payments(within the option period). See Hull section 13.12 to see how that is done (easy tounderstand). However, because of what is said below, you really can't use <strong>Black</strong>-<strong>Scholes</strong> to estimate values of options for dividend-paying American stocks<strong>The</strong>re is no easy estimator for American options prices, but as Hull points out inchapter 9 section 9.5, with the exception of exercising a call option just prior to an exdividenddate, "it is never optimal to exercise an American call option on a nondividendpaying stock before the expiration date."<strong>The</strong> <strong>Black</strong>-<strong>Scholes</strong> model can be used to estimate "implied volatility". To do this,however, given an actual option value, you have to iterate to find the volatility solution(see Hull's discussion of this in 13.12). This procedure is easy to program and not verytime-consuming in even an Excel version of the model.For those of you interest in another elegant implied volatility model, see Hull'sdiscussion of the IVF model in 26.3. <strong>The</strong>re you will see a role played by delta andvega, but again you would have to iterate to get the value of the sensitivity of the call tothe strike price.Calculating implied volatility with B/S:d1ln 2SP STR 2Very easy to do:Once <strong>Black</strong>-<strong>Scholes</strong> Shl isstructured, you can usean iterative technique tosolve for σ.Name:Date:Gary R. EvansOctober 27, 2011Put OptionImplicit Daily Volatility (IDV) CalculatorStockSymbol: DIAPrice: 121.60Month: DecPut Strike: 120.00Price: 3.250Expiration date: 12/17/2011Interest rate: 0.0100Days to maturity today:Days to maturity override:Implied daily volatility:One-day time decay:Version 3.4 Aug 16, 201151510.014520.045Calculate5

VBasic iterative technique used in IDV master'Below is the actual calculation of implied volatility.'<strong>The</strong> Ringer is for testing temporary values in construction only.'DoCIPD = CIPD + 0.00001DeNom = Log(StockPR / StrikePR) + ((IntRR / 365) + (CIPD ^ 2) / 2) * DTMRDurVol = CIPD * DTMR ^ 0.5DND1 = WorksheetFunction.NormSDist(DeNom / DurVol)DND2 = WorksheetFunction.NormSDist(DeNom / DurVol - DurVol)Ringer = Exp(-IntRR * DTMR / 365)TempCallPR = StockPR * DND1 - StrikePR * Exp(-IntRR * DTMR / 365) * DND2Loop Until TempCallPR >= CallPR'Command below writes a value back to a named designated cellRange("CIPD").Value = CIPDCalculating IDV for strangles (V. 3.3)Name: Gary R. EvansDate: March 30, 2012Strangle Implied Daily Volatility CalculatorStock Symbol: DIA Interest rate:Stock Price: 131.680 0.010CALL PUTMonth: Apr AprStrike: 134.00 130.00Expiration: 4/21/12 4/21/12Price: 0.460 0.980Days to maturity: 22 22DTM override: 22 22Implied daily volatility: 0.00516 0.00702One-day time decay: 0.022022 0.035035Version 3.3 August 16, 2011One Year:Average DGR: 0.00038Standard Deviation: 0.01299Average ABS DCGR: 0.0090960 day:Average DGR: 0.00109Standard Deviation: 0.00565Average ABS DCGR: 0.00415CalculateExample: March 30, 2012weekend strangle6

=LN(SP/KP)+(IR+(DV*DV)/2)*(DTM/365)=LN(SP/KP)+((IR/365)+(DV*DV)/2)*DTMAn example ...Consider an itm option with 20 days to expiration. <strong>The</strong>strike price is 105 and the price of the stock is 100 and thestock has an daily volatility of 0.02. Assume an interest rateof 0.01 (1% annual).d2 105r365 0.02 220 0. 49464ln 10010.0220d2 d1 0.02 20 0.584090.0120365C 100N 0.04424 105eN0.584091.70Using an Option Value Calculator toCalculate this same ValueCall Option Price Calculator(Daily Volatility)Stock symbol: TrialCall option: MayDate Today: 4/26/2011Expiration Date: 5/16/2011DTM: 20Stock Price:Strike Price:100.00105.00Daily Volatility: 0.0200Interest Rate: 0.010Time: 20d1 Numerator: -0.04424Duration Volatility: 0.08944Delta N(d1): 0.3104N(d2): 0.2796Option Price: 1.70Option Premium: 1.70NUM=LN(SP/KP)+((IR/365)+(DV*DV)/2)*DTM(( ) ( ) )DUV=NORMSDIST(NUM/DUV)7