Annual Report Samas NV 2008 2009 Annual ... - Alle jaarverslagen

Annual Report Samas NV 2008 2009 Annual ... - Alle jaarverslagen

Annual Report Samas NV 2008 2009 Annual ... - Alle jaarverslagen

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

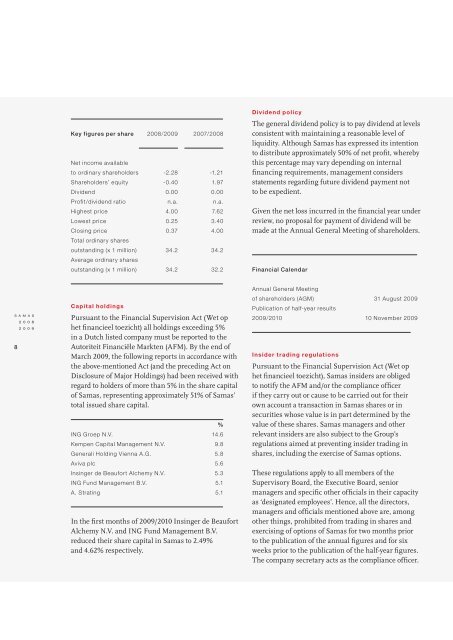

Key figures per share <strong>2008</strong>/<strong>2009</strong> 2007/<strong>2008</strong>Net income availableto ordinary shareholders -2.28 -1.21Shareholders’ equity -0.40 1.97Dividend 0.00 0.00Profit/dividend ratio n.a. n.a.Highest price 4.00 7.62Lowest price 0.25 3.40Closing price 0.37 4.00Total ordinary sharesoutstanding (x 1 million) 34.2 34.2Average ordinary sharesoutstanding (x 1 million) 34.2 32.2Dividend policyThe general dividend policy is to pay dividend at levelsconsistent with maintaining a reasonable level ofliquidity. Although <strong>Samas</strong> has expressed its intentionto distribute approximately 50% of net profit, wherebythis percentage may vary depending on internalfinancing requirements, management considersstatements regarding future dividend payment notto be expedient.Given the net loss incurred in the financial year underreview, no proposal for payment of dividend will bemade at the <strong>Annual</strong> General Meeting of shareholders.Financial CalendarS a m a s2 0 0 82 0 0 98Capital holdingsPursuant to the Financial Supervision Act (Wet ophet financieel toezicht) all holdings exceeding 5%in a Dutch listed company must be reported to theAutoriteit Financiële Markten (AFM). By the end ofMarch <strong>2009</strong>, the following reports in accordance withthe above-mentioned Act (and the preceding Act onDisclosure of Major Holdings) had been received withregard to holders of more than 5% in the share capitalof <strong>Samas</strong>, representing approximately 51% of <strong>Samas</strong>’total issued share capital.%ING Groep N.V. 14.6Kempen Capital Management N.V. 9.8Generali Holding Vienna A.G. 5.8Aviva plc 5.6Insinger de Beaufort Alchemy N.V. 5.3ING Fund Management B.V. 5.1A. Strating 5.1In the first months of <strong>2009</strong>/2010 Insinger de BeaufortAlchemy N.V. and ING Fund Management B.V.reduced their share capital in <strong>Samas</strong> to 2.49%and 4.62% respectively.<strong>Annual</strong> General Meetingof shareholders (AGM) 31 August <strong>2009</strong>Publication of half-year results<strong>2009</strong>/2010 10 November <strong>2009</strong>Insider trading regulationsPursuant to the Financial Supervision Act (Wet ophet financieel toezicht), <strong>Samas</strong> insiders are obligedto notify the AFM and/or the compliance officerif they carry out or cause to be carried out for theirown account a transaction in <strong>Samas</strong> shares or insecurities whose value is in part determined by thevalue of these shares. <strong>Samas</strong> managers and otherrelevant insiders are also subject to the Group’sregulations aimed at preventing insider trading inshares, including the exercise of <strong>Samas</strong> options.These regulations apply to all members of theSupervisory Board, the Executive Board, seniormanagers and specific other officials in their capacityas ‘designated employees’. Hence, all the directors,managers and officials mentioned above are, amongother things, prohibited from trading in shares andexercising of options of <strong>Samas</strong> for two months priorto the publication of the annual figures and for sixweeks prior to the publication of the half-year figures.The company secretary acts as the compliance officer.