5 Monopoly and Regulation - Luiscabral.net

5 Monopoly and Regulation - Luiscabral.net

5 Monopoly and Regulation - Luiscabral.net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

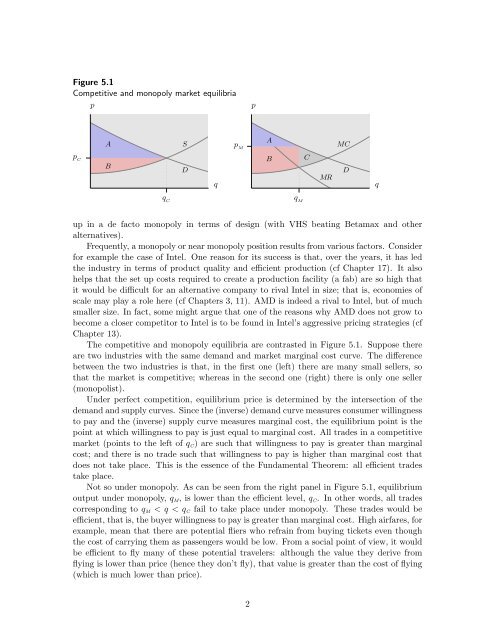

Figure 5.1Competitive <strong>and</strong> monopoly market equilibriappp CAB..........SDqp MAB.............CMRMCDqq Cq Mup in a de facto monopoly in terms of design (with VHS beating Betamax <strong>and</strong> otheralternatives).Frequently, a monopoly or near monopoly position results from various factors. Considerfor example the case of Intel. One reason for its success is that, over the years, it has ledthe industry in terms of product quality <strong>and</strong> efficient production (cf Chapter 17). It alsohelps that the set up costs required to create a production facility (a fab) are so high thatit would be difficult for an alternative company to rival Intel in size; that is, economies ofscale may play a role here (cf Chapters 3, 11). AMD is indeed a rival to Intel, but of muchsmaller size. In fact, some might argue that one of the reasons why AMD does not grow tobecome a closer competitor to Intel is to be found in Intel’s aggressive pricing strategies (cfChapter 13).The competitive <strong>and</strong> monopoly equilibria are contrasted in Figure 5.1. Suppose thereare two industries with the same dem<strong>and</strong> <strong>and</strong> market marginal cost curve. The differencebetween the two industries is that, in the first one (left) there are many small sellers, sothat the market is competitive; whereas in the second one (right) there is only one seller(monopolist).Under perfect competition, equilibrium price is determined by the intersection of thedem<strong>and</strong> <strong>and</strong> supply curves. Since the (inverse) dem<strong>and</strong> curve measures consumer willingnessto pay <strong>and</strong> the (inverse) supply curve measures marginal cost, the equilibrium point is thepoint at which willingness to pay is just equal to marginal cost. All trades in a competitivemarket (points to the left of q C ) are such that willingness to pay is greater than marginalcost; <strong>and</strong> there is no trade such that willingness to pay is higher than marginal cost thatdoes not take place. This is the essence of the Fundamental Theorem: all efficient tradestake place.Not so under monopoly. As can be seen from the right panel in Figure 5.1, equilibriumoutput under monopoly, q M , is lower than the efficient level, q C . In other words, all tradescorresponding to q M < q < q C fail to take place under monopoly. These trades would beefficient, that is, the buyer willingness to pay is greater than marginal cost. High airfares, forexample, mean that there are potential fliers who refrain from buying tickets even thoughthe cost of carrying them as passengers would be low. From a social point of view, it wouldbe efficient to fly many of these potential travelers: although the value they derive fromflying is lower than price (hence they don’t fly), that value is greater than the cost of flying(which is much lower than price).2