IBEC Audiovisual Federation Report 2009 - Irish Film Board

IBEC Audiovisual Federation Report 2009 - Irish Film Board

IBEC Audiovisual Federation Report 2009 - Irish Film Board

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

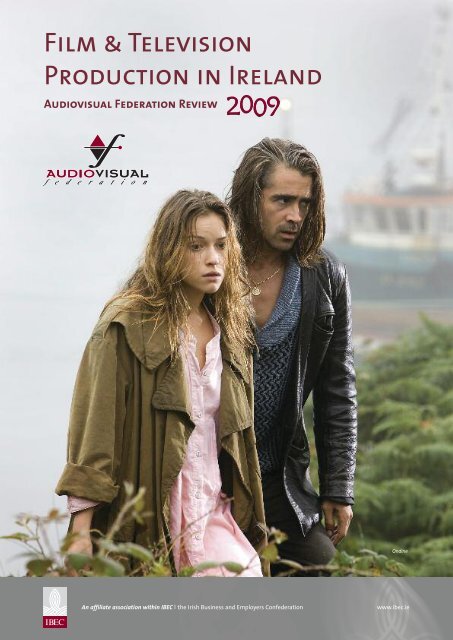

<strong>Film</strong> & TelevisionProduction in Ireland<strong>Audiovisual</strong> <strong>Federation</strong> ReviewOndineAn affiliate association within <strong>IBEC</strong> | the <strong>Irish</strong> Business and Employers Confederationwww.ibec.ie

AUDIOVISUAL FEDERATION REVIEWGeorge GentlyGarth & BevRoyCman CamanDragons Den

<strong>IBEC</strong> <strong>Audiovisual</strong> <strong>Federation</strong>AUDIOVISUAL FEDERATION REVIEWAFThe <strong>Audiovisual</strong> <strong>Federation</strong> consists of <strong>IBEC</strong> member companies involved in Ireland’s audiovisual industry. These include broadcasters,producers, animators, studios, facilities and other organisations supporting the sector.The <strong>Federation</strong> has a number of objectives designed to support Ireland’s audiovisual production and distribution industry. These includepromotion of the sector, representing the views of members to relevant bodies and submitting the industry view on relevant policy.The <strong>Audiovisual</strong> <strong>Federation</strong> maintains an economic database for the <strong>Irish</strong> audiovisual production sector and publishes the results in anannual report with an economic analysis on the benefits of the audiovisual sector to the <strong>Irish</strong> economy. In order to sustain the growthand development within the sector during the last number of years the <strong>Federation</strong> has sought internationally competitive financialincentives and international co-production treaties. Together with Enterprise Ireland, the <strong>Federation</strong> organises conferences, seminars andworkshops on relevant audiovisual issues.The <strong>Audiovisual</strong> <strong>Federation</strong> is a member of the <strong>Irish</strong> Business and Employers Confederation (<strong>IBEC</strong>).Chair:Andrew Lowe, Element PicturesVice Chair:Anne O’Connor, RTÉSecretariat:Tommy McCabe, DirectorEmer Condon, ExecutiveCarolyn Doumeni, Personal AssistantTel: 01-605 1528 Fax: 01-638 1528email: audiovisual.fed@ibec.ieWeb: www.ibec.ie/avf<strong>IBEC</strong> Mission<strong>IBEC</strong> promotes the interests of business and employers in Ireland by working to foster thecontinuing development of a competitive environment that encourages sustainable growth, andwithin which both enterprise and people can flourish- 1 -

AUDIOVISUAL FEDERATION REVIEWRawOlivia- 2 -

<strong>Audiovisual</strong> <strong>Federation</strong>AUDIOVISUAL FEDERATION REVIEWReview <strong>2009</strong>The data in this report relates to feature films, independent TV productions (including major TV dramas) and animation projects wherethe majority of the work was carried out in 2008. It also gives an overview of productions to date in <strong>2009</strong>. It does not include otherproductions in this sector, e.g. commercials, promotional videos, games, etc. This report is based on productions where completed formshave been returned to the <strong>Audiovisual</strong> <strong>Federation</strong>.This is the seventeenth report on the audiovisual sector, which was drawn up under the auspices of the following organisations –members of the <strong>Audiovisual</strong> <strong>Federation</strong> Database Steering Committee:● Chairman AF Database Steering Committee● Bord Scannán na hÉireann/<strong>Irish</strong> <strong>Film</strong> <strong>Board</strong>● Radio Telefís Éireann● TG4● An Roinn Ealaíon, Spóirt agus Turasóireachta/The Department of Arts, Sports and Tourism● Screen Producers Ireland● Facilities● Animation Sector● Broadcasting Commission of Ireland/Broadcasting Authority of Ireland● <strong>Audiovisual</strong> <strong>Federation</strong> of <strong>IBEC</strong>Kevin Moriarty, Ardmore StudiosTeresa McGranePatrick O’NeillMichael HylandJohn DunnePádhraic Ó CiardhaMáire Uí ChadhainSile BhreathnachDeclan BrennanSean StokesLorraine MorganKevin Moriarty, Ardmore StudiosCathal Gaffney, Brown Bag <strong>Film</strong>sStephanie ComeyTommy McCabe (Director)Emer Condon (Executive)Eoin Keogh, (<strong>IBEC</strong> Research Unit)Carolyn Doumeni (Personal Assistant)This data for this report was compiled by the Research Unit of <strong>IBEC</strong>.Acknowledgements:The <strong>Audiovisual</strong> <strong>Federation</strong> is very much indebted to the members of the Steering Committee for their commitmentand guidance in producing this report.The <strong>Audiovisual</strong> <strong>Federation</strong> Review <strong>2009</strong>© <strong>2009</strong> <strong>IBEC</strong>Prepared by the <strong>Audiovisual</strong> <strong>Federation</strong> of <strong>IBEC</strong>Affiliated to ICT Ireland<strong>IBEC</strong> <strong>Audiovisual</strong> <strong>Federation</strong>Confederation House84/86 Lower Baggot StreetDublin 2E-mail: audiovisual.fed@ibec.ieWebsite: www.ibec.ie/avf- 3 -

International Awards for the SectorAUDIOVISUAL FEDERATION REVIEWAwards <strong>2009</strong>International Awards for the SectorGolden Globe Awards – Colin Farrell, In Bruges – Best Actor, Musical or ComedyGolden Globe Awards – Gabriel Byrne, In Treatment – Best Actor, DramaEmmy Awards - Brendan Gleeson, Into The Storm - Outstanding Lead Actor in a Mini-Series or a MovieEmmy Awards - Dearbhla Walsh, Little Dorrit - Outstanding Directing for a Miniseries, Movie or a Dramatic Special categorySundance <strong>Film</strong> Festival – Oliver Hirschbiegel, Five Minutes of Heaven – World Cinema Directing Award: DramaticSundance <strong>Film</strong> Festival – Guy Hibbert, Five Minutes of Heaven – World Cinema Screenwriting AwardCartoon Movie Tributes 2008 – Tomm Moore, The Secret of Kells – Director of the YearCartoon Tributes <strong>2009</strong> - Brown Bag <strong>Film</strong>s - European Producer of the YearCartoon d’Or Award <strong>2009</strong> - David O'Reilly - Please Say SomethingTribeca <strong>Film</strong> Festival Awards <strong>2009</strong> - Ciarán Hinds - The Eclipse - Best Actor - a Narrative Feature <strong>Film</strong>Locarno International <strong>Film</strong> Festival - Lotte Verbeek - Nothing Personal - Leopard Award for Best First Feature; the LeopardAward for Best Actress (Verbeek); the First Prize Youth Jury Award; Ecumenical Jury Prize Special Mention; CICAE Prize andthe FIPRESCI PrizeAnnecy Animation Festival - The Secret of Kells – Audience AwardEdinburgh <strong>Film</strong> Festival - The Secret of Kells – Audience AwardKarlovy-Vary International <strong>Film</strong> Festival - Eamon – Independent Camera AwardIn Bruges- 4 -

International Awards for the SectorAUDIOVISUAL FEDERATION REVIEWAwards <strong>2009</strong>International Awards for the SectorThe Secret of KellsFive Minutes of HeavenIn TreatmentEamonThe Eclipse- 5 -

International Awards for the SectorAUDIOVISUAL FEDERATION REVIEWAwards <strong>2009</strong>RTÉ AwardsMonte-Carlo Television Festival - Charlene McKenna, Whistleblower – Outstanding actress in a Mini-SeriesCeltic Media Festival - Whistleblower - Drama awardCeltic Media Festival - Patrick McCabe - Blood Relations - Documentary Arts awardCeltic Media Festival - In The Name Of The Fada - Factual Entertainment awardLondon Independent <strong>Film</strong> Festival - Out Of The Blue - Best International Short <strong>Film</strong>Rhode Island International <strong>Film</strong> Festival - Out Of The Blue - Grand Prix for Best CinematographyIn the Name of the Fada Blood Relations WhistleblowerSignificant NominationsAcademy Awards Nomination – Martin McDonagh - In Bruges – Best Original ScreenplayAcademy Awards Nomination - New Boy – Best Short <strong>Film</strong>Emmy Awards Nominations●●●●Director Thaddeus O’Sullivan nominated for his work on Into The Storm<strong>Irish</strong> actor star Gabriel Byrne nominated for his performance in In TreatmentCostume Designer Consolata Boyle, Into The Storm - Outstanding Costumes for a Mini-Series, Movie or a Special ProductionDesigner Tom Conroy, Costume Designer Joan Bergin and Wardrobe Supervisor Susan O'Connor Cave,Casting Directors Frank and Nuala Moiselle and Head Hairstylist Dee Corcoranwere all nominated for their work on The Tudors seriesEuropean <strong>Film</strong> Academy <strong>2009</strong> Nominations●●Niko and the Way to the Stars - Animated Feature <strong>Film</strong>The Secret of Kells - Animated Feature <strong>Film</strong>- 6 -

International Awards for the SectorAUDIOVISUAL FEDERATION REVIEWAwards <strong>2009</strong>TG4 AwardsCeltic Media Festival - Ceolchuairt – EntertainmentCeltic Media Festival - Seacht – Young PeopleCircom - Seán Mac an tSíthigh – Silver medal Visual JournalismWorld Fest Houston - Ernie O’Malley – Remi AwardWorld Fest Houston - Kennedy’s Cadets – Remi AwardWorld Fest Houston - Mobs Mheiriceá – Remi AwardWorld Fest Houston - Críostaíocht – Remi AwardO’MalleyCeolchuairtCríostaíochtKennedy’s Cadets- 7 -

AUDIOVISUAL FEDERATION REVIEWIreland In Their Own WordsNeil Jordan - Ondine- 8 -

AUDIOVISUAL FEDERATION REVIEWIreland In Their Own WordsIf you combine the first-class crews, wonderful locations, enhanced tax incentive and IFB'sproduction and regional support, Ireland has a viable product to sell abroad andattract international film-making activity hereNeil Jordan, Director OndineIreland's physical and cultural landscape inspired me to become a filmmaker.I am grateful to work here as a collaborative storyteller, perpetuallyfascinated by this country and the people who live hereSteph Green, Director New BoyThe combination of a focused, professional and first class crew combined with anenhanced and highly competitive tax incentive has made Ireland a highly attractive optionJames Flynn, Producer Leap YearThe wealth of talent in the Animation sector both from a production and pre-production perspective makeIreland a wonderful place in which to produce and foster creative ventures. Furthermore, this yearfor the first time, JAM have been contacted by numerous international rights holders wishing to co-produce.With the support of the <strong>Irish</strong> <strong>Film</strong> <strong>Board</strong> and Section 481 coupled with the talent, Ireland can competeinternationally and negotiate IP that will add long term value to companies and as a result the economy.John Rice, CEO, JAM MediaThe recently enhanced tax breaks along with the availability of highly skilled professional crew combined withfirst class production and post production facilities makes Ireland an attractive location for filmingSuzanne McAuley, Producer Raw- 9 -

AUDIOVISUAL FEDERATION REVIEWContentsForeword 11Achoimre Feidhme 12Executive Summary 13Chapter 1: <strong>Audiovisual</strong> Production in Ireland – 2008/<strong>2009</strong> 14Chapter 2: Economic Analysis 2008 25Chapter 3: The <strong>Irish</strong> <strong>Audiovisual</strong> Sector – 2008/<strong>2009</strong> Review International Context 28Case Study 1: The Clinic Series 6 30Case Study 2: Noddy in Toyland 31Case Study 3: Ros Na Rún 32Case Study 4: Ondine 33Appendices: 34Appendix I: Economic Analysis 2008 35Appendix II: Production Details – Summary 2004 - 2008 Comparison 39Appendix III: Production Details – By Type of Production – 2008 40Appendix IV: Funding Details – By Type of Production - 2008 41Appendix V: Contribution of the <strong>Irish</strong> <strong>Film</strong> Sector to the <strong>Irish</strong> Economy 2008 43Appendix VI: Clarification Notes 44Appendix VII: Section 481 Investment 45Appendix VIII: Agencies Involved with the <strong>Audiovisual</strong> Production Industry in Ireland 46Appendix IX: List of Productions included in the <strong>Report</strong> 2008 and <strong>2009</strong> 50Ballet Chancers- 10 -

AUDIOVISUAL FEDERATION REVIEWForewordThe annual <strong>Audiovisual</strong> <strong>Federation</strong> Review of <strong>Film</strong> and Television Production in Ireland is an important resource for monitoring the growth andtrends within the industry over the years.The economic analysis for 2008 shows a production value of €246.8 million, an increase on 2007 (€195.7 million). This growth had beenpredicted for 2008 but production value is still below that of 2006 (€279.9 million). While the funding and commissioning input by the <strong>Irish</strong> <strong>Film</strong><strong>Board</strong>, the Broadcasting Commission of Ireland and the broadcasters was maintained over this period, the difficulty in achieving the growth of2006 was inevitable because of the non competitiveness of the financial incentive Section 481, resulting from improvements in correspondingincentives in other jurisdictions.The decision by the Government to provide the necessary enhancements to the Section 481 tax incentive in the Finance Act <strong>2009</strong> in order torestore competitiveness indicates the Government’s commitment to this sector. The effectiveness of the enhanced Section 481 is dependent onthe complementary role of the <strong>Irish</strong> <strong>Film</strong> <strong>Board</strong>’s funding policy. The combination will enable a return to growth for the <strong>Irish</strong> <strong>Film</strong> and Televisionindustry with the effect of increased economic activity, an injection of foreign investment into the economy, creation of employment and significanttourism profile.This analysis is divided under three headings and the trends shown therein highlight the challenges to be addressed if the potential for continuousgrowth is to be achieved.Feature <strong>Film</strong>Production activity in 2008 increased to €71.9 million (2007: €19.3 million) but this is still significantly below levels achieved in earlier yearsand confirms the overall loss of growth in feature activity which had achieved a level of €244.3 million in 2003. It is estimated that the level ofproduction activity for feature films will reduce to €65 million in <strong>2009</strong>. However, the Government amendments to the Section 481 film tax reliefscheme only became effective in March <strong>2009</strong> and it is predicted that these, combined with the <strong>Irish</strong> <strong>Film</strong> <strong>Board</strong> support, will facilitate a returnto growth.Indigenous production activity has maintained continuous growth over this period as a result of funding made available through the <strong>Irish</strong> <strong>Film</strong><strong>Board</strong>. The profile and success of <strong>Irish</strong> indigenous production is currently very high (see awards on pages 4-7) but Ireland has not been sufficientlycompetitive to attract international feature film production as a result of enhanced incentives in competing jurisdictions. Continuation of thisdramatic reduction in inward production activity would have had a serious negative impact on the level of experienced personnel andinfrastructure which in turn would have been a significant restriction on indigenous development.The Government has been very supportive of maintaining competitiveness in the past. The current amendments contained in the Finance Bill<strong>2009</strong> in restoring competitiveness, not only continues this support but demonstrates the Government’s willingness to respond to the changinginternational competitive landscape.Independent TV including Major TV DramaProduction in this sector had shown a consistent upward trend in recent years. While total production in 2008 was €136 million compared to€154 million in 2007, it is estimated that total production for <strong>2009</strong> will reduce to €109 million. Domestically, RTÉ continued its policy of stronginvestment in the independent television sector, TG4 maintained its position as an important source of television commissions, TV3 providedcommissions and the BCI’s Sound and Vision broadcast funding scheme provided a significant allocation to film and television production.Unlike incentives in other jurisdictions Section 481 is applicable to television as well as film. This fact, coupled with the <strong>Irish</strong> <strong>Film</strong> <strong>Board</strong>’sInternational Production Fund, has enabled Ireland to attract many international television productions which has had an important positiveimpact on this sector.AnimationAnimation in Ireland has shown consistent growth in recent years and the sector is now the largest provider of full time and permanentemployment in the <strong>Film</strong> and Television independent sector. Total output in 2008 was €38.9 million (2007: €22.4 million). The estimate for <strong>2009</strong>is €43.0 million. The adequacy of tax incentives, funding opportunities and commissions will all play an essential role if the growth in this sectoris to be continued.OverviewThis report concentrates on measuring and analysing <strong>Film</strong> and Television production output in the independent sector which is one aspect of theindustry as a whole. The audiovisual industry content production sector is worth over €550 million, employs over 6,000 with an SME profile ofover 560 companies (PwC, 2008). In 2008 18% of tourists cited film as a reason for visiting Ireland. This resulted in tourist expenditure of €369million which can be directly attributed.The <strong>Film</strong> and Television industry continues to have great potential, economically and culturally, and the Government is to be congratulated ontaking measures to restore competitiveness and enable Ireland to continue to participate in the huge growth internationally of the industry.Kevin MoriartyChairman, <strong>Audiovisual</strong> <strong>Federation</strong> Database Steering Committee, November <strong>2009</strong>- 11 -

AUDIOVISUAL FEDERATION REVIEWAchoimre FeidhmeDéanann an tuarascáil seo anáil is ar thionchar eacnamúil266 léiriú closamhairc, ar leiríodh a bhformhór in Éirinn i2008, ag a raibh luach iomlán léiricúcháin €246.8 milliún.Léiríonn an tuarascáil go raibh méadú ar léiriú scannán agusanamúlachta, rud a bhfuil fáilte roimhe ach gur tháinig laghdúar léirithe teilifíse agus ar mhórthograí drámaíochta teilifíse. Táméadú 26% ar na figiúirí iomlána sa tuarascáil do 2008 achtá laghdú beag atá á thuar againn arís sna meastacháin do<strong>2009</strong>.Caiteachas na hÉireannAschur ClosamhaircMórscannáinTeilifís Neamhspleách(Mórdhrámaí san áireamh)BeochanAschur Iomlán2005 2006 2007 2008 <strong>2009</strong>*G milliún33.574.144.8152.484.8 19.3143.751.4154.022.4279.9 195.771.9 65136.0 10938.9 43246.8 217*Measta€167.8 milliún de chaiteachas iomlán ar earraí agus arsheirbhísí Éireannacha atá tuairiscithe do 2008, ardú €24.6milliún (17%) don earnáil. Is de thoradh an mhéadú 43% archaiteachas Éireannach i 2008 san earnáil Anamúlachta agusan méadú 190% san earn áil Mhórscannáin (le hais 2007) atharla cuid mhaith de seo. (Feic Appendix I).FostaíochtTháinig laghdú de bheagán, ar an fhostaíocht iomlánÉireannach i ndáil le socrúcháin i 2008 go 12,660 in 2008(le hais 12,727 i 2007). Laghdaigh an líon postanna coibhéislánaimseartha freisin ó 1,735 i 2007 go 1,631 i 2008.Cuidiú FioscachAr bhonn tairbhe costais, lean Earnáil Chlosamharc nahÉireann de bheith ag cur go suntasach le heacnamaíocht nahÉireann i 2008. Mar a tharla i mblianta eile, bhí na haischurchuig an Státchiste i 2008 ó ioncaim agus caiteachais níosmó ná an cháin nár gearradh trí Alt 481. Thug seoglanghnóthachán €25.7 milliún d’Eacnamaíocht nahéireann i 2008, an gnóthachan is airde ó 2003Foinsí MaoinitheTháinig €188.8 milliún den mhaoiniú as Éirinn. Chuir Alt 481ollmhaoiniú €101.2 milliún ar fáil. Ar na foinsí tábhachtachaeile bhí RTÉ, TG4, Bord Scannán na hÉireann agus Fuaim agusFís Choimisiún Craolacháin na hÉireann302520151050Caiteachas ÉireannachMórscannáinTeilifís Neamhspleách(Mórdhrámaí san áireamh)BeochanCaiteachas Éireannach Iomlán200517.566.313.196.92006 2007 2008 <strong>2009</strong>*G milliún29.8113.817.6161.212.2118.612.4143.235.4114.617.8167.8Sochar Glan don Eacnamaíocht Éireannach (€ Milliún)*Measta2004 2005 2006 2007 200829*Cúlra na Tuarascála:Tiomsaíodh an tuarascáil seo agus tuarascálacha afoilsíodh roimhe seo 1993-2008 ó staitisticí a fuairCónaidhm Chlosamhairc <strong>IBEC</strong>. Ag tráth a scríofa, ní raibhfáil ar fhigiúirí iniúchta do léiriúcháin iomlána <strong>2009</strong>. Dáthoradh sin tagraíonn an phríomhanailís eacnamaíoch do2008. Léiríonn na figiúirí do <strong>2009</strong> tuairisceáin neamhiniúchtanach raibh dian go leor le go bhféadfaí anailísmhionshonraithe a dhéanamh orthu.9019138- 12 -

AUDIOVISUAL FEDERATION REVIEWExecutive SummaryThis report analyses the economic impact of a total of 266audiovisual productions, the majority of which were producedin Ireland in 2008, comprising a total production value of€246.8 million. The report shows a welcomed increase inthe production of feature films and animation buta drop in independent TV including major TV dramaproductions. Overall figures for 2008 show a 26% increaseon the previous year, but our estimates for <strong>2009</strong> are showinga slight fall again.<strong>Irish</strong> Expenditure<strong>Audiovisual</strong> OutputFeature filmIndependent TVIncl. major TV DramaAnimationTotal Overall Output2005 2006 2007 2008 <strong>2009</strong>*G million33.574.144.8152.484.6 19.3143.851.4154.022.4279.9 195.771.9 65136.0 10938.9 43246.8 217*estimateThe total expenditure on <strong>Irish</strong> goods and services arising fromthe audiovisual productions for 2008 was €167.8 millionwhich shows an increase of €24.6 million (17%) for the sector.This increase is largely due to a 43% increase in the <strong>Irish</strong>expenditure within the Animation sector and a 190% increasein the Feature <strong>Film</strong> sector on the previous year, 2007 (seeAppendix I).<strong>Irish</strong> ExpenditureFeature filmIndependent TVIncl. major TV DramaAnimation200517.566.313.12006 2007 2008 <strong>2009</strong>*G million29.8 12.2 35.4 29113.8 118.6 114.6 9017.6 12.4 17.8 19EmploymentTotal <strong>Irish</strong> Expenditure96.9161.2143.2167.8 138*estimateTotal <strong>Irish</strong> employment in terms of placement fell slightly from12,727 in 2007 to 12,660 in 2008. The number of full-timeequivalent jobs also decreased from 1,735 in 2007 to 1,631in 2008.Fiscal ContributionOn a cost benefit basis the <strong>Irish</strong> <strong>Audiovisual</strong> Sector continuedto make a significant contribution to the <strong>Irish</strong> economy. Thereturns to the exchequer in 2008 derived from incomes andexpenditure generated again exceeded tax forgone throughSection 481. This yielded a €25.7 million net gain to the <strong>Irish</strong>Economy in 2008, the highest return since 2003.Sources of FundingThe proportion of funding originating in Ireland was €188.8million. Section 481 contributed gross funding of €101.2million. Important sources of <strong>Irish</strong> funds were RTÉ, TG4, <strong>Irish</strong><strong>Film</strong> <strong>Board</strong> and the BCI Sound & Vision.302520151050Net Benefit to the <strong>Irish</strong> Economy (€ Millions)2004 2005 2006 2007 2008*Background to <strong>Report</strong>:This report and previous reports published in 1993-2008have been compiled from statistics obtained by the <strong>IBEC</strong><strong>Audiovisual</strong> <strong>Federation</strong>. At the time of writing, auditedfigures for all <strong>2009</strong> productions were not available. As aresult the main economic analysis refers to 2008.Figures for <strong>2009</strong> represent non-audited returns that werenot sufficiently rigorous to allow detailed analysis.- 13 -

<strong>Audiovisual</strong> Production in Ireland 2008 – <strong>2009</strong>AUDIOVISUAL FEDERATION REVIEWChapter OneMartin Cullen TD, Minister for Arts, Sport and TourismAt the outset I believe it is important that I should comment about the proposals in the <strong>Report</strong> of the SpecialGroup on Public Sector Numbers and Expenditure Programmes (McCarthy <strong>Report</strong>), insofar as they relate to filmmaking in Ireland. The proposals in the <strong>Report</strong> have not been adopted by the Government as policy but will beconsidered in the context of the 2010 estimates process. As part of that process I will be articulating the benefitsto Ireland of having a vibrant film industry that can create employment and attract inward investment.<strong>Film</strong> and filmmaking is of great value to Ireland, both financially and as a cultural asset for the country. A surveypublished last year by the <strong>Irish</strong> <strong>Film</strong> <strong>Board</strong> showed that the value of the <strong>Irish</strong> audiovisual content sector at overhalf a billion Euro with direct employment at 6,000. An earlier survey in 1992 identified that at that time direct employment was 1,000.There is now more than ever greater global competition in securing film and television productions. In fairness, Ireland continues to holdits own thanks to the work of the <strong>Irish</strong> <strong>Film</strong> <strong>Board</strong>, our impressive talent pool of directors, writers, actors and technical crews and the varioussupports that are on offer. This support manifests itself through various mechanisms including the Section 481 tax incentive for film andtelevision production in Ireland, which was extended until the end of 2012 earlier this year with significant enhancements. This gives agreat boost not only to the <strong>Irish</strong> audiovisual industry but also to the <strong>Irish</strong> economy in general. A number of significant productions wereattracted to Ireland during <strong>2009</strong> because of these changes and further productions are in the pipeline for next year and beyond.Quantifying the impact of the audiovisual sector on the broader economy, including its impact on tourism, digital media and broaderindustrial productivity is challenging given the intangible nature of these impacts. More importantly, how can anyone quantify the impactof a film in communicating messages about Ireland to <strong>Irish</strong> and international audiences such as – reminding people of the cultural richnessof Ireland, promoting Ireland as a tourist location, promoting the multi-cultural aspects of modern Ireland and reminding artists in Irelandof the potential for success on a world stage.It was pleasing for me as the Minister with responsibility for the film industry to see further achievements for <strong>Irish</strong> film talent in <strong>2009</strong> -with Golden Globe awards for Colin Farrell and Gabriel Byrne, Emmys for Brendan Gleeson and Dearbhla Walsh, ongoing successes at filmfestivals such as Edinburgh, Sundance and Tribeca and two Oscar nominations.It is obvious that there is huge talent in the film making industry in Ireland, both in front and behind the camera. The challenge now is toensure that we build on that talent during this very difficult economic period and that the hard fought advantages we have won are notlost. I am committed to doing what I can to ensure that happens.Eamon Ryan TD, Minister for Communications, Energy and Natural ResourcesIn the last year, significant advances have been made in Ireland’s broadcasting sector, most notably in theenactment last July of the Broadcasting Act <strong>2009</strong>. The most comprehensive legislation governing <strong>Irish</strong>broadcasting in almost 50 years, this Act provides a modern and up to date framework for the broadcasting sector,both public and private.The Act replaces all previous broadcasting content legislation. It introduces many new concepts, creates a newrange of functions for broadcasters and the regulator. It also provides for new activities and services, particularlyin light of the latest technological developments.The Act aims to protect, not only the interests of the industry, but crucially those of the audience. Thus, it introduces new standards inrelation to broadcast content and to advertising. It also provides for a right of reply, whereby those impugned can have their concernsaddressed in the same manner as they were broadcast.This legislation changes and improves the nature of broadcast regulation in Ireland. It allows for the establishment of a new singlebroadcasting regulator, the Broadcasting Authority of Ireland (BAI), for both RTÉ and the independent broadcasting sector. The BAI’sprimary focus is to support and grow the diverse variety of services and information, entertainment and enjoyment currently available tothe <strong>Irish</strong> listener and viewer. As well as Ministerial input, the Oireachtas Committee on Broadcasting proposes nominees for membershipof the board of the Authority – a significant advance in creating a more democratic process of board appointments in IrelandFrom Analogue to DigitalProgress is also being made in the deployment of Digital Terrestrial Television (DTT) which was provided for under the Broadcasting(Amendment) Act, 2007 and now under the Broadcasting Act <strong>2009</strong>. Since 2007, RTÉ has been awarded a national licence to provide anational free to air DTT service offering access to RTÉ, TV3, TG4, at minimum. RTÉ has started to build the network to provide this serviceand to date, thirteen sites have been DTT enabled.- 14 -

<strong>Audiovisual</strong> Production in Ireland 2008 – <strong>2009</strong>AUDIOVISUAL FEDERATION REVIEWIn addition, OneVision – a consortium comprising eircom, Arqiva, TV3 and Setanta Ltd. - has been offered a contract by the BroadcastingCommission of Ireland (BCI) to provide commercial DTT services. The offer to OneVision was made after the original Boxer consortiumannounced its intention to withdraw from the <strong>Irish</strong> market. While this withdrawal has resulted in some delay in the introduction of DTTservices in Ireland, the European Commission analogue switch-off deadline of 2012 will be reached.Sound and VisionThe funding of innovative broadcasting projects remains a priority and accordingly, the Broadcasting Act <strong>2009</strong> provides for an increase inthe monies available under the Sound and Vision scheme. The Sound and Vision scheme, administered by the Broadcasting Authority ofIreland, is a valuable support to broadcasters and independent producers in the production of programme material on <strong>Irish</strong> culture,heritage and experience, as well as programmes in the <strong>Irish</strong> language for broadcast on <strong>Irish</strong> television and radio. A key objective of thescheme is to increase public access at national, local and community level to high-quality radio and television programmes. To date, asum in excess of €40 million has been disbursed under the Scheme by the Broadcasting Commission of Ireland in the development ofsuch programming.European DevelopmentsFollowing on from the adoption of the <strong>Audiovisual</strong> Media Services Directive, new regulatory frameworks for audiovisual services will bedeveloped in Europe, which take into account advances in technology and market developments over recent years. In practical terms,almost half of television services watched by <strong>Irish</strong> audiences are provided by broadcasters based in other member states. The Directiveprovides the guarantee that such services will be subject to a certain minimum degree of harmonised measures, and will be transposedacross all Member States by the end of this year.With these developments and those due in the years ahead, both audience and industry can be sure of a vibrant, effective and successfulbroadcasting sector in Ireland.The future is promising.Simon Perry, Chief Executive, Bord Scannán na hÉireann/the <strong>Irish</strong> <strong>Film</strong> <strong>Board</strong>2008 finished on a high for the <strong>Irish</strong> film industry. It was a record year for production with 25 films having goneinto production, Section 481, the <strong>Irish</strong> tax incentive for film and television production improved in order to restorethe competitiveness of Ireland as an international film and television location and a survey completed byPricewaterhouseCoopers valued the <strong>Irish</strong> audiovisual sector at over €500 million, employing over 6,000individuals.The improvements to Section 481 which became legislation in April <strong>2009</strong> had the knock on effect of a quietbeginning to the year on the production front, whilst the new legislation was being processed. However, productionsoon got going with the major US feature film Leap Year starring Amy Adams filming on location in Ireland. Indigenous projects green litfor production included The Runway, Snap and The Guard all of which filmed on location outside of the Dublin area, providing much neededlocal spend and jobs in regional areas.Throughout <strong>2009</strong>, the <strong>Irish</strong> film industry has received major international recognition and acclaim, representing Ireland on the world stageat the highest levels, emphasising Ireland’s reputation as a centre of cultural excellence. <strong>Irish</strong> stories and images of Ireland were seen byaudiences all over the world and the industry scooped over 45 international awards to date in <strong>2009</strong>. Highlights included the A-list TorontoInternational <strong>Film</strong> Festival, where a record eight <strong>Irish</strong> films were selected, two Emmy awards and two Golden Globes for <strong>Irish</strong> talent, anAcademy Award nomination for an IFB short film, two awards at the Sundance <strong>Film</strong> Festival, a Best Actor award at the Tribeca <strong>Film</strong> Festivaland audience awards at Edinburgh, Oberhausen and Annecy.2010 promises to be a difficult year in terms of public funding cutbacks, however Bord Scannán na hÉireann/the <strong>Irish</strong> <strong>Film</strong> <strong>Board</strong> (IFB)remains ambitious in its goals for the industry. Following from the results of the PwC report which recognised significant economic growthpotential for the industry, the Department of Arts, Sport and Tourism has engaged with the IFB in a strategic plan to enable the domesticaudiovisual content production sector to develop into an internationally traded sector for products and services, over a five year period2010 – 2015.The growth potential of the audiovisual content industry, as an essential component of the Smart Economy strategy, represents strongprospects of employment for young people seeking jobs in the future.- 15 -

<strong>Audiovisual</strong> Production in Ireland 2008 – <strong>2009</strong>AUDIOVISUAL FEDERATION REVIEWSteve Carson, Director of Programmes Television, RTÉ2008 saw RTÉ Television reaping the benefits of continued investment in original <strong>Irish</strong> programming.In commercial terms, it was a year of two parts: buoyant growth in the first three quarters of the year and sharpdecline in the last. This has tested the mettle of RTÉ, as a public service broadcaster, but also as the largestcreative organisation in this country: to continue to deliver to our viewers a schedule with the quality, range andambition that they associate with RTÉ, and which they have a right to expect. It has taken creativity and hard workto deliver this under mounting financial pressure.And we have delivered: all ten of the Top 10 most-watched programmes on any television channel available in Ireland were home-producedand broadcast by RTÉ. RTÉ last enjoyed monopolising all top 10 slots in 2003. Indeed, 19 out of the Top 20 were broadcast by RTÉ and48 out of the Top 50 were broadcast by RTÉ television: A significant achievement.These programmes, marking and covering key national sporting events like The All Ireland Finals and Munster v the All Blacks; keyentertainment high points like The Late Late Toy Show, The Rose of Tralee, Tubridy Tonight; key appointment-to-view dramas like Fair Cityand Whistleblower; events of national importance in cutting-edge news and current affairs from Six One to Prime Time Investigates; bitingconsumer issues in Buyer Beware; alongside the highest quality television service for young people’s programming on this island, includinginnovations such as Aisling’s Diary and Red, with a life online as well as on television, contributed to the 3050 hours of young people’sprogramming in 2008 on RTÉ Two, 26% of which was indigenous. These encapsulate what RTÉ does so well – make relevant, engagingprogramming that informs, entertains and fuels the national conversation.RTÉ programmes compete in a very crowded market. In September 2008, digital penetration had increased to 52% of the 1.5 million TVhouseholds (Source: AGB Nielsen Media Research, Establishment Survey). This represents an increase of 5-points year-on-year and 11-points compared with September 2006. In real terms, the number of digital households has increased by 36% over the past two years,to stand at 803,000 households in September 2008. Digital homes can access from around 60 to 500 television channels. RTÉ hasperformed well to retain audience in the context of this increase in competition for viewers. RTÉ increased its peak-time national individualsaudience by 0.1 TVRs during 2008 when compared with 2007. RTÉ’s peak-time increase in audience was driven by RTÉ Two, whichincreased its audience from 3.7 TVRs to 3.8 TVRs, while RTÉ One maintained 9.7 TVRs.Despite the financial difficulties that became apparent in the latter part of the year, RTÉ Television broadcast 5,231 hours of indigenousprogramming in 2008, an increase of 72 hours (1%) on 2007. Of those hours 2076 (40%) were broadcast in peak-time, an increase of43 hours (2%) on 2007. These hours included our ongoing commitment to high quality factual programming in prime time, such asCromwell in Ireland, which achieved an average audience of 365,000 and Death or Canada, which won an audience of 332,000 onaverage, while the four-part Bertie, a combined biography and analysis of the longest-serving politician of modern times in Ireland,attracted an average 558,000 viewers across all four episodes. Again, the focus was on home-production rather than acquisitions, with€199.6million spent on home-produced programming contrasting with €24.7million on acquired programming. Between 2003 and 2008indeed, the spend on acquisitions has increased by 7%, whereas the spend on indigenous programming has increased by 60% in thesame period.Again this year, RTÉ Television’s commitment to the Independent Sector was far in excess of our statutory obligation. The actual expenditureincurred on commissioned programmes during 2008 was €75million (including RTÉ attributable organisational overhead)***, which wasmore than twice our €32.8million statutory requirement. We remain committed to the sector and our expenditure in <strong>2009</strong> will again exceedthe new statutory obligation set by the Broadcasting Bill 2008, of €40million. We have also changed the way we work with the sector,instigating a new rolling commissioning system in <strong>2009</strong>, to foster creativity, timeliness and ensure a steadier stream of potentialcommissions, and therefore income, for independent programme makers.RTÉ won a record 182 awards at home and abroad in 2008, across radio and television, proving yet again that the quality of RTÉprogrammes is world class. Television fared particularly well with a prestigious Prix Italia (At Home with the Clearys) award this year, fourHugo Awards in Chicago, in Drama (Prosperity), Arts (Being John Banville), History (Killings at Coolacrease) and Documentary categories(The Catalpa Rescue). As well as ten IFTAs; Celtic Media Awards, etc. This international recognition of quality is particularly gratifying aswe manage our way through an unprecedented drop in our commercial income. In the context of the national recession that is hitting allsectors of society, RTÉ is far from alone in facing the challenges that this economic climate brings. Despite the shortfall we’re seeking toaddress in the <strong>2009</strong> balance sheet, our focus is very firmly on maximising home-production. We launched over 100 new and returninghome-produced series/documentaries in autumn <strong>2009</strong> and look forward to maintaining the depth and breadth of such programming intothe future.*source: ComReg** please note figures for 2008 are calculated on a cost of transmission basis under IFRS.*** source: RTÉ Annual <strong>Report</strong> 2008- 16 -

<strong>Audiovisual</strong> Production in Ireland 2008 – <strong>2009</strong>AUDIOVISUAL FEDERATION REVIEWMichael Cantwell, Manager, Telecoms, Internet, Media & Entertainment, Enterprise IrelandWhile the economic climate is demanding for business overall, Telecoms, Internet, Media & Entertainment hasnot been as unfavourably affected as other industries. Despite the general downturn, industry forecasts arepositive with the digital reality impact resulting in both opportunities and challenges for <strong>Irish</strong> business.The industry must position itself on the international stage where multiple opportunities abound. <strong>Irish</strong> industryhas the creative capability but must further develop its business and sales development skills to competeinternationally and gain market share. This industry can potentially deliver real added value for Ireland. Theopportunity for the <strong>Irish</strong> Media & Entertainment industry to serve global markets remains significant.Enterprise Ireland (EI) assists Media & Entertainment key clients in their endeavours to scale their business globally through customiseddevelopment plans with targeted ongoing financial support including initial R&D funding for start ups, ongoing R&D funding support andbusiness expansion for established SMEs. EI supports a range of management development, business acceleration programs andidentification of new business opportunities with client /buyer introductions on a global level through our network of international offices.High level contacts, including telcos, broadcasters, production studios and key industry people visited Ireland to meet our leadingcompanies. In <strong>2009</strong>, as a direct result of these initiatives, a number of significant deals were signed by EI client companies.For Media & Entertainment overall, Enterprise Ireland provides the sector various knowledge sharing events with leading internationalindustry experts. Additionally, Enterprise Ireland supports and leads Media & Entertainment client delegations to international events andexhibitions where companies meet key global players. EI’s support of participation at these events enables Ireland to showcase its best ofbreed companies on an international stage.With the evolution of the digital landscape, the opportunity for the <strong>Irish</strong> Media & Entertainment industry to serve global markets remainssignificant. In 2010, Enterprise Ireland is committed to promote and assist key Media & Entertainment companies to internationally scaletheir business.Sarah Glennie, Director, <strong>Irish</strong> <strong>Film</strong> InstituteThe IFI is Ireland’s national cultural institution for film and as such is the only organisation to exhibit, preserveand educate. Our exhibition programmes bring our audiences the best of new <strong>Irish</strong> and international nonmainstreamcinema, through new releases, curated seasons and festivals, talks and special events.In addition the IFI’s Education and audience development programmes actively introduce new audiences to arthouse and alternative film. This is achieved through an extensive schools programme and a number of innovativeprogrammes aimed at family, youth and life-long learning audiences. The IFI schools programme is a significantnational resource that alone provides school children throughout Ireland (17,000 in 2008) access to challengingand inspiring cinema. It is currently undertaking a national research project, <strong>Film</strong> Focus, in collaboration with the <strong>Irish</strong> <strong>Film</strong> <strong>Board</strong> whichwill initiate a co-ordinated nationwide approach to film education.The <strong>Irish</strong> <strong>Film</strong> Archive collection is unique within the state, representing all aspects of indigenous film production, amateur andprofessional, from 1897 to the present day and through on going partnership agreements is the home of the IFB, BCI and Arts Councilarchives. It has recently acquired several important collections including the Concern film collection, the Radharc paper collection and thecollection of Dublin Zoo. Providing the public with access to this rich resource is central to the IFI’s activities and monthly archivescreenings bring our Dublin audience with unique access to <strong>Irish</strong> filmmaking and our national programme of curated projects from theArchive connects audiences nationally with their film heritage.IFI Reel Ireland, our international touring programme of <strong>Irish</strong> film funded by Culture Ireland, is now in its fifth year and to date we havefacilitated events in more than 40 countries around the world. Already in <strong>2009</strong> IFI Reel Ireland programmes have been screened in 23venues in 16 different countries including Mexico, Egypt, Iceland, Canada, and Russia.<strong>2009</strong> sees the IFI heading into an exciting redevelopment which will be complete before the end of the year and comprises an additionalcinema of 60 seats, new public facilities and significant development to the <strong>Irish</strong> <strong>Film</strong> Archive research facilities.The redevelopment will allow the IFI continue to grow in strength and help off-set the impact of the economic downturn on our commercialincome streams. However the IFI is vulnerable to cuts in funding from its three main public partners – Arts Council, <strong>Irish</strong> <strong>Film</strong> <strong>Board</strong>, CultureIreland – all of which are currently under threat. Our Arts Council funding represents 20% of our annual turnover with the remaining 80%is generated by the IFI. This strong track record of income generation places the IFI in a strong position in comparison to other artsorganisations that are more reliant on public subsidy. The challenge facing the IFI is to protect our ability to invest in diverse programming,the <strong>Irish</strong> <strong>Film</strong> Archive and Education all of which are central to our remit as a publicly funded cultural institution committed to providingaccess to film culture to a wide-range of audiences.- 21 -

<strong>Audiovisual</strong> Production in Ireland 2008 – <strong>2009</strong>AUDIOVISUAL FEDERATION REVIEWHelen McMahon, Project Advisor, FÁS Screen Training Ireland<strong>2009</strong> has presented significant challenges to the audiovisual industry, in terms of budgets, funding, andemployment. In times of economic uncertainty, training continues to play a crucial role in several ways.Firstly, and most crucially, re-skilling and cross-skilling is hugely important to professionals seeking to enhancetheir skillset, and is the cornerstone of professional survival in chastened times. Re-skilling is not only aboutlearning new skills; re-skilling requires a significant and complete understanding of this industry’s role in the widerlabour market, and the very real part we, as professionals in a creative and progressive industry, play in Ireland’sknowledge economy. The expertise and the talent of this industry is now the currency of an economy that can onlysurvive by nurturing and promoting it indigenous products; our content creators are the intellectual property owners that will emerge fromthis downturn as leaders on an international stage.How can training play a role in developing the key players in the knowledge economy? One vital step has already been taken. ScreenLeaders, Ireland’s first MEDIA-supported training programme, is currently cultivating the business leaders of the new economic reality. Intraining <strong>Irish</strong> and European producers to develop their companies to face dramatic changes in the industry, Screen Leaders is focusing oncreating businesses that are not dependent on inward investment, but rather significant exporters of intellectual property.At a national level, FÁS Screen Training Ireland with funding support from the Bord Scannán na hÉireann/the <strong>Irish</strong> <strong>Film</strong> <strong>Board</strong> continuesto provide a range of training for industry practitioners, but now faces the challenge of ensuring that these practitioners are prepared fora contracting industry, and have other areas of business interest to pursue. As this industry contracts, so training must open new doors topractitioners, providing them with the tools and expertise to explore new creative and professional avenues.To build on the work already done and to assist in the future development of the industry, training is required to focus on skills across allaspects of the content creation process, intellectual property development, creative entrepreneurship and management expertise. Trainingwill play a key role in preparing creative professionals for the transformation of the marketplace. Another key element will be up-skillingand re-skilling the industry for new production, sales and distribution models in an internet age. The entertainment industry, as one of theworld’s fastest-growing industries, is in a unique position to spearhead technological convergence and promote Ireland’s smart economy.One Hundred Mornings- 22 -

<strong>Audiovisual</strong> Production in Ireland 2008 – <strong>2009</strong>AUDIOVISUAL FEDERATION REVIEWBunny MaloneyNiko & The Way to the Stars- 23 -

<strong>Audiovisual</strong> Production in Ireland 2008 – <strong>2009</strong>AUDIOVISUAL FEDERATION REVIEWHappy Ever AftersNothing PersonalHeatAll Ireland Talent Show- 24 -

Economic AnalysisAUDIOVISUAL FEDERATION REVIEWExpenditure 2008 (see appendix I)Overall <strong>Irish</strong> expenditure in the economy, the key driver fordomestic employment and income, amounted to €167.8 millionfor the 266 productions analysed. As part of this figure,expenditure from independent TV production including major TVdrama stood at €114.6 million representing 68% of <strong>Irish</strong>expenditure.Feature <strong>Film</strong>s 2008In 2008, the production of feature film accounted for 29% of thetotal cost of productions within the State. Of the €71.9 millionspent on productions, €35.4 million (49%) was spent on <strong>Irish</strong>goods and services. These productions generally draw on <strong>Irish</strong>and non-<strong>Irish</strong> funding. The main sources for <strong>Irish</strong> funding wereSection 481 (€31.9 million), the <strong>Irish</strong> <strong>Film</strong> <strong>Board</strong> (€9.9 million),BCI and RTÉ (€0.9 million) combined.200180160140120100806040200Independent TV Productionsincluding Major TV Drama68%Animation11%Feature <strong>Film</strong>21%<strong>Irish</strong> Expenditure (G167.8 million)<strong>Irish</strong> Expenditure (G167.8million)2004 2005 2006 20072008 *<strong>2009</strong>(*Estimate)4035302520151050Feature <strong>Film</strong> (<strong>Irish</strong> Expenditure G35.4million)2004 2005 2006 2007 2008 *<strong>2009</strong>(*Estimate)The analysis examines the performance of Feature <strong>Film</strong>s,Independent TV Productions including Major TV Drama andAnimation over the last five years, excluding <strong>2009</strong>.The ClinicHugh Leonard - Odd Man In- 26 -

Economic AnalysisAUDIOVISUAL FEDERATION REVIEWIndependent TV Production(including Major TV Drama) 2008Animation 2008The output for independent TV productions in 2008 was €136million a 12% decrease on 2007. Of that €114.6 million wasspent within the <strong>Irish</strong> economy. The main sources of TVcommissions continue to be RTÉ and TG4.The growth in the <strong>Irish</strong> animation industry, which is almostentirely export sales, shows a significant increase on last yearyielding a total output of €38.9 million, of which <strong>Irish</strong>expenditure amounted to €17.8 million.140Independent TV Productions including Major TV Drama(<strong>Irish</strong> Expenditure G114.6 millions)2018Animation (<strong>Irish</strong> Expenditure G17.8 millions)1201008016141210604020864202004 2005 2006 2007 2008 *<strong>2009</strong>02004 2005 2006 2007 2008 *<strong>2009</strong>(*Estimate)(*Estimate)Employment (see Appendix I)Employment in 2008 showed a slight decrease, with job placements down from 12,727 to 12,660. The number of full time equivalentjobs totalled 1,608 in 2008.MarconiPerrier’s Bounty- 27 -

International ContextAUDIOVISUAL FEDERATION REVIEWChapter ThreeThe international filmed entertainment sector is expected toexperience strong growth over the coming years withPriceWaterhouseCoopers Global Entertainment and Media Outlookestimating the compound annual growth rate at 4%, with theworldwide industry reaching $102 billion in 2013. While adownturn is expected for <strong>2009</strong>, and the industry remaining weak in2010, it is due to recover with low growth in 2011.Cinema admission figures across Europe have risen slightly from920 million in 2007 to 924 million in 2008. It is difficult to predictan overall trend for <strong>2009</strong> as while some territories such as Franceare experiencing a decrease in attendances, other territories suchas the UK are experience strong increases. A positive trend to notefrom a European perspective is the fact that there seems to be asteady demand for European cinema. European films market sharein the EU for 2008 has remained similar to 2007, at 28%.European film production levels continue to show growth year onyear with the European <strong>Audiovisual</strong> Observatory estimating a totalof 1,145 films that were produced in the EU in 2008, representingan 11% increase on the previous year’s total of 1,033. This growthhas many factors, the primary being the reduced barriers of entryof film production due to new digital technologies, which arecontinuing to lower the costs of production. Co-productions are alsoat a healthy level with Ireland involved in 11 official film and TV coproductionsin 2008, through the European Convention onCinematographic co-production and the Canada and Ireland coproductiontreaty.The International industry, while on the surface is performing well interms of production levels and box office revenues, is in a period offlux. There is a converging of content and an increase in the blurringof lines between TV, Internet, Mobile applications, Games etc.Formats have increased their share on TV screens, with the globalproduction volume of traded TV formats reaching €9.3 billionbetween 2006 and 2008. The introduction of product placementand branded content will take on increased importance, given thedecrease in the value of traditional television advertising and theinability to incorporate ad breaks for on-line content. There will bean increase in the level of clustering and companies creatingalliances with “Innovation Partners”, digital projection is opening uptheatres to alternative content like opera and gaming, and theincreasing worry for producers on how to “monetize” their contentgiven the levels of piracy through bit torrent and file sharingwebsites.With recent improvements to the <strong>Irish</strong> tax incentive, Section 481,the Government hopes to have improved Ireland’s competitivenessas a location for mobile film, TV and animation production. Whileincoming productions in <strong>2009</strong> have dipped slightly, despite thenotable exceptions of The Tudors Season 4 and the Hollywood filmLeap Year starring Amy Adams, there is a strong slate of productionsscheduled for 2010 including the ITV drama Primeval, which hasdecided to re-locate to Ireland from the UK for Season 4 & 5. Therewere numerous factors for the decline for incoming productions in<strong>2009</strong>, primarily the further strengthening of the Euro against thedollar and the British Pound, and the delay in the approval from theEuropean Commission on the changes to Section 481 – thiseffectively halted International production for the first quarter of theyear.<strong>Irish</strong> film, TV and animation is currently selling well worldwide,despite difficult market conditions brought on by a decline in DVDsales, piracy and uncertainty in the financial world. The feature filmThe Eclipse has recently been picked up for international and USdistribution by Magnolia Pictures, one of the leading indiedistributors, and Neil Jordan’s Ondine has sold to numerousterritories to date by Paramount Vantage. Indigenous independenttelevision drama, factual and lifestyle production has alsoperformed well internationally over the last year with RTÉcommissioned programmes such as Single Handed (which wasbroadcast on ITV Primetime), Prosperity, Customs, Traffic Blues,Showhouse, Designs for Life and Room to Improve being amongthose that have been successfully exported abroad.<strong>Irish</strong> animation continues to perform well internationally with two ofthe three films nominated by the European <strong>Film</strong> Academy in <strong>2009</strong>for best animated feature being <strong>Irish</strong> and for the second yearrunning, an <strong>Irish</strong> studio won the prestigious ‘European Producer ofthe Year’ award at Cartoon Forum. Within international children’sbroadcasting and animation circles, Ireland is widely regarded as acreative hub producing some of the most popular and innovativeprogrammes for children today. The animation sector is almostentirely export focused and excluding Section 481 funds, almost80% of its income is generated from international sources.<strong>Irish</strong> Pavilion in Cannes 2008- 28 -

AUDIOVISUAL FEDERATION REVIEWDaithi ar Highway 61Mobs MheiriceaHis & Hers- 29 -

Case Study OneAUDIOVISUAL FEDERATION REVIEWCASE STUDY: THE CLINIC SERIES 6BackgroundIn late 2007, Parallel <strong>Film</strong> Productions was commissioned by RTÉ toproduce the sixth series of ten one hour episodes of the highlysuccessful prime-time television drama series The Clinic. Productioncommenced in Spring 2008 and the series was broadcast as part ofRTÉ’s prime time Autumn schedule in the same year.Set in Dublin and shot on location and in studio, in and around thegreater Dublin area, The Clinic is an entirely indigenous production.The series was financed through a combination of development andproduction funding from RTÉ and S481 investment.Just as the first five years of The Clinic tapped into the zeitgeist of theCeltic Tiger, series 6 and beyond had to tap into the Post Tiger eraand reflect an Ireland beginning to come to terms with the boom tobust phenomenon after more than a decade of unprecedentedeconomic growth. This new reality would be explored throughcompulsive drama taking an uncompromising and realistic approachto contemporary topics and issues that would strike a chord with abroad spectrum of the large and loyal Clinic audience. And just asIreland had moved on over the first five years of the series so too hadTV generally and TV drama in particular. The storytelling and filmingstyle for series 6 would have to be reinvigorated to reflect thechanging tastes and audience expectation.So the particular creative challenge for series 6 was to give it thebenefit of a vibrant and sassy makeover whilst still maintaining theheart and ethos of the original idea. This was the starting point forthe team as they started to map out and eventually write the series– a process which takes place over several months and moves fromseries outline to episodic outlines to scene by scene breakdownsand eventually draft scripts – each stage being refined and reviseduntil the scripts are ready for production.Production/Post ProductionThe production was based at a dedicated facility in Dublin 12 whichprovided office, storage, construction, production and studio floorspace at one location. This was a new base for series 6 and someimprovements to the existing facility (previously a distribution andtelesales base for an international beverage company) were requiredto get it to an acceptable standard for production. This includedsome minor structural alternations and additions to the existingbuildings.From the commencement of early script development until finaldelivery of the last episodes to RTÉ, it took approximately ten monthsto develop and produce 10 x 52’ episodes of The Clinic Series 6.Formal pre-production and production accounted for five months.For the purposes of production the ten episodes were grouped as fiveblocks of two episodes, each block having a 15 day shooting periodcomprising of approximately ten days shooting on the sound stageand five days on location. This equates to 7.5 days shooting for each52’ episode.The Clinic 6 had a large cast and crew – a total of 883 people wereemployed on the series. This figure includes all core cast, guest cast,day players and extras, all production, design, scripting, locations,make up, costume and shooting crew, all construction, catering,security and all others associated with the provision of services andfacilities directly to the production. 871 of these were <strong>Irish</strong> nationals,ten were EU citizens and two were non EU citizens.In addition, eight trainees were employed on the production underthe supervision of the Production Manager together with the head ofeach specific department concerned. The trainees deployed acrossthe production, camera, sound, wardrobe, hair and assistant directordepartments, varied in experience, ranging from starting their firsttelevision series to more experienced crew who would soon beupgrading to the level of Assistant. All Trainees worked for theduration of the 15 week shoot and for a variety of prep and wrapweeks, depending on department requirements. The training for alltrainees was balanced between the specific requirements of the joband the scope for improving individual and technical skills.All of the post production services were provided in Ireland by <strong>Irish</strong>companies. These services included online and off line editing,grading, sound mixing and editing, foley and ADR, music scoring andrecording.Approximately 25 people were involved in the provision of a range ofpost production services.AppealThe ClinicSince its debut on RTÉ One in September 2003, The Clinic hasbecome a highly successful original indigenous drama receivingcritical and popular success in Ireland. Each year has seen theaudience grow from a series average of 362,000 adults 15+ in series1 to 533,000 for series 6.The series had a very broad appeal across all demographics withseries 6 engaging particularly well with young women and men agedbetween 15-25.The <strong>Irish</strong> audience respond particularly well to what they regard as“their stories” and particular attention and effort has always beenmade to ensure that the stories reflect contemporary issues ofinterest to the local audience but with wider resonance for the largeinternational following now enjoyed by The Clinic as the seriescontinues to sell particularly well to a wide variety of territoriesincluding Latin America, Scandinavia, Europe, the Middle East, Asiaand the Caribbean.- 30 -

Case Study TwoAUDIOVISUAL FEDERATION REVIEWCASE STUDY: NODDY IN TOYLANDBrown Bag <strong>Film</strong>s secured the contract to produce the remake of EnidBlyton’s Noddy in Toyland for Chorion and FIVE(UK), TF1(FRA) in timefor its 60th Anniversary. This was a 52 x 11 minute episode series ofhigh definition computer animation. Over 40 people were involved inits production over 76 weeks and it had an <strong>Irish</strong> spend of more than€3 million. Noddy in Toyland went straight to the number one spot forfour to six-year old viewers on FIVE in its first month of broadcast.With the exception of scripts, every senior position was filled by an<strong>Irish</strong> person. The series was directed by David McCamley (who hadpreviously worked in Walt Disney Feature Animation on hit films TheLion King and Tarzan). “It has been a great honour for us to work onsuch a classic property. Everyone at Brown Bag <strong>Film</strong>s has enjoyedbringing Noddy back to the look of the original Enid Blyton books. Wegave the series the look and feel of the old stop motion shows thatwe all grew up with as we wanted it to look warm and appealing tothe young viewers which is lacking in a lot of pre-school animationthese days” said McCamley.The show was produced by Gillian Higgins “The first part of theanimation process is to record voices. From here, we preparestoryboard animatics which is the Storyboards edited to synch withthe final voice track. Animation works on a 1:1 ratio so we only evertrim a few frames in edit, we know exactly what a finished episode isgoing to look like before we even begin to animate” said Higgins.“When the animatics are completed with the pre production packs,it is ready to be sent overseas via the internet”All the key creative decisions are made during an extensive preproductionstage which involves the building of the 3D charactersand 3D sets, rigging and texturing of characters, key animation,lighting, camera moves. The production pipeline necessitatessending a portion of the animation overseas to studios and everymonth terabytes of HD files were uploaded and downloaded.“The series was post-produced in Brown Bag <strong>Film</strong>s and mastered tothe US high definition specification. The series was broken up into sixdelivery blocks of eight episodes which overlapped, so the editorswould find themselves having multiple episodes in any given a day.FIVE had started to broadcast the first batch of episodes before wehad delivered the final two batches” said Higgins.Noddy in ToylandNoddy in Toyland- 31 -

Case Study ThreeAUDIOVISUAL FEDERATION REVIEWCASE STUDY: ROS NA RÚNDevelopment:Ros na Rún receives no development funding. All development is partof the pre-production process.Production:Now in its 14th year of production, Ros na Rún’s production base isa studio complex in An Spideal, Galway. The fictitious village housesstudios, production and post-production facilities. Locations arewithin a 15 mile radius.€1,426,377 was spent on <strong>Irish</strong> goods and services, and with theexception of stunts, legal and insurance, all services were sourcedlocally. Ros na Rún was shot over 25 weeks, shooting primarily inautumn/winter, producing 36 hours of broadcast drama.Direct employment and contracted personnel amount to 189, with acost of €2,998,662; 86 in Production, 89 Cast, and 14 Writing.Ros na Rún is a significant driver of the development of a viableproduction sector outside Dublin. Because of the linguistic andgeographic challenges it faces, Ros na Rún has developed an inhousescript to screen policy to ensure that all the skills andproduction expertise can be locally sourced.The production has made a substantial investment in on-goingpersonnel development and embedding training in the productionprocess. We have developed a number of on-the-floor training andupskilling processes for both crew and cast. All Heads ofdepartments have a clause in their contracts giving them activeresponsibility for upskilling trainees in their departments.Three in four Directors are locally based and with one exception havebeen trained by the production. Virtually all the production personnelare local and have been trained by us.and mobile phone content as part of a strategy to engage with a new,younger and more technologically literate <strong>Irish</strong>-speaking audience.We embarked on a project to digitize are archives in order to makematerial available for multiplicity of cultural uses including studentsof the language. The development of such initiatives has resulted inthe retention of trained and well-motivated technicians in the region.Successfully identifying new modes of storytelling through digitalplatforms offers prospect of further jobs in the local economy andcould be a significant contribution to the development of the <strong>Irish</strong>language for the digital future.Other:● Cultural Tourism – the series is shot in the costal village of AnSpidéal, County Galway. Because of the nature of the drama, 80% isshot in a studio environment and the remainder on locations in thelocal area, which gives a feel for its geographical location, using thecoastline, natural beauty spots, local traditions and culture.● While the series is owned by the broadcaster, there is opencollaboration between the broadcaster and the producers on anysales potential. Derry O’Brien is the International sales agent. Theproduction has been successful in getting sales to Scotland, Walesand PBS Channel in the United States and we are hopeful that thiswill continue. However, sales of Ros na Rún are unlikely to returnrevenues at levels achievable for English drama/soaps as subtitlingexpenditure adds to the cost.● The production is a co-production between two <strong>Irish</strong> basedproduction companies, EO Teilifis in An Spidéal and TyroneProductions in Dublin. The co-production partnership is in existencefor 14 years, it has been successful in partnering with Sterling <strong>Film</strong>,and TV Production in Belfast is setting up the drama series Seacht inBelfast, which is broadcast by TG4 and BBCNI.Storytelling and scriptwriting in the <strong>Irish</strong> language are critical area forRos na Rún. The production has by necessity developed writing talentboth in-house and freelance.With regard to actors, as Ros na Rún casts quite a number ofrelatively inexperienced young actors on a regular basis we have atraining & coaching process for them. For more experienced actorswe have Stunt training and performance coaching workshops.Innovation:By facilitating greater job mobility than is usual in the productionsector, Ros na Rún has a very high number of multi-skilled personnel,which has resulted in very streamlined production processes.Only 2% of the budget is spent on postproduction facilities. This isdue in part to the fact that Ros na Rún recorded over 80% of itsmaterial direct to hard-drive for rough assemble during production.We continue to innovate both in conventional TV production andincreasingly in the multi-platform digital domain. In the past year, wemoved from Avid to final Cut in order to facilitate the transition to HDacquisition and multi-platform production. We developed a mediumterm plan to extend the brand into other media such as webisodesRos Na Rún- 32 -

Case Study FourAUDIOVISUAL FEDERATION REVIEWCASE STUDY: ONDINENeil Jordan’s sixteenth feature film Ondine starring Colin Farrell(Minority <strong>Report</strong>), Stephen Rea (Breakfast on Pluto) and newcomerAlicja Bachleda-Curus (Trade) filmed in summer 2008 in Cork. Thefilm was produced by James Flynn of Octagon <strong>Film</strong>s (Inside I'mDancing, H3, Nora), Neil Jordan, and Ben Browning of WayfareEntertainment.Ondine tells the story of Syracuse (Farrell), a local fisherman whoseeveryday life is transformed by a beautiful and mysterious womanwhom he fishes from the sea and who his young daughter believes isa mermaid. But like all fairytales, enchantment and darkness gohand in hand.The film had a total budget of almost €8m, the majority of which wasspent on <strong>Irish</strong> labour, goods and services. Ondine received <strong>Irish</strong>funding from the <strong>Irish</strong> <strong>Film</strong> <strong>Board</strong>, Section 481, RTÉ and theBroadcasting Commission of Ireland, 65% (over €5 million) wasraised from International sources.The film has provided a great opportunity for established cast suchas Farrell and Rea to work at home as well as providing a platformfor up and coming talent such as newcomer <strong>Irish</strong> actress Alison Barry.<strong>Irish</strong> creative personnel were employed across the filmmakingprocess including production designer Anna Rackard and costumedesigner Eimer Ni Mhaoldomhnaigh. Their work will now beshowcased to a significant audience on the International stage.In total, there were 615 cast, crew and crowd extras employedthroughout the production and post-production period, 575 were<strong>Irish</strong>. There were also a large number of trainee positions on theproduction, with many of whom were sourced locally for positionsacross production, costume and camera.The film availed of the IFB's Regional Support Fund in order to helpoffset some of the costs incurred with filming regionally in Ireland.Ondine has led to substantial inward investment in Castletownberewhere the film received huge community support throughout filminglast summer. Ondine filmed for 42 days in Ireland, 41 of which wereon location with a substantial local regional budget spend of over€1.7 million on cast, crew and services in the area. The postproductionwork was carried out in Windmill Lane in Dublin.This film has the potential to provide great tourism opportunities forthe area of west Co. Cork, given that 18% of all tourists coming toIreland quote “<strong>Film</strong>” as a reason for their visit. This translates to €369million in overall <strong>Irish</strong> expenditure in 2008.Ondine was one of eight <strong>Irish</strong> films that recently premiered at theToronto International <strong>Film</strong> Festival, where it was being represented byParamount Vantage, who are selling the film internationally. It hasalready sold to many major territories and will be distributed shortlyin France, Germany and Spain amongst others. It has garnered greatreviews to date, with Screen describing it as “……a modern love storyinfused with strong flavours of Celtic myth.”Ondine- 33 -

AUDIOVISUAL FEDERATION REVIEWAppendicesAppendix I: Economic Analysis 2008Appendix II:Production Details – Summary 2004 - 2008 ComparisonAppendix III: Production Details – By Type of Production – 2008Appendix IV: Funding Details – By Type of Production - 2008Appendix V: Contribution of the <strong>Irish</strong> <strong>Film</strong> Sector to the <strong>Irish</strong> Economy 2008Appendix VI:Appendix VII:Appendix VIII:Clarification NotesSection 481 InvestmentAgencies Involved with the <strong>Audiovisual</strong> Production Industry in IrelandAppendix IX: List of Productions included in the <strong>Report</strong> 2008 and <strong>2009</strong>Arbharrnadtonn- 34 -

Appendix I:Economic Analysis 2008AUDIOVISUAL FEDERATION REVIEWFundingIn 2008, the 266 productions had combined budgets totalling €246.8 million. Funding from <strong>Irish</strong> sources amounted to€188.8 million, 77% of the total funding.Funding by Type of Production<strong>Irish</strong> Funding of which:2006Feature <strong>Film</strong>sGm2007Independent TV Productionsincluding Major TV Drama GmAnimationGmTotalGm2008 2006 2007 2008 2006 2007 20082006 2007 2008• Section 481 Raised21.18.731.950.862.252.916.410.716.488.381.6101.2• <strong>Irish</strong> <strong>Film</strong> <strong>Board</strong>6.03.99.93.33.03.01.00.90.910.37.813.8*• BCI1.60.90.74.13.12.80.70.40.46.44.43.9^• RTÉ0.20.20.253.548.250.81.00.30.354.7*48.7*51.3*• TG40.3--11.613.612.20.10.2-12.0*13.8*12.2*• Other4.40.81.21.32.21.96.63.43.312.36.46.4Total <strong>Irish</strong> Funding33.614.543.9124.6132.3123.625.815.921.3184.0162.7188.8Non-<strong>Irish</strong> Funding51.24.828.019.121.721.425.66.517.695.933.0 +58.0 +TOTAL84.819.371.9143.7154.0136.051.422.438.9279.4195.7246.8* Excludes RTÉ/TG4’s spend in respect of projects receiving S481 funding+ Excludes non-<strong>Irish</strong> funding in Section 481 Raised^The BCI figures above relate only to report forms received by <strong>IBEC</strong> and do not account for the total BCI Sound & Vision allocation in the periodTriage- 35 -

Appendix I:Economic Analysis 2008ExpenditureExpenditure by Type of ProductionOf the €246.8 million combined budgets, €167.8 million was spent in the <strong>Irish</strong> economy.Type of ProductionTotal Expenditure Gm(See (1) Below)2006 2007 2008<strong>Irish</strong> ExpenditureGm2006 2007 2008Feature <strong>Film</strong>s84.819.371.929.812.235.4Independent Productions & Major TV Drama143.7154.0136.0113.8118.6114.6• RTÉ*72.864.570.261.256.364.3• TG4*22.425.922.119.120.719.0• Other TV Productions48.563.643.233.541.631.3Animation51.422.438.917.612.417.8TOTAL279.9195.7246.8161.2143.2167.81. These Independent TV productions are classified by the organisation which was primarily involved with the various productions. Therefore, although forexample TG4 are shown to have a total expenditure of G22.1 million, some of this expenditure arose from other sources of funding for TG4 productions e.g.private finance. Similarly for RTÉ – other sources of funding contributed to this expenditure of G77.1 million.* Includes RTÉ/TG4’s spend in respect of projects receiving S481 funding. The figures for RTÉ and TG4 are based on completed projects for which economicdatabase forms have been received. See clarification notes in appendix VI.The Trial- 36 -

Appendix I:Economic Analysis 2008EmploymentA total of 15,147 people were directly employed in relation to these 266 independent productions, of which 84% were<strong>Irish</strong>. This figure excludes direct employment generated through the expenditure of €82.2 million on <strong>Irish</strong> Goods andServices and indirect employment generated through the multiplier effects of the total <strong>Irish</strong> expenditure €167.8 millionin the economy. A total of 2,836,029 work hours were generated, which translates to the equivalent of 1,608 full-timejobs (see (2) below).Employment by Type of Production - Direct Employment - <strong>Irish</strong>/Non <strong>Irish</strong>Type of ProductionTotal Employment<strong>Irish</strong> EmploymentNon-<strong>Irish</strong>EmploymentFeature <strong>Film</strong>s4,2782,8831,395Independent Productions & Major TV Drama10,3979,440957• RTÉ*5,0474,634413• TG4*2,1131,967146• Other TV Productions3,2372,839398Animation472337135TOTAL15,14712,6602,487Employment by Type of Production - Equivalent Full-time JobsType of ProductionFeature <strong>Film</strong>sIndependent Productions & Major TV Drama• RTÉ*• TG4*• Other TV ProductionsAnimationTOTALTotal <strong>Irish</strong> Work Hours515,2992,020,1871,008,608509,944501,635342,4922,877,978Full-Time Equivalent Jobs2921,1455722892841941,6312. Based on a 38 hour week and a working year of 232 days. The 38 hour average is taken from a 39 hour week average for manual workers and a 37 hourweek for clerical, professional and technical workers. The 232 day working year is derived as follows: 365 minus 104 days weekends minus 9 public holidaysminus 20 days average annual leave days = 232.- 37 -