2009 Annual Report - Cerebral Palsy Alliance

2009 Annual Report - Cerebral Palsy Alliance

2009 Annual Report - Cerebral Palsy Alliance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

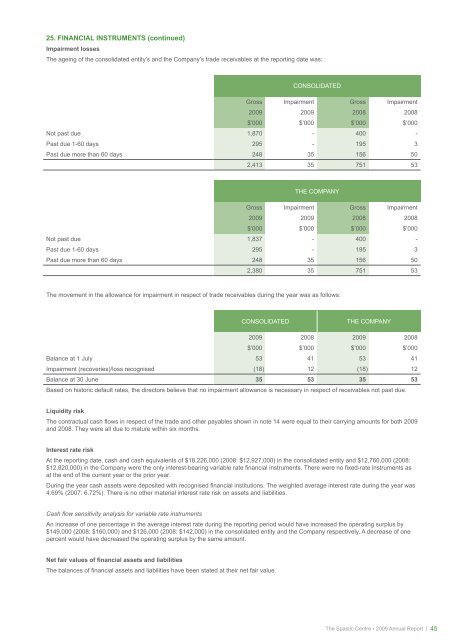

25. FINANCIAL INSTRUMENTS (continued)Impairment lossesThe ageing of the consolidated entity’s and the Company’s trade receivables at the reporting date was:CONSOLIDATEDGross Impairment Gross Impairment<strong>2009</strong> <strong>2009</strong> 2008 2008$’000 $’000 $’000 $’000Not past due 1,870 - 400 -Past due 1-60 days 295 - 195 3Past due more than 60 days 248 35 156 502,413 35 751 53THE COMPANYGross Impairment Gross Impairment<strong>2009</strong> <strong>2009</strong> 2008 2008$’000 $’000 $’000 $’000Not past due 1,837 - 400 -Past due 1-60 days 295 - 195 3Past due more than 60 days 248 35 156 502,380 35 751 53The movement in the allowance for impairment in respect of trade receivables during the year was as follows:CONSOLIDATEDTHE COMPANY<strong>2009</strong> 2008 <strong>2009</strong> 2008$’000 $’000 $’000 $’000Balance at 1 July 53 41 53 41Impairment (recoveries)/loss recognised (18) 12 (18) 12Balance at 30 June 35 53 35 53Based on historic default rates, the directors believe that no impairment allowance is necessary in respect of receivables not past due.Liquidity riskThe contractual cash flows in respect of the trade and other payables shown in note 14 were equal to their carrying amounts for both <strong>2009</strong>and 2008. They were all due to mature within six months.Interest rate riskAt the reporting date, cash and cash equivalents of $18,226,000 (2008: $12,927,000) in the consolidated entity and $12,760,000 (2008:$12,820,000) in the Company were the only interest-bearing variable rate financial instruments. There were no fixed-rate instruments asat the end of the current year or the prior year.During the year cash assets were deposited with recognised financial institutions. The weighted average interest rate during the year was4.69% (2007: 6.72%). There is no other material interest rate risk on assets and liabilities.Cash flow sensitivity analysis for variable rate instrumentsAn increase of one percentage in the average interest rate during the reporting period would have increased the operating surplus by$149,000 (2008: $160,000) and $126,000 (2008: $142,000) in the consolidated entity and the Company respectively. A decrease of onepercent would have decreased the operating surplus by the same amount.Net fair values of financial assets and liabilitiesThe balances of financial assets and liabilities have been stated at their net fair value.The Spastic Centre ● <strong>2009</strong> <strong>Annual</strong> <strong>Report</strong> | 45