Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Global REIT Survey 2011 - EPRA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

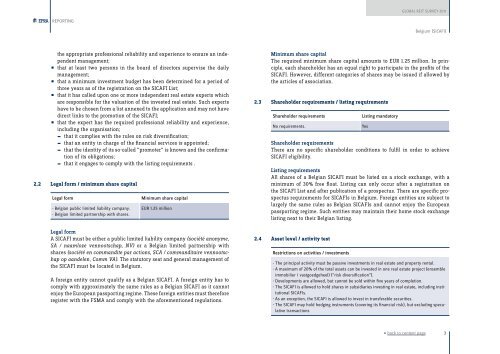

<strong>Global</strong> <strong>REIT</strong> <strong>Survey</strong> <strong>2011</strong>REPORTINGBelgium (SICAFI)the appropriate professional reliability and experience to ensure an independentmanagement;that at least two persons in the board of directors supervise the daily• management;that a minimum investment budget has been determined for a period of• three years as of the registration on the SICAFI List;that it has called upon one or more independent real estate experts which• are responsible for the valuation of the invested real estate. Such expertshave to be chosen from a list annexed to the application and may not havedirect links to the promotion of the SICAFI;that the expert has the required professional reliability and experience,• including the organisation;that it complies with the rules on risk diversification;that an entity in charge of the financial services is appointed;--that the identity of its so-called “promoter” is known and the confirmationof its obligations;that it engages to comply with the listing requirements .--2.2 Legal form / minimum share capitalLegal form- Belgian public limited liability company.- Belgian limited partnership with shares.Minimum share capitalEUR 1.25 millionLegal formA SICAFI must be either a public limited liability company (société anonyme,SA / naamloze vennootschap, NV) or a Belgian limited partnership withshares (société en commandite par actions, SCA / commanditaire vennootschapop aandelen, Comm VA). The statutory seat and general management ofthe SICAFI must be located in Belgium.A foreign entity cannot qualify as a Belgian SICAFI. A foreign entity has tocomply with approximately the same rules as a Belgian SICAFI as it cannotenjoy the European passporting regime. These foreign entities must thereforeregister with the FSMA and comply with the aforementioned regulations.Minimum share capitalThe required minimum share capital amounts to EUR 1.25 million. In principle,each shareholder has an equal right to participate in the profits of theSICAFI. However, different categories of shares may be issued if allowed bythe articles of association.2.3 Shareholder requirements / listing requirementsShareholder requirementsNo requirements.Listing mandatoryShareholder requirementsThere are no specific shareholder conditions to fulfil in order to achieveSICAFI eligibility.Listing requirementsAll shares of a Belgian SICAFI must be listed on a stock exchange, with aminimum of 30% free float. Listing can only occur after a registration onthe SICAFI List and after publication of a prospectus. There are specific prospectusrequirements for SICAFIs in Belgium. Foreign entities are subject tolargely the same rules as Belgian SICAFIs and cannot enjoy the Europeanpassporting regime. Such entities may maintain their home stock exchangelisting next to their Belgian listing.2.4 Asset level / activity testRestrictions on activities / investments- The principal activity must be passive investments in real estate and property rental.- A maximum of 20% of the total assets can be invested in one real estate project (ensembleimmobilier / vastgoedgeheel) (“risk diversification”).- Developments are allowed, but cannot be sold within five years of completion.- The SICAFI is allowed to hold shares in subsidiaries investing in real estate, including institutionalSICAFIs.- As an exception, the SICAFI is allowed to invest in transferable securities.- The SICAFI may hold hedging instruments (covering its financial risk), but excluding speculativetransactionsYes« back to content page3