law of 20 December 2002 - Alfi

law of 20 December 2002 - Alfi

law of 20 December 2002 - Alfi

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

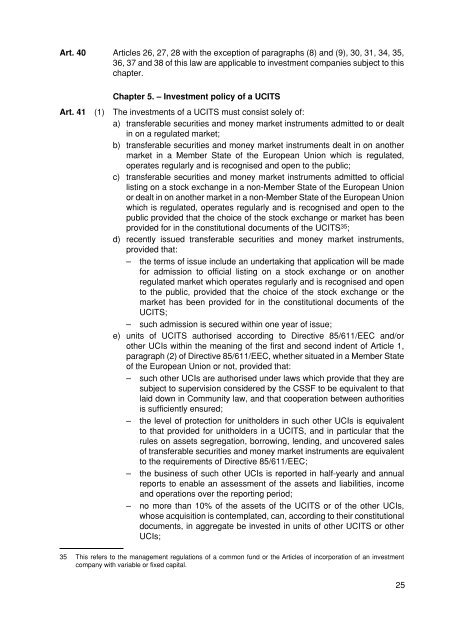

Art. 40 Articles 26, 27, 28 with the exception <strong>of</strong> paragraphs (8) and (9), 30, 31, 34, 35,36, 37 and 38 <strong>of</strong> this <strong>law</strong> are applicable to investment companies subject to thischapter.Chapter 5. – Investment policy <strong>of</strong> a UCITSArt. 41 (1) The investments <strong>of</strong> a UCITS must consist solely <strong>of</strong>:a) transferable securities and money market instruments admitted to or dealtin on a regulated market;b) transferable securities and money market instruments dealt in on anothermarket in a Member State <strong>of</strong> the European Union which is regulated,operates regularly and is recognised and open to the public;c) transferable securities and money market instruments admitted to <strong>of</strong>ficiallisting on a stock exchange in a non-Member State <strong>of</strong> the European Unionor dealt in on another market in a non-Member State <strong>of</strong> the European Unionwhich is regulated, operates regularly and is recognised and open to thepublic provided that the choice <strong>of</strong> the stock exchange or market has beenprovided for in the constitutional documents <strong>of</strong> the UCITS 35 ;d) recently issued transferable securities and money market instruments,provided that:– the terms <strong>of</strong> issue include an undertaking that application will be madefor admission to <strong>of</strong>ficial listing on a stock exchange or on anotherregulated market which operates regularly and is recognised and opento the public, provided that the choice <strong>of</strong> the stock exchange or themarket has been provided for in the constitutional documents <strong>of</strong> theUCITS;– such admission is secured within one year <strong>of</strong> issue;e) units <strong>of</strong> UCITS authorised according to Directive 85/611/EEC and/orother UCIs within the meaning <strong>of</strong> the first and second indent <strong>of</strong> Article 1,paragraph (2) <strong>of</strong> Directive 85/611/EEC, whether situated in a Member State<strong>of</strong> the European Union or not, provided that:– such other UCIs are authorised under <strong>law</strong>s which provide that they aresubject to supervision considered by the CSSF to be equivalent to thatlaid down in Community <strong>law</strong>, and that cooperation between authoritiesis sufficiently ensured;– the level <strong>of</strong> protection for unitholders in such other UCIs is equivalentto that provided for unitholders in a UCITS, and in particular that therules on assets segregation, borrowing, lending, and uncovered sales<strong>of</strong> transferable securities and money market instruments are equivalentto the requirements <strong>of</strong> Directive 85/611/EEC;– the business <strong>of</strong> such other UCIs is reported in half-yearly and annualreports to enable an assessment <strong>of</strong> the assets and liabilities, incomeand operations over the reporting period;– no more than 10% <strong>of</strong> the assets <strong>of</strong> the UCITS or <strong>of</strong> the other UCIs,whose acquisition is contemplated, can, according to their constitutionaldocuments, in aggregate be invested in units <strong>of</strong> other UCITS or otherUCIs;35 This refers to the management regulations <strong>of</strong> a common fund or the Articles <strong>of</strong> incorporation <strong>of</strong> an investmentcompany with variable or fixed capital.25