Panorama of Investment Options - Nationwide Retirement Solutions

Panorama of Investment Options - Nationwide Retirement Solutions

Panorama of Investment Options - Nationwide Retirement Solutions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

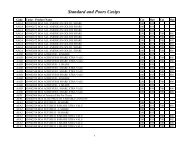

TABLE OF CONTENTSFIXED INVESTMENT OPTION<strong>Investment</strong> Contract Pool 1MONEY MARKET FUNDVanguard Prime Money Market Fund 1BOND FUNDFederated U.S. Government Securities Fund: 2-5 Years 2PIMCO Total Return Fund - Institutional Shares 2BALANCED FUNDSFidelity Puritan Fund 3DWS Value Builder Fund - Institutional Shares 3LARGE-CAP STOCK FUNDSFidelity Growth & Income Portfolio 4Legg Mason Value Trust Fund - Institutional Shares 4Vanguard Institutional Index Fund 5Growth Fund <strong>of</strong> America - Class A 5Washington Mutual Investors Fund - Class A 6MID-CAP STOCK FUNDSDreyfus Mid Cap Index Fund 6Lord Abbett Mid Cap Value Fund 7SMALL-CAP STOCK FUNDSDelaware Trend Fund - Institutional Class 7T. Rowe Price Small-Cap Stock Fund 8INTERNATIONAL FUNDSEuroPacific Growth Fund - Class A 8INVESTMENT FUNDAMENTALSTypes <strong>of</strong> <strong>Investment</strong>s 9Understanding and Managing Risk 11Asset class data provided by Segal Advisors, unless otherwise noted. Although gathered from reliable sources,data accuracy and completeness cannot be guaranteed.

Fixed <strong>Investment</strong> <strong>Options</strong>Money Market Fund<strong>Investment</strong> Contract Pool*[457plan, 401(k) plan and the 401(a) match plan]Vanguard ® Prime Money Market Fund[403(b) plan only]This option is a portfolio <strong>of</strong> investment contracts placedperiodically with qualified fixed-income managers/underwritersand insurance companies. The board hired ING Life Insurance &Annuity Company as the pool’s fund manager. ING placescollected funds into a new or existing contract according to aformal investment policy. The placement may be for a set periodor for a certain portion <strong>of</strong> the pooled fund. Some contracts havea fixed rate <strong>of</strong> interest for the length <strong>of</strong> the contract. Othercontracts, however, reset the rate <strong>of</strong> interest on a regular basisthroughout the life <strong>of</strong> the contract. The contract interest rate isbased on the earnings <strong>of</strong> the contract’s underlying investments atthat time. Participants’ accounts are credited with a quarterlyrate that is a blend <strong>of</strong> all contracts in the pool (the blended rate).Approximate Size<strong>Investment</strong> ObjectiveInception Date$50.6 million total fund netassets under managementThis fund seeks the highestlevel <strong>of</strong> income consistentwith maintaining a stableshare price <strong>of</strong> $1.June 4, 1975Approximate Size<strong>Investment</strong> ObjectiveInception Date$544.9 millionThis option’s objectives are to protect principal and toprovide participants with credited interest rates that areabove comparable duration U.S. government Treasurybills. Contract issuers are selected to maintain a diversifiedportfolio. This option allows participants to transferinto or out <strong>of</strong> the pool at any time. New payroll deferralsto the pool also can be made at any time.January 1, 1987An investment in a money market fund isn’t insuredor guaranteed by the Federal Deposit InsuranceCorporation or any other government agency.Although the fund seeks to preserve your investmentat $1 per share, it’s possible to lose money byinvesting in the fund.Asset Allocations (December 31, 2005)Cash 100.0%100.0% TOTAL<strong>Investment</strong> Contract Pool Carriers (December 31, 2005)*Information provided by ING Stable Value Product GroupPage 1

Bond FundsFederated U.S. Government Securities Fund:2-5 YearsPIMCO Total Return Fund -Institutional SharesApproximate Size$666 million total fund netassets under managementApproximate Size$90.6 billion total fund netassets under management<strong>Investment</strong> ObjectiveThis fund seeks currentincome.<strong>Investment</strong> ObjectiveThis fund seeks maximumtotal return, consistent withpreservation <strong>of</strong> capital andprudent investment management.Inception DateFebruary 18, 1983Inception DateMay 11, 1987Asset Allocations (December 31, 2005) Asset Allocations (December 31, 2005)Bonds 99.6%Cash 0.4%100.0% TOTALBonds 85.0%Convertible Securities 1.0%Cash 14.0%100.0% TOTAL* While the fund invests primarily in securities <strong>of</strong>the U.S. Government and its agencies, the fund’svalue is not guaranteed by these entities.* While the fund invests primarily in securities <strong>of</strong>the U.S. Government and its agencies, the fund’svalue is not guaranteed by these entities.Page 2

Balanced FundsFidelity Puritan FundDWS Value Builder Fund - Institutional Shares(Renamed from Scudder Flag Investors Value Builder Fund on 2/26/06)Approximate Size$24.1 billion total fund netassets under managementApproximate Size$88.0 million total fund netassets under management<strong>Investment</strong> ObjectiveThis fund seeks income andcapital growth consistentwith reasonable risk.<strong>Investment</strong> ObjectiveThis fund seeks to maximizetotal return through acombination <strong>of</strong> long-termgrowth <strong>of</strong> capital and currentincome. The fund’s LeadPortfolio Manager, HobartBuppert II holds a BA and aMBA from Loyola College.Inception DateApril 16, 1947Inception DateNovember 2, 1995Asset Allocations (December 31, 2005) Asset Allocations (December 31, 2005)Equity 62.0%Bonds 32.5%Convertible Securities 1.0%Cash/Other 4.5%100.0% TOTALEquity 75.0%Bonds 23.0%Convertible Securities 0.0%Cash 2.0%100.0% TOTALPage 3

Large-Cap Stock FundsFidelity Growth and Income PortfolioLegg Mason Value Trust FundInstitutional SharesApproximate Size$31.1 billion total fund netassets under managementApproximate Size$6.0 billion total fund netassets under management<strong>Investment</strong> ObjectiveThis fund seeks a high totalreturn through a combination<strong>of</strong> current income andcapital appreciation.<strong>Investment</strong> ObjectiveThis fund seeks long-termgrowth <strong>of</strong> capital by usingthe “Value Approach” toinvesting.Inception DateDecember 30, 1985Inception DateDecember 1, 1994Asset Allocations (December 31, 2005) Asset Allocations (December 31, 2005)Equity 98.2%Convertible Securites 0.4%Cash/Other 1.4%100.0% TOTALEquity 99.4%Convertible Securitues 0.4%Cash 0.2%100.0% TOTALPage 4

Large-Cap Stock FundsVanguard Institutional Index FundGrowth Fund <strong>of</strong> AmericaClass AApproximate Size$56.2 billion total fund netassets under managementApproximate Size$71.5 billion total fund netassets under management<strong>Investment</strong> ObjectiveThis fund seeks long-termgrowth <strong>of</strong> capital andincome from dividends.<strong>Investment</strong> ObjectiveThis fund seeks to providelong-term growth <strong>of</strong> capital.Inception DateJuly 31, 1990Inception DateDecember 1, 1973Asset Allocations (December 31, 2005) Asset Allocations (December 31, 2005)Equity 99.3%Convertible Securoties 0.6%Cash 0.1%100.0% TOTALEquity 89.2%Bonds 0.2%Cash 10.6%100.0% TOTALPage 5

Large-Cap Stock FundsMid-Cap Stock FundsWashington Mutual Investors FundClass ADreyfus MidCap Index FundApproximate Size$62.7 billion total fund netassets under managementApproximate Size$2.3 billion total fund netassets under management<strong>Investment</strong> ObjectiveThis fund seeks to providecurrent income and theopportunity for growth <strong>of</strong>principal consistent withsound common-stockinvesting.<strong>Investment</strong> ObjectiveThe fund generally invests inall 400 stocks in the S&PMidCap 400 in proportionto their weighting in theindex.Inception DateJuly 31, 1952Inception Date June 19, 1991Asset Allocations (December 31, 2005) Asset Allocations (December 31, 2005)Equity 97.9%Cash 2.1%100.0% TOTALEquity 100.0%Cash/Other 0.0100.0% TOTALPage 6

Small-Cap Stock FundInternational Stock FundT. Rowe Price Small-Cap Stock FundEuroPacific Growth FundClass AApproximate Size$7.4 billion total fund netassets under managementApproximate Size$43.1 billion total fund netassets under management<strong>Investment</strong> ObjectiveThis fund seeks long-termcapital appreciation.<strong>Investment</strong> ObjectiveThis fund seeks to providelong-term growth <strong>of</strong> capital byinvesting in companies basedoutside the United States.Inception DateOn August 31, 1992, T.Rowe Price Associates, Inc.became the investmentmanager <strong>of</strong> this fund. Allperformance data prior tothis date is the result <strong>of</strong>other investment managers.Asset Allocations (December 31, 2005)Equity 91.2%Cash 8.8%100.0% TOTALInception DateApril 16, 1984Asset Allocations (December 31, 2005)Equity 89.8%Convertible Securites 0.0%Cash 10.2%100.0% TOTAL* Small company funds involve increased riskand volatility.* International investing involves additionalrisks including: currency fluctuations,political instability, and foreign regulations.Page 8

Notes to the <strong>Investment</strong> <strong>Options</strong>Mutual funds involve market risk including the possible loss <strong>of</strong>principal. The return and principal value <strong>of</strong> an investment in stocksfluctuate with changes in market conditions such that an investor’sshares when redeemed may be worth more or less than theiroriginal cost.Asset AllocationsThe asset allocations are presented to show the funds’ allocationsas <strong>of</strong> the date in the parentheses. They may not berepresentative <strong>of</strong> the funds’ current or future investments. Themutual funds are regularly buying, selling and rebalancing theirholdings. Therefore, the percentages and holdings publishedmay change at any time.<strong>Investment</strong> StyleFor purposes <strong>of</strong> this booklet, short duration bond funds havean average effective maturity (average term length <strong>of</strong> a fund’sbond portfolio) <strong>of</strong> less than four years. An intermediate termbond fund would have an average effective maturity greaterthan or equal to four years but less than or equal to 10 years,and those with maturity that exceeds 10 years would beconsidered long-term. High quality funds are the safestwhereas low quality are the riskiest. A growth-oriented fundgenerally holds stocks <strong>of</strong> companies that are believed to havethe potential to increase earnings faster than the rest <strong>of</strong> themarket. A value-oriented fund contains stocks that are believedto be undervalued in price, and whose worth will eventually berecognized by the market. A blend fund may hold growthstocks and value stocks, or it may contain stocks that displayboth characteristics. Domestic hybrid funds resemble balancedfunds. Balanced funds typically provide for a predictablecombination, usually 50/50 or 60/40, <strong>of</strong> stock (equities) andbond (fixed income) exposure. Many balanced funds’ equityportions resemble the S&P 500, while their bond portfolios<strong>of</strong>ten track indices <strong>of</strong> investment-grade debt. In contrast,domestic hybrid funds actively adjust their mix <strong>of</strong> securities inresponse to market conditions. Many utilize a variety <strong>of</strong>securities in addition to common stock and investment-gradedebt, including foreign securities, high-yield debt, preferred stock,and convertible bonds. Median market capitalization (cap) is ameasure <strong>of</strong> a company’s size. It’s determined by multiplying acompany’s share price by its number <strong>of</strong> outstanding shares <strong>of</strong>stock. For purposes <strong>of</strong> this brochure, all funds with medianmarket caps less than $2 billion are considered small-cap funds.Funds with median market caps greater than or equal to $2billion but less than or equal to $10 billion are considered midcapfunds. And those with median market caps greater than$10 billion are considered large-cap.Mutual Fund Savings ProgramThrough successful negotiations by the MSRP Board <strong>of</strong>Trustees, most <strong>of</strong> the mutual funds in the Maryland supplementalretirement plans reimburse part <strong>of</strong> their annualoperating expense back to the plans. At the Board’sdirection, these savings are used to buy additional shares inthe applicable funds and then distributed to participants’accounts on a quarterly basis as they are received.Types <strong>of</strong> <strong>Investment</strong>sStocks. Stocks are units <strong>of</strong> ownership <strong>of</strong> a company. Acompany can raise money for start-up, expansion or growth byselling shares <strong>of</strong> its stock. There are generally two types <strong>of</strong>stocks: common and preferred. Common stock is the mostbasic form <strong>of</strong> ownership in a company—it typically givesshareholders the right to vote on issues concerning thecompany and a percentage share <strong>of</strong> ownership in the company.For example, if you own one share <strong>of</strong> common stock in acompany that has 100 shares, you own 1% <strong>of</strong> the company.Preferred stock usually does not <strong>of</strong>fer voting rights, but owners<strong>of</strong> preferred stock are generally entitled to dividends (thecompany’s pr<strong>of</strong>its distributed in cash) before common stockholders.Preferred stockholders generally receive dividends atset times, whereas common stockholders may or may notreceive dividends.Bonds. Bonds are loans, or debt instruments, issued bygovernments or corporations that need to raise money. When aninvestor buys a bond, he/she is actually loaning money to thegovernment or company. They are issued for a set period,during which interest payments are typically made to the bondholder. The amount <strong>of</strong> these payments depends on the interestrate established by the bond issuer when the bond is first sold.This is called a coupon rate, which can be fixed or variable. Atthe end <strong>of</strong> the set period, or the maturity date, the bond issueris required to repay the original loan amount, or the par value <strong>of</strong>the bond. As with consumer loans, there is a great variety in thefinancial markets with regard to these details, i.e. how and whenpayments will be made, and the prevailing interest rate. Bondsare generally a more stable form <strong>of</strong> investment than stocks, andusually provide a more steady flow <strong>of</strong> income. Their stabilitytypically means that their long-term return will be less than that<strong>of</strong> stocks generally, although it might be greater than the investmentreturn <strong>of</strong> a particular stock.Page 9

Mutual Funds. Mutual Funds are funds operated by aninvestment company. They combine the money <strong>of</strong> manyinvestors into a single pool, and then use it to buy securitiessuch as stocks, bonds or money market instruments. Thesesecurities form the underlying portfolio <strong>of</strong> the fund. The fundearns money on those securities and distributes the earnings tothe investors (also known as shareholders) as dividends. If thesecurities in the fund are sold for a pr<strong>of</strong>it, the pr<strong>of</strong>its aredistributed to shareholders as capital gains. Of course, securitiescan also be sold at a loss which is ultimately born by theinvestors in the form <strong>of</strong> reduced share value. As is the case inthe Maryland supplemental retirement plans, dividends andcapital gains may be automatically reinvested to buy additionalfund shares. <strong>Investment</strong> objectives, policies and degrees <strong>of</strong> riskvary among mutual funds, but because mutual funds diversifytheir holdings (or invest in many securities), they provide lessrisk than an investment in stock <strong>of</strong> an individual company. Allmutual funds are required to file a registration statement withan agency <strong>of</strong> the federal government, the Securities andExchange Commission. The registration statement containsdetailed information on the finances, expenses, management,and risks <strong>of</strong> the fund. This information is, in turn, available toinvestors (including you, as a plan participant) in a detaileddocument called a prospectus. The prospectus will tell you thetypes <strong>of</strong> stocks and bonds in a particular mutual fund, risks fromthese stocks and bonds, and the investment return <strong>of</strong> the fundin the past. Before investing, you should always request andreview a prospectus for your investments in this plan. You canrequest a prospectus by calling the <strong>Nationwide</strong> <strong>Retirement</strong><strong>Solutions</strong>’ Baltimore <strong>of</strong>fice at 410-252-7201.Cash Equivalents. Cash equivalents are short-term securitiessuch as bank certificates <strong>of</strong> deposit (CDs) and money marketfunds. They typically have less risk than stocks and bondsbecause the investments are for a short period, and chances <strong>of</strong>failure during that short period are small and predictable. Theyalso generally provide a lower long-term return on yourinvestment. (CDs are insured by the FDIC and <strong>of</strong>fer a fixed rate<strong>of</strong> return.)Fixed <strong>Investment</strong> <strong>Options</strong>. Fixed investment options<strong>of</strong>fer a set rate <strong>of</strong> return for a specified period. Examples <strong>of</strong>fixed options include the investment contract pools, individualinsurance annuity contracts, and certificates <strong>of</strong> deposit (CDs).Fixed options are <strong>of</strong>ten called stable value options because theyprovide a constant or stable principle value like a savingsaccount, and pay interest on that value. Many retirement plans<strong>of</strong>fer “investment contract pools.” The pools are a collection <strong>of</strong>fixed, stable value contracts sold by different insurance orinvestment companies, each with a different interest rate. Thecontracts’ interest rates are blended together to provide therate paid to the participant, the blended rate. The advantage <strong>of</strong>the pools is that they provide the stable value preferred bymany participants, but reduce the risk <strong>of</strong> relying on a singleinsurance company to provide that stable value. The pools arealso advantageous because they do not require advance notice<strong>of</strong> withdrawal or penalty charges to transfer to another investment.Fixed options, in general, lock participants into a fixedreturn regardless <strong>of</strong> market conditions. They do not reflectmarket value changes when interest rates rise and fall. Whenshort-term interest rates are high, shorter term investmentsmay outperform the fixed options. Over time, however, you canexpect that the fixed options will provide a stable return.Small-, Mid-, or Large-Cap Stocks. The size <strong>of</strong> acompany usually is defined by its market capitalization, the shareprice <strong>of</strong> the company’s stock times the number <strong>of</strong> outstandingshares. A small-cap (capitalization) fund is a mutual fundthat invests mostly in stocks <strong>of</strong> small companies; a large-cap fundinvests mostly in stocks <strong>of</strong> larger companies. Mid-cap funds arePage 10

somewhere in between. Small companies can typically grow muchfaster than big companies, but their stocks tend to be morevolatile (more rise and fall in value) than the stock <strong>of</strong> largecompanies. Small companies fail more <strong>of</strong>ten than large companiesdo, so small companies have more risk. Over the long term(1925 to present), small-cap stocks have outperformed largecapstocks; but an investor in these small-cap stocks must bewilling to accept the risks <strong>of</strong> a high degree <strong>of</strong> market ups anddowns, and the increased risk in any particular period.Growth Stocks and Value Stocks. Within the sizecategories <strong>of</strong> stocks (small-, mid-, large-cap), there are two basicstyles: growth and value. Growth stocks generally have a highprice relative to the company’s earnings due to anticipation <strong>of</strong>growth opportunities. Value stocks generally have a low pricerelative to earnings. The mutual funds in the Maryland Supplemental<strong>Retirement</strong> Plans are described in part by their growthor value orientations. Generally, a growth-oriented mutual fundmostly contains stocks <strong>of</strong> companies that its portfolio managerbelieves have the potential to increase earnings faster than therest <strong>of</strong> the market. A value-oriented portfolio focuses on stocksthat the manager thinks are currently under-valued in price andbelieves will eventually see their worth recognized.International Stocks. International stocks are those <strong>of</strong>companies located outside <strong>of</strong> the United States. Risks <strong>of</strong>international investments include currency fluctuations, politicalinstability, different and less restrictive securities regulations, anddiffering accounting practices.Understanding and Managing RiskUnderstanding Risk. Risk is a major factor to considerbecause all investments carry risk. In theory, the more risk youtake, the greater your potential return. Understanding thedifferent types <strong>of</strong> risk helps you make choices that will reduceyour risk to an acceptable level, and at the same time provideyou with a desirable investment. There are five basic types <strong>of</strong>investment risk: inflation, market, business, credit and interestrate risk.Inflation Risk. This is the chance that your investment will notgrow enough over time to keep up with inflation. Inflation is thepurchasing power <strong>of</strong> your money - $1 generally will buy less inthe future than it buys today. If your investments earn less thaninflation, they actually lose value in real economic terms. Inflationhas been very low in recent years . However, from the late1960s through the early 1980s it was very high.Market Risk. This is the risk that your investment choicemay decline in value (buy it for $100, sell it at $80) becauseother investors have a different belief in its worth and will payless for it.Business Risk. This is the risk that an investment will have lessvalue because <strong>of</strong> poor business results -which can range fromincidental (ex. Burger Palace’s Beef Deluxe is not a popular menuitem) to catastrophic (ex. company bankruptcy).Credit Risk. This is the risk that a bond issuer will not be ableto make interest payments as promised or repay the originalamount <strong>of</strong> the loan when it is due.Interest Rate Risk. This is the risk that your investment willlose value when interest rates rise. Bonds are highly sensitive tochanges in interest rates. When interest rates rise, bond pricesdrop and vice versa. The longer the duration <strong>of</strong> the bond(length <strong>of</strong> time until the original loan amount is due), thegreater the impact changing interest rates will have on thebond’s value. The desire to avoid this risk is one <strong>of</strong> the reasonsbehind the stable value investment contract pools.Page 11

Managing Risk. One way to reduce risk is to spread yourmoney among different investments. This is called diverersifsificaica-tion. Diversifying your investments among several types, such asstocks, bonds and cash equivalents, is known as asset allocation.Diversification and asset allocation protect you against a single,devastating loss; there is less risk that all <strong>of</strong> your investments willbe hit hard (suffer market, business or credit loss) at the sametime. They also enhance your chance that some <strong>of</strong> yourinvestments will do well when others suffer. This principle <strong>of</strong>diversification is one <strong>of</strong> the basic advantages <strong>of</strong> mutual fundinvesting. This does not mean that mutual funds are guaranteedto make money; it means that most pr<strong>of</strong>essionals view mutualfunds as less risky than other types <strong>of</strong> investments. In addition tospreading your money among different types <strong>of</strong> investments, youcan diversify your money within those types <strong>of</strong> investments. Thismeans that you buy stock from more than one company, orbonds from more than one issuer. You also diversify when youinvest in more than one type <strong>of</strong> mutual fund. For instance, in theMaryland Supplemental <strong>Retirement</strong> Plans, you can diversify byinvesting in a combination <strong>of</strong> bond, growth and income, growth,small-cap, and international funds. Another strategy for reducingrisk is called dollar cost avereragingaging. This involves investing thesame amount <strong>of</strong> money at regular times, regardless <strong>of</strong> whetherthe stock market is up or down. As a participant in the MarylandSupplemental <strong>Retirement</strong> Plans, this will be easy for you!Your biweekly contributions will continually go toward buyingshares, more shares when the mutual fund share prices aredown and fewer when the prices are higher. By buying moreshares when prices are down, your average cost per share canend up being lower than the average in the market over thesame period. Dollar cost averaging does not assure a pr<strong>of</strong>it anddoes not guarantee against loss in a declining market. This type<strong>of</strong> strategy involves continuous investment in the securityregardless <strong>of</strong> fluctuating price levels <strong>of</strong> such securities. Youshould consider your financial ability to continue your purchasesthrough periods <strong>of</strong> low price levels. The use <strong>of</strong> asset allocationdoes not guarantee returns or insulate you from potentiallosses.Page 12

MSRP <strong>Investment</strong> <strong>Options</strong> & FundamentalsThe Enrollment Hotline1-877-628-2499To enroll, for info about the match, or to change your contribution amount, orto transfer in money from an IRA or previous employer’s plan<strong>Nationwide</strong> <strong>Retirement</strong> <strong>Solutions</strong> Web eb Sitehttp://www.Mar.MarylandDCylandDC.comTo enroll, for 24-hour account information, to make investment optionexchanges and allocation changes, to change contribution amount and todownload forms<strong>Nationwide</strong> <strong>Retirement</strong> <strong>Solutions</strong> Baltimore Office410-252-7201 or 1-800-966-6355To enroll, to change your deferral amount, for mutual fund prospectuses orannual reports, for investment option booklets, for payout calculations, or toarrange a meeting with a representative<strong>Nationwide</strong> <strong>Retirement</strong> <strong>Solutions</strong> Customer Service Center1-800-545-4730For 24-hour account information, to make investment option exchanges andallocation changes, to change address, name or beneficiary and for financialhardship inquiries (press “0” to reach a representative), Office Hours: Mondaythru Friday, 8:00 a.m. to 9:00 p.m.MarylandTeachereachers s & State Employees Supplemental <strong>Retirement</strong> Plans410-767-8740 or 1-800-543-5605For info about the Maryland supplemental retirement plans, for investmentoption booklets, for mutual fund prospectuses and other general information;to arrange attendance at educational seminarsMSRP Web eb Sitehttp://www.msrp.msrp.state.state.md.us.md.usFor info about the Maryland supplemental retirement plans and the match,including the latest on pension reformSecurities <strong>of</strong>fered through <strong>Nationwide</strong> <strong>Investment</strong> Services Corporation, member NASD.<strong>Nationwide</strong> and the <strong>Nationwide</strong> framework are federally registered service marks <strong>of</strong><strong>Nationwide</strong> Mutual Insurance Company.NRS-3035-0306 (03/06)