Health Care Benefits Brochure - Pension Fund

Health Care Benefits Brochure - Pension Fund

Health Care Benefits Brochure - Pension Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

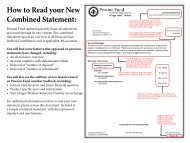

IntroductionThe Christian Church <strong>Health</strong> <strong>Care</strong> Benefit Trust (CCHCBT) and<strong>Pension</strong> <strong>Fund</strong> have been offering health coverage (Churchwide<strong>Health</strong>care) since 1972 to clergy and employees of the ministriesof the Stone-Campbell Movement. These organizationsinclude, but are not limited to, congregations, wider ministries,seminaries, and universities and colleges associated with theChristian Church (Disciples of Christ), Christian Churches/Churches of Christ, or Churches of Christ in the United States.The Christian Church <strong>Health</strong> <strong>Care</strong> Benefit Trust, with the<strong>Pension</strong> <strong>Fund</strong> of the Christian Church as Trustee, manages theseprograms on behalf of the General Assembly of the ChristianChurch (Disciples of Christ). Read on to learn more about thebreadth of our health insurance plan.3

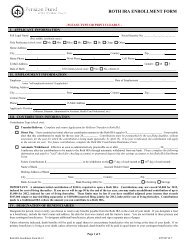

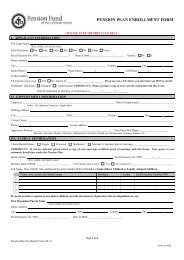

<strong>Health</strong> InsuranceKey <strong>Benefits</strong>We offer three medical plan options, which coverprescription drugs and vision; two fully insured dentalplans; and flexible spending account administration.Together with our partner vendors, the Christian Church<strong>Health</strong> <strong>Care</strong> Benefit Trust strives to offer comprehensive,affordable and portable coverage to clergy and employeesof the Stone-Campbell Movement.Our partner vendors are:Medical & Flexible Spending Accounts <strong>Benefits</strong> PlansHighmark Blue Cross Blue Shield800.648.4078www.highmarkbcbs.comPreferred Provider NetworkBlue Card PPO Network800.648.4078www.highmarkbcbs.comPharmacy Benefit ManagerExpress Scripts800.818.0093www.express-scripts.comVision <strong>Benefits</strong>VSP800.877.7195www.vsp.comDental BenefitDelta Dental of Indiana, Inc.800.524.0149www.deltadentalin.comEligibility and ApplicationTo participate in the Churchwide <strong>Health</strong>careprogram, you must be a compensated staff memberof an organization affiliated with the Stone-CampbellMovement. These organizations include, but are notlimited to, congregations, wider ministries, seminaries,and universities and colleges associated with the ChristianChurch (Disciples of Christ), Christian Churches/Churches of Christ, or Churches of Christ in the UnitedStates. Eligible staff includes: ministers, church support,missionaries, K-12 Christian school personnel, andnon-profit Christian college and university employees.Specific eligibility rules are determined by each individualentity/organization.If you qualify as an eligible staff member, you can alsocover your eligible dependents. Eligible dependents include:• Spouse/Domestic Partner• Children under 26 years of age, including:- Newborn Children- Stepchildren- Children legally placed for adoption- Legally adopted children for whom the employee’sspouse is the child’s legal guardian- Children awarded coverage pursuant to anorder of court• Children older than age 26 who are not able to supportthemselves due to mental disability, physical disability,mental illness or developmental disability.Enrollment changes during the yearIn most cases, your benefit elections remain in effectfor the entire plan year. During each annual enrollmentperiod, you will have the opportunity to review yourbenefit elections and make changes for the coming year.4

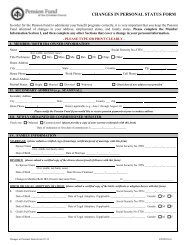

Certain coverage allows limited changes to electionsduring the year. These benefits include the medical, dentaland vision plans. Under these benefits, you may only makechanges to your elections during the year if you have achange in family status. Family status changes includethe following:• Marriage, divorce or legal separation• Gain or loss of an eligible dependent for reasonssuch as birth, adoption, court order, disability, death,marriage or reaching the dependent child age limit• Changes in your spouse’s employment affectingbenefit eligibility• Changes in your spouse’s benefit coverage withanother employer that affects benefit eligibilityThe change to your benefit elections must be consistentwith the change in family status. For example, if yougain a new dependent due to birth, you may only changeyour benefit elections to add that dependent. In this case,coverage for other dependents cannot be changed.You have 30 days from the date of a change in family statusto complete an enrollment change form and return it to theDirector of <strong>Health</strong> Services, <strong>Pension</strong> <strong>Fund</strong>. Otherwise, youmust wait until the next annual enrollment period to make achange to your elections. Your elections will become effectivethe first of the month, with the exception of a change due tobirth or adoption.Detailed Overview of <strong>Benefits</strong>Medical Program:Highmark Blue Cross Blue ShieldChurchwide <strong>Health</strong>care (CWHC) coverage through TheChristian Church <strong>Health</strong>care Benefit Trust (CCHCBT) hascontracted with Highmark Blue Cross Blue Shield (BCBS)to act as third-party administrator of the benefits program,which gives you access to the Blue Cross Blue Shieldsystem, one of the most widely recognized and acceptedthroughout the United States.For decades, the nationwide BCBS family of independentplan providers has offered members innovative healthcoverage through the CWHC Preferred ProviderOrganization (PPO) plan administered by Highmark BCBS.No matter where you live in the United States, you can takeadvantage of the expansive provider networks and discountsarranged by the PPO plans around the country. In mostcases, you should not have to file claim forms or pay anythingexcept your co-payments, deductibles, etc., in advance.This guide explains your coverage through CWHC andthe PPO program. For more information, such as detailsabout how we cover a particular service or prescriptiondrug, please read your contract or use one of the sourceslocated in the front of this guide.How does my medical plan work?You pay less out pocket if you use the physicians, hospitalsand other health care providers that participate in theBCBS PPO network. While you don’t need referrals tovisit specialists, you receive the highest level of benefitswhen you use preferred providers. In some instances, suchas hospital admissions and home health care services,Highmark BCBS can require prior approval. In otherwords, Highmark BCBS must approve the need for thecare before you seek it, or they may choose not to pay forsuch care.To find preferred providers (in-network):Visit the www.Highmarkbcbs.com and click on “Find aPhysician or Facility.” Call 800.648.4078 to find out ifthe provider you select is preferred.5

<strong>Health</strong> InsuranceNote about out-of-network providers:Remember, you will reach your out-of-pocket maximumquicker when you use providers that are out of theBCBS network. In addition, separate deductibles andout-of-pocket limits exist for out-of-network medicalservices. The medical summary of benefits enclosedshows a comparison between benefits when you usein-network providers and benefits when you use out-ofnetworkproviders.Also, keep in mind that your health plan pays theallowed price for services and supplies. In-networkproviders agree to accept the allowed price as paymentin full. When you use out-of-network providers, youmust pay the difference between the allowed price andthe provider’s charge. <strong>Benefits</strong> for most services requirethat you pay a deductible each year for in-networkprovider services and out-of-network providers’services. After you have met your deductible, you sharethe cost of your care through coinsurance. Deductibleand out-of-pocket amounts do not cross apply. Again,your coinsurance percentage amount for out-ofnetworkprovidersis higher than the one forin-network providers.You need only pay thedeductible andcoinsurance until youmeet your out-of-pocketmaximum for the year.Tier 1 (Generic): $10Tier 2 (Brand Formulary): 20%($25 minimum/$75 maximum)Tier 3 (Brand Non-Formulary): 50%($40 minimum/$120 maximum)When you go to in-network pharmacies, you will beresponsible for paying the copay or coinsurance – nothingmore. The pharmacy will bill Express Scripts for theleftover amount. As you can see, you will pay the lowestcopay if you use a generic drug. Make sure to ask yourpharmacist if a generic alternative is available for thebrand-name drug you are prescribed.You must use pharmacies that are in Express Scripts’network to receive the benefit levels above. Over 90% ofpharmacies nationwide currently belong to this network.Should you use an out-of-network pharmacy, you will beresponsible for the co-pay listed above plus 20% of theremaining cost of the drug.The plan provides for three refills of medication at a retailpharmacy. After this, the plan will require you to pay anadditional cost; unless you have this medication filledusing Express Scripts by Mail.Brand Formulary-Name DrugsPrescription Drug Program: Express ScriptsThe CCHCBT, through its partnership with ExpressScripts, a pharmaceutical benefit manager, has a tieredprescription drug program. That means that you pay thelowest co-payments when you use tier 1 (generic) drugs.Below is the co-payment structure at retail pharmaciesfor a 30-day supply:Annual Deductible: $50 individual; $100 FamilyFollowing are some definitions of brand formularynamedrugs:Brand-name drug – a prescription drug that is marketedunder a proprietary, trademark-protected name.Tier 2 prescription drug – a “preferred” brand-name drug.A list of these preferred drugs is provided by Express Scripts,your pharmacy vendor. Many factors are taken into accountwhen deriving the list, such as the utilization of the drugs,their cost and the therapeutic class.6

Wouldn’t you ratherpay $4 for yourprescription?What is important to know is that Tier 2 prescription drugsare less expensive than Tier 3 prescription drugs. Tier 3prescription drugs are non-preferred and are at the highestcoinsurance level.Formulary Drug List – This list, which is updatedquarterly to ensure the newer, more effective drugs areon it, is available to you by registering at www.expressscripts.com.Once there, you can download the formularylisting or search for a medication by name. Drugsautomatically come off the list when generic alternativesbecome available.You may want to print off the most updated formulary listand take it with you to your next doctor’s appointment.If your next doctor has the list, he or she can be sure toprescribe a preferred drug.Mandated GenericsIf you purchase non-preferred drugs, including nonsedatingantihistamines (Allegra®, Clarinex®, Zyrtec®, etc.),or if you purchase a brand medication when a generic isavailable, you will pay your copay plus the difference incost between the brand and generic.Express Scripts By Mail PharmaciesMore than six million members enjoy the convenienceand savings of having their long-term medications(maintenance medications, those taken for three monthsor more) delivered to their home or office. Express Scriptsby Mail advantages include:• Getting up to a 90-day supply (compared with atypical 30-day supply at retail) of each coveredmedication for just one mail order payment.- Tier 1 (Generic): $20- Tier 2 (Brand Formulary): 20%($60 minimum/$180 maximum)- Tier 3 (Brand Non-Formulary): 50%($100 minimum/$300 maximum)Did you know thatWal-Mart offers morethan 300 different drugs at only $4 perprescription fill or refill (up to a 30-day supply or60 pill maximum)? The program is available at allWal-Mart, Sam’s Club and Neighborhood Marketpharmacies. A similar program is also offeredthrough Target stores.• Ordering refills 24 hours a day online, by mail orby phone. To order online, register at www.expressscripts.com.Refills are usually delivered within threeto five days after Express Scripts receives your order.You can also have your doctor fax your prescriptions.Ask your doctor to call 888.327.9791.• Choosing a convenient payment option. Express Scriptsoffers two safe, automatic options for prescription orders.You can use e-check to have payments automaticallydeducted from your checking account, or you can useAutoCharge to have payments charged automaticallyto your credit card. For more information, visitwww.express-scripts.com or call member services at800.418.9925.Specialty MedicationsSpecialty medications are drugs that are used to treatcomplex conditions, such as cancer, growth hormonedeficiency, hemophilia and multiple sclerosis. ExpressScripts’ specialty pharmacy, Accredo <strong>Health</strong> Group,Inc., is composed of therapy-specific teams that providean enhanced level of personalized service to patientswith special therapy needs. By ordering your specialtymedications through Accredo, you can receive:• Personalized counseling from our dedicated team ofregistered nurses and pharmacists.• Expedited, scheduled delivery of your medications atno charge.• Complimentary supplies, such as needles and syringes.• Refill reminder calls.• Safety checks to help prevent potential druginteractions.7

<strong>Health</strong> InsuranceFlexible Spending AccountA health care flexible spending account (FSA) provides youthe opportunity to benefit from the tax savings available bysetting aside money to pay for future health care expenses ona pre-tax basis. <strong>Health</strong> care FSA contributions are not subjectto federal income tax, Social Security taxes, and most stateand local income taxes. Check with your local tax advisorregarding your state and local income tax laws.How the FSA worksThe Christian Church (Disciples of Christ) FlexibleSpending Accounts for <strong>Health</strong>care (“<strong>Health</strong>care FSA”)allows you to prefund out-of-pocket medical and dentalcosts and other qualified medical costs not otherwisecovered through the Churchwide <strong>Health</strong>care. Qualifiedexpenses may include:• Deductibles• Well baby care• Co-payments• Organized weight loss programs• Vision care (including RK and LASIK)• Dental care• Hearing aids and other related expenses• Prescription drugs• Transportation to receive care• Certain non-covered procedures such asexperimental surgeries• Annual physicals• Body scanning and heart scoringPlease note that the IRS does not allow reimbursementof monthly medical and dental insurance premiumsthrough a flexible spending account.ReimbursementTo get reimbursed, you do not need to submit a copy of acanceled check or a receipt for a bill that is already paidas proof of expense. An invoice or copy of an unpaid billThe before-tax advantageBy contributing to a <strong>Health</strong>care FSA, you authorizea congregation or church-related organization to setaside a certain amount from your pay before taxesare withheld. Since you are taxed only on the cashsalary amount remaining in your paycheck, thisreduces your taxable wages. Lower taxable incomemeans that you pay less in taxes. Your <strong>Health</strong> <strong>Care</strong>FSA contributions are not subject to:is acceptable since the program operates on an incurreddate. We will look at the date the service was received todetermine if it is eligible for the program year.Dependent <strong>Care</strong> Spending AccountDay care expenses are covered for the following dependentswhile you work. This also applies if you are married and yourspouse is working, a full-time student or living with a disability:• Your children under 13• Your dependent (spouse or child of any age) living witha mental or physical disability and incapable of self-care• Claimed as dependents for income tax purposes• Your dependent parent or other dependent who spendsat least eight hours a day in your homeEligible dependent care expenses include care in your home,a babysitter’s home, or at a licensed day care facility.• Minimum expense: $520• Maximum expense: $ 5,000 (or $2,500 if you aremarried and file separate income tax returns)Use it or lose it• Federal Income Taxes,• Social Security (FICA or SECA)taxes, and• Most state and local (including county) incometaxes. (Rules vary, and state and local taxes aresubject to frequent changes.)For the FSA, it is important to accurately estimate yourexpenses and only elect an annual contribution to coverexpected claims because IRS regulations require that anymoney left in your FSA account be forfeited. As long youare a participant, however, you have until March 31 to8

submit any eligible expenses you incur between January 1and March 15 of the next year.Submitting claimsWhen you have an eligible expense to be reimbursed fromyour <strong>Health</strong> <strong>Care</strong> FSA, you can file a claim by completinga Flexible Spending Account claim form and submitting it,and proof of expense, to Highmark BCBS:Spending Account Processing CenterP.O. Box 25173Lehigh Valley, PA 18002-5173Fax: 866.228.9417This form is also available at www.pensionfund.org.When to enroll in the FSAYou must enroll within 31 days of your hire date or withenrollment in the Churchwide <strong>Health</strong> <strong>Care</strong> Program. Ifyou do, your contributions take effect as of the date youenroll. If you don’t enroll within those time frames, youmust wait until the next annual enrollment period. Duringthis time, you can start, stop, or change the amounts youare contributing to the flexible spending account(s). Anyelections you make, however, take effect on January 1 andremain in effect through December 31 of that calendar year.Voluntary Dental Program:Dental PPO Plan – Delta DentalDelta Dental has one of largest networks of dentists in thecountry through DeltaPremier USA. With the PPO dental plan,you may see any dentist that you choose. However, you haveaccess to discounted charges by utilizing network providers.In addition, through our Passport Dental program, havingDelta Dental coverage makes it easy for our enrolleesto get expert dental care almost anywhere in the world.This program gives you access to a worldwide network ofdentists and dental clinics. English-speaking operators areavailable around the clock to answer questions and helpyou schedule care.To learn more, including enrollment information, participatingdentists and Passport Dental, visit www.deltadental.comor call 800.524.0149. After enrolling, you will receive yourDental ID card in the mail within three weeks.Covered services• Oral exams (including evaluations by a specialist) arepayable twice per calendar year.• Prophylaxes (cleanings) are payable twice percalendar year.• Fluoride treatments are payable once per calendar yearfor people up to age 14.• Bitewing X-rays are payable once per calendar year andfull mouth X-rays (which include bitewing X-rays) arepayable once in any five-year period.• Sealants are only payable once per tooth per lifetime forthe occlusal surface of first permanent molars up to agenine and second permanent molars up to age 14. Thesurface must be free from decay and restorations.• Crowns, inlays and substructures are payable once pertooth in any seven-year period.• Composite resin (white) restorations are coveredservices on posterior teeth.• Porcelain crowns are optional treatment onposterior teeth.• Full and partial dentures are payable once in anyseven-year period.• Bridges and substructures are payable once in anyseven-year period.• Implants and implant related services are payable onceper tooth in any seven-year period.• People with certain high-risk medical conditions maybe eligible for additional prophylaxes (cleanings) orfluoride treatment. The patient should talk with his orher dentist about treatment.9

<strong>Health</strong> InsuranceMaximum paymentMaximum payment is $1,000 per person, per benefityear on all services except orthodontics. The maximumpayment for orthodontic services is $500 per person,per lifetime.DeductibleThere is a $50 deductible per person, per benefit year.The deductible does not apply to diagnostic services,prophylaxes (cleanings), fluoride, brush biopsy, bitewingx-rays and orthodontic services.Employer-Paid Dental Program:Dental PPO Plan – Delta DentalDeltaPremier USA is a carefully managed fee-for-serviceprogram administered by Delta Dental. “Fee-for-service”means that the dentist charges a fee for each serviceperformed and then sends a claim to Delta Dental. DeltaDental then pays a certain percentage for each coveredservice. With DeltaPremier USA, you are likely to loweryour out-of-pocket costs by going to a DeltaPremierparticipating dentist. This is because participatingdentists agree to accept their fee or Delta Dental’s Usualand Customary (UCR) fee, whichever is less, as fullpayment for covered services. More than 108,000 dentiststhroughout the United States and its territories participatein DeltaPremier USA.In addition, through our Passport Dental program, havingDelta Dental coverage makes it easy for our enrolleesto get expert dental care almost anywhere in the world.This program gives you access to a worldwide network ofdentists and dental clinics. English-speaking operators areavailable around the clock to answer questions and helpyou schedule care.To learn more, including enrollment information,participating dentists and Passport Dental, visitwww.deltadental.com or call 800.524.0149. After enrolling,you will receive your Dental ID card in the mail withinthree weeks.Covered services• Oral exams (including evaluations by a specialist) arepayable twice per calendar year.• Prophylaxes (cleanings) are payable twice percalendar year.• Fluoride treatments are payable twice per calendar yearfor people up to age 19.• Bitewing X-rays are payable once per calendar year andfull mouth X-rays (which include bitewing X-rays) arepayable once in any five-year period.• Sealants are only payable once per tooth per lifetime forthe occlusal surface of first permanent molars up to agenine and second permanent molars up to age 14. Thesurface must be free from decay and restorations.• Composite resin (white) restorations are coveredservices on posterior teeth.• Porcelain crowns are optional treatment onposterior teeth.• Implants and implant related services are payable onceper tooth in any seven-year period.• People with certain high-risk medical conditions maybe eligible for additional prophylaxes (cleanings) orfluoride treatment. The patient should talk with his orher dentist about treatment.Maximum paymentThe maximum payment is $1,200 per person, per benefityear on all services, except orthodontics, which is $1,000per person, per lifetime.10

of the coverage be delivered to all plan participants uponenrollment and annually thereafter. This languageserves to fulfill that requirement for this year. Theseservices include:DeductibleThere is a $50 deductible per person, per benefit yearlimited to a maximum deductible of $150 per family perbenefit year. The deductible does not apply to diagnosticand preventive services, emergency palliative treatment,x-rays, sealants and orthodontic services.Vision – Vision Service Plan (VSP)Your vision coverage will be provided by Vision Service Plan(VSP) with national and local network access. With VSPdoctors, you’ll enjoy quality, personalized care. Your VSPdoctors will get to know you and your eyes, helping you keepthem healthy year after year. Besides helping you see better,routine eye exams can detect symptoms of serious conditionssuch as glaucoma, cataracts, diabetes, and even tumors.To get started, simply choose a VSP doctor by visitingwww.vsp.com or calling 800.877.7195. Make anappointment and tell the doctor you are a VSP member.That’s it! No ID cards or filling out claim forms.Legal UpdatesThe Women’s <strong>Health</strong> and Cancer Rights ActThe Women’s <strong>Health</strong> and Cancer Rights Act requiresgroup health plans that provide coverage for mastectomyand certain reconstructive services. Thislaw also requires that written notice of the availability• Reconstruction of the breast(s) upon which themastectomy has been performed.• Surgery/reconstruction of the other breast to produce asymmetrical appearance.• Prostheses.• Treatment for physical complications during all stagesof mastectomy, including Lymphedemas.In addition, the plan may not:• Interfere with a participant’s rights under the plan toavoid these requirements; or• Offer inducements to the health care provider, orassess penalties against the provider, in an attempt tointerfere with the requirements of the law.However, the plan may apply deductibles, coinsurance, andcopays consistent with other coverage provided by the plan.HIPAA Special Enrollment RightsIf you are declining or have declined enrollment foryourself or your dependents (including your spouse)because of other health insurance coverage, you may in thefuture be able to enroll yourself or your dependents in thisplan, provided that you request enrollment within30 days after your other coverage ends.You may also be able to enroll yourself or your dependentsin the future if you or your dependents lose healthcoverage under Medicaid or your state’s Children’s <strong>Health</strong>Insurance Program (CHIP), or become eligible for statepremium assistance for purchasing coverage under a grouphealth plan, provided that you request enrollment within60 days after that coverage ends or after you becomeeligible for premium assistance.11

<strong>Health</strong> InsuranceIn addition, if you have a new dependent as a result ofmarriage, birth, adoption or placement for adoption,you may be able to enroll yourself and your dependents,provided that you request enrollment within 30 days afterthe marriage, birth, adoption or placement for adoption.HIPAA Privacy NoticeContact the Director of <strong>Health</strong> Services for more detailsor questions. Churchwide <strong>Health</strong>care follows all legalrequirements with regard to protecting your Protected<strong>Health</strong> Information (PHI).Newborn’s and Mother’s <strong>Health</strong> Protection ActFederal Law (Newborn’s and Mother’s <strong>Health</strong> ProtectionAct of 1996) prohibits the plan from limiting a mother’sor newborn’s length of hospital stay to less than 48 hoursfor a normal delivery or 96 hours for a cesarean deliveryor from requiring the provider to obtain pre-authorizationfor a stay of 48 hours or 96 hours, as appropriate. However,federal law generally does not prohibit the attendingprovider, after consultation with the mother, fromdischarging the mother or her newborn earlier than 48hours for normal delivery or 96 hours for cesarean delivery.Mental <strong>Health</strong> Parity ActAccording to the Mental <strong>Health</strong> Parity Act of 1996, the lifetimemaximum and annual maximum dollar limits for mentalhealth benefits under the CCHCBT Group Medical Planare equal to the lifetime maximum and annual maximumdollar limits for medical and surgical benefits under this plan.However, mental health benefits may be limited to a maximumnumber of treatment days per year or series per lifetime.(other than for gross misconduct). Federal law alsoenables your dependent(s) to continue health insuranceif their coverage ceases due to your death, divorce, legalseparation, or with respect to a dependent child(ren),failure to continue to qualify as a dependent. Continuationmust be elected in accordance with the rules of youremployer’s group health plan(s) and is subject to Federallaw, regulations and interpretations.Children’s <strong>Health</strong> Insurance Program(CHIP) CoverageUnder the Churchwide <strong>Health</strong>care group health plans,employees and their eligible dependents may enroll forcoverage when they first become eligible for coverage andannually during open enrollment. In addition, employeesand/or their eligible dependents are allowed to enrollin the group health plan if they experience a specialenrollment event under the <strong>Health</strong> Insurance Portabilityand Accountability Act (HIPAA). Effective April 1, 2009, theplan rules have changed to allow you and/or your eligibledependents to enroll for coverage under a new HIPAA specialenrollment opportunity. If you have any questions or wantmore information, please contact Michael Porter, Director of<strong>Health</strong> Services, at 866.495.7322.Continuation Required by Federal Law for Youand Your DependentsFederal law enables you or your dependent to continuehealth insurance if coverage would cease due to a reductionof your work hours or termination of your employment12

Medicare Part D: Important notice about your prescription drug coverage and MedicarePlease read this notice carefully and keep it where you can find it. This notice has information about your currentprescription drug coverage with Churchwide <strong>Health</strong>care and about your options under Medicare’s prescription drugcoverage. This information can help you decide whether or not you want to join a Medicare drug plan. If you areconsidering joining, you should compare your current coverage, including which drugs are covered at what cost, with thecoverage and costs of the plans offering Medicare prescription drug coverage in your area. Information about where youcan get help to make decisions about your prescription drug coverage is at the end of this notice.You need to remember two important things about yourcurrent coverage and Medicare’s prescription drug coverage:Medicare prescription drug coverage became available in 2006to everyone with Medicare. You can get this coverage if youjoin a Medicare Prescription Drug Plan or join a MedicareAdvantage Plan (like a <strong>Health</strong> Maintenance Organization/HMO or Preferred Provider Organization/PPO) that offersprescription drug coverage. All Medicare drug plans provide atleast a standard level of coverage set by Medicare. Some plansmay also offer more coverage for a higher monthly premium.CCHCBT has determined that the prescription drugcoverage offered by the Churchwide <strong>Health</strong>care <strong>Health</strong> Planis, on average for all plan participants, expected to pay out asmuch as standard Medicare prescription drug coverage paysand is therefore considered “creditable coverage.” Becauseyour existing coverage is creditable coverage, you can keepthis coverage and not pay a higher premium (a penalty) if youlater decide to join a Medicare drug plan.Joining a Medicare drug planYou can join a Medicare drug plan when you first becomeeligible for Medicare, and, each year from Novemberthrough December.However, if you lose your current creditable prescriptiondrug coverage, through no fault of your own, you will alsobe eligible for a two-month Special Enrollment Period(SEP) to join a Medicare drug plan.Impacts of current coverage if you join a Medicare drug planIf you decide to join a Medicare drug plan, your currentCCHCBT coverage will not be affected. Your current coveragepays for other expenses in addition to prescription drugs. Ifyou enroll in a Medicare prescription drug plan, you and youreligible dependents will still be eligible to receive all of yourcurrent health and prescription drug benefits. If you drop yourcurrent coverage and enroll in Medicare prescription drugcoverage, you may re-enroll into Churchwide <strong>Health</strong>care’sbenefit plan during the annual enrollment period underChurchwide <strong>Health</strong>care’s Benefit Plan.When you pay a penalty to join a Medicare Drug PlanYou should also know that if you drop or lose your currentcoverage with CCHCBT and don’t join a Medicare drugplan within 63 continuous days after your current coverageends, you may pay a higher premium (a penalty) to join aMedicare drug plan later.If you go 63 continuous days or longer without creditableprescription drug coverage, your monthly premium maygo up by at least 1% of the Medicare base beneficiarypremium per month for every month that you did not havethat coverage. For example, if you go 19 months withoutcreditable coverage, your premium may consistently beat least 19% higher than the Medicare base beneficiarypremium. You may have to pay this higher premium (apenalty) as long as you have Medicare prescription drugcoverage. In addition, you may have to wait until thefollowing November to join.13

<strong>Health</strong> InsuranceFor more information about this notice or your current prescription drug coverage,contact the Director of <strong>Health</strong> Services at 866.495.7322.NOTE: You will get this notice each year. You will also receive it before the next period you can join a Medicaredrug plan and if this coverage through CCHCBT changes. You also may request a copy of this notice at any time.For more information about your options under Medicare prescription drug coverage,refer to the “Medicare & You” handbook. You will get a copy of the handbook in the mail everyyear from Medicare. You may also be contacted directly by Medicare drug plans.For more information about Medicare prescription drug coverage:• Visit www.medicare.gov.• Call your state health insurance assistance program for personalized help. See the inside backcover of your copy of the “Medicare & You” handbook for their telephone number.• Call 800.MEDICARE (800.633.4227). TTY users should call 877.486.2048.• If you have limited income and resources, extra help paying for Medicare prescription drugcoverage is available. For information about this extra help, visit www.socialsecurity.gov orcall 800.772.1213 (TTY 800.325.0778).Name of Entity/Sender: Christian Church <strong>Health</strong> <strong>Care</strong> Benefit TrustContact: Michael Porter, Director of <strong>Health</strong> ServicesAddress: 130 East Washington Street, Indianapolis, IN 46204Phone Number: 866.495.7322Remember: Keep this creditable coverage notice. If you decide to join one of the Medicare drug plans, you maybe required to provide a copy of this notice when you join to show whether or not you have maintained creditablecoverage and, therefore, whether or not you are required to pay a higher premium (a penalty).14

Terms to KnowCoinsurance: The percentage of eligible expensesyou and the plan share. The exact coinsurancedepends on the plan your employer offers.Co-payment: The fixed, up-front dollaramount you pay for certain covered expenses.Co-payment amounts do not apply toward yourdeductible or coinsurance, and they do notaccumulate toward the out-of-pocket maximum.Deductible: Initial amount you must pay eachbenefit year for covered services before the planbegins to provide benefits.Flexible Savings Account (FSA): An accountallowed under Section 125 of the tax codeto allow employees to set aside funds on apre-tax basis to reimburse the member for IRSapproved medical, dental and vision expensesnot covered by Churchwide <strong>Health</strong>care. Thecatch is the “use it or lose it” clause, whichmeans if you do not exhaust your account in thecalendar year, then remaining funds remitto Churchwide <strong>Health</strong>care.High Deductible <strong>Health</strong> Plan (HDHP): A highdeductible health plan is defined as a healthplan that does not have deductible less than$1,200 for an individual/$2,400 for a family (not toexceed $6,050 individual/$12,100 for family). Maybe used with either a <strong>Health</strong> ReimbursementAccount or <strong>Health</strong> Savings Account for approvednon-covered medical expenses.<strong>Health</strong> Insurance Portability andAccessibility Act (HIPAA): This law has twoeffects on Churchwide <strong>Health</strong>care. On onehand, it mandates the issuance of certificatesof credible coverage to help offset pre-existingcondition time periods. More recently, it hasbeen updated to protect personal healthinformation (PHI) from being distributed todisinterested parties and to ensure the privacy ofour members.<strong>Health</strong> Maintenance Organization (HMO):This is a broad term encompassing a varietyof health care delivery systems utilizing grouppractice and providing alternatives to the feefor-serviceprivate practice of medicine andallied health professions.<strong>Health</strong> Reimbursement Account (HRA):<strong>Health</strong> Reimbursement Accounts are set upby employers to reimburse employees for IRSapproved medical, dental and vision expensesnot covered by Churchwide <strong>Health</strong>care, usuallypaired with the high deductible health plan.<strong>Health</strong> Savings Account (HSA): <strong>Health</strong>Savings Accounts are money market likeaccounts that can be set up with contributionsfrom the employer, employee or both. <strong>Fund</strong>s gointo these accounts tax-free and as long as thefunds are used for IRS approved medical, dentaland vision expenses not covered by Churchwide<strong>Health</strong>care high deductible health plans, theycan be withdrawn tax-free. <strong>Fund</strong>s are owned bythe employee, regardless of the contributor, andcan be carried over year to year.In-Network <strong>Care</strong>: <strong>Care</strong> you receive fromin-network physicians, specialists, hospitals,rehabilitation centers, labs and other healthcare providers that have signed an agreementwith their local Blue Cross and Blue Shield plan.In-network providers accept the allowablecharge as payment in full. They also file claimsfor you. In-network care is paid at the higherlevel of benefits.Out-of-Network <strong>Care</strong>: <strong>Care</strong> you receivefrom health care providers who are not in thenetwork. This care is covered at the lower, outof-networklevel when it is determined to bemedically necessary and appropriate.Out-of-Pocket Maximum: The amount youpay out of your pocket for eligible health careexpenses before the plan begins to pay 100% foradditional eligible expenses. The out-of-pocketlimit does not include co-payments, deductibles,mental health/substance abuse expenses,prescription drug expenses or amounts over theallowable plan charge.Preferred Provider Organization Program(PPO): A program that does not require theselection of a primary care physician, but isbased on a provider network made up ofphysicians, specialists, hospitals and otherhealth care facilities. Using this provider networkhelps assure members receive coverage foreligible services.Patient Protection and Affordable <strong>Care</strong>Act of 2010 (PPACA): Commonly known as the<strong>Health</strong> <strong>Care</strong> Reform Law, this law is the guidingforce of health coverage starting 2011 goingforward. Some of the changes already in placeinclude covering dependents to age 26, no preexistingcondition clauses for children under age19, and codifying preventive care services to becovered at 100%.

About <strong>Pension</strong> <strong>Fund</strong>Participation in <strong>Pension</strong> <strong>Fund</strong> programs provides peace of mind that you are investing in an organization withmore than 115 years of experience in managing financial assets. Our track record and financial strength aretestimony that <strong>Pension</strong> <strong>Fund</strong> is Strong. Smart. Secure.It is our objective and practice to maintain excess reserves for all <strong>Pension</strong> <strong>Fund</strong> programs. <strong>Pension</strong> <strong>Fund</strong> isfully funded, which means we have more assets than benefit obligations and, from an actuarial standpoint,can pay all current and future retirement obligations. This strong reserve position allows us to weather marketdownturns, as well as provide financial underpinning to develop new programs to benefit our participants andparticipant organizations.<strong>Pension</strong> <strong>Fund</strong> has prudently managed assets for more than 115 years and has responded to changing needsof our members. We continue to introduce programs to supplement members’ existing retirement andpension savings.We measure our success by protecting and adding value for your retirement. In good times and bad, <strong>Pension</strong><strong>Fund</strong> serves its members faithfully. In the history of <strong>Pension</strong> <strong>Fund</strong>, no participant has experienced a reductionin pension or pension credits, nor suffered any loss in value of his or her retirement account.To learn more about <strong>Pension</strong> <strong>Fund</strong>’s full range of programs, visit www.pensionfund.org.Before making decisions about financial matters, please consult your attorney, tax preparer or other financialadvisor to find out how these programs will impact your individual situation. If any differences exist between thissummary and the Churchwide <strong>Health</strong>care document, the Churchwide <strong>Health</strong>care document will control.www.facebook.com/pensionfundchristianchurch866.495.7322Visit us on the web:www.pensionfund.orgSend us an email:pfcc1@pensionfund.org130 E. Washington StreetIndianapolis, IN 46204-365904/2013