Promoting small and medium-sized enterprises with equity and debt ...

Promoting small and medium-sized enterprises with equity and debt ...

Promoting small and medium-sized enterprises with equity and debt ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

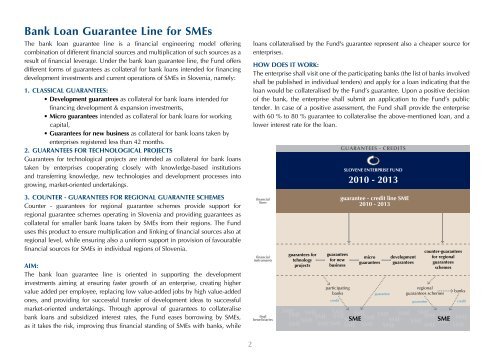

Bank Loan Guarantee Line for SMEsThe bank loan guarantee line is a financial engineering model offeringcombination of different financial sources <strong>and</strong> multiplication of such sources as aresult of financial leverage. Under the bank loan guarantee line, the Fund offersdifferent forms of guarantees as collateral for bank loans intended for financingdevelopment investments <strong>and</strong> current operations of SMEs in Slovenia, namely:1. CLASSICAL GUARANTEES:• Development guarantees as collateral for bank loans intended forfinancing development & expansion investments,• Micro guarantees intended as collateral for bank loans for workingcapital,• Guarantees for new business as collateral for bank loans taken by<strong>enterprises</strong> registered less than 42 months.2. GUARANTEES FOR TECHNOLOGICAL PROJECTSGuarantees for technological projects are intended as collateral for bank loanstaken by <strong>enterprises</strong> cooperating closely <strong>with</strong> knowledge-based institutions<strong>and</strong> transferring knowledge, new technologies <strong>and</strong> development processes intogrowing, market-oriented undertakings.loans collateralised by the Fund's guarantee represent also a cheaper source for<strong>enterprises</strong>.HOW DOES IT WORK:The enterprise shall visit one of the participating banks (the list of banks involvedshall be published in individual tenders) <strong>and</strong> apply for a loan indicating that theloan would be collateralised by the Fund’s guarantee. Upon a positive decisionof the bank, the enterprise shall submit an application to the Fund’s publictender. In case of a positive assessment, the Fund shall provide the enterprise<strong>with</strong> 60 % to 80 % guarantee to collateralise the above-mentioned loan, <strong>and</strong> alower interest rate for the loan.GUARANTEES - CREDITSSLOVENE ENTERPRISE FUND2010 - 20133. COUNTER - GUARANTEES FOR REGIONAL GUARANTEE SCHEMESCounter - guarantees for regional guarantee schemes provide support forregional guarantee schemes operating in Slovenia <strong>and</strong> providing guarantees ascollateral for <strong>small</strong>er bank loans taken by SMEs from their regions. The Funduses this product to ensure multiplication <strong>and</strong> linking of financial sources also atregional level, while ensuring also a uniform support in provision of favourablefinancial sources for SMEs in individual regions of Slovenia.AIM:The bank loan guarantee line is oriented in supporting the developmentinvestments aiming at ensuring faster growth of an enterprise, creating highervalue added per employee, replacing low value-added jobs by high value-addedones, <strong>and</strong> providing for successful transfer of development ideas to successfulmarket-oriented undertakings. Through approval of guarantees to collateralisebank loans <strong>and</strong> subsidized interest rates, the Fund eases borrowing by SMEs,as it takes the risk, improving thus financial st<strong>and</strong>ing of SMEs <strong>with</strong> banks, whilefinanciallinesfinancialinstrumentsfinalbeneficiariesguarantees fortehnologyprojectsguaranteesfor newbusinessparticipatingbankscreditguarantee - credit line SME2010 - 2013microguaranteesguaranteedevelopmentguaranteescounter-guaranteesfor regionalguaranteesschemesregionalguarantees schemesguaranteebanksSMESME SME SME SMESME SMESME SME SMESMESME SME SMESME SME SMESME SME SMESMESMESME SMESME SME SME SME SMEcredit2