2013 Life Insurance Conference (2013) - LIMRA.com

2013 Life Insurance Conference (2013) - LIMRA.com

2013 Life Insurance Conference (2013) - LIMRA.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Jazz UpYour <strong>Life</strong>Tuesday, April 16Continental Breakfast — 7:00 to 8:00 a.m.Grand SalonGeneral Session — 8:00 to 10:00 a.m.Grand Ballroom C/DAndy Ferris, FSA, MAAA, PresidingSenior Manager, Deloitte ConsultingMember, SOA Board of Directors<strong>Life</strong> <strong>Insurance</strong> Industry: Executive OutlookCarolyn M. JohnsonExecutive Vice Presidentand Chief Operating OfficerProtective <strong>Life</strong> CorporationPresidentWest Coast <strong>Life</strong> <strong>Insurance</strong> CompanyJoin Carolyn Johnson as she shares her insights on the state of thelife insurance industry. This informative session will highlight thechallenges and opportunities that the industry has endured andover<strong>com</strong>e as well as those that lie ahead.Economic and Investment Outlook and Implications forthe <strong>Life</strong> <strong>Insurance</strong> IndustryEric R. JohnsonExecutive Vice Presidentand Chief Investment OfficerCNO Financial GroupConcurrent Sessions — 10:30 to 11:30 a.m.Grand Ballroom C/D2.1 The Challenge of Today’s Low InterestEnvironmentToday’s interest rate environment is challengingfor life insurers in markets around the world.A sustained low-rate environment makes itdifficult for life insurers to achieve their targetspreads. Also, today’s policy responses of centralbanks may increase the chance of a rapid rise ininterest rates in the future. This scenario is alsochallenging for the financial management oflife insurers. In this session, we will reviewapproaches to quantify interest rate exposure,the strategic options available to life insurers,and the techniques used to implement thesestrategies in the market.Terry Long, FSA, MAAA, Senior Vice Presidentand Consulting Actuary, Lewis & Ellis, Inc.;Mark Whitford, FSA, CERA, MAAA, Senior<strong>Insurance</strong> Investment Strategist, Franklin TempletonSalon C182.2 A Look at the Current Effects of theDodd-Frank ActNow that some of the regulatory pieces of the DFAare in place, <strong>com</strong>e here how it affects your businesstoday.Ethan T. James, Partner, Debevoise & Plimpton, LLP;Satish M. Kini, Partner, Debevoise & Plimpton, LLP;Amanda Greenwold Wise, Counsel, Debevoise &Plimpton, LLPLearn the latest on the current economic conditionsand trends as Eric Johnson discusses these, as well as current andprospective investment opportunities. He will also share specificinsights on how low interest rates are impacting the life insuranceindustry.Refreshment Break — 10:00 to 10:30 a.m.Grand Salon3

The <strong>Life</strong> <strong>Insurance</strong> <strong>Conference</strong>Concurrent Sessions — 10:30 to 11:30 a.m.(continued)Salon A62.3 Call, Click, or Come In: Insights onMulti-Channel Distribution in the<strong>Insurance</strong> IndustryHow will consumers’ increasing familiarity with amultichannel (phone, Web, in-person) shoppingexperience affect the insurance industry? Willconsumers expect the same choices and exhibit thesame behaviors when shopping for insurance asthey do when shopping for clothes, books, andelectronics? This workshop will examine theseissues as it addresses the reality of today’spurchasing behaviors and consumers’ channelpreferences for insurance and financial services.Highlights from new <strong>LIMRA</strong> research will also bediscussed, examining the factors that drive channelchoice for various insurance products andidentifying implications for <strong>com</strong>panies looking toeffectively reach today’s multichannel consumer.Sean F. O’Donnell, Assistant Vice President,Member Relations, U.S. Client Services, <strong>LIMRA</strong>;Todd A. Silverhart, Ph.D., Corporate Vice Presidentand Director of <strong>Insurance</strong> Research, <strong>LIMRA</strong>Salon B122.4 Debunking the Myths of AutomatedUnderwriting and Other E-ssential ActivitiesThere is an increased interest for underwritingautomation to improve ease of doing businesswith agents, improve workload management andhelp facilitate better underwriting decisions. Asautomated underwriting is more readily accepted,it also be<strong>com</strong>es increasingly more important for<strong>com</strong>panies to embrace the use of electronicapplications and e-signatures. This session will helpindividuals gain a better understanding of carriers’top underwriting challenges and uncover specificplans and solutions for improving overallunderwriting effectiveness and the integrationwith e-apps and e-signatures.Deb Smallwood, Founder, Strategy Meets ActionConcurrent Sessions — 1:00 to 2:00 p.m.Grand Ballroom C/D3.1 Indexed Universal <strong>Life</strong>: What You Need to KnowIndexed UL brought in the most additional new lifeinsurance premium over the past few years and is one ofonly two products able to increase its sales each year of therecession. In this workshop you will hear about importantissues that surround this hot product (such as pricing,ethics and distribution) and how some may relate to otherproducts in your portfolio.Bobby Samuelson, Executive Editor, The <strong>Life</strong> Product ReviewSalon B123.2 Introduction to Reinsurance: Lose Your Fearof the Dark SideIf you work in insurance, reinsurance affects much ofwhat you do and some of how you do it. Can you affordnot to understand the basics of something so beneficialand <strong>com</strong>monplace, yet largely behind the scenes? Thiscrash course will cover various kinds of reinsurancearrangements, reinsurance treaty language, and keyreinsurance regulations. Here is your opportunity tolearn from the Society of Actuaries’ Reinsurance SectionCouncil’s LEARN (<strong>Life</strong> Education and ReinsuranceNavigation) initiative. Don’t miss out!Jeffrey Katz, FSA, MAAA, Senior Vice President – Head ofMarketing Actuaries, Swiss Re American Holding CorporationSalon A63.3 Actuarial Models: Friend or Foe?Are you involved in conversations dealing with your<strong>com</strong>pany’s actuarial models? Do you have a good graspon what they do and how they are used? Good actuarialmodels require consistent data and processes, a goodunderstanding of which can benefit everyone. This sessionwill provide an overview of what actuarial models do,why they are important, and what best practices help<strong>com</strong>panies control and govern models. Non-actuarial andactuarial participants alike should gain an increasedunderstanding of model processes and model uses.John Christensen, FSA, MAAA, <strong>Life</strong> Chief Actuary, AmericanFamily <strong>Life</strong> <strong>Insurance</strong> Company; Rob Stone, FSA, MAAA,Principal and Consulting Actuary, Milliman, Inc.Luncheon — 11:30 a.m. to 1:00 p.m.Grand Salon4

Jazz Up Your <strong>Life</strong>Salon C183.4 Connecting With the Hispanic MarketThe 2010 Census counted over 50 million Hispanics livingin the United States. This market has be<strong>com</strong>e increasingly<strong>com</strong>plex in terms of demographics and culture. Come andhear about the latest <strong>LIMRA</strong> research findings and whatapplications they may have from a <strong>com</strong>pany standpoint.Nilufer Ahmed, Ph.D., Senior Research Director, MarketsResearch, <strong>LIMRA</strong>; Jorge Enderica, CLU, ChFC, RHU, VicePresident, Business Development, Global <strong>Life</strong>, Pan-American<strong>Life</strong> <strong>Insurance</strong> CompanyBreak — 2:00 to 2:15 p.m.Grand SalonConcurrent Sessions — 2:15 to 3:15 p.m.Salon A64.1 Social Media is Mardi Gras MarketingIf you want to grow “apptivity,” attending this session isa must! Video integrated with social media campaignshave revolutionized the recruitment of producers andconsumers with consistent content distributed overmultiple Internet channels. The Mardi Gras mantra ofsocial media <strong>com</strong>munication of tweets, blogs, and articlesmust include entertainment value.Content is King. Consistent distribution is a must.Hear from a firm whose videos and social media<strong>com</strong>munications exceed 65,000 page views anddownloads a month!Steve Savant, Host of the Business <strong>Insurance</strong> Zone, BrokersAllianceSalon C184.2 The Moment of TruthIt is the moment that we hope never to face, yet also thetime when the unquestionable value of the life insuranceindustry shines through — filing a death claim for a lovedone. In this session, <strong>LIMRA</strong> will share the results of a 2012pilot research study that measured the effectiveness of thelife insurance claims process. Come hear about theexperiences of over 4,000 beneficiaries.Jennifer Douglas, Associate Research Director,Developmental Research, <strong>LIMRA</strong>Salon B124.3 Predictive Analytics — Here to Stay orPassing Fad?Predictive analytics has gained a lot of momentumoutside of the life insurance industry over the pastseveral years as the amount of data and itsaccessibility has dramatically increased. However,this is not the first time that we have seen outsidetechnologies or initiatives fail to take hold or makea material difference in our industry. This sessionwill explore how predictive analytics initiatives arepenetrating the life insurance business and what thefuture holds for additional analytical possibilities.Chris Stehno, Senior Manager, Deloitte ConsultingGrand Ballroom C/D4.4 Jazzing Up the <strong>Life</strong> <strong>Insurance</strong> ProductDevelopment and Introduction ProcessAs insurers seek ways to grow their business andsatisfy distribution channel demands, they arelooking to simplify their product introductionprocess while quickly evaluating market acceptance.This session will provide carriers insight into how theemergence of “as a service” models enable carriers to:• Dramatically shift the way product introductionsare managed and maintained• Quickly evaluate market acceptance of the newproduct to allow for fine-tuning the marketingand sales approach• Drive new levels of efficiency and performancewhile quickly developing products in a highlyautomated and consistent manner.John Albanese, CLU, ChFC, Vice President, BusinessProcess Services, CSC; Enrico Treglia, Senior VicePresident and Chief Operation Officer, Wilton ReRefreshment Break — 3:15 to 3:45 p.m.Grand Salon5

The <strong>Life</strong> <strong>Insurance</strong> <strong>Conference</strong>General Session — 3:45 to 4:45 p.m.Grand Ballroom C/DMarket Signals: What The Financial MarketsAre Telling Us NowPeter F. RicchiutiFounder and Director of ResearchBURKENROAD REPORTSFreeman School of BusinessTulane University“If the majority of people were right, the majority of thepeople would be rich...and they’re not!” Following theherd has rarely produced superior long-term results.Tulane University’s Peter Ricchiuti will share hisinformative and entertaining perspective on financialmarkets, the importance of proper diversification, andthe cyclical nature of both stocks and investmentsectors.Wednesday, April 17Continental Breakfast — 7:00 to 8:00 a.m.Grand SalonGeneral Session — 8:00 to 8:45 a.m.Grand Ballroom C/DStrengthening the Brand and Business Model —Exponential Growth in Turbulent TimesJosé S. SuquetChairman of the Board,President and CEOPan-American <strong>Life</strong> <strong>Insurance</strong> GroupSince his arrival as President and CEO ofPan-American <strong>Life</strong> in November of 2004, José Suquethas redefined the <strong>com</strong>pany by establishing a newstrategic focus, going back to what it does best, lifeand health insurance. A new operating model wasimplemented, launching new products and services,adding new distribution channels, and entering intonew markets. This approach solidified the <strong>com</strong>pany’sfinancial strength and resulted in a rating upgrade in2010, at the height of the worst economic recessionsince the great depression. Learn how strengtheningyour <strong>com</strong>pany’s brand and business model can lead toexponential profitable growth, even in turbulent times.Refreshment Break and Exhibitor Raffle —8:45 to 9:15 a.m.Grand SalonConcurrent Sessions — 9:15 to 10:15 a.m.Salon B125.1 Unclaimed Property — The Pain GrowsInsurers continue to wrestle with the implications of stateaudits, retroactively changing the rules of the insurancebusiness as they relate to unclaimed benefits. The auditorspress for greater transfers of funds to the states and moreaffirmative — but onerous — outreach to potentialbeneficiaries. The aggressive enforcement approach ofstate officials continues to create questions for insurers,policyholders, beneficiaries and state officials. Legislativeinitiatives and lawsuits are generating new dynamics andtensions. Hear two nationally-respected attorneys, one fromeach coast of the United States, unravel the <strong>com</strong>plexity ofthe situation.Katherine Evans, Esq., Partner, SNR Denton;Michael Lovendusky, Vice President, AssociateGeneral Counsel, American Council of <strong>Life</strong> Insurers;Maeve O’Connor, Esq., Partner, Debevoise & Plimpton LLPGrand Ballroom C/D5.2 <strong>Life</strong> <strong>Insurance</strong> Product Update: Brave New WorldThe regulatory and economic environments continue tofactor in today’s life insurance market. Our panel of expertswill discuss life insurance product trends, today andtomorrow, including:• Term insurance, Universal <strong>Life</strong> with secondaryguarantees, and Indexed UL• Regulatory impacts on products such as AG38,valuation rate changes• Underwriting trends affecting life products• Top ten drivers of product design over the nextfive yearsParticipants will learn to identify key product offeringsand how the regulatory world, economic environment,and other factors are influencing the ever-changing lifeinsurance business.Donna Megregian, FSA, MAAA, Actuary, Milliman Inc.;Tim Pfeifer, FSA, MAAA, President, Pfeifer Advisory LLC6

Jazz Up Your <strong>Life</strong>Salon A65.3 E-Processing: From Application to IssueTechnology continues to challenge long-accepted insurancepractices while it can accelerate and condense the salesand issue process. In this session you will learn abouttechnology trends in life insurance sales, application andissue as well as policy delivery and social media. Newtechniques and processes will be discussed along with thepractical business challenges they present. Speakers alsowill address the rewards — and pitfalls — in crossing thedigital divide.Tom Benton, Principal, Novarica; Chad Hersh, Partner,Novarica; Robert McIsaac, FLMI, LLIF, Principal, NovaricaSalon C185.4 Reinsurance Challenges for Small-to-MediumSized CompaniesThis session will cover the topic of reinsurance for thenot-so-large insurance carriers. Do they have challenges inobtaining reinsurance capacity, and if so, how does thisget addressed by some <strong>com</strong>panies? What about nontraditionalforms of reinsurance, to help with managementof surplus and capital requirements? And finally, how dosmall-to-medium-sized <strong>com</strong>panies utilize reinsurance as apart of their risk management strategies? A panel ofreinsurance industry experts will address this in an openforum and dialog with the attendees.David Dorans, Senior Vice President, Value Added Services,SCOR Global <strong>Life</strong> Americas; Nathan E. Eshelman, FSA,MAAA, Actuary, RGA; Jean-Marc Fix, FSA, MAAA, VicePresident, Research & Development, Optimum Re <strong>Insurance</strong>Company; Michael L. Kaster, FSA, MAAA, Senior VicePresident, <strong>Life</strong> Solutions Group, Willis Re Inc.Break — 10:15 to 10:30 a.m.Grand SalonConcurrent Sessions — 10:30 to 11:30 a.m.Grand Ballroom C/D6.1 How to Sell More <strong>Life</strong> <strong>Insurance</strong>Over time, traditional insurance agents and advisors haveincorporated investment products into their practice,oftentimes at the expense of life insurance. What will drivetoday’s more investment-focused agents and advisors tosell more life insurance? Come to this session to hear theresults of the latest <strong>LIMRA</strong>-McKinsey study of experiencedfinancial advisors and learn the implications of this trend,and how organizations can provide the support today’sagents and advisors need in order to have a renewed focuson life insurance. Once the research groundwork is laid,learn what one <strong>com</strong>pany is doing to capture the attentionof advisors, and sell more life insurance in the process.Roy Freiman, CLU, ChFC, Vice President, <strong>Life</strong> Product Sales,Prudential; Patrick Leary, LLIF, Assistant Vice President,Distribution Research, <strong>LIMRA</strong>Salon A66.2 Predictive Modeling: Pitfalls and PossibilitiesWith an increasing emphasis on Simplified Issueproducts, more and more <strong>com</strong>panies are looking toalternative data sources to help improve speed andreduce costs. Learn how to avoid <strong>com</strong>mon pitfallsin implementing predictive models while betterunderstanding ways in which these models can drivereduced expenses, improved persistency, and fasterunderwriting decisions. Specific examples from arecent LexisNexis benchmarking study will highlightuses cases for underwriting classification andconservation/customer retention.Patrick Sugent, Vice President, Analytics, LexisNexis;Elliott Wallace, Vice President, <strong>Life</strong> <strong>Insurance</strong> Vertical,LexisNexisSalon B126.3 Professionalism in the Everyday <strong>Life</strong> ofAn ActuaryProfessionalism issues that may be encountered inthe everyday life of an actuary will be highlightedusing brief case studies. Members of the audiencewill be actively solicited for their <strong>com</strong>ments,observations and insights. Participants will also gainan awareness of the multitude of resources availableto the actuary as they navigate professionalism issues.Mike Boot, FSA, MAAA, Managing Director – Sectionsand Practice Advancement, Society of Actuaries;James Miles, FSA, MAAA, Consulting Staff Fellow,Society of Actuaries<strong>Conference</strong> Adjourns — 11:30 a.m.7

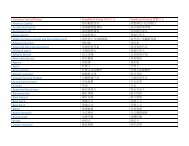

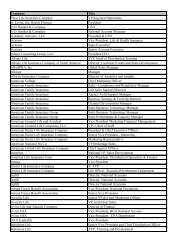

Monday4:00 to5:00 p.m.Tuesday10:30 to11:30 a.m.Tuesday1:00 to2:00 p.m.Tuesday2:15 to3:15 p.m.Wednesday9:15 to10:15 a.m.Wednesday10:30 to11:30 a.m.Distribution of Concurrent SessionsDistribution/ Actuarial/ AdministrationSession # Session Title Marketing Product and CustomerMarkets Dev. Underwriting Experience Reinsurance Regulatory Technology1.1 <strong>Life</strong> <strong>Insurance</strong> Service Times, NIGO and e-Applications:How Do You Measure Up? (Salon A6) u u1.2 The Importance of Cybersecurity: Helping BusinessOpportunities Unfold (Salon C18) u1.3 Reaching the Elusive Middle Market (Grand Ballroom C/D) u1.4 Actuarial Communication Is Not an Oxymoron (Salon B12) u2.1 The Challenge of Today's Low Interest Environment (Grand Ballroom C/D) u2.2 A Look at the Current Effects of the Dodd-Frank Act (Salon C18) u2.3 Call, Click, or Come In: Insights on Multi-Channel Distribution inthe <strong>Insurance</strong> Industry (Salon A6) u u2.4 Debunking the Myths of Automated Underwriting andOther E-ssential Activities (Salon B12) u u u3.1 Indexed Universal <strong>Life</strong>: What You Need to Know (Grand Ballroom C/D) u u3.2 Introduction to Reinsurance (Salon B12) u3.3 Actuarial Models: Friend or Foe? (Salon A6) u3.4 Connecting With the Hispanic Market (Salon C18) u4.1 Social Media is Mardi Gras Marketing (Salon A6) u u4.2 The Moment of Truth (Salon C18) u4.3 Predictive Analytics — Here to Stay or Passing Fad? (Salon B12) u u4.4 Jazzing Up the <strong>Life</strong> <strong>Insurance</strong> Product Developmentand Introduction Process (Grand Ballroom C/D) u u u5.1 Unclaimed Property — The Pain Grows (Salon B12) u u u5.2 <strong>Life</strong> <strong>Insurance</strong> Product Update: Brave New World (Grand Ballroom C/D) u5.3 E-Processing: From Application to Issue (Salon A6) u u5.4 Reinsurance Challenges for Small-to-Medium Sized Cos. (Salon C18) u u u6.1 How to Sell More <strong>Life</strong> <strong>Insurance</strong> (Grand Ballroom C/D) u6.2 Predictive Modeling: Pitfalls and Possibilities (Salon A6) u6.3 Professionalism in the Everyday <strong>Life</strong> of An Actuary (Salon B12) u8

General Session Speaker BiographiesCarolyn M. JohnsonExecutive Vice President, Chief Operating OfficerProtective <strong>Life</strong> CorporationPresidentWest Coast <strong>Life</strong> <strong>Insurance</strong> CompanyCarolyn Johnson is responsible for Protective and WestCoast <strong>Life</strong>’s life insurance and annuity sales, marketing,product development, underwriting, technology andoperational functions. She joined Protective <strong>Life</strong> inAugust 2004, and has been in the industry over 25 years.Johnson serves as a board member of LL Global; and is amember of <strong>LIMRA</strong>’s Strategic Marketing InitiativesCommittee and ACLI’s <strong>Life</strong> <strong>Insurance</strong> Committee.Eric R. JohnsonExecutive Vice President and Chief Investment OfficerCNO Financial GroupEric Johnson is the Executive Vice President and ChiefInvestment Officer of the CNO Financial Group. He isalso the President of 40|86 Advisors, a CNO subsidiary.He has more than 20 years of financial services andinvestment experience, beginning with a predecessorbank of the current J.P. Morgan and Co. Johnson holds aB.A. in American history from Harvard University,where he graduated cum laude. He is a board member ofWFYI, INC. and The Julian Center.Peter F. RicchiutiFounder and Director of ResearchBURKENROAD REPORTSFreeman School of BusinessTulane UniversityPeter Ricchiuti teaches courses on the financialmarkets at Tulane University’s Freeman School ofBusiness. His insight and humor have twice madehim the school’s top professor. He started his careerwith the investment firm of Kidder Peabody andlater managed over three billion dollars as theassistant treasurer for the state of Louisiana.In 1993, he founded Tulane’s highly acclaimedBURKENROAD REPORTS stock research program.Ricchiuti has been featured on CNN and CNBC aswell as in The New York Times, BARRON’S, TheWashington Post and The Wall Street Journal.José S. SuquetChairman of the Board, President and CEOPan-American <strong>Life</strong> <strong>Insurance</strong> GroupJosé Suquet is chairman of the board, presidentand CEO of Pan-American <strong>Life</strong> <strong>Insurance</strong> Group,a leading provider of insurance throughout theAmericas. Previously, he held senior managementposts in the insurance industry for more than threedecades, including serving as Senior Executive VicePresident and Chief Distribution Officer of AXAFinancial. Suquet presently serves as member of theboard of directors of the Federal Reserve Bank ofAtlanta and Ochsner Health Systems.9

10Thank You to Our <strong>Conference</strong> Sponsors and Exhibitors

Antitrust Policy and CautionEach person attending this function must be mindful of the constraints imposed by federal and state antitrust laws.The people here today represent <strong>com</strong>panies that are in direct business <strong>com</strong>petition with one another. The conference partners’purpose is to provide a forum for the free exchange of ideas on the designated topics of our meetings. It is not the purposeof these meetings to reach any agreement that could have anti<strong>com</strong>petitive effects.Individuals must keep in mind that a violation of the antitrust laws may subject them to substantial fines and a jail term.You can avoid problems by following simple guidelines:1. Stick to the published agenda. Informal or “rump” sessions should not be held.2. Be cautious about discussions involving pricing, premiums, benefits to be offered or terminated, and who should orshould not be covered. The Justice Department views these types of discussions with concern and suspicion. Nevertake a poll of people’s positions or make a collective agreement on these issues.3. Always retain your right to make an independent judgment on behalf of your <strong>com</strong>pany.The conference partners are dedicated to the purpose of assisting all of its members to achieve their <strong>com</strong>petitive potential.No smoking during any function.Continuing Education InformationFor information on SOA CPD Credit and Continuing Education Credit — U.S. Qualification Standards please visit the<strong>Life</strong> <strong>Insurance</strong> <strong>Conference</strong> pages at the SOA website: www.soa.org.The conference partners, in conjunction with the Society of Financial Service Professionals, are pleased to inform you thatattendance at any of the sessions will qualify interested individuals for PACE credits.First FloorHilton New Orleans Riverside11

2014 <strong>Life</strong> <strong>Insurance</strong> <strong>Conference</strong>April 7–9, 2014Chicago Marriott Downtown Magnificent Mile, Chicago, ILNew This Year!View the agenda in an interactive format on any type of tablet device or smartphone.Get the app at http://eventmobi.<strong>com</strong>/life or scan this QR code:005935-0313 (562-60-0-MQ2)