<strong>IRS</strong> <strong>Form</strong> 8949<strong>IRS</strong> <strong>Form</strong> 8949 is used to report your trading activity. Enter your trading information exactly as it appears onAccount 10029775your <strong>IRS</strong> <strong>Form</strong> <strong>1099</strong>-B. Proceeds from Broker and Barter Exchange Transactions<strong>USAA</strong> FEDERAL SAVINGS BANK<strong>USAA</strong> INVESTMENT MANAGEMENT CO2013 <strong>1099</strong>-B*(continued)1c - LONG-TERM TRANSACTIONS 6 - COVERED tax lot for which cost basis is reported to the <strong>IRS</strong>**Report on <strong>Form</strong> 8949, Part II, with Box D checked8 - Description / CUSIP / 1d - Symbol1a - Date of Sale2a - Proceeds of # 1b - Date of3 - Cost oror exchange1e - Quantity stocks, bonds, etc. acquisitionother basisINTEL CORPORATION / CUSIP: 458140100 / Symbol: INTC (cont'd)These columns are not reported to the <strong>IRS</strong>5 - Wash saleloss disallowed Gain or loss(-) Additional information4 tax lots for 03/06/13. Total proceeds (and cost when required) reported to the <strong>IRS</strong>.0.828 17.98 02/09/12 22.37 0.00 -4.39 Sale20.172 437.20 02/09/12 545.03 0.00 -107.83 Sale25.000 541.83 02/22/12 671.45 0.00 -129.62 Sale1.647 35.70 03/01/13 44.14 0.00 -8.44 Sale03/06/13 47.647 1,032.71 VARIOUS 1,282.99 0.00 -250.28 Total of 4 lotsSecurity total: 1,555.19 1,948.94 9.45 -384.30OMB No. 1545-0715Page 14 of 62MAGNUM HUNTER RESOURCES CORP / CUSIP: 55973B102 / Symbol: MHR09/05/13 200.000 1,049.62 06/01/12 757.93 0.00 291.69 Sale2 tax lots for 09/06/13. Total proceeds (and cost when required) reported to the <strong>IRS</strong>.100.000 541.54 05/10/12 495.77 0.00 45.77 OMB Sale No. 1545-0074100.000 547.19 05/10/12 495.78 0.00 51.41 SaleName(s) <strong>Form</strong> 8949shown on return. (Name andSalesSSN or taxpayerandidentificationOtherno. not requiredDispositionsif shown on other side.)of Social Capital security number Assets or taxpayer identification number09/06/13 200.000 1,088.73 VARIOUS 991.55 0.00 97.18 Total of 2 lots▶ Information about <strong>Form</strong> 8949 and its separate instructions is at www.irs.gov/form8949. 2013Department of the Treasury3 tax lots ▶ for 09/27/13. Total proceeds (and cost when required) reported to the <strong>IRS</strong>.AttachmentMost Internal brokers Revenue issue Service their own 100.000 substituteFile withstatementyour Schedule619.03 insteadD tooflistusingyour04/02/12 <strong>Form</strong>transactions<strong>1099</strong>-B.forTheylinesalso1b,665.75 may2, 3, 8b,provide9, andbasis10 of0.00information Schedule D.(usually -46.72 your Sequence Sale cost) No. to you 12A onthe Name(s) statement shown even on return if it is not 100.000 reported to the <strong>IRS</strong>. Before 613.23 you check 04/03/12 Box D, E, or F below, determine 662.75 Social security whether number 0.00 you received or taxpayer any -49.52 identification statement(s) Sale number and, if so,the transactions for which basis100.000was reported to the594.03<strong>IRS</strong>. Brokers04/04/12are required to report basis632.75to the <strong>IRS</strong> for0.00most stock you bought-38.72inSale2011 or later.09/27/13 300.000 1,826.29 VARIOUS 1,961.25 0.00 -134.96 Total of 3 lotsMost Part 10/03/13 brokers II Long-Term. issue their own 100.000 substitute Transactions statement involving 671.23 instead of capital using 03/06/12 <strong>Form</strong> assets <strong>1099</strong>-B. you They held also more 623.95 may than provide one basis 0.00 year information are long (usually term. 47.28 your Sale For cost) short-term to you on<strong>Form</strong> 8949 (2013) Attachment Sequence No. 12A Page 2the statement transactions, even if it 3 is tax not lots reported see for 10/04/13. page to Total the 1. <strong>IRS</strong>. proceeds Before (and you cost when check required) Box A, reported B, or to C the below, <strong>IRS</strong>. determine whether you received any statement(s) and, if so,the transactions 15.000 99.04 03/02/12 101.54 0.00 -2.50 SaleNote. for which You basis may was aggregate reported to all the long-term <strong>IRS</strong>. Brokers transactions are required to reported basis on to <strong>Form</strong>(s) the <strong>IRS</strong> for <strong>1099</strong>-B most stock showing you bought basis in 2011 was or reported later.35.000 244.99 03/02/12 236.91 8.08 SalePart I to Short-Term. the <strong>IRS</strong> and 50.000 Transactions for which no involving adjustments 349.99 capital 03/02/12 or codes assets are you required. held one 348.95 Enter year the or less total 0.00are directly short on term. 1.04 Schedule For Salelong-termD, line 8a;10/04/13 you are not 100.000 required to report 694.02 these transactions VARIOUS on <strong>Form</strong> 8949 687.40 (see instructions). 0.00 6.62 Total of 3 lotstransactions, see page 2.You must check Note. Box You 3 tax D, lots may E, for 10/16/13. aggregate F below. Total proceeds Check all short-term (and only cost one when transactions box. required) If more reported than to reported the one <strong>IRS</strong>. box on applies <strong>Form</strong>(s) for <strong>1099</strong>-B your long-term showing transactions, basis was completea separate <strong>Form</strong> 8949, page50.0002, for each applicable366.61box. If02/29/12you have more long-term355.95transactions 0.00than will fit on10.66this pageSalereported to the <strong>IRS</strong> and for which no adjustments codes are required. Enter the total directly on for one or50.000 366.62 02/29/12 352.45 0.00 14.17 Salemore of the boxes, Schedule complete D, 100.000 line as 1a; many you forms are not 744.03with required the same02/29/12 to box report checked these as transactions you723.94need. on <strong>Form</strong> 0.00 8949 (see 20.09 instructions).Sale10/16/13(D) Long-term transactions200.000reported on1,477.26<strong>Form</strong>(s) <strong>1099</strong>-BVARIOUSshowing basis was1,432.34reported to the0.00<strong>IRS</strong> (see Note44.92above)Total of 3 lotsYou must check Box A, B, or C below. Check only one box. If more than one box applies for your short-term transactions,complete10/21/13 100.000 798.53 02/28/12 760.75 0.00 37.78 Sale(E) Long-term a separate transactions <strong>Form</strong> 8949, page reported 1, for on each <strong>Form</strong>(s) applicable <strong>1099</strong>-B box. showing If you basis have was more not short-term reported transactions to the <strong>IRS</strong> than will fit on this pageSecurity total: 7,605.68 7,215.17 0.00 390.51for one (F) or Long-term more of the transactions boxes, complete not reported as many to forms you on with <strong>Form</strong> the <strong>1099</strong>-B same box checked as you need.(A) Short-term transactions reported on <strong>Form</strong>(s) <strong>1099</strong>-B showing basis was reported to the <strong>IRS</strong> (see Note above)Adjustment, if any, to gain or loss.* This is important tax information and is being furnished to the Internal Revenue Service. If you are required to file a return, a negligence penalty or other sanction may be imposed on youif this 1income is taxable and the <strong>IRS</strong> determines that it has not been reported. Remember, taxpayers are ultimately (e) responsible If for you the enter accuracy an amount of their in column tax return(s). (g),(B) Short-term transactions reported on <strong>Form</strong>(s) <strong>1099</strong>-B showing basis was not reported**For NONCOVERED tax lots, values for "Date of acquisition," "Cost or other (c) basis" and "Wash sale (d) loss disallowed" Cost are or other provided basis. for your reference enter to the a code <strong>IRS</strong>(h)and are in column NOT reported (f). to the Gain <strong>IRS</strong>. or (loss).# Less commissions.(C) Short-term (a) transactions not reported (b) to Date you sold on or <strong>Form</strong> Proceeds <strong>1099</strong>-B See the Note below See the separate instructions. Subtract column (e)Description of property Date acquireddisposed (sales price) and see Column (e)from column (d) and(Example: 100 sh. XYZ Co.) (Mo., day, yr.)Adjustment,(Mo., day, yr.) (see instructions) in the separate (f)if any, to gain or loss.1(g) combine the result(e)instructions Code(s)If you enterfroman amount in column (g), (h)Amount of with column (g)(c)(d) Cost or other basis. enter a code in column (f).(a)(b)instructions adjustmentGain or (loss).Date sold or Proceeds See the Note below See the separate instructions. Subtract column (e)Description of property Date acquireddisposed (sales price) and see Column (e)from column (d) and(Example: 100 sh. XYZ Co.) (Mo., day, yr.)(Mo., day, yr.) (see instructions) in the separatecombine the resultinstructionswith column (g)(f)Code(s) frominstructions(g)Amount ofadjustmentEven though your <strong>IRS</strong> <strong>Form</strong> <strong>1099</strong>-B has a gain or loss figure, do not enter a gain or loss figure on <strong>IRS</strong> <strong>Form</strong> 8949.This will be determined when recapped on Schedule D. The final column on <strong>IRS</strong> <strong>Form</strong> 8949 is reserved for anyadjustments to your cost basis, such as a disallowed loss due to a wash sale transaction.6

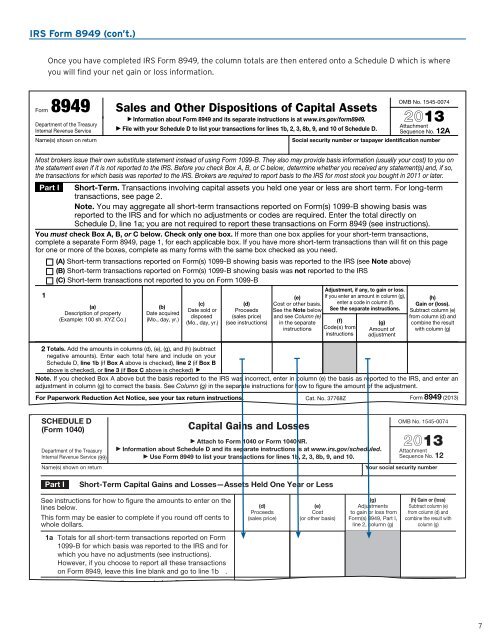

1(A) Short-term transactions reported on <strong>Form</strong>(s) <strong>1099</strong>-B showing basis was reported to the <strong>IRS</strong> (see Note above)(B) Short-term transactions reported on <strong>Form</strong>(s) <strong>1099</strong>-B showing basis was not reported to the <strong>IRS</strong>(C) Short-term transactions not reported to you on <strong>Form</strong> <strong>1099</strong>-BAdjustment, if any, to gain or loss.(e) If you enter an amount in column (g), (h)(c)(d) Cost or other basis. enter a code in column (f). Gain or (loss).(a)(b)Date sold or Proceeds See the Note below See the separate instructions. Subtract column (e)Description of property Date acquireddisposed (sales price) and see Column (e)from column (d) and(Example: 100 sh. XYZ Co.) (Mo., day, yr.)(Mo., day, yr.) (see instructions) in the separate (f)(g) combine the resultinstructions Code(s) fromOnce you have completed <strong>IRS</strong> <strong>Form</strong> 8949, the column totals are then entered onto a Schedule Amount D of which with is column where (g)instructions adjustment<strong>IRS</strong> <strong>Form</strong> 8949 (con’t.)you will find your net gain or loss information.<strong>Form</strong> 8949Department of the TreasuryInternal Revenue ServiceName(s) shown on returnSales and Other Dispositions of Capital Assets▶ Information about <strong>Form</strong> 8949 and its separate instructions is at www.irs.gov/form8949.▶ File with your Schedule D to list your transactions for lines 1b, 2, 3, 8b, 9, and 10 of Schedule D.OMB No. 1545-00742013AttachmentSequence No. 12ASocial security number or taxpayer identification numberMost brokers issue their own substitute statement instead of using <strong>Form</strong> <strong>1099</strong>-B. They also may provide basis information (usually your cost) to you onthe statement even if it is not reported to the <strong>IRS</strong>. Before you check Box A, B, or C below, determine whether you received any statement(s) and, if so,the transactions for which basis was reported to the <strong>IRS</strong>. Brokers are required to report basis to the <strong>IRS</strong> for most stock you bought in 2011 or later.Part I Short-Term. Transactions involving capital assets you held one year or less are short term. For long-termtransactions, see page 2.Note. You may aggregate all short-term transactions reported on <strong>Form</strong>(s) <strong>1099</strong>-B showing basis wasreported to the <strong>IRS</strong> and for which no adjustments or codes are required. Enter the total directly onSchedule D, line 1a; you are not required to report these transactions on <strong>Form</strong> 8949 (see instructions).You must check Box A, B, or C below. Check only one box. If more than one box applies for your short-term transactions,complete a separate <strong>Form</strong> 8949, page 1, for each applicable box. If you have more short-term transactions than will fit on this pagefor one or more of the boxes, complete as many forms with the same box checked as you need.(A) Short-term transactions reported on <strong>Form</strong>(s) <strong>1099</strong>-B showing basis was reported to the <strong>IRS</strong> (see Note above)(B) Short-term transactions reported on <strong>Form</strong>(s) <strong>1099</strong>-B showing basis was not reported to the <strong>IRS</strong>(C) Short-term transactions not reported to you on <strong>Form</strong> <strong>1099</strong>-B1(a)Description of property(Example: 100 sh. XYZ Co.)(b)Date acquired(Mo., day, yr.)(c)Date sold ordisposed(Mo., day, yr.)(d)Proceeds(sales price)(see instructions)(e)Cost or other basis.See the Note belowand see Column (e)in the separateinstructionsAdjustment, if any, to gain or loss.If you enter an amount in column (g),enter a code in column (f).See the separate instructions.(f)Code(s) frominstructions(g)Amount ofadjustment(h)Gain or (loss).Subtract column (e)from column (d) andcombine the resultwith column (g)2 Totals. Add the amounts in columns (d), (e), (g), and (h) (subtractnegative amounts). Enter each total here and include on yourSchedule D, line 1b (if Box A above is checked), line 2 (if Box Babove is checked), or line 3 (if Box C above is checked) ▶Note. If you checked Box A above but the basis reported to the <strong>IRS</strong> was incorrect, enter in column (e) the basis as reported to the <strong>IRS</strong>, and enter anadjustment in column (g) to correct the basis. See Column (g) in the separate instructions for how to figure the amount of the adjustment.For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 37768Z <strong>Form</strong> 8949 (2013)SCHEDULE D(<strong>Form</strong> SCHEDULE 1040) D(<strong>Form</strong> 1040)Department of the TreasuryInternal Department Revenue of the Service Treasury (99)Internal Revenue Service (99)Name(s) shown on returnName(s) shown on returnCapital Gains and LossesCapital Gains and LossesOMB No. 1545-0074OMB No. 1545-00742013 2013 Attach to <strong>Form</strong> 1040 or <strong>Form</strong> 1040NR. Information about Schedule Attach D and to its <strong>Form</strong> separate 1040 or instructions <strong>Form</strong> 1040NR. is at www.irs.gov/scheduled. Attachment Information Use about <strong>Form</strong> Schedule 8949 to list D and your its transactions separate instructions for lines 1b, is 2, at 3, www.irs.gov/scheduled.8b, 9, and 10.Sequence Attachment No. 12 Use <strong>Form</strong> 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10.Sequence No. 12<strong>Your</strong> social security number<strong>Your</strong> social security numberPart I Short-Term Capital Gains and Losses—Assets Held One Year or LessPart I Short-Term Capital Gains and Losses—Assets Held One Year or LessSee instructions for how to figure the amounts to enter on thelines See instructions below. for how to figure the amounts to enter on the(d)(e)lines below.Proceeds (d)Cost (e)This form may be easier to complete if you round off cents to (sales Proceeds price) (or other Cost basis)whole This form dollars. may be easier to complete if you round off cents to (sales price) (or other basis)whole dollars.1a Totals for all short-term transactions reported on <strong>Form</strong>1a <strong>1099</strong>-B Totals for for all which short-term basis was transactions reported reported to the <strong>IRS</strong> on and <strong>Form</strong> forwhich <strong>1099</strong>-B you for have which no basis adjustments was reported (see instructions).to the <strong>IRS</strong> and forHowever, which you if have you choose no adjustments to report (see all these instructions). transactionson However, <strong>Form</strong> 8949, if you leave choose this to line report blank all and these go transactionsto line 1b .on <strong>Form</strong> 8949, leave this line blank and go to line 1b .1b Totals for all transactions reported on <strong>Form</strong>(s) 8949 with1b Box Totals A for checked all transactions . . . reported . . . on . <strong>Form</strong>(s) . . . 8949 . . with .Box A checked . . . . . . . . . . . . .2 Totals for all transactions reported on <strong>Form</strong>(s) 8949 with2 Box Totals B for checked all transactions . . . reported . . . on . <strong>Form</strong>(s) . . . 8949 . . with .2 Totals. Box3 Totals Add Bfor the checkedall amounts transactions in . columns . . .reported (d),.(e),.(g),. on and .<strong>Form</strong>(s) (h) . (subtract . . . .8949 withnegative 3 amounts). Enter each total here and include on yourBox Totals C for checked all transactions . . . reported . . . on . <strong>Form</strong>(s) . . . 8949 . . with .Schedule D, line 1b (if Box A above is checked), line 2 (if Box BBox C checked . . . . . . . . . . . . .above is checked), or line 3 (if Box C above is checked) ▶(g)Adjustments (g)to gain Adjustments or loss from<strong>Form</strong>(s) to gain 8949, or loss Part from I,<strong>Form</strong>(s) line 2, column 8949, Part (g) I,line 2, column (g)(h) Gain or (loss)Subtract (h) Gain column or (loss) (e)from Subtract column column (d) and (e)combine from column the result (d) and withcombine column the result (g) withcolumn (g)7