Models & Technicals - Wholesale Banking - Home

Models & Technicals - Wholesale Banking - Home

Models & Technicals - Wholesale Banking - Home

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

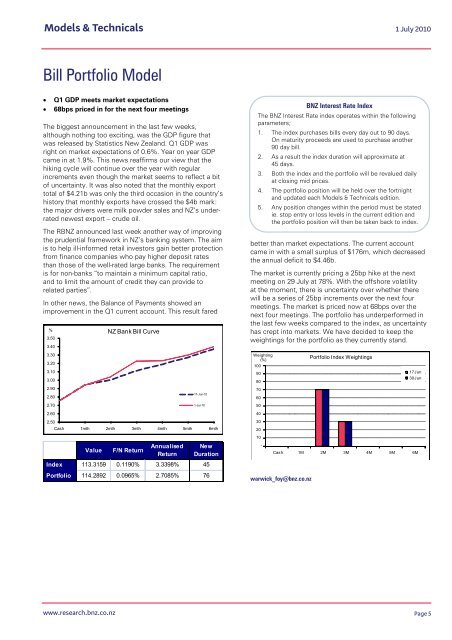

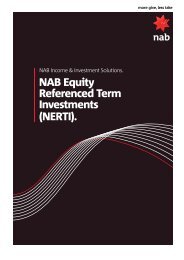

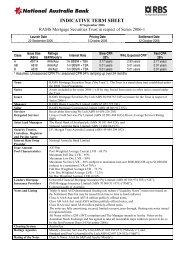

<strong>Models</strong> & <strong>Technicals</strong>1 July 2010Bill Portfolio ModelQ1 GDP meets market expectations68bps priced in for the next four meetingsThe biggest announcement in the last few weeks,although nothing too exciting, was the GDP figure thatwas released by Statistics New Zealand. Q1 GDP wasright on market expectations of 0.6%. Year on year GDPcame in at 1.9%. This news reaffirms our view that thehiking cycle will continue over the year with regularincrements even though the market seems to reflect a bitof uncertainty. It was also noted that the monthly exporttotal of $4.21b was only the third occasion in the country’shistory that monthly exports have crossed the $4b mark:the major drivers were milk powder sales and NZ’s underratednewest export – crude oil.The RBNZ announced last week another way of improvingthe prudential framework in NZ’s banking system. The aimis to help ill-informed retail investors gain better protectionfrom finance companies who pay higher deposit ratesthan those of the well-rated large banks. The requirementis for non-banks “to maintain a minimum capital ratio,and to limit the amount of credit they can provide torelated parties”.In other news, the Balance of Payments showed animprovement in the Q1 current account. This result fared%3.503.403.303.203.103.002.902.802.702.602.50NZ Bank Bill Curve17-Jun-101-Jul-10Cash 1mth 2mth 3mth 4mth 5mth 6mthValueF/N ReturnAnnualisedReturnNewDurationIndex 113.3159 0.1190% 3.3398% 45Portfolio 114.2892 0.0965% 2.7085% 76better than market expectations. The current accountcame in with a small surplus of $176m, which decreasedthe annual deficit to $4.46b.The market is currently pricing a 25bp hike at the nextmeeting on 29 July at 78%. With the offshore volatilityat the moment, there is uncertainty over whether therewill be a series of 25bp increments over the next fourmeetings. The market is priced now at 68bps over thenext four meetings. The portfolio has underperformed inthe last few weeks compared to the index, as uncertaintyhas crept into markets. We have decided to keep theweightings for the portfolio as they currently stand.Weighting(%)100908070605040302010-Portfolio Index Weightings17Jun30JunCash 1M 2M 3M 4M 5M 6Mwarwick_foy@bnz.co.nzBNZ Interest Rate IndexThe BNZ Interest Rate index operates within the followingparameters;1. The index purchases bills every day out to 90 days.On maturity proceeds are used to purchase another90 day bill.2. As a result the index duration will approximate at45 days.3. Both the index and the portfolio will be revalued dailyat closing mid prices.4. The portfolio position will be held over the fortnightand updated each <strong>Models</strong> & <strong>Technicals</strong> edition.5. Any position changes within the period must be statedie. stop entry or loss levels in the current edition andthe portfolio position will then be taken back to index.www.research.bnz.co.nzPage 5