Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

custom clearing services<strong>Technology</strong>The Custom Clearing Services Advantagemember Finra/siPc

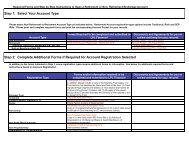

The BranchNet ResourceCenter offers 24/7accessibility to financialadvisors and their staff.BranchNet Resource CenterLocated within BranchNet, the BranchNet Resource Centercontains important department-specific information, as well as<strong>LPL</strong> <strong>Financial</strong> exclusive research that makes it easier to run abusiness and guide clients in making sound financial decisions.The BranchNet Resource Center offers 24/7 accessibilityto financial advisors and their staff so they can grow theirbusinesses and minimize their workloads simultaneously.BranchNet Resource Center provides financial advisorswith direct access to:• Valuable market research• Up-to-date broker/dealer news• Investment product information• Extensive <strong>LPL</strong> <strong>Financial</strong> Research commentaries• Extensive third-party research and market dataTools and Support• Valuable marketing tools• Client-approved sales and prospecting presentations• Comprehensive training materials• <strong>Technology</strong> support forms for brokerage, advisory, and directbusiness accounts• Numerous client presentations and communication resources• Forms for brokerage, advisory, and direct business accounts

Portfolio Review ToolThe Portfolio Review Tool (PRT) is a powerful web-based toolthat allows financial advisors to provide an immediate assetallocation overview of existing or prospective client portfolios.The overview relates directly to clients’ specific positions andinvestment objectives.PRT can help financial advisors compare the current holdingsof a portfolio to an asset allocation model. Overweightsand underweights, as well as sector breakdowns, will helpfinancial advisors and their clients make important decisions inrebalancing and facilitating trade recommendations. Lastly, thereis the ability to present hypothetical portfolios demonstrating thebenefit added as a valued financial advisor.This tool offers a quick and easy method for organizing clientaccount information. PRT is designed for financial advisors toquickly and easily organize their clients’ account information,where accounts may be qualified or non-qualified and includestocks, bonds, mutual funds, CDs, and variable annuities.Key features and benefits of PRT include:• 24/7 monitoring of client portfolios• Complete portfolio review of household assets held at andoutside of <strong>LPL</strong> <strong>Financial</strong>• Problems with a portfolio’s current structure are easily andclearly illustrated for use with existing or prospective clients• Load accounts quickly—then view, print or email to clientsand prospects• Store client portfolios for updated future reviews• Create custom models• Generate a list of trades based on the proposed assetallocationThe Portfolio Review Tooloffers a quick and easymethod for organizing clientinformation.

automaticallyillustrates allportfolioassets

Portfolio ManagerPortfolio Manager provides an extensive resource to financialadvisors to manage client and household portfolios. The financialadvisor simply groups the accounts and Portfolio Managerautomatically illustrates all portfolio assets. Even non-<strong>LPL</strong><strong>Financial</strong> held assets may be manually loaded.Whether financial advisors are assessing the asset allocationof the portfolio compared to its stated investment objective, orillustrating the performance of a portfolio, Portfolio Managermakes it possible with just a click of a mouse.With these advanced features, financial advisors enjoyaccess to:• Performance reporting on brokerage and advisory accounts• z Any date to any date• z At the household, group, account, asset class, securitytype and position levels• z Benchmark performance comparisons• Aggregate account management and reporting• z Householding of accounts• z Automatic grouping of accounts by client• Manual addition of non-<strong>LPL</strong> <strong>Financial</strong> assets and theirtransaction histories• z Automatic market value updates for tracked securities• Customizable asset classes• Numerous client-approved reports• Aggregate position views and reporting• Batch reporting capabilities• z Customize report parameters and/or client groups toquickly generate meaningful reports for client reviews• z Share customized report batches across multipleBranchNet users to streamline office operations• z Quickly generate updated reports (as of the previous daymarket close) for any report group created within the last13 monthsStreamlined accountmanagement and enhancedpresentation capabilities aremore important than everthese days. The <strong>LPL</strong> <strong>Financial</strong>Portfolio Manager tool willempower financial advisors toquickly answer their clients’questions of “How am I doing”versus “What am I worth?”

www.lpl.com<strong>LPL</strong> <strong>Financial</strong> – A registered Investment AdvisorMember FINRA/SIPC