<strong>Ernst</strong> & <strong>Young</strong>’s New Study onEU Energy Market Restructuring<strong>Ernst</strong> and <strong>Young</strong> is about to release a new report on the impact of unbundling on European utilities. It examines the implications for differentmarkets and the strategic options which companies now face. Below is a summary of the report’s contents and conclusions. For a copy of thefull report please get in touch with Helmut Edelmann on helmut.edelmann@de.ey.com or call your usual <strong>Ernst</strong> & <strong>Young</strong> contact.Unbundling Study 2007: <strong>Executive</strong> <strong>Summary</strong>IntroductionEuropean countries may acknowledge the value of cooperation,but they tend to resist conformity. The utilities sector is a perfectexample of this tension: there’s a massive diversity from country tocountry in terms of openness, competition, regulation, and ownershipacross the industry. The challenge on the European Union’s (EU)hands is creating a level playing field for competition in the faceof such diversity. If they cannot find a way to do this, the stated aimof the European Commission (EC) “…to open up Europe’s gasand electricity markets to competition and to create a singleEuropean energy market,” 1 could very well be in jeopardy.There are clearly two camps with clearly opposing views, one oneither side of the EU’s new proposals to deliver a single Europeanenergy market. Those in favor – which tend to be the countries aroundthe edge of Europe – have largely fulfilled ownership unbundling andmany, with the exception of the UK, have an industry which is stilldriven by state-owned utilities.The other camp – the ‘opponents’ if you like – encompassesthe countries in the middle of the European continent, where themarkets tend to be dominated by vertically integrated transmissioncompanies, in many cases privately-owned. The countries in favor –and their utilities – are likely to be seen as the winners at the endof this process.Depending on who you talk to, the proposed unbundling reformsmay or may not solve the problems of conflict of interest.Opinion among EU Member States remains divided, with Franceand Germany strongly resistant, whilst Spain, Sweden, and theUK are in favor. What is clear is that unbundling would certainlyhave serious consequences for the ownership, structure, andmanagement of the present vertically integrated utilities (VIUs),and for the utilities sector as a whole.1Sector Inquiry 10 January 20072W ILL OWNERSHIP U NBUNDLING D ELIVER?

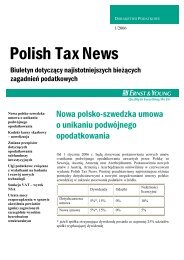

Impacts on CompaniesSo what has been the impact of the EC’s various competitionenhancing mechanisms on utilities management so far? Whereliberalization has been fully implemented, it has often been followedby reconsolidation as the remaining large vertically integratedindustries purchase the smaller companies in the liberalized markets.There has also been a tendency for gas and electricity companiesto merge or to be acquired. This has resulted in a complex structureto the industry in Europe with a disparate population of companiesof different sizes, functions, and geographical scope (as shown in thefigure below).REGULATEDNON-REGULATEDRegulatedwires/pipes(regulatedtransmission &distribution withsome non-regulatedactivities)Regulatedintegrated(regulated generation,wires & supply withsome non-regulatedactivities)Integratedtransmission &distribution(generation & supplynon-regulated)Integrateddistribution(generation& supplynon-regulated)Non-regulatedbusinessIntegrated electricityand gas playersNational Grid EnBW, E.ON, RWE Iberdrola, Essent,NuonCentricaElectricity players Red Electrica, Terna EDP, PPC, UESR EDF, Verbund,VattenfallEndesa, Enel, CEZ,FortumAtel, Suez 2 , StatkraftGas players SNAM Rete Gas GDF ENIThe EC’s proposed third round of legislation will affect all theseorganizations differently. Specialist grid companies such asNational Grid (NG) in the UK are likely to be interested in acquiringtransmission assets or possibly in Independent System Operator(ISO) management contracts. The nature of the market for thecompetitive businesses will also change; ownership unbundlingwould bring non-discriminatory access to the grid for competinggeneration companies, with the result that sales, margins,and service standards will be challenged by new entrants.For VIUs involved in the transmission business, ownershipunbundling presents three critical decisions:1) Should they dispose of the network?2) If so, how should this be done?3) When is the right time to do it?2Only very little gas activities in BelgiumEssentially, there are two unbundling options: either create two ormore separate companies by splitting the shares, or dispose of thetransmission asset to a third party. In the case of disposal, there willbe a choice over how much cash to retain in the company, and howmuch to distribute to shareholders. The generating supply remainderof the VIU can use this cash for new investment. Management islikely to prefer this option.The next choice is how quickly to dispose of the network. There aredifferent forces that might cause management to accelerate or delaydisposal. Early disposal gives the company ‘first mover’ advantagesin the acquisition of new assets elsewhere. It is also likely that gridswill depreciate as more become available and as their strategic valuedisappears, so early disposal may be advisable. There are also somedisadvantages, but in the case of obligatory ownership unbundlingthese disadvantages will materialize in any case. The advantagesof early disposal may therefore prevail.3W ILL OWNERSHIP U NBUNDLING D ELIVER?