Manmohan Singh deserves our heartiest congratulations ... - cuts ccier

Manmohan Singh deserves our heartiest congratulations ... - cuts ccier

Manmohan Singh deserves our heartiest congratulations ... - cuts ccier

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

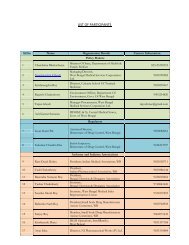

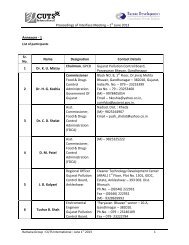

PolicyWatchCovering developmentson policy responses,policy implementationand policy distortionson a quarterly basis.Comments are welcome.Volume 10, No. 2 April-June, 2009I N S I D E T H I S I S S U ENumber Portability ................3Pre-budget Consultations ....9EAC Lowers GrowthProjection ........................... 10Energy Shortage ................ 13Falling Standards in the‘August Houses’ ................ 14Tough Balancing Act .......... 19E-redressal........................ 22H I G H L I G H TSIn Raja’s Raj– Payal Malik .............................. 8Bigger does not mean Better– Kaushik Das ........................... 16Getting the Right People– Jamini Bhagwati .................... 17Editor’s ChoiceWhatever form they are in,No Mercy for Cartels– Augustine Peter ..................... 21“The reformer has enemies in all those whoprofit by the old order and only lukewarmdefenders in all those who would profit bythe new.” Machiavelli in The PrinceWe Can and We Should Do<strong>Manmohan</strong> <strong>Singh</strong> <strong>deserves</strong> <strong>our</strong> <strong>heartiest</strong> <strong>congratulations</strong> on being electedfor a second term, a rare performance. It is thus time for him to introspectand travel down the memory lane. On December 25, 2004 he wrote in this newspaper:“I do hope that in the New Year (2005) we can all work together to build a moreequitable, competitive and humane India…This is a doable agenda provided wecan set aside <strong>our</strong> ‘make-do’ attitude and adopt a ‘can do’ spirit”. We hope that<strong>Singh</strong>’s second term can becomea Can-Do and Shall-Do period,and not just for one year.During the last f<strong>our</strong> years,many hurdles came his way,including the global economicdownturn. With a more stablecoalition, progress for thecountry along the path ofinclusive growth will need morethan stimulus packages andsome ‘out of the box’ andManjul Cartoonsdetermined thinking, like thenuclear deal. Many ideas cannot be postponed or vital issues left hanging on acliff. This will need clear signalling and include harvesting low-hanging fruitswithin the next 100 days.As Dr <strong>Singh</strong> and many others have said, we need to boost investment in theinfra sector as a counter-cyclical measure. The malaise in the infra area in therecent past was aided by poor governance and pork barrel politics in spite of Dr<strong>Singh</strong> assuming command of the situation. Alas, the process became a stumblingblock, rather than a catalyst. This needs to be revisited.The recommendations for reform in infrastructure governance arising from thesplendid work done by think tanks like the Planning Commission and NGOs haveto make the j<strong>our</strong>ney from paper to the realm of implementation. For example, thePlanning Commission’s draft paper on ‘Approach to Regulation of Infrastructure’and the draft Regulatory Reform Bill, a law for designing a uniform architecture forregulatory authorities.In 2004, the government had also promised that “competition, both domesticand external, will be deepened across industry with professionally-run regulatoryinstitutions in place to ensure that competition is free and fair”. Not many willagree that this goal has been achieved, though some very small steps forwardhave been taken. One of them is the adoption of a National Competition Policy, asrecommended in the Planning Commission’s policy document: ‘Inclusive growth’,which highlights the role of private sector investment in bridging <strong>our</strong> infrastructuredeficit.However, business regulatory framework is itself an entry barrier to newentrants. The World Bank has assigned India a rank of 122 among 181 nations interms of the ‘ease of doing business’ in 2009. However, the government needs toput legal reforms on the fast track and engage the judiciary actively. In sum, thereare many things that Dr <strong>Singh</strong> can do and should do.Published by Consumer Unity & Trust Society (CUTS), D-217, Bhaskar Marg, Bani Park, Jaipur 302 016, IndiaPhone: 91.141.228 2821, Fax: 91.141.228 2485 Email: <strong>cuts</strong>@<strong>cuts</strong>.org, Website: www.<strong>cuts</strong>-<strong>ccier</strong>.orgPrinted by: Jaipur Printers P. Ltd., M.I. Road, Jaipur 302 001, India.

TRANSPORTTo Do ListWhen it comes to Civil Aviation,there are some issues that requireimmediate attention of the newgovernment. The first is the issue ofground handling – design a newground handling policy or continuefor some more time with the currentpolicy. The second important issuewill be considering what needs to bedone to the Rs 3,000 crore which AirIndia is seeking largely to meet itsworking capital needs.Some more issues that await adecision are: allowing foreign airlinesto pick up a minority stake in domesticairlines; deployment of additionalmanpower for the airline watchdog;and the need for creation of airportinfrastructure; expediting the creationof a civil aviation policy. (BL, 12.05.09)SupremoThe Planning Commission’sproposal to set up a super regulatorin the infrastructure sector has notbeen appreciated by the concernedministries. There are plans to set up asupremo for all public-privatepartnership (PPP) projects ofhighways, ports, airports andrailways.The supremo will oversee:whether the users of infrastructurefacilities are being provided with theright level of services and level of userfees being levied. The NationalHighways Authority of India (NHAI),The Department of Shipping and theI N F R A S T R U C T U R E – N E W STimes of IndiaMinistry of Aviation feel that thegovernment has been unable to carryout the process of restructuring andstrengthening the existinginstitutions, so would it be feasible toset up another body. (BL, 07.05.09)Regulator Tightens GripAviation regulator, DirectorateGeneral of Civil Aviation (DGCA)plans to make it mandatory for airlinesoperating in the country to report thetime of arrivals and departures of theirflights, and delays, if any. This datawill be collated to analyse the reasonsfor delayed flights at various airports.In the past few months, DGCA hastightened ticket rules asking airlinesto reflect airfare details due to growingconsumer complaints over differencesin advertised fares and actual ones.But data collection alone may not helpunless it is verified from air trafficcontrollers and through randomchecks by DGCA.(Livemint.com,15.05.09)All-pervasive BodyAll ports in the country, bothstate-owned and private, will soon begoverned by one tariff regulatorybody, Tariff Authority for Major Ports(TAMP). The Union government isplanning to give deterrent powers toTAMP, including penal andenforcement rights by having a fullfledgedTAMP Act, rather than justbe a part of the Major Port Trusts Act.Ports currently regulated by TAMPfunction as trusts under the MajorPort Trusts Act, 1963. There is a needfor a powerful and all-pervasiveTAMP. The idea is to have atransparent tariff structure acrossports with TAMP acting as a disputesettlement mechanism with morepowers. (Livemint.com, 13.04.09)Sharpened TeethThe Union government’s plan togive more teeth to a proposedregulatory body that will replace theexisting tariff regulator for its dozenports is a step in the right direction.The new regulatory body will becreated through a separate,independent legislation.The new port authority would bea full-fledged regulator. It would havethe powers to set rates for the facilitiesD I G E S Tand services provided at the 12 ports,to prescribe and monitor performancenorms and standards for services andfacilities provided by port authoritiesand private operators and also todecide on disputes between portauthorities, private operators andusers of the facilities and services.(Livemint.com, 26.06.09)Connecting CitiesThe NHAI is working on a plan toidentify at least 50 cities it shouldconnect on a priority, based onpopulation and traffic volume. Ifapproved, this would be a departurefrom the current system where theauthority divides the highwaystretches under several phases ofNational Highway DevelopmentProgramme.A ceiling of 1,000km has also beenset on an annuity basis where thegovernment pays highway developersan annual sum over the concessionperiod, while the developer financesand builds the highways. Governmentorganisations prefer the toll model,where the developer derives revenuesthrough tolls. Private developers onthe other hand prefer the annuitymodel. (Livemint.com, 11.06.09)COMMUNICATIONBharti, MTN ReconnectBharti Airtel Ltd. and SouthAfrica’s MTN Group have restartedmerger talks to create a US$20bnemerging markets telecom entity. Thepotential deal, which seeks to tiptoearound the emotional sensitivities thatscuppered their merger talks last year,will catapult the combine into theleague of top five telecom operatorsglobally, with over 200 millioncustomers spread across 24 countriesin Asia, Africa and the Middle East. Itwould also be India’s biggest crossborderdeal.Sunil Bharti Mittal, Chairman andManaging Director of Bharti, said,“We see real power in the combinationand we will work hard to unleash it forall <strong>our</strong> shareholders”. PhuthumaNhleko, Chief Executive Officer ofMTN, said, “rationale for this potentialtransaction between MTN and Bhartiwas highly compelling”.(BL, 25.05.09 & ET, 26.05.09)2 / www.<strong>cuts</strong>-international.org April-June 2009 PolicyWatch

Satellite RadioThe floodgates are set to open forsatellite radio services in the countrywith the government finalising a freshset of policy guidelines. Religiousorganisations, political parties, privatenews channels will be barred fromsetting up channels. Commercialadvertisements will not be allowed,news broadcasts or audio feeds ofstate-run All India Radio andDoordarshan will be allowed.The operators would be allowed amaximum of two minutes per h<strong>our</strong> ofpromotional material about thechannels. Broadcast of public interestannouncements for a maximum of oneh<strong>our</strong> per day might be mademandatory.Former Telecom RegulatoryAuthority of India (TRAI) Chairman,Pradip Baijal said, “It (satellite radio)will give the subscriber more choiceand I would go a step further to saythat even terrestrial television shouldbe opened up and not be limited onlyto Doordarshan”. (HT, 12.04.09)Check on Windfall GainsThe Ministry of Corporate Affairshas given its nod to a proposal fromthe Department of Telecommunications(DoT) to impose a ban on promotersof new telecom companies from sellingtheir stake for a three-year period. Thismay apply to companies likeVodafone, Idea Cellular etc. who weregiven additional licences to operatein new service areas.The TRAI has already given itsconsent to the proposal aimed atI N F R A S T R U C T U R E – N E W Spreventing ‘fly-by-night’ operatorsfrom making profits by tradingspectrum. The DoT had initiated thepolicy after concerns were raised overnew private telecom players makingwindfall gains allegedly at the cost ofthe national exchequer.(BL, 07.04.09 & ET, 08.04.09)Number PortabilityComprehensive Act on the AnvilThe DoT is planning a completerevamp of the Wireless PlanningCoordination (WPC) wing in order toimprove spectrum management andbetter the processes being followedcurrently. Under this plan, acomprehensive Spectrum Act will bepushed through an Act of theParliament providing a legal basis fortaking away spectrum from operatorswhich do not use it efficiently.Currently, the WPC wing isresponsible for planning, regulatingand managing spectrum allocationamong various users. It also issueslicences for use of radio equipmentand also ensures that there is nointerference among various spectrumusers. DoT is also planning to reorganisethe Spectrum ManagementPolicy. The revamped Group will havethe mandate to look into only policyrelated issues. (BL, 21.06.09)A Bane in DisguiseThe mobile tariffs in the world’scheapest telecom market are set to fallfurther by at least 20-25 percent during2009, more so due to increasingnumber of telecom operators andinfrastructure overcapacity. TheMobile users in Kolkata metro and the telecom circles of Karnataka,Andhra Pradesh and Tamil Nadu can change the service provider whileretaining their numbers. MNP Interconnection Telecom Solutions Pvt Ltd –a joint venture of the US-based Telcordia Technologies and its Indian partnerDTC Pvt Ltd who have been awarded a10-year licence for 11 telecomcircles in south and east India.TRAI and DoT are likely to comeup jointly with the tariff structurefor mobile number portabilityservices soon. The subscriber mighthave to pay a one-time charge toavail the service. The applicationfor retaining of the old number isto be placed with the newly chosenservice provider. (BL, 04.05.09 & ET, 30.04.09)Financial ExpressD I G E S Tcountry has the lowest telecom tariffsin the world.However, price reduction is not allthat good. According to Idea CellularManaging Director, Sanjeev Aga,“Indian companies are rolling <strong>our</strong>predatory prices without conductingproper studies, unlike in thedeveloped countries. Price reductionscoming in from desperate companiesare anticompetition and are not basedon economic sense, and in the longrun this would be anticonsumer andantiindustry”. In the short term, it isthe customer who will reap thebenefits of the tariff fall. (BS, 03.05.09)OIL & GASNatural Gas to Fuel GrowthAs part of its new gasinfrastructure policy, the governmentis working on setting up a suitableadministrative mechanism forexecuting and managing national gashighways. It is likely to set up an apeximplementation agency on the lines ofNHAI that will lay natural gas pipelinesalong the national highways acrossthe country.Other options under discussionare setting up a board having variousstakeholders and permitting GasAuthority of India Ltd. (GAIL) Indiato manage the project.Once created, the infrastructure willbelong to the nation and consumerswill not have to bear the burden of thecapital cost. The proposed changesin the gas transportation policy aim toensure availability of gas toconsumers across the country ataffordable prices. (ET, 04.06.09)Cess on Natural GasThe government is planning tolevy a cess on natural gas to generatefunds to put in place necessaryinfrastructure for building a nationalgas highway network across thecountry. Gas pipelines are requiredthroughout the country to transportenvironment friendly fuel to regionsuntouched till now.There is an urgent need for anational gas highway on the lines ofthe national highways. India produces105 million cubic meters a day of gaswhile 25 mmcmd is imported in the formof LNG. A nominal 20 cents per millionApril-June 2009 PolicyWatchwww.<strong>cuts</strong>-international.org / 3

Deregulating PricesBritish thermal unit cess ondomestically produced natural gasmay be levied to garner Rs 3,000 croreannually that can help build 500-600km of gas pipeline. (TH, 14.05.09)CSR MandateThe government has set amandatory target on social welfareactivities for PSUs. At present, oilPSUs spend 0.5 to 0.75 percent oncorporate social responsibility (CSR)activities, which is voluntary.PSUs like ONGC, Indian Oil, GailIndia, BPCL, HPCL and Oil India willspend at least two percent of their netprofits for 2008-09 on socialdevelopment projects as thegovernment has set a floor for theirsocial spending. The ministry hasdecided to keep a close watch on theirsocial projects. Quarterly progressreviews will be conducted by theministry to ensure fund utilisationunder CSR. (ET, 18.04.09)Policy for the PoorsThe petroleum ministry is workingon a policy to decontrol fuel pricing.The new government may alsowithdraw dual pricing of kerosene andcooking gas and devise a plan tosupply subsidised fuel directly to poorbeneficiaries through smart cards orcoupons. Alternative mechanisms arebeing worked upon to provide cheapkerosene and cooking gas to the poorand subsidised diesel to theagricultural sector.A revised draft of the proposedIntegrated Energy Policy (IEP) is tobe submitted for approval. The IEPcriticised the government forregulating retail prices of petrol, diesel,I N F R A S T R U C T U R E – N E W SPublic sector undertakings (PSUs) suchas Indian Oil, Bharat Petroleum andHindustan Petroleum may have freedomto fix petrol and diesel prices when crudeoil prices are below US$75 a barrel andraising rates of natural gas produced byOil and Natural Gas Corp (ONGC) andOil India Ltd from nominated fields.The government is consideringderegulation of petrol and diesel prices.The attempt is to make available fuel tocommon man at affordable prices. The fall in crude oil prices has however,presented an opportunity to free the auto fuel prices that were broughtunder government control in 2004. (BS, 22.05.09)kerosene and cooking gas. Theultimate objective should be to removegovernment intervention in pricing ofall petroleum products and providetargeted subsidies directly to thebeneficiaries. (ET, 19.05.09)Reliance on RelianceThe government, which will beearning close to US$9bn fromReliance Industries Ltd. (RIL), as partof its profit share, is likely to intervenein the RIL vs. Reliance NaturalRes<strong>our</strong>ces Ltd. (RNRL) case yet again,as the Bombay High C<strong>our</strong>t order putsa huge question mark on its gasutilisation policy.The c<strong>our</strong>t order directs RIL to sellgas to RNRL, which in turn will sell itto its affiliate, Reliance Power (R-Power). At present, R-Power does nothave any gas-based plant; therefore,the company has two options: eitherto use it as fuel for the proposed powerplant at Dadri, which is yet to comeup, or to buy an existing one. And,selling gas to a new power plant isnot allowed under the present gasutilisation policy. (ET, 17.06.09)POWERReforms in T&D NetworkThe Planning Commission hasproposed setting up a NationalElectricity Fund to financedevelopment of power transmissionand distribution (T&D) network bystate utilities so as to reduce T&Dlosses.The idea behind setting up thisfund is to reduce T&D losses in thenext three years to 15 percent bysetting up new electricity transmissionD I G E S Tlines, transformers, replacingoverloaded lines and using newtechnology. State run Power FinanceCorp and Rural Electrification Corp willbe the nodal agencies to finance stateutilities. The government will help theagencies through interest subvention.(FE, 30.04.09)Empowered Power CompaniesPower generating companiesowned by the Central governmenthave now been given the green lightto reduce power supply to a stateutility in case it defaults in opening ofor maintaining the letter of credit (LC)for paying its dues. This follows arecent judgment of the AppellateTribunal for Electricity (APTEL) in acase filed by NTPC.“Should a state default in future,the company can legally take action.This will act as a deterrent to otherstates. Though this does not apply tothe private companies, they can takeheart from the fact that the regulatoryframework in the power sector isactive”, said Arvind Mahajan,Executive Director, KPMG AdvisoryServices. (BS, 03.05.09)Losing StreamSince 2002-03, growth in powergeneration slipped below the threepercent mark last fiscal due to tardyprogress in project implementation bystate, central and private operators,as well as an acute shortage offeedstock, especially coal. This hasled to an increase in the gap betweensupply and demand to double digitsfor the first time since 2002-03.However, the peak-h<strong>our</strong> deficit hascome down drastically, mainly due toimprovement in plant load factors. Inthe improvement graph, private sectorgeneration companies fared the best,while the central sector rated secondand the state sector rated the lowest.(FE, 21.04.09)TNEB not to be PrivatisedThe Tamil Nadu Electricity Board(TNEB) would not be privatised uponits reorganisation. TNEB Chairmanwould head all the three utilities –TNEB Ltd., the Tamil NaduTransmission Corporation Ltd. andthe Tamil Nadu Generation andDistribution Corporation Ltd.4 / www.<strong>cuts</strong>-international.org April-June 2009 PolicyWatchGurera Cartoons

The Centre had made it clear thatits assistance would not be availableunless State Electricity Boards wererestructured. So there was no optionbut to agree to the re-organisation toavail Central assistance. (TH,18.06.09)Welcome Change!Private players in the power sectorare expecting an amendment to theAtomic Energy Act and a well-definedpolicy on nuclear agreements. Industryexecutives have pointed at the need toopen up nuclear sector by amendingthe Atomic Energy Act of 1962 whichprohibits private sector players fromsetting up nuclear power stations.The country also needs anelaborate regulatory and licensingsystem from the government. TheAtomic Energy Act also restrictsnuclear generation business to stateownedcompanies only.Indian companies, such as TataPower, Reliance Energy, Essar andGMR have already expressed theirinterest in participating in nucleargeneration business. Entry of privateindustry into the nuclear power sectorwould enable a more rapid expansionof the sector. (ET, 18.05.09)MIXED BAGLIC to Pare Down its StakeThe Insurance Regulatory andDevelopment Authority (IRDA) hasasked Life Insurance Corporation(LIC) to chalk out a plan to reduce itsstake in those companies where itholds more than 10 percent.Though IRDA will not insist onLIC reducing its stake below 10percent for some time, but haveinformed them it should be hikedbeyond this limit. LIC is expected tochart its c<strong>our</strong>se of action and revertto the IRDA with its plan ofcompliance in a few days. (ET, 11.05.09)No Fav<strong>our</strong>itismThe Gujarat High C<strong>our</strong>t hascriticised the practice of governmentnominating members of politicalparties as non-official directors(NoDs) on boards of public sectorbanks, saying it sends a wrong signal.Such appointments would do nogood to the public sector banks, manyof which are reeling under tremendousApril-June 2009 PolicyWatchI N F R A S T R U C T U R E – N E W Seconomic crisis. It has been observedthat the government has to do someserious thinking while nominatingNoDs to various public sector bankskeeping in mind their specialknowledge and practical experience invarious fields, which would help thebank in formulating various policies.(BS, 26.03.09)Amendment to FRBM ActWith the Centre already breachingthe deficit targets stipulated under theFiscal Responsibility & BudgetManagement (FRBM) Act, the financeministry is seeking to ask the newgovernment to amend it. Formerfinance minister PalaniappanChidambaram had already suspendedthe FRBM’s revenue deficit target for2008-09 by a year.The Centre had amended thecommission’s terms of reference inAugust 2008 to include a review of“the roadmap for fiscal adjustments”and suggest a “suitably revisedroadmap to maintain the gains of fiscalconsolidation through 2010 to 2015”.(FE, 18.05.09)No NoCs!The logic behind continuation ofno-objection certificate (NoC) is undersurveillance by the chief minister (CM)of Delhi. NoC has to be obtained bythe Delhi Jal Board from the DelhiDevelopment Authority (DDA), theMunicipal Corporation of Delhi andthe Delhi Traffic Police for carryingout digging activities for developmentworks.The CM said that most of thedelays caused in replacing old sewerlines with new ones in the capital werebecause of these NoCs that have tobe obtained by the Jal Board. She saidwhen works are being done for publicgood, there is no need for such NoCs.Noting that politics should not beallowed to come in the way ofdevelopment, the CM called for aD I G E S Twww.blonnet.comtransparent system that did away withthe need for such NoCs. (TH, 20.06.09)Deterring the WrongdoerThe Law Commission of India,which has recommended the settingup of fast track c<strong>our</strong>ts (FTCs) todispose off over 38 lakh pendingcheque bounce cases, has suggestedan amendment to Section 138 of theNegotiable Instruments Act to compelthe drawer of a cheque to pay 50percent of the amount on receipt ofsummons.Even after the serving of summons,the accused prolonged trial for yearstogether, thereby putting thecomplainant to not only financial lossbut also a lot of inconvenience andharassment. The insertion of thisclause would certainly deter theunscrupulous drawer from causingcheque bounce, and would result inreduction of litigation. (TH, 31.05.09)New Investment GuidelinesThe Pension Fund Regulatory andDevelopment Authority (PFRDA) willissue investment guidelines for itsmega new pension scheme (NPS).PFRDA has invited public commentson the recommendations, as well ascertain modifications proposed by itto these suggestions.In the NPS both the employeesand the employer contribute an equalamount to the pension fund. However,the NPS for all citizens will not haveany mandatory obligation foremployers to give matchingcontributions to the pension fund.(BS, 03.04.09)Three-pronged ApproachThe government is planning a‘national fibre policy’ for the textileindustry as a part of its three-prongedapproach. The over US$50bn industryis not keeping pace with thegovernment’s vision for the currentFive-Year Plan.The new policy will be a neutralaimed at restoring competitiveness ofthe industry and will benefit all. Theministry has also made it clear that itwants to make India a brand and, atthe same time, promote the domesticmarket. so that it could be insulatedfrom the future slowdowns.(BS, 19.06.09)www.<strong>cuts</strong>-international.org / 5

The use of third generation (3G)technology in telecommunicationis the demand and need of the h<strong>our</strong>. Itis being used all over the globeincluding Bangladesh and Pakistanbut was missing in India till recently.Recently, after a delay of eight years,only public sector companies, BSNLand MTNL, were allowed to launchthis service in their respective areas.Controversies over spectrumallocation and development of apricing formula for the use of spectrumhave been major concerns in this area.I N F R A S T R U C T U R E – I NThe entry of new players has beenanother subject of debate. Thegovernment is very keen to enc<strong>our</strong>agenew players into the bidding processso that market price of scare spectrumcan be discovered. However,differences of opinion between TRAIand DoT have delayed this process.It is high time that the two resolvedtheir differences to facilitate furtherprogress in the issue.TRAI has been arguing stronglyagainst allowing new entrantsbecause of the following reasons: first,given that the launch of 3G is overdue,banking solely on existing players toroll out 3G services would minimisefurther delays; second, this wouldfacilitate the usage of excess capacityin infrastructure installed for 2G toprovide some 3G services at affordablerates; third, allowing entry by newplayers directly into 3G could beconstrued as unfair and even illegal, given that 300applications are awaiting DoT clearance for access to 2Gspectrum.DoT, on the other hand, holds a radically different view. Itcontends that an open bidding process will fetch higherrevenue and introduce more competition in the market.The DoT view is being welcomed by new entrants forobvious reasons.According to the recently issued guidelines for 3Gspectrum auction, the new entrants will have to pay ahuge fee of Rs 1,651 crore to acquire the Unified AccessService License (USAL). In addition to this, according toindustry estimates, the 3G auction price is expected to bearound Rs 8,000 crore. Further, to reach the breakevenF E A T U R EGovernment Efforts to Promote Competition in3G Services: A Misguided Effort?– Rashi Rathore*The government is lookingfor more competition andresultant higher revenuesby allowing new playersincluding global firms tobid for the 3G spectrum.Therefore, it should ensurea level playing field eitherthrough an infrastructuresharing mechanism orpreferential treatment fornew players* Intern at CUTS CCIER; pursuing MBA (Tech) at NMIMS University, Mumbai.point, a new operator has to developinfrastructure to serve a subscriberbase of 50 lakh which would costanother Rs 7,500 crore inclusive ofrequired investment in transmissionfacilities. Thus, a new entrant has toinvest around Rs 17,000 crore in allfor setting up a network.Given these additional costliabilities, new entrants will notbe able to compete with existingplayers. Further, the quality of serviceprovided by new 3G players is boundto suffer as they have to accommodatevoice and data transfer out ofallocated 3G spectrums only whileexisting players have 2G and 3Gspectrum both to support suchtransmission. Augmentation ofcapacity by new entrants would thenrequire purchase of 2G spectrum fromexisting holders which would again becharacterised by limited choice andhigh prices.All the above factors give existingplayers an advantage over newplayers in the 3G market as the formerface much lower investment costs andhave a large subscriber base in 2G.Thus, they already have a captivemarket for 3G services as existing 2Gsubscribers with more sophisticateddemand can be shifted to the newlyforming 3G subscriber base. Thus,these players can accommodate moreusers of 2G services, thereby, tidingover the spectrum crunch.In a bid to end controversies relating to the 3G spectrum,the government is planning to create a spectrum regulator.Creating a separate regulator is not a good idea when atelecom regulator already exists. However, as has oftenbeen the case, the government might ignore TRAI’sopinion and constitute a new regulator.The government is looking for more competition andresultant higher revenues by allowing new playersincluding global firms to bid for the 3G spectrum. But levy ofa large fee will be counterproductive and thwart competition.Therefore, the government should ensure a level playingfield either through an infrastructure sharing mechanismor preferential treatment for new players. It is important torealise that you cannot eat you cake and have it too!6 / www.<strong>cuts</strong>-international.org April-June 2009 PolicyWatchThe Economic Times

I N F R A – T A L KAdding Megawatts– P Raghavan*Private sector investment in power has picked upbut there is much variation across regions.Sustained efforts to boost private sector investments in the power sectorseem to be finally paying off. Most recent numbers show that installedcapacity of the private sector has grown more than three times faster than thegovernment sector (state and central), in the first two years of the eleventhPlan. While the installed capacity of the private sector shot up by 32.8 percentin the first 47 months (up to February 2009) of the eleventh Plan that of thecentral and state governments rose by just 8.5 percent each.Though some cynics may contend that the sharp pick-up in power capacitiesadded by the private sector is because of its low base – it still accounts foronly about 15 percent of the total capacity even now – the size of the additionalcapacity built shows that it is more than just a statistical blip. For instance, thenumbers till February 2009 show that the private sector added 5,592 mw ofcapacity in the Eleventh Plan while the state sector, which account for morethan half the total power generation capacity in the country, could install only5,944 mw and the central government, with a one-third share, just 3,850 mw.The pick up in performance of the private sector is also evident from its superiorrecord in meeting the plan targets. While the private sector achieved 37.2percent of the additional power capacity targeted for the sector in the EleventhPlan period by February 2009, the state sector could only install 22.2 percentof the targeted addition. The worst record was that of the central governmentwhich could meet only 10.4 percent of the plan target during this period.What is more surprising about the significant improvement of the privatepower in the generation business is that the states like Orissa andHaryana which were at the forefront of power sector reforms have fallen farbehind other states in promoting private sector investments in powergeneration.In fact the early numbers show that it was the western and southern Statesthat made most of the gains in this segment. For instance at the end of December2005 the Western region has registered the highest gains with its total powergeneration capacity in the private sector at 5,793 MW followed closely by theSouthern region with its private generation capacity at 5,212 MW. Togetherthese two regions accounted for more than f<strong>our</strong> fifth of the private powercapacity built till then.The figures for 2009 show that the scenario has not changed significantlysince then though the southern region has replaced the western region withthe largest power generation capacity in the private sector. While the totalpower generation capacity in the private sector in the southern region wentup to 9,771 MW that of the western region touched 9,467 MW.Apart from regional inequalities what is more disturbing is the sharplyskewed distribution of private power generating units in the states.Numbers show that till now not a single MW of capacity has been built in adozen odd states including Orissa, Bihar, Delhi, Jammu and Kashmir, Sikkimand the most of the North Eastern states, the sole exception of Assam. Theprivate power generation capacity distribution scenario turns worse whenone accounts for the fact that theprivate capacity set up so far in stateslike Haryana, Punjab, Goa, MadhyaPradesh, Kerala and Assam was lessthan a percentage share of the nationalshare.So the bulk of the private powergeneration capacity set up so far wasconcentrated in a few states. Leadingthem was Tamil Nadu with 5,434 MW(24 percent of total capacity),followed by Maharashtra with 4,217MW (18.6 percent), Andhra Pradeshwith 2,126 MW (9.4 percent),Karnataka with 2,015 MW (8.9percent), Chattisgarh with 1,156 MW(5.1 percent), West Bengal with 1,002MW (4.8 percent) and Rajasthan with696 MW (3.1 percent). These ninestates now account for more than 90percent of the private generationcapacities.The role or significance of theprivate power sector in theseleading states also variessubstantially. In fact it was only inTamil Nadu, Chattisgarh and Gujaratthat private sector has come tooccupy a major role with its sharearound a third of the total powergeneration. The share of privatepower in Maharashtra, AndhraPradesh and Karnataka was just abouta fifth and that in West Bengal andRajasthan even much lower at aroundone tenth.www.images.com* Senior Editor, Financial Express. Abridged from an article that appeared in the Financial Express, on April 17, 2009.April-June 2009 PolicyWatchwww.<strong>cuts</strong>-international.org / 7

I N F R A – T A L KIn Raja’s Raj– Payal Malik*An importantpolicymeasure thatcan fostercompetitionand preventthe possibilityof collusivebehavi<strong>our</strong>amongcurrent firmsis numberportabilityThe policy mandate of the outgoing government in thetelecom sector has left much to be desired. Otherthan some odd positive development like allowing passiveand active infrastructure sharing the policy developmentsdid not promote the furtherance of competition.The test of competition must be contestability or ease ofentry into the industry. Contestability naturally meansthat existing operators should not be able to precludeentry, but it also means that the government should notbe able to stop it either. For quite a long time the DoT wasnot in fav<strong>our</strong> of new entry. Moreover, any new entry isinextricably linked to the availability of spectrum for it tooffer credible contestability. Here, too, the policymakerdrew a naught, be it 2G or 3G spectrum.If the policy has been so inimical how does one explainmillions of subscriber additions each month? Withsaturated markets in the urban areas operators are nowseeing expansion possibilities in tier two towns and evenin rural areas. The “budget telecom” model (a model basedon compromising on investments for qualityimprovements) will allow packing more subscribers withinnovative market driven schemes and hence the policyis irrelevant for these outcomes. However, it is still relevantwhen it comes to the issue of licensing, management ofscarce res<strong>our</strong>ces and universal service. Unfortunately theUPA does not have a good record these.Expressing dissatisfaction with the licensing procedure,TRAI said that the decision to give Letters of Intent tonew players was not totally in line with theirrecommendations. TRAI said that while it had notManjul Cartoonssuggested any cap on the number of operators,it had suggested that the government makesure that there is adequate spectrum beforeallowing new players. What irked the telecomregulator was that the DoT tried to justify itsdecisions on grounds that they were basedon TRAI recommendations.By issuing licences bundled with a promise ofallocating 2G spectrum at an arbitrarily decidedprice of Rs 1651 crores (the price paid by thef<strong>our</strong>th cellular operator way back in 2001) thepolicymaker violated all the principles ofefficient allocation of this scarce res<strong>our</strong>ce.Once these firms got the licence they resoldlarge chunks of their businesses at a price thatwas determined in the market. Not surprisinglyit was way above the paltry licence fee that they had paid.This rent seeking on the part of these companies was anobvious outcome of the flawed spectrum allocationmechanism. The policy of bundling spectrum with licencemeant that the firms got spectrum cheaply and this deniedthe public huge amount of money.TRAI was asked for recommendations on allocation of3G spectrum in April 2006. It furnished them inSeptember 2006. The government issued guidelines inNovember 2007. Since then, the government has beendithering and issuing amendments to the 3G policy andthe auctions have been postponed till a later date. Policysluggishness in this regard is also impacting the growthof Broadband through wireless. An important policymeasure that can foster competition and prevent thepossibility of collusive behavi<strong>our</strong> among current firms isnumber portability. The policy has not been implementedand the operators are in cosy arrangements as they donot compete on quality and the consumer is crying hoarseas the quality of service deteriorates across board.Though the universal service policy was changed in 2007and infrastructure providers became the beneficiary of theuniversal service funds but funds have not been disbursedspeedily. Of the Rs 20404 crores collected so far, India hasbeen able to use only 34 percent for promoting universalaccess.For the next government fixing of the spectrum policyand a speedy disbursement of universal service fundsfor projects that enc<strong>our</strong>age infrastructure and backhaulcreation should be important items on the policy agenda.* Associate Professor, Delhi University, and Adviser, Indicus Analytics. Abridged from an article that appeared in the FinancialExpress, on April 20, 2009.8 / www.<strong>cuts</strong>-international.org April-June 2009 PolicyWatch

T R A D E & E C O N O M I C S – N E W S D I G E S TIndia Becomes the Key PlayerThe 1999 Montreal Conventionunified the rules on internationalcarriage by air and modernised theprovisions on limitation of liability forinternational air carriers. Theamendment act should help to avoidcomplex jurisdictional discrepancieswhen deciding matters relating topassenger or goods liability.The incorporation of theconvention into Indian law means thatIndia is now operating at the samelevel as the prevailing internationalregime. This will augment India’sposition as a key player in internationalcivil aviation. (ILO, 29.04.09)Round-tripping under ReviewThe Organisation for EconomicCooperation and Development(OECD) has begun a review of India’sforeign direct investment (FDI) policyto suggest measures that will easesector-specific ceilings as well as lookinto issues of round tripping.The first-of-its-kind review isexpected to propose measures to makethe FDI policy more open andtransparent, methods to improve datamaintenance, clauses on ‘security’,and also look into dependence oninvestment that is round-tripped fromtax havens.The review is significant as itcomes at a time when the globalfinancial crisis has slowed downforeign investment into the country.This will be the first OECD InvestmentPolicy Review of India. (FE, 13.04.09)States may get GST DamagesThe Centre is considering aproposal to compensate states for anyrevenue loss that they might sufferon implementation of the Goods andService Tax (GST). The move isexpected to enc<strong>our</strong>age them to adoptthe new tax structure.The enactment of GST meansintegrating service tax legislation withcentral excise law and harmonising taxrates. While this requires legislativeand constitutional changes, the movewill reduce cascading of taxes and willgive comfort to consumers. A welldesignedGST will also contribute tolowering manufacturing costs and willmake businesses more efficient.(ET, 30.06.09)April-June 2009 PolicyWatchWal-Mart Outs<strong>our</strong>cing to IndiaWal-Mart Stores has shortlistedtop Indian tech firms, including TCS,Infosys and Wipro, for an outs<strong>our</strong>cingcontract potentially worth US$500mnover next few years, as the retailerseeks to award multiple contracts formanaging its business applicationsand other back office activities.Wal-Mart has been testing thewaters by outs<strong>our</strong>cing smallerprojects to companies but now, theretailer wants to flesh out a morecomprehensive outs<strong>our</strong>cing strategyand has shortlisted these techvendors. (ET, 08.06.09)Safeguard MeasuresMoving against dumping of cheapproducts, India has imposed up to 30percent duty on import of keyaluminium products from China toprotect the domestic industry againstcheap shipments.The Directorate General ofSafeguards initiated a probe into cheaparrival of aluminium products after thedomestic industry had filed a petitionfor levying the duty against importfrom China. Safeguard duty is a WTOcompatibletemporary measure to avertany damage to domestic industry fromcheap imports. (TH, 24.06.09)Downturn takes its TollFollowing the downturn in privateequity investments, merger andacquisition (M&A) deals are alsowitnessing a steep decline. The totalnumber of M&A deals (excludinggroup mergers and restructuringdeals) during the first f<strong>our</strong> months of2009 declined to 74 as against 174deals during the correspondingperiod in 2008.The total number of M&A andgroup restructuring deals for themonth of April 2009 stands at 21 ascompared to 42 deals for April 2008.There were 13 domestic deals andseven cross-border deals. F<strong>our</strong> of thecross border deals were outboundand three were inbound deals.(FE, 17.05.09)Growth Beats ForecastsIndia reported robust economicgrowth weathering the globaldownturn better than many of itspeers. Growth expanded by 5.8percent in the last quarter of the fiscalyear to March 2009, beating forecastsof five percent. Growth for the fullyear was 6.7 percent, down from thenine percent posted a year earlier.The Finance Minister said thegovernment will make increasinggrowth its top priority to help India’s“common man” – even at the risk ofballooning an already large fiscaldeficit. Eyes will now be on thebudget, due in early July, to see howquickly the government moves onreforms such as opening up thefinancial sector to more foreign firmsand disinvestment.(Google News, 29.05.09)Pre-budget ConsultationsIn pre-Budget consultations withFinance Minister, chiefs offinancial service firms were of theconsensus that this is the time topromote growth in the country andtherefore the time to promoteinvestment in various sectors incapacity building, infrastructure,agriculture and so on.Representatives of these firmsmade recommendations on howfunds can flow better in all sectors.Recommendations were –disinvestment of PSUs so thatgovernment can get proceeds to take care of the ballooning fiscal deficit;government should consider giving priority to long-term insurance productswithin one lakh limit of tax-exempted savings; and carry forward losses forinsurance companies should be increased to 10 years. (NDTV Profit, 10.06.09)www.worldsikhnews.comwww.<strong>cuts</strong>-international.org / 9

Stakes at SaleThe government has sought torevive plans for the divestment ofminority stake in government-ownedcompanies. About nine PSUs maymake it to the market over the next fewmonths. An amount of Rs 45,000 to Rs53,000 crore could be raised throughsale of stake in select central PSUs.More than half of the proceedsmay come from two high-profile offers– 10 percent stake sale each in BSNLand Coal India. Similar estimatessuggest that stake sales in smallergovernment companies such asNHPC, RITES, Oil India and UnitedBank may bring in another Rs 6,100crore-Rs 6,850 crore. BHEL, Power GridCorporation and Rural ElectrificationCorporation are also likely to contributeRs 16,000 crore. (BL, 29.06.09)Core StatisticsThe Statistics Ministry hasstarted the process to operationalisethe newly passed Collection ofStatistics Act, 2008, by framing draftrules and guidelines that will enablebetter data collection anddissemination.Under the new Act, people orcompanies not divulging data wouldhave to pay a fine, thus making itobligatory for companies to complywith timely data collection activities.The Act also makes wilfulmanipulation or omission of data, acriminal offence, punishable by aprison term. The government is alsoplanning to finalise a list of data seriesthat will be called as “core statistics”,that is, numbers which are of nationalT R A D E & E C O N O M I C S – N E W S D I G E S Timportance, within the next threemonths. (BS, 05.05.09)No Blanket ClearancesFlooded with demands from bothprivate and public sector companiesfor fast track environmental clearanceof various power projects,Environment and Forests Minister,Jairam Ramesh, said the track recordof these companies did not inspiremuch confidence, and they needed tolook within to set right the damage toenvironment and ecology.Ruling out any kind of blanketclearance to power projects in thename of achieving targets, Rameshsaid he was prepared to help the powersector in getting early clearances, butthese companies would have to showgreater sensitivity on environmentalissues. Those not adhering to locallaws, and to environmental and forestissues in the development of projects,will face action. (TH, 30.06.09)Integrative DevelopmentIndia badly needs privateinvestment in retail. Theseinvestments are needed from bothIndian and foreign s<strong>our</strong>ces, but shouldinitially be restricted to the wholesalesegment, said the Confederation ofIndian Industry (CII) Northern RegionChairman, Harpal <strong>Singh</strong>.Referring to the newly openedBharti-Walmart ‘cash and carry’ outletin Amritsar, he said that privateplayers have more access toinvestment and, hence, can maintaingood storage and refrigerationsystems required to store perishableEAC Lowers Growth ProjectionWith slackening demand hitting Indiantrade more than anticipated, the PrimeMinister’s Economic Advisory Council (PMEAC)has lowered India’s growth rate forecast to 6.5-7 percent from earlier projection of 7.1 percentfor 2008-09 due to “painful adjustments to theabrupt changes in the international economy”.PMEAC chairman said the global crisisaffected the Indian economy through export andexport-related industries and capital outflows,which took place not because of lowerprofitability but foreign institutional investorshad their obligation to meet back home. Thepsychology of gloom and doom which essentially pervaded in theindustrialised countries was imported to this country. (FE, 05.04.09)items. Moreover, they can provideaccess to products from distantmarkets, such as fish from South Indiaand fruits from other countries, hesaid. (BL, 15.06.09)Intentions to ActualsUndeterred by global economiccrisis, Indian firms mostly in steel andelectrical equipment sectors, proposedinvestment of Rs 99,958 crore inJanuary.However, economists are scepticalabout these figures. Financial ratingfirm CRISIL’s Chief Economist D KJoshi felt the translation of theinvestment intentions into realprojects would depend on the globaleconomy. “These are only proposedinvestments. It is reflection ofintentions. During the current economicscenario to change the intentions intoactuals… it depends how the globaldownturn behaves in the comingmonths”, Joshi said. (BS, 11.05.09)India Strides Past ChinaIndia will have a gross domesticproduct (GDP) growth that is higherthan that of China in the next fewyears, said Oxus Research andInvestment Chairman, Surjit Bhalla inhis address to delegates at the f<strong>our</strong>thglobal meeting of the EmergingMarkets Forum.Bhalla said that while India willpost a GDP growth of more than ninepercent, China’s growth rate will bebelow eight percent in the not sodistant future. The strides that Indiahas taken in the last few years needsto be taken into consideration.(IE, 24.06.09)Low Inflation but High PricesThe inflation rate has dropped toalmost zero, but the prices for foodcontinue to remain high, especially foressentials such as rice, sugar andpulses. The prices of what is beingput on y<strong>our</strong> table actually reflects thedemand-supply situation globally.Prices of rice and all pulses haveincreased though wheat prices,however, have been stable.Sugar prices have soared whileedible oil prices have shown adeclining trend in line with the globalmarket. Vegetable oil prices began theirdownslide mainly after crude oil ratescrashed. (BL, 03.04.09)10 / www.<strong>cuts</strong>-international.org April-June 2009 PolicyWatchManjul Cartoons

T R A D E & E C O N O M I C S – I N F E A T U R EDevelopment Strategies Still Matter– Yoginder K Alagh*We need to move away from intellectual orthodoxy inresponse to the global economic turmoilOur Planning Commission isgood, as good as the one Iserved for, with persons likeSukhomoy Chakravarti and theones I served with, like AbidHussain, Raja Chelliah and HitenBhaiyya. But jokes apart, the 11thPlan is a good document. Many ofits chapters are technically good.But, sometimes they do not hangtogether and there are no largerframeworks, with some numbers indifferent portions actuallycontradicting each other. Itsproduction and some of itstechnicalities are outs<strong>our</strong>ced andthe novelty is attractive.Also there is an overarchingideology behind them which comesfrom the UPA and Sonia Gandhi’s National AdvisoryCouncil, which lends coherence. The section onagriculture and rural development is based on critiquesof the mistakes of the 1990s and work done on them.These essentials must continue.India and the world have gone through tumultuous timesin the last two years. But we have protected <strong>our</strong>selvesfrom the worst ravages of the meltdown. The jury is stillout on whether that was on account of momentum orstrategy, with some like this column arguing that quicker,more coherent responses could have been possible. Itwill be a mistake though to believe that all that is requirednow is private research agencies to giving fact findingreports on sectors and regions.This mindset comes from a strong ideological positionthat development planning as a strategy was wrong.Treatises by government economists denying the growthof the eighties (a decade, one said, was without ‘vision’and so on), facile critiques of the National PlanningCommittee chaired by Nehru (to build up the case ofalternate visions) are all interesting pieces of writing buthave not been subjected to any serious professionalscrutiny. None of these approaches, for example, wereable to articulate the perception that India was growingfast from the 1980s. Apart from some Indian economistslike Nagaraj, Sebastian Morris, Arvind Virmani and y<strong>our</strong>columnist, this aspect was articulated largely byeconomists working outside India.These economists workingoutside India were from theBrettenwoods institutions andhad a largely col<strong>our</strong>ed andjaundiced view of policyformulation in India. Alternatelythey reflected perceptions on Indiain their country of residence. Forexample some of the most severecritiques of India have emergedfrom liberal friends from theDemocratic or Lab<strong>our</strong> Party.Remember Selig Harrisson and thefactual inaccuracies abundant inManjul Cartoons Francine Frankel. Okay, if youbelieve...that good governance isan Anglo Saxon monopoly. A veryastute Canadian friend recentlystartled me by saying that Indianfilm makers in his country, very critical of India were nevera part of the critical social disc<strong>our</strong>se there. Ditto foreconomists leaving aside hon<strong>our</strong>able exceptions.The upshot of the story is that there is a genuine needfor a debate on development strategy for India. It isrubbish to say that those who want it do not see themerits of market-based reform. But strategic developmentpolicy approaches are on the agenda and in this columnwe will chip away at them. These relate, among others tomaking agriculture grow faster in an uncertain world, openeconomy macro strategies, technology policies forindustry in a globalising world, organisational systemsfor public sector functioning and newer institutions withmixes of public and private initiatives, the South Asianregion, and larger questions of energy and water. Thesepolicies need to be integrated with the questioning beingraised on institutions all over the world. It’s not going tohappen if the establishment in India is wedded as it is toits own grooves and its global friends now in disarray.The inability of any ranking Indian authority to commentintelligently on Obama’s America or the intellectual turmoilin Europe and the propensity of the Delhi intellectualestablishment to stick to its earlier interlocutors is full ofbathos. But pathetic as it is, it also stops us fromreinventing <strong>our</strong> future, apart from reducing <strong>our</strong> influencein the region and the world. That has to change as we getout of another election.* Former Union Minister. The article appeared in the Financial Express, on May 08, 2009.April-June 2009 PolicyWatchwww.<strong>cuts</strong>-international.org / 11

India’s opposition party leader L KAdvani sparked a politicalconflagration with pre-electioncampaign remarks that India waslosing tens of billions of dollars eachyear in illicit financial outflows, or“black money”. He asserted that theNational Democratic Alliance wouldvigorously pursue recovery of theselost assets if voted into power. Withthe rolling election now in progress,the issue of India’s missing billionshas grown progressively thornier, asboth sides vie to take the moral highground.Whatever the outcome of theelection, India’s problem has broaderimplications both for the developingworld and for efforts by the Group of20 developed and developing nationsto craft an effective post-crisiseconomic plan for the global financialsystem.In his discussion of black money,Advani cited <strong>our</strong> estimates of illicitcapital flight, which suggest totalillicit outflows from the developingworld of US$1,000bn a year. Indiaranked fifth highest at US$22bn-US$27bn a year, coming in behindRussia (US$32bn- US$38bn), Mexico(US$41bn-US$46bn), Saudi Arabia(US$54bn-US$55bn) and China(US$233bn-US$289bn).Mainland China’s massiveoutflows were predominantlythe result of trade mispricing – acommon practice wherebymultinational corporations manipulateT R A D E & E C O N O M I C S – I N F E A T U R EIndia Shows us the Curse of ‘Black Money’– Raymond Baker*www.wordpress.comTrade mispricingis the drivingforce behind mostof illicit capitalexiting developingcountriesfigures on commerce and earnings tominimise tax liabilities. A popularmeans of tax evasion for companies,trade mispricing is the driving forcebehind most of the illicit capital exitingdeveloping countries.Second-ranked Saudi Arabia andf<strong>our</strong>th-ranked Russia were exceptionsto the trade mispricing rule becauseof their status as oil exporters, oilbeing difficult to misprice. Theproceeds of criminal activity,corruption and corporate tax evasion,these flows are clandestine in natureand usually end up in financialcentres featuring low regulation andhigh secrecy. This makes it tricky tostudy illicit financial flows.India is the latest of several nationsto raise the alarm about illicit capitalflight. Following high-profile scandalsinvolving Liechtenstein andSwitzerland, the Group of 20 nationshas demanded greater co-operationin tackling the shadow financialsystem. Made up of tax havens,jurisdictions allowing secrecy,disguised corporations, anonymoustrust accounts, fake foundations andassorted money-launderingmechanisms, it is designed to movemoney and obscure its s<strong>our</strong>ces.What have thus far remained absentare the concrete reforms needed todismantle this shadowy network andenforce greater transparency andaccountability in the global financialsystem. The G20 is poised to acceptthe OECD standard for exchange oftax information, a well-meaning butweak approach to the problem. Whilethe much-publicised post-G20arrangements by several havens tosign tax information exchangeagreements are welcomed, theseagreements are extraordinarilycumbersome. The onus remains onthe requesting nation to prove thatthe information sought is“foreseeably relevant” to suspectedcrime or tax evasion.Furthermore, havens andjurisdictions supporting secrecy arenot required to provide informationthey do not normally collect. Underthe OECD standard, all elements ofthe global shadow financial systemcan remain in place.What needs to happen now is for theG20 to broaden its dialogue oninformation exchange agreements,international co-operation andinternational financial protocols.Most effective in curtailing themassive illicit outflows fromdeveloping countries would be arequirement for automatic crossborderexchange of tax information onpersonal and business accounts andcountry-by-country reporting ofsales, profits and taxes paid bymultinationals.The global recession is expectedto have a severe impact ondeveloping economies and undoyears of poverty alleviation effortsand economic gains. The desire tooffset this predicted impact is sincere.But until efforts are made to dismantlethe shadow financial system andmandate more co-operative andrigorous reporting, success willremain as elusive as India’s missingblack money. India has shown thatthis issue resonates with voters.Politicians in other developingcountry democracies would be wiseto take note.* Director of Global Financial Integrity. Abridged from an article that appeared in the Financial Times, on April 24, 2009.12 / www.<strong>cuts</strong>-international.org April-June 2009 PolicyWatch

R E P O R T D E S K – N E W S D I G E S TBottlenecks in T&DTrade & Development (T&D)bottlenecks are expected to hamperthe Centre’s ambitious target toachieve 78,575 MW of power capacityduring the Eleventh Plan period.Unless there is a robust transmissionand distribution infrastructure inplace, it is difficult for the governmentto woo big ticket investments fromthe private players, who are lookingat major role to play in the T&D sector.To attract and facilitate privateparticipation in a big way, it requiresa well-structured project identificationand selection process in place. Tomake private participation moresuccessful, it is also imperative forthe government to assign risks tothose who can handle them best, theanalysis added. (FE, 07.06.09)Separate Governance CodeA report by the Committee onFinancial Sector Assessment,appointed by the Reserve Bank ofIndia (RBI) and the government said,“It is recommended that a separatecorporate governance code forunlisted companies may be broughtunder the Companies Act, whichtakes into account the interests ofstakeholders in such companies”.There is also a need for enhancingthe focus on unlisted companies tostrengthen the overall system, saidthe committee. “The role andresponsibilities of the ministry ofcorporate affairs may be crystallisedin the Companies Act itself,especially in the case of mergers andamalgamations”, the report added.(FE, 07.04.09)Upgraded Growth ForecastThe OECD, a club of rich nations(30) raised India’s growth forecast to5.9 percent for 2009. “With the gradualrecovery of the global economy andeasier financial conditions, growth isprojected to gradually regainmomentum”, said OECD.The report said, “The newgovernment will face the need torestore fiscal discipline, speed upstructural reform and increase salesof public sector assets”. The reportfurther said the extent of thedeterioration in the fiscal positionprior to the slowdown has reducedApril-June 2009 PolicyWatchthe scope for “discretionary fiscalpolicy action”. (BS, 24.06.09)Single handed RegulationIndian retail sector should begoverned by a single central authoritythat not only makes policies butensures their proper implementationinstead of the current practice ofmultiple authorities, according toAssociated Chambers of Commerceand Industry of India (Assocham).A survey by the chamber revealedthat over 95 percent of organisedretailers have opposed retail sectorbeing jointly regulated by theministries of Commerce and Industryand Consumer Affairs.Assocham said multiplegovernance agencies in the sectorhave caused confusion which needsto be eradicated. While the Departmentof Commerce is responsible for makingpolicies for retailing, theirimplementation is watched under theConsumer Affairs Ministry. Thiscauses distortions and ambiguities ingrowth of retail. The report suggeststhe government to make acomprehensive ‘National Retail Policy’under which retailing should befacilitated with only one nodal agency.(BL, 03.05.09)Consumer Friendly LawsIndia has been ranked as thecountry with the world’s mostconsumer friendly intellectual property(IP) laws since its copyrightregulations allow citizens greatfreedom to access and utiliseinformation for educational anddevelopment purposes. This emergedin a study of 16 countries undertakenby the Malaysia-based ConsumersInternational, which calls itself the“world’s only global consumeradvocacy body”.The study praises India’sCopyright Act as being “a relativelybalanced instrument that recognisesthe interests of consumers”. It pointsout that “neither has India rushed toaccede to the World IntellectualProperty Organisation (WIPO)Copyright Treaty”. (ET, 07.05.09)Growth Projections by WBThe World Bank (WB) hasprojected an eight percent growth forIndia in 2010, which will make it thefastest-growing economy for the firsttime according to its GlobalDevelopment Finance Report.The report calls on governmentsaround the world to be vigilant whendrawing up strategies to reverse therecent expansionary monetary andfiscal policies once the world economytakes off.The bank has urged rich countriesto boost the flow of credit todeveloping nations to help speed upeconomic recovery. Since globalgrowth will only return to its fullpotential by 2011, the gap betweenactual and potential output,unemployment and disinflationarypressures continue to build, the reportadds. (ET, 23.06.09)Energy Shortagendia will continue to face both energy and“I peak shortages in 2009-10”, according tothe Load Generation Balance Report for 2009-10 released by Central Electricity Authority(CEA). The eastern region will be surplus inenergy while all other regions will face energyshortage. The peak shortage will prevail in allregions varying from 6.3 percent in the easternregion to 15. 5 percent in the northern region.According to CEA, there will be surplusenergy in northern region states havingpredominantly hydro systems during themonsoon months while shortage conditionswould prevail during winters. States with hydel power will be surplus inenergy during monsoon period, while they will face severe shortageconditions during the winter low flow months when the generation fromhydro schemes dwindles to the minimum. (FE, 04.05.09)Times of Indiawww.<strong>cuts</strong>-international.org / 13

Resurging Asian EconomiesAsian economies may be the firstto emerge from the global crisisbecause the region’s banks hold fewertoxic assets than lenders elsewhere,said Zhao Xiaoyu, vice-president ofthe Asian Development Bank (ADB).Zhao said European and Americanfinancial institutions are sellingvaluable Asian assets to get hold ofcash and improve their balance sheets.ADB predicts that economies inAsia excluding Japan will grow 3.4percent in 2009 and six percent in 2010.ADB report said, improving tradefinance is one of the keys to an earlyrecovery in the region. The financialcrisis has prompted banks around theworld to reduce lending to emergingmarkets and cut credit lines toimporters and exporters.(Livemint.com, 10.04.09)Stress Stressing TreasuryWork-related ailments like heartdiseases, strokes and diabeteswill likely cost India’s exchequeraround US$160bn during 2009-15,an industry lobby study jointlyprepared by Assocham andPricewaterhouseCoopers (PwC).Though India is a fast-developingcountry, it is yet to create facilities tomitigate tension and high bloodpressure from work-related stress,which often leads to cardiovasculardiseases, says the report.According to the report, toprevent chronic diseases, Indiansshould reduce tobacco intake, eathealthier diet and exercise regularly.(BS, 10.05.09)Babudom – A CurseIn a damning judgement on thebabus, the Political and Economic RiskR E P O R T D E S K – N E W S D I G E S T“TFalling Standards in the ‘August Houses’he unseemly behavi<strong>our</strong> ofpeople’s representatives inthe ‘August Houses’ and theirunethical misdemean<strong>our</strong> are acause for high concern”, saysthe Citizens Report onGovernance and Development2008-09 by the National SocialWatch Coalition. Theperformance of the 14 th LokSabha as it comes to an end isa telling tale on the “falling standards”, according to the report.The report says that there is not a single session during these two yearsthat has not lost valuable man-h<strong>our</strong>s on account of unruly incidents such asslogan-shouting, walkouts and boycotts. The year 2008 even witnessed thevirtual abrogation of a whole session of Parliament. The report points to a“new high” in the corruption and criminalisation of legislators witnessed inthe cash-for-vote scam. (TH, 07.04.09)Consultancy (PERC), which releasedthe survey report said, “India’ssuffocating bureaucracy was rankedthe least efficient” and virtuallyslammed babudom as India’s biggestcurse where working with thecountry’s civil servants was a “slowand painful” process.“They are a power centre in theirown right at both the national andstate levels, and are extremely resistantto reforms that affect them or the waythey go about their duties”, PERCconcluded. (ET, 04.06.09)Unstable Policy RegimeAccording to the 2009 Ernst andYoung (E&Y) Business Risk Report,the continued instability in policyregime makes the business scenariouncertain for national andinternational oil companies.“A fragmented energy policycreates ambiguity, forcing oil and gascompanies to repeatedly makedecisions in uncertain environmentPoor Performersand deters long-term planning”, thereport said.It said the oil and gas sector hasbeen impacted globally by theeconomic downturn, which hascreated new risks for the industrythreatening the near-term survival andprospects of a number of oil and gascompanies. (TH, 25.06.09)Redefined Employment StrategyAccording to a report ‘TheChallenge of Employment in India –An Informal Economy Perspective’,the slowdown should not be blamedfor the lack of jobs, instead rapidgrowth of the past decades should beblamed.The Indian economy’s rapidexpansion has actually widenedinequality, shrunk job opportunitiesand reduced wages, according to thereport. The report highlightsstructural weaknesses in India’s lab<strong>our</strong>market, such as illiteracy and lack ofskill development etc.(Livemint.com, 09.05.09)Performance of celebrities from business, sports, and film, as parliamentarians has been disappointing: infact, their track record has been “abysmally poor” as far as contribution to parliamentary democracy isconcerned, according to a report by National Social Watch Coalition.Of the 80,000–odd questions asked in both the Houses, their contribution is not even one percent. Govindadid not attend the Lok Sabha, while Dharmendra and Shyam Benegal did not ask a single question. Hema Malinifared better with 10 percent attendance and asked 179 questions while Bimal Jalan asked just one question; hisattendance was 20 percent and was active in debates 10 times.Vijay Mallya asked 126 questions; his attendance was a poor seven percent. Dara <strong>Singh</strong>’s contribution — 131questions, zero participation in debates and 14 percent attendance. Navjot <strong>Singh</strong> Sidhu was uncharacteristicallyquiet during debates while his attendance was six percent. Jaya Prada and Jaya Bachchan fared the best among thelot. Jaya Prada asked 178 questions and Jaya Bachchan 159, the latter being more active in the debates. (TH, 12.04.09)14 / www.<strong>cuts</strong>-international.org April-June 2009 PolicyWatchTimes of India

Global Financial Integrity (GFI) recently published areport entitled ‘Illicit Financial Flows fromDeveloping Countries: 2002-2006’ as part of a projectfinanced by the Ford Foundation. This report, which waswell received by academia, governments and nongovernmentalorganisations, came to be widely discussedin the Indian media. The report found that black money tothe tune of US$22.7-US$27.3bn a year has been leavingIndia over the five-year period, 2002-2006. It should benoted that even the upper range of GFI’s estimates likelyunderstates the outflow of black money from India. Afterall, economic models cannot capture all the channelsthrough which money can betransferred illegally out of acountry.A few examples will suffice. Itis well known that illicithawala transactions are animportant way by whichresidents can swap the rupeefor foreign exchange. A USstate department reportestimates that hawalatransactions in India rangebetween US$13bn and US$17bn annually, and present asecurity threat to the country.R E P O R T D E S K – I N F E A T U R EHow much Cash Leaves India?Economists capture theoutflow of black money in two ways — by estimatingoutflows that are unrecorded in the country’s externalaccounts and the ways through which residents can accrueforeign exchange abroad by under-invoicing exports andover-invoicing imports. Both these models can show illicitoutflows as well as illicit inflows.Traditionally, economists have tended to take thedirection of flows as they are and simply netted outinflows from outflows in a straightforward manner.However, we found the traditional method wanting in anumber of ways.First, it generated large swings from net outflows of blackmoney to net inflows for a large number of countries,whereas one would not expect such outflows to simplyturn around without supportive economic policies or adecline in pervasive corruption. That’s not how blackmoney behaves in real life. Second, the traditional methodalso generated some strange regional patterns such asAfrica being a net receiver of about US$12bn annually inblack money. We, therefore, rejected the traditional methodin fav<strong>our</strong> of an approach that looks at outflows and inflowsfor a country in a much more realistic way.Even the upper range of GFI’sestimates likely understates theoutflow of black money from India– Dev Kar *Instead of taking an “automatic” net position with regardto inflows and outflows in each year, the GFI method looksat how illicit flows behave over the entire five-year periodand includes only those outflows that are sufficiently large.According to the GFI approach, illicit flows must meet certaincriteria — they must flow out of a country in a persistentmanner (at least three outflows within a five-year period) andoutflows must be large enough to rule out data problems.Both conditions must hold simultaneously for each country.Even though, as a result of these conditions, GFI’s estimatesof illicit flows from developing countries are quiteconservative, they have nowcome to outstrip officialdevelopment assistance by afactor of 10:1. If for every dollarin official developmentassistance, an amount of US$10leaves a developing countrythrough the back door, it is timeLive Mintthat both donor and recipientcountries adopt policy measuresto address the serious long-termimplications for povertyalleviation.Even the upper range of recentestimates likely understates theoutflow of black money from thecountry. We are now studyingthe absorption of these illicit outflows into offshore financialcentres (OFCs), tax havens (most of which are also OFCs),and traditional onshore banks. Available data suggests thatdeposits in OFCs have been growing very fast; externaldeposits in the Cayman Islands alone, the largest OFC, hasgrown from US$722.6bn at the end of 2002 to nearly US$2tnby the end of the first quarter of 2008 — before coming downto US$1.7tn by the end of third quarter 2008 as a result of theglobal financial crisis.While all these deposits are not necessarily illicit, asubstantial proportion are, given that large transfersof private capital in contravention of foreign exchangecontrols make those transfers illicit. The stock of illicitmoney worldwide is huge, given that the Cayman Islandsis just one OFC out of a conglomeration of financialinstitutions engaged in that business. This means thatnational governments and regulatory agencies ofdeveloping countries would not only need to adopt policymeasures to stem the outflow of black money, but the G20as well as international regulatory agencies would also needto make the absorption of black money much more difficult.* Lead Economist at Global Financial Integrity, Washington, DC and a Former Senior Economist of the International MonetaryFund. Abridged from an article that appeared in the Live Mint on April 30, 2009.April-June 2009 PolicyWatchwww.<strong>cuts</strong>-international.org / 15

G O V E R N A N C E & R E F O R M S – S P E C I A L A R T I C L EBigger does not mean Better– Kaushik Das*Government is a “negative” concept. If one goes backto history to understand the motive for the formationof the government, it becomes clear that it was built bythe public primarily to protect and provide justice to thepublic against unlawful acts such as external aggression,theft, rape and vandalism. The government was, therefore,not envisaged to be “positive” in its role but to operateas a passive body — to only weed out or to preventnegative acts in a civil society, under the rule of law.The only other crucial role of the government, apart fromprotecting and providing law and justice to its citizens,was the provision of public goods through the collectionof taxes. All other goods and services were expected tobe provided by the forces of the free market, operatingunder the universal doctrines of division of lab<strong>our</strong> andknowledge.At this point, it should be noted that the governmentdoes not have its own s<strong>our</strong>ce of income. All theexpenditure of the government has to be funded throughtaxes collected from citizens. If the state has to spendmore and more on its citizens, it has to increase taxes fromthe already high tax burden to fund its additionalexpenditure. But given the fact that raising taxes ispolitically suicidal, the government funds additionalexpenditures by resorting to borrowing money by issuingbonds or by printing money. The result is inflation andthe crowding out of private investments, which is a netdeadweight loss for society.What some section of society gains due to the seeminglybenevolent acts of the government gets more thannegated by the ill effects of running fiscal deficits andinflation. Inflation is a form of tax: What the governmentgives with one hand, it takes away from the other.In this context, it is interesting to note that wherever thereis intense market competition, there is no inflation. Pricesof mobile phones, DVD players, television sets and airlinetickets have been falling over the years due to cut-throatcompetition in these sectors, thus benefiting consumers.Meanwhile, wherever there is a government monopoly,there is inflation, reducing the real income of citizens andleaving them worse off.Moreover, the government running state-ownedenterprises with public money is a sheer waste ofres<strong>our</strong>ces. One small example can make this point clear.Suppose the government collects Rs 100 as taxes from itscitizens to provide protection, law and justice and publicA bloatedgovernmentonlyhindersdevelopment,impedingfree andcompetitivemarketsgoods to them. Now, say the government spends Rs 40out of this tax money to run the state-owned enterprises.This means that Rs40 less is available for the core functionsof the government, which will never be compensated bythe private companies due to free-rider problems.But if the government did not run these state-ownedenterprises, then the private entities would have gladlycome and filled the void. Therefore, the government tryingto do more and more with limited tax money means thatwe as citizens will get fewer and fewer benefits. Onecannot expect to get great security from the state if thegovernment is using the limited tax res<strong>our</strong>ces in certainfields where private people would have invested gladly.One should remember that the institution of governmentis not immune from the principle of diminishing marginalutility. With every additional increase in the unit of thegovernment, the utility starts reducing; and after a point,a big government just turns out to be more of disutilitythan utility. So, it becomes clear that if citizens want aneffective government, they have to demand a smallergovernment. In other words, so far as the institution ofgovernment is concerned, people should appreciate that“less is more”.So, wealth generation or development is not a statesubject; rather, it is clearly a market subject. Put simply,development requires private saving, private investmentand entrepreneurs working under the forces of free marketcompetition – not under the umbrella of a big welfare state.www.irancartoon.com* An economist with Kotak Mahindra Bank. Abridged from an article that apperaed in Live Mint, on June 22, 2009.16 / www.<strong>cuts</strong>-international.org April-June 2009 PolicyWatch