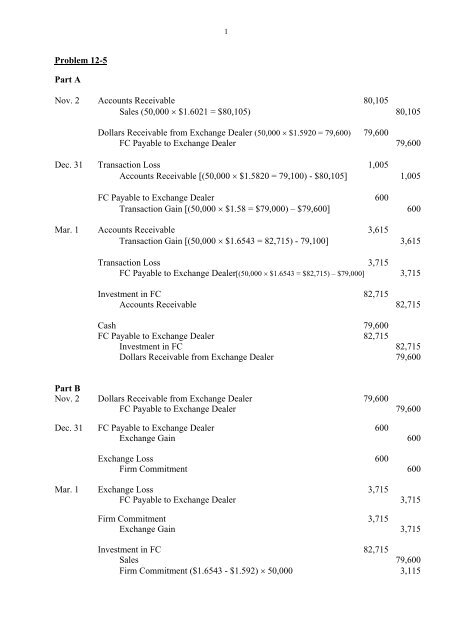

Problem 12-5 Part A Nov. 2 Accounts Receivable 80,105 Sales ...

Problem 12-5 Part A Nov. 2 Accounts Receivable 80,105 Sales ...

Problem 12-5 Part A Nov. 2 Accounts Receivable 80,105 Sales ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2Cash 79,600FC Payable to Exchange Dealer 82,715Investment in FC 82,715Dollars <strong>Receivable</strong> from Exchange Dealer 79,600<strong>Part</strong> C<strong>Nov</strong>. 2 Dollars <strong>Receivable</strong> from Exchange Dealer 79,600FC Payable to Exchange Dealer 79,600Dec. 31 FC Payable to Exchange Dealer ((50,000 × $1.5<strong>80</strong>0 = $79,000) - $79,600) 600Transaction Gain 600Mar. 1 Transaction Loss ((50,000 × $1.6543 = $82,715) - $79,000) 3,715FC Payable to Exchange Dealer 3,715Investment in FC 82,715Cash 82,715Cash 79,600FC Payable to Exchange Dealer 82,715Dollars <strong>Receivable</strong> from Exchange Dealer 79,600Investment in FC 82,715<strong>Part</strong> D 2008 A B C<strong>Sales</strong> <strong>80</strong>,<strong>105</strong> 0 0Transaction gain (loss) 600 600 600(1,005) (600) 0Increase (decrease) in net income $ 79,700 $ 0 $ 6002009<strong>Sales</strong> 0 79,600* 0Transaction gain (loss) 3,615 3,715 0(3,715) (3,715) (3,715)Increase (decrease) in net income $ (100) $79,600 $(3,715)Net increase (decrease) in net income 2008 + 2009 $79,600 $79,600 $(3,115)*** $82,715 - $3,115 = $79,600** Verification of lossCash paid to buy currency 82,715Cash paid to complete forward contract 79,600Net loss on forward contract $ 3,115On BS 2008$ <strong>Receivable</strong> $79,600FC Payable 79,000$ 600

3<strong>Problem</strong> <strong>12</strong>-6<strong>Part</strong> A Oct 1 <strong>Sales</strong> contract - No entry required since it is a commitment to sell.1 Dollars <strong>Receivable</strong> from Exchange Dealer 371,341FC Payable to Exchange Dealer 371,34150,100,000 × $.0074<strong>12</strong> = $371,341Dec 31 Exchange Loss 24,950FC Payable to Exchange Dealer 24,950[(50,100,000 × $.007910 = $396,291) - $371,341]Firm Commitment 24,950Exchange Gain 24,950Jan 28 FC Payable 11,824FC Payable to Exchange Dealer 11,824[(50,100,000 × $.007674 = $384,467) - $396,291]28 Exchange Loss 11,824Firm Commitment 11,824Jan 28 <strong>Accounts</strong> <strong>Receivable</strong> (50,100,000 × $.007623) 381,9<strong>12</strong><strong>Sales</strong> 368,786Firm Commitment 13,<strong>12</strong>6<strong>Accounts</strong> <strong>Receivable</strong> is recorded at spot rate28 Cost of Goods Sold (25,000 × $7.50) 187,500Inventory 187,500Mar 29 <strong>Accounts</strong> <strong>Receivable</strong> 852Transaction Gain 852[(50,100,000 × $.007640 = $382,764) - $381,9<strong>12</strong>]29 FC Payable 1,703Transaction gain 1,703[(50,100,000 × $.007640 = $382,764) - $384,467]29 Investment in FC 382,764<strong>Accounts</strong> <strong>Receivable</strong> 382,76429 Cash (50,100,000 × $.0074<strong>12</strong>) 371,341FC Payable to Exchange Dealer 382,764Dollars <strong>Receivable</strong> from Exchange Dealer 371,341Investment in FC 382,764

4<strong>Part</strong> B 2008 - 0 -2009 <strong>Sales</strong> ($381,9<strong>12</strong> - $13,<strong>12</strong>6) $368,786Cost of goods sold 187,500Gross profit $181,286Transaction Gain $1,703852 2,555Net increase $183,841orCash received $371,341Cost of goods sold 187,500$183,841<strong>Part</strong> C 2008 - 0 -2009 <strong>Sales</strong> $381,9<strong>12</strong>Cost of goods sold 187,500Gross profit $194,4<strong>12</strong>Transaction gain 852Net increase $195,264orCash received on March 29 $382,764Cost of goods sold 187,500Net increase $195,264<strong>Problem</strong> <strong>12</strong>-7<strong>Part</strong> A Rather than focusing on the solution, students should focus on the rationalsupporting their conclusions. Accordingly, the following questions should be givenconsideration:1. What is the purpose of the company policy? Under what conditions might it bejustified to deviate from company policy, if any?2. In whose best interest was the controller acting? Is there some overall "bestinterest" which supersedes company policy?3. Is it appropriate to have "situation specific" ethics?<strong>Part</strong> B1. HAL may hedge against future losses by entering into forward exchangecontracts.2. Advantages:(a) Determine the extent of loss related to each transaction which is important forplanningpurposes, and(b) Minimize potential losses.Disadvantage:Eliminates potential to take advantages of any favorable exchange rate changes.3. SFAS No. 133 specifies the disclosure requirements concerningconcentrations of credit risk for all financial instruments. SFAS No. 107 is relied onto provide valuation guidance for measuring fair value.SFAS No. 133 requires that an entity recognize all derivatives as either assets orliabilities measured at fair value. Specific disclosures required under SFAS No. 133

5are the objectives of the instruments, the context needed to understand them, thestrategies for achieving them, the risk management policy, and a description ofitems or transactions that are hedged for each of the following:1. Fair value hedges2. Cash flow hedges3. Foreign currency net investment hedges; and4. All other derivatives.For derivative instruments not designated as hedges, the purpose of their activitymust be disclosed. Qualitative disclosures concerning the use of derivativeinstruments are encouraged, particularly in a context of overall risk management, aswell as for financial instruments or nonfinancial assets and liabilities related byactivity to derivative instruments.<strong>Part</strong> C 1. Options are to (a) enter into foreign currency hedges or (b) leave the contractsexposed tofuture currency fluctuations.2. Rather than focusing on the specific decision, students should giveconsideration to theconflict between fiduciary responsibility to shareholders and desire for individualfinancial gain.

6<strong>Problem</strong> <strong>12</strong>-8December 1, 2009Option to sell Francs 6,000Cash 6,000December 31, 2009Option to sell Francs 3,000Exchange Gain – Other Comprehensive Income (balance sheet equity) 3,000To record a gain on the change in option value ($9,000 - $6,000)February 25, 2010(3) Option to sell Francs 3,000Exchange Gain – Other Comprehensive Income 3,000To adjust the option value to its current realizable value of $<strong>12</strong>,000:the value of the option [($.60 exercise price less $.57 spot rate) x 400,000 francs]of $<strong>12</strong>,000 less the carrying value of the option ($9,000)(4) Cash (400,000 × .60) 240,000Option to sell Francs <strong>12</strong>,000Payable to Option Trader (400,000 × $.57) 228,000To exercise the option and settle with the trader.<strong>Problem</strong> <strong>12</strong>-9Dec. 1 Dollars <strong>Receivable</strong> from Exchange Dealer (200,000 × $1.02) 204,000FC Payable to Exchange Dealer 204,000Dec. 31 FC Payable to Exchange Dealer 4,000Foreign Exchange Gain – Other Comprehensive Income 4,000[200,000 × ($1.02- $1.00)]Jan. 31 FC Payable to Exchange Dealer 2,000Foreign Exchange Gain – Other Comprehensive Income 2,000[200,000 × ($1.00 - $0.99)]Investment in FC 198,000<strong>Sales</strong> (200,000 × $0.99) 198,000Cost of Goods Sold (cost of equipment sold) 170,000Inventory 170,000Foreign Exchange Gain – Other Comprehensive Income ($4,000 + $2,000) 6,000Cost of Goods Sold 6,000To reclassify other comprehensive income into earnings